Let& #39;s talk about HB 3752 @RepJamesFrank and HB 3924 @TomOliverson. These bills allow affordable alternative health plans to be offered. I want to address one of the main concerns about these bills -- that "cherry picking" will occur. #txlege

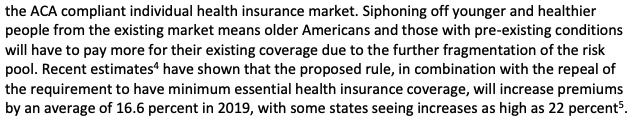

"Cherry-picking" is the concern that plans like these will will have a negative impact on the existing ACA Marketplace risk pool, making premiums more expensive for those plans, because the younger and healthier people will choose these plans instead of ACA plans.

But there just aren& #39;t many ACA cherries to pick. The ACA was designed to disincentivize younger and healthier folks from enrolling in the first place. The only thing keeping some younger and healthier people in the market was subsidies, and those were poorly designed.

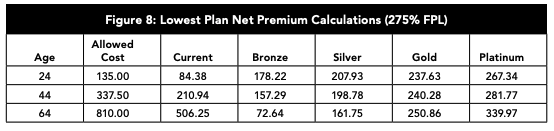

From the outset, at the same income level, younger people had to pay more money for their policy than older people. This created the adverse selection death spiral that we saw occur. https://www.soa.org/globalassets/assets/library/newsletters/health-watch-newsletter/2014/may/hsn-2014-iss-75-fann.pdf">https://www.soa.org/globalass...

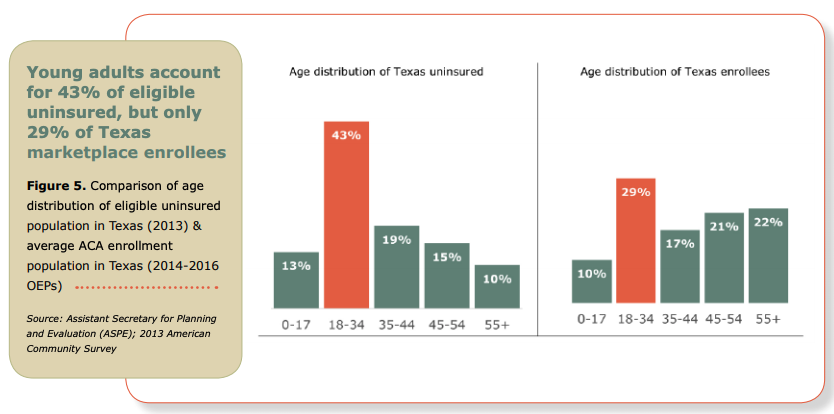

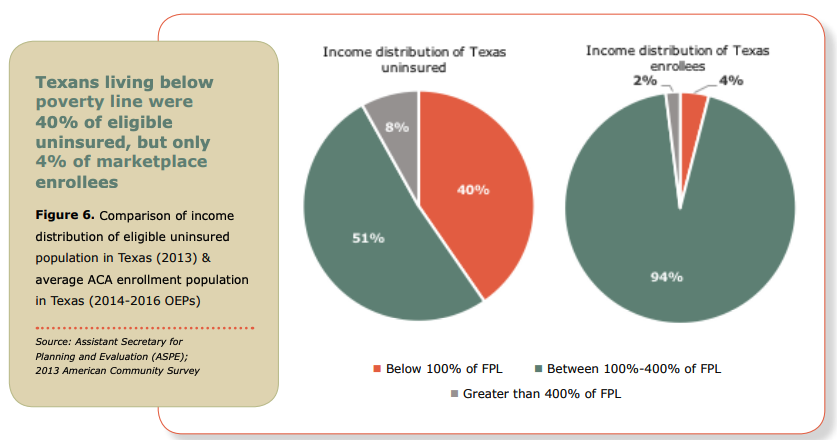

Given the incentives, the risk pool skewed much much older than the subsidy eligible population, which is what we& #39;d expect when older residents could access less expensive plans. https://ehfprod.wpengine.com/wp-content/uploads/2020/01/EHF_ACA_Enrollment_in_Texas_report.pdf">https://ehfprod.wpengine.com/wp-conten...

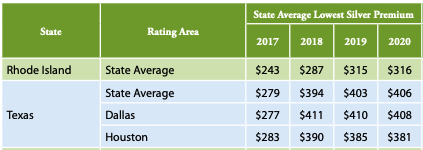

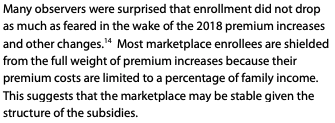

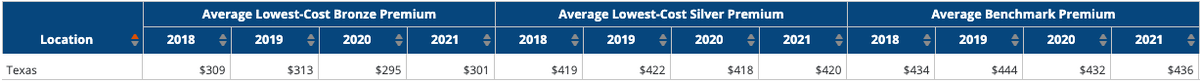

The adverse selection death spiral stopped after 2018. Silver premiums that year spiked up mostly due to "silver-loading" and after that, premiums stabilized. Despite (well, really, because of) the Silver spike, enrollment stabilized as well. https://www.urban.org/sites/default/files/publication/101499/moni_premiumchanges_final.pdf">https://www.urban.org/sites/def...

By that time, the younger, healthier folks had almost entirely opted out of the ACA plans, unless their income was low enough that they were getting free or exceedingly low-cost plans. EHF analysis showed 94% of enrollees were subsidy eligible by 2016. https://ehfprod.wpengine.com/wp-content/uploads/2020/01/EHF_ACA_Enrollment_in_Texas_report.pdf">https://ehfprod.wpengine.com/wp-conten...

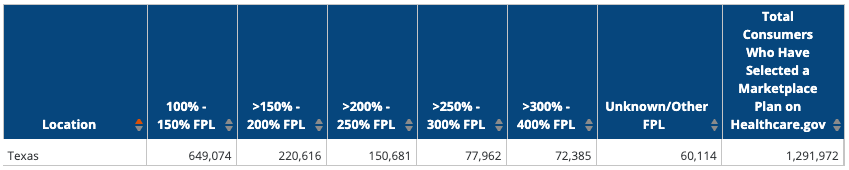

This is still the case in 2021. Of the ~1.3 Million Texans that enrolled for 2021, over 1 Million of them have incomes below 250% of the FPL, making them eligible not only for subsidies, but also for CSRs that reduce deductibles and OOP expenses. https://www.kff.org/health-reform/state-indicator/marketplace-plan-selections-by-household-income-2/?currentTimeframe=0&selectedRows=%7B%22states%22:%7B%22texas%22:%7B%7D%7D%7D&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D">https://www.kff.org/health-re...

So ~95% of enrollees are premium-subsidy eligible by income and ~80% of enrollees are eligible for both heavily subsidized premiums and out of pocket cost assistance. Buyers know ACA plans are a bad deal unless they are heavily subsidized, or already sick (i.e., not cherries).

Because ACA enrollees are so heavily subsidized, it doesn& #39;t make any sense that the availability of alternative plans would have a big impact on the existing ACA plans. A heavily subsidized ACA plan will still be cheaper than an unsubsidized Farm Bureau plan.

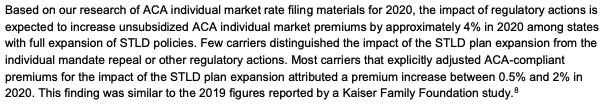

We& #39;ve seen this argument play out before with two other changes to the ACA. For the 2019 plan year, the individual mandate penalty was lowered to $0, and Short-Term plans were made more widely available. Many predicted these changes would have horrible effects on the ACA market.

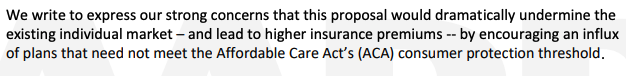

For example, AARP, who has opposed these bills in Texas, previously expressed the same "cherry-picking" concern about STLD plans. Specifically, they predicted increases in premiums of 16.6%. The evidence shows this didn& #39;t come close to happening in Texas. https://www.aarp.org/content/dam/aarp/politics/advocacy/2018/04/aarp-comment-short-term-health-plans-042318.pdf">https://www.aarp.org/content/d...

Actual premium changes from 2018-2019 comport with a Milliman actuarial study that showed premiums should increase by only about 0.5% - 2% due to STLD availability. https://www.lls.org/sites/default/files/National/USA/Pdf/STLD-Impact-Report-Final-Public.pdf">https://www.lls.org/sites/def...

It turns out that repealing the individual mandate and making other ACA alternatives available didn& #39;t have much of an impact because the federal subsidies are the biggest reason keeping healthy people enrolled.

Farm Bureau and Texas Mutual plans will mostly compete for enrollees with other alternatives like Health Sharing Ministries and STLD plans. There simply aren& #39;t many "cherries" left in the ACA for these alternative plans to pick.

But, let& #39;s suppose, for the sake of argument, that ACA premiums did increase. For those enrollees eligible for subsidies (the overwhelming majority of the market), their *net cost* wouldn& #39;t change a bit because their subsidies would cover the difference.

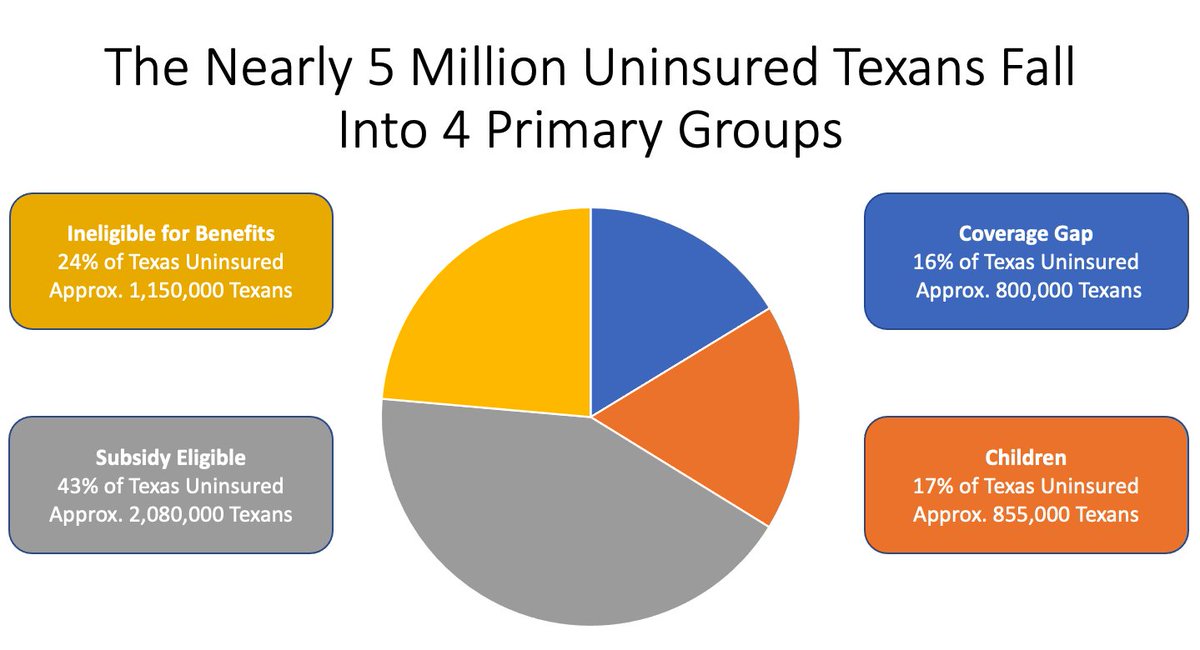

So, the ACA will still be there for those with pre-existing conditions, just like before. But for the ~1.2 Million Texans the ACA left behind -- those it doesn& #39;t heavily subsidize -- Farm Bureau and Texas Mutual can offer affordable plans to reduce the number of uninsured.

Read on Twitter

Read on Twitter