I throw the term "expected value" (EV for short) around a lot. What is it, and, more important, why is it the thing that matters?

A thread about the median and the mean.

A thread about the median and the mean.

Let& #39;s step back from trading and focus on an idealized situation which is sorta like trading. Say you& #39;ve got $10 and all you& #39;re allowed to do with it is pay $10 to flip a coin which comes up heads 55% of the time, and you win $20 when it does. You can play as much as you want.

The *expected value* (EV) of each flip is

-$10 (cost of playing) + $.55 * 20 = $1

Meaning that each time you play, you& #39;re expected to make $1. Pretty good!

-$10 (cost of playing) + $.55 * 20 = $1

Meaning that each time you play, you& #39;re expected to make $1. Pretty good!

You& #39;ve just got $10, though, and maybe you need to make sure you can buy lunch today, so you *really* don& #39;t wanna lose all of it. It& #39;s possible to imagine a reasonable utility function which *really* wants lunch and so doesn& #39;t want to play this game, even though it& #39;s +EV.

Adjusting EV for risk is often a reasonable thing to do, especially when the risks you& #39;re taking are high relative to how much $ you have, or if losing would be especially bad for some reason.

This is the source of advice like "don& #39;t bet more than you can afford to lose."

This is the source of advice like "don& #39;t bet more than you can afford to lose."

This is why, for instance, the insurance industry can succeed. Paying for insurance on your house is -EV -- on average, people pay more than the insurance company ever spends fixing houses. But for most, losing their house would be a giant setback.

Really what& #39;s happening here is -- people& #39;s utility curves are not linear.

(Something something Kelly Criterion, not re-opening that can of worms, suffice to say many people can rationally discount EV for risk, see below for why Alameda doesn& #39;t really.)

(Something something Kelly Criterion, not re-opening that can of worms, suffice to say many people can rationally discount EV for risk, see below for why Alameda doesn& #39;t really.)

In simple terms: how much value does your first $1m give you, as compared to your 10th? Your 100th?

For most people who are just optimizing for their own happiness, utility is *definitely* sub-linear at some point -- $0 -> $1m is great, $99m -> $100m barely matters.

For most people who are just optimizing for their own happiness, utility is *definitely* sub-linear at some point -- $0 -> $1m is great, $99m -> $100m barely matters.

Why doesn& #39;t Alameda really have to do this? There are a few reasons.

Day-to-day, the big one is that we have a ton of capital, and it& #39;s legit just quite rare that losing a potential bet would cause us real harm.

Day-to-day, the big one is that we have a ton of capital, and it& #39;s legit just quite rare that losing a potential bet would cause us real harm.

Using the coin flip analogy, we& #39;ve got $10000 instead of $10, and we can freely play the game as much as we want without having substantial risk of ruin. It& #39;s powerful, and increases our aggregate EV (per time unit since technically the EV is unbounded) since we can& #39;t go to $0.

Markets rarely have sufficient liquidity such that our bet sizing is limited by our capital base -- much more often they& #39;re limited by how much we can put on without having giant price impact. The only things we can& #39;t do because of capital are like, buy half the ETH that exists.

This is powerful! It lets us maximize short-term EV almost all the time, assuming we are trying to maximize overall EV longer-term. And we *are* trying to do that -- @SBF_Alameda has talked extensively about the altruistic goals Alameda operates with.

(This is as opposed to, e.g., a trading firm where everyone& #39;s trying to make $15m and then retire -- which exists! and can be true for some Alameda traders -- but which is not true generally for the collective.)

Understanding that our best move is to try to directly maximize EV almost all the time makes a lot of decisions clearer; here are just a few examples, but this is the philosophy underpinning basically every post I have ever made:

Let& #39;s say that ca. January, we expect DOGE to move over the next weeks/whatever according to this distribution:

- 10%: up 1000% because Elon keeps going crazy

- 90%: down 75% because he doesn& #39;t

- 10%: up 1000% because Elon keeps going crazy

- 90%: down 75% because he doesn& #39;t

This makes the EV

.1 * 1000% + .9 * -75% = +32.5%

So: you& #39;re supposed to buy a TON, even though you& #39;ll USUALLY lose a lot.

(And, FWIW, I think 10% was a massive under-estimate, but whatever, "not zero" matters most.)

.1 * 1000% + .9 * -75% = +32.5%

So: you& #39;re supposed to buy a TON, even though you& #39;ll USUALLY lose a lot.

(And, FWIW, I think 10% was a massive under-estimate, but whatever, "not zero" matters most.)

Being EV-maximizing and not having to care about median (etc.) outcomes means we get to do this for big size -- we knew we& #39;d most likely lose, but making 100 similar bets would come out way ahead.

And results aren& #39;t the important thing, but ...

And results aren& #39;t the important thing, but ...

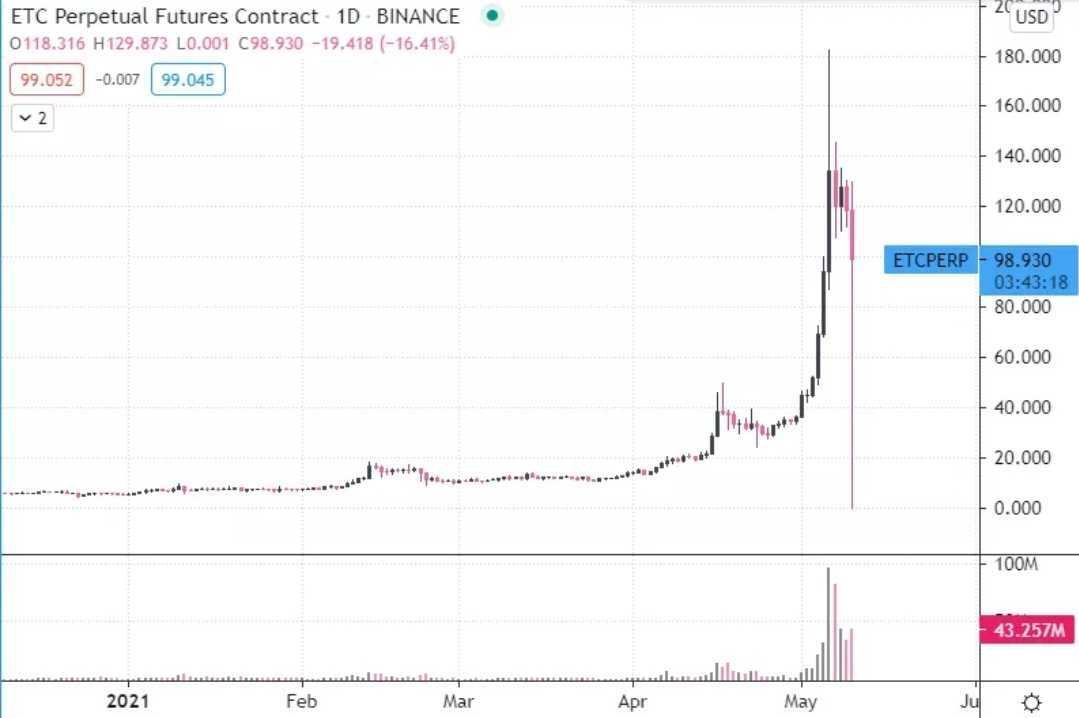

Crypto exchanges are known for having these weird errant prints -- so-called "wicks." If you can manage to be on the good side of these wicks, you can actually make a good amount of money!

But should you?

But should you?

A "typical" giant wick is for something like 50% edge. There are a few per day, on average, and a total of 1000 or so important / liquid markets -- so say that this happens on 1/500 of big markets per day.

Let& #39;s say your capital would make .15%/day not tied up (from other trading, or yield farming, or whatever -- you have a better idea of this for your personal strategies). This makes your EV from trying to catch the wick

.002 * 50% + .998 * -.15% = .05%/day -- a loss!

.002 * 50% + .998 * -.15% = .05%/day -- a loss!

Of course 1/500 is just a guess, and 50% might not be optimal -- it& #39;s possible some market dynamics *do* make this worthwhile. But it& #39;s not quite as simple as "no-risk way to maybe make a lot" because of opportunity cost.

A personal example: should I abandon my high-paying but safe job to pursue crypto trading?

This choice was easy: I made as much as my "tradfi" bonus in a few weeks trading BTC arbs, and that was that :P "EV" isn& #39;t even the word, I demonstrated the value was higher from leaving.

This choice was easy: I made as much as my "tradfi" bonus in a few weeks trading BTC arbs, and that was that :P "EV" isn& #39;t even the word, I demonstrated the value was higher from leaving.

And eventually I joined Alameda because the upside was really just WAY too high working on these things with the best team I& #39;d ever seen - I could run the EV numbers from back then but they& #39;re "large."

Most people (young, far from retirement, etc.) have the same kind of luxury we do (on a smaller scale). It& #39;s generally way more OK to lose all your $ when you& #39;re young than people realize, and I recommend carefully inspecting whether not doing so is capping your potential.

And maximizing EV -- while still quite hard -- is at least an elegant framework to be able to use. It& #39;s still important to not let yourself get screwed, but in general betting super big and trying to maximize your expected value is right more often than people think.

Try it!

Try it!

Read on Twitter

Read on Twitter