1/ Inflation is coming.

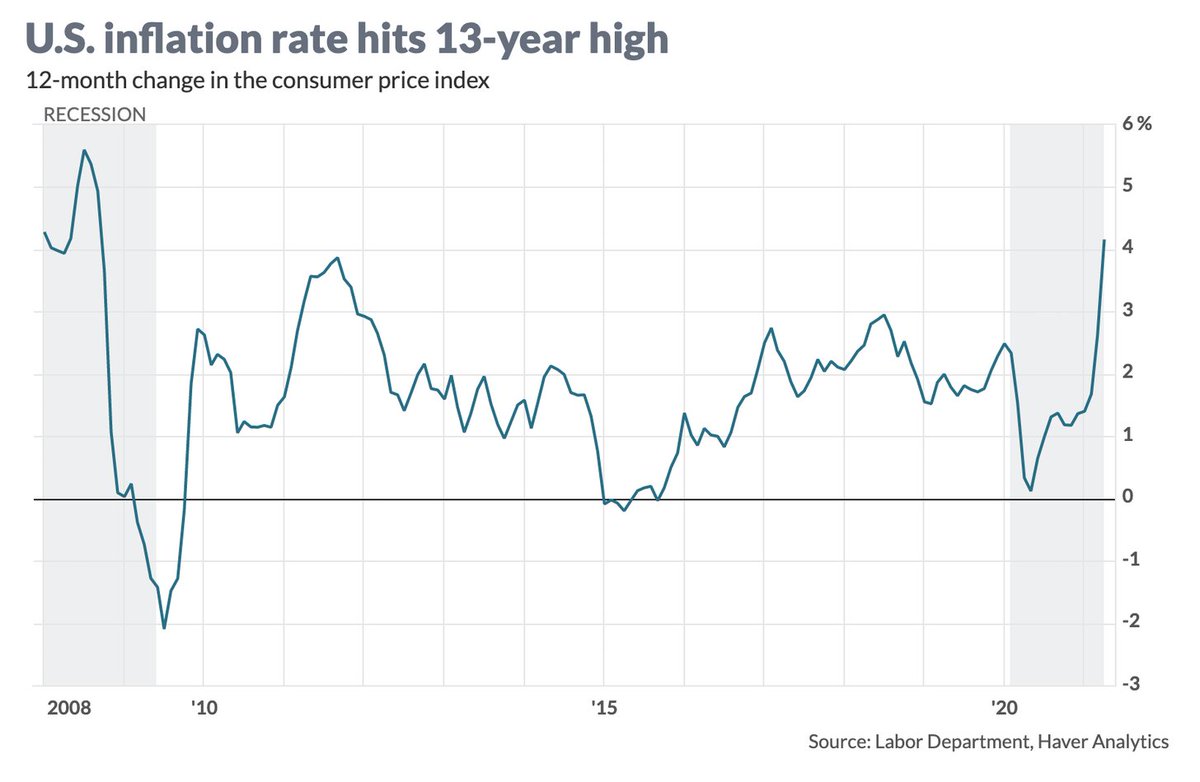

The US just hit a 13 year high inflation rate. This was unexpected by policymakers and economists. To an individual of average intelligence, it was entirely intuitive given the massive money printing (stimulus) that happened since COVID.

The US just hit a 13 year high inflation rate. This was unexpected by policymakers and economists. To an individual of average intelligence, it was entirely intuitive given the massive money printing (stimulus) that happened since COVID.

2/ Economists/central banks argue that the inflation we’re seeing could be temporary, that its just an a supply shortage. However, nearly every asset has been impacted by these stimulus initiatives including: real estate, stocks, startup investing, etc.

3/ Real Estate

Home prices nationally in January were up 11.2% year over year. That’s the largest annual gain in nearly 15 years.

Home prices nationally in January were up 11.2% year over year. That’s the largest annual gain in nearly 15 years.

4/ “They’ve continued on autopilot. I don’t think there’s been any discussion within the Fed. The Fed is just afraid to change because they don’t want it to be seen as a form of taking their foot off the pedal”- Peter Boockvar (CIO at Bleakley Advisory Group)

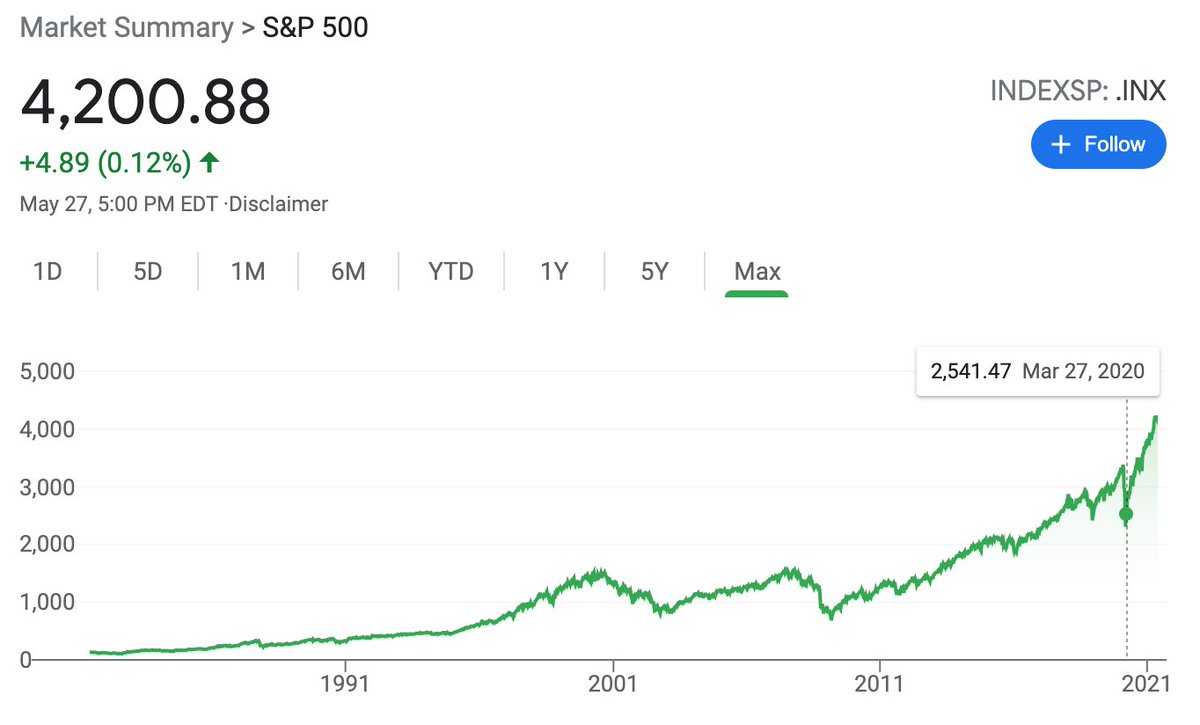

6/ Stonks

Equities have soared. The S&P 500 is up nearly 40% post COVID! What has changed about the economy that would make these companies more valuable?

Equities have soared. The S&P 500 is up nearly 40% post COVID! What has changed about the economy that would make these companies more valuable?

8/ Fed moves the goalpost

The Fed recently changed its language on inflation, replacing its 2% inflation target commitment with “[seeking] to achieve inflation that averages 2% over time.”

The Fed recently changed its language on inflation, replacing its 2% inflation target commitment with “[seeking] to achieve inflation that averages 2% over time.”

9/ "This change is a substantial departure from the previous flexible inflation targeting method. Monetary policy under inflation targeting was symmetric—the Fed would respond equally to overshooting and undershooting of the target."

10/ Average inflation targeting means that policymakers would consider those deviations and allow inflation to modestly and temporarily run above target to make up for past shortfalls, or vice versa.

11/ Larry Summers, Former US Treasury Secretary weighed in recently:

"We& #39;re taking very substantial risks on the inflation side……The sense of...complacency being projected by the economic policymakers, that this is all something that can easily be managed, is misplaced."

"We& #39;re taking very substantial risks on the inflation side……The sense of...complacency being projected by the economic policymakers, that this is all something that can easily be managed, is misplaced."

12/ The Fed doesn’t care about potential inflation worries. It is signaling that interest rates will remain super low for the near term, while currently buying $120B a month of bonds.

13/ "The Fed& #39;s idea used to be that it removed the punchbowl before the party got good….now, the Fed& #39;s doctrine is that it will only remove the punchbowl after it sees some people staggering around drunk….We are printing money...we are borrowing on unprecedented scales…" - LS

14/ Fed officials have repeatedly insisted that rising inflation — consumer prices in April jumped the most since 2008 — will fade as the economy fully reopens.

15/ However, if people expect prices to rise, coupled with supply shortages, coupled with lack of trust in fiat, then we could easily see this become a self-fulfilling prophecy as expectations of price increase climb so do prices.

16/ Inflation is not evenly distributed

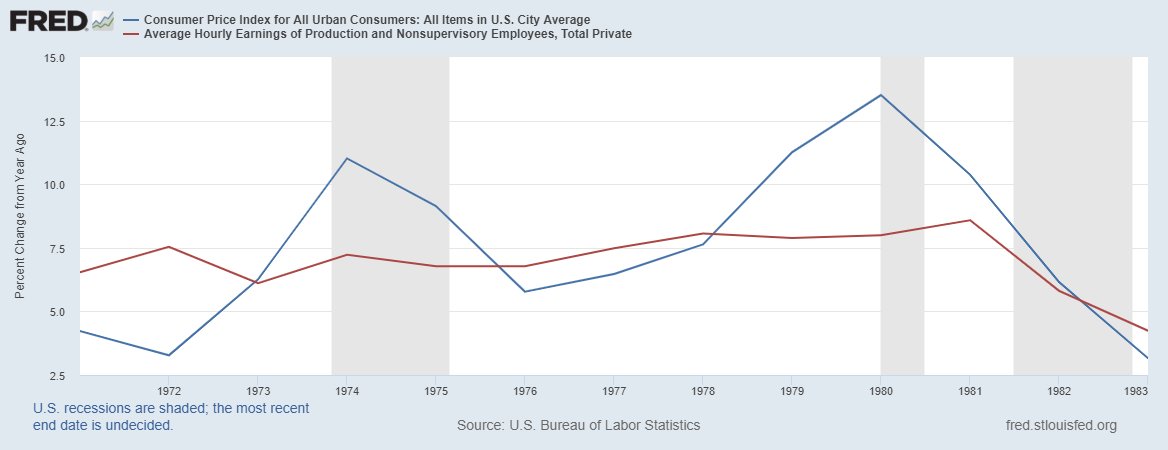

If wages kept up with inflation, then it wouldn’t be a big deal. Costs would rise, but so would your salary, which means that nothing really changes other than unit of account number.

If wages kept up with inflation, then it wouldn’t be a big deal. Costs would rise, but so would your salary, which means that nothing really changes other than unit of account number.

17/ The problem is that inflation isn’t evenly distributed. As Noah Smith recently highlighted in his newsletter. https://noahpinion.substack.com/p/why-do-people-hate-inflation">https://noahpinion.substack.com/p/why-do-...

18/ Wages didn’t keep up with inflation, so workers got poorer. TL;DR wages are more “sticky” than prices which can be adjusted much more easily.

19/ How inflation impacts Bitcoin

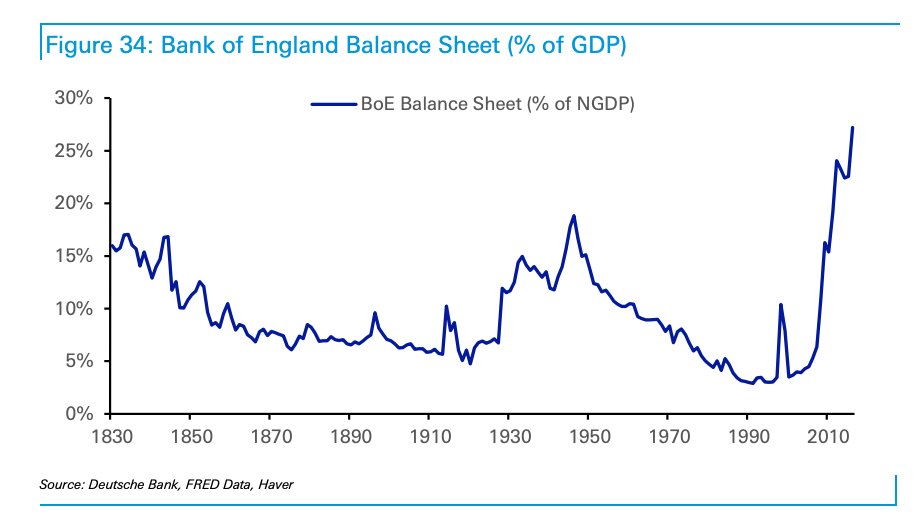

Bitcoin was launched in the 2008 financial crisis as an antidote to bad central banking policy. What policymakers did then was unprecedented in all recorded financial history...

Bitcoin was launched in the 2008 financial crisis as an antidote to bad central banking policy. What policymakers did then was unprecedented in all recorded financial history...

20/ ..but that pales in comparison to 2020 when policymakers completely abandoned any rational long-term thinking.

Read on Twitter

Read on Twitter