1/ I’ve noticed a good number of IRs recently being promoted to CFO at large public companies.

Toward the end of my time on the sell-side I was nearly appointed Head of IR at a large global financial institution. I didn’t take it in the end as I wanted to move to the buy-side.

Toward the end of my time on the sell-side I was nearly appointed Head of IR at a large global financial institution. I didn’t take it in the end as I wanted to move to the buy-side.

2/ It does make me wonder if I stuck it out that maybe I could be on the path to become CFO. In reality though, I would be a terrible Head of IR.

But having been on the sell-side and now buy-side, I have lots of ideas to improve IR if I were to make the move...

But having been on the sell-side and now buy-side, I have lots of ideas to improve IR if I were to make the move...

3/ Ditch opening remarks - Opening remarks on conference calls are unnecessary if you already have the earnings release out there. If you must make opening remarks just release them ahead of time.

Make the earnings call Q&A only.

Make the earnings call Q&A only.

4/ Limit questions per analyst - On the sell-side I hated it when my competitors asked 4/5 questions on a call. I’m a fan of companies that enforce the max 1 question and maybe 1 follow up rule. I remember Jerre at IHS rigidly enforced it when analysts tried to ask 2/3 part q’s.

5/ Post call catch ups - Always appreciated when companies called me on the sell-side after the call for 15 mins to address any other questions I had.

I also like how $PYPL hosts a call the next day for investors moderated by one of the covering sell side analysts

I also like how $PYPL hosts a call the next day for investors moderated by one of the covering sell side analysts

6/ Investor deck summary - On the buy-side, especially for companies I’ve never looked at, I hate it when there isn’t an investor presentation with a summary of the business. An example of good practice is $TXN https://investor.ti.com/static-files/285c885f-42b8-4fb2-a7e3-8284f9413f2f">https://investor.ti.com/static-fi...

7/ Present interesting metrics - In earnings slide decks, you can grab the attention of analysts and investors by adding killer charts based on metrics not reported in the earnings release.

8/ Don’t tell investors what you think your stock valuation is - Companies can piss off analysts and investors when they try to tell the market how to value their stock. $BX is a big culprit of this. Investors hate it. Don’t do it.

9/ No annual investor days - In my view investor days should be big events where you adjust targets and showcase your business lines to investors. Annual investor days are pointless. I used to dread them as a sell-side analyst when the company had nothing new to say.

10/ Showcase your bench - I usually meet the CEO/CFO of a stock I’m invested in at least 2-4 times a year. It’s great when companies deploy the divisional heads to conferences and investor meetings instead, so you can understand how certain businesses are run. Good example: V/MA

11/ Detailed explanations in the earnings release - Good companies in the earnings release provide detailed explanations of the results (why did x item do x) and call out one-time items, even if some are b/s. Also a line by line reconciliation of GAAP to adjusted is good.

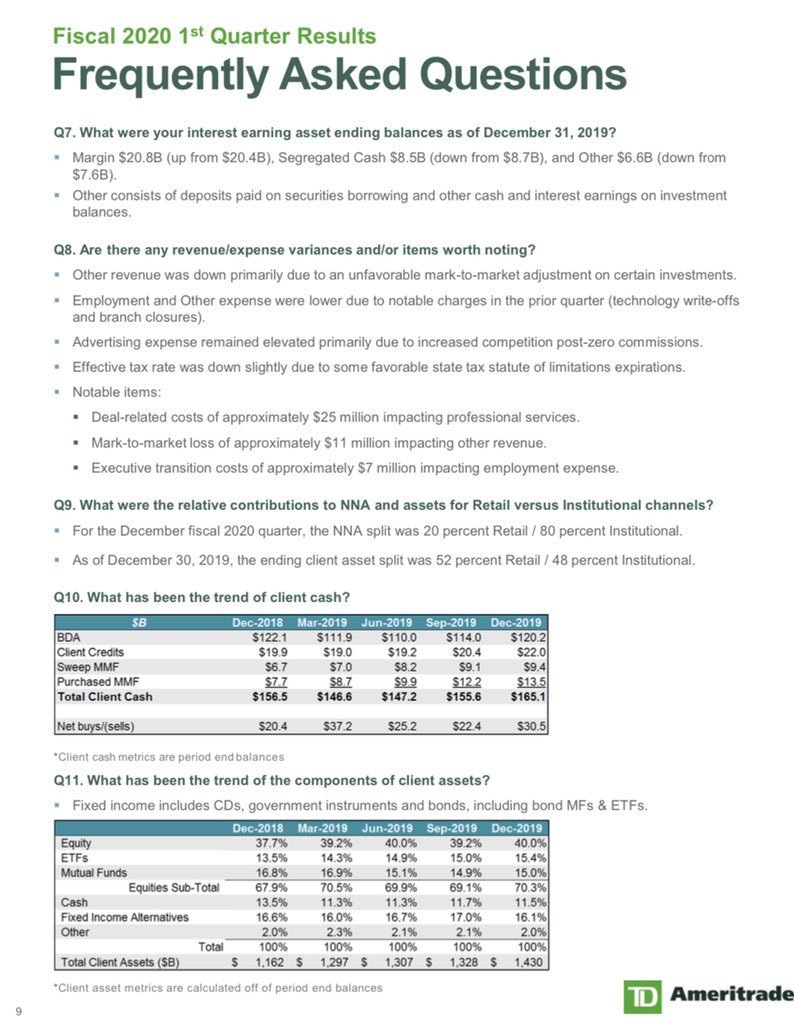

12/ Results FAQs - TD Ameritrade used to publish an FAQ with their release to explain various moving parts, so analysts wouldn’t waste time asking IR or on the

13/ Put investor Q&A on website/Twitter - It would be cool if some IR accounts should answer investor questions on Twitter. Though probably not good use of time.

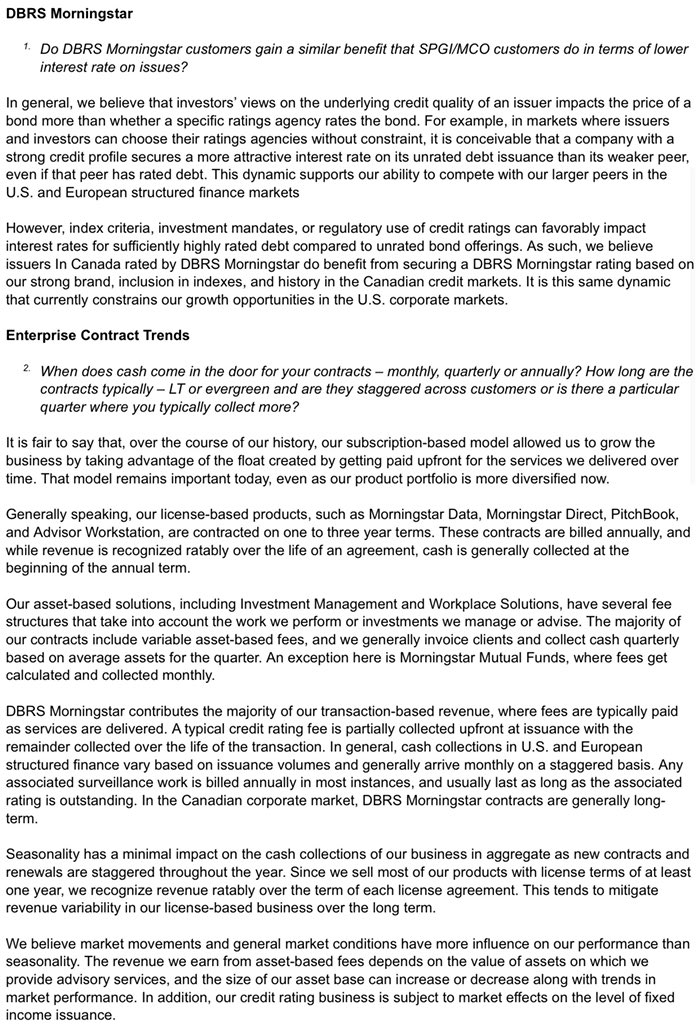

Or do like $MORN by collating all inbound investor Q’s and distributing answers to the market by 8-K each month.

Or do like $MORN by collating all inbound investor Q’s and distributing answers to the market by 8-K each month.

14/ Stop blacklisting analysts - On the sell-side I had a sell on a company and it got me banned from mgmt dinners with the sell-side and asking Q’s on the call. As a result, I would talk shit about them to all my clients and now I would never invest in them. Don’t do it.

15/ Steer/help analysts - On the sell-side, if I was doing a deep dive on a stock, I always appreciated input from a company if i was trying to estimate the upside/impact of something impacting the number. Yes you can’t disclose this but any directional steer is useful.

16/ Take an interest in sell-side work - Companies should provide sell-siders who write on their stock with feedback, both positive and negative.

They should also reach out and ask what investors are thinking. Not enough IR’s do that.

They should also reach out and ask what investors are thinking. Not enough IR’s do that.

17/ Excel sheets with financials - Make updating models less painful for analysts/investors by putting them in Excel format on the IR site. European companies are very good at it. $SQ is a good example of this.

18/ Quarterly guidance - Just why?

19/ Know your holders - I’m a page one holder in a few large caps. But the IR teams do a bad job of tracking their shareholders even with 13F filings, so I don’t get targeted for access like I do with other companies. Good IRs know their holders and make efforts to engage.

20/ Crisis management - When shit hits the fan, don’t disappear. Ideally, have a response ready that highlights revenue/EPS impact and have management host an emergency conference call. If you fucked up then admit it.

21/ Acknowledge underperformance - Stocks that have been long-term underperformers usually have mgmt teams that don’t acknowledge they suck. Analysts and investors hate deluded mgmt teams.

22/ Data - You don’t want to give too much away to competitors but put out as much data as possible to tell the story. Usually companies don’t disclose things like divisional margins, new product revenues or exposures to this bad thing until they’re forced to by investors.

Read on Twitter

Read on Twitter