1/6 During yesterday& #39;s mini-dip, I saw unrest in my feed & some people were pinging me if I was still bullish on #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

To me this was nothing but another shake-out of weak hands and leverage, while nothing changed regarding the big picture https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">

A short https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> on (not) getting rekt

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> on (not) getting rekt

To me this was nothing but another shake-out of weak hands and leverage, while nothing changed regarding the big picture

A short

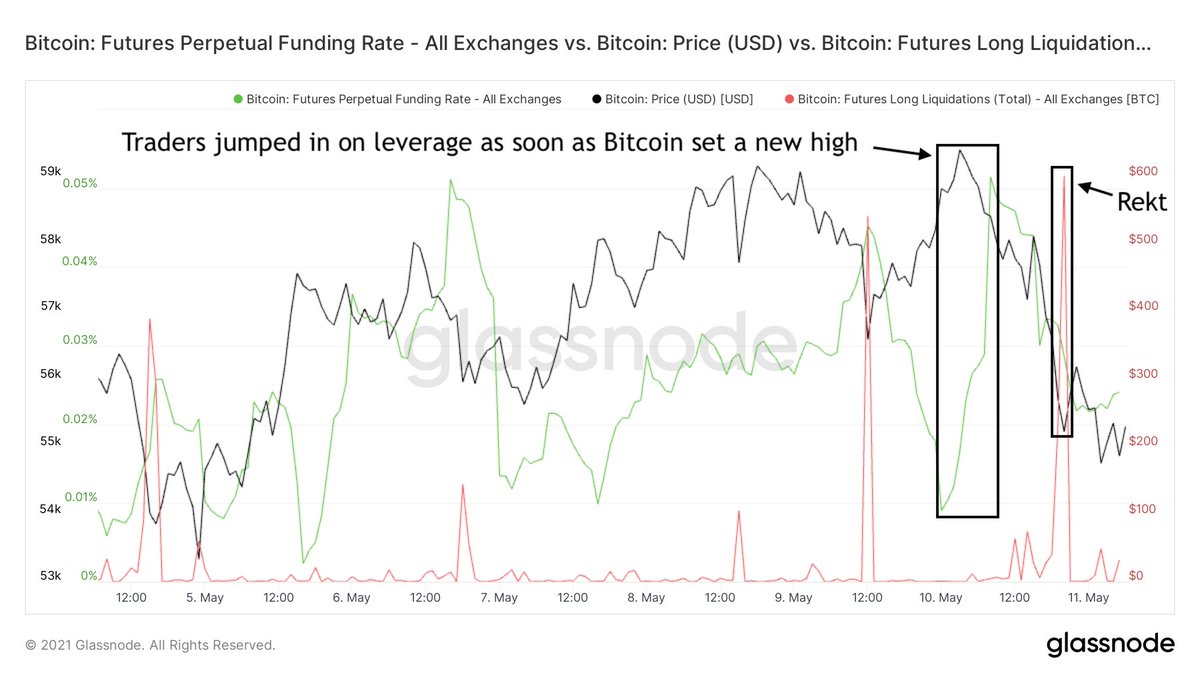

2/6 So, what happened?

Simple: as soon as #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> set a new local high and dipped a bit, there was a steep uptick in people aping in long on leverage again

https://abs.twimg.com/hashflags... draggable="false" alt=""> set a new local high and dipped a bit, there was a steep uptick in people aping in long on leverage again  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦍" title="Gorilla" aria-label="Emoji: Gorilla">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦍" title="Gorilla" aria-label="Emoji: Gorilla">

As always, this is a recipe for getting rekt - which is exactly what happened a few hours later https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤦" title="Person schlägt sich die Hand vors Gesicht" aria-label="Emoji: Person schlägt sich die Hand vors Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤦" title="Person schlägt sich die Hand vors Gesicht" aria-label="Emoji: Person schlägt sich die Hand vors Gesicht">

Simple: as soon as #Bitcoin

As always, this is a recipe for getting rekt - which is exactly what happened a few hours later

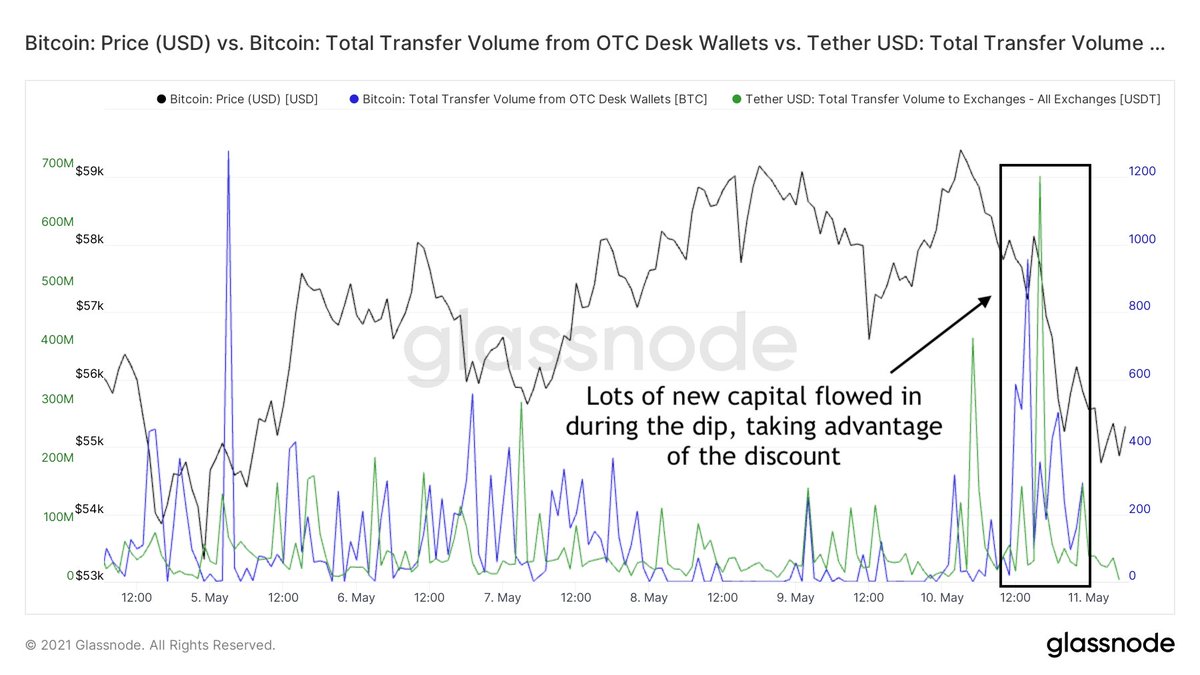

3/6 Meanwhile, there were large stablecoin inflows to exchanges and large #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> outflows from OTC desks - both signs that there is some serious dip buying going on

https://abs.twimg.com/hashflags... draggable="false" alt=""> outflows from OTC desks - both signs that there is some serious dip buying going on

"Thanks for the liquidity, (rekt) apes!" https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">

"Thanks for the liquidity, (rekt) apes!"

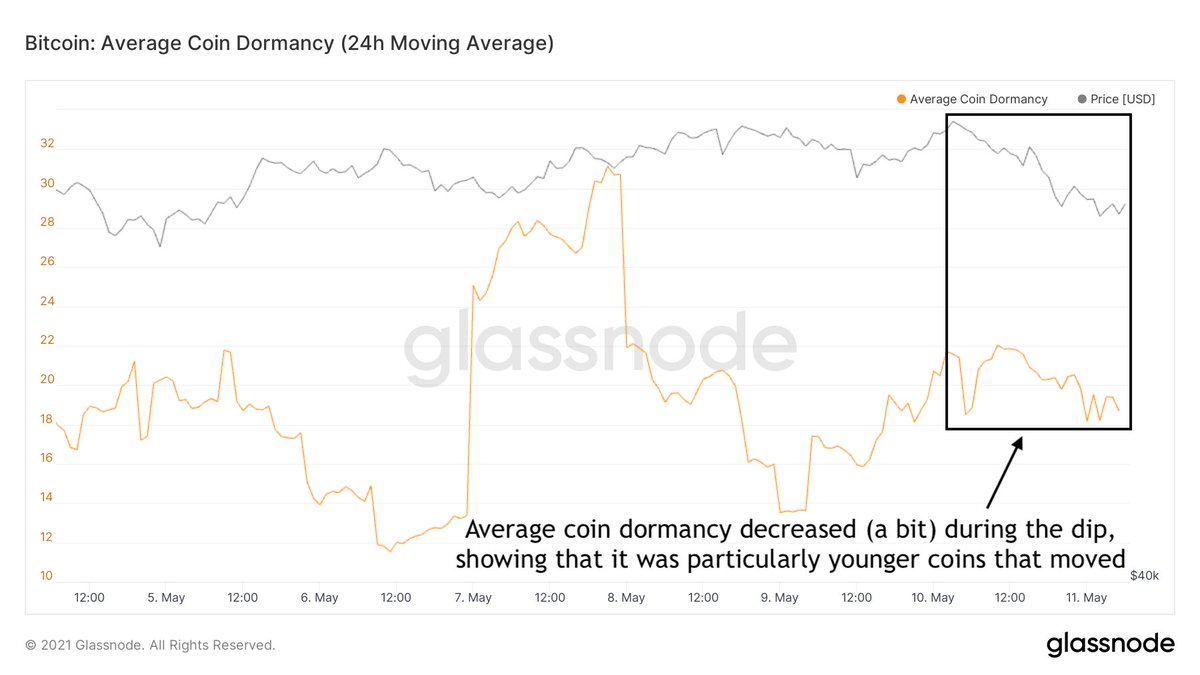

4/6 During this dip, the average coin dormancy decreased (a bit), which means that relatively young coins made up an increasingly large part of the on-chain volume

Another sign that it was particularly the less experienced market participants that were triggered by the dip

Another sign that it was particularly the less experienced market participants that were triggered by the dip

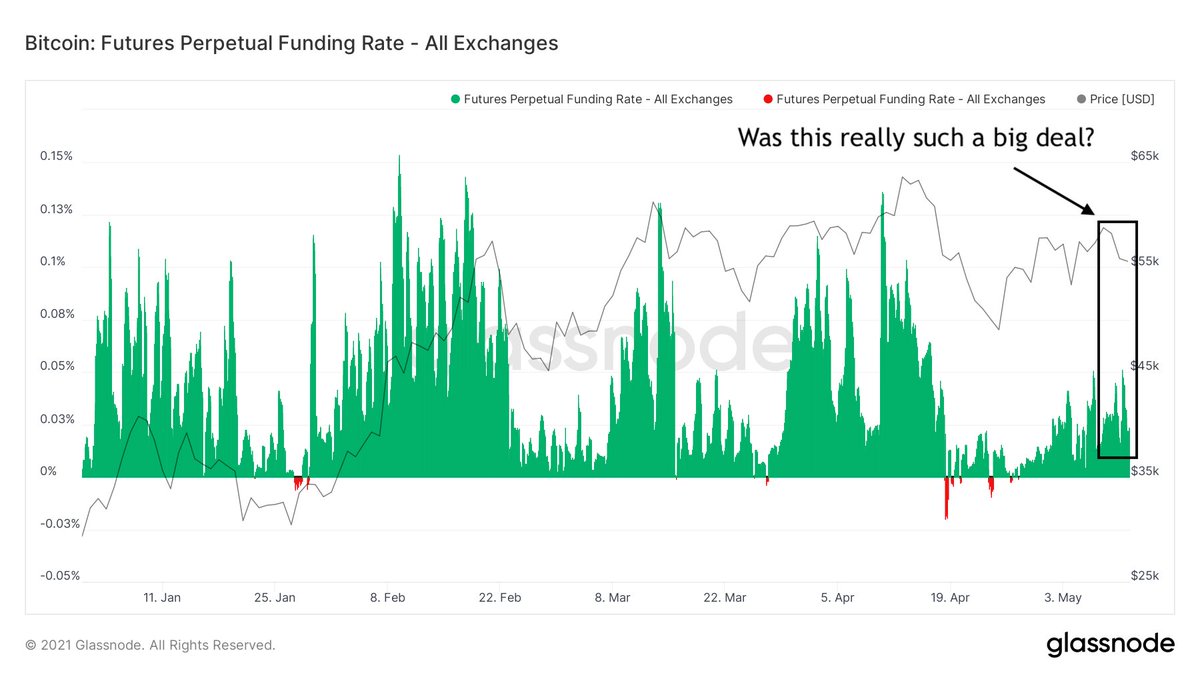

5/6 The irony is that if you zoom out (even just a little bit), none of this was a big deal at all  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤏" title="Kneifende Hand" aria-label="Emoji: Kneifende Hand">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤏" title="Kneifende Hand" aria-label="Emoji: Kneifende Hand">

Unless you& #39;re an experienced, professional trader that consciously chooses to trade small timeframes: zoom out & slow down (lower your time preference)

Unless you& #39;re an experienced, professional trader that consciously chooses to trade small timeframes: zoom out & slow down (lower your time preference)

6/6 That is why I am personally not looking at intra-day charts and on-chain flows but particularly focus on the larger (4-year) market cycle

If you& #39;re curious about my current thoughts on the bigger picture and why I am not worried, this https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder"> might help: https://twitter.com/dilutionproof/status/1390994566686314496">https://twitter.com/dilutionp...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder"> might help: https://twitter.com/dilutionproof/status/1390994566686314496">https://twitter.com/dilutionp...

If you& #39;re curious about my current thoughts on the bigger picture and why I am not worried, this

Read on Twitter

Read on Twitter set a new local high and dipped a bit, there was a steep uptick in people aping in long on leverage again https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦍" title="Gorilla" aria-label="Emoji: Gorilla">As always, this is a recipe for getting rekt - which is exactly what happened a few hours later https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤦" title="Person schlägt sich die Hand vors Gesicht" aria-label="Emoji: Person schlägt sich die Hand vors Gesicht">" title="2/6 So, what happened?Simple: as soon as #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> set a new local high and dipped a bit, there was a steep uptick in people aping in long on leverage again https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦍" title="Gorilla" aria-label="Emoji: Gorilla">As always, this is a recipe for getting rekt - which is exactly what happened a few hours later https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤦" title="Person schlägt sich die Hand vors Gesicht" aria-label="Emoji: Person schlägt sich die Hand vors Gesicht">" class="img-responsive" style="max-width:100%;"/>

set a new local high and dipped a bit, there was a steep uptick in people aping in long on leverage again https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦍" title="Gorilla" aria-label="Emoji: Gorilla">As always, this is a recipe for getting rekt - which is exactly what happened a few hours later https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤦" title="Person schlägt sich die Hand vors Gesicht" aria-label="Emoji: Person schlägt sich die Hand vors Gesicht">" title="2/6 So, what happened?Simple: as soon as #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> set a new local high and dipped a bit, there was a steep uptick in people aping in long on leverage again https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦍" title="Gorilla" aria-label="Emoji: Gorilla">As always, this is a recipe for getting rekt - which is exactly what happened a few hours later https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤦" title="Person schlägt sich die Hand vors Gesicht" aria-label="Emoji: Person schlägt sich die Hand vors Gesicht">" class="img-responsive" style="max-width:100%;"/>

outflows from OTC desks - both signs that there is some serious dip buying going on"Thanks for the liquidity, (rekt) apes!" https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">" title="3/6 Meanwhile, there were large stablecoin inflows to exchanges and large #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> outflows from OTC desks - both signs that there is some serious dip buying going on"Thanks for the liquidity, (rekt) apes!" https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">" class="img-responsive" style="max-width:100%;"/>

outflows from OTC desks - both signs that there is some serious dip buying going on"Thanks for the liquidity, (rekt) apes!" https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">" title="3/6 Meanwhile, there were large stablecoin inflows to exchanges and large #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> outflows from OTC desks - both signs that there is some serious dip buying going on"Thanks for the liquidity, (rekt) apes!" https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎩" title="Zylinder" aria-label="Emoji: Zylinder">" class="img-responsive" style="max-width:100%;"/>

Unless you& #39;re an experienced, professional trader that consciously chooses to trade small timeframes: zoom out & slow down (lower your time preference)" title="5/6 The irony is that if you zoom out (even just a little bit), none of this was a big deal at all https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤏" title="Kneifende Hand" aria-label="Emoji: Kneifende Hand">Unless you& #39;re an experienced, professional trader that consciously chooses to trade small timeframes: zoom out & slow down (lower your time preference)" class="img-responsive" style="max-width:100%;"/>

Unless you& #39;re an experienced, professional trader that consciously chooses to trade small timeframes: zoom out & slow down (lower your time preference)" title="5/6 The irony is that if you zoom out (even just a little bit), none of this was a big deal at all https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤏" title="Kneifende Hand" aria-label="Emoji: Kneifende Hand">Unless you& #39;re an experienced, professional trader that consciously chooses to trade small timeframes: zoom out & slow down (lower your time preference)" class="img-responsive" style="max-width:100%;"/>