It& #39;s the weekend!

Grab a cup of coffee, in this thread I will explain

1. The relationship between Inflation and Margins

2. Why do some companies report margin contraction while others thrive?

3. Will Earnings & Margins of companies remain forever depressed?

Lets dive right in!

Grab a cup of coffee, in this thread I will explain

1. The relationship between Inflation and Margins

2. Why do some companies report margin contraction while others thrive?

3. Will Earnings & Margins of companies remain forever depressed?

Lets dive right in!

Lets start with the quick basics first!

What is inflation?

More than increase in prices, Inflation is described as a decline of purchasing power of a given currency over time.

More than increase in prices, Inflation is described as a decline of purchasing power of a given currency over time.

Inflation is actually good for an economy in small dozes.

Small amounts of inflation keeps an economy churning along and brings about an increase in prosperity and growth.

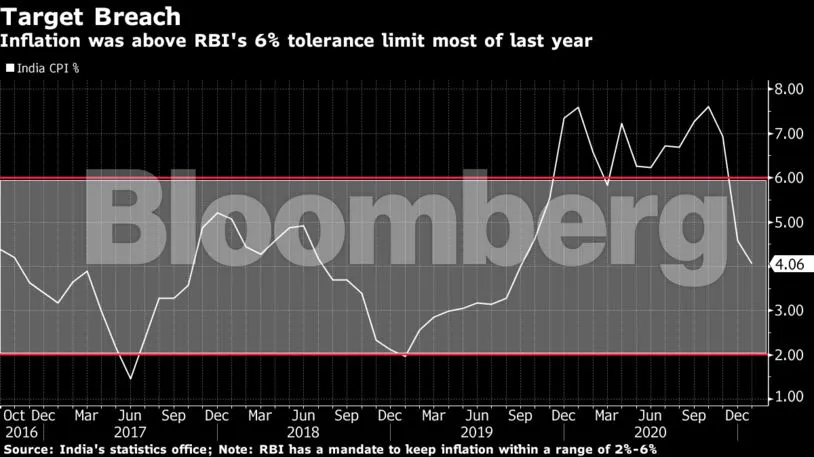

This is the reason why US Fed has a target inflation of 2% while RBI has a target inflation rate of 6%.

Small amounts of inflation keeps an economy churning along and brings about an increase in prosperity and growth.

This is the reason why US Fed has a target inflation of 2% while RBI has a target inflation rate of 6%.

Without balanced inflation, economies cannot grow and businesses will eventually suffer.

That& #39;s why Inflation is described as a tight rope for a central bank to balance upon.

That& #39;s why Inflation is described as a tight rope for a central bank to balance upon.

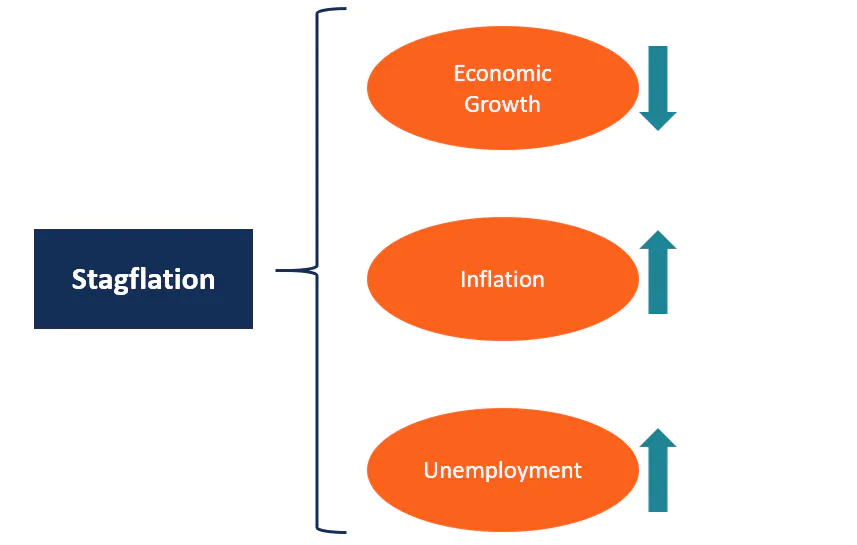

Swing either side on the rope too much and you may just bring about either deflation or worse stagflation and in some cases even hyperinflation.

*Stagflation: When an economy has slow growth but very high unemployment and a stable but upwards rise of prices of goods and services.

Stagflation is a Central Banker& #39;s worse nightmare.

Stagflation is a Central Banker& #39;s worse nightmare.

US and UK economies during the 1970s is a classic example of stagflation.

Here is a short 4 min video on why US experienced stagflation in the 1970s. https://youtu.be/XfYuA4OL82U ">https://youtu.be/XfYuA4OL8...

Here is a short 4 min video on why US experienced stagflation in the 1970s. https://youtu.be/XfYuA4OL82U ">https://youtu.be/XfYuA4OL8...

*Hyperinflation: When inflation runs without a leash, prices increase without any control, sometimes even more than 50% in a single month!

Hyperinflation is a rare economic event and has destroyed many economies like Russia, Hungary and even China in the past!

Hyperinflation is a rare economic event and has destroyed many economies like Russia, Hungary and even China in the past!

Now that you have a general idea of inflation and its various types, lets understand the root causes behind it.

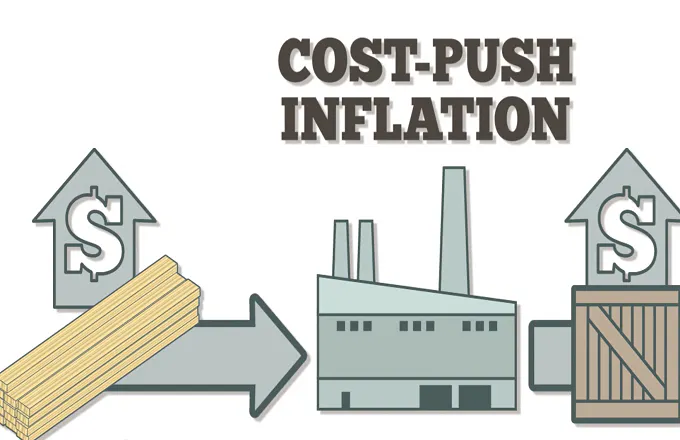

The two main drives behind Inflation are

1. Cost Push

2. Wage Push

1. Cost Push

2. Wage Push

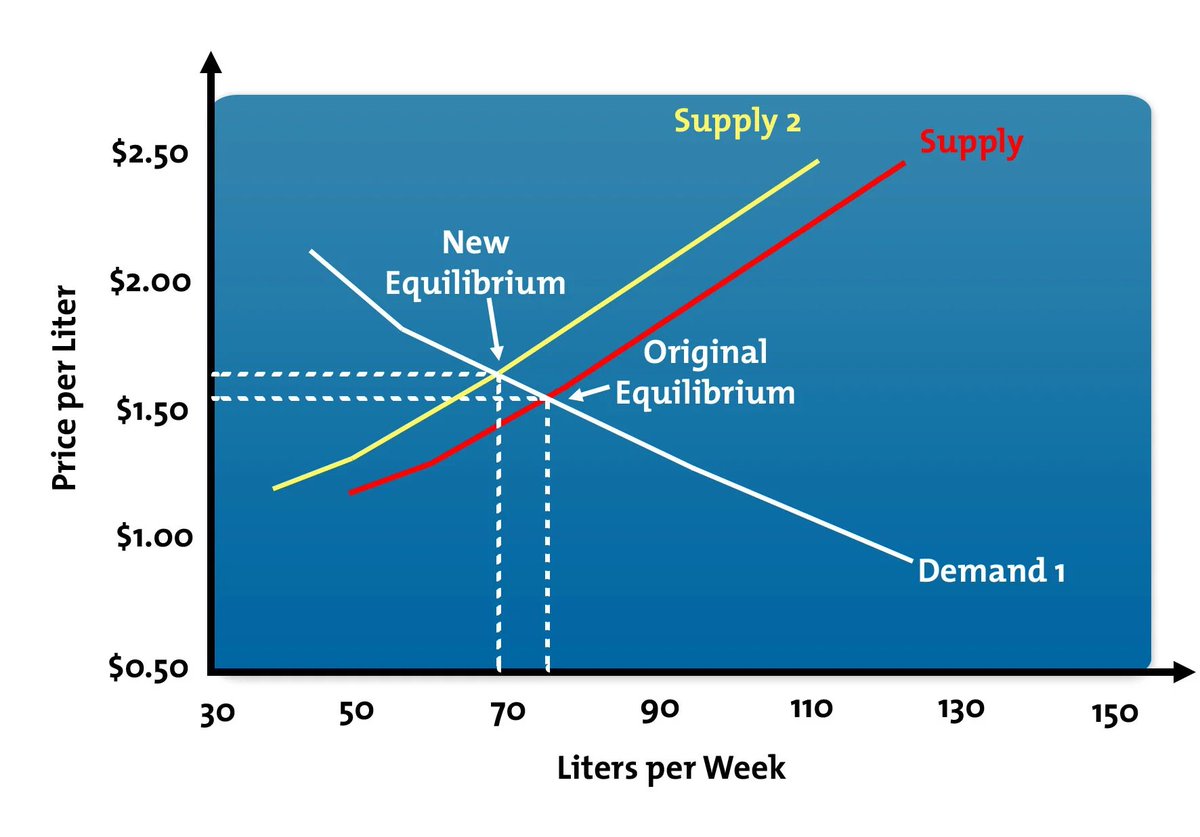

Cost Push Inflation occurs when overall wages and prices of raw materials lead to a decrease in aggregate supply while the demand for the goods remains the same.

As high school economics will tell you, if supply decreases while demand remains stable, prices go up.

Wage Push inflation, as the name suggests, is due to an increase in corporate wages that lead to prices of goods and services (primarily services) increasing.

Indian IT Service industry today (in 2021) is witnessing Wage Push Inflation.

Indian IT Service industry today (in 2021) is witnessing Wage Push Inflation.

With the above in mind, lets understand the choices a company has, to deal with inflation.

Any rise in cost of production or service, will and is eventually passed on to the consumer.

It is the SPEED and MAGNITUDE of this pass through that determines the margins of the company and its place in the industry structure.

It is the SPEED and MAGNITUDE of this pass through that determines the margins of the company and its place in the industry structure.

Companies with pricing power can easily pass on inflation costs than companies without pricing power.

But!

Pass on the price too soon and a company can risk losing its market share.

Wait for a while and a company will definitely report declining profit margins.

But!

Pass on the price too soon and a company can risk losing its market share.

Wait for a while and a company will definitely report declining profit margins.

Protecting market share of its products is the main reason why companies dillydally when it comes to passing on inflationary costs and live with short term compression of margins.

This is also the reason why across the board, companies in Q2 reported depressed margins and higher Cost of Goods Sold (COGS).

Safe to assume, even Q3 performance will be along the similar lines.

Safe to assume, even Q3 performance will be along the similar lines.

So does that mean margins for these companies will forever be depressed?

No!

No!

Just like there are forces and drives of inflation, there are forces that are working on the supply side of the industry as well.

For example,

Wage Push Inflation is rampant today in the Indian IT Service industry.

Good wage growth, career prospects and stability will eventually attract more talent and even out the playing field when it comes to demand and supply of IT talent.

Wage Push Inflation is rampant today in the Indian IT Service industry.

Good wage growth, career prospects and stability will eventually attract more talent and even out the playing field when it comes to demand and supply of IT talent.

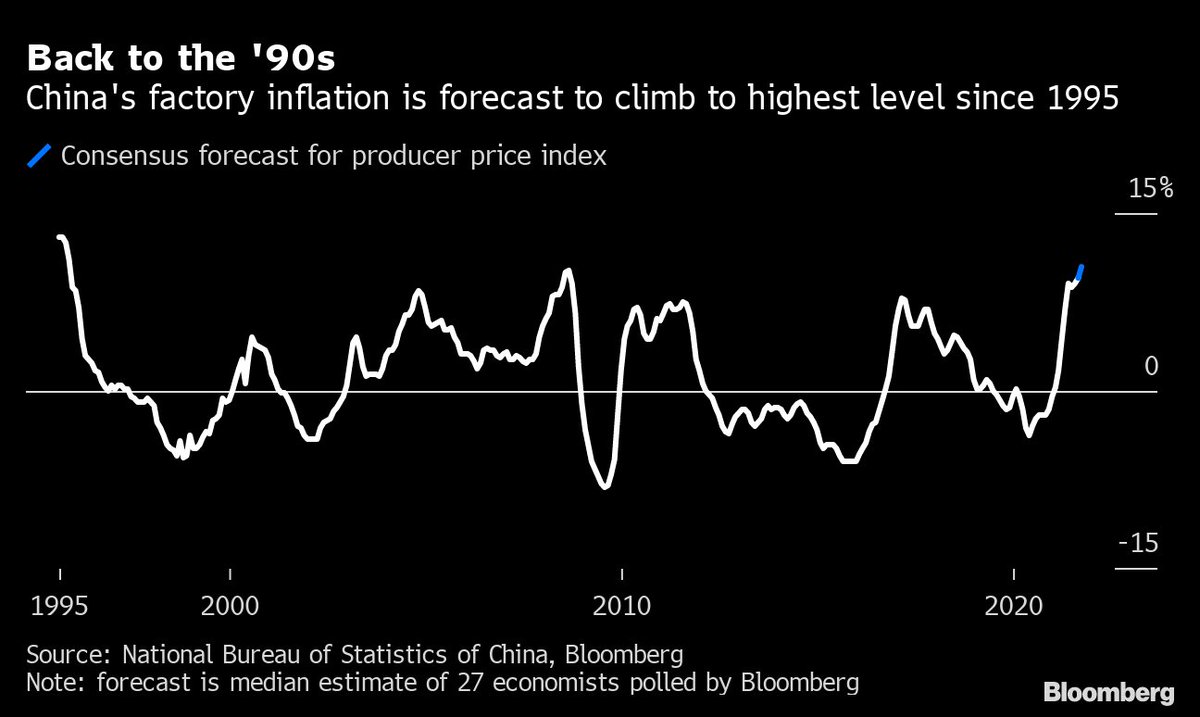

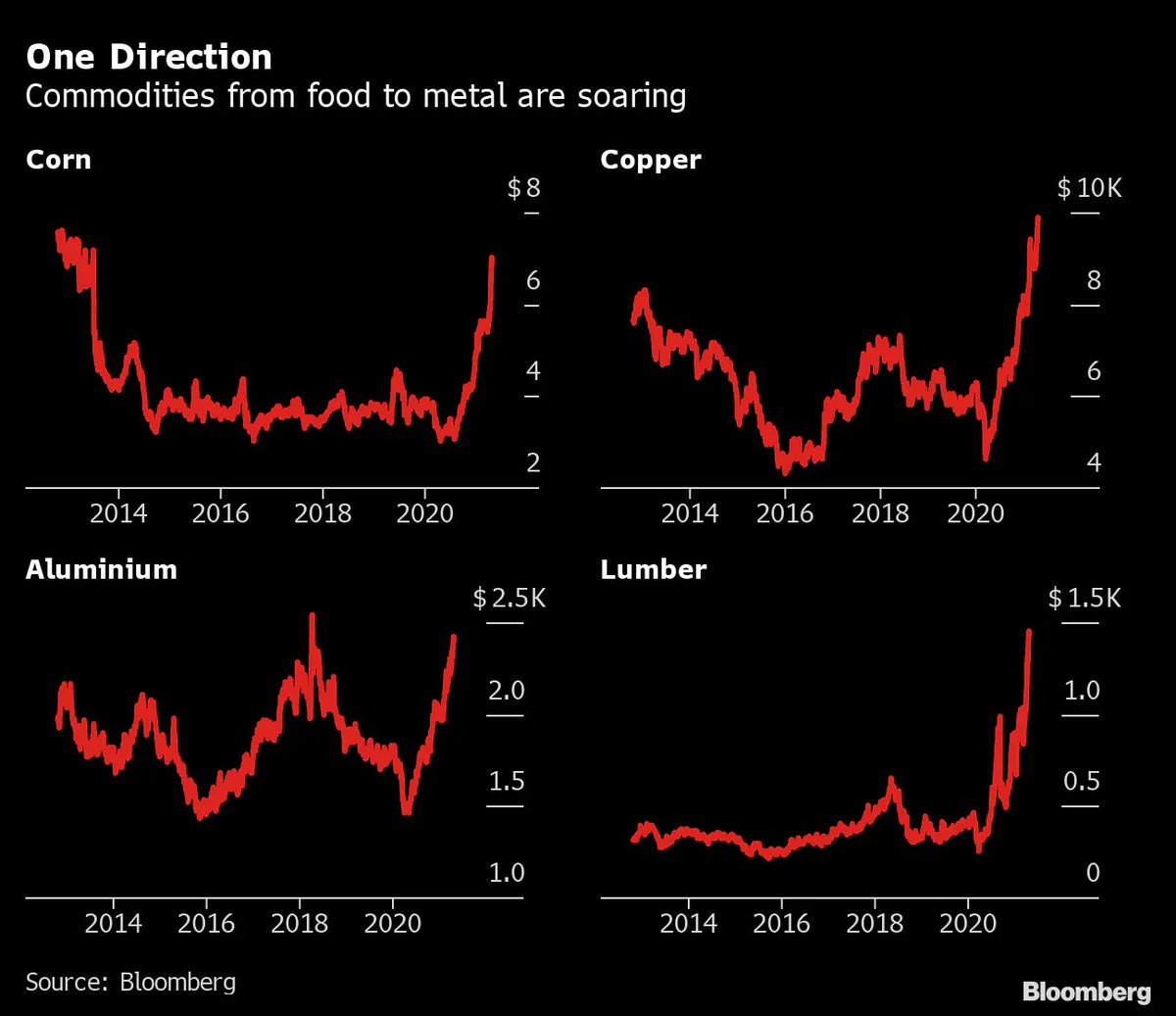

Similarly, Cost Push Inflation because of shutdowns in China and disruptions in global supply chains, caused prices of basic industrial raw materials to shoot through the roof within the last few quarters.

As these costs shoot up, it incentives others to jump in and add more to the supply chain of the materials.

Again, as high school economics will tell you, as supply increases faster than demand, prices stabilize.

Again, as high school economics will tell you, as supply increases faster than demand, prices stabilize.

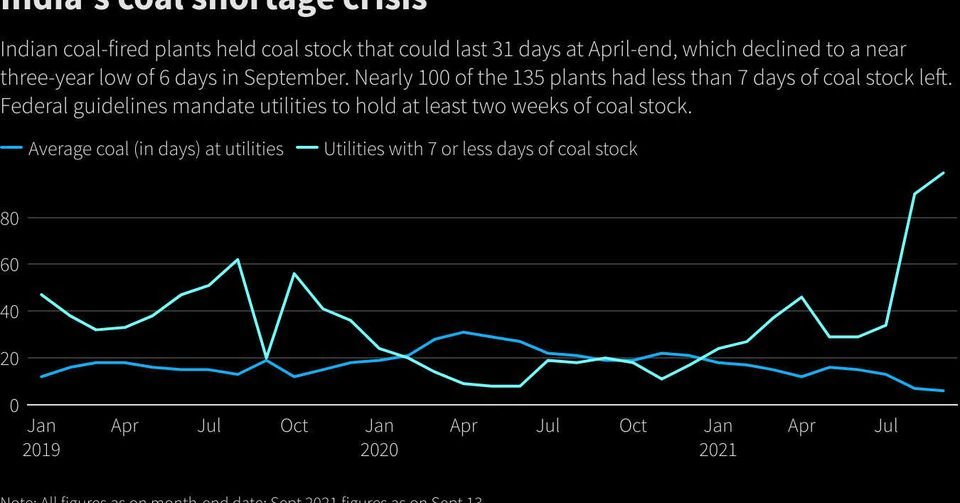

A classic example of this is what happened with power and coal sector within India in the last few months.

Coal and power shortage caused prices to rise which in turn incentivized previously loss making units to come online and start alleviating the supply shortage issues.

Coal and power shortage caused prices to rise which in turn incentivized previously loss making units to come online and start alleviating the supply shortage issues.

Tata Power& #39;s Mundra plant which has been a topic of several losses, is now supplying power to Govt of India at profitable rates.

This is also the same reason why Oil has never shot above $100 since last decade and may never again in future simply cause the moment it does so, other alternative energy options like Natural Gas will start substituting the demand for oil.

Those raw materials costs that depressed profit margins in Q2, almost all of them have started correcting to their average levels.

Will these increased raw material costs forever remain high or migrate back to their pre-pandemic levels in a single quarter?

No.

It will take a few quarters to even out but they will eventually even out.

No.

It will take a few quarters to even out but they will eventually even out.

Below is the chart common commodities, stuff that makes up everything.

As history and law of Demand and Supply Economics states, these prices will revert to mean soon enough.

As history and law of Demand and Supply Economics states, these prices will revert to mean soon enough.

I hope this thread, helped you to understand why profit margin in various companies across sectors were subdued and what can you expect from them in the next few quarters.

If you& #39;re new here, I write a new thread every weekend, explaining an investing concept.

Here is a link to all my other threads https://twitter.com/itsTarH/status/1401095938945425410?s=20">https://twitter.com/itsTarH/s...

Here is a link to all my other threads https://twitter.com/itsTarH/status/1401095938945425410?s=20">https://twitter.com/itsTarH/s...

I also teach a few classes at @skillshare , sign up using any of the below links to get access to them along with 30,000+ classes on the Skillshare platform absolutely FREE for 30 days.

Class on Data Visualization

Get access to the class by using the below link

https://skl.sh/2XNug6A ">https://skl.sh/2XNug6A&q... https://twitter.com/itsTarH/status/1427993843127906304?s=20">https://twitter.com/itsTarH/s...

Get access to the class by using the below link

https://skl.sh/2XNug6A ">https://skl.sh/2XNug6A&q... https://twitter.com/itsTarH/status/1427993843127906304?s=20">https://twitter.com/itsTarH/s...

Class on Personal Finance

Get access to the class by using the below link

https://skl.sh/2Wjk7A7 ">https://skl.sh/2Wjk7A7&q... https://twitter.com/itsTarH/status/1419694448892514311?s=20">https://twitter.com/itsTarH/s...

Get access to the class by using the below link

https://skl.sh/2Wjk7A7 ">https://skl.sh/2Wjk7A7&q... https://twitter.com/itsTarH/status/1419694448892514311?s=20">https://twitter.com/itsTarH/s...

Also, write and publish long form articles on my @SubstackInc

Subscribe for FREE, if you& #39;re interested and join 6000+ readers that get insights on companies like Nykaa, PolicyBazaar, Renewables, etc. delivered straight to their inbox every few weeks. http://investkaroindia.substack.com"> http://investkaroindia.substack.com

Subscribe for FREE, if you& #39;re interested and join 6000+ readers that get insights on companies like Nykaa, PolicyBazaar, Renewables, etc. delivered straight to their inbox every few weeks. http://investkaroindia.substack.com"> http://investkaroindia.substack.com

Please retweet, the first tweet in this thread.

Thank you for reading!

See you next weekend with a brand new thread.

Thank you for reading!

See you next weekend with a brand new thread.

Read on Twitter

Read on Twitter