1/25

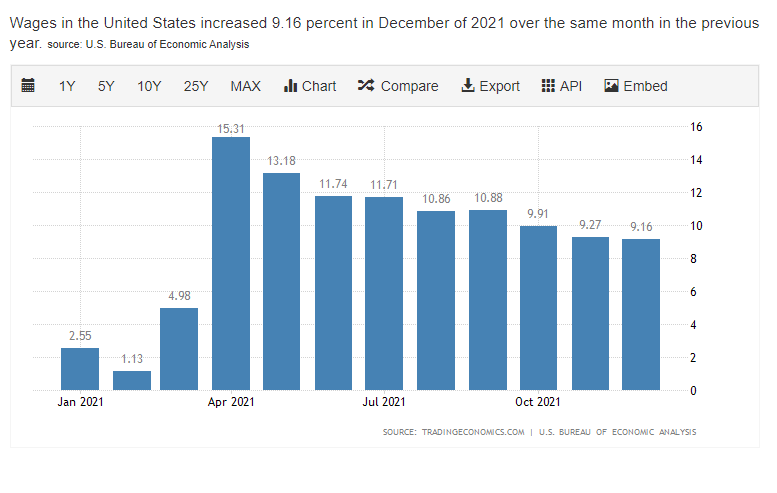

One thing that isn& #39;t well captured in this CPI is wage inflation.

People use that as an excuse to avoid rate hikes, with the view that an average rising wage counterbalances inflation, so everything is fine.

Rising wages are great - but in this case, make inflation worse

One thing that isn& #39;t well captured in this CPI is wage inflation.

People use that as an excuse to avoid rate hikes, with the view that an average rising wage counterbalances inflation, so everything is fine.

Rising wages are great - but in this case, make inflation worse

2/25

We want to see wage growth move up, overtime, against inflation, purchasing power, average costs of set goods, etc.

But, we don& #39;t want that to exceed by too much (except for maybe the US min wage, which is nonsense low and not livable)

We want to see wage growth move up, overtime, against inflation, purchasing power, average costs of set goods, etc.

But, we don& #39;t want that to exceed by too much (except for maybe the US min wage, which is nonsense low and not livable)

3/25

These numbers are complicated as they change based on the average job seniority in your market, the industry make up, etc.

But, we want to see wage growth beating inflation when inflation runs on a target of 2%.

These numbers are complicated as they change based on the average job seniority in your market, the industry make up, etc.

But, we want to see wage growth beating inflation when inflation runs on a target of 2%.

4/25

When wages rapidly move along with CPI we get what we call a "wage-price spiral" ( https://www.investopedia.com/terms/w/wage-price-spiral.asp)

Basically">https://www.investopedia.com/terms/w/w... meaning that as your costs go up, you are unphased because the amount of dollars goes up.

So you do nothing about inflation.

When wages rapidly move along with CPI we get what we call a "wage-price spiral" ( https://www.investopedia.com/terms/w/wage-price-spiral.asp)

Basically">https://www.investopedia.com/terms/w/w... meaning that as your costs go up, you are unphased because the amount of dollars goes up.

So you do nothing about inflation.

5/25

So why is that a problem?

Two reason.

1) Not everyone earns that hike.

It& #39;s an *average* hike and there is no average person.

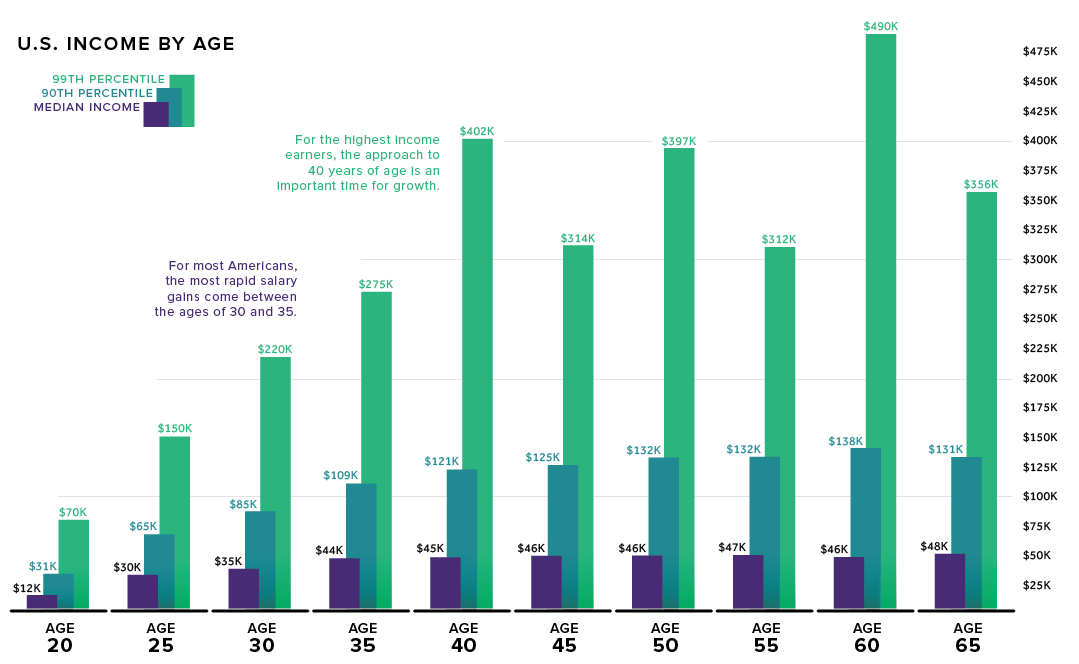

For example earnings growth by age varies in a regular market:

So why is that a problem?

Two reason.

1) Not everyone earns that hike.

It& #39;s an *average* hike and there is no average person.

For example earnings growth by age varies in a regular market:

6/25

But, you usually get four key event drivers that change your income:

1) Annual inflation adjustment (which most businesses can& #39;t afford now)

2) Promotions.

3) Job change.

4) Job retention from other offer.

But, you usually get four key event drivers that change your income:

1) Annual inflation adjustment (which most businesses can& #39;t afford now)

2) Promotions.

3) Job change.

4) Job retention from other offer.

7/25

Right now, wage growth is highly concentrated in:

-Financial sectors

-Tech sectors

-Hospitality

But the hospitality industry wage growth seems like it& #39;s actually transient and due to people not wanting to deal with pandemic, or riding out gov support checks.

Right now, wage growth is highly concentrated in:

-Financial sectors

-Tech sectors

-Hospitality

But the hospitality industry wage growth seems like it& #39;s actually transient and due to people not wanting to deal with pandemic, or riding out gov support checks.

8/25

So that means that this wage growth that we& #39;re seeing is mostly in the top few percent of earners.

They can afford to spend, and hike prices to bid on the limited demand (due to supplychain strain).

This means companies can hike prices, and post more profits...which

So that means that this wage growth that we& #39;re seeing is mostly in the top few percent of earners.

They can afford to spend, and hike prices to bid on the limited demand (due to supplychain strain).

This means companies can hike prices, and post more profits...which

9/25

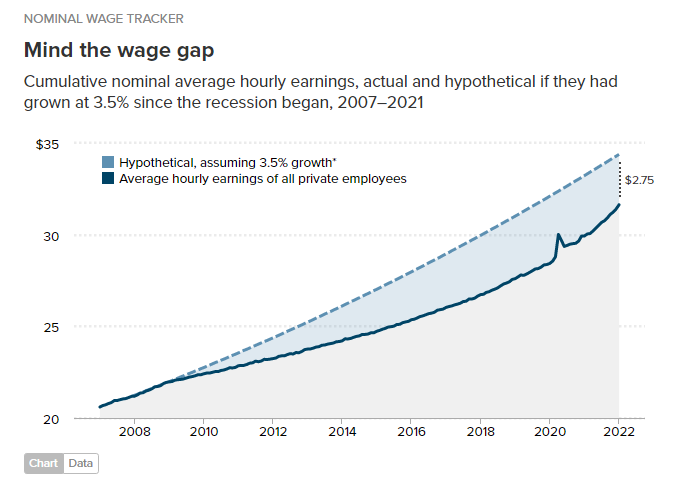

...Which mostly goes back to shareholders who are usually once again the top earners.

The nominal wage gap alone (the hypothetical growth target of all jobs) has widened, but that includes all private sectors.

...Which mostly goes back to shareholders who are usually once again the top earners.

The nominal wage gap alone (the hypothetical growth target of all jobs) has widened, but that includes all private sectors.

10/25

According to the US Bureau of Labor Statistics, 55% of all US workers are on hourly pay, with an average annual income of $36.5k/year.

Which is actually an 8.75% *decrease* from prior years.

According to the US Bureau of Labor Statistics, 55% of all US workers are on hourly pay, with an average annual income of $36.5k/year.

Which is actually an 8.75% *decrease* from prior years.

11/25

And, on average part-time workers in fast-food, leisure and big box, are working 15% less hours than they were previously.

So while wages have gone up in raw number, they end up with around 16.45% less purchasing power.

And, on average part-time workers in fast-food, leisure and big box, are working 15% less hours than they were previously.

So while wages have gone up in raw number, they end up with around 16.45% less purchasing power.

12/25

In fact if we factor in inflation we& #39;ll see that the average value of dollar on the lowest incomes has been stagnant, not only behind purchasing power but also typical full-time wages.

In fact if we factor in inflation we& #39;ll see that the average value of dollar on the lowest incomes has been stagnant, not only behind purchasing power but also typical full-time wages.

13/25

So why does this matter?

Well first, this is people we& #39;re talking about. They are working and still struggling to get by, and that sucks regardless of the economics.

So why does this matter?

Well first, this is people we& #39;re talking about. They are working and still struggling to get by, and that sucks regardless of the economics.

14/25

But if you are some kind of asshole who doesn& #39;t care about that, there is also an economic impact.

Poverty is expensive.

In any economic system, it costs more per capita to provide and administer benefit programs, than it does to have someone gainfully employed.

But if you are some kind of asshole who doesn& #39;t care about that, there is also an economic impact.

Poverty is expensive.

In any economic system, it costs more per capita to provide and administer benefit programs, than it does to have someone gainfully employed.

15/25

For example, the growth of food stamp (SNAP) programs alone have been insane these past few years.

That& #39;s more tax pressure from government, but also the government spending on safety nets, rather than economic stimulation or infrastructure investment projects.

For example, the growth of food stamp (SNAP) programs alone have been insane these past few years.

That& #39;s more tax pressure from government, but also the government spending on safety nets, rather than economic stimulation or infrastructure investment projects.

16/25

The opportunity cost is huge.

You are not only spending on raw output to correct the economic course, but you are missing out on the opportunity to spring forward in a compounding way by investing in your nation.

The opportunity cost is huge.

You are not only spending on raw output to correct the economic course, but you are missing out on the opportunity to spring forward in a compounding way by investing in your nation.

17/25

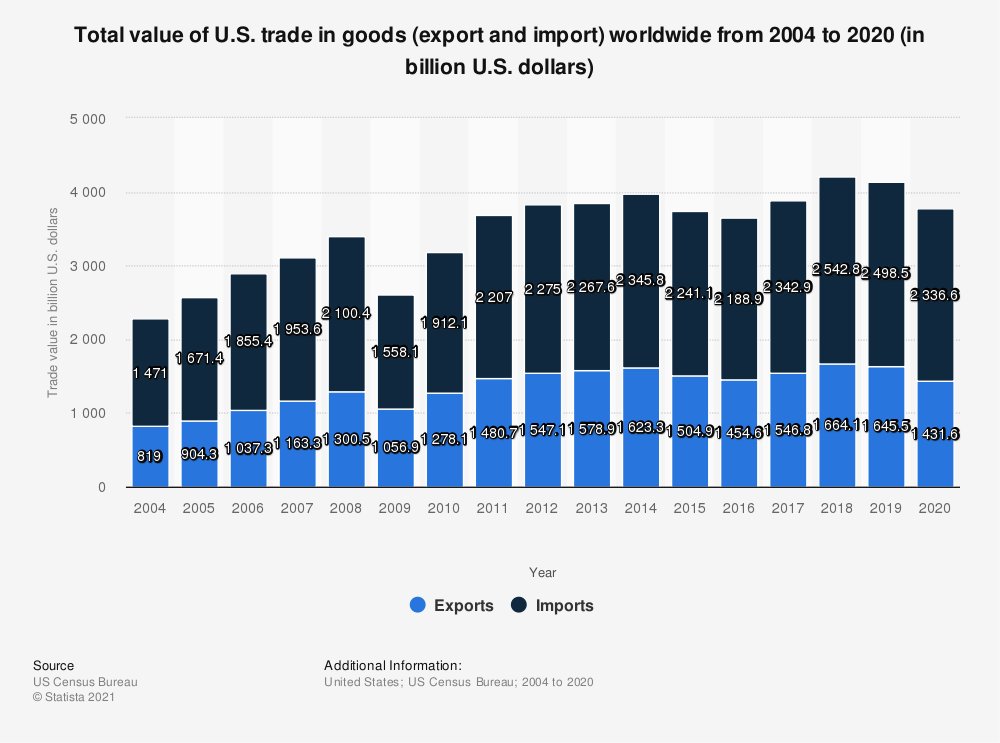

2) External Pricing

The second reason a wage-price spiral is an issue, is that countries are no longer insular entities.

Around 20% of goods in the US are imports, 15% of labor is offshore, and 71% of raw materials are sourced overseas.

2) External Pricing

The second reason a wage-price spiral is an issue, is that countries are no longer insular entities.

Around 20% of goods in the US are imports, 15% of labor is offshore, and 71% of raw materials are sourced overseas.

18/25

The labor and raw costs of goods in these other countries is priced in their own currency.

As your own dollar weakens, even if your home country & #39;real wage& #39; (purchasing power of dollars earned) stays flat, your overseas purchasing power declines.

The labor and raw costs of goods in these other countries is priced in their own currency.

As your own dollar weakens, even if your home country & #39;real wage& #39; (purchasing power of dollars earned) stays flat, your overseas purchasing power declines.

19/25

Because many other nations don& #39;t have the same wage growth, due to different job market make-ups, they aren& #39;t locked in the same spiral and so you don& #39;t move in tandem with their currency.

Because many other nations don& #39;t have the same wage growth, due to different job market make-ups, they aren& #39;t locked in the same spiral and so you don& #39;t move in tandem with their currency.

20/25

This flux is fine for a while, but, people forget that most payments and settlements operate on a Net30 - Net90 cycle.

So if your currency is rapidly shifting in inflation (such as say 7% annually) and mine isn& #39;t, I have to start thinking of how to protect my billing.

This flux is fine for a while, but, people forget that most payments and settlements operate on a Net30 - Net90 cycle.

So if your currency is rapidly shifting in inflation (such as say 7% annually) and mine isn& #39;t, I have to start thinking of how to protect my billing.

21/25

This means your currency is less desirable, and I have to tack on fees for that foreign buying. Perhaps 1.75% (just to cover the raw Net90 of 7%)

But, this means prices go up, and your currency is less desirable.

This means your currency is less desirable, and I have to tack on fees for that foreign buying. Perhaps 1.75% (just to cover the raw Net90 of 7%)

But, this means prices go up, and your currency is less desirable.

22/25

What happens as I put my prices up 1.75%?

Those who earned the wage bump don& #39;t flinch and pay it. Adding to the wage-price spiral, and so now you gradually tip more inflation, so we& #39;ll repeat that cycle again.

What happens as I put my prices up 1.75%?

Those who earned the wage bump don& #39;t flinch and pay it. Adding to the wage-price spiral, and so now you gradually tip more inflation, so we& #39;ll repeat that cycle again.

23/25

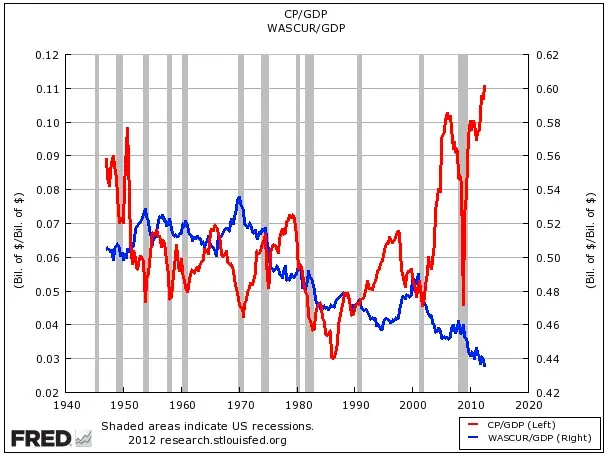

Look the great resignation is a good thing.

The American dream is broken. You can& #39;t just work hard at a 9-5, have work life balance and get ahead.

The gap in wages versus profit has never been higher.

Look the great resignation is a good thing.

The American dream is broken. You can& #39;t just work hard at a 9-5, have work life balance and get ahead.

The gap in wages versus profit has never been higher.

24/25

And wages moving up on average is a good thing as well, people deserved to be paid for the economic value they create.

But, seeing the headline "Wages are up 9.16% in 2022" seems great, but is actually horrible, partly because it& #39;s skewed,

And wages moving up on average is a good thing as well, people deserved to be paid for the economic value they create.

But, seeing the headline "Wages are up 9.16% in 2022" seems great, but is actually horrible, partly because it& #39;s skewed,

25/25

But also because it& #39;s happen as a result of inflation. Not because of a change in the economic mix of the country, or a better share of profits.

The Fed needs to act to curb inflation and not use wage as an excuse.

But also because it& #39;s happen as a result of inflation. Not because of a change in the economic mix of the country, or a better share of profits.

The Fed needs to act to curb inflation and not use wage as an excuse.

Read on Twitter

Read on Twitter