BUDGET THREAD: if you want to skip ahead while the Treasurer’s talking, here’s a hastily compiled Budget summary thread. Headline: govt really has changed its stripes.

Big ticket spends: aged care ($18b), mental health ($2b), childcare ($2b), women’s safety ($1b) and work support ($2b), apprenticeships including care ($3b), and bits and pieces for hard-hit sectors (arts, tourism)

If you go and find one of those ‘winners and losers’ lists from last year, you could just about flip all the losers over. That’s not a coincidence – it’s clear the government has heard the message about its blindspots. The result makes political and economic sense.

Are the spends going to reshape the entire world and fix all our problems? No. There isn’t really a lot of structural reform in any of the big areas. But it’s still a step in the right direction. Bit more detail in the next few tweets

On childcare: same as announced last week. Well short of what we’ve recommended, but a start and targeted at parents with the most acute cost pressures.

On aged care: home care pkgs and more resi care funding will help, but yet to see the rights-based system the RC says we need. Focus on recruiting and training workforce is good, although not much to say about pay. Funky arrows though.

On mental health: funding for better access and measures for suicide prevention, but reform to make the system co-ordinated and coherent is still lacking.

On policies for women: lots of measures for women’s safety, and also a concerted effort to support training and employment for women. Plus a more comprehensive Women’s Budget Statement than usual. Long way to go to fix problems but signal of intent is a promising start.

Then there’s the tax cuts – the Lamington lives for another year, no surprises. Stage 3 for the rich is still firmly in place for 2024, no surprises. Real interest will come closer to election – is the govt serious about removing Lamington? And the Oppn?

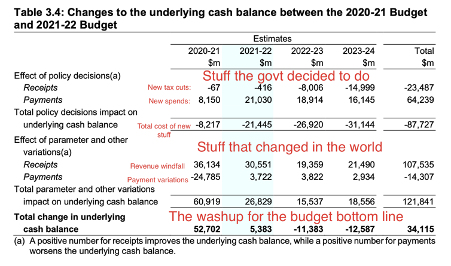

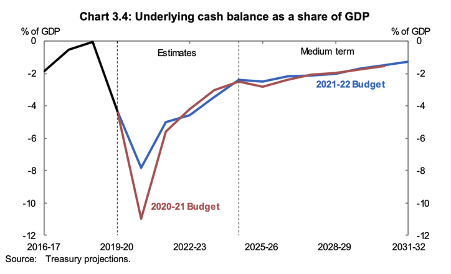

Those are bits and pieces. What about big picture? How do the books look? There’s *huge* revenue windfalls. But the govt has used it all (and then some!) on spends and tax cuts, so no dramatic shift to bottom line or rush to surplus.

In fact, there’s not even a surplus in sight for a decade. As Budget rightly notes, that’s not a worry – growth and interest rates mean debt can stabilise and fall relative to economy even while deficits continue.

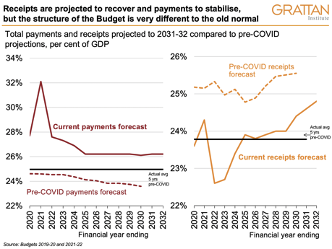

So for now, no worries on that front! But at some point govt might have to grapple with its commitment to maintaining tax at old normal. Spends are permanently higher – we’re in a new normal.

That’s it for the books. What about the glimpse offered into the state of the economy? Here things are looking rosy-ish:

Unemployment to dip below 5 next year (still a little way off) and get to 4.5 eventually. Treasury believes this is full employment – notably a fair bit less ambitious than RBA Gov has hinted.

Real GDP to settle a bit over 2% after a bigger year. Inflation and wages growth still somewhat subdued.

What assumptions does this rely on? Peachy iron ore prices and an assumption that borders go back to normal-ish in 2022 (at least intl students, tourists and migrants begin to return). Premised on assumption vaccination ‘plan’ is in place by end of year. + no hit from JK removal.

And that’s all there is to say really. All went pretty much as expected. Pretty unremarkable stuff, except for the confirmation that the structure of the budget has changed – but we knew that already.

I suspect a lot of the narrative will be about the ‘soft landing’ on the way out of the recession, and the government ‘softening its approach’. Some will naturally be cynical about that, but it’s basically what’s happened.

For the most part, Frydenberg seems to have shown that ideology is secondary to circumstance. And to the extent that we avoid a hard landing as we exit the recession, that’s a good thing.

Hit me up in the replies or in my DMs if you want to know more about this or any other bits and pieces – got the chance to look at most of it over the last 6hrs so happy to be of assistance!

Couple more things I didn& #39;t mention in the thread:

- Obsession with endless $ on megaprojects continues

- Kicked on full expensing and loss carry-back another year at great expense (more than $20b)

- Nominal GDP a bit volatile (bc of iron ore)

- Obsession with endless $ on megaprojects continues

- Kicked on full expensing and loss carry-back another year at great expense (more than $20b)

- Nominal GDP a bit volatile (bc of iron ore)

Another addendum for the record: should not be forgotten that there *are* some losers. Some of them here. https://twitter.com/TomisCrowley/status/1392062735874101250?s=20">https://twitter.com/TomisCrow...

I& #39;ll probably add more stuff as I think of it (for at least as long as the adrenaline lasts - I have eaten exclusively unhealthy snacks today)

Read on Twitter

Read on Twitter