This is my first Thread/extensive research. Feel free to point anything wrong. Only for Educational Purpose.

Disc: Invested and biased. Invest at your own risk.

CONTENTS: -

1. Value Chain

2. Business Segments

3. Segmental Information.

1/x

4. Recent Acquisitions

5. Business Structure

6. Plants

7. Capex

8. Growth

9. My Thesis

10. Anti-Thesis

11. Moat

2/x

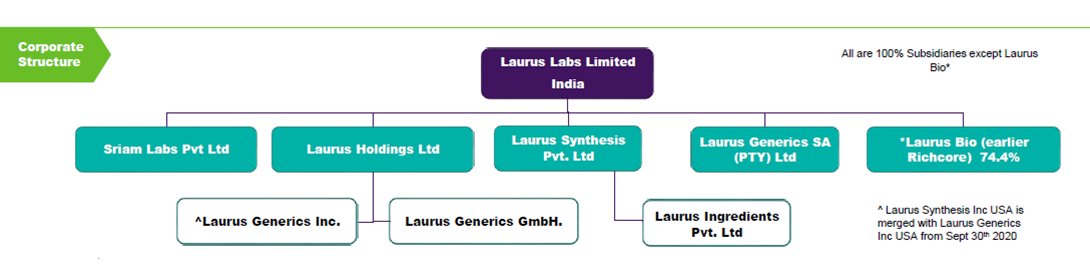

5. Business Structure

6. Plants

7. Capex

8. Growth

9. My Thesis

10. Anti-Thesis

11. Moat

2/x

• Today, we are among the world’s leading manufacturers of active pharmaceutical ingredients (API) for anti-retroviral (ARV), oncology, cardiovascular, antidiabetics, anti-asthma, and gastroenterology.

• Develop and manufacture oral solid formulations

3/x

• Develop and manufacture oral solid formulations

3/x

• R&D team comprises of 750+ scientists (~16% of total employee strength) including over 60 PhDs

• Also provide contract research and manufacturing services (CRAMS)

• Produce specialty ingredients for nutraceuticals, dietary supplements and cosmeceuticals

4/x

• Also provide contract research and manufacturing services (CRAMS)

• Produce specialty ingredients for nutraceuticals, dietary supplements and cosmeceuticals

4/x

VALUE CHAIN

From making just API’s (Active Substance), they now make all Advanced Intermediates they use and make formulations of the api’s they produce in the value chain.

(* shows backward & forward integration)

5/x

From making just API’s (Active Substance), they now make all Advanced Intermediates they use and make formulations of the api’s they produce in the value chain.

(* shows backward & forward integration)

5/x

Business Segments

• Laurus Generics - API - Development, manufacture and sale of APIs and advanced

intermediates

• Laurus Generics – Finished Dosage Form (FDF) - Development and manufacture of oral solid formulations from the api’s they make

6/x

• Laurus Generics - API - Development, manufacture and sale of APIs and advanced

intermediates

• Laurus Generics – Finished Dosage Form (FDF) - Development and manufacture of oral solid formulations from the api’s they make

6/x

• Laurus Synthesis - Key starting materials, intermediates and APIs for New Chemical Entities (NCEs)

• Laurus Bio – Recombinant products - animal origin free products for safer and viral free bio manufacturing

Quick update : now only 3 : Generics(API,FDF) , Synthesis, Bio

7/x

• Laurus Bio – Recombinant products - animal origin free products for safer and viral free bio manufacturing

Quick update : now only 3 : Generics(API,FDF) , Synthesis, Bio

7/x

Segmental Information

1. Laurus Generics – API

ARV API: Anti-Retroviral used in the treatment of HIV-AIDS. This is a 3yr tender driven business. When 1st line of drugs fails, then 2nd line of treatment drugs are given.

(Growth will be at max 5-8%)

8/x

(source: soicfinance)

1. Laurus Generics – API

ARV API: Anti-Retroviral used in the treatment of HIV-AIDS. This is a 3yr tender driven business. When 1st line of drugs fails, then 2nd line of treatment drugs are given.

(Growth will be at max 5-8%)

8/x

(source: soicfinance)

• Hepatitis C: Approved for Tenofovir Alafenamide used in the treatment of chronic hepatitis B virus infection with compensated liver disease.

• Non-ARV:

o anti-diabetic: 2 products already validated

o Cardiovascular: conditions affecting the heart or blood vessels

9/x

• Non-ARV:

o anti-diabetic: 2 products already validated

o Cardiovascular: conditions affecting the heart or blood vessels

9/x

o anti-asthma: Breathing problems

o gastroenterology: focused on the digestive system and its disorders

o Proton Pump Inhibitors (PPIs): reduction of stomach acid production

10/x

o gastroenterology: focused on the digestive system and its disorders

o Proton Pump Inhibitors (PPIs): reduction of stomach acid production

10/x

2. Laurus Generics – Formulations

Development and manufacturing of oral solid formulations for low and middle-income countries (LMIC), North America and European Union (EU) markets

Formulations are made using API’s they make. (Types of formulations are same as API’s)

11/x

Development and manufacturing of oral solid formulations for low and middle-income countries (LMIC), North America and European Union (EU) markets

Formulations are made using API’s they make. (Types of formulations are same as API’s)

11/x

3. Laurus Synthesis (CDMO)

• Steroids and hormone manufacturing capability

• specialty ingredients for use in nutraceuticals, dietary supplements and cosmeceutical products.

4. Laurus BIO

Acquired 72.55% stake in Richcore Lifesciences and renamed to Laurus Bio.

12/x

• Steroids and hormone manufacturing capability

• specialty ingredients for use in nutraceuticals, dietary supplements and cosmeceutical products.

4. Laurus BIO

Acquired 72.55% stake in Richcore Lifesciences and renamed to Laurus Bio.

12/x

Entering high-growth areas of recombinant animal origin free products (nonanimal cultured meat)

Laurus Bio operates through three distinct revenue streams – biotech, enzymes and CDMO

13/x

Laurus Bio operates through three distinct revenue streams – biotech, enzymes and CDMO

13/x

Going ahead, the CDMO segment is likely to be a major contributor to growth as a major portion of the incremental capacities are towards this business.

( clear play on operating leverage hinted ) *biased

14/x

( clear play on operating leverage hinted ) *biased

14/x

Recent Acquisitions

[JAN 21] Acquired 72.55% in Richcore Lifesciences to enter Biologics. Renamed to Laurus Bio Private Limited.

[JAN 22] to acquire 26.62% stake in Immunoadoptive Cell Therapy Private Limited (lmmunoACT), an advanced cell and gene therapy company.

15/x

[JAN 21] Acquired 72.55% in Richcore Lifesciences to enter Biologics. Renamed to Laurus Bio Private Limited.

[JAN 22] to acquire 26.62% stake in Immunoadoptive Cell Therapy Private Limited (lmmunoACT), an advanced cell and gene therapy company.

15/x

Treatment for Immuno deceases and particularly for Cancer treatment.

This investment provides Laurus an access and entry into CAR-T therapy.

A very promising treatment option which has had great success in the western part of the world.

16/x

This investment provides Laurus an access and entry into CAR-T therapy.

A very promising treatment option which has had great success in the western part of the world.

16/x

In India, CAR-T therapy is not available, and this collaboration will help us in bringing this novel technology to the Indian patients at a very affordable pricing.

Must Read on this here : https://twitter.com/itsTarH/status/1461635789071151109?s=20

(">https://twitter.com/itsTarH/s... can be fully acquired in the coming years )

17/x

Must Read on this here : https://twitter.com/itsTarH/status/1461635789071151109?s=20

(">https://twitter.com/itsTarH/s... can be fully acquired in the coming years )

17/x

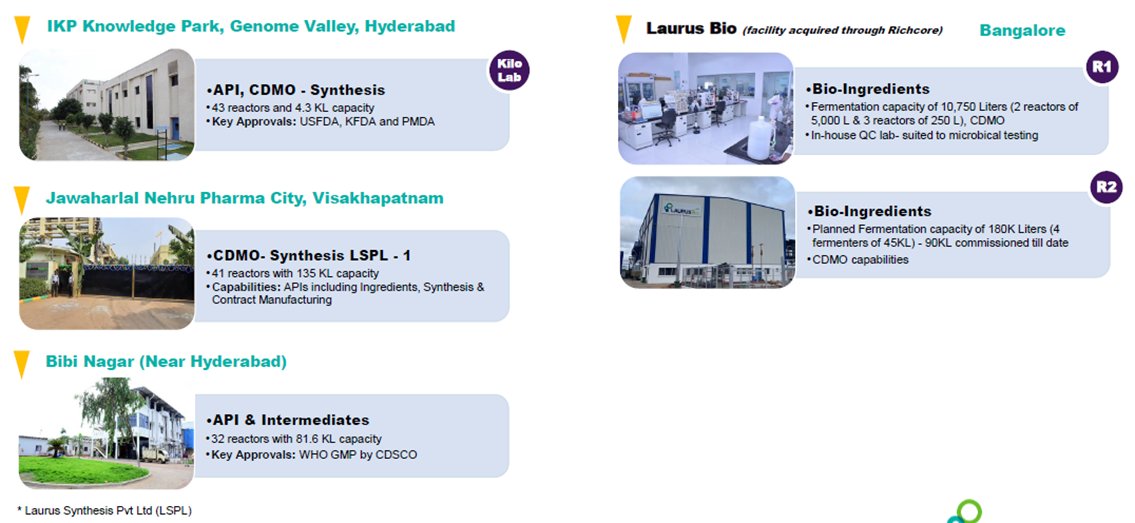

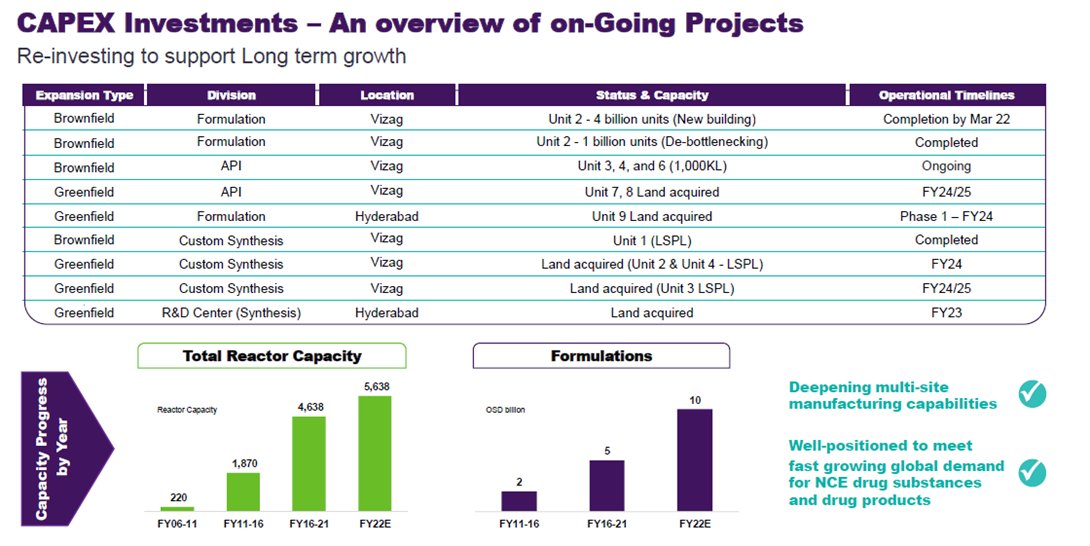

GROWTH via Capacity Expansion:

API’s: +21.56% increase when done(ongoing)

Formulations: +66.66% increase starting from FY23(Mar2022)

Synthesis: now 5535KL capacity. More coming in FY 2023,2024,2025.

Bio: +90KL fermentation capacity to the existing 90KL.

21/x

API’s: +21.56% increase when done(ongoing)

Formulations: +66.66% increase starting from FY23(Mar2022)

Synthesis: now 5535KL capacity. More coming in FY 2023,2024,2025.

Bio: +90KL fermentation capacity to the existing 90KL.

21/x

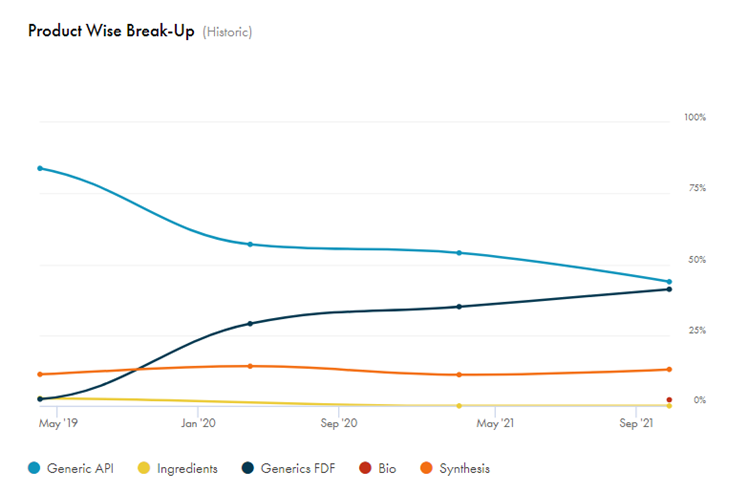

THESIS

Walking the Talk & Excellent Capital Allocation: Revenue mix has improved from ARV to other segments and also shows excellent capital allocation of taking cashflow from a lumpy ARV api business into Non-ARV api’s, backward integration into intermediates

22/x

Walking the Talk & Excellent Capital Allocation: Revenue mix has improved from ARV to other segments and also shows excellent capital allocation of taking cashflow from a lumpy ARV api business into Non-ARV api’s, backward integration into intermediates

22/x

forward integration into formulations, synthesis(CDMO) and now Bio.

Laurus API & Formulations: Diversification from ARV api to Anti-diabetic, cardiovascular and others.

Formulations are now also going to be done for NON-ARV api’s (start of FY23).

23/x

Laurus API & Formulations: Diversification from ARV api to Anti-diabetic, cardiovascular and others.

Formulations are now also going to be done for NON-ARV api’s (start of FY23).

23/x

Laurus Synthesis: Developing capacities where once operating leverage kick’s-in, it’s a bomb. (fixed cost + lower incremental costs and exponential revenues)

Laurus Bio: sky is the limit. hinted for 1mil, then 3-4mil capacity. so, ~5x, then ~19x revenue from bio if done.

24/x

Laurus Bio: sky is the limit. hinted for 1mil, then 3-4mil capacity. so, ~5x, then ~19x revenue from bio if done.

24/x

Addition of high Potent Molecules from 2025: Maybe because they are currently working on it (HIGH PROBABLITY) but the existing drugs might go off patent in 2025.

Dr. Satyanarayana Chava: "These launches will happen after 2025."

25/x

Dr. Satyanarayana Chava: "These launches will happen after 2025."

25/x

Injectables: They currently only do oral solids. They used to doge injectables. But, in the Nov’21 concall, finally they said of entering into the segment.

26/x

26/x

Anti-Thesis

Raw Material: High Dependence on Raw Material imports from China.

Injectables: Not easy to get process expertise. Then comes approvals. Then comes manufacturing part.

Regulatory Risks: The major risk in the company is any USFDA export ban on the facilities.

27/x

Raw Material: High Dependence on Raw Material imports from China.

Injectables: Not easy to get process expertise. Then comes approvals. Then comes manufacturing part.

Regulatory Risks: The major risk in the company is any USFDA export ban on the facilities.

27/x

Wipeout of ARV api’s: Recently there has been a clearance of a new injectable drug, that can replace ARV drugs consumed in oral solids way (pills, tablets) as it is 1/4th the cost and less dosage.

Must read: https://twitter.com/Dr_Midhun_cs/status/1463165201809825792

28/x">https://twitter.com/Dr_Midhun...

Must read: https://twitter.com/Dr_Midhun_cs/status/1463165201809825792

28/x">https://twitter.com/Dr_Midhun...

Also, ARV api is a tender driven business (3 years). If their customers don’t win bids, they might have some revenue fall.

High Freight Charges: The company had to suffer a bit in their earnings for the freight charges due to less availability of containers.

29/x

High Freight Charges: The company had to suffer a bit in their earnings for the freight charges due to less availability of containers.

29/x

So, we must have this in our mind if this thing comes again in future.

Laurus Bio unable to scale: Considering Bio a new stream, if this segment does not grow, things can go wrong.

Debt: Even tough the debt is ok considering the upcoming growth, (D/E = 0.53).

30/x

Laurus Bio unable to scale: Considering Bio a new stream, if this segment does not grow, things can go wrong.

Debt: Even tough the debt is ok considering the upcoming growth, (D/E = 0.53).

30/x

However, the upcoming greenfield capex in the 3-4 land acquired can be a pain point as well.

They weren’t looking to reduce debt as growth opportunity was very good.

Now suddenly, within 3-4 months, they say, debt reduction might happen in the next year.

31/x

They weren’t looking to reduce debt as growth opportunity was very good.

Now suddenly, within 3-4 months, they say, debt reduction might happen in the next year.

31/x

MOAT

• USFDA approvals & compliance is not easy

• Biologics is a high gestation & high investment area within the Pharma industry. Typical development times range in many years and take about 5+ years on average to really scale up and transition to commercial production

32/x

• USFDA approvals & compliance is not easy

• Biologics is a high gestation & high investment area within the Pharma industry. Typical development times range in many years and take about 5+ years on average to really scale up and transition to commercial production

32/x

(from, Tar’s tweet mentioned earlier)

• Economies of scale in ARV api. Replication in non-arv api expected.

• Backward and forward integrated which helps them absorb price hikes of solvents/KSM.

33/x

• Economies of scale in ARV api. Replication in non-arv api expected.

• Backward and forward integrated which helps them absorb price hikes of solvents/KSM.

33/x

Valuations, abb, ye aap log decide karlo, coz, neend aa ri ab. gd nt. Else, i& #39;ll do it tmrw.

But, it is a very long term bet.. the real story will start when cdmo starts picking up.. from FY24 and FY25.

NOTE : NOT AN INVESTMENT ADVICE. PLEASE CONSULT YOUR FINANCIAL ADVISOR.

But, it is a very long term bet.. the real story will start when cdmo starts picking up.. from FY24 and FY25.

NOTE : NOT AN INVESTMENT ADVICE. PLEASE CONSULT YOUR FINANCIAL ADVISOR.

Read on Twitter

Read on Twitter

![Recent Acquisitions[JAN 21] Acquired 72.55% in Richcore Lifesciences to enter Biologics. Renamed to Laurus Bio Private Limited.[JAN 22] to acquire 26.62% stake in Immunoadoptive Cell Therapy Private Limited (lmmunoACT), an advanced cell and gene therapy company.15/x Recent Acquisitions[JAN 21] Acquired 72.55% in Richcore Lifesciences to enter Biologics. Renamed to Laurus Bio Private Limited.[JAN 22] to acquire 26.62% stake in Immunoadoptive Cell Therapy Private Limited (lmmunoACT), an advanced cell and gene therapy company.15/x](https://pbs.twimg.com/media/FKDX5BBaIAEsGmI.jpg)