Red pill or Blue Pill?

I have a confession: I invest most of my savings in the S&P500. But most financial advice is heavily biased by experience.

So I studied the last 20+ years of data on various investment strategies to find the options out there.

I am offering you a choice:

I have a confession: I invest most of my savings in the S&P500. But most financial advice is heavily biased by experience.

So I studied the last 20+ years of data on various investment strategies to find the options out there.

I am offering you a choice:

1/ You take the blue pill, the story ends, you can close the page now and believe that DCAing into the S&P 500 is your best bet.

You take the red pill, you stay in wonderland, and I show you how deep the rabbit-hole goes.

Let& #39;s start with how you judge an investment:

You take the red pill, you stay in wonderland, and I show you how deep the rabbit-hole goes.

Let& #39;s start with how you judge an investment:

2/ Returns can be measured in two ways.

Say your investment grows by 40% in two years.

Cumulative return is the total return you made on your invested amount. (40%)

Annualized return is the return per year (20%, here). Use it to compare investments over different time periods.

Say your investment grows by 40% in two years.

Cumulative return is the total return you made on your invested amount. (40%)

Annualized return is the return per year (20%, here). Use it to compare investments over different time periods.

3/ But there is no return without risk.

Sharpe ratio measures the investment return adjusted for risk. All else the same, the higher it is, the better the investment.

Max drawdown measures the max loss from a peak to a subsequent bottom of the portfolio - It measures volatility

Sharpe ratio measures the investment return adjusted for risk. All else the same, the higher it is, the better the investment.

Max drawdown measures the max loss from a peak to a subsequent bottom of the portfolio - It measures volatility

4/ I am considering an equal amount invested every month in every strategy.

(This is how the majority of regular investors invest, and I want to remove reliance on the starting point for lump-sum)

Let& #39;s get started!

(This is how the majority of regular investors invest, and I want to remove reliance on the starting point for lump-sum)

Let& #39;s get started!

5/ $SPY and Chill

Buy the S&P500 and hold on for a long time. One of the most common strategies out there.

As the economy grows, your wealth grows.

While this gave an excellent return of 12.3% per year, there was a max drawdown of 40% (the 2008 crash)!

This is our benchmark.

Buy the S&P500 and hold on for a long time. One of the most common strategies out there.

As the economy grows, your wealth grows.

While this gave an excellent return of 12.3% per year, there was a max drawdown of 40% (the 2008 crash)!

This is our benchmark.

6/ Balanced portfolio

This is an equal split of stocks and bonds - though your returns are lesser, you can sleep easier.

The Sharpe ratio is an excellent 1.35 compared to SPY& #39;s 0.69, and the max drawdown is just 14%.

Even better, this portfolio beat $SPY during crashes!

This is an equal split of stocks and bonds - though your returns are lesser, you can sleep easier.

The Sharpe ratio is an excellent 1.35 compared to SPY& #39;s 0.69, and the max drawdown is just 14%.

Even better, this portfolio beat $SPY during crashes!

7/ Diversified portfolio

This is an equal 33.3% split of Large, mid and small cap stocks ($SPY, $VO, $IJR). I expected it to beat $SPY.

But while the drawdown is lesser, SPY gives better returns and Sharpe ratio

My guess is that the high conc. of Tech gave SPY a boost here.

This is an equal 33.3% split of Large, mid and small cap stocks ($SPY, $VO, $IJR). I expected it to beat $SPY.

But while the drawdown is lesser, SPY gives better returns and Sharpe ratio

My guess is that the high conc. of Tech gave SPY a boost here.

8/ Tech enthusiast

In this, I put all of my money in the $QQQ - And would you look at that!

Over the last two decades, the value has *more than doubled.*

This is probably because Tech had an amazing run, and the starting point is *after* the dot-com crash.

Hindsight 20/20!

In this, I put all of my money in the $QQQ - And would you look at that!

Over the last two decades, the value has *more than doubled.*

This is probably because Tech had an amazing run, and the starting point is *after* the dot-com crash.

Hindsight 20/20!

9/ Growth seeker

Solely focusing on growth, this is an investment in $VUG.

But due to the dominance of tech, we live in a rare period where the fastest growing stocks are also the biggest ones in the market!

The returns are correlated with the $QQQ.

Solely focusing on growth, this is an investment in $VUG.

But due to the dominance of tech, we live in a rare period where the fastest growing stocks are also the biggest ones in the market!

The returns are correlated with the $QQQ.

10/ Buying the dip

The idea is simple - Save funds and only invest during a crash. The returns seem unreal!

There& #39;s a catch. As @dollarsanddata pointed out to me, this is misleading as it& #39;s next to impossible to buy the dip in practice.

Check our analysis on this (link https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">)

The idea is simple - Save funds and only invest during a crash. The returns seem unreal!

There& #39;s a catch. As @dollarsanddata pointed out to me, this is misleading as it& #39;s next to impossible to buy the dip in practice.

Check our analysis on this (link

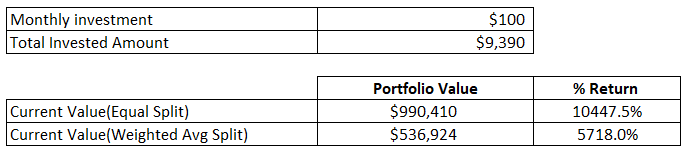

11/ DCA of Crypto

One of our most popular analyses to date - Here, you invest a fixed amount in the top 10 cryptos by trading volume every month.

While this gives returns from 5k%-10k%, it& #39;s *extremely volatile* and has had multiple drawdowns of > 80-90% !

Link to analysis https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

One of our most popular analyses to date - Here, you invest a fixed amount in the top 10 cryptos by trading volume every month.

While this gives returns from 5k%-10k%, it& #39;s *extremely volatile* and has had multiple drawdowns of > 80-90% !

Link to analysis

12/ A lot to digest for sure!

It& #39;s not about the perfect strategy, it& #39;s about finding what fits you.

Maybe you want the simplicity of Spy and Chill.

Or the safety of a balanced portfolio.

Or the insane risk and returns of Crypto.

It& #39;s your choice -but $SPY isn& #39;t the only one.

It& #39;s not about the perfect strategy, it& #39;s about finding what fits you.

Maybe you want the simplicity of Spy and Chill.

Or the safety of a balanced portfolio.

Or the insane risk and returns of Crypto.

It& #39;s your choice -but $SPY isn& #39;t the only one.

13/ In the immortal words of Morpheus...

14/ For the original analysis and more details, here& #39;s the full post link.

In the post, I have shared the complete data using @RowsHQ - Really love their product!

I have also shared my backtests of a few strategies.

Check it out! https://twitter.com/mkt_sentiment/status/1491037774887399424">https://twitter.com/mkt_senti...

In the post, I have shared the complete data using @RowsHQ - Really love their product!

I have also shared my backtests of a few strategies.

Check it out! https://twitter.com/mkt_sentiment/status/1491037774887399424">https://twitter.com/mkt_senti...

15/ Follow @mkt_sentiment for more interesting threads 2-3x a week.

If you enjoyed this thread, please consider liking and retweeting the first tweet :)

If you enjoyed this thread, please consider liking and retweeting the first tweet :)

16/ Here& #39;s the link to the analysis on buying the dip: https://twitter.com/mkt_sentiment/status/1408442711070285827">https://twitter.com/mkt_senti...

17/ This is the link to the Crypto DCA post - One of our most popular ever! https://twitter.com/mkt_sentiment/status/1450450809238396932">https://twitter.com/mkt_senti...

Read on Twitter

Read on Twitter

)" title="10/ Buying the dipThe idea is simple - Save funds and only invest during a crash. The returns seem unreal!There& #39;s a catch. As @dollarsanddata pointed out to me, this is misleading as it& #39;s next to impossible to buy the dip in practice.Check our analysis on this (link https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">)" class="img-responsive" style="max-width:100%;"/>

)" title="10/ Buying the dipThe idea is simple - Save funds and only invest during a crash. The returns seem unreal!There& #39;s a catch. As @dollarsanddata pointed out to me, this is misleading as it& #39;s next to impossible to buy the dip in practice.Check our analysis on this (link https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">)" class="img-responsive" style="max-width:100%;"/>

" title="11/ DCA of CryptoOne of our most popular analyses to date - Here, you invest a fixed amount in the top 10 cryptos by trading volume every month.While this gives returns from 5k%-10k%, it& #39;s *extremely volatile* and has had multiple drawdowns of > 80-90% !Link to analysis https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">">

" title="11/ DCA of CryptoOne of our most popular analyses to date - Here, you invest a fixed amount in the top 10 cryptos by trading volume every month.While this gives returns from 5k%-10k%, it& #39;s *extremely volatile* and has had multiple drawdowns of > 80-90% !Link to analysis https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">">

" title="11/ DCA of CryptoOne of our most popular analyses to date - Here, you invest a fixed amount in the top 10 cryptos by trading volume every month.While this gives returns from 5k%-10k%, it& #39;s *extremely volatile* and has had multiple drawdowns of > 80-90% !Link to analysis https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">">

" title="11/ DCA of CryptoOne of our most popular analyses to date - Here, you invest a fixed amount in the top 10 cryptos by trading volume every month.While this gives returns from 5k%-10k%, it& #39;s *extremely volatile* and has had multiple drawdowns of > 80-90% !Link to analysis https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">">