There has been a lot of chatter among the intellectual and policy classes worldwide about investing in infrastructure. Part of the impetus, of course, is record-low costs of borrowing worldwide (although that is slowly changing). Singapore is no different. (1/n)

Borrowing to fund high-return projects isn’t just about taking advantage of cheap financing; it is actually the sort of fiduciary responsibility any financial steward should consider, as long as conditions are right. Otherwise, we are forgoing potential opportunities. (2/n)

Traditional thinking on infrastructure, of course, is focused on hard stuff, like roads and rails, ports and power plants. All that is well and good, assuming that it’s needed. But it’s not the sort of infrastructure that increasingly matters for the future. (3/n)

Soft infrastructure, instead, builds human capital. It’s about spending to educate our kids and raise them well, about tending to our sick and those with healthcare needs, about training the next generation of scientists and researchers. (4/n)

These only appear to be recurrent needs if we look at it from the perspective of paying fees and salaries in schools and hospitals. But they are also about vesting into the long-term future of our children and students and patients. (5/n)

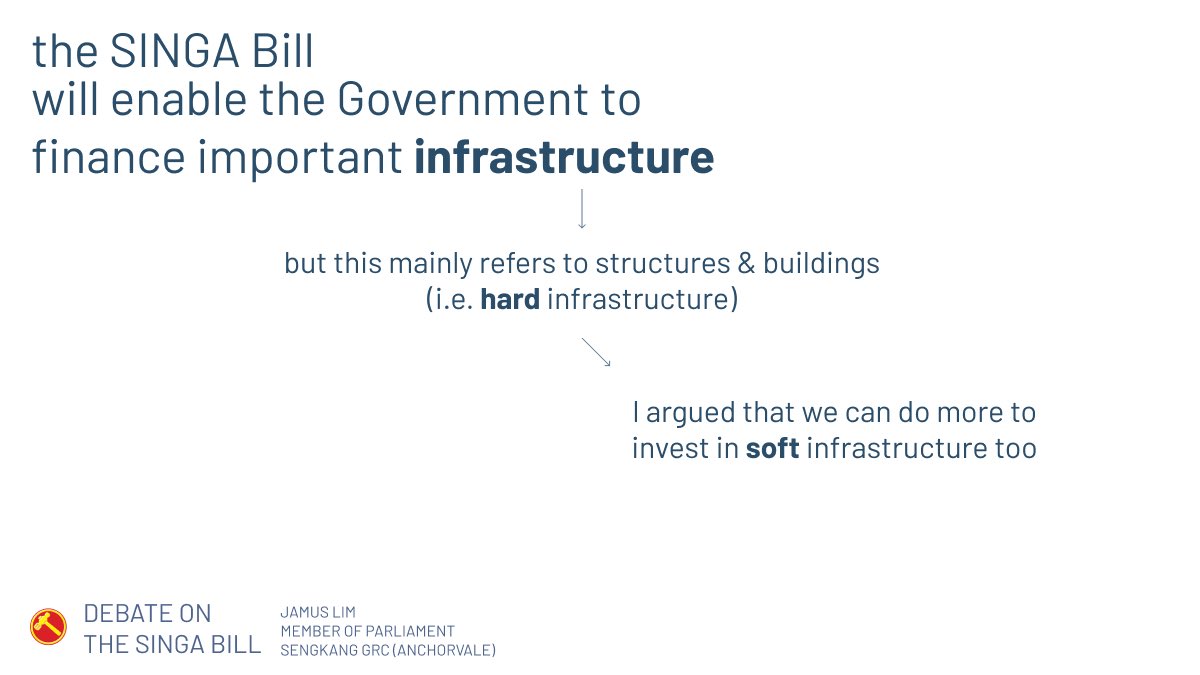

That’s why I suggested that SINGA bonds shouldn’t be just directed to hard infrastructure, but also soft ones. Because we want to sustain our global #1 ranking not just in regular infrastructure, but also in human development. (6/n)

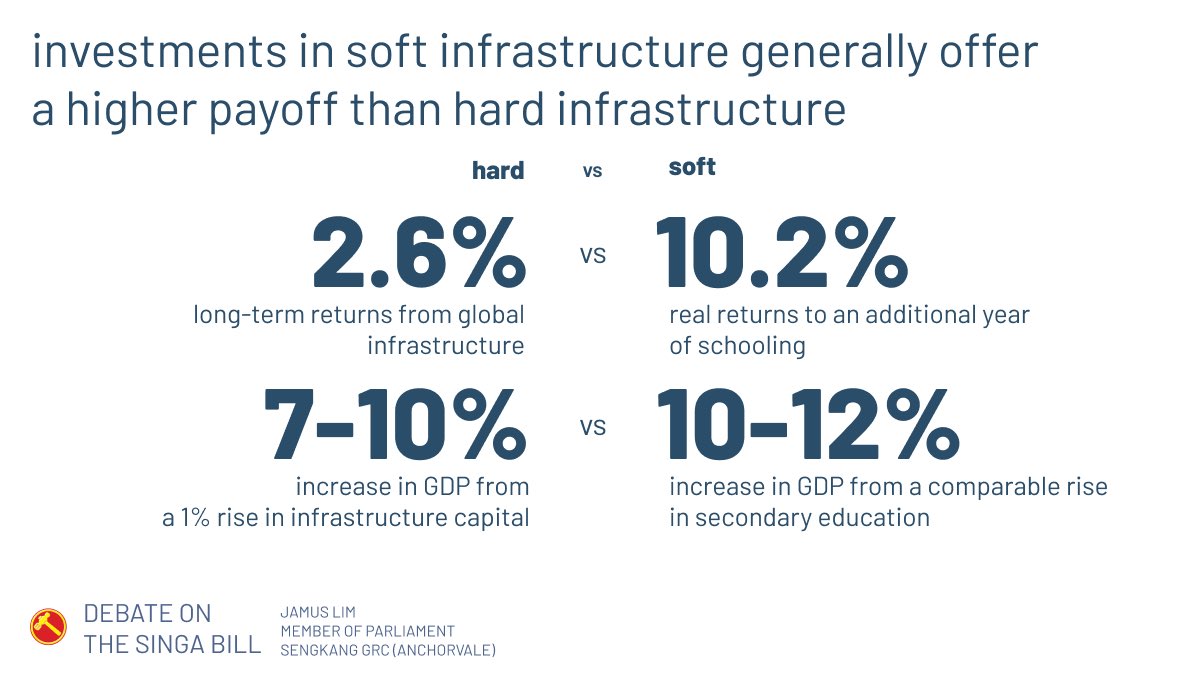

What’s more, soft infrastructure investments offer much more bang for the buck. Payoffs are usually higher in the former, whether in terms of rates of return, or contribution to national output. (7/n)

Not all spending on health and education qualify as infrastructure, of course. But it is possible to define clear conditions where certain projects would meet the necessary criteria, just like how we evaluate physical capital investments. (8/n)

In my speech in Parliament, I described these criteria in detail, along with example policies that meet them. Most crucially, these are investments that will more than pay for themselves over time, mainly in the form of higher tax receipts. (9/n)

While Finance Minister Heng cautioned against the imprudence of loosely classifying all manner of recurrent spending as infrastructure, I remain hopeful that we do not rule out human capital projects from SINGA. (10/n)

The #workersparty believes that there is no reason to privilege buildings and bridges over the raw potential of our people, as we take advantage of low-cost financing to invest for the future. #makingyourvotecount (n/n)

Read on Twitter

Read on Twitter