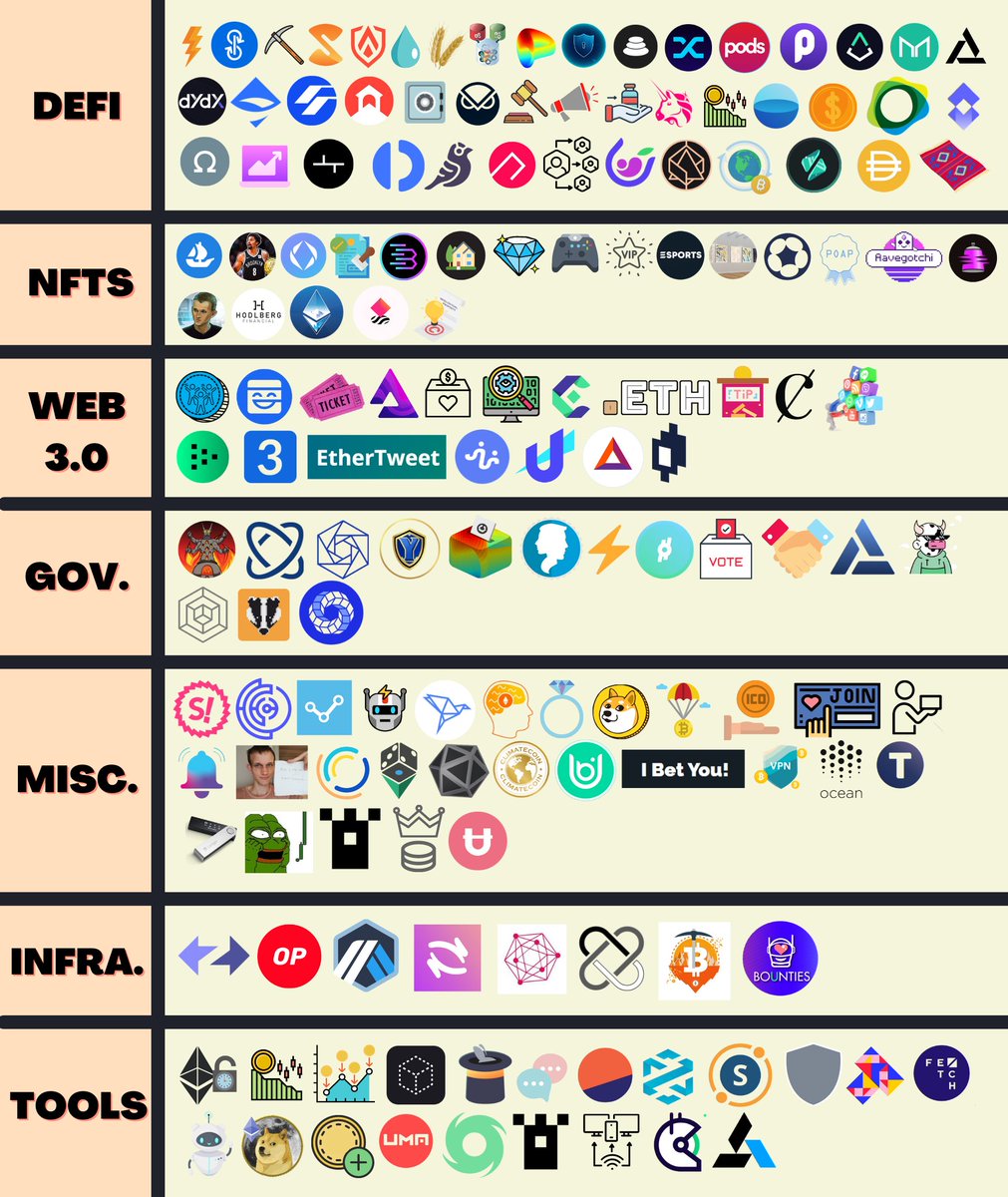

The following thread is the culmination of countless hours of research . @PastryEth & I have dedicated to the ETH ecosystem during our time as pastries.

In it we& #39;ll attempt to simply explain the hundreds of brilliant, funky & sometimes rather unconventional dApps in DeFi. (1/107)

In it we& #39;ll attempt to simply explain the hundreds of brilliant, funky & sometimes rather unconventional dApps in DeFi. (1/107)

We split this write up into broad categories and detail each of their subcomponents in no particular order.

Let us now introduce you guys to my list of the most innovative and unique protocols existing on Ethereum...

note: there is a quiz at the end, so pay attention. (2/107)

Let us now introduce you guys to my list of the most innovative and unique protocols existing on Ethereum...

note: there is a quiz at the end, so pay attention. (2/107)

If I told you that you could get millions of dollars in assets in seconds, with no bank, with no collateral, and at no risk to the lender...

I& #39;d probably sound mad, right?

Well, flash loans on Aave are built to be repaid in the same tx, otherwise it& #39;ll revert and fail. (4/107)

I& #39;d probably sound mad, right?

Well, flash loans on Aave are built to be repaid in the same tx, otherwise it& #39;ll revert and fail. (4/107)

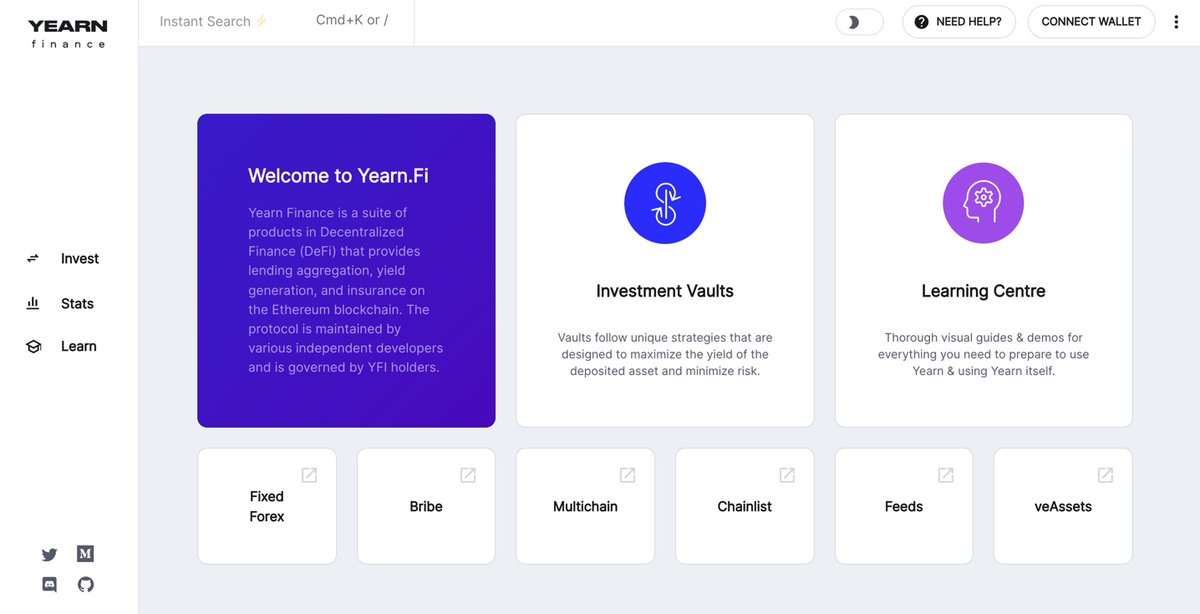

Not interested? Head over to YFI & join the yield farms, with many different options to choose from.

The YFI community works hard at developing strategies for their vaults, acting like a high interest savings account.

Users can deposit & immediately start earning yield! (5/107)

The YFI community works hard at developing strategies for their vaults, acting like a high interest savings account.

Users can deposit & immediately start earning yield! (5/107)

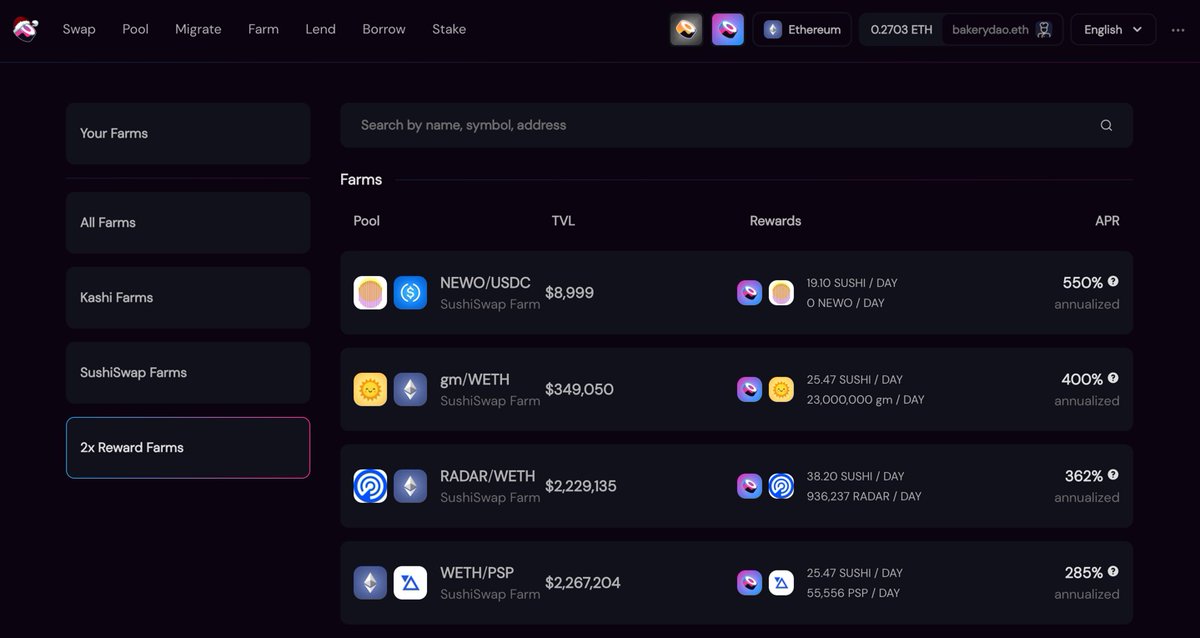

Speaking of liquidity mining... Do you have idle assets that you want to put to work?

Many DeFi protocols such as Uniswap, Sushiswap, & Curve are in need of liquidity.

Deposit tokens of your choice to start earning yield in different tokens, & earn trade fees on swaps! (6/107)

Many DeFi protocols such as Uniswap, Sushiswap, & Curve are in need of liquidity.

Deposit tokens of your choice to start earning yield in different tokens, & earn trade fees on swaps! (6/107)

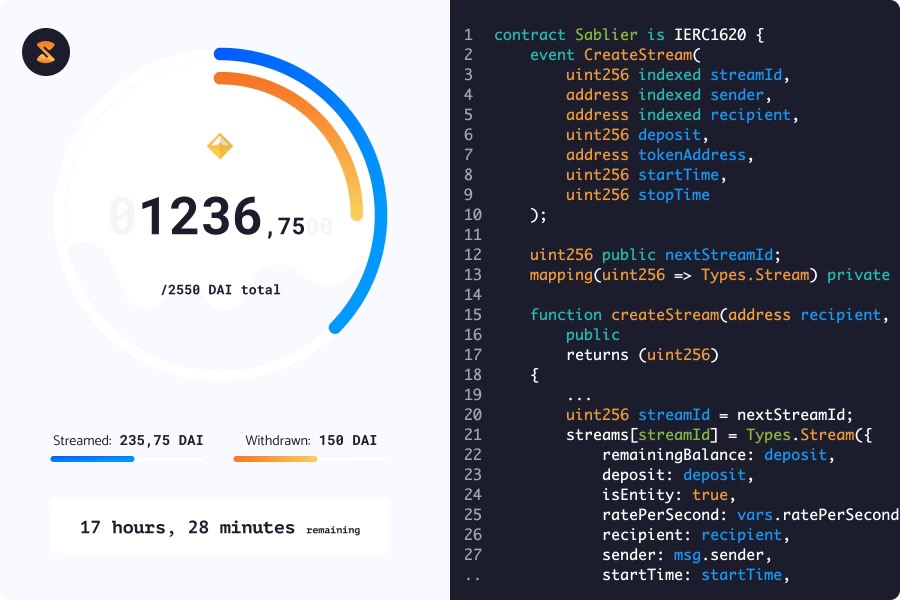

Not your cup of tea? No problem. You can also decide to use Sablier Finance, where you can set up payments streams to employees.

With Sablier smart contracts, I can choose where & what tokens are distributed over time.

No more annoying payroll. Happy employees. (7/107)

With Sablier smart contracts, I can choose where & what tokens are distributed over time.

No more annoying payroll. Happy employees. (7/107)

Worried about security?

Authereum has built a smart contract wallet capable of social recovery, and created & #39;guardians,& #39; which have special permissions for wallets.

This essentially allows users to set up a unique & secure wallet controlled by nothing other than code. (8/107)

Authereum has built a smart contract wallet capable of social recovery, and created & #39;guardians,& #39; which have special permissions for wallets.

This essentially allows users to set up a unique & secure wallet controlled by nothing other than code. (8/107)

Do you hate having to worry about opportunity cost? Of course, that& #39;s not a problem for DeFi.

Simply access liquid staking derivatives in order to unlock liquidity and put it to use.

sETH represents staked ETH on Lido. After depositing, these sETH can be used in DeFi. (9/107)

Simply access liquid staking derivatives in order to unlock liquidity and put it to use.

sETH represents staked ETH on Lido. After depositing, these sETH can be used in DeFi. (9/107)

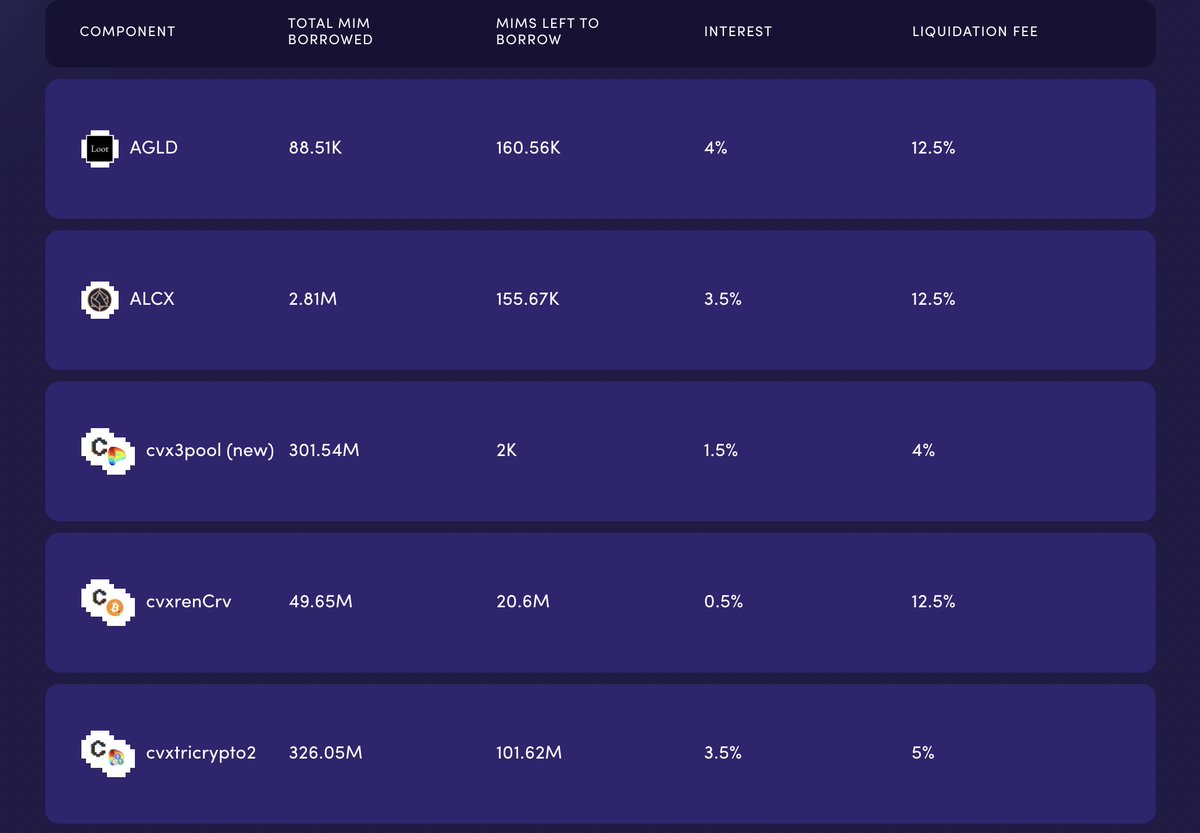

In for a thrill? Go beyond just yield farming and take on leveraged yield farming!

Some protocols allow users to deposit interest-bearing assets, and borrow stablecoins

Tokens earning yield on CRV can be used as collateral for Abracadabra, for maximized composability. (10/107)

Some protocols allow users to deposit interest-bearing assets, and borrow stablecoins

Tokens earning yield on CRV can be used as collateral for Abracadabra, for maximized composability. (10/107)

Are you a true DeFi native? Visit Curve to start earning complex, double digit yields on your holdings.

Curve has incentivized stablecoin pools, which people use to trade high volumes with minimal slippage, and even conduct arbitrage for yield.

Find APY > 25%! (11/107)

Curve has incentivized stablecoin pools, which people use to trade high volumes with minimal slippage, and even conduct arbitrage for yield.

Find APY > 25%! (11/107)

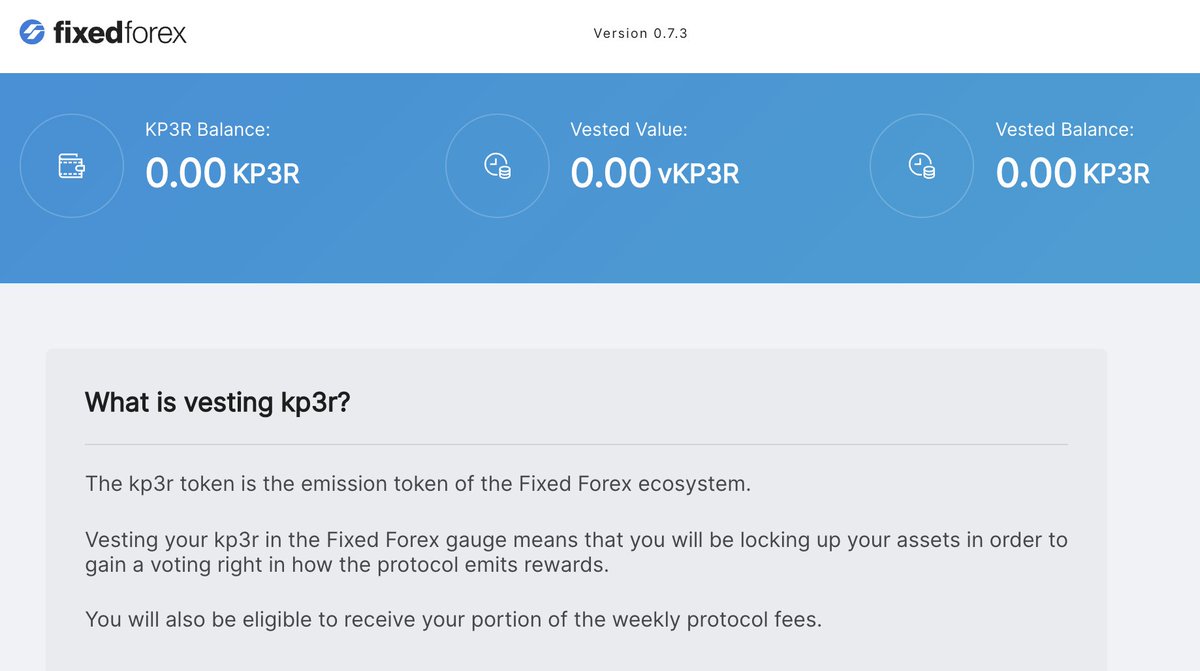

Want to align incentives? ERC-20 tokens can be vested on several protocols, then slowly be released over time to ensure long-term commitment.

Many tokens have even expanded this model to give vested token holders a share of protocol revenue (i.e. Curve, Keep3r). (12/107)

Many tokens have even expanded this model to give vested token holders a share of protocol revenue (i.e. Curve, Keep3r). (12/107)

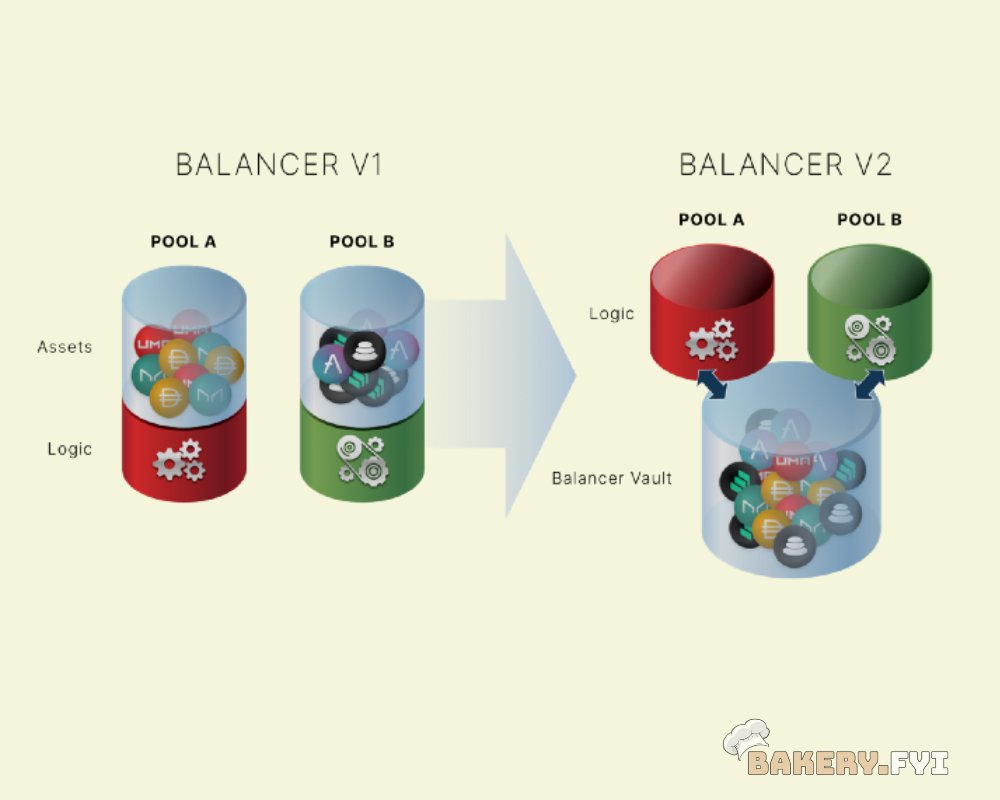

Want to balance pools?

Balancer is a liquidity provision dapp allowing users trade on various tokens.

Rather than swapping tokens in several pools, Balancer only ever transfers the net amount of tokens out of a single pool, resulting in significantly cheaper trades. (13/107)

Balancer is a liquidity provision dapp allowing users trade on various tokens.

Rather than swapping tokens in several pools, Balancer only ever transfers the net amount of tokens out of a single pool, resulting in significantly cheaper trades. (13/107)

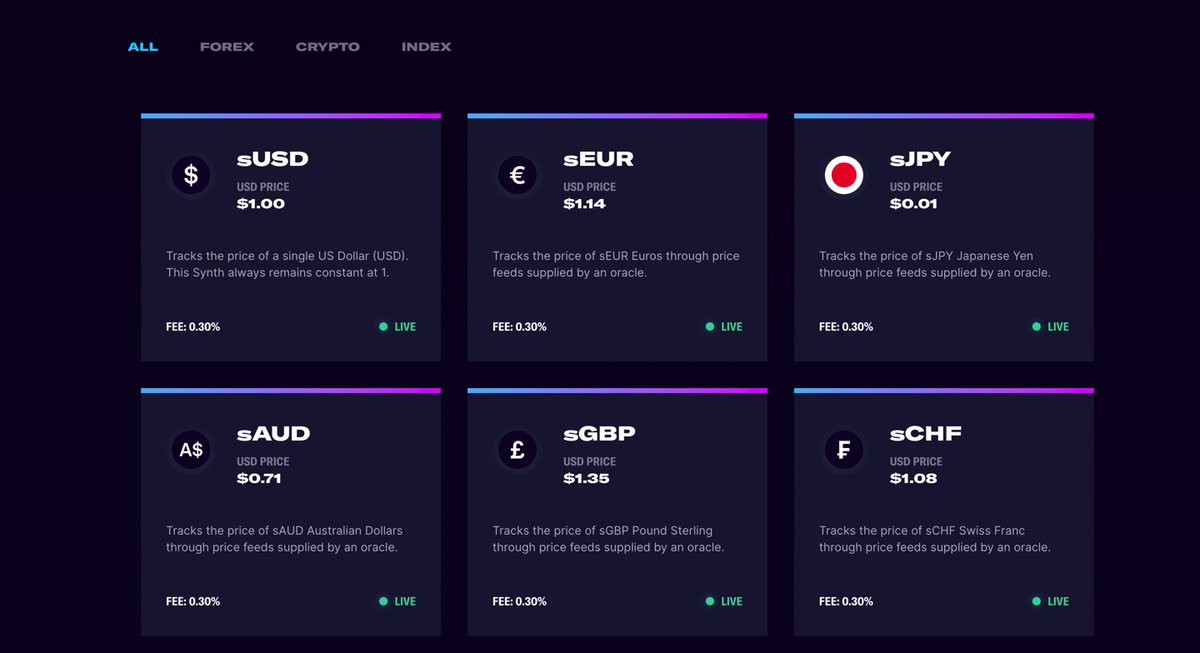

Want to trade other assets?

Synthetix offers a platform for users to swap various synthetic tokens like stocks, forex, or even precious metals!

They use oracles which take data off-chain and bring them on-chain to offer tokens which are pegged to real life assets... (14/107)

Synthetix offers a platform for users to swap various synthetic tokens like stocks, forex, or even precious metals!

They use oracles which take data off-chain and bring them on-chain to offer tokens which are pegged to real life assets... (14/107)

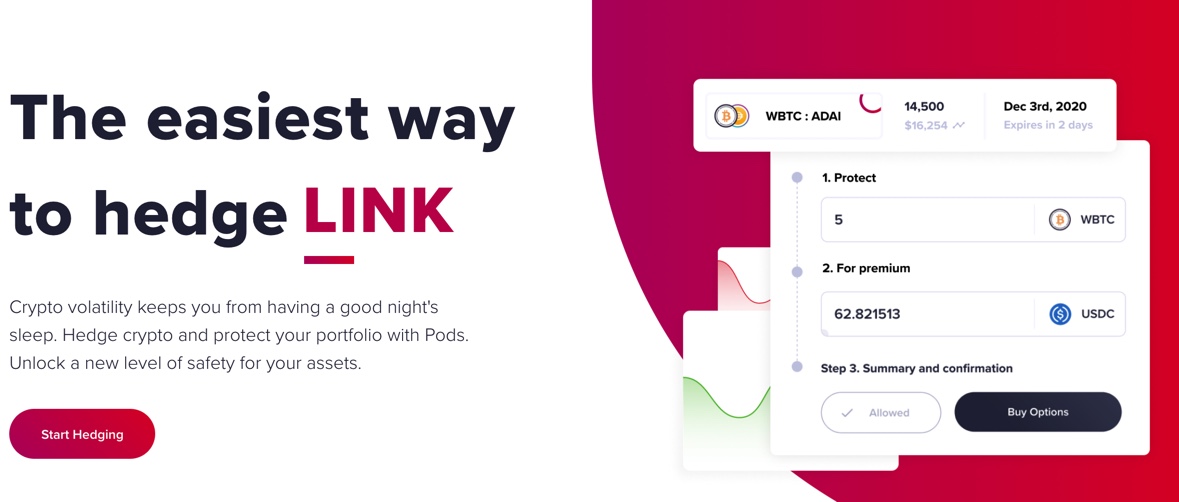

Want to hedge your bets?

Pods finance is a decentralized options protocol which introduces the "OptionsAMM."

The first of its kind.

DeFi users can hedge their holdings by purchasing put options, earn yield on their tokens, or maximize your yield as an LP on this dApp! (15/107)

Pods finance is a decentralized options protocol which introduces the "OptionsAMM."

The first of its kind.

DeFi users can hedge their holdings by purchasing put options, earn yield on their tokens, or maximize your yield as an LP on this dApp! (15/107)

Want to join the lottery?

Well, PoolTogether isn& #39;t just any lottery. It& #39;s a DeFi protocol allowing for "no loss lotteries."

How? Users are able to deposit funds, & yield is given to a verifiably random address in the pool. Losers can then still withdraw their assets. (16/107)

Well, PoolTogether isn& #39;t just any lottery. It& #39;s a DeFi protocol allowing for "no loss lotteries."

How? Users are able to deposit funds, & yield is given to a verifiably random address in the pool. Losers can then still withdraw their assets. (16/107)

Want to place a bet?

There are many options to choose from on Ethereum, the most popular being augur.

This is a global, no-limit betting platform where you can bet on sports events, economics, world events, and a whole lot more on a decentralized marketplace. (17/107)

There are many options to choose from on Ethereum, the most popular being augur.

This is a global, no-limit betting platform where you can bet on sports events, economics, world events, and a whole lot more on a decentralized marketplace. (17/107)

Need a loan?

ETH is great for this. With Maker (or many other protocols), you can deposit collateral & take a loan on your assets to use in the real world wherever.

This process involves no bank, no intermediary fees and offers much higher yield than trad finance. (18/107)

ETH is great for this. With Maker (or many other protocols), you can deposit collateral & take a loan on your assets to use in the real world wherever.

This process involves no bank, no intermediary fees and offers much higher yield than trad finance. (18/107)

Want to invest in a index?

Of course it& #39;s possible. There are a handful of DeFi native indexes that offer exposure to a basket of assets in a single, convenient token.

This can be an index of the top tokens in DeFi, a basket of NFTs, or anything else you could imagine. (19/107)

Of course it& #39;s possible. There are a handful of DeFi native indexes that offer exposure to a basket of assets in a single, convenient token.

This can be an index of the top tokens in DeFi, a basket of NFTs, or anything else you could imagine. (19/107)

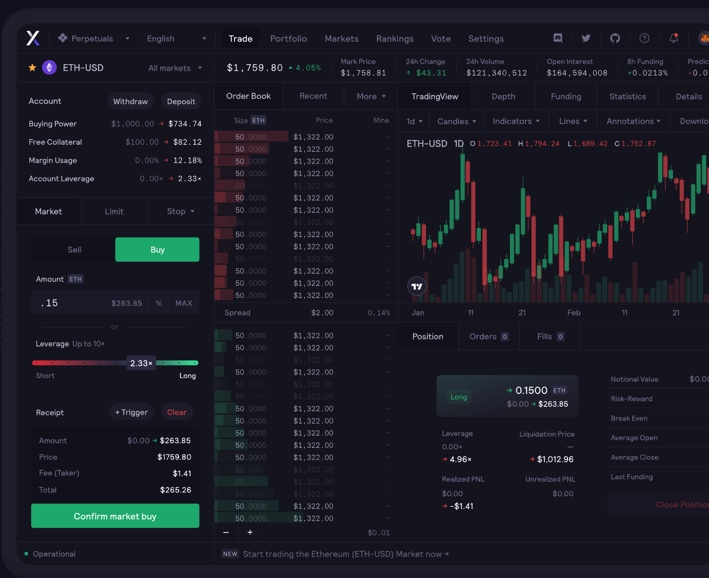

Want to trade with leverage?

DYDX offers the perfect interface for this! On it, you can trade perpetuals at any time on a variety of different contracts that are supported.

It uses StarkWare& #39;s layer 2 solution for increased security, fast withdrawals, and cheap trades. (20/107)

DYDX offers the perfect interface for this! On it, you can trade perpetuals at any time on a variety of different contracts that are supported.

It uses StarkWare& #39;s layer 2 solution for increased security, fast withdrawals, and cheap trades. (20/107)

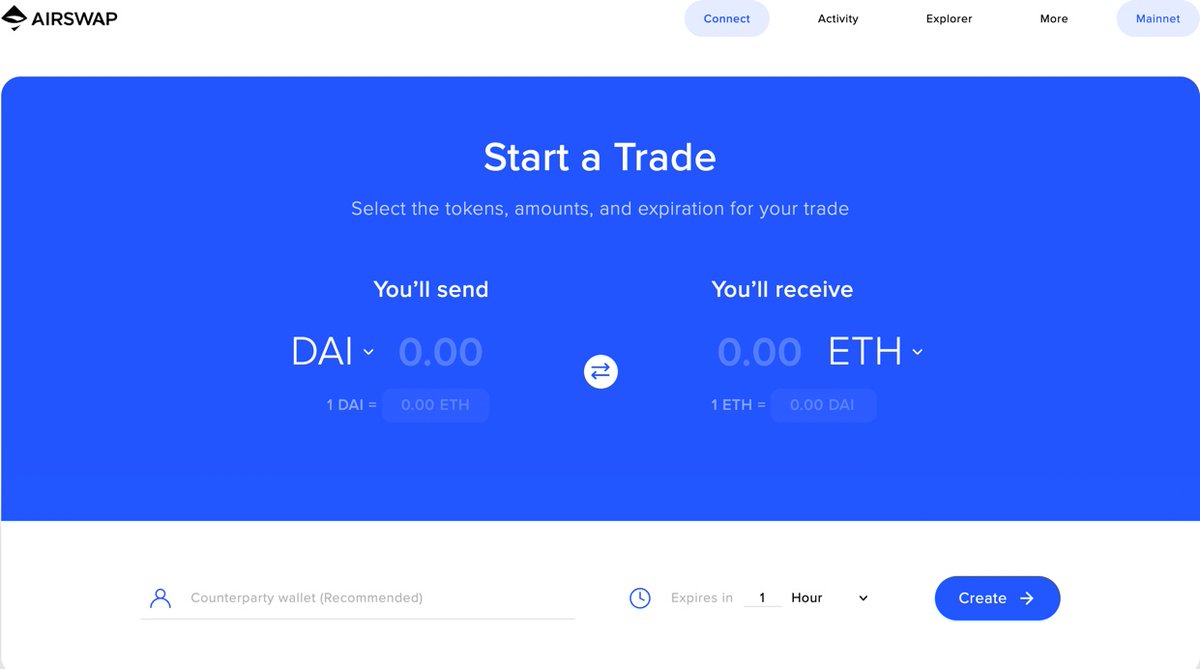

Want to swap tokens p2p?

AirSwap offers a unique P2P DEX: entirely open-source, supporting gas-less swaps. You can set up a trust-less trade with any counter-party, to conduct swaps that will only occur once specified conditions are met.

This is perfect for OTC. (21/107)

AirSwap offers a unique P2P DEX: entirely open-source, supporting gas-less swaps. You can set up a trust-less trade with any counter-party, to conduct swaps that will only occur once specified conditions are met.

This is perfect for OTC. (21/107)

Want to trade various forex currencies?

Fixed Forex provides an alternative to USD denominated stable coins. It allows liquidity providers exposure to currencies such as EUR, KRW, GBP, CHF, AUD, and JPY.

On the DEX, you can make trades with no slippage & minimal fees. (22/107)

Fixed Forex provides an alternative to USD denominated stable coins. It allows liquidity providers exposure to currencies such as EUR, KRW, GBP, CHF, AUD, and JPY.

On the DEX, you can make trades with no slippage & minimal fees. (22/107)

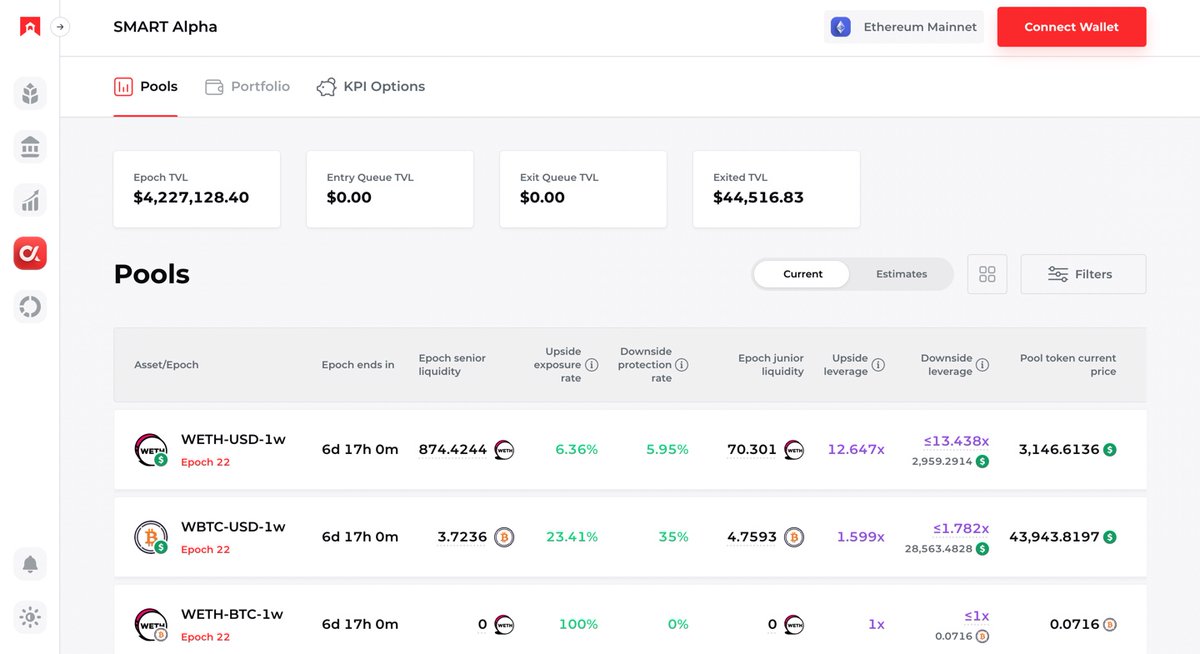

Want to tokenize your risk?

Barnbridge is a fluctuations derivatives protocol for hedging yield sensitivity and market price for assets.

Using tranched volatility derivatives, Barnbridge lets you clarify the exposure to risk you want to take on a specific token. (23/107)

Barnbridge is a fluctuations derivatives protocol for hedging yield sensitivity and market price for assets.

Using tranched volatility derivatives, Barnbridge lets you clarify the exposure to risk you want to take on a specific token. (23/107)

Want to get a bit more sophisticated?

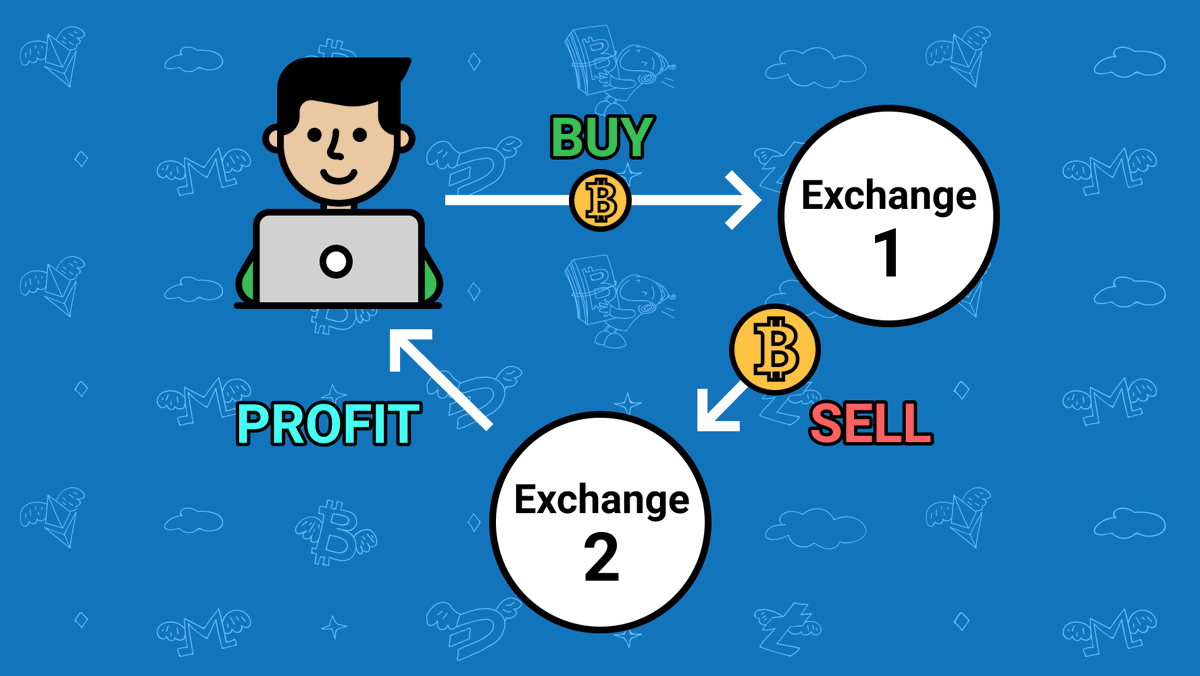

Arbitrage is a very profitable trade if done right. It involves of scanning different networks and exchanges to take advantage of price changes on tokens.

A bot will purchase tokens cheaper on uniswap & sell on sushiswap for profit (24/107)

Arbitrage is a very profitable trade if done right. It involves of scanning different networks and exchanges to take advantage of price changes on tokens.

A bot will purchase tokens cheaper on uniswap & sell on sushiswap for profit (24/107)

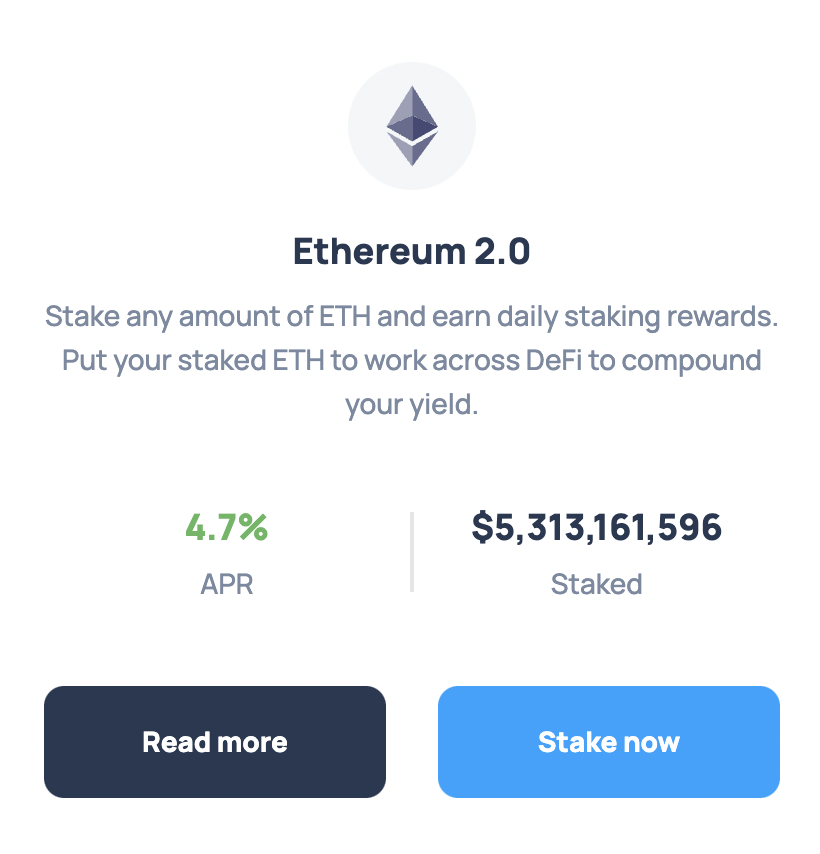

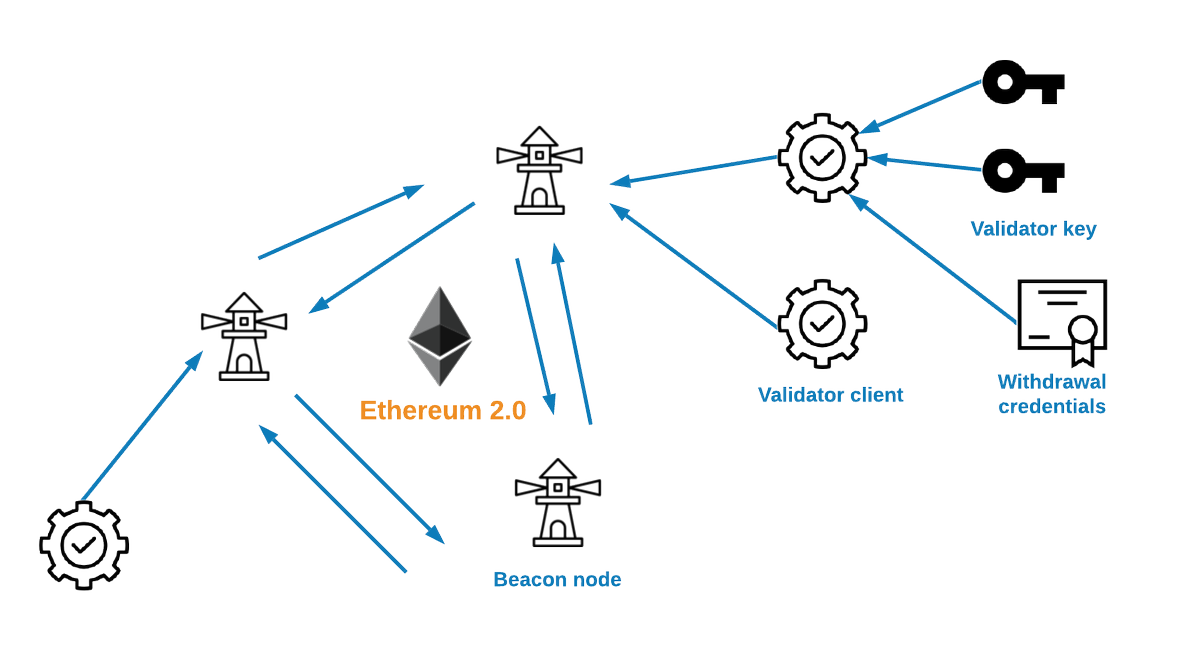

Want to stake?

There are plenty of tokens out there that can be staked to earn yield, including eth.

Stakers provide extra security for the network, and receive rewards for verifying txs.

APY for staking eth can be upwards of 7%, and is expected to increase soon. (25/107)

There are plenty of tokens out there that can be staked to earn yield, including eth.

Stakers provide extra security for the network, and receive rewards for verifying txs.

APY for staking eth can be upwards of 7%, and is expected to increase soon. (25/107)

Want a multi sig?

Gnosis provides a dApp for easily making multi-signature wallets that require multiple addresses to approve a tx

This is especially useful for project treasuries, daos, and anything else you could imagine.

These are customizable in many unique ways. (26/107)

Gnosis provides a dApp for easily making multi-signature wallets that require multiple addresses to approve a tx

This is especially useful for project treasuries, daos, and anything else you could imagine.

These are customizable in many unique ways. (26/107)

Want to start an auction?

Bounce finance let’s you create Fixed swap, Sealed-bid, Dutch and English auctions for you ERC-20 or ERC-721 tokens.

It is 100% permission-less

It additionally offers a tool kit for UIs, API access, and more for devs making projects. (27/107)

Bounce finance let’s you create Fixed swap, Sealed-bid, Dutch and English auctions for you ERC-20 or ERC-721 tokens.

It is 100% permission-less

It additionally offers a tool kit for UIs, API access, and more for devs making projects. (27/107)

Want to get the best quotes?

Decentralized exchange aggregators such as 1inch let users search through different pools and routes to determine which will offer minimal slippage.

It will then make one tx for you upon swapping to get you the best price for your trades (28/107)

Decentralized exchange aggregators such as 1inch let users search through different pools and routes to determine which will offer minimal slippage.

It will then make one tx for you upon swapping to get you the best price for your trades (28/107)

Want to trade tokens quickly and easily?

Visit Uniswap to utilize its automated market maker technology, allowing for pools of various tokens to be traded against at any time!

Furthermore, you may also provide liquidity and earn a portion of all trading fees! (29/107)

Visit Uniswap to utilize its automated market maker technology, allowing for pools of various tokens to be traded against at any time!

Furthermore, you may also provide liquidity and earn a portion of all trading fees! (29/107)

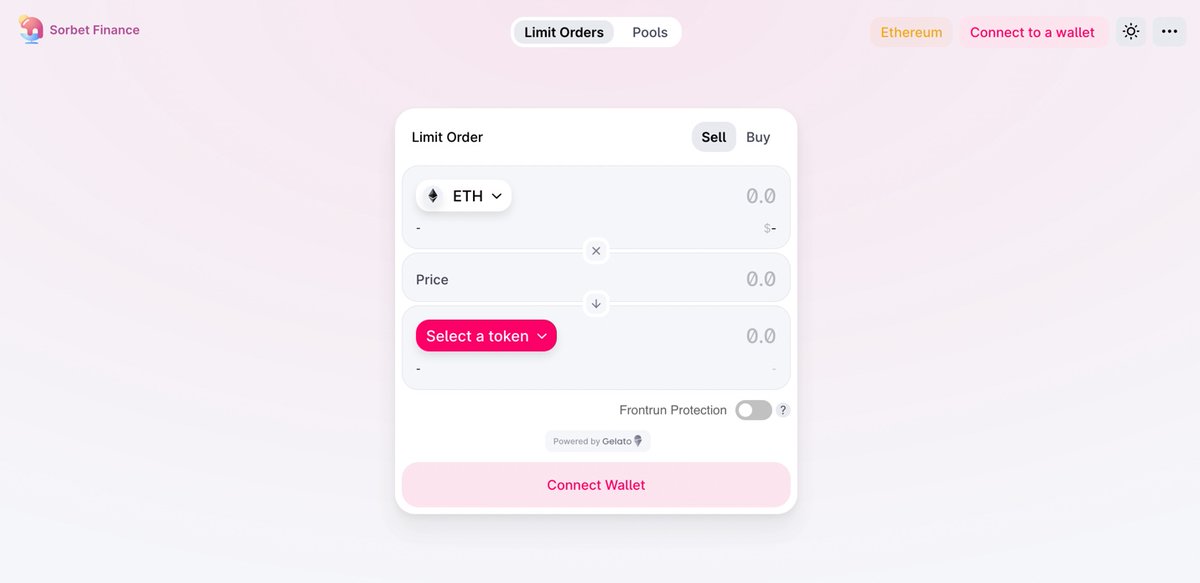

Want to set up limit orders?

Good news! Using Gelato Network and its bot network, we can automate these transactions to occur for us!

We can sell our tokens before they hit a certain price, or buy when it does. It has a UI like Uniswap for making these orders. (30/107)

Good news! Using Gelato Network and its bot network, we can automate these transactions to occur for us!

We can sell our tokens before they hit a certain price, or buy when it does. It has a UI like Uniswap for making these orders. (30/107)

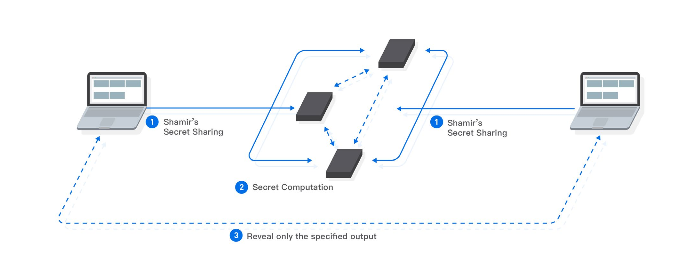

Want privacy?

Dark pools aren’t visible to the rest of the market.

Every trader in it only knows their own orders. RenVM is very useful for this.

This allows people to anonymously place large buy or sell orders without revealing their interest to other actors. (31/107)

Dark pools aren’t visible to the rest of the market.

Every trader in it only knows their own orders. RenVM is very useful for this.

This allows people to anonymously place large buy or sell orders without revealing their interest to other actors. (31/107)

Want a digital dollar?

There are several trustworthy stables to choose from which allow you to "cash out" while still being able to be benefit from DeFi.

These tokens are pegged to $1, and can be swapped back at any time

This includes things like $DAI, $USDC, & $USDT. (32/107)

There are several trustworthy stables to choose from which allow you to "cash out" while still being able to be benefit from DeFi.

These tokens are pegged to $1, and can be swapped back at any time

This includes things like $DAI, $USDC, & $USDT. (32/107)

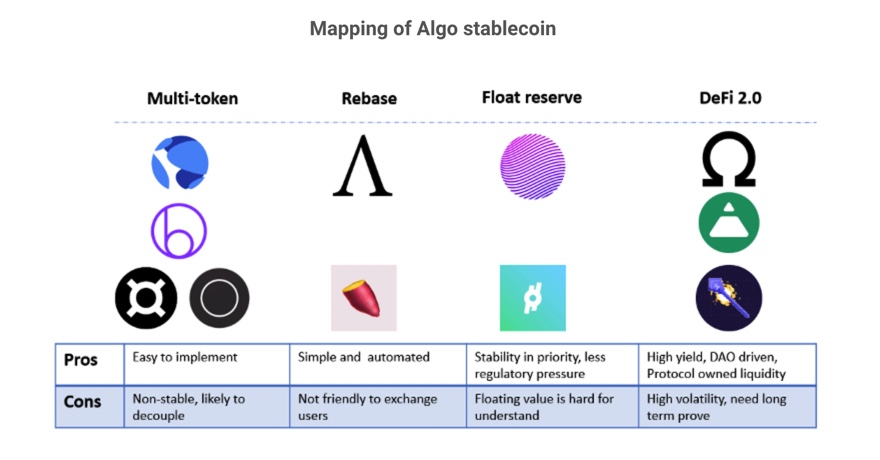

Want something more risky?

You can explore the fields of algorithmic stablecoins, which use different mechanics to keep tokens stable, outside of the trad methods.

$RAI is even more interesting here, as it has a floating price, yet still remains stable. (33/107)

You can explore the fields of algorithmic stablecoins, which use different mechanics to keep tokens stable, outside of the trad methods.

$RAI is even more interesting here, as it has a floating price, yet still remains stable. (33/107)

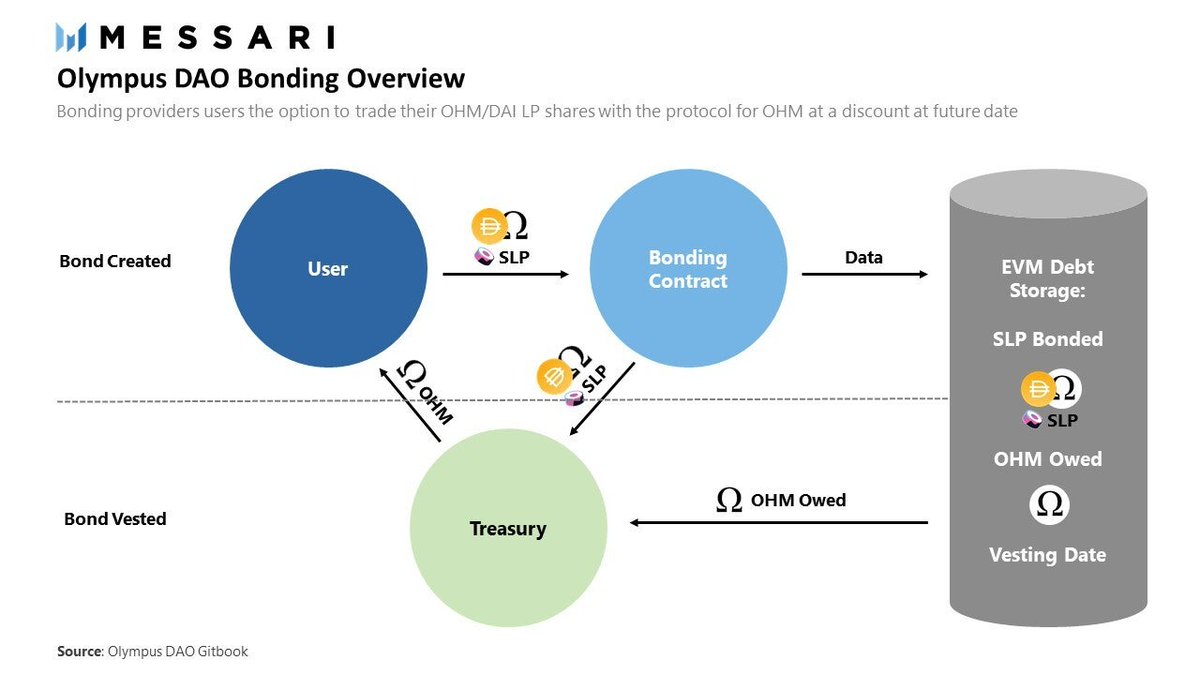

Wishing for high yield?

Anyone who owns liquidity provider tokens or certain stablecoins (such as DAI & FRAX) can sell them to Olympus in return for discounted OHM tokens.

Bonding is typically higher yield than staking, and allows the protocol to earn revenue (34/107)

Anyone who owns liquidity provider tokens or certain stablecoins (such as DAI & FRAX) can sell them to Olympus in return for discounted OHM tokens.

Bonding is typically higher yield than staking, and allows the protocol to earn revenue (34/107)

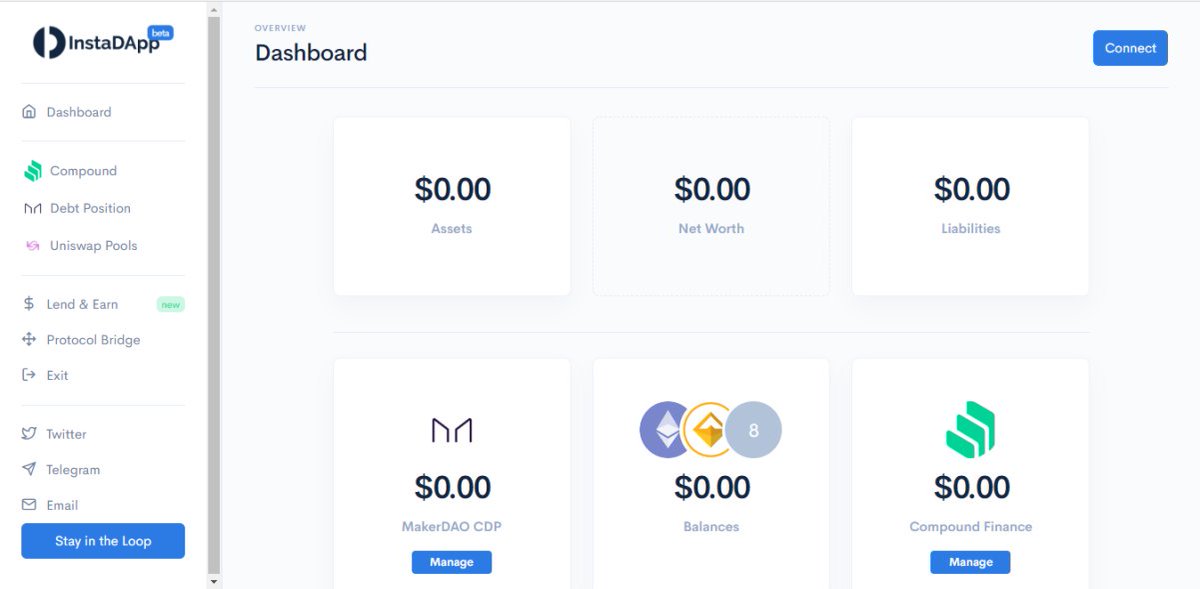

Want one platform for everything?

InstaDapp has just that. It combines many complex protocols into an easy to use one-click interface.

You can compare yield across chains, protocols, farms, and more with this dapp.

The best part? It is 100% trust-less. (35/107)

InstaDapp has just that. It combines many complex protocols into an easy to use one-click interface.

You can compare yield across chains, protocols, farms, and more with this dapp.

The best part? It is 100% trust-less. (35/107)

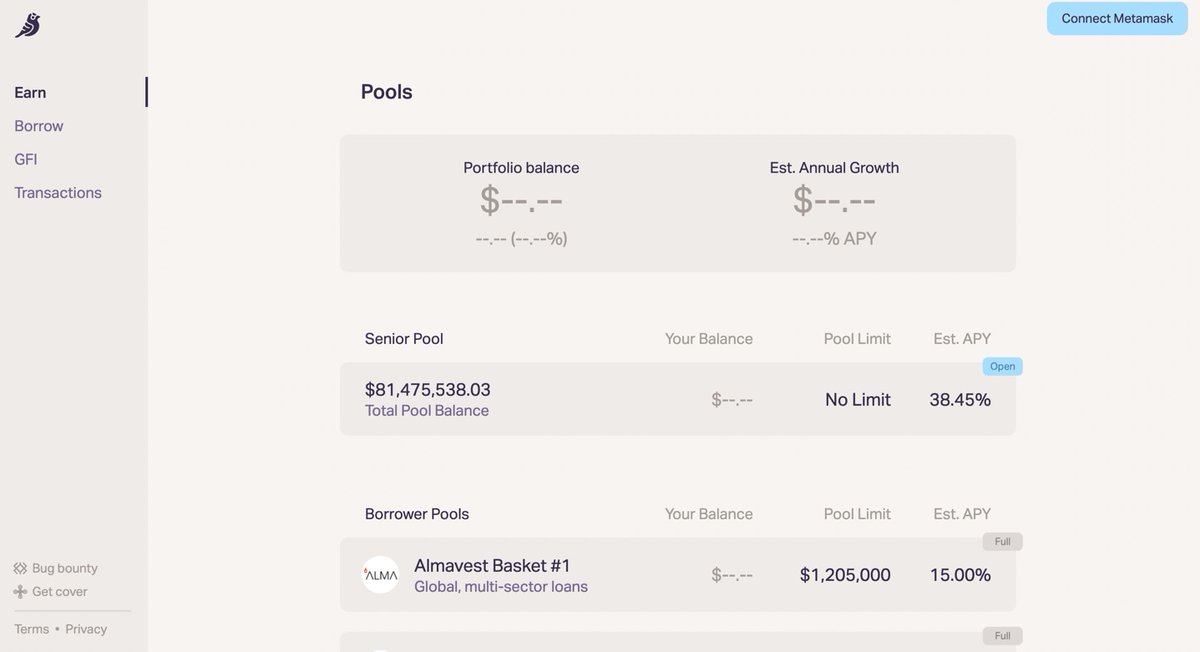

Want to get a loan with no capital?

Goldfinch aims to decentralize the process of making loans, AND getting loans without collateral, the “missing piece” that connects CeFi with DeFi.

So far they already have more than 200,000 borrowers across Mexico, Nigeria, and Asia (36/107)

Goldfinch aims to decentralize the process of making loans, AND getting loans without collateral, the “missing piece” that connects CeFi with DeFi.

So far they already have more than 200,000 borrowers across Mexico, Nigeria, and Asia (36/107)

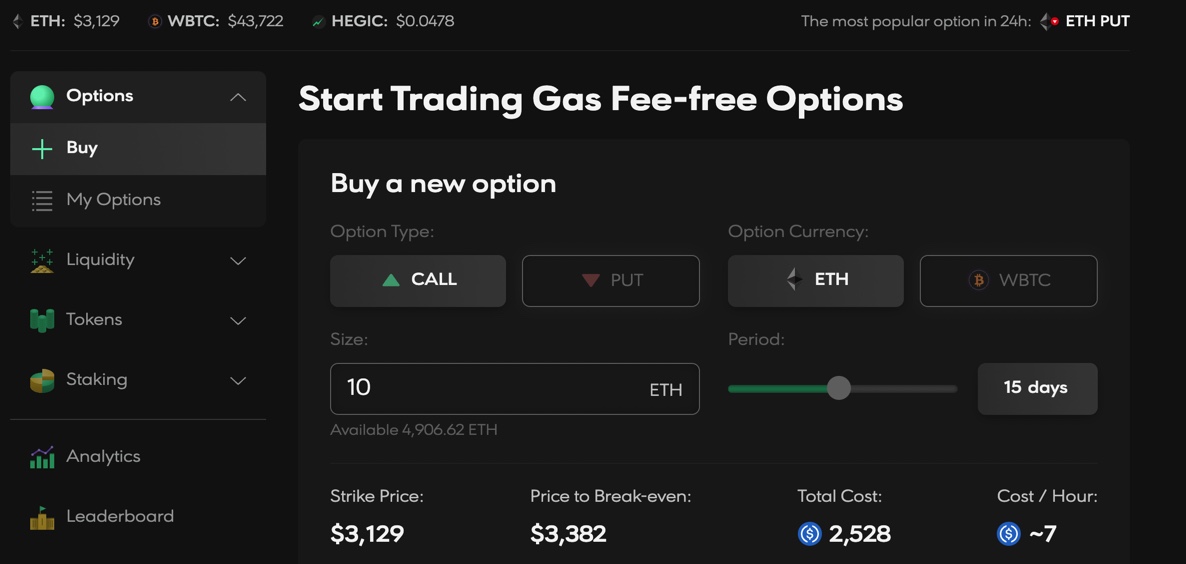

Looking for somewhere to trade options?

Look no further than Hegic, Opyn, or Ribbon where you& #39;ll get access to options with no questions asked!

Get started now without trusting a soul.

They feature cool things like gas-less trades, deep liquidity, and no KYC is needed (37/107)

Look no further than Hegic, Opyn, or Ribbon where you& #39;ll get access to options with no questions asked!

Get started now without trusting a soul.

They feature cool things like gas-less trades, deep liquidity, and no KYC is needed (37/107)

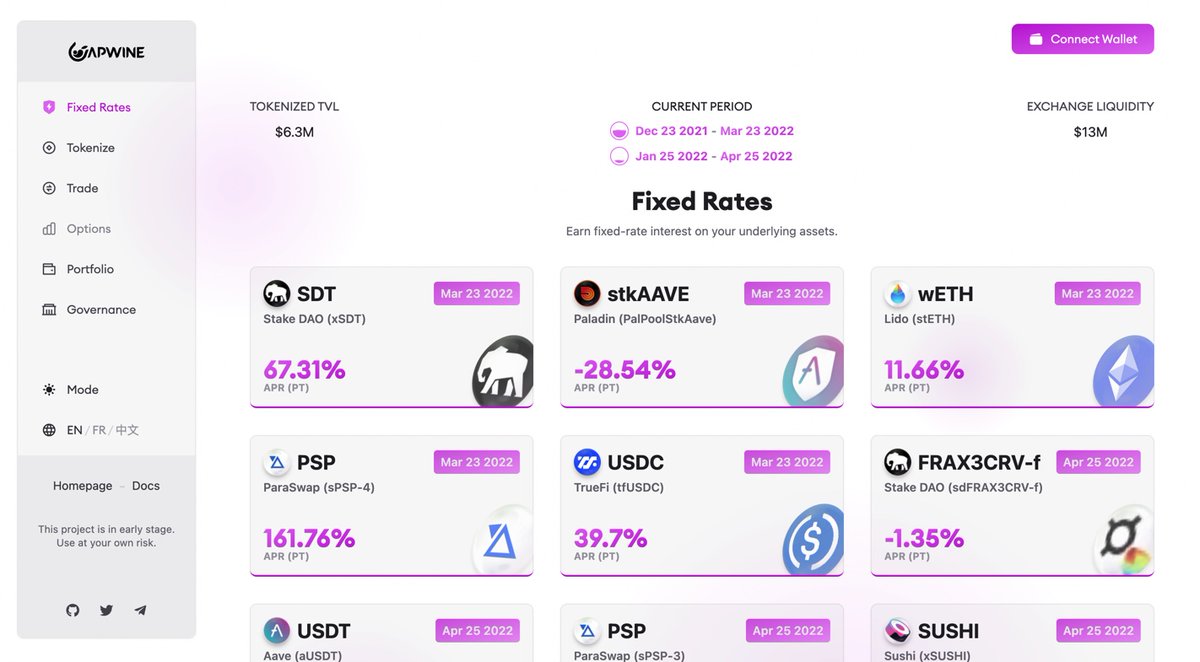

Want to tokenize your future yield?

APWine is an interesting protocol that allows you to trade unrealized yield in DeFi.

The key functions of this application combine to create an ecosystem of tokenized yield across DeFi protocols that users can speculate on. (38/107)

APWine is an interesting protocol that allows you to trade unrealized yield in DeFi.

The key functions of this application combine to create an ecosystem of tokenized yield across DeFi protocols that users can speculate on. (38/107)

Want to send money to your loved ones?

There are many services which offer unmatched levels of experience when compared to tradfi, including Aztec Network, and zkSync.

With these, you can instantly send across the world in a matter of seconds, with no banks in between! (39/107)

There are many services which offer unmatched levels of experience when compared to tradfi, including Aztec Network, and zkSync.

With these, you can instantly send across the world in a matter of seconds, with no banks in between! (39/107)

Want yield on DAI?

rDai (redeemable DAI) allows you to invest funds in an interest generating pool used for loans

You still hold on to the exact amount you that you invested, & can spend and transfer it at will

You also decide who benefits from the generated interest! (40/107)

rDai (redeemable DAI) allows you to invest funds in an interest generating pool used for loans

You still hold on to the exact amount you that you invested, & can spend and transfer it at will

You also decide who benefits from the generated interest! (40/107)

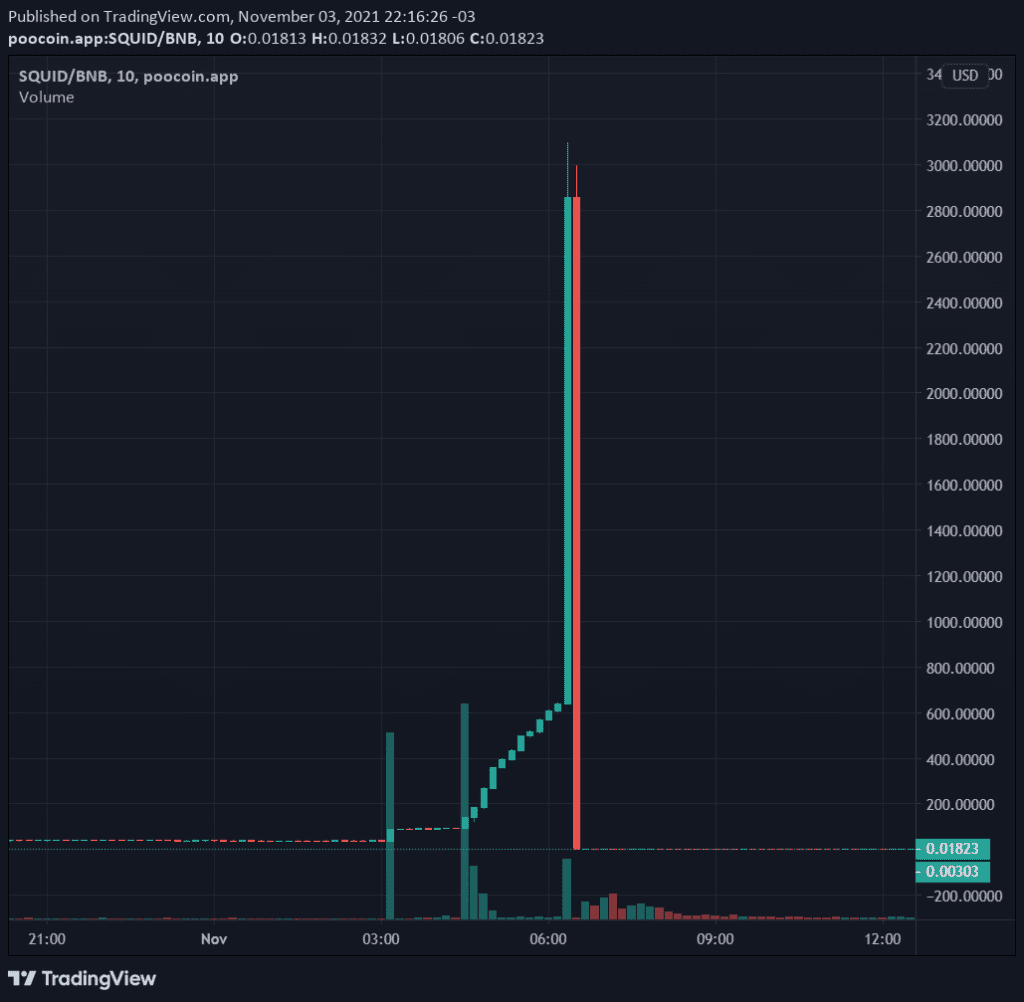

Want to get rugged?

I& #39;m not sure theres a better place for this. Experience your first rug pull quickly and easily on a DEX like uniswap or sushiswap. This is an important learning lesson.

Just don& #39;t make it an expensive one! (41/107)

I& #39;m not sure theres a better place for this. Experience your first rug pull quickly and easily on a DEX like uniswap or sushiswap. This is an important learning lesson.

Just don& #39;t make it an expensive one! (41/107)

Where to trade NFTs?

There are many applications which let you trade NFTs on ETH, including OpenSea, LooksRare, & Rarible. These apps let users place bids on or purchase NFTs similar to an Ebay site.

Platforms like this are easy to use, only requiring an ETH wallet! (43/107)

There are many applications which let you trade NFTs on ETH, including OpenSea, LooksRare, & Rarible. These apps let users place bids on or purchase NFTs similar to an Ebay site.

Platforms like this are easy to use, only requiring an ETH wallet! (43/107)

Want some Metaverse land?

Purchase LAND parcels on Decentraland, represented as NFTs, and do whatever you want on it!

You can create scenes, artworks, challenges and more, using the simple builder tool.

This LAND is owned by you until sold on the secondary market! (44/107)

Purchase LAND parcels on Decentraland, represented as NFTs, and do whatever you want on it!

You can create scenes, artworks, challenges and more, using the simple builder tool.

This LAND is owned by you until sold on the secondary market! (44/107)

Have you ever wanted to play video games, while making money for doing so?

Like millions of other gamers, you may enjoy the new play to earn narrative sprouting from ETH.

There are tons of applications built reinventing the way video games work, including Axie Infinity (45/107)

Like millions of other gamers, you may enjoy the new play to earn narrative sprouting from ETH.

There are tons of applications built reinventing the way video games work, including Axie Infinity (45/107)

Want to experience NFTs in VR?

Oncyber lets users connect their Ethereum wallet, and set up a display of their NFTs in a virtual reality environment, to share with friends or other people.

It is the easiest way for collectors to show their NFTs in immersive experiences (46/107)

Oncyber lets users connect their Ethereum wallet, and set up a display of their NFTs in a virtual reality environment, to share with friends or other people.

It is the easiest way for collectors to show their NFTs in immersive experiences (46/107)

Want to organize your holdings?

Holdberg Financial is a dapp letting users combine their wallet balances into a single, convenient token to be used and read by other apps if authorized.

This works by attesting different cryptocurrency wallet balances, and tx signing. (47/107)

Holdberg Financial is a dapp letting users combine their wallet balances into a single, convenient token to be used and read by other apps if authorized.

This works by attesting different cryptocurrency wallet balances, and tx signing. (47/107)

Like Ethmojis?

These are digital collectible NFTs that live on the ETH blockchain.

Each one is "composed" of different components; like eyes, ears and accessories. When you compose a new emoji, all the owners of the Ethmoji used in the composition earn royalties. (48/107)

These are digital collectible NFTs that live on the ETH blockchain.

Each one is "composed" of different components; like eyes, ears and accessories. When you compose a new emoji, all the owners of the Ethmoji used in the composition earn royalties. (48/107)

Want to trade NFTs like ERC-20s?

NFTx is a protocol that lets DeFi users create, mint and trade NFT-backed tokens.

It is essentially a community owned and led protocol for NFT index funds on Ethereum, that make NFTs tradable on an interface like Uniswap! (49/107)

NFTx is a protocol that lets DeFi users create, mint and trade NFT-backed tokens.

It is essentially a community owned and led protocol for NFT index funds on Ethereum, that make NFTs tradable on an interface like Uniswap! (49/107)

Ever wish you could invest in your favorite creator/artist?

With fan tokens, and web3 this is possible. There are already things like Chiliz, and Rally available to the masses on ETH.

It lets fans support who they want, and become part of an exclusive community! (50/107)

With fan tokens, and web3 this is possible. There are already things like Chiliz, and Rally available to the masses on ETH.

It lets fans support who they want, and become part of an exclusive community! (50/107)

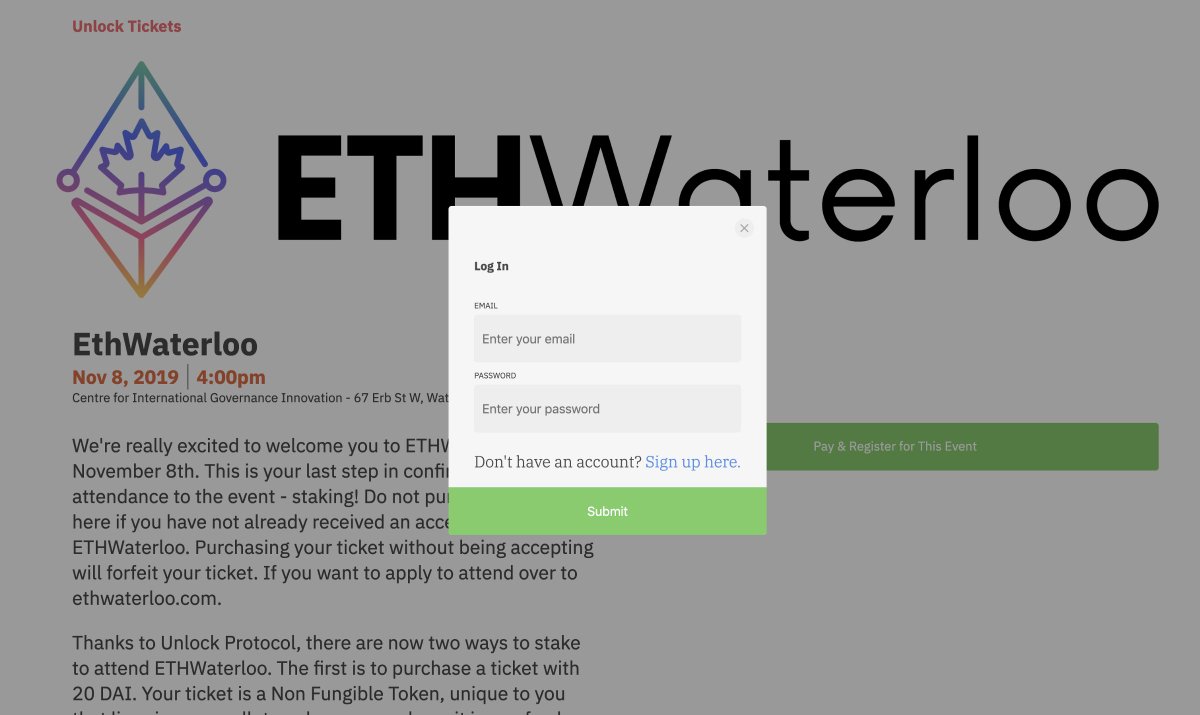

Want to create tickets for an event?

Ethereum has many applications exactly for this purpose, and they even let you customize specific parameters for the tickets including a secondary market tax on each transaction to get extra funds from royalties. (52/107)

Ethereum has many applications exactly for this purpose, and they even let you customize specific parameters for the tickets including a secondary market tax on each transaction to get extra funds from royalties. (52/107)

Like to write?

Writers looking for new & interesting ways to grow your audience & possibly make money, this may interest you.

Mirror xyz is a decentralized writing platform that allows writers to earn in crypto & seek crowdfunding opportunities for projects via NFTs. (53/107)

Writers looking for new & interesting ways to grow your audience & possibly make money, this may interest you.

Mirror xyz is a decentralized writing platform that allows writers to earn in crypto & seek crowdfunding opportunities for projects via NFTs. (53/107)

Like the internet?

BAT is a token on ETH that powers Brave’s digital advertising platform

Users on Brave’s browser can choose to replace the ads they see with ads on Brave’s network

These users are then compensated in BAT from advertisers for their attention. (54/107)

BAT is a token on ETH that powers Brave’s digital advertising platform

Users on Brave’s browser can choose to replace the ads they see with ads on Brave’s network

These users are then compensated in BAT from advertisers for their attention. (54/107)

Unstoppable websites?

Unstoppable Domains aims to onboard the world onto the decentralized web by building blockchain based domain names.

These domains allow users to replace cryptocurrency addresses with human-readable names, host decentralized websites, & more. (55/107)

Unstoppable Domains aims to onboard the world onto the decentralized web by building blockchain based domain names.

These domains allow users to replace cryptocurrency addresses with human-readable names, host decentralized websites, & more. (55/107)

Web3 profiles?

3Box is the best way for devs to manage user data w/o operating a backend server

Data is publicly available, but private data can only be decrypted by dapps w explicit permission

With 3Box’s SDK, developers can easily create DIDs, auth, profiles, & more (56/107)

3Box is the best way for devs to manage user data w/o operating a backend server

Data is publicly available, but private data can only be decrypted by dapps w explicit permission

With 3Box’s SDK, developers can easily create DIDs, auth, profiles, & more (56/107)

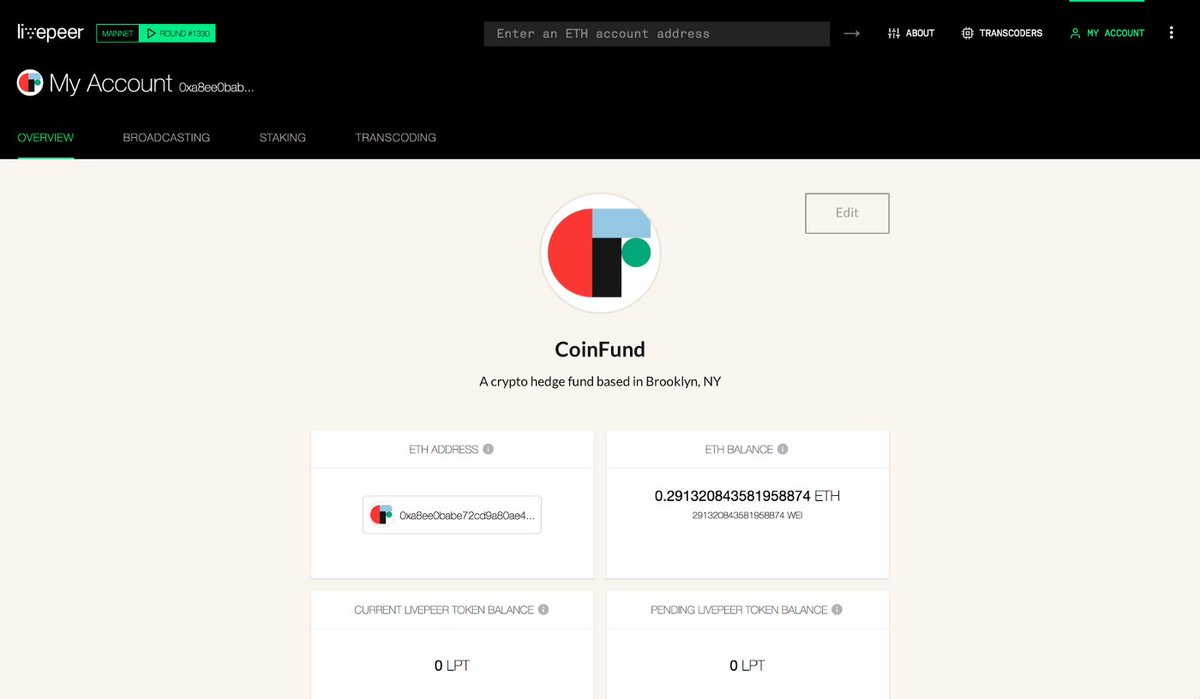

Fan of videos?

80% of bandwidth is from streaming. This is very expensive for companies.

Livepeer has launched a platform as a service for devs who want to add live video to their projects, increasing reliability of streaming & decreasing costs associated w it by 50x. (57/107)

80% of bandwidth is from streaming. This is very expensive for companies.

Livepeer has launched a platform as a service for devs who want to add live video to their projects, increasing reliability of streaming & decreasing costs associated w it by 50x. (57/107)

Want a human-readable wallet address?

The Ethereum Name Service (ENS) is essentially a nickname generator for public ETH addresses.

On the ENS platform, users can translate machine readable ETH addresses into human readable addresses like “alice.eth.” (58/107)

The Ethereum Name Service (ENS) is essentially a nickname generator for public ETH addresses.

On the ENS platform, users can translate machine readable ETH addresses into human readable addresses like “alice.eth.” (58/107)

Are you a creator?

Creaton is a decentralized competitor to OnlyFans & Patreon that offers monetization for creators through memberships.

With Creaton, artists can grant themselves an unlimited means of income by trading NFTs through a subscription-based model. (59/107)

Creaton is a decentralized competitor to OnlyFans & Patreon that offers monetization for creators through memberships.

With Creaton, artists can grant themselves an unlimited means of income by trading NFTs through a subscription-based model. (59/107)

Like music?

In a study done by Citigroup, an estimated 12% of profits in the music industry found its way back to artists

Audius is a streaming platform that aims to solve this by allows artists to showcase & merchandise their own NFTs in a direct-to-fans approach. (60/107)

In a study done by Citigroup, an estimated 12% of profits in the music industry found its way back to artists

Audius is a streaming platform that aims to solve this by allows artists to showcase & merchandise their own NFTs in a direct-to-fans approach. (60/107)

Want to donate?

Many organizations are overwhelmed with bad records & lost funds.

However, the blockchain could revolutionize this industry.

All txs on the blockchain are done securely, transparently, & with minimal fees. (61/107)

Many organizations are overwhelmed with bad records & lost funds.

However, the blockchain could revolutionize this industry.

All txs on the blockchain are done securely, transparently, & with minimal fees. (61/107)

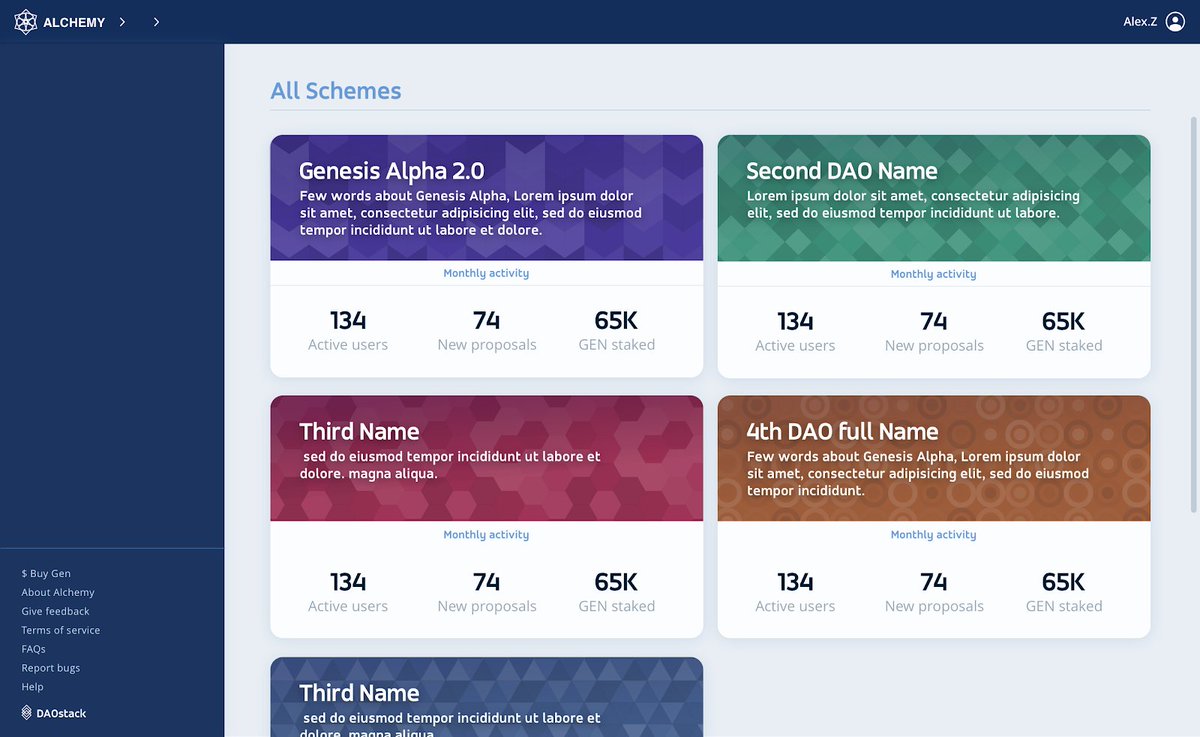

Want to kickstart your own DAO?

A decentralized autonomous organization can be created with no coding knowledge.

Using apps like alchemy or aragon, this process becomes as simple as a few clicks and confirming the transaction in your wallet from there. (63/107)

A decentralized autonomous organization can be created with no coding knowledge.

Using apps like alchemy or aragon, this process becomes as simple as a few clicks and confirming the transaction in your wallet from there. (63/107)

Want DAO power?

Existing governance structures suffer from voter apathy & low participation.

CVP aims to solve this problem of meta governance by allowing gov token holders to pool together in an index, & delegate their voting power to PowerPool stakeholders. (64/107)

Existing governance structures suffer from voter apathy & low participation.

CVP aims to solve this problem of meta governance by allowing gov token holders to pool together in an index, & delegate their voting power to PowerPool stakeholders. (64/107)

Like BTC?

DeFi has had an explosive growth over the past year, however, the majority of BTC holders have been sidelined from this.

As a result Badger DAO set out to build DeFi for BTC, making it easy to bridge BTC to other blockchains & use it as collateral in DeFi. (65/107)

DeFi has had an explosive growth over the past year, however, the majority of BTC holders have been sidelined from this.

As a result Badger DAO set out to build DeFi for BTC, making it easy to bridge BTC to other blockchains & use it as collateral in DeFi. (65/107)

Curious about DAOs?

DAOs offer a robust architecture where anyone, even your average user, can vote on and have a say in the future direction of their favorite protocol.

Don’t like how things are being run? Create a proposal or vote on a change. (66/107)

DAOs offer a robust architecture where anyone, even your average user, can vote on and have a say in the future direction of their favorite protocol.

Don’t like how things are being run? Create a proposal or vote on a change. (66/107)

Don& #39;t like governance?

The concept of ungovernance was popularized by Reflexer.

Their belief is that governance is detrimental to every protocols sustainability in the long run.

Reflexer’s ungovernance roadmap aims to progressively remove human control over the code. (67/107)

The concept of ungovernance was popularized by Reflexer.

Their belief is that governance is detrimental to every protocols sustainability in the long run.

Reflexer’s ungovernance roadmap aims to progressively remove human control over the code. (67/107)

Want to team up?

Constitution DAO is a group organized to raise money to bid on a copy of the United States Constitution, which was put up for auction at Sotheby’s.

The group raised $47m in ETH from over 17,000 contributors but eventually lost to a bid of $43.2m. (68/107)

Constitution DAO is a group organized to raise money to bid on a copy of the United States Constitution, which was put up for auction at Sotheby’s.

The group raised $47m in ETH from over 17,000 contributors but eventually lost to a bid of $43.2m. (68/107)

Want to join a guild?

The explosion of Play to Earn gaming has led to innovative ways projects can profit

Yield Guild purchases NFTs required to participate in P2E games, then lends them out to guild members in exchange for profits made from playing the game. (69/107)

The explosion of Play to Earn gaming has led to innovative ways projects can profit

Yield Guild purchases NFTs required to participate in P2E games, then lends them out to guild members in exchange for profits made from playing the game. (69/107)

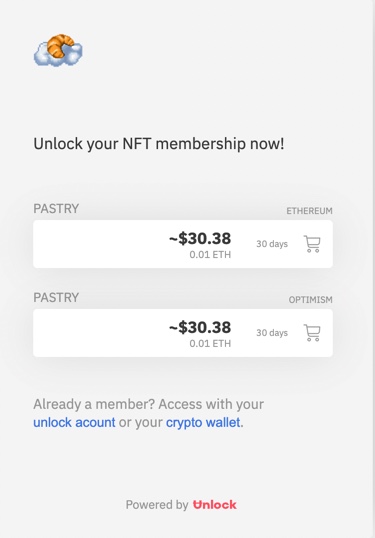

Did you know NFTs can be used for much than art?

Using Unlock, creators can add “locks” to their creations by adding a JS snippet on a website

This snippet acts as a paywall to the content, which can only be viewed after purchasing a key (NFT) associated with the lock. (71/107)

Using Unlock, creators can add “locks” to their creations by adding a JS snippet on a website

This snippet acts as a paywall to the content, which can only be viewed after purchasing a key (NFT) associated with the lock. (71/107)

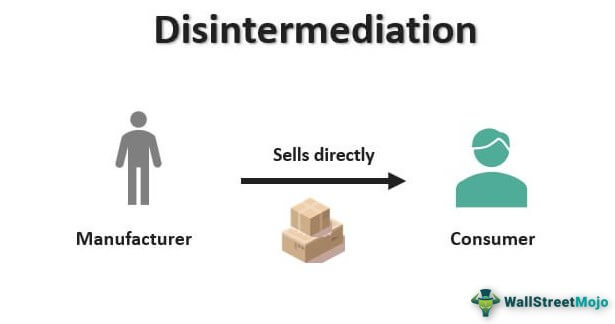

Annoyed by middlemen?

In its current model, the entertainment industry is littered with middlemen pocketing profits that should go to the creators.

Using NFTs, creators & artists can bypass middlemen, and ensure that royalties on sales are going to them through code. (72/107)

In its current model, the entertainment industry is littered with middlemen pocketing profits that should go to the creators.

Using NFTs, creators & artists can bypass middlemen, and ensure that royalties on sales are going to them through code. (72/107)

Don& #39;t like MEV?

KeeperDAO has a novel concept called the “Hiding game”, which hides & redistributes MEV

When a trade is submitted, it is sent to a private order book where only whitelisted keepers can execute it, with all MEV profits distributed to the treasury. (73/107)

KeeperDAO has a novel concept called the “Hiding game”, which hides & redistributes MEV

When a trade is submitted, it is sent to a private order book where only whitelisted keepers can execute it, with all MEV profits distributed to the treasury. (73/107)

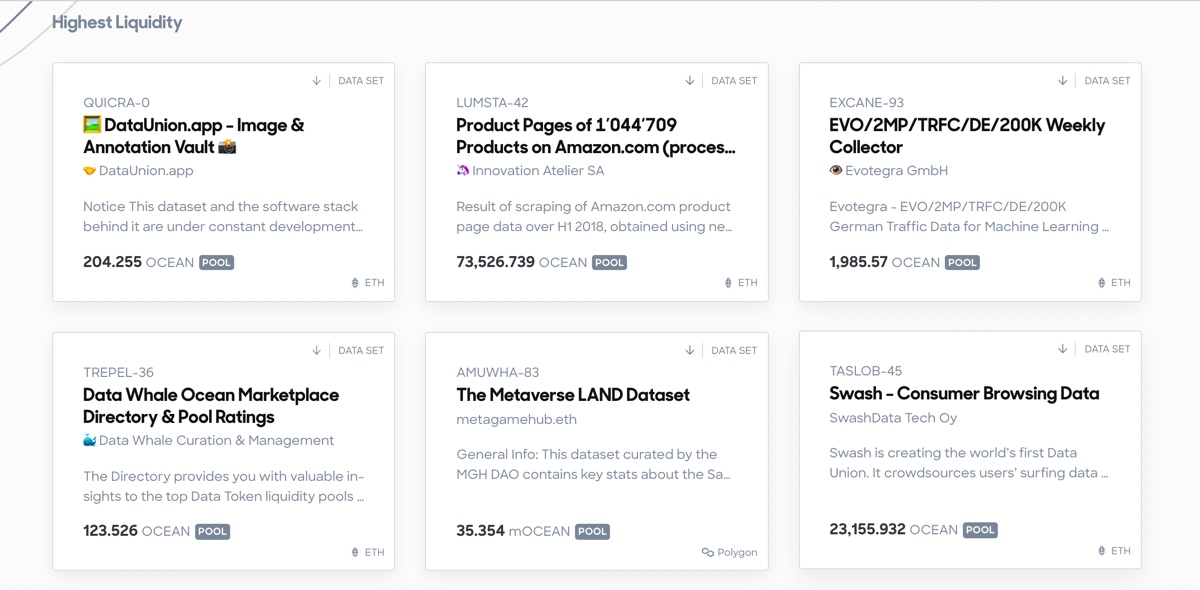

Need decentralized data?

Using Ocean, users can monetize & exchange data & data-based services.

Ocean uses “datatokens” to gate access to data sets. These tokens are then redeemed by users who need to access the information. (74/107)

Using Ocean, users can monetize & exchange data & data-based services.

Ocean uses “datatokens” to gate access to data sets. These tokens are then redeemed by users who need to access the information. (74/107)

Wanna bet?

"I Bet You" is a platform that takes the basic principles of gambling & combines it with crypto.

Using the immutable nature of smart contracts, both a challenger & opposer can send tokens to smart contract which acts as escrow & bet on anything imaginable. (75/107)

"I Bet You" is a platform that takes the basic principles of gambling & combines it with crypto.

Using the immutable nature of smart contracts, both a challenger & opposer can send tokens to smart contract which acts as escrow & bet on anything imaginable. (75/107)

Like UBI?

Proof of humanity’s token is a project setting out to provide a basic income to every human being.

Users can go through a verification process to prove their uniqueness.

Once verified, the user is streamlined a basic income of 1 $UBI token per hour. (76/107)

Proof of humanity’s token is a project setting out to provide a basic income to every human being.

Users can go through a verification process to prove their uniqueness.

Once verified, the user is streamlined a basic income of 1 $UBI token per hour. (76/107)

Want decentralized resolutions?

Kleros is crypto based dispute resolution dapp aiming to create decentralized arbitration.

When disputes arise, they& #39;re sent to Kleros Court, a crowdsourced pool of jurors with the skills necessary to settle disputes in a timely manner. (77/107)

Kleros is crypto based dispute resolution dapp aiming to create decentralized arbitration.

When disputes arise, they& #39;re sent to Kleros Court, a crowdsourced pool of jurors with the skills necessary to settle disputes in a timely manner. (77/107)

Legal smart contracts?

Legal agreements are fractured. Agreements sit as attachments in emails, or in cabinets until a dispute arises.

With Open Law, agreements can be signed & stored securely, & embedded with smart contracts to decrease ambiguity around legal prose. (78/107)

Legal agreements are fractured. Agreements sit as attachments in emails, or in cabinets until a dispute arises.

With Open Law, agreements can be signed & stored securely, & embedded with smart contracts to decrease ambiguity around legal prose. (78/107)

Need proof?

It turns out blockchains are useful for proving livelihood

In 2017, rumors stated Vitalik died in a car crash.

The rumor spread quickly, before Vitalik posted a selfie on Twitter w info on the latest block mined, providing cryptographic proof he was alive. (79/107)

It turns out blockchains are useful for proving livelihood

In 2017, rumors stated Vitalik died in a car crash.

The rumor spread quickly, before Vitalik posted a selfie on Twitter w info on the latest block mined, providing cryptographic proof he was alive. (79/107)

Want on-chain notifs?

In a market where time is always of the essence, being notified is crucial.

EPNS is a notification protocol for dapps on ETH.

Using EPNS, Web3 actors can create notifications that are triggered when a smart contract reaches certain conditions. (80/107)

In a market where time is always of the essence, being notified is crucial.

EPNS is a notification protocol for dapps on ETH.

Using EPNS, Web3 actors can create notifications that are triggered when a smart contract reaches certain conditions. (80/107)

Feeling generous?

Giveth is a community using $ETH to empower environmental & humanistic impact projects.

The Giveth platform creates bridges between for-good projects & givers looking to make a difference.

Creation of philanthropic projects can be done within minutes (81/107)

Giveth is a community using $ETH to empower environmental & humanistic impact projects.

The Giveth platform creates bridges between for-good projects & givers looking to make a difference.

Creation of philanthropic projects can be done within minutes (81/107)

Want to join?

ETH’s eco is filled with diverse & thriving projects looking for a hand.

If you have knowledge in a specific field, or feel like you could be of use to these projects, they will not turn you down.

You may even be rewarded monetarily for contributions. (82/107)

ETH’s eco is filled with diverse & thriving projects looking for a hand.

If you have knowledge in a specific field, or feel like you could be of use to these projects, they will not turn you down.

You may even be rewarded monetarily for contributions. (82/107)

Need funds?

ICOs are one of the best avenues for crowdfunding.

Due to the distributed nature of $ETH, projects looking for funding can launch an ICO & reach an exponentially higher number of investors, and, therefore, raise an exponentially higher amount of capital. (83/107)

ICOs are one of the best avenues for crowdfunding.

Due to the distributed nature of $ETH, projects looking for funding can launch an ICO & reach an exponentially higher number of investors, and, therefore, raise an exponentially higher amount of capital. (83/107)

Need help gathering a community or potential investors for your project?

Look no further than airdrops.

As seen by Uniswap & ENS, airdrops are one of the most efficient ways to kickstart a project & align interests within a community. (84/107)

Look no further than airdrops.

As seen by Uniswap & ENS, airdrops are one of the most efficient ways to kickstart a project & align interests within a community. (84/107)

Getting married?

Of all the fringe use cases of blockchain technology, marriage has somehow found its way in there.

In April of 2021, a California couple wrote a 2218 line smart contract tokenizing their wedding rings as NFTs. (85/107) https://twitter.com/rgoldilox/status/1378014362896461839?s=21">https://twitter.com/rgoldilox...

Of all the fringe use cases of blockchain technology, marriage has somehow found its way in there.

In April of 2021, a California couple wrote a 2218 line smart contract tokenizing their wedding rings as NFTs. (85/107) https://twitter.com/rgoldilox/status/1378014362896461839?s=21">https://twitter.com/rgoldilox...

Need insurance?

Decentralized insurance protocol, Etherisc, showcased Ethereum’s ability to act as an unbiased insurer when it processed insurance payouts for more than 17k farmers in Kenya.

It allows thousands of farmers to receive coverage for weather related risks. (86/107)

Decentralized insurance protocol, Etherisc, showcased Ethereum’s ability to act as an unbiased insurer when it processed insurance payouts for more than 17k farmers in Kenya.

It allows thousands of farmers to receive coverage for weather related risks. (86/107)

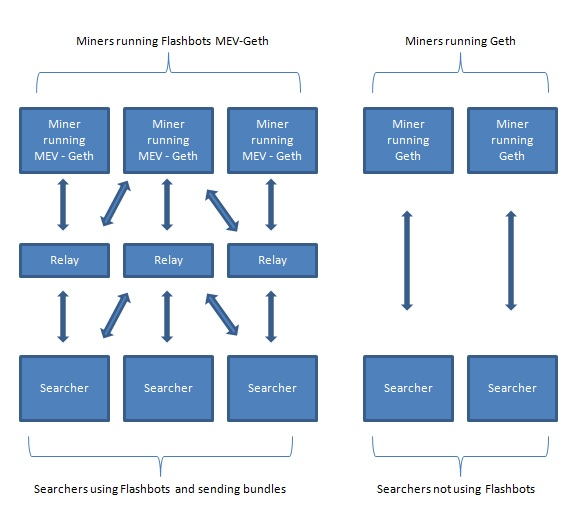

Want private txs?

Flashbots is an RPC endpoint that enables front-running protection, no failed tx’s, & priority in blocks.

When a user submits a tx using the flashbots RPC, it is sent directly to the flashbots auction, then directly to miners, not the public mempool. (87/107)

Flashbots is an RPC endpoint that enables front-running protection, no failed tx’s, & priority in blocks.

When a user submits a tx using the flashbots RPC, it is sent directly to the flashbots auction, then directly to miners, not the public mempool. (87/107)

Thirsty?

Adult entertainers have a hard time finding platforms that will process payments related to their work, often resorting to platforms w high fees.

Spankchain aims to solve this by creating an adult entertainment dapp where viewers pay creators directly in ETH. (88/107)

Adult entertainers have a hard time finding platforms that will process payments related to their work, often resorting to platforms w high fees.

Spankchain aims to solve this by creating an adult entertainment dapp where viewers pay creators directly in ETH. (88/107)

Tired of gas fees?

Gas fees on ETH can be a nuisance for frequent traders. Luckily, we have optimistic rollups.

Optimistic rollups like Arbitrum & Optimism move extensive computation off Layer 1 ETH, & onto L2 platforms where txs can be done at a fraction of the cost (90/107)

Gas fees on ETH can be a nuisance for frequent traders. Luckily, we have optimistic rollups.

Optimistic rollups like Arbitrum & Optimism move extensive computation off Layer 1 ETH, & onto L2 platforms where txs can be done at a fraction of the cost (90/107)

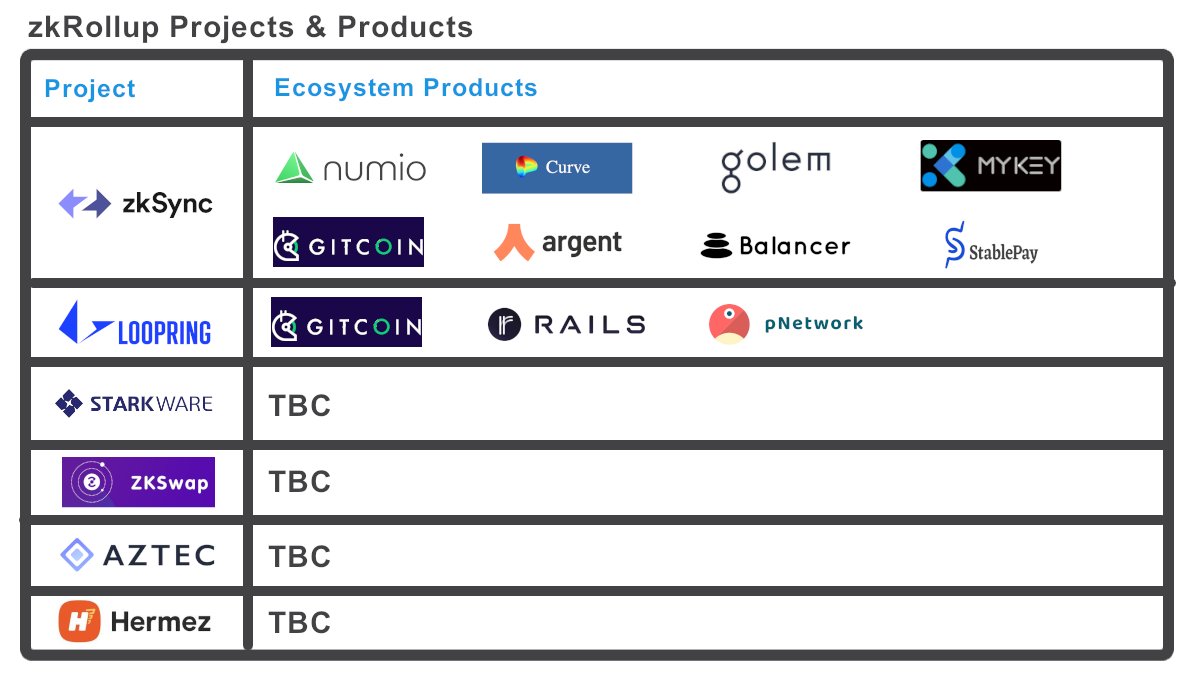

Not happy Optimistic rollups? No problem, zkproof rollups will solve this.

ZK rollups like ZkSync do this by bundling up txs into batches, performing the computation on L2 then submitting them back to L1 along with a cryptographic proof that validates each tx (91/107)

ZK rollups like ZkSync do this by bundling up txs into batches, performing the computation on L2 then submitting them back to L1 along with a cryptographic proof that validates each tx (91/107)

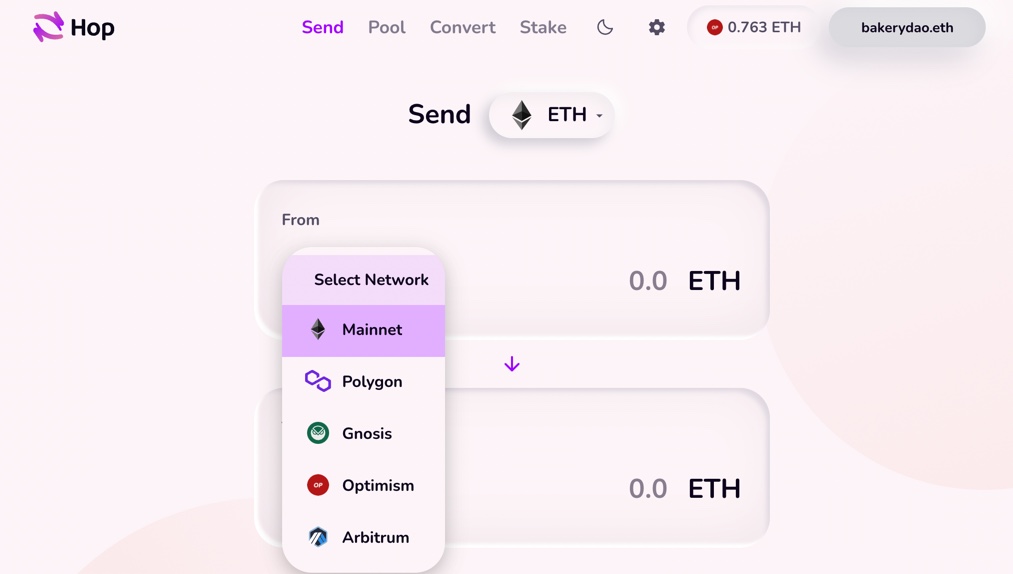

Like L2?

Hop Protocol allows users to transfer tokens directly between L2s, sidechains, & L1 ETH

The Hop Bridge issues hTokens that can be moved between L2& #39;s or claimed on layer-1 for its underlying asset, allowing users to bypass withdraw periods on optimistic rollups (92/107)

Hop Protocol allows users to transfer tokens directly between L2s, sidechains, & L1 ETH

The Hop Bridge issues hTokens that can be moved between L2& #39;s or claimed on layer-1 for its underlying asset, allowing users to bypass withdraw periods on optimistic rollups (92/107)

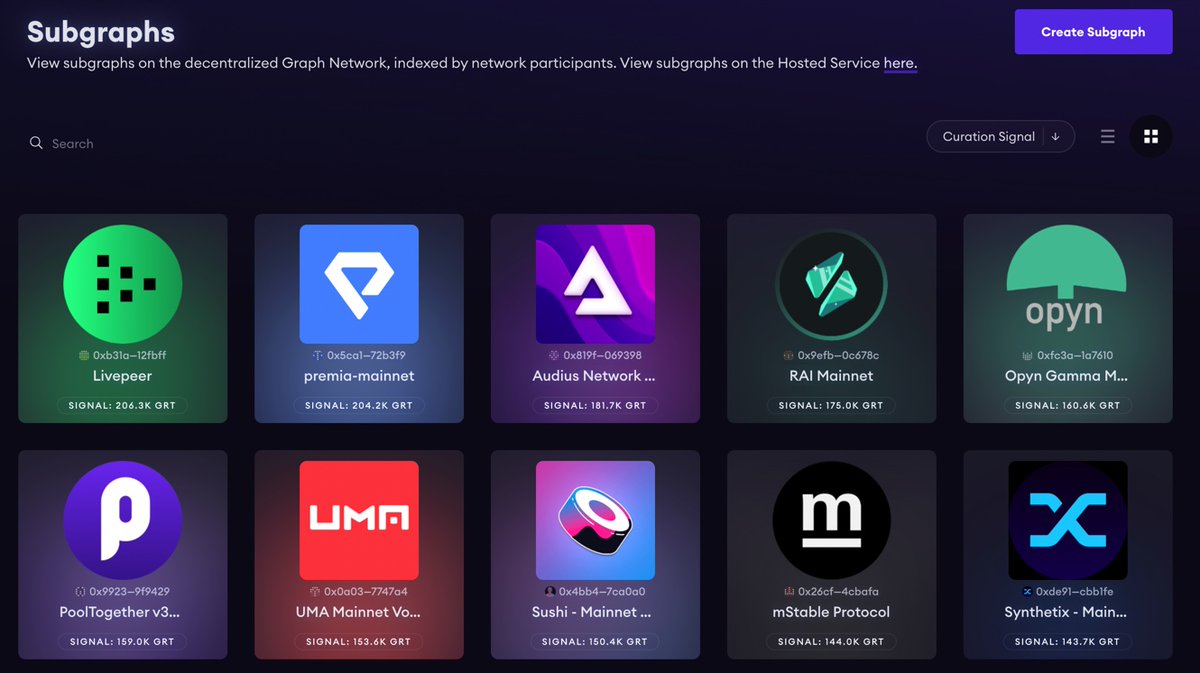

Have queries?

The Graph is an indexing protocol for querying networks like ETH

Users can compose subgraphs which form into a global graph of all the worlds public information

This data can then be shared across applications for anyone to query with a few clicks (93/107)

The Graph is an indexing protocol for querying networks like ETH

Users can compose subgraphs which form into a global graph of all the worlds public information

This data can then be shared across applications for anyone to query with a few clicks (93/107)

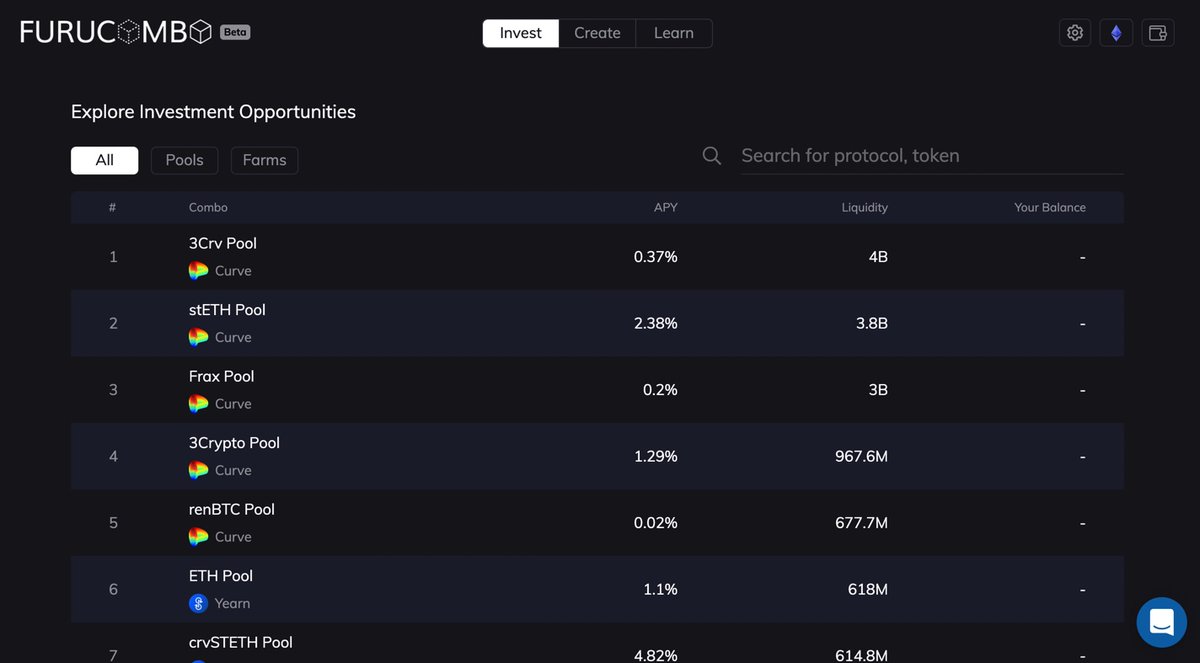

Want multiple txs in one?

Furucombo allows users to develop complex DeFi legos using drag & drop technology

It visualizes complex DeFi protocols into cubes. Users just need to enter info & set up orders of the cubes, COMBO will package all them into a tx & send it out (95/107)

Furucombo allows users to develop complex DeFi legos using drag & drop technology

It visualizes complex DeFi protocols into cubes. Users just need to enter info & set up orders of the cubes, COMBO will package all them into a tx & send it out (95/107)

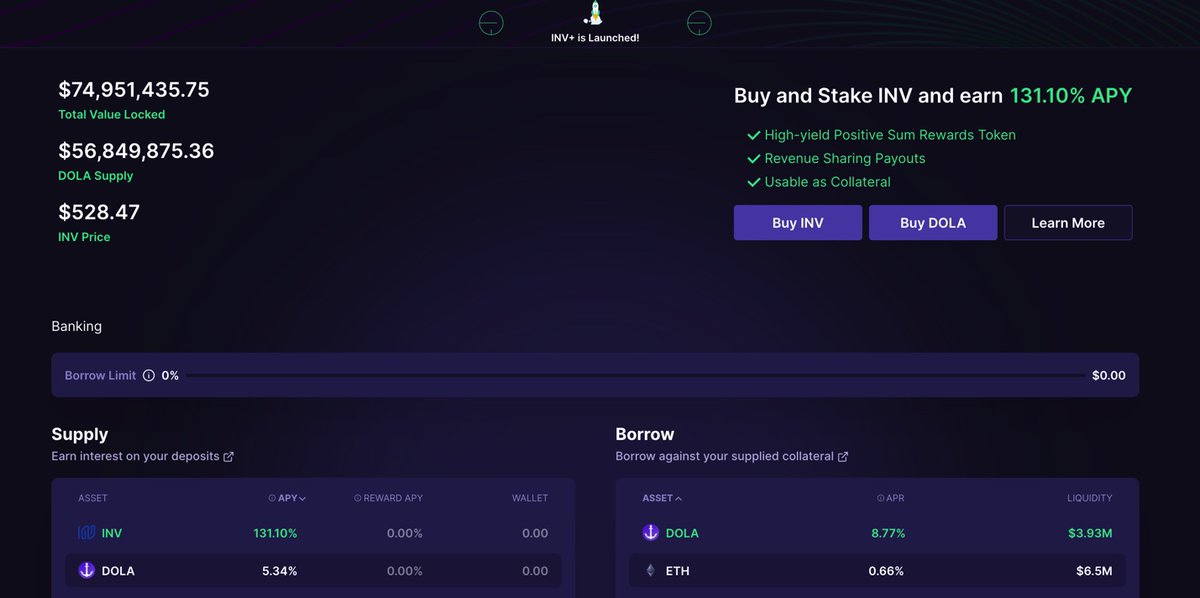

Tired of waiting for the perfect entry, or don’t have enough time to keep up with the increasingly volatile markets?

Inverse’s DCA Vaults allow you to invest your tokens into yield-bearing strategies while continuously purchasing an asset of your choice. (96/107)

Inverse’s DCA Vaults allow you to invest your tokens into yield-bearing strategies while continuously purchasing an asset of your choice. (96/107)

Don& #39;t know where to get started when joining the crypto ecosystem?

If users can’t filter through the noise, they won’t be using decentralized apps.

With Rabbit hole, users can acquire XP, level up, & earn rewards for interacting with well known protocols. (97/107)

If users can’t filter through the noise, they won’t be using decentralized apps.

With Rabbit hole, users can acquire XP, level up, & earn rewards for interacting with well known protocols. (97/107)

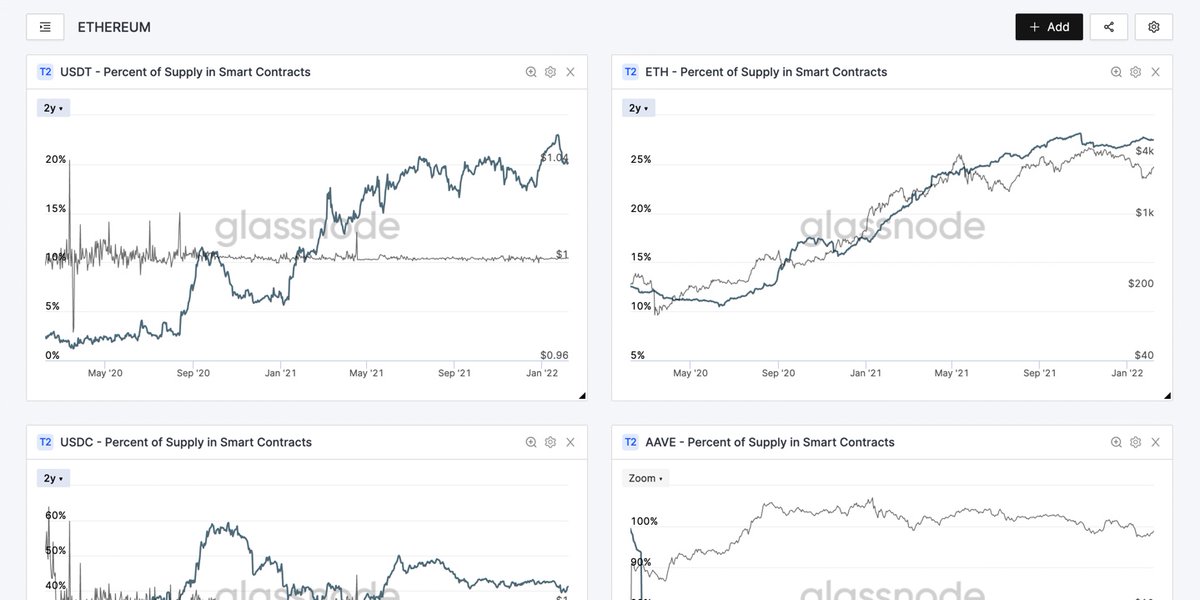

The beauty of decentralized technology is its transparency.

Anything & everything that occurs on chain is available to the public.

Using tools like Glassnode & Nansen, the average investor can make informed trading decisions based on a variety of on-chain metrics. (98/107)

Anything & everything that occurs on chain is available to the public.

Using tools like Glassnode & Nansen, the average investor can make informed trading decisions based on a variety of on-chain metrics. (98/107)

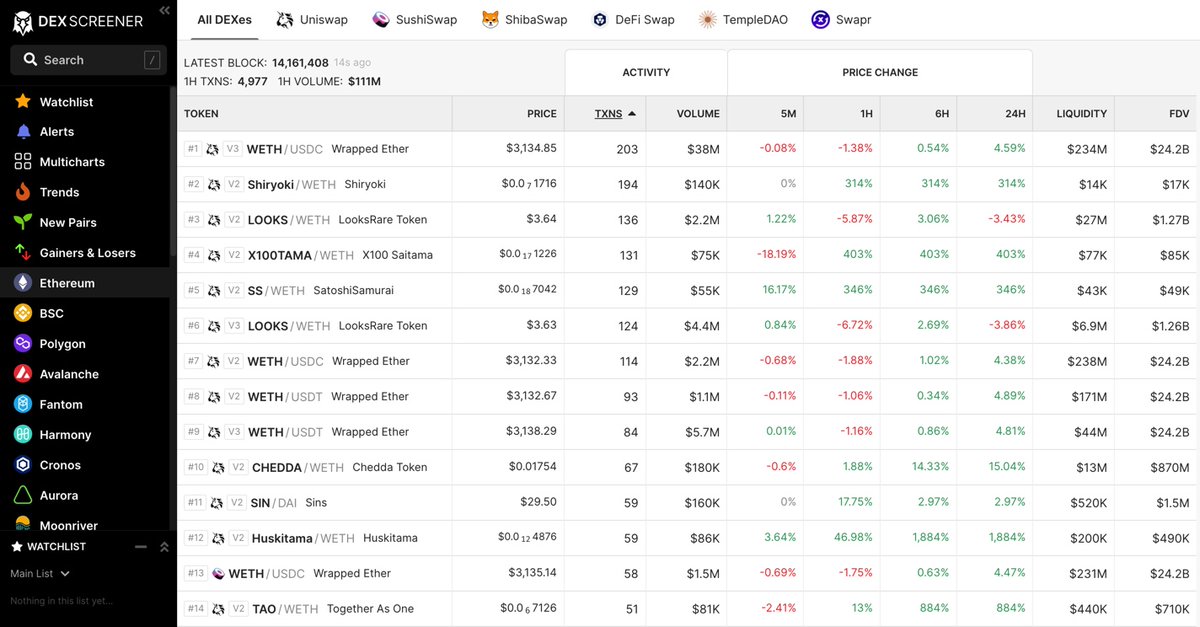

Wish you could see all the stats?

Having access to charts, prices, & metrics of the top tokens on all chains is your best bet to getting in early on projects

Using the many tools, traders can see charts & trading history for tokens across ETH, AVAX, FTM, & more. (99/107)

Having access to charts, prices, & metrics of the top tokens on all chains is your best bet to getting in early on projects

Using the many tools, traders can see charts & trading history for tokens across ETH, AVAX, FTM, & more. (99/107)

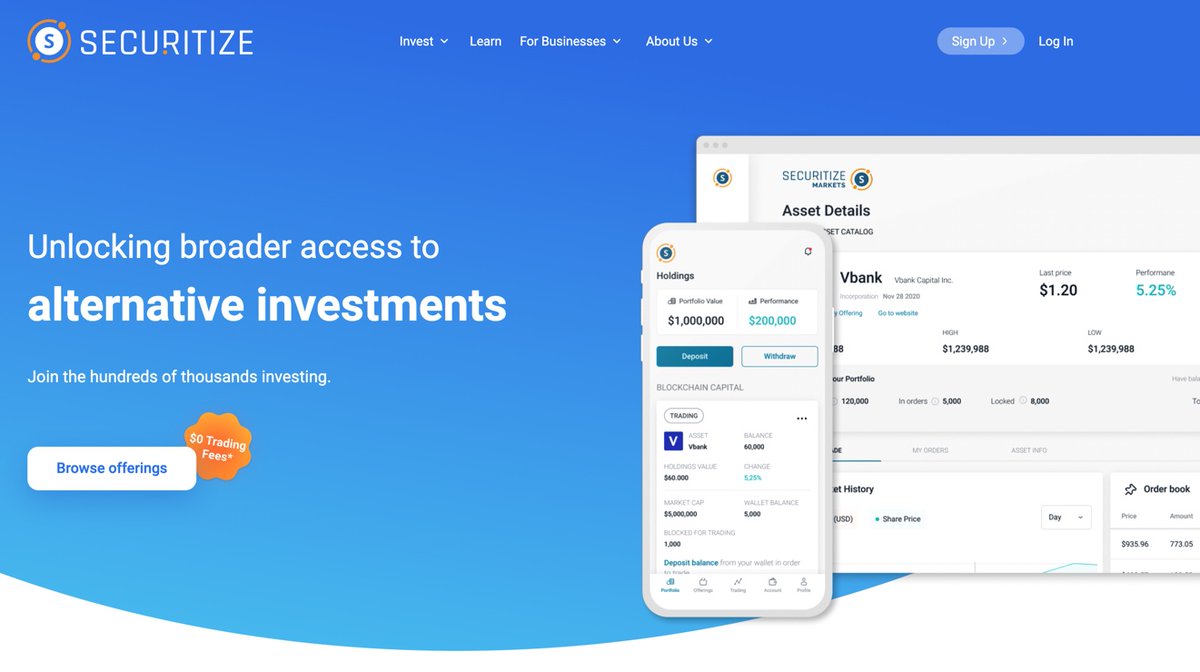

Want access to "private" markets?

Using Securitize, private companies can raise capital through security tokens.

This allows retail investors trade anything from pre-IPO shares of the next big tech company, to a new real estate project. (100/107)

Using Securitize, private companies can raise capital through security tokens.

This allows retail investors trade anything from pre-IPO shares of the next big tech company, to a new real estate project. (100/107)

Want to automate txs?

DevOps are a tedious. Nearly everything has to be triggered manually, & making sure these tasks are secure adds a whole new step.

Using OZ Defender, devs can streamline their manual & error prone tasks to be done in an automated and secure way. (101/107)

DevOps are a tedious. Nearly everything has to be triggered manually, & making sure these tasks are secure adds a whole new step.

Using OZ Defender, devs can streamline their manual & error prone tasks to be done in an automated and secure way. (101/107)

Ever wish you had the know-how to harness the power of artificial intelligence?

Then Fetch is for you.

Using the Fetch AI framework, users can create complex economies with the help of autonomous AI agents that leverage a global network of data to execute tasks. (102/107)

Then Fetch is for you.

Using the Fetch AI framework, users can create complex economies with the help of autonomous AI agents that leverage a global network of data to execute tasks. (102/107)

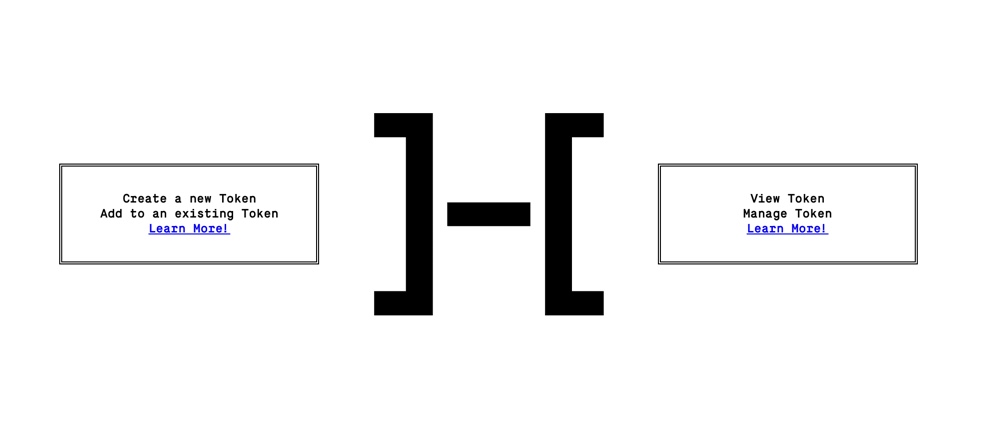

Want to start a token?

The permission-less nature of $ETH allows anyone to build on it.

With little to no exp in coding, you can build the next big thing.

Using Open Zeppelin’s ERC20 standard contracts, smart contract development is made available to the masses. (103/107)

The permission-less nature of $ETH allows anyone to build on it.

With little to no exp in coding, you can build the next big thing.

Using Open Zeppelin’s ERC20 standard contracts, smart contract development is made available to the masses. (103/107)

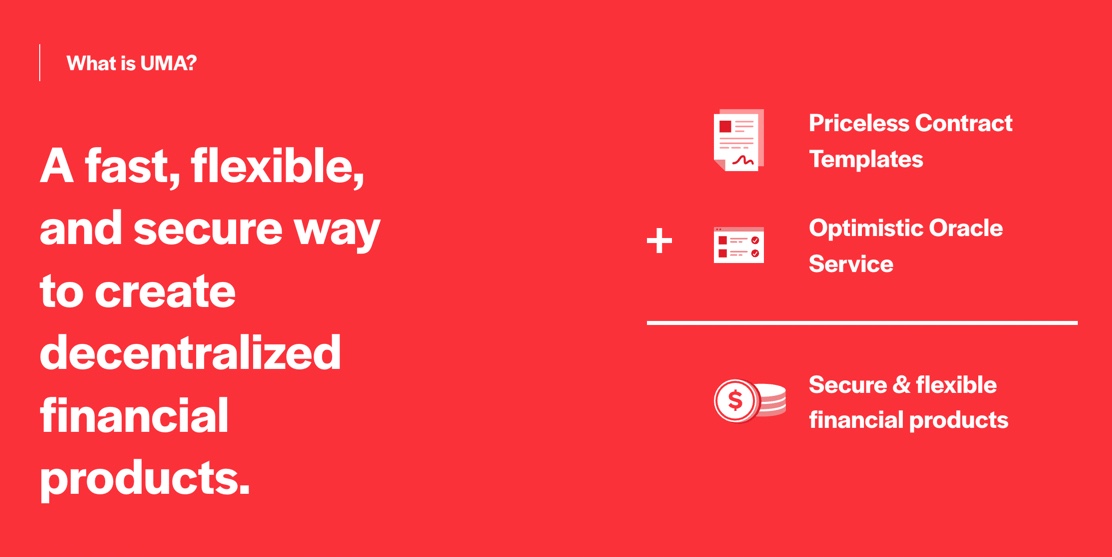

Want UMA?

Having Universal Market Access to any asset is the first step toward banking the unbanked.

Using UMA’s trust-less tokenization, anyone can create tokens to with synthetic exposure to any asset with a price.

This can be equities, yield curves, TVL, & more. (104/107)

Having Universal Market Access to any asset is the first step toward banking the unbanked.

Using UMA’s trust-less tokenization, anyone can create tokens to with synthetic exposure to any asset with a price.

This can be equities, yield curves, TVL, & more. (104/107)

Are you tired of MEV bots?

If you want to avoid being a target of opportunistic bots on $ETH, MEV protection is for you.

Using Flashbots or Keeper DAO, txs are routed privately and away from the predatory bots swimming in ETH’s mempool. (105/107)

If you want to avoid being a target of opportunistic bots on $ETH, MEV protection is for you.

Using Flashbots or Keeper DAO, txs are routed privately and away from the predatory bots swimming in ETH’s mempool. (105/107)

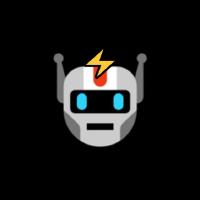

Want to show your support?

Let’s face it, OSS devs are severely underfunded in crypto.

Gitcoin is a quadratic funding tool designed to fix this.

With Gitcoin, developers are paid to contribute to open source software in Python, Rust, Ruby, JS, Solidity, HTML, & more. (106/107)

Let’s face it, OSS devs are severely underfunded in crypto.

Gitcoin is a quadratic funding tool designed to fix this.

With Gitcoin, developers are paid to contribute to open source software in Python, Rust, Ruby, JS, Solidity, HTML, & more. (106/107)

Read on Twitter

Read on Twitter