1/206

As promised, here& #39;s my 2022 outperform shopping list and my 2022 thesis.

Let& #39;s breakdown what this is, why these assets, and how I approach this, and then the bullcase for each individual asset.

As promised, here& #39;s my 2022 outperform shopping list and my 2022 thesis.

Let& #39;s breakdown what this is, why these assets, and how I approach this, and then the bullcase for each individual asset.

2/206

First off, this is a *shopping list* for things I think will *outperform* in 2022.

That means it isn& #39;t something where I buy all these at once, but instead how I prioritize buying on dips.

First off, this is a *shopping list* for things I think will *outperform* in 2022.

That means it isn& #39;t something where I buy all these at once, but instead how I prioritize buying on dips.

3/206

It& #39;s also things I think will outperform an index, major holdings (BTC) and their peers.

That means there are some good projects that don& #39;t make this list.

An example is Solana had a breakout year, it would be tough for it to outperform the market again next year.

It& #39;s also things I think will outperform an index, major holdings (BTC) and their peers.

That means there are some good projects that don& #39;t make this list.

An example is Solana had a breakout year, it would be tough for it to outperform the market again next year.

4/206

It could go up equally (or slightly more than an index) but its unlikely.

A lot of projects in its ecosystem are also in FDV hell, so even though they are great products, its unlikely they out perform.

It could go up equally (or slightly more than an index) but its unlikely.

A lot of projects in its ecosystem are also in FDV hell, so even though they are great products, its unlikely they out perform.

5/206

To be on this list it:

-Needed a working product.

-Had a catalyst that makes 2022 a potential year for it.

-Has room for growth against its peers.

-Bonus for anything with external cashflow.

To be on this list it:

-Needed a working product.

-Had a catalyst that makes 2022 a potential year for it.

-Has room for growth against its peers.

-Bonus for anything with external cashflow.

6/206

There is also a ton of great tech and projects that don& #39;t make this list because 2022 simply won& #39;t be their year.

People drastically underestimate the time required to build, grow adoption and sustain market outpacing.

There is also a ton of great tech and projects that don& #39;t make this list because 2022 simply won& #39;t be their year.

People drastically underestimate the time required to build, grow adoption and sustain market outpacing.

7/206

These assets are ones I think have a good case to outperform. But, it& #39;s worth remembering that (obviously) not all of these assets will be a hit.

No portfolio is 100%, and you don& #39;t weight all assets in a portfolio equally.

These assets are ones I think have a good case to outperform. But, it& #39;s worth remembering that (obviously) not all of these assets will be a hit.

No portfolio is 100%, and you don& #39;t weight all assets in a portfolio equally.

8/206

As a long term value investor, I may rebalance my portfolio but I& #39;m willing to have 60%-70% miss rate, hold projects for 5+ years, and eat losses for up to 3 years on anything I buy.

As a long term value investor, I may rebalance my portfolio but I& #39;m willing to have 60%-70% miss rate, hold projects for 5+ years, and eat losses for up to 3 years on anything I buy.

9/206

Normally I don& #39;t have that kind of downside, but investing in real assets that aren& #39;t just hype is like startup investing, you need to be in it long term.

Normally I don& #39;t have that kind of downside, but investing in real assets that aren& #39;t just hype is like startup investing, you need to be in it long term.

11/206

We& #39;ve gone through another bullcycle of fluff, hype and vapor.

It made a lot of people, a lot of money, on a whole lot of nothing.

We& #39;ve gone through another bullcycle of fluff, hype and vapor.

It made a lot of people, a lot of money, on a whole lot of nothing.

12/206

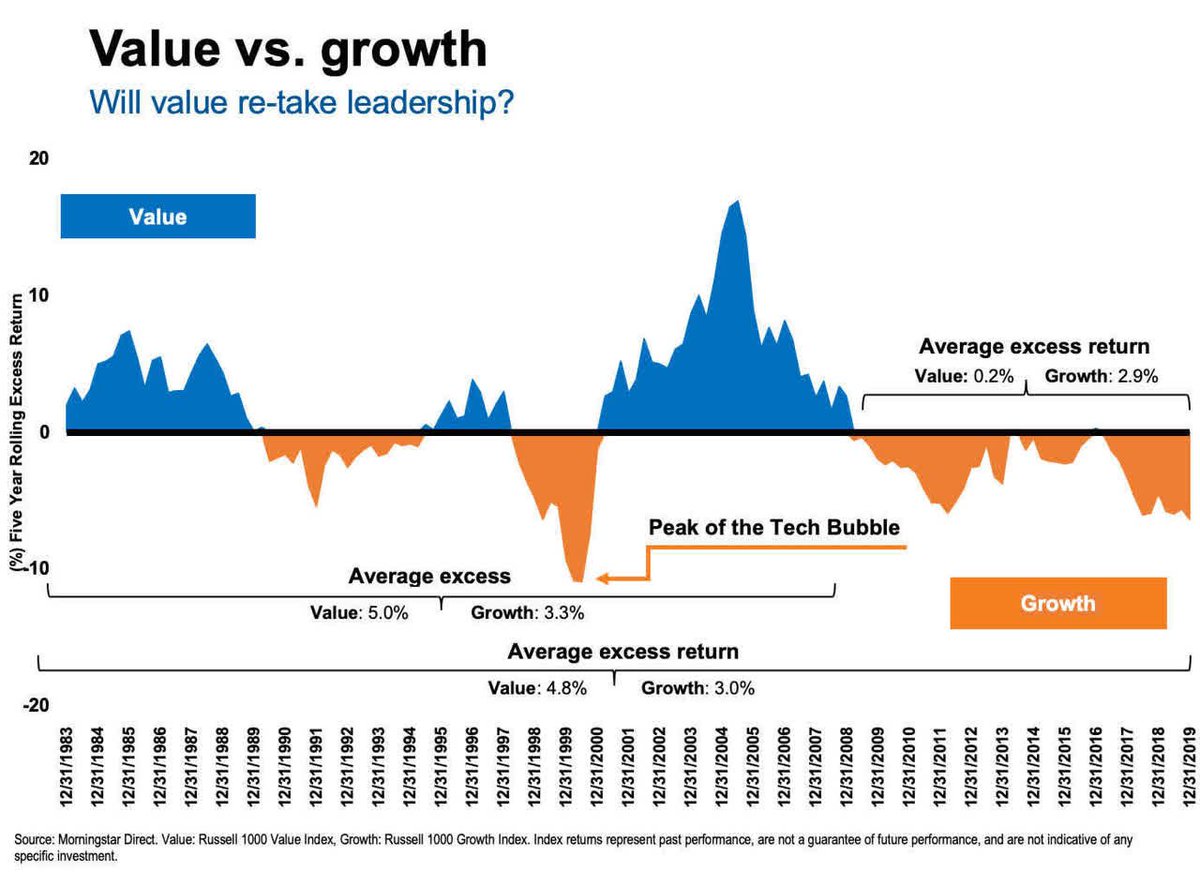

When traditional markets go through this we see a rotation from what we call "growth stocks" to "value stocks" as people seek real stable returns to shelter speculative monetary gains.

When traditional markets go through this we see a rotation from what we call "growth stocks" to "value stocks" as people seek real stable returns to shelter speculative monetary gains.

13/206

In most crypto cycles we didn& #39;t really have the equivalent of "value" stocks.

Almost everything was priced on its & #39;future& #39; (and lets be honest, retail has no clue what things are worth, especially in the future)

In most crypto cycles we didn& #39;t really have the equivalent of "value" stocks.

Almost everything was priced on its & #39;future& #39; (and lets be honest, retail has no clue what things are worth, especially in the future)

14/206

But, as crypto adoption has grown, that& #39;s start to shift, we start to see protocols that do make revenue.

TokenTerminal gives us a great overview that a number of protocols are starting to drive real revenue.

But, as crypto adoption has grown, that& #39;s start to shift, we start to see protocols that do make revenue.

TokenTerminal gives us a great overview that a number of protocols are starting to drive real revenue.

15/206

Even protocols that don& #39;t drive give revenue to a token (yet) still see huge demand, such as lending protocols which had an average 10x increase in borrow rates in 2021.

Even protocols that don& #39;t drive give revenue to a token (yet) still see huge demand, such as lending protocols which had an average 10x increase in borrow rates in 2021.

16/206

Dissecting the quality and origin of the revenue is important (and complicated) but what is clear, is that protocols that have *actual* revenue have often drastically *underperformed* in 2021.

Dissecting the quality and origin of the revenue is important (and complicated) but what is clear, is that protocols that have *actual* revenue have often drastically *underperformed* in 2021.

17/206

Because 2021 was a crypto growth cycle, where while trapped at home, with stimulus checks in hand, and eyes all a glow we collectively looked at markets and thought "Yup this dog coin is probably the future"

Because 2021 was a crypto growth cycle, where while trapped at home, with stimulus checks in hand, and eyes all a glow we collectively looked at markets and thought "Yup this dog coin is probably the future"

18/206

so anything that didn& #39;t bottle up hopium was punished and drastically over sold.

Because the reality is, most people have no sense of the time, complexity, cost, or upper bound potential of a growing business.

so anything that didn& #39;t bottle up hopium was punished and drastically over sold.

Because the reality is, most people have no sense of the time, complexity, cost, or upper bound potential of a growing business.

19/206

At the end of the day all that matters is cash and value.

If you provide a valuable service worth protecting or controlling, people will buy.

If you have a profitable product that shares revenue, people will buy.

At the end of the day all that matters is cash and value.

If you provide a valuable service worth protecting or controlling, people will buy.

If you have a profitable product that shares revenue, people will buy.

20/206

Because cash sustains teams of builders, builds products that can cross the chasm, and that can provide value.

That& #39;s why you& #39;ll see a lot of my 2022 picks have classic defi products of teams who have spent 5+ years building in any market.

Because cash sustains teams of builders, builds products that can cross the chasm, and that can provide value.

That& #39;s why you& #39;ll see a lot of my 2022 picks have classic defi products of teams who have spent 5+ years building in any market.

21/206

Fluff and vaporware will bleed out and we& #39;ll have a strong flight to things that make cash and have broad, real, value add user bases.

Fluff and vaporware will bleed out and we& #39;ll have a strong flight to things that make cash and have broad, real, value add user bases.

22/206

The second category is infrastructure.

We learned this year with the L1 boon, that there are a lot of gaps in our tooling.

In my main CEHV Blockchain OSI investment thesis ( https://cehv.com/cehvs-blockchain-osi-model-thesis/)">https://cehv.com/cehvs-blo... I talk a lot about the gaps we need to fill for the mainstream.

The second category is infrastructure.

We learned this year with the L1 boon, that there are a lot of gaps in our tooling.

In my main CEHV Blockchain OSI investment thesis ( https://cehv.com/cehvs-blockchain-osi-model-thesis/)">https://cehv.com/cehvs-blo... I talk a lot about the gaps we need to fill for the mainstream.

23/206

I don& #39;t think we made a lot of strives in that this year.

Not nearly enough.

But what we did do is validate the demand.

I don& #39;t think we made a lot of strives in that this year.

Not nearly enough.

But what we did do is validate the demand.

24/206

We saw L1s and L2s pop-up that taught us how painful, slow and insecure bridging can be.

We also learned that in L2s with offboarding times, people are willing to pay a strong premium for instant offramps.

We saw L1s and L2s pop-up that taught us how painful, slow and insecure bridging can be.

We also learned that in L2s with offboarding times, people are willing to pay a strong premium for instant offramps.

25/206

And with Vitalik& #39;s "Endgame" post earlier this month ( https://vitalik.ca/general/2021/12/06/endgame.html)">https://vitalik.ca/general/2... we learned that the path forward for Ethereum actually looks *A LOT* like a multichain world.

When shards exist, moving between them is kind of like moving between L2s.

And with Vitalik& #39;s "Endgame" post earlier this month ( https://vitalik.ca/general/2021/12/06/endgame.html)">https://vitalik.ca/general/2... we learned that the path forward for Ethereum actually looks *A LOT* like a multichain world.

When shards exist, moving between them is kind of like moving between L2s.

26/206

We& #39;re starting to see that in some of the planning that Avalanche is doing around subnets, and that projects like Cosmos and Atom have been thinking about as well.

We& #39;re starting to see that in some of the planning that Avalanche is doing around subnets, and that projects like Cosmos and Atom have been thinking about as well.

27/206

All of this validates a huge key problem.

In a multichain world, data and asset availability is a massive gap.

We need reliable data, across networks/chains/shards, and to move assets quickly in that manner.

All of this validates a huge key problem.

In a multichain world, data and asset availability is a massive gap.

We need reliable data, across networks/chains/shards, and to move assets quickly in that manner.

28/206

Most of the solutions for this like multichain dexes, onchain identity, or full blown scaling solutions won& #39;t have their outperform case in 2022. (I& #39;d guess 2023-2024)

But a few like real world assets, onchain futures, and bridges are probably ready for primetime.

Most of the solutions for this like multichain dexes, onchain identity, or full blown scaling solutions won& #39;t have their outperform case in 2022. (I& #39;d guess 2023-2024)

But a few like real world assets, onchain futures, and bridges are probably ready for primetime.

29/206

Infrastructure plays are a dime a dozen, and most of them will underperform.

It will be like the AMM boom we saw post-Sushi, where 99% of them will fail.

But the winners will make out like bandits capturing multi-year marketshare.

Infrastructure plays are a dime a dozen, and most of them will underperform.

It will be like the AMM boom we saw post-Sushi, where 99% of them will fail.

But the winners will make out like bandits capturing multi-year marketshare.

30/206

Other things may pop up during the year, maybe we stumble into a new defi primative, or a new scaling tech that gives a real boon.

But all of those feel ephemeral to me.

I have no interest in investing in bandaids.

Other things may pop up during the year, maybe we stumble into a new defi primative, or a new scaling tech that gives a real boon.

But all of those feel ephemeral to me.

I have no interest in investing in bandaids.

31/206

Instead 2022 is the year focused on real value drivers that I think can breakout, out perform in 2022 and then hold and sustain value moving forward.

Let& #39;s start to breakdown the list shall we?

Instead 2022 is the year focused on real value drivers that I think can breakout, out perform in 2022 and then hold and sustain value moving forward.

Let& #39;s start to breakdown the list shall we?

32/206

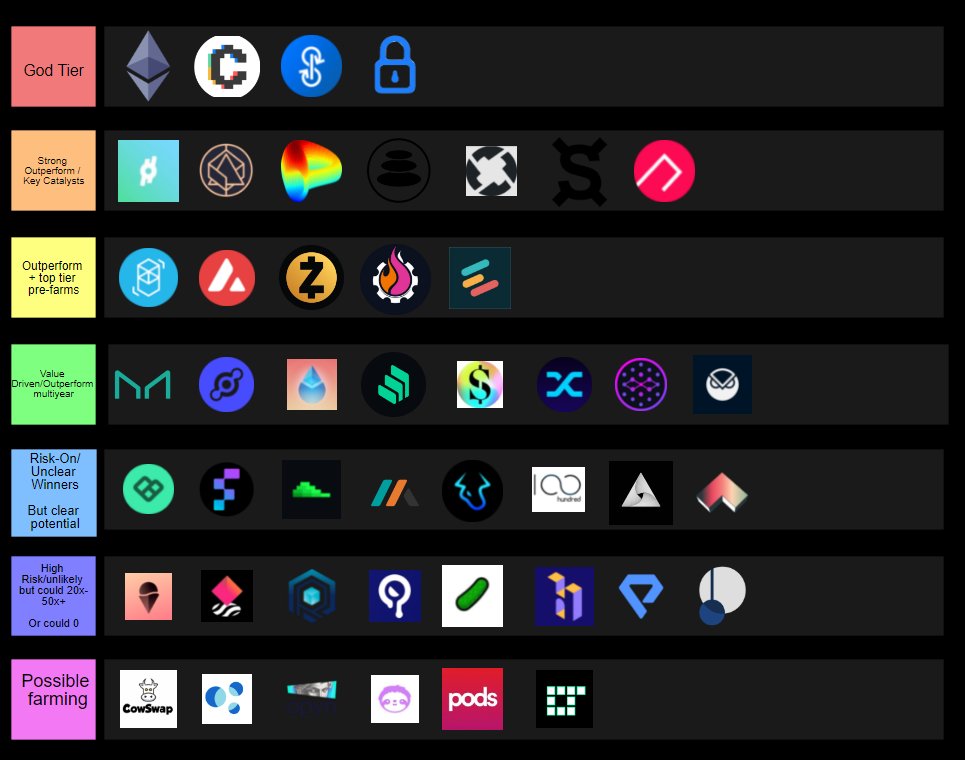

The list is broken down into categories kind of using a gaming tier list.

You can& #39;t actually just vertically rate an investment portfolio as its not apples to oranges, but I& #39;ve tried to give some priority order.

The list is broken down into categories kind of using a gaming tier list.

You can& #39;t actually just vertically rate an investment portfolio as its not apples to oranges, but I& #39;ve tried to give some priority order.

33/206

I& #39;ll explain each of the categories and then the assets within it.

And remember, these are my personal picks, that make sense in my balanced, long term portfolio, with diverse risk, high risk tolerance etc.

This isn& #39;t financial advice.

I& #39;ll explain each of the categories and then the assets within it.

And remember, these are my personal picks, that make sense in my balanced, long term portfolio, with diverse risk, high risk tolerance etc.

This isn& #39;t financial advice.

34/206

The God Tier:

For lack of any better naming convention, these are my top picks for 2022 that I think will out perform and continue strong.

They are basically things that I buy, stake/lock, forget about for a decade and buy and island with.

The God Tier:

For lack of any better naming convention, these are my top picks for 2022 that I think will out perform and continue strong.

They are basically things that I buy, stake/lock, forget about for a decade and buy and island with.

35/206

A big driver of this category is not that I think they& #39;ll only strong price appreciation moving forward but that they have lucrative external return drivers.

A big driver of this category is not that I think they& #39;ll only strong price appreciation moving forward but that they have lucrative external return drivers.

36/206

That means returns from staking/locking these assets have APY payouts that cover a lot of the cost risk of the asset, and are external non-dilutive revenue.

That means returns from staking/locking these assets have APY payouts that cover a lot of the cost risk of the asset, and are external non-dilutive revenue.

37/206

More importantly, most of these assets are also major enough tokens that you can borrow liquidity against from multiple providers allowing you to defer taxable events while still making other plays.

More importantly, most of these assets are also major enough tokens that you can borrow liquidity against from multiple providers allowing you to defer taxable events while still making other plays.

38/206

So my top tier picks consist of four assets:

-$ETH

-$YFI

-$CVX

-$KP3R

So my top tier picks consist of four assets:

-$ETH

-$YFI

-$CVX

-$KP3R

39/206

-$ETH

This one should be obvious, I& #39;ve been saying it for ages ETH 2.0 drives huge economic cycles.

As the merge gets closer, the drums of a flippening will beat louder (and I think we hit it in & #39;22) https://twitter.com/adamscochran/status/1250938829449674752">https://twitter.com/adamscoch...

-$ETH

This one should be obvious, I& #39;ve been saying it for ages ETH 2.0 drives huge economic cycles.

As the merge gets closer, the drums of a flippening will beat louder (and I think we hit it in & #39;22) https://twitter.com/adamscochran/status/1250938829449674752">https://twitter.com/adamscoch...

40/206

This prediction for ETH 2.0 to really create a huge upcycle in price was also before EIP-1559 was implemented and so this just becomes tenfold.

This prediction for ETH 2.0 to really create a huge upcycle in price was also before EIP-1559 was implemented and so this just becomes tenfold.

41/206

With scaling solutions growing, ETH burning in EIP-1559 and a merge on the horizon, ETH is that multi-year hold that will be tough to beat, and I think it will out perform any other major.

With scaling solutions growing, ETH burning in EIP-1559 and a merge on the horizon, ETH is that multi-year hold that will be tough to beat, and I think it will out perform any other major.

42/206

$YFI

For Yearn, I& #39;ll defer to my top picks thread from last week.

Their growth, external revenue ($100M~/year) (with no incentives), changing token model, upcoming buybacks ($45M) and use case make me think they break their ATH this year. https://twitter.com/adamscochran/status/1471518544944943104">https://twitter.com/adamscoch...

$YFI

For Yearn, I& #39;ll defer to my top picks thread from last week.

Their growth, external revenue ($100M~/year) (with no incentives), changing token model, upcoming buybacks ($45M) and use case make me think they break their ATH this year. https://twitter.com/adamscochran/status/1471518544944943104">https://twitter.com/adamscoch...

43/206

$CVX

I was early into CVX and have called it a "kingmaker" of DeFi.

I thought that it would likely continue to be strong into 2022 but previously didn& #39;t have it on my outperform list. https://twitter.com/adamscochran/status/1437444431641288711">https://twitter.com/adamscoch...

$CVX

I was early into CVX and have called it a "kingmaker" of DeFi.

I thought that it would likely continue to be strong into 2022 but previously didn& #39;t have it on my outperform list. https://twitter.com/adamscochran/status/1437444431641288711">https://twitter.com/adamscoch...

44/206

Three things changed that:

1) Votium Bribes: They grew way faster than I expected and validated the model.

2) Curve V2: Will scoop up most AMM volume for new projects (and therefore Bribes)

3) Convex is expanding outside of just Curve (see cvxFXS)

Three things changed that:

1) Votium Bribes: They grew way faster than I expected and validated the model.

2) Curve V2: Will scoop up most AMM volume for new projects (and therefore Bribes)

3) Convex is expanding outside of just Curve (see cvxFXS)

45/206

I expected to just continue to lock and farm my CVX (which is like a 50% APY, and roughly 2.4 P/E equivalent from vote bribes) and for CVX to maybe post another 2x over the year.

But,

I expected to just continue to lock and farm my CVX (which is like a 50% APY, and roughly 2.4 P/E equivalent from vote bribes) and for CVX to maybe post another 2x over the year.

But,

46/206

With those changes that rapidly evolved in the tail end of this year, I still probably wouldn& #39;t flinch if $CVX was an 8x-10x from current value over the next few years.

That would still put it in one of the most profitable P/Es around.

With those changes that rapidly evolved in the tail end of this year, I still probably wouldn& #39;t flinch if $CVX was an 8x-10x from current value over the next few years.

That would still put it in one of the most profitable P/Es around.

47/206

I think it& #39;s probably worth that if it scoops up other DeFi protocols too, never mind if Curve V2 scoops up the AMM market.

In a thread last night, I pointed out the bullcase for vote bribes in a CurveV2 model: https://twitter.com/adamscochran/status/1476381825505316864">https://twitter.com/adamscoch...

I think it& #39;s probably worth that if it scoops up other DeFi protocols too, never mind if Curve V2 scoops up the AMM market.

In a thread last night, I pointed out the bullcase for vote bribes in a CurveV2 model: https://twitter.com/adamscochran/status/1476381825505316864">https://twitter.com/adamscoch...

48/206

For CVX I just plan to relock my $CVX each cycle, delegate to http://Votium.app"> http://Votium.app and continue to pull in the returns as it takes over defi governance.

With the current returns, CVX could drop 50% and you& #39;d still break even on staking..

For CVX I just plan to relock my $CVX each cycle, delegate to http://Votium.app"> http://Votium.app and continue to pull in the returns as it takes over defi governance.

With the current returns, CVX could drop 50% and you& #39;d still break even on staking..

49/206

- #KP3R:

Did a thread on Keeper last week as part of my top picks.

General thesis is:

-You are getting two protocols for the price of one.

-FixedForex is basically Andre building Curve for international currencies. https://twitter.com/adamscochran/status/1474085379976404994">https://twitter.com/adamscoch...

- #KP3R:

Did a thread on Keeper last week as part of my top picks.

General thesis is:

-You are getting two protocols for the price of one.

-FixedForex is basically Andre building Curve for international currencies. https://twitter.com/adamscochran/status/1474085379976404994">https://twitter.com/adamscoch...

50/206

TradFi Forex does $6.6 *TRILLION* per *DAY* offchain.

Eventually some comes on chain.

Keeper is rapidly growing that market, and it helps change the game for international users, because payment rails chew us up.

TradFi Forex does $6.6 *TRILLION* per *DAY* offchain.

Eventually some comes on chain.

Keeper is rapidly growing that market, and it helps change the game for international users, because payment rails chew us up.

51/206

My other guess is that at somepoint $CVX starts gobbling up #KP3R the same way they are about to do with FXS.

That& #39;s going to add compounding value to both of them.

My other guess is that at somepoint $CVX starts gobbling up #KP3R the same way they are about to do with FXS.

That& #39;s going to add compounding value to both of them.

52/206

Strong Outperform:

This category is assets that I think have a key catalyst in 2022 to strongly outperform their peer groups.

Many of these assets land here by being way over sold but driving revenue, a few are growth potential.

Strong Outperform:

This category is assets that I think have a key catalyst in 2022 to strongly outperform their peer groups.

Many of these assets land here by being way over sold but driving revenue, a few are growth potential.

53/206

So who is in this top category?

-$FLX (Reflexer)

-$CRV

-$ALCX

-$BAL

-$ZRX

-$FXS

-$RBN

So who is in this top category?

-$FLX (Reflexer)

-$CRV

-$ALCX

-$BAL

-$ZRX

-$FXS

-$RBN

54/206

$FLX (Reflexer)

Creators of the $RAI stablecoin, I did a dedicated thread on them. The TL;DR is that its the purest of stablecoin money, strongly overlooked, plenty of key catalysts. https://twitter.com/adamscochran/status/1473390246205214730">https://twitter.com/adamscoch...

$FLX (Reflexer)

Creators of the $RAI stablecoin, I did a dedicated thread on them. The TL;DR is that its the purest of stablecoin money, strongly overlooked, plenty of key catalysts. https://twitter.com/adamscochran/status/1473390246205214730">https://twitter.com/adamscoch...

55/206

I think long term that web3 will adopt its own floating money and you& #39;ll see a weakening of the dollar denomination. $RAI is the perfect candidate. That& #39;s its long term driver.

2022 though is its first pass breakout.

I think long term that web3 will adopt its own floating money and you& #39;ll see a weakening of the dollar denomination. $RAI is the perfect candidate. That& #39;s its long term driver.

2022 though is its first pass breakout.

56/206

$CRV:

I don& #39;t have a dedicated thread for Curve, but the bullcase here is simple.

While I think the value of emissions for its stablepools are over frothed, Curve 2.0 changes all of that.

$CRV:

I don& #39;t have a dedicated thread for Curve, but the bullcase here is simple.

While I think the value of emissions for its stablepools are over frothed, Curve 2.0 changes all of that.

57/206

Curve 2.0 is crypto<>crypto pools rather than stable<>stable pools.

Right now, new projects often incentivize their staking via Sushiswap Onsen pools and majors often trade on Uniswap.

Curve 2.0 is crypto<>crypto pools rather than stable<>stable pools.

Right now, new projects often incentivize their staking via Sushiswap Onsen pools and majors often trade on Uniswap.

58/206

UniV3& #39;s complexity leads to a lot of traders losing capital in an unsustainable manner. It& #39;s great for pro market makers, but, mainstream users aren& #39;t a fan of the complexity. https://twitter.com/NateHindman/status/1457744185235288066">https://twitter.com/NateHindm...

UniV3& #39;s complexity leads to a lot of traders losing capital in an unsustainable manner. It& #39;s great for pro market makers, but, mainstream users aren& #39;t a fan of the complexity. https://twitter.com/NateHindman/status/1457744185235288066">https://twitter.com/NateHindm...

59/206

Sushi is also going through its own turmoil, which while I think they can come out of fine, it will take a while to get their footing right.

This leaves a big gap in the AMM marketplace.

Sushi is also going through its own turmoil, which while I think they can come out of fine, it will take a while to get their footing right.

This leaves a big gap in the AMM marketplace.

60/206

I think most of this gets absorbed by $CRV, $BAL, and $ZRX (more on those other two later)

But Curve incentives will *EASILY* become the new way that projects incentivize their pools at launch.

I think most of this gets absorbed by $CRV, $BAL, and $ZRX (more on those other two later)

But Curve incentives will *EASILY* become the new way that projects incentivize their pools at launch.

61/206

That will bring Curve new users, help them capture routing volume, and make way more projects interested in Convex and Curve.

The only way this doesn& #39;t play out is if Curve moves too slowly on rolling out more V2 pools, or governance blocks too many gauges.

That will bring Curve new users, help them capture routing volume, and make way more projects interested in Convex and Curve.

The only way this doesn& #39;t play out is if Curve moves too slowly on rolling out more V2 pools, or governance blocks too many gauges.

62/206

Overall a huge opportunity for them. That I think they will easily capture and will lead to a signifgant outperformance for them (when measured by price appreciation + staking returns)

Overall a huge opportunity for them. That I think they will easily capture and will lead to a signifgant outperformance for them (when measured by price appreciation + staking returns)

63/206

$ALCX:

This is another one I don& #39;t yet have a dedicated thread for, but $ALCX is one of my few & #39;growth& #39; potential plays in 2022.

It& #39;s one of the highest risk assets in these high tiers, but also such high potential.

$ALCX:

This is another one I don& #39;t yet have a dedicated thread for, but $ALCX is one of my few & #39;growth& #39; potential plays in 2022.

It& #39;s one of the highest risk assets in these high tiers, but also such high potential.

64/206

The self-repaying loans from @AlchemixFi are one of the most brilliant new DeFi designs we saw over the past few years but it wasn& #39;t without its snags on things like tokenomics and efficiency rates.

The self-repaying loans from @AlchemixFi are one of the most brilliant new DeFi designs we saw over the past few years but it wasn& #39;t without its snags on things like tokenomics and efficiency rates.

65/206

They& #39;ve went back to the drawing board and been working on AlchemixV2 which solves a lot of key problems and makes some ambitious new additions. https://alchemixfi.medium.com/alchemix-roadmap-f569ae958623">https://alchemixfi.medium.com/alchemix-...

They& #39;ve went back to the drawing board and been working on AlchemixV2 which solves a lot of key problems and makes some ambitious new additions. https://alchemixfi.medium.com/alchemix-roadmap-f569ae958623">https://alchemixfi.medium.com/alchemix-...

66/206

When we think about growth rather than value, the most important question is "Can this be a foundational primative that other protocols use?"

And here the answer is an overwhelming yes.

When we think about growth rather than value, the most important question is "Can this be a foundational primative that other protocols use?"

And here the answer is an overwhelming yes.

67/206

The self-repaying loan model creates huge opportunities for investors to take on risk and leverage in an evolving system, but have a capped downside in return.

The self-repaying loan model creates huge opportunities for investors to take on risk and leverage in an evolving system, but have a capped downside in return.

68/206

And the addition of new strategies models make it essentially like a mini-Yearn which you borrow from and self-repay.

And the addition of new strategies models make it essentially like a mini-Yearn which you borrow from and self-repay.

69/206

This is one that I& #39;m prepared to eat multi-year loses on if I have to, because I think it changes the game. But, I think the V2 launch is likely a game changer for $ALCX and that it will out perform next year.

This is one that I& #39;m prepared to eat multi-year loses on if I have to, because I think it changes the game. But, I think the V2 launch is likely a game changer for $ALCX and that it will out perform next year.

70/206

$BAL:

Balancer is one of those classic defi protocols that& #39;s been dramatically oversold and overlooked.

I& #39;ve got a detailed thread on it here: https://twitter.com/adamscochran/status/1473699268095533072">https://twitter.com/adamscoch...

$BAL:

Balancer is one of those classic defi protocols that& #39;s been dramatically oversold and overlooked.

I& #39;ve got a detailed thread on it here: https://twitter.com/adamscochran/status/1473699268095533072">https://twitter.com/adamscoch...

71/206

But the summary is that Balancer has a huge potential to be one of the most important AMM& #39;s in the space, regardless of if anyone goes to their site or not.

Balancer is good at making incredible foundational and flexible tech.

But the summary is that Balancer has a huge potential to be one of the most important AMM& #39;s in the space, regardless of if anyone goes to their site or not.

Balancer is good at making incredible foundational and flexible tech.

72/206

That tech struggles to be gas efficient, which held it back, but it acts as an incredible building block, that underpins some great use cases and high performance capital efficiency.

That tech struggles to be gas efficient, which held it back, but it acts as an incredible building block, that underpins some great use cases and high performance capital efficiency.

73/206

And their partnerships with Gnosis on Cowswap will lead to them being a key component of treasury management in the future.

And their partnerships with Gnosis on Cowswap will lead to them being a key component of treasury management in the future.

74/206

While I think that classic defi is going to have a strong year, I think $BAL has a huge potential to outperform, especially with their shift to a veToken model (which makes them another great Convex candidate)

While I think that classic defi is going to have a strong year, I think $BAL has a huge potential to outperform, especially with their shift to a veToken model (which makes them another great Convex candidate)

75/206

While they likely outperform this year, I think their real strength will be on a multi-year time horizon, where I make the contrarian bet that they will be a top AMM by underpinning treasury volume, indexing and LBP token offerings.

While they likely outperform this year, I think their real strength will be on a multi-year time horizon, where I make the contrarian bet that they will be a top AMM by underpinning treasury volume, indexing and LBP token offerings.

76/206

Those are things that no one else can do with the multi-asset capital efficiency that Balancer has.

So its a market that is all for them if they execute correctly.

Those are things that no one else can do with the multi-asset capital efficiency that Balancer has.

So its a market that is all for them if they execute correctly.

77/206

$ZRX

The @0xProject is another oversold overlooked defi infrastructure component that I think makes 2022 its breakout year driven primarily by the adoption of end user wallets: https://twitter.com/adamscochran/status/1472960035391217675">https://twitter.com/adamscoch...

$ZRX

The @0xProject is another oversold overlooked defi infrastructure component that I think makes 2022 its breakout year driven primarily by the adoption of end user wallets: https://twitter.com/adamscochran/status/1472960035391217675">https://twitter.com/adamscoch...

78/206

It actually plays into both components of my 2022 thesis, as it is both something with strong external revenue/adoption, and a key pillar of a multichain future, as 0x is the strongest competitor for building cross chain dex tooling.

It actually plays into both components of my 2022 thesis, as it is both something with strong external revenue/adoption, and a key pillar of a multichain future, as 0x is the strongest competitor for building cross chain dex tooling.

79/206

If we think of $ZRX in relation to the CEHV Blockchain OSI model, I think that 0x is going to sit at a lower layer of infrastructure and be the tooling that most chains and wallets adopt for order filling.

If we think of $ZRX in relation to the CEHV Blockchain OSI model, I think that 0x is going to sit at a lower layer of infrastructure and be the tooling that most chains and wallets adopt for order filling.

80/206

Currently, users use 0x without knowing it when swapping in MetaMask and other major wallets, and as we see retail expansion through accessibility in L2s that trend is going to continue.

Currently, users use 0x without knowing it when swapping in MetaMask and other major wallets, and as we see retail expansion through accessibility in L2s that trend is going to continue.

81/206

I think the likely launch of a MetaMask token, and some key tooling upgrades for RFQs and crosschain trades with the expansion of L1s and L2s in 2022 will make it a driver year for 0x but there is a also a long term consideration here.

I think the likely launch of a MetaMask token, and some key tooling upgrades for RFQs and crosschain trades with the expansion of L1s and L2s in 2022 will make it a driver year for 0x but there is a also a long term consideration here.

82/206

The tokenomics are underwhelming to some, which keeps the price oversold for sure, but I think there is a future where 0x is as ubiquitous as leading banking software which will strongly drive rewards for node operators and in turn staking.

The tokenomics are underwhelming to some, which keeps the price oversold for sure, but I think there is a future where 0x is as ubiquitous as leading banking software which will strongly drive rewards for node operators and in turn staking.

83/206

$FXS:

I added Frax to this list a few weeks ago and it& #39;s already outperformed at levels I wasn& #39;t expecting.

The summary here is that Frax is probably the best integrator in the stablecoin space.

$FXS:

I added Frax to this list a few weeks ago and it& #39;s already outperformed at levels I wasn& #39;t expecting.

The summary here is that Frax is probably the best integrator in the stablecoin space.

84/206

For a long time I underestimated them, but they& #39;ve proven time and time again to be strong executors at trying new financial models, but absolutely the best at building diverse, value-added bridges with other protocols.

For a long time I underestimated them, but they& #39;ve proven time and time again to be strong executors at trying new financial models, but absolutely the best at building diverse, value-added bridges with other protocols.

85/206

The most recent example is their partnership with Convex on the Frax FPI and cvxFXS integration which is set to do its airdrop in the coming weeks.

And once the vote allocation starts, it just becomes a flywheel.

The most recent example is their partnership with Convex on the Frax FPI and cvxFXS integration which is set to do its airdrop in the coming weeks.

And once the vote allocation starts, it just becomes a flywheel.

86/206

If there are two things that are worth not underestimating in this space, its relentless builders and relentless build bridgers.

Frax is both.

If there are two things that are worth not underestimating in this space, its relentless builders and relentless build bridgers.

Frax is both.

87/206

$RBN:

Ribbon is one of the few assets I like that is in a rough spot from FDV.

But, I think the tokenomics, distribution model, upcoming lockup model and external revenue more than make up for it.

$RBN:

Ribbon is one of the few assets I like that is in a rough spot from FDV.

But, I think the tokenomics, distribution model, upcoming lockup model and external revenue more than make up for it.

88/206

I have this theory, that no matter how hard we try, we& #39;re not going to be able to teach 99% of people to properly use options.

Which is really well captured by this joke from CMS: https://twitter.com/cmsholdings/status/1475656381856423937">https://twitter.com/cmsholdin...

I have this theory, that no matter how hard we try, we& #39;re not going to be able to teach 99% of people to properly use options.

Which is really well captured by this joke from CMS: https://twitter.com/cmsholdings/status/1475656381856423937">https://twitter.com/cmsholdin...

89/206

But that doesn& #39;t mean that options aren& #39;t insanely lucrative, if used correctly.

Ribbon, in my best TL;DR, is kind of like Yearn for options.

But that doesn& #39;t mean that options aren& #39;t insanely lucrative, if used correctly.

Ribbon, in my best TL;DR, is kind of like Yearn for options.

90/206

Users stake in a vault, that uses a defined pre-built options strategy, and benefit from it.

As we& #39;ve seen with Yearn, the best strategies for vaults are the ones that are so complex that even if you know what the are doing, you can& #39;t really replicate it.

Users stake in a vault, that uses a defined pre-built options strategy, and benefit from it.

As we& #39;ve seen with Yearn, the best strategies for vaults are the ones that are so complex that even if you know what the are doing, you can& #39;t really replicate it.

91/206

I& #39;d be willing to bet that 90% of vault stakers in Ribbon, cannot replicate the execution of their vault strategy, but they are probably pretty happy to get 30% returns on things like ETH and USDC.

I& #39;d be willing to bet that 90% of vault stakers in Ribbon, cannot replicate the execution of their vault strategy, but they are probably pretty happy to get 30% returns on things like ETH and USDC.

92/206

This means that Ribbon drives value, from external rewards and not just $RBN distribution.

And, since its not farming like Yearn vaults, it& #39;s models can make solid returns in bull, bear or crab markets. Which is pretty unique for the space.

This means that Ribbon drives value, from external rewards and not just $RBN distribution.

And, since its not farming like Yearn vaults, it& #39;s models can make solid returns in bull, bear or crab markets. Which is pretty unique for the space.

93/206

The tokenomics have held them back, and so has the vault caps, because the reality is, you cannot make returns on options at an unlimited scale.

But that& #39;s why I find Ribbon so interesting.

I think its probably the only path to scaling options.

The tokenomics have held them back, and so has the vault caps, because the reality is, you cannot make returns on options at an unlimited scale.

But that& #39;s why I find Ribbon so interesting.

I think its probably the only path to scaling options.

94/206

Just like a large amount of retail can& #39;t build advanced farming strategies, and need Yearn, most people can& #39;t build options strategies and need Ribbon.

Ribbon needs more options participants to grow.

Just like a large amount of retail can& #39;t build advanced farming strategies, and need Yearn, most people can& #39;t build options strategies and need Ribbon.

Ribbon needs more options participants to grow.

95/206

Most options protocols (which we& #39;ll cover later in this thread) need volume providers to grow and can& #39;t easily onboard users, at scale, without...well chaos.

So Ribbon, and the upcoming boon of onchain options protocols actually make each other viable.

Most options protocols (which we& #39;ll cover later in this thread) need volume providers to grow and can& #39;t easily onboard users, at scale, without...well chaos.

So Ribbon, and the upcoming boon of onchain options protocols actually make each other viable.

96/206

Not to mention Ribbon is reworking the tokenomics and switching to a veToken model, which makes them a lockup flyhweel and yet another primate candidate for future Convex integration (are you seeing a trend yet?)

Not to mention Ribbon is reworking the tokenomics and switching to a veToken model, which makes them a lockup flyhweel and yet another primate candidate for future Convex integration (are you seeing a trend yet?)

97/206

Outperforms + Top Tier Farms:

These are my & #39;safe& #39; outperformers for 2022. I don& #39;t think they (most of them) will 10x, but I think they will provider strong growth, have less downside risk, and clear value.

Outperforms + Top Tier Farms:

These are my & #39;safe& #39; outperformers for 2022. I don& #39;t think they (most of them) will 10x, but I think they will provider strong growth, have less downside risk, and clear value.

98/206

The list also includes a few that I think *will* fall into that category once they launch but that are in a pre-farming spot right now.

The list also includes a few that I think *will* fall into that category once they launch but that are in a pre-farming spot right now.

99/206

The list for outperforms is:

-$FTM

-$AVAX

-$ZEC

-Gearbox

-Euler Finance (watch out there is a similar named protocol with a live token that you should avoid)

The list for outperforms is:

-$FTM

-$AVAX

-$ZEC

-Gearbox

-Euler Finance (watch out there is a similar named protocol with a live token that you should avoid)

100/206

$FTM:

In the L1 rallies, Fantom has been a bit overlooked in favor of its peers.

Unlike other L1s that are heavily VC owned and with projects that are VC owned, Fantom feels a lot more organic like early Ethereum.

$FTM:

In the L1 rallies, Fantom has been a bit overlooked in favor of its peers.

Unlike other L1s that are heavily VC owned and with projects that are VC owned, Fantom feels a lot more organic like early Ethereum.

101/206

The aBFT model provides strong scalability, the staking provides reliable lockups (and decent APR rewards on holdings) it has lots of early stage projects, and good builder incentives.

The aBFT model provides strong scalability, the staking provides reliable lockups (and decent APR rewards on holdings) it has lots of early stage projects, and good builder incentives.

102/206

I think as users branch out in search of more L1s at the end of this L1 mania rotation, Fantom scoops up lots of new users and builders and has a strong year of reasonable returns.

I think as users branch out in search of more L1s at the end of this L1 mania rotation, Fantom scoops up lots of new users and builders and has a strong year of reasonable returns.

103/206

$AVAX

Avax had its breakout earlier than I had expected, and so I was more on the fence and thought it may be hard for it to continue an out performance.

But honestly, if you put it in a basket with other L1s I think it will still out perform.

$AVAX

Avax had its breakout earlier than I had expected, and so I was more on the fence and thought it may be hard for it to continue an out performance.

But honestly, if you put it in a basket with other L1s I think it will still out perform.

104/206

Compared to Polkadot, Cardano, Polygon, etc. It has the clearest path to scaling for any EVM based major asset right now, and I do think the subnet model is a game changer.

Compared to Polkadot, Cardano, Polygon, etc. It has the clearest path to scaling for any EVM based major asset right now, and I do think the subnet model is a game changer.

105/206

The subnet model is basically like a mini-version of sharding that allows anyone to build purpose driven appchains, and so I think a lot of the early experiments we need for Ethereum sharding are going to live within Avax subnets.

The subnet model is basically like a mini-version of sharding that allows anyone to build purpose driven appchains, and so I think a lot of the early experiments we need for Ethereum sharding are going to live within Avax subnets.

106/206

Capturing that innovation will be lucrative, and so I think Avax still has a decent change to outperform in the coming year.

Capturing that innovation will be lucrative, and so I think Avax still has a decent change to outperform in the coming year.

107/206

$ZEC:

I respectfully disagree with some of @BarrySilbert& #39;s calls (although they are at least well founded) but, Zcash is one where I overwhelmingly agree.

$ZEC:

I respectfully disagree with some of @BarrySilbert& #39;s calls (although they are at least well founded) but, Zcash is one where I overwhelmingly agree.

108/206

The privacy benefits of ZCash are one thing, but the incredible amount of research that ZEC does that is critical to the ecosystem is the real magic.

The privacy benefits of ZCash are one thing, but the incredible amount of research that ZEC does that is critical to the ecosystem is the real magic.

109/206

ZCash has been working on zero-knowledge proofs since long before most people in this industry had even heard the word.

And that research overlap is something that hasn& #39;t been overlooked.

ZCash has been working on zero-knowledge proofs since long before most people in this industry had even heard the word.

And that research overlap is something that hasn& #39;t been overlooked.

110/206

As early as 2018, there were vague ideas floated around by Vitalik and Zooko of how you could merge Zcash and Ethereum: https://twitter.com/VitalikButerin/status/1043920886183661569?s=20">https://twitter.com/VitalikBu...

As early as 2018, there were vague ideas floated around by Vitalik and Zooko of how you could merge Zcash and Ethereum: https://twitter.com/VitalikButerin/status/1043920886183661569?s=20">https://twitter.com/VitalikBu...

111/206

Now reading that tweet, doesn& #39;t sound like how we& #39;d approach a Zcash integration today, but it is the core concept that drives my own personal investment in ZEC.

Now reading that tweet, doesn& #39;t sound like how we& #39;d approach a Zcash integration today, but it is the core concept that drives my own personal investment in ZEC.

112/206

As we increasingly see what the post-merge, sharded, sidechain, multi-L2 future world looks like, it& #39;s pretty clear that there is a huge opportunity for a secondary layer ZK transfer protocol on top of Ethereum.

As we increasingly see what the post-merge, sharded, sidechain, multi-L2 future world looks like, it& #39;s pretty clear that there is a huge opportunity for a secondary layer ZK transfer protocol on top of Ethereum.

113/206

The exact specifics of that are unclear, it could operate in an L2 style like Starkware apps do, or in a bridge L2 like rollups (Arbitrum/Optimisim) or there may be a future where there are ETH 2.0 shards that treat it as a first class citizen.

The exact specifics of that are unclear, it could operate in an L2 style like Starkware apps do, or in a bridge L2 like rollups (Arbitrum/Optimisim) or there may be a future where there are ETH 2.0 shards that treat it as a first class citizen.

114/206

Ultimately my thesis is that Zcash has ultimately been building the privacy transfer/zk-snark layer that Ethereum has always needed, and the rest of the world has ignored it thinking its a standalone thing.

Ultimately my thesis is that Zcash has ultimately been building the privacy transfer/zk-snark layer that Ethereum has always needed, and the rest of the world has ignored it thinking its a standalone thing.

115/206

Maybe it just continues as a standalone chain and we get better at cross-chain interoperability. But, I think ZEC merges into the Ethereum world at somepoint, and either way becomes a critical part of value transfer in web3.

Maybe it just continues as a standalone chain and we get better at cross-chain interoperability. But, I think ZEC merges into the Ethereum world at somepoint, and either way becomes a critical part of value transfer in web3.

116/206

Gearbox:

http://gearbox.fi"> http://gearbox.fi

Governance token exists but isn& #39;t yet tradable. Seems likely it will continue to airdrop/farm from the protocol use.

Gearbox:

http://gearbox.fi"> http://gearbox.fi

Governance token exists but isn& #39;t yet tradable. Seems likely it will continue to airdrop/farm from the protocol use.

117/206

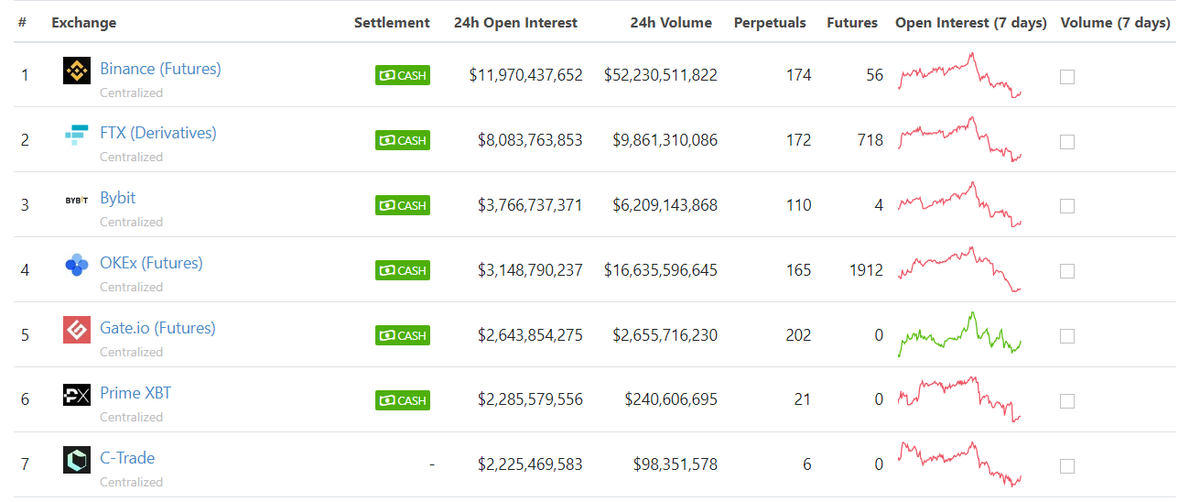

The protocol is basically designed to help bring leverage/margin to defi.

As we know leverage volume on CEX& #39;s outweighs spot volume by at least 5:1 on average.

The protocol is basically designed to help bring leverage/margin to defi.

As we know leverage volume on CEX& #39;s outweighs spot volume by at least 5:1 on average.

118/206

But this boon is missing from defi, which also means its missing from the earliest stages of investing and farming for when tokens aren& #39;t yet listed on centralized exchanges.

But this boon is missing from defi, which also means its missing from the earliest stages of investing and farming for when tokens aren& #39;t yet listed on centralized exchanges.

119/206

Imagine you find a new token that you want to be in.

You have $100 of collateral.

On a CEX you could long up to $2000 of a token, but in DeFi you are stuck farming with that $100.

Imagine you find a new token that you want to be in.

You have $100 of collateral.

On a CEX you could long up to $2000 of a token, but in DeFi you are stuck farming with that $100.

120/206

With gearbox, you have the opportunity to open credit accounts which allow you to borrow leveraged positions and use them in various defi apps.

Allowing you to go long in a decentralized environment.

With gearbox, you have the opportunity to open credit accounts which allow you to borrow leveraged positions and use them in various defi apps.

Allowing you to go long in a decentralized environment.

121/206

That& #39;s a game changer, and not just for Gearbox, but I actually think that Gearbox will drive a huge amount of the classic defi 1.0 bluechip growth this cycle.

As it will do for defi volume what perps/futures did for CEX volume.

That& #39;s a game changer, and not just for Gearbox, but I actually think that Gearbox will drive a huge amount of the classic defi 1.0 bluechip growth this cycle.

As it will do for defi volume what perps/futures did for CEX volume.

123/206

http://Euler.finance"> http://Euler.finance

Euler is probably one of the first major reworks of the lend and borrow model that we& #39;ve seen since Aave.

It& #39;s a complete reimagination of what you can do with a lending protocol.

http://Euler.finance"> http://Euler.finance

Euler is probably one of the first major reworks of the lend and borrow model that we& #39;ve seen since Aave.

It& #39;s a complete reimagination of what you can do with a lending protocol.

124/206

A clever contract/accounts model, and the ability to create isolated pairs from a diverse set of oracles including AMM pools, creates a strong opportunity for diverse asset growth.

A clever contract/accounts model, and the ability to create isolated pairs from a diverse set of oracles including AMM pools, creates a strong opportunity for diverse asset growth.

125/206

Most lending protocols have the issue that they are only as strong as their weakest asset.

That& #39;s part of why we saw Cream face so many devastating exploits.

Most lending protocols have the issue that they are only as strong as their weakest asset.

That& #39;s part of why we saw Cream face so many devastating exploits.

126/206

But Euler takes a careful balance here with four types of market:

-Collateral

-Cross

-Isolated

-Protected

But Euler takes a careful balance here with four types of market:

-Collateral

-Cross

-Isolated

-Protected

127/206

This will allow them to keep risky markets isolate but permissionless, while still allowing opportunities to use collateral to borrow main and diverse assets.

This will allow them to keep risky markets isolate but permissionless, while still allowing opportunities to use collateral to borrow main and diverse assets.

128/206

Not only do I think that will make Euler competitive themselves, but just like Gearbox I think this will create a boon for bluechip defi tokens.

Not only do I think that will make Euler competitive themselves, but just like Gearbox I think this will create a boon for bluechip defi tokens.

129/206

It& #39;s been hard to borrow against a lot of new protocols where users have capital locked up.

Euler will unlock a lot of idle capital for more diverse plays which will breathe a lot of life into the space.

It& #39;s been hard to borrow against a lot of new protocols where users have capital locked up.

Euler will unlock a lot of idle capital for more diverse plays which will breathe a lot of life into the space.

130/206

Value Driven/Outperform Multiyear:

This category is bets where I don& #39;t know if 2022 is their break out year but can make a strong case that it might be, and believe they will outperform most things over a multi-year time period even if they don& #39;t break out this year.

Value Driven/Outperform Multiyear:

This category is bets where I don& #39;t know if 2022 is their break out year but can make a strong case that it might be, and believe they will outperform most things over a multi-year time period even if they don& #39;t break out this year.

131/206

These assets are:

-$MKR

-$HNT

-$LDO

-$COMP

-$RARE

-$SNX

-$SYN

-$GNO

These assets are:

-$MKR

-$HNT

-$LDO

-$COMP

-$RARE

-$SNX

-$SYN

-$GNO

132/206

There are a lot of these, so I& #39;ll try and keep it a bit more brief.

If you are a value investor with a multi-year believe in the space, take the time to dig into them.

If not...well, I& #39;m not sure why you& #39;ve read this far at all then..

There are a lot of these, so I& #39;ll try and keep it a bit more brief.

If you are a value investor with a multi-year believe in the space, take the time to dig into them.

If not...well, I& #39;m not sure why you& #39;ve read this far at all then..

133/206

$MKR:

Huge cashflow, $DAI isn& #39;t going away, one of the few organizations that has survived multiple iterations of community and leadership, and pushing into real world assets.

$MKR:

Huge cashflow, $DAI isn& #39;t going away, one of the few organizations that has survived multiple iterations of community and leadership, and pushing into real world assets.

134/206

I& #39;d rather they& #39;d stuck to pure money, but I can& #39;t den the lucrative path before them that is going to steadily return year over year.

I& #39;d rather they& #39;d stuck to pure money, but I can& #39;t den the lucrative path before them that is going to steadily return year over year.

135/206

As we shift to a market more dominated by institutions and bankers who have lower return targets than crypto traders, they are going to keep on eating this up on a steady basis.

As we shift to a market more dominated by institutions and bankers who have lower return targets than crypto traders, they are going to keep on eating this up on a steady basis.

136/206

$HNT:

Is it frothy? Yes.

Is 2022 their year? Coin toss.

But they& #39;ve built the *only* viable physical layer network that fits into my OSI model thesis and I cannot ignore that.

$HNT:

Is it frothy? Yes.

Is 2022 their year? Coin toss.

But they& #39;ve built the *only* viable physical layer network that fits into my OSI model thesis and I cannot ignore that.

137/206

They have a long way to go but the Helium node coverage of the globe isdamn impressive, and the way we& #39;ve seen telcos fumble 5g and the pursuit of Helium in 5g and IoT physical connectivity layers is impressive.

They have a long way to go but the Helium node coverage of the globe isdamn impressive, and the way we& #39;ve seen telcos fumble 5g and the pursuit of Helium in 5g and IoT physical connectivity layers is impressive.

138/206

I& #39;d be willing to accept that 2022 could not be their outperform year, but it stays on the shopping list because I& #39;m going to be buying it with other profits all year because it has a clear long term competitive advantage.

I& #39;d be willing to accept that 2022 could not be their outperform year, but it stays on the shopping list because I& #39;m going to be buying it with other profits all year because it has a clear long term competitive advantage.

139/206

$LDO:

Owning LDO is basically owning an index of all possible L1 and L2 solutions.

It consumes them rapidly and is a path to profit.

People are worried about the FDV. This is one rare case where I& #39;m not.

$LDO:

Owning LDO is basically owning an index of all possible L1 and L2 solutions.

It consumes them rapidly and is a path to profit.

People are worried about the FDV. This is one rare case where I& #39;m not.

140/206

The opportunity to earn from 10% of all L1/L2 captured is worth it.

A lot of the early presale stuff has changed hands already at higher prices and multiyear locks on OTC.

The opportunity to earn from 10% of all L1/L2 captured is worth it.

A lot of the early presale stuff has changed hands already at higher prices and multiyear locks on OTC.

141/206

Plus there is a future path where the start to gobble up staking/node operation for none L1 protocols.

To me $LDO is a thing I buy so I don& #39;t have to keep up with what the next lucrative L1 is, I can just own some of it.

Plus there is a future path where the start to gobble up staking/node operation for none L1 protocols.

To me $LDO is a thing I buy so I don& #39;t have to keep up with what the next lucrative L1 is, I can just own some of it.

142/206

$COMP:

Lending giant, relentless team of problem solvers.

First to explore multichain by choosing to go the appchain path.

They hit a wall dealing with substrate.

$COMP:

Lending giant, relentless team of problem solvers.

First to explore multichain by choosing to go the appchain path.

They hit a wall dealing with substrate.

143/206

But, the team has continued to execute and I have no doubt they& #39;ve been continuing to work on an appchain model.

But, the team has continued to execute and I have no doubt they& #39;ve been continuing to work on an appchain model.

144/206

Broke twitter, here is the rest: https://twitter.com/adamscochran/status/1476651883871674371">https://twitter.com/adamscoch...

Broke twitter, here is the rest: https://twitter.com/adamscochran/status/1476651883871674371">https://twitter.com/adamscoch...

Read on Twitter

Read on Twitter