1/20

The obsession with UK Gov contracts will be the death of some #AVCT investors.

A successful rollout of the Affidix test does not need UK Gov contracts at the heart of it. It needs demand and manufacturing capacity.

How much is debatable given the current MC but my view...

The obsession with UK Gov contracts will be the death of some #AVCT investors.

A successful rollout of the Affidix test does not need UK Gov contracts at the heart of it. It needs demand and manufacturing capacity.

How much is debatable given the current MC but my view...

2/

is that a c. 5-7m tests per month would deliver enough for much stronger success to be witnessed over the coming 12-18 months or so.

Whilst yesterday& #39;s news from Mologic could be argued to have some read across to #AVCT it is mainly death by association only.

Some facts.

is that a c. 5-7m tests per month would deliver enough for much stronger success to be witnessed over the coming 12-18 months or so.

Whilst yesterday& #39;s news from Mologic could be argued to have some read across to #AVCT it is mainly death by association only.

Some facts.

2/

Here is the section from the 2020 FY Report.

It highlights & #39;uncertainty& #39; as to whether their test can pass Porton Down. It does not present a conclusion.

There was no expectation of failure and the wording is deliberately cautious because it is presented in...

Here is the section from the 2020 FY Report.

It highlights & #39;uncertainty& #39; as to whether their test can pass Porton Down. It does not present a conclusion.

There was no expectation of failure and the wording is deliberately cautious because it is presented in...

3/

the Principal Risks section of the report, which is designed to highlight all known highlights for investors.

These same Principal Risks include the following,

"Should the Group’s facilities become inaccessible through damage caused by fire, flooding or theft,

the Principal Risks section of the report, which is designed to highlight all known highlights for investors.

These same Principal Risks include the following,

"Should the Group’s facilities become inaccessible through damage caused by fire, flooding or theft,

4/

the ability to carry on development programmes and meet customer deadlines may be affected depending on the severity of the incident."

Again could happen but not guaranteed. The same applies to Porton Down.

the ability to carry on development programmes and meet customer deadlines may be affected depending on the severity of the incident."

Again could happen but not guaranteed. The same applies to Porton Down.

5/

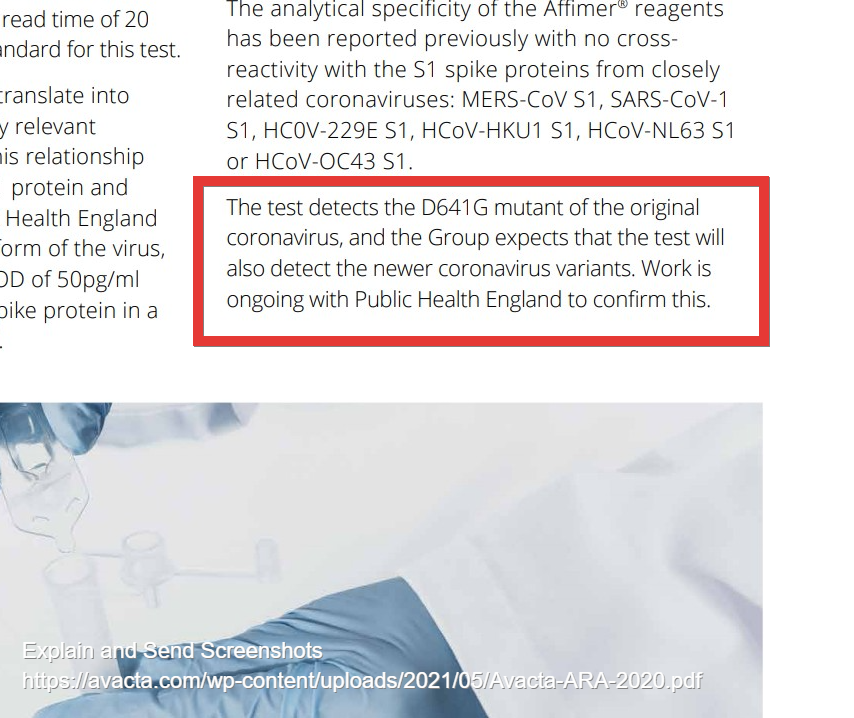

In that same 22nd April report AVCT discussed variants with the disclosure that,

"work is ongoing with Public Health England" to confirm that the AVCT test detects the newest ones.

If supposed Porton Down failings have killed AVCTÄs chance of UK Gov contracts off,

In that same 22nd April report AVCT discussed variants with the disclosure that,

"work is ongoing with Public Health England" to confirm that the AVCT test detects the newest ones.

If supposed Porton Down failings have killed AVCTÄs chance of UK Gov contracts off,

6/

then why are they applying resources to test the AVCT test for new variants?

Since the delivery of the FY Report, the company has gone on to say other things which indicate that they feel UK Gov contracts remain an option.

then why are they applying resources to test the AVCT test for new variants?

Since the delivery of the FY Report, the company has gone on to say other things which indicate that they feel UK Gov contracts remain an option.

7/

On example being 7th June update,

"The product registration by the MHRA allows the Company to sell the product in the UK for professional use"

If the UK is a closed market and AVCT has no chance of UK Gov contracts then why highlight this?

On example being 7th June update,

"The product registration by the MHRA allows the Company to sell the product in the UK for professional use"

If the UK is a closed market and AVCT has no chance of UK Gov contracts then why highlight this?

8/

Why also in their 10th May RNS did AVCT focus on the UK registration with the MHRA and not mention the EU registration at all?

The same RNS talked about being "excited" about interest from potential "commercial partners, distributors and end users" without mentioning the EU.

Why also in their 10th May RNS did AVCT focus on the UK registration with the MHRA and not mention the EU registration at all?

The same RNS talked about being "excited" about interest from potential "commercial partners, distributors and end users" without mentioning the EU.

9/

Why if the EU is the main market for AVCT moving forward was its registration an afterthought that was first included in the 1st June RNS?

As I said at the start this is not about who the contract is with but the fact that enough contracts can be completed and the...

Why if the EU is the main market for AVCT moving forward was its registration an afterthought that was first included in the 1st June RNS?

As I said at the start this is not about who the contract is with but the fact that enough contracts can be completed and the...

10/

production is there to meet it.

Just 1 week ago AVCT were talking about how excited they are about the interest their test has already attracted from "potential commercial partners and distributors."

1 week later a product partner indicates a willingness to sue the UK...

production is there to meet it.

Just 1 week ago AVCT were talking about how excited they are about the interest their test has already attracted from "potential commercial partners and distributors."

1 week later a product partner indicates a willingness to sue the UK...

11/

Gov because their own product is perceived to be being stonewalled and investors are supposed to forget that all of the above ever happened.

Furthermore, that same FY Report said this,

Gov because their own product is perceived to be being stonewalled and investors are supposed to forget that all of the above ever happened.

Furthermore, that same FY Report said this,

12/

I& #39;ll park the "posied to capitalise on a substantial commercial opportunity for high quality

rapid testing for COVID-19" part because it& #39;s been covered.

"A pipeline of non-COVID-related in-house diagnostic tests for a range of diseases and conditions being developed to be...

I& #39;ll park the "posied to capitalise on a substantial commercial opportunity for high quality

rapid testing for COVID-19" part because it& #39;s been covered.

"A pipeline of non-COVID-related in-house diagnostic tests for a range of diseases and conditions being developed to be...

13/

brought to market from 2022 onwards, adding to long-term COVID-19 testing revenues."

The quality of the AVCT Affidix test and its pending success can help the company deliver equally as successful products in other areas of diagnostics.

brought to market from 2022 onwards, adding to long-term COVID-19 testing revenues."

The quality of the AVCT Affidix test and its pending success can help the company deliver equally as successful products in other areas of diagnostics.

14/

They aren& #39;t there yet but they are expected to arrive from 2022 onwards.

That means that Covid test sales don& #39;t have to deliver it all. It means that the Covid test has already delivered a message that it is top-end quality and the company can repeat the process elsewhere.

They aren& #39;t there yet but they are expected to arrive from 2022 onwards.

That means that Covid test sales don& #39;t have to deliver it all. It means that the Covid test has already delivered a message that it is top-end quality and the company can repeat the process elsewhere.

15/

The same applies to,

"Affimer® reagent licensing deals for diagnostic and other applications now being delivered for a pipeline of Affimer® technology evaluations creating the potential for long-term royalty income."

The same applies to,

"Affimer® reagent licensing deals for diagnostic and other applications now being delivered for a pipeline of Affimer® technology evaluations creating the potential for long-term royalty income."

16/

Some would have us believe that AVCT is a Covid test play with some nice ideas on therapeutics that are years away from delivery.

Others talk about AVCT being worth a fraction of this valuation prior to Covid. And? This isn& #39;t the same company it was before.

Some would have us believe that AVCT is a Covid test play with some nice ideas on therapeutics that are years away from delivery.

Others talk about AVCT being worth a fraction of this valuation prior to Covid. And? This isn& #39;t the same company it was before.

17/

What they forget is that whilst we have been waiting for what is now a proven high-quality test, the company has been busy building up its capabilities to deliver diagnostic products direct to market.

An option they never had before.

What they forget is that whilst we have been waiting for what is now a proven high-quality test, the company has been busy building up its capabilities to deliver diagnostic products direct to market.

An option they never had before.

18/

Their Covid tests will sell and as a minimum deliver meaningful further options to a company that is already cashed up until 2023.

But in the background far more is being achieved to support and replace those Covid tests sales as time goes on.

Their Covid tests will sell and as a minimum deliver meaningful further options to a company that is already cashed up until 2023.

But in the background far more is being achieved to support and replace those Covid tests sales as time goes on.

19/

This is pharma. A company operating in that field with exciting tech that is self-sufficient on the funding side demands far greater valuations.

Prior to this Covid opportunity, AVCT wasn& #39;t in such a position so to compare brings nothing to the debate at all.

This is pharma. A company operating in that field with exciting tech that is self-sufficient on the funding side demands far greater valuations.

Prior to this Covid opportunity, AVCT wasn& #39;t in such a position so to compare brings nothing to the debate at all.

20/

This is a really exciting time for AVCT and their shareholders and the obsession with UK Gov contracts is clouding that too much because AVCT is set to be a big success with or without such contracts in play.

This is a really exciting time for AVCT and their shareholders and the obsession with UK Gov contracts is clouding that too much because AVCT is set to be a big success with or without such contracts in play.

Read on Twitter

Read on Twitter