Ethereum $ETH vibe check with a little help from @glassnode https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

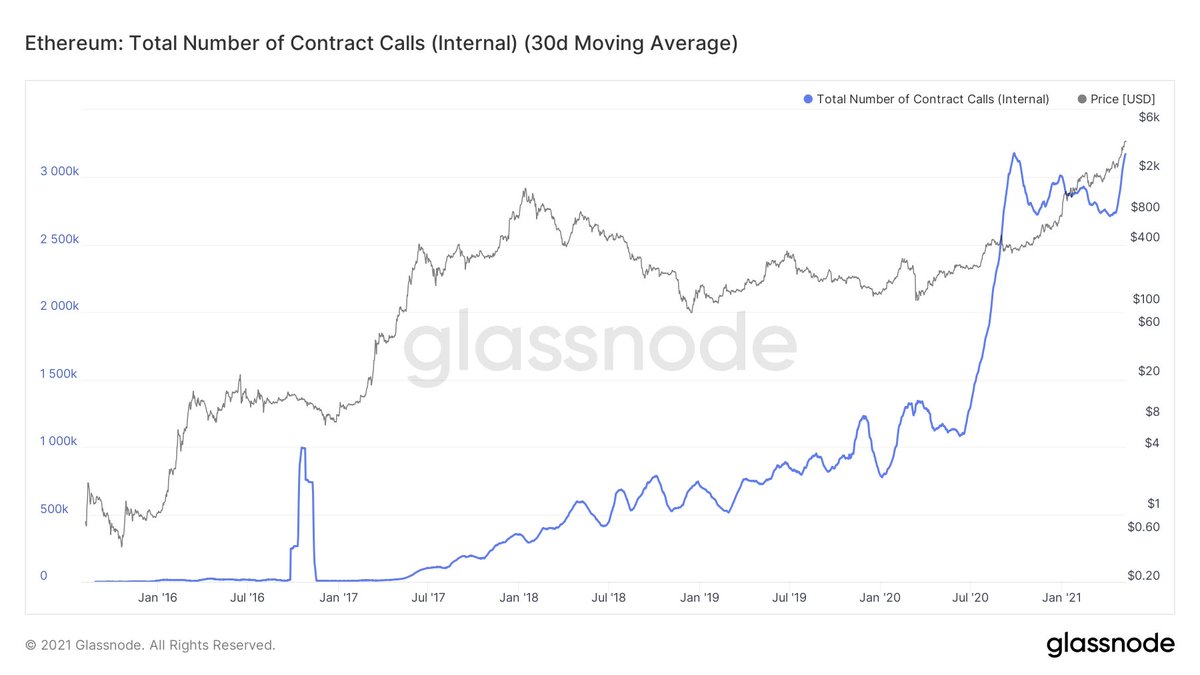

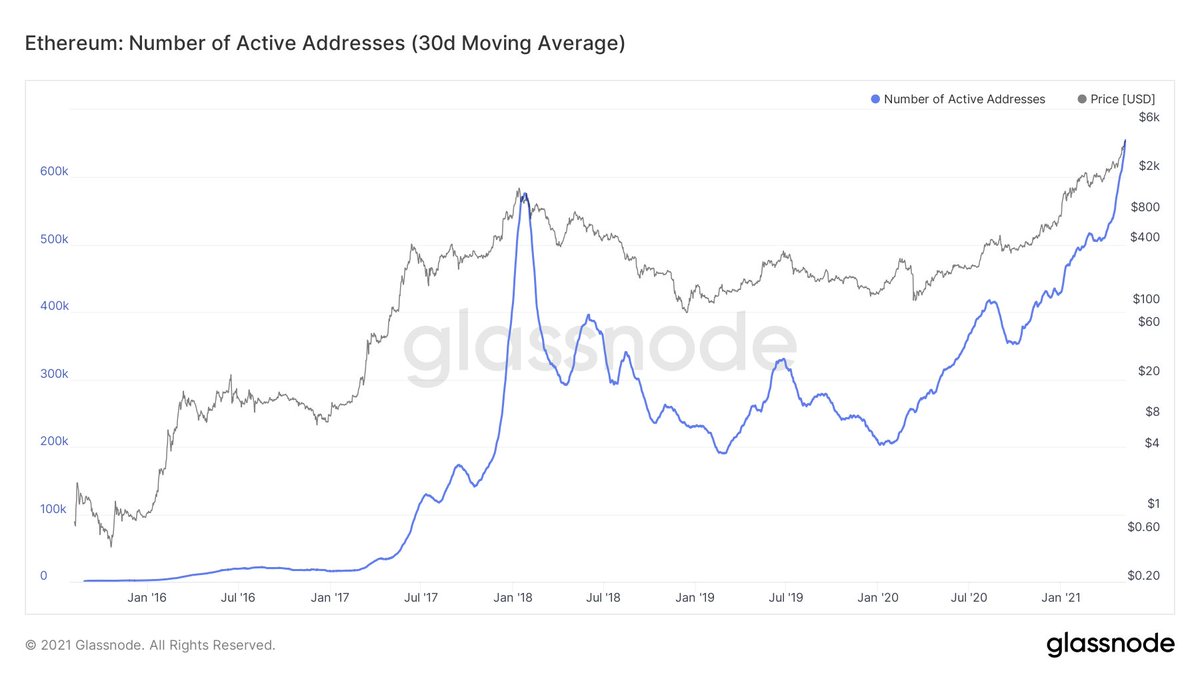

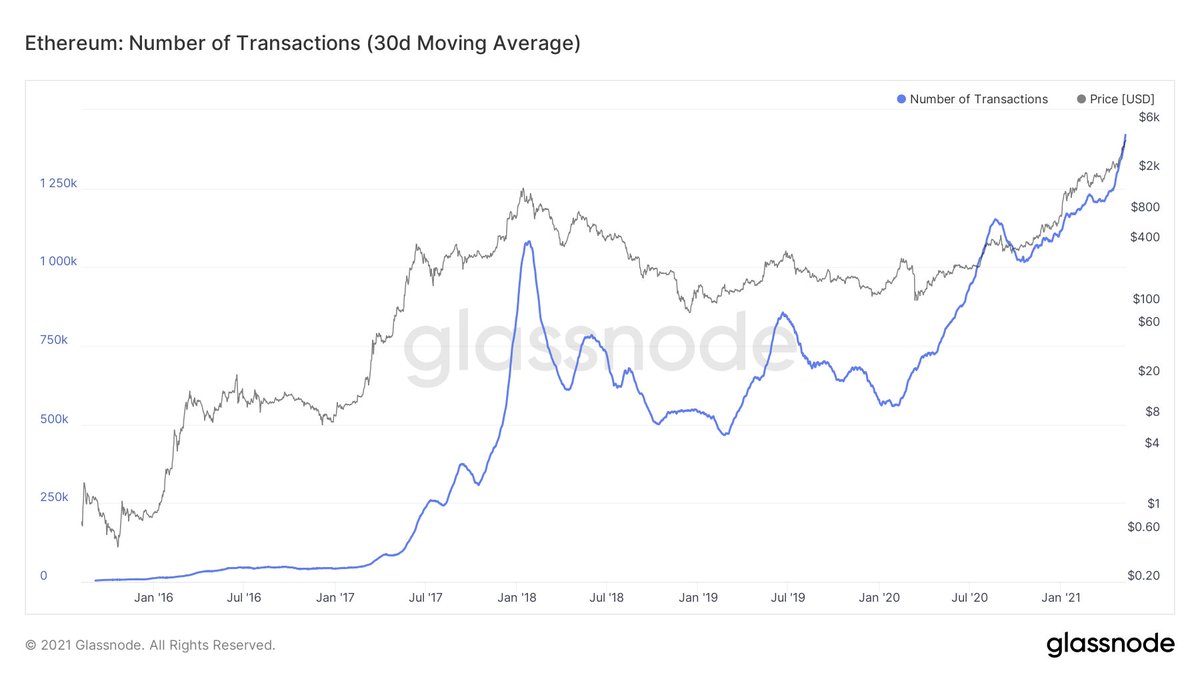

2/ Transactions exploded to new highs in April 2021. Uniswap is responsible for approx. 15% of those  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">

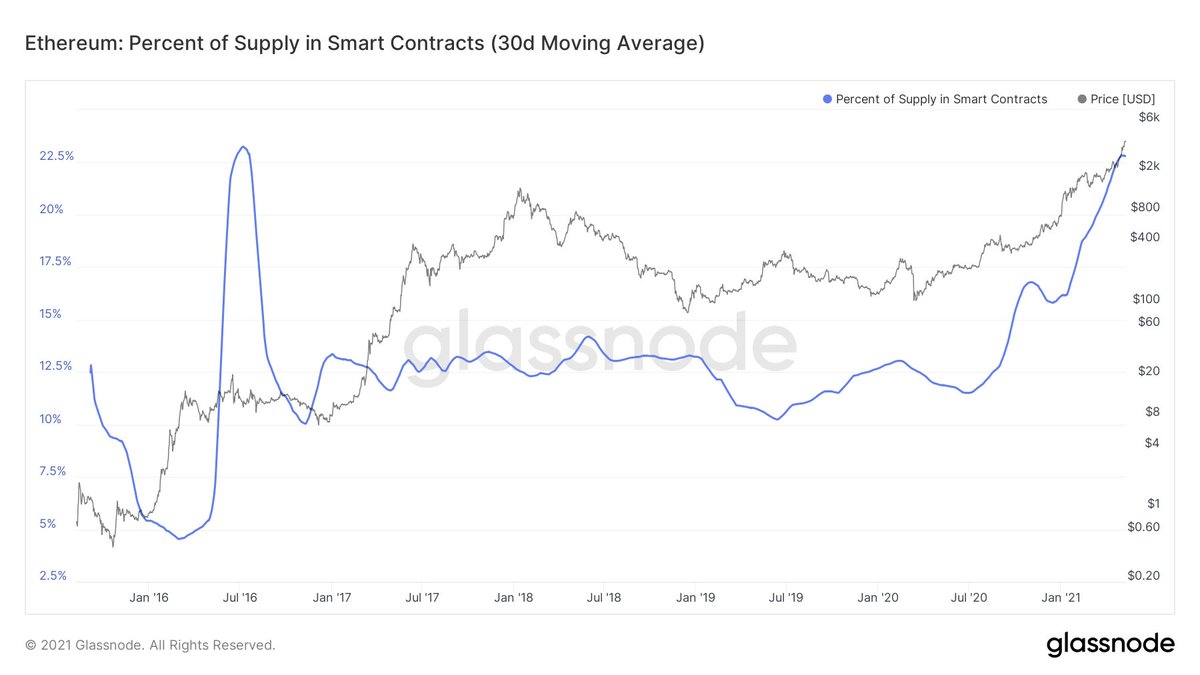

3/ Contracts and pools are gobbling up the $ETH supply. 12.5% of the ETH float lives in exchange wallets vs 22.5% of it in smart contracts.

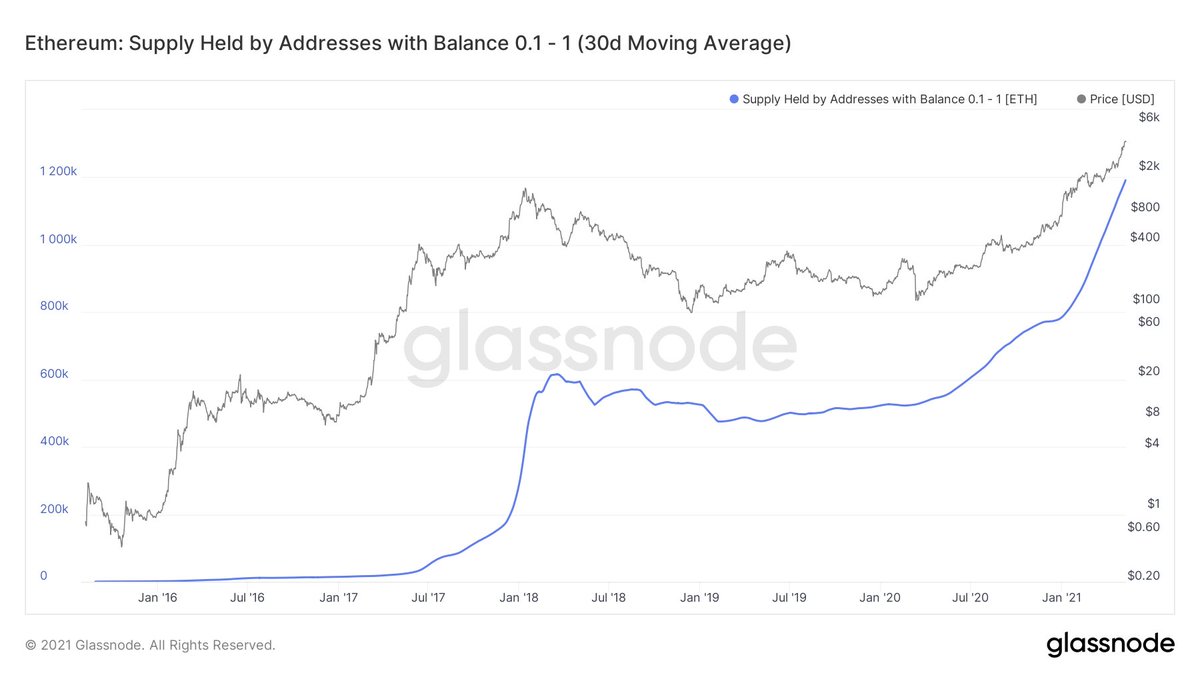

4/ Accounts with balances under 1 ETH are growing fast and 50% of those roughly map to new addresses.

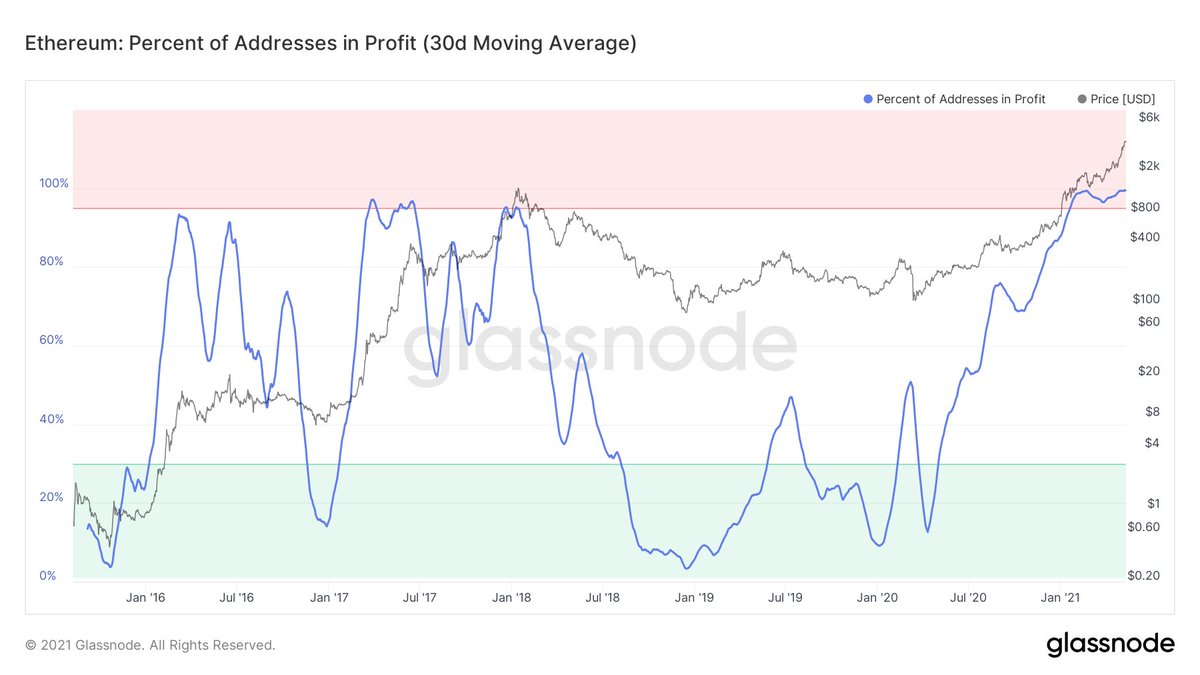

5/ 99% of $ETH addresses are in profit. Everybody happy.

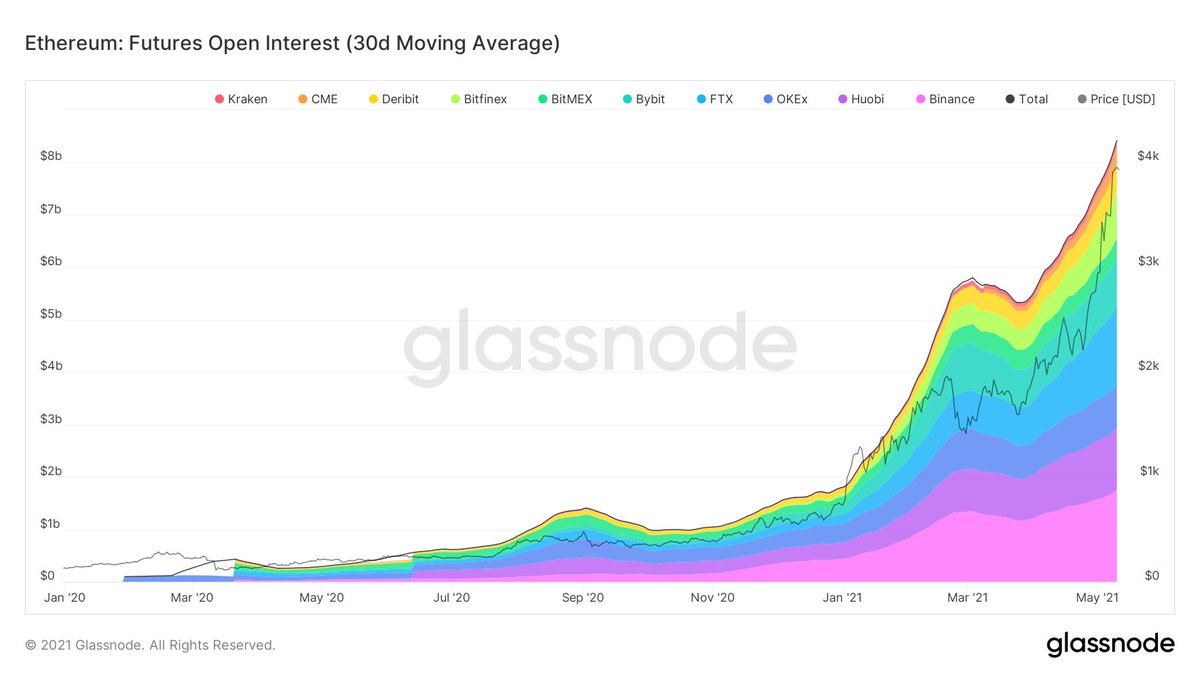

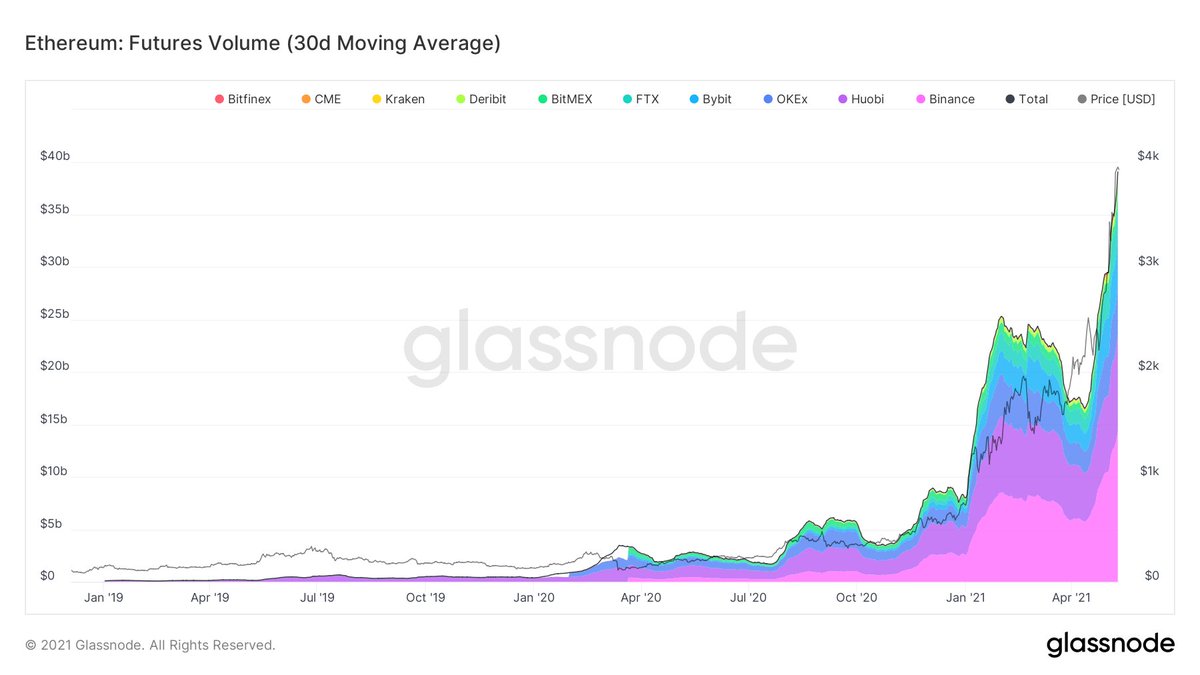

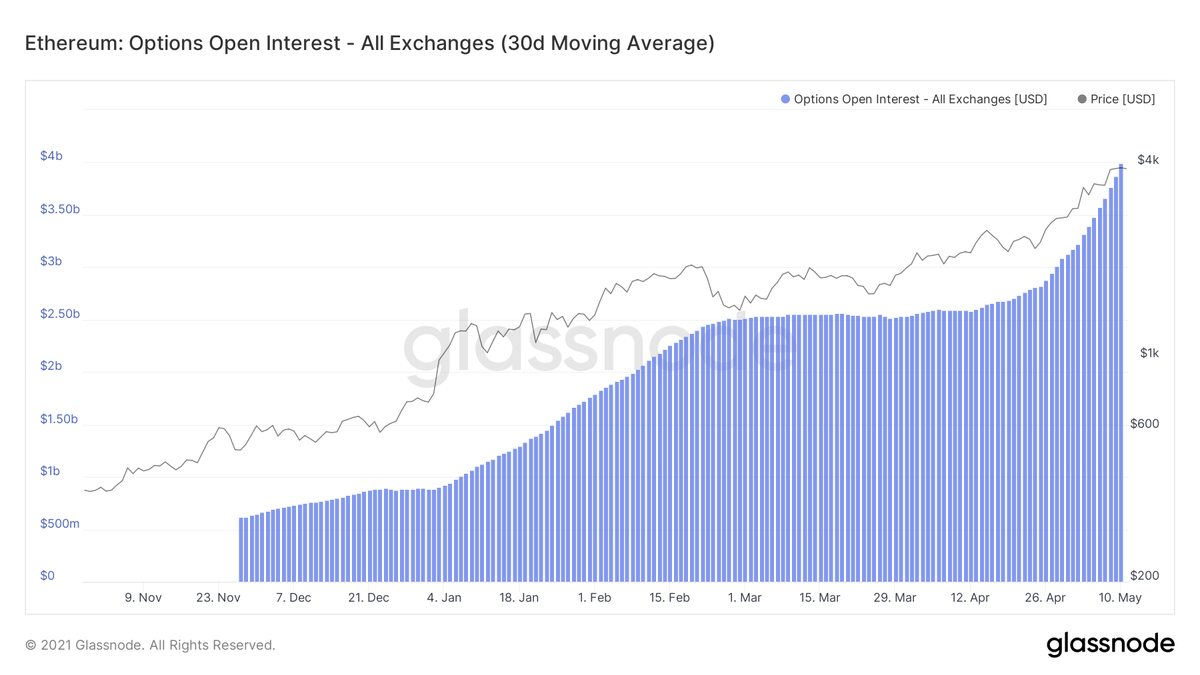

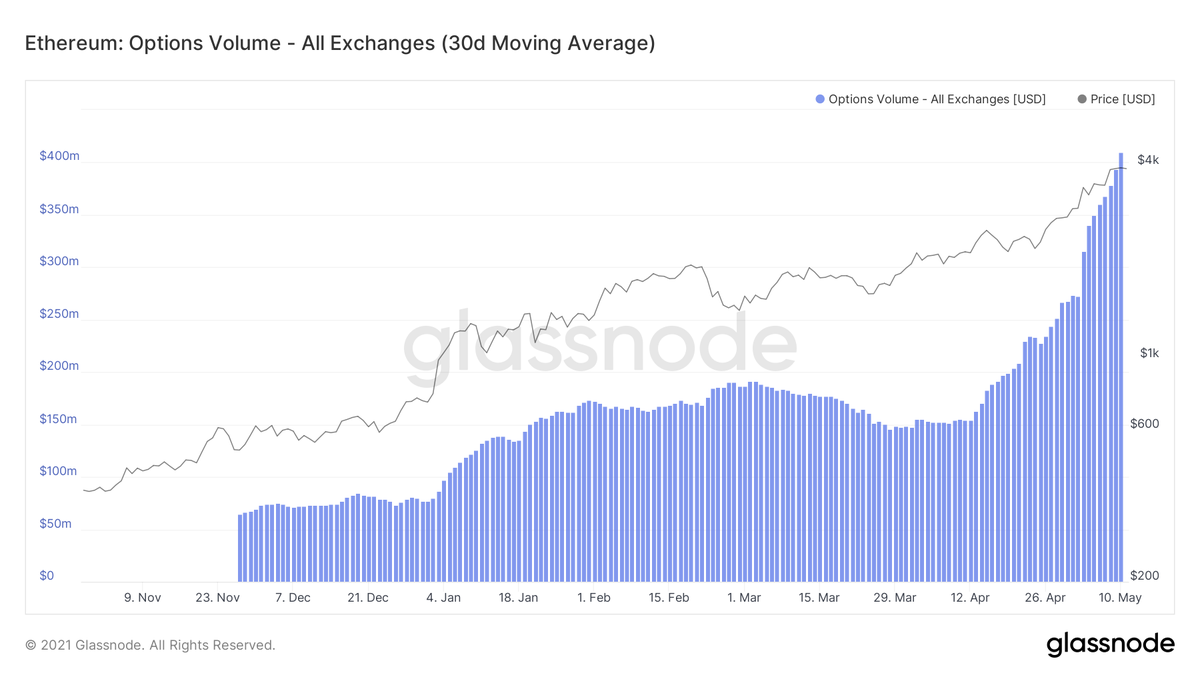

6/ Volume and open interest on $ETH futures and options at eye-popping highs.

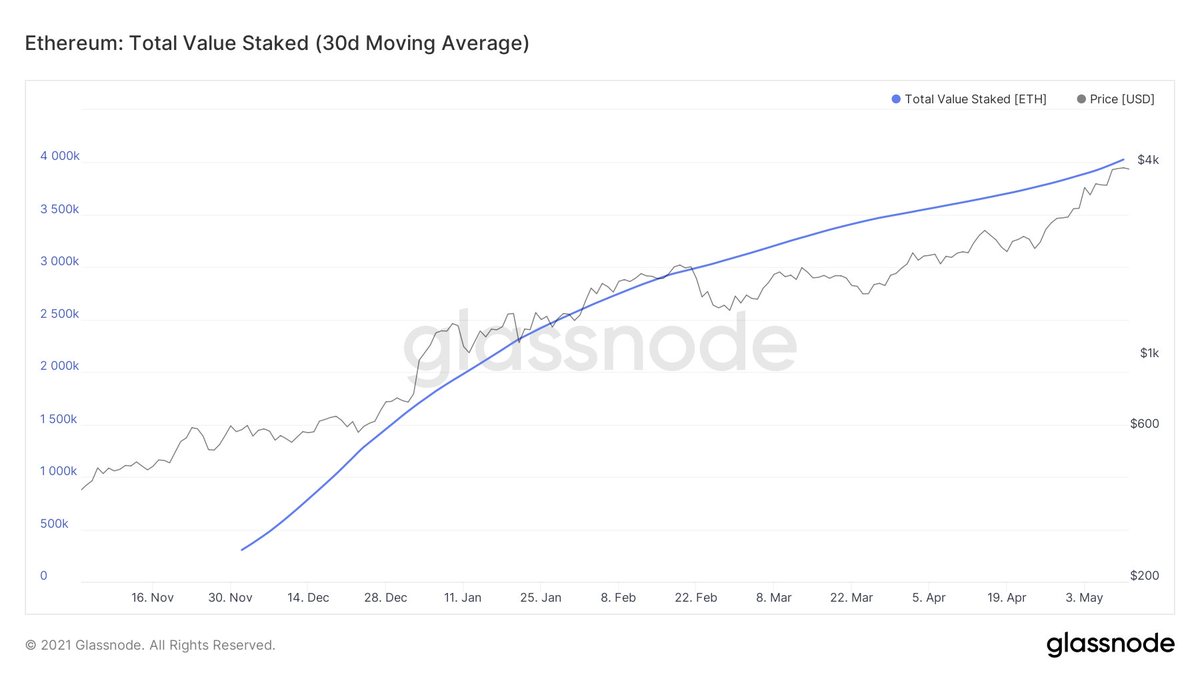

7/ $ETH staked in eth2 has crossed the 4M mark.

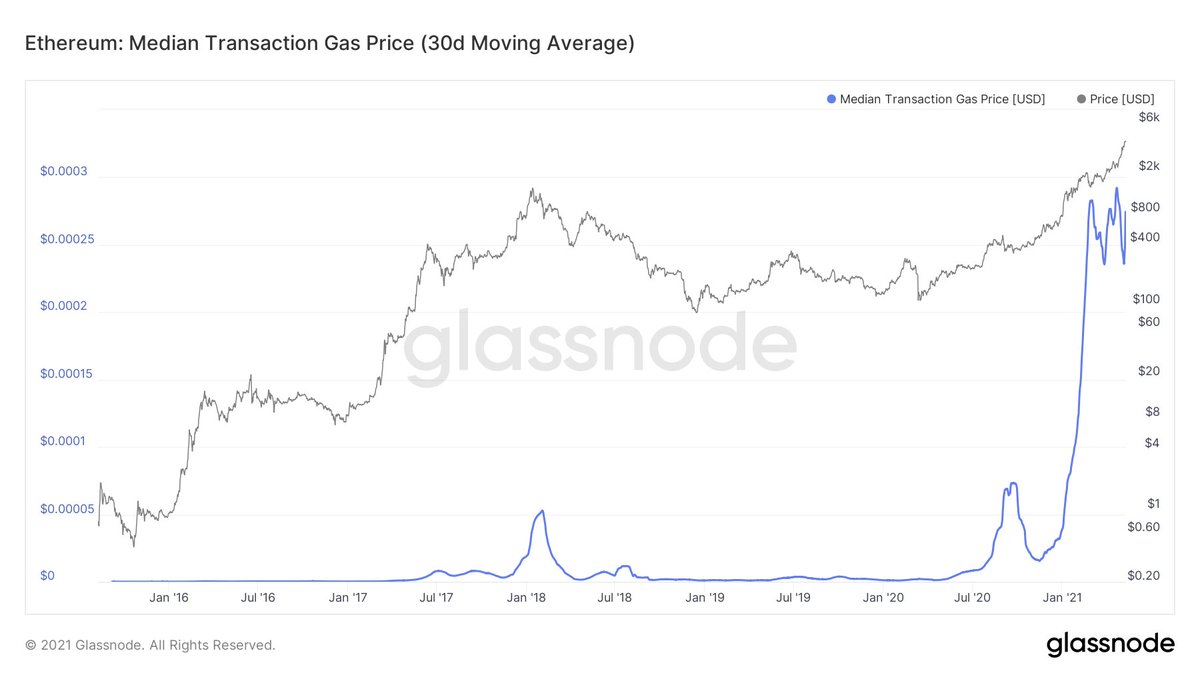

8/ Ok, so interest and activity are marking up and to the right. But so is the cost of operating on Ethereum.

In USD terms it& #39;s 54x more expensive to transact compared to just a year ago.

In USD terms it& #39;s 54x more expensive to transact compared to just a year ago.

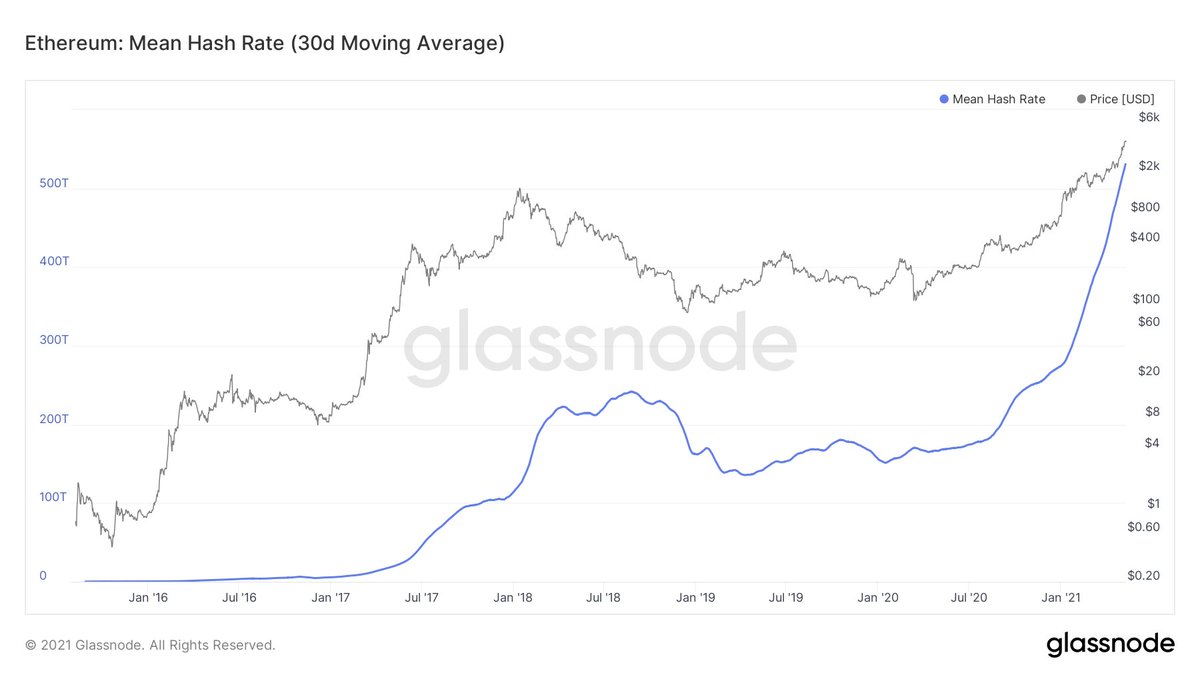

9/ Invariably, miners are making bank. Fees collected sit at all time highs–at an average of $27.5 daily.

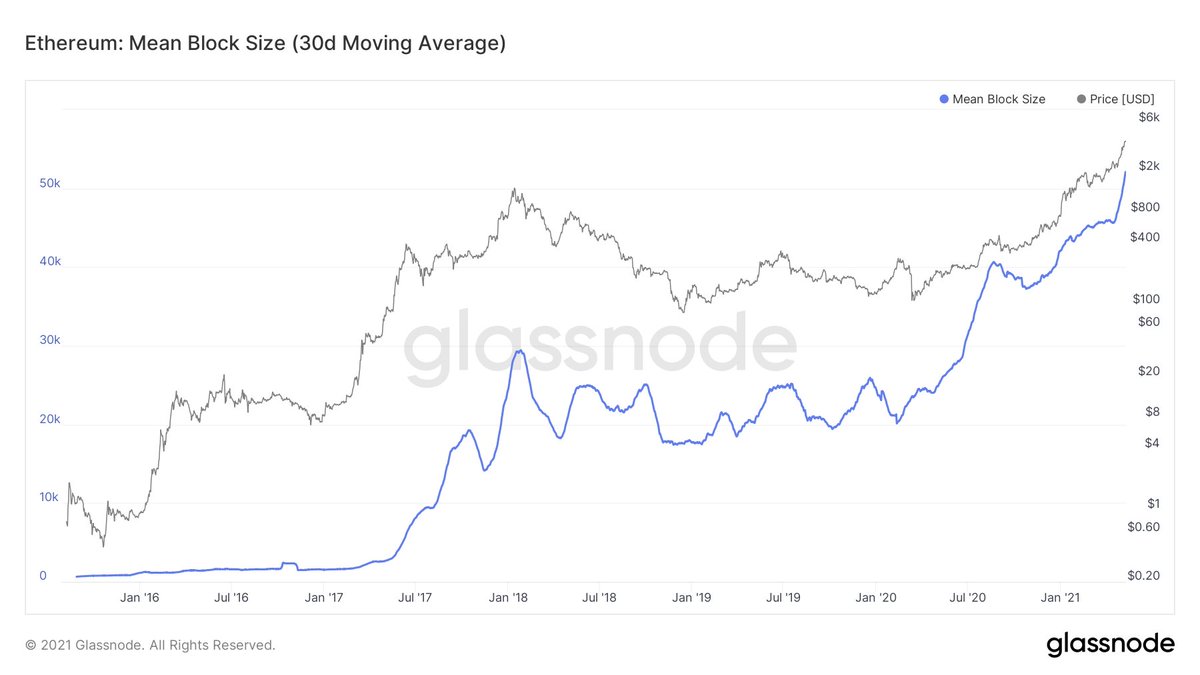

11/ Blocks pack more information in than they ever did before, thanks to miners increasing the block size to 15M gas.

12/ And after a brief pause, Ethereum& #39;s *network effect density* is picking back up.

12/ Idk what you gauge from this, but my sense is that...

Read on Twitter

Read on Twitter

" title="2/ Transactions exploded to new highs in April 2021. Uniswap is responsible for approx. 15% of those https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">" class="img-responsive" style="max-width:100%;"/>

" title="2/ Transactions exploded to new highs in April 2021. Uniswap is responsible for approx. 15% of those https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">" class="img-responsive" style="max-width:100%;"/>