/RESEARCHING A STOCK FROM TOP TO BOTTOM/

Purple Group Edition https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Paars hart" aria-label="Emoji: Paars hart">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Paars hart" aria-label="Emoji: Paars hart">

[THREAD]

Purple Group Edition

[THREAD]

Grab some coffee, this is a lengthy thread. https://abs.twimg.com/emoji/v2/... draggable="false" alt="☕" title="Warme drank" aria-label="Emoji: Warme drank">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="☕" title="Warme drank" aria-label="Emoji: Warme drank">

If you would like to skip to certain information, here are the contents https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

Contents:

1) Who are PPE?

2) EasyEquities

3) GT247

4) Emperor Asset Management

5) Financials

6) Competitors

7) Management

8) Future Outlook

9) Conclusion

If you would like to skip to certain information, here are the contents

Contents:

1) Who are PPE?

2) EasyEquities

3) GT247

4) Emperor Asset Management

5) Financials

6) Competitors

7) Management

8) Future Outlook

9) Conclusion

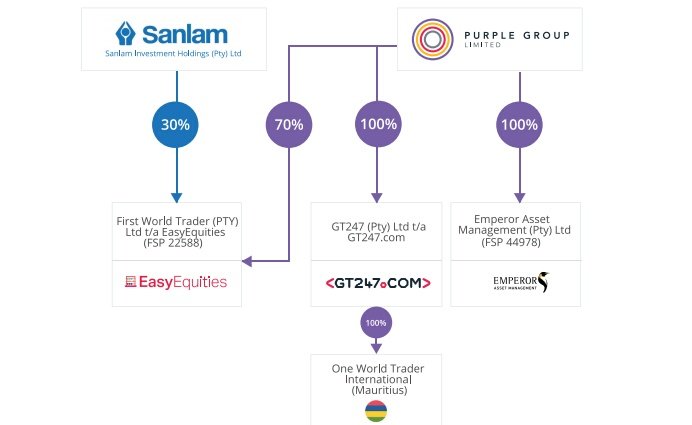

1/ Who are Purple Group?

Purple Group has the following subsidiaries:

-EasyEquities

-GT247

-One World Trader

-Emperor Asset Management

The big one here is @EasyEquities. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

(This screenshot was taken from the Annual Report year ended 31 August)

Purple Group has the following subsidiaries:

-EasyEquities

-GT247

-One World Trader

-Emperor Asset Management

The big one here is @EasyEquities.

(This screenshot was taken from the Annual Report year ended 31 August)

2.1/ EasyEquities

EasyEquities is, in my opinion, the best low cost investment platform in South Africa.

They offer retail investors with opportunities to buy fractionalized shares.

This means that almost anyone can invest, as even smallest deposits can be invested https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Paars hart" aria-label="Emoji: Paars hart">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Paars hart" aria-label="Emoji: Paars hart">

EasyEquities is, in my opinion, the best low cost investment platform in South Africa.

They offer retail investors with opportunities to buy fractionalized shares.

This means that almost anyone can invest, as even smallest deposits can be invested

EasyEquities provide a unique product, coupled with great results.

It has created some kind of brand loyalty. People really feel part of a community, thanks to them.

That& #39;s something money can& #39;t buy.

It would really take a lot to convince clients to switch from EE. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📚" title="Boeken" aria-label="Emoji: Boeken">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📚" title="Boeken" aria-label="Emoji: Boeken">

It has created some kind of brand loyalty. People really feel part of a community, thanks to them.

That& #39;s something money can& #39;t buy.

It would really take a lot to convince clients to switch from EE.

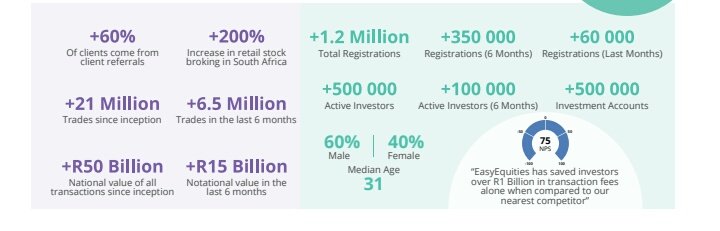

Its no secret that the market in which EasyEquities is in will most likely increase in the years to come.

60% of clients come from referrals!

New clients = more new clients. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👌" title="Hand met & #39;oké& #39;-gebaar" aria-label="Emoji: Hand met & #39;oké& #39;-gebaar">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👌" title="Hand met & #39;oké& #39;-gebaar" aria-label="Emoji: Hand met & #39;oké& #39;-gebaar"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Aangespannen biceps" aria-label="Emoji: Aangespannen biceps">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Aangespannen biceps" aria-label="Emoji: Aangespannen biceps"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

(Screenshot from annual report)

60% of clients come from referrals!

New clients = more new clients.

(Screenshot from annual report)

Profit per active customer = +-R196.2

(R98.1 mil ÷ 500 000 active investors)

For every 1mil active investors, there is +-R196 200 000 profit!

Thought that was interesting. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

(R98.1 mil ÷ 500 000 active investors)

For every 1mil active investors, there is +-R196 200 000 profit!

Thought that was interesting.

2.2/ EasyEquities structure

EasyEquities consists of EasyEquities Australia, EasyEquities international, EasyProperties, RISE and EasyCrypto.

Let& #39;s talk about these further https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

EasyEquities consists of EasyEquities Australia, EasyEquities international, EasyProperties, RISE and EasyCrypto.

Let& #39;s talk about these further

2.3/ EasyCrypto

EasyCrypto allows investors access to buy and sell the EC10 token, which is an index of the top 10 Cryptos by value.

Individual Cryptos are likely to be available in the future as well.

51% Of EC10 is owned by EasyEquities.

49% owned by founding team https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Aangespannen biceps" aria-label="Emoji: Aangespannen biceps">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Aangespannen biceps" aria-label="Emoji: Aangespannen biceps">

EasyCrypto allows investors access to buy and sell the EC10 token, which is an index of the top 10 Cryptos by value.

Individual Cryptos are likely to be available in the future as well.

51% Of EC10 is owned by EasyEquities.

49% owned by founding team

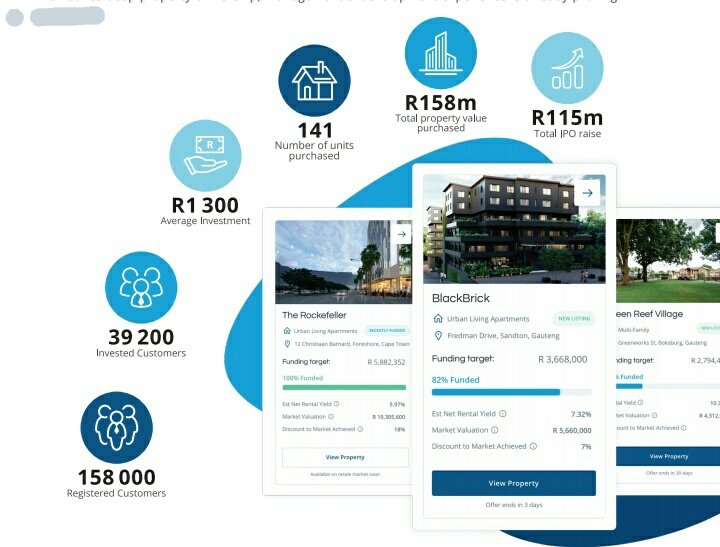

2.4/ EasyProperties

There are many friction points when it comes to buying property including:

-Maintainance https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔧" title="Moersleutel" aria-label="Emoji: Moersleutel">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔧" title="Moersleutel" aria-label="Emoji: Moersleutel">

-Dealing with Bad tenants https://abs.twimg.com/emoji/v2/... draggable="false" alt="👎" title="Duimen omlaag" aria-label="Emoji: Duimen omlaag">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👎" title="Duimen omlaag" aria-label="Emoji: Duimen omlaag">

-Fees https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld met vleugels" aria-label="Emoji: Geld met vleugels">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld met vleugels" aria-label="Emoji: Geld met vleugels">

@properties_easy solves this by offering fractionalized shares on property entitled to dividends.

This has massive potential. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

There are many friction points when it comes to buying property including:

-Maintainance

-Dealing with Bad tenants

-Fees

@properties_easy solves this by offering fractionalized shares on property entitled to dividends.

This has massive potential.

The numbers speak for themselves. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

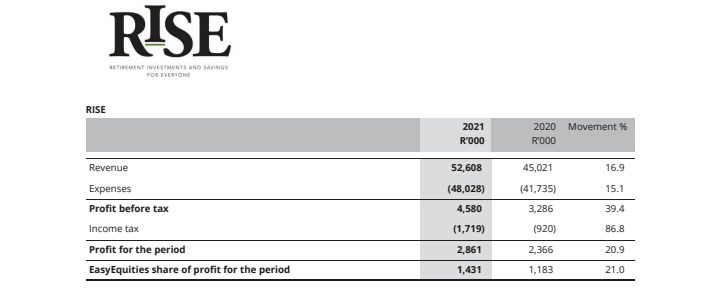

2.5/ RISE

Retirement Investment and Savings for Everyone.

As we know from earlier, RISE is a joint venture (50/50) with NBC fund Administration Services.

RISE reduces the cost of administration and enables members access to investment and savings options https://abs.twimg.com/emoji/v2/... draggable="false" alt="✌" title="Overwinningshand" aria-label="Emoji: Overwinningshand">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✌" title="Overwinningshand" aria-label="Emoji: Overwinningshand">

Retirement Investment and Savings for Everyone.

As we know from earlier, RISE is a joint venture (50/50) with NBC fund Administration Services.

RISE reduces the cost of administration and enables members access to investment and savings options

RISE year ended 31 August 2021:

-The business is profitable, thanks to management& #39;s efforts to Streamline the business. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👌" title="Hand met & #39;oké& #39;-gebaar" aria-label="Emoji: Hand met & #39;oké& #39;-gebaar">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👌" title="Hand met & #39;oké& #39;-gebaar" aria-label="Emoji: Hand met & #39;oké& #39;-gebaar">

-The business is in a strong position to pursue new business in the near future. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Aangespannen biceps" aria-label="Emoji: Aangespannen biceps">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Aangespannen biceps" aria-label="Emoji: Aangespannen biceps">

(Screenshot taken from Annual Report ended 31 August on PPE website)

-The business is profitable, thanks to management& #39;s efforts to Streamline the business.

-The business is in a strong position to pursue new business in the near future.

(Screenshot taken from Annual Report ended 31 August on PPE website)

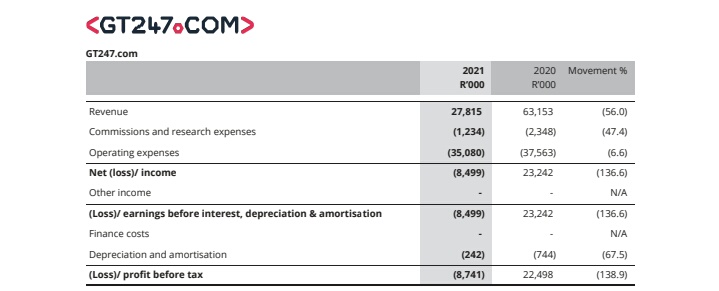

3/ GT247

GT247 enables access to world class trading platforms, tools and research.

Positive aspects:

-No monthly fees https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛔" title="Geen doorgang" aria-label="Emoji: Geen doorgang">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛔" title="Geen doorgang" aria-label="Emoji: Geen doorgang">

-Low cost trading https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

-Pioneers of CFD and Spread Trading https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Raket" aria-label="Emoji: Raket">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Raket" aria-label="Emoji: Raket">

GT247 enables access to world class trading platforms, tools and research.

Positive aspects:

-No monthly fees

-Low cost trading

-Pioneers of CFD and Spread Trading

Unfortunately GT247 was the only subsidiary to have a loss at the year ended 31 August 2021.

Revenue decreased 56% largely due to low trading activity. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👎" title="Duimen omlaag" aria-label="Emoji: Duimen omlaag">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👎" title="Duimen omlaag" aria-label="Emoji: Duimen omlaag">

It is possible that we see GT be rebranded with the & #39;Easy& #39; brand. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Raket" aria-label="Emoji: Raket">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Raket" aria-label="Emoji: Raket">

Revenue decreased 56% largely due to low trading activity.

It is possible that we see GT be rebranded with the & #39;Easy& #39; brand.

4/ Emperor Asset Management

Emperor offers access to low cost investment solutions.

Emperor has the team, track record and technology to fulfill its purpose https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Aangespannen biceps" aria-label="Emoji: Aangespannen biceps">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Aangespannen biceps" aria-label="Emoji: Aangespannen biceps"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="📚" title="Boeken" aria-label="Emoji: Boeken">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📚" title="Boeken" aria-label="Emoji: Boeken">

Emperor offers access to low cost investment solutions.

Emperor has the team, track record and technology to fulfill its purpose

5/ Financials

Now that we understand Purple Group and how they operate, let& #39;s look at the group& #39;s financials as a whole. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

5.1/ Revenue

5.2/ Gross Profit Margin

5.3/ Net profit margin

5.4/ Cash Vs Debt

5.5/ P/S ratio and P/E ratio

5.6/ ROA and ROA

Now that we understand Purple Group and how they operate, let& #39;s look at the group& #39;s financials as a whole.

5.1/ Revenue

5.2/ Gross Profit Margin

5.3/ Net profit margin

5.4/ Cash Vs Debt

5.5/ P/S ratio and P/E ratio

5.6/ ROA and ROA

5.1/ Revenue

Revenue increased 26% to R205 million.

This will grow as long as the demand for Investing grows as well.

This tells investors that money generated by services has grown well. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎓" title="Afstudeerhoed" aria-label="Emoji: Afstudeerhoed">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎓" title="Afstudeerhoed" aria-label="Emoji: Afstudeerhoed">

Revenue increased 26% to R205 million.

This will grow as long as the demand for Investing grows as well.

This tells investors that money generated by services has grown well.

5.2/ Gross Profit Margin

GPM = 20.33%

This is the profit made before any deductions.

The higher the Gross Profit margin, the better. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

GPM = 20.33%

This is the profit made before any deductions.

The higher the Gross Profit margin, the better.

5.3/ Net Profit Margin

This is the profit a company has made after all deductions have been made.

The net profit margin is 22.51%

This isn& #39;t bad at all. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Raket" aria-label="Emoji: Raket">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Raket" aria-label="Emoji: Raket">

This is the profit a company has made after all deductions have been made.

The net profit margin is 22.51%

This isn& #39;t bad at all.

5.4/ Cash Vs Debt

Purple group has more cash than it has debt.

Purple group& #39;s debt to equity ratio has increased from 4.6% to 10.4%.

This is a good sign since & #39;competitors& #39; don& #39;t have debt under control. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Duimen omhoog" aria-label="Emoji: Duimen omhoog">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Duimen omhoog" aria-label="Emoji: Duimen omhoog">

Purple group has more cash than it has debt.

Purple group& #39;s debt to equity ratio has increased from 4.6% to 10.4%.

This is a good sign since & #39;competitors& #39; don& #39;t have debt under control.

5.5/ P/S ratio and P/E ratio

P/S = 15.24

P/E = 70.40

As far as entry points go, now is not the time.

These metrics suggest that the stock is overvalued and will most likely pull back. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Grafiek met dalende trend" aria-label="Emoji: Grafiek met dalende trend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Grafiek met dalende trend" aria-label="Emoji: Grafiek met dalende trend">

P/S = 15.24

P/E = 70.40

As far as entry points go, now is not the time.

These metrics suggest that the stock is overvalued and will most likely pull back.

5.6/ ROA and ROE

The ROA is 11.45%. This seems low but compared to their & #39;competitors& #39; average of 8%, it is pretty good.

The ROE 16.21%. Again, this is great compared to their & #39;competitors& #39; who have an average of 10%. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

The ROA is 11.45%. This seems low but compared to their & #39;competitors& #39; average of 8%, it is pretty good.

The ROE 16.21%. Again, this is great compared to their & #39;competitors& #39; who have an average of 10%.

The ROA and ROE both indicate that management at Purple Group are good at using assets and shareholder& #39;s money to generate profits.

This is literally the whole point of a business https://abs.twimg.com/emoji/v2/... draggable="false" alt="👌" title="Hand met & #39;oké& #39;-gebaar" aria-label="Emoji: Hand met & #39;oké& #39;-gebaar">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👌" title="Hand met & #39;oké& #39;-gebaar" aria-label="Emoji: Hand met & #39;oké& #39;-gebaar">

This is literally the whole point of a business

6/ Competitors

As far as competition goes, Purple Group have at least a few years advantage on any other competitors.

This is due to many entry barriers in the market.

Their services makes it very hard yo distinguish local competitors. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

As far as competition goes, Purple Group have at least a few years advantage on any other competitors.

This is due to many entry barriers in the market.

Their services makes it very hard yo distinguish local competitors.

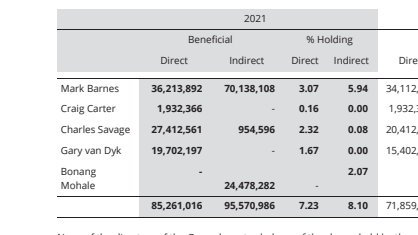

7/ Management

CEO, Charles Savage, has 17+ years in the fintech space.

He was also CTO of GT247 while helping them pioneer spread trading.

He is also the founder of EasyEquities and has a passion for its service. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧘♀️" title="Vrouw in lotushouding" aria-label="Emoji: Vrouw in lotushouding">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧘♀️" title="Vrouw in lotushouding" aria-label="Emoji: Vrouw in lotushouding">

CEO, Charles Savage, has 17+ years in the fintech space.

He was also CTO of GT247 while helping them pioneer spread trading.

He is also the founder of EasyEquities and has a passion for its service.

Group CFO, Gary Van Dyk, competed his article and is a qualified chartered accountant.

Gary was head of corporate finance at Purple Group up until 2013 when he was appointed as CFO. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📚" title="Boeken" aria-label="Emoji: Boeken">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📚" title="Boeken" aria-label="Emoji: Boeken">

Gary was head of corporate finance at Purple Group up until 2013 when he was appointed as CFO.

Independent non-executive director, Craig Carter, has over 30 years experience in technology and financial services.

He was previously appointment as COO of Purple Group.

Craig joined the Board in February 2005. Craig is also a member of the Risk Committee. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏰" title="Europees kasteel" aria-label="Emoji: Europees kasteel">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏰" title="Europees kasteel" aria-label="Emoji: Europees kasteel">

He was previously appointment as COO of Purple Group.

Craig joined the Board in February 2005. Craig is also a member of the Risk Committee.

Non Executive director, Bonang Mohale, is Professor of Practice in the Johannesburg Business School (JBS) College of Business and Economics.

He was formerly CEO of BLSA.

He has had leadership roles of several major South African and multinational companies https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Paars hart" aria-label="Emoji: Paars hart">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Paars hart" aria-label="Emoji: Paars hart">

He was formerly CEO of BLSA.

He has had leadership roles of several major South African and multinational companies

Mark Barnes has over 30 years experience in financial services.

He has had leadership positions at Standard Bank, Capital Alliance and Brait.

He is currently a significant shareholder of the business https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

He has had leadership positions at Standard Bank, Capital Alliance and Brait.

He is currently a significant shareholder of the business

As for ownership, each person mentioned above owns a significant amount of shares.

See here https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">

See here

A great team of people is arguably the most important thing about a business.

Getting the right people on the bus means that the bus is capable of going somewhere great.

This here, is a great team https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Paars hart" aria-label="Emoji: Paars hart">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Paars hart" aria-label="Emoji: Paars hart">

Getting the right people on the bus means that the bus is capable of going somewhere great.

This here, is a great team

8/ Future Outlook

With partnerships being tied up along the journey, new investors will continue to increase. (e.g. Capitec, Discovery and Telkom)

Each new investor increases revenue, thus growing the business. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

With partnerships being tied up along the journey, new investors will continue to increase. (e.g. Capitec, Discovery and Telkom)

Each new investor increases revenue, thus growing the business.

In the future, we could see Purple Group potentially:

-Expanding abroad, perhaps to East Africa.

-Adding EU stocks.

-Introducing EasyLending, EasyVenture, EasyEducation and many more.

He also suggested that we can expect new businesses in the coming year. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelsteen" aria-label="Emoji: Edelsteen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelsteen" aria-label="Emoji: Edelsteen">

-Expanding abroad, perhaps to East Africa.

-Adding EU stocks.

-Introducing EasyLending, EasyVenture, EasyEducation and many more.

He also suggested that we can expect new businesses in the coming year.

9/ Conclusion

In my own personal opinion, Purple Group is a stock that I will continue to buy.

The opportunity is endless.

It seems as though the Flywheel is starting to gain momentum and I would like to part of what they are doing. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

In my own personal opinion, Purple Group is a stock that I will continue to buy.

The opportunity is endless.

It seems as though the Flywheel is starting to gain momentum and I would like to part of what they are doing.

Things I tweet about:

-Investing https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">

-Market Research https://abs.twimg.com/emoji/v2/... draggable="false" alt="💻" title="PC" aria-label="Emoji: PC">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💻" title="PC" aria-label="Emoji: PC">

-My Financial Freedom Journey https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld met vleugels" aria-label="Emoji: Geld met vleugels">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld met vleugels" aria-label="Emoji: Geld met vleugels">

-Educational Tweets https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎓" title="Afstudeerhoed" aria-label="Emoji: Afstudeerhoed">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎓" title="Afstudeerhoed" aria-label="Emoji: Afstudeerhoed">

If you align with this, drop a follow https://abs.twimg.com/emoji/v2/... draggable="false" alt="👌" title="Hand met & #39;oké& #39;-gebaar" aria-label="Emoji: Hand met & #39;oké& #39;-gebaar">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👌" title="Hand met & #39;oké& #39;-gebaar" aria-label="Emoji: Hand met & #39;oké& #39;-gebaar">

-Investing

-Market Research

-My Financial Freedom Journey

-Educational Tweets

If you align with this, drop a follow

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Paars hart" aria-label="Emoji: Paars hart">[THREAD]" title="/RESEARCHING A STOCK FROM TOP TO BOTTOM/Purple Group Editionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Paars hart" aria-label="Emoji: Paars hart">[THREAD]">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Paars hart" aria-label="Emoji: Paars hart">[THREAD]" title="/RESEARCHING A STOCK FROM TOP TO BOTTOM/Purple Group Editionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Paars hart" aria-label="Emoji: Paars hart">[THREAD]">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Paars hart" aria-label="Emoji: Paars hart">[THREAD]" title="/RESEARCHING A STOCK FROM TOP TO BOTTOM/Purple Group Editionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Paars hart" aria-label="Emoji: Paars hart">[THREAD]">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Paars hart" aria-label="Emoji: Paars hart">[THREAD]" title="/RESEARCHING A STOCK FROM TOP TO BOTTOM/Purple Group Editionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Paars hart" aria-label="Emoji: Paars hart">[THREAD]">

(This screenshot was taken from the Annual Report year ended 31 August)" title="1/ Who are Purple Group?Purple Group has the following subsidiaries:-EasyEquities-GT247-One World Trader -Emperor Asset ManagementThe big one here is @EasyEquities.https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">(This screenshot was taken from the Annual Report year ended 31 August)" class="img-responsive" style="max-width:100%;"/>

(This screenshot was taken from the Annual Report year ended 31 August)" title="1/ Who are Purple Group?Purple Group has the following subsidiaries:-EasyEquities-GT247-One World Trader -Emperor Asset ManagementThe big one here is @EasyEquities.https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">(This screenshot was taken from the Annual Report year ended 31 August)" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Aangespannen biceps" aria-label="Emoji: Aangespannen biceps">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">(Screenshot from annual report)" title="Its no secret that the market in which EasyEquities is in will most likely increase in the years to come.60% of clients come from referrals! New clients = more new clients.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👌" title="Hand met & #39;oké& #39;-gebaar" aria-label="Emoji: Hand met & #39;oké& #39;-gebaar">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Aangespannen biceps" aria-label="Emoji: Aangespannen biceps">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">(Screenshot from annual report)" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Aangespannen biceps" aria-label="Emoji: Aangespannen biceps">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">(Screenshot from annual report)" title="Its no secret that the market in which EasyEquities is in will most likely increase in the years to come.60% of clients come from referrals! New clients = more new clients.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👌" title="Hand met & #39;oké& #39;-gebaar" aria-label="Emoji: Hand met & #39;oké& #39;-gebaar">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Aangespannen biceps" aria-label="Emoji: Aangespannen biceps">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Grafiek met stijgende trend" aria-label="Emoji: Grafiek met stijgende trend">(Screenshot from annual report)" class="img-responsive" style="max-width:100%;"/>

" title="2.2/ EasyEquities structureEasyEquities consists of EasyEquities Australia, EasyEquities international, EasyProperties, RISE and EasyCrypto.Let& #39;s talk about these furtherhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">" class="img-responsive" style="max-width:100%;"/>

" title="2.2/ EasyEquities structureEasyEquities consists of EasyEquities Australia, EasyEquities international, EasyProperties, RISE and EasyCrypto.Let& #39;s talk about these furtherhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">" class="img-responsive" style="max-width:100%;"/>

" title="The numbers speak for themselves.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">" class="img-responsive" style="max-width:100%;"/>

" title="The numbers speak for themselves.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">" class="img-responsive" style="max-width:100%;"/>

-The business is in a strong position to pursue new business in the near future.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Aangespannen biceps" aria-label="Emoji: Aangespannen biceps">(Screenshot taken from Annual Report ended 31 August on PPE website)" title="RISE year ended 31 August 2021:-The business is profitable, thanks to management& #39;s efforts to Streamline the business.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👌" title="Hand met & #39;oké& #39;-gebaar" aria-label="Emoji: Hand met & #39;oké& #39;-gebaar">-The business is in a strong position to pursue new business in the near future.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Aangespannen biceps" aria-label="Emoji: Aangespannen biceps">(Screenshot taken from Annual Report ended 31 August on PPE website)" class="img-responsive" style="max-width:100%;"/>

-The business is in a strong position to pursue new business in the near future.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Aangespannen biceps" aria-label="Emoji: Aangespannen biceps">(Screenshot taken from Annual Report ended 31 August on PPE website)" title="RISE year ended 31 August 2021:-The business is profitable, thanks to management& #39;s efforts to Streamline the business.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👌" title="Hand met & #39;oké& #39;-gebaar" aria-label="Emoji: Hand met & #39;oké& #39;-gebaar">-The business is in a strong position to pursue new business in the near future.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Aangespannen biceps" aria-label="Emoji: Aangespannen biceps">(Screenshot taken from Annual Report ended 31 August on PPE website)" class="img-responsive" style="max-width:100%;"/>

It is possible that we see GT be rebranded with the & #39;Easy& #39; brand.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Raket" aria-label="Emoji: Raket">" title="Unfortunately GT247 was the only subsidiary to have a loss at the year ended 31 August 2021.Revenue decreased 56% largely due to low trading activity.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👎" title="Duimen omlaag" aria-label="Emoji: Duimen omlaag">It is possible that we see GT be rebranded with the & #39;Easy& #39; brand.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Raket" aria-label="Emoji: Raket">" class="img-responsive" style="max-width:100%;"/>

It is possible that we see GT be rebranded with the & #39;Easy& #39; brand.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Raket" aria-label="Emoji: Raket">" title="Unfortunately GT247 was the only subsidiary to have a loss at the year ended 31 August 2021.Revenue decreased 56% largely due to low trading activity.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👎" title="Duimen omlaag" aria-label="Emoji: Duimen omlaag">It is possible that we see GT be rebranded with the & #39;Easy& #39; brand.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Raket" aria-label="Emoji: Raket">" class="img-responsive" style="max-width:100%;"/>

" title="As for ownership, each person mentioned above owns a significant amount of shares.See herehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">" class="img-responsive" style="max-width:100%;"/>

" title="As for ownership, each person mentioned above owns a significant amount of shares.See herehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rug van hand met omlaag wijzende wijsvinger" aria-label="Emoji: Rug van hand met omlaag wijzende wijsvinger">" class="img-responsive" style="max-width:100%;"/>