0/9 Ethereum& #39;s Liquidity Crisis means its pricing relative to bitcoin will result in new highs.

The catalyst is Ethereum& #39;s narrative.

Upon the London upgrade, EIP-1559 will change ETH& #39;s monetary policy and with it, the narrative will take form. Here& #39;s what I mean..

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

The catalyst is Ethereum& #39;s narrative.

Upon the London upgrade, EIP-1559 will change ETH& #39;s monetary policy and with it, the narrative will take form. Here& #39;s what I mean..

1/9 - Bitcoin saw its gold 2.0 narrative take hold as it broke its all-time high.

Ethereum on the other hand lacked a single narrative that everybody could get behind.

Ethereum on the other hand lacked a single narrative that everybody could get behind.

2/9 Ethereum& #39;s London upgrade that& #39;s scheduled to happen in July will allow for a new narrative to take hold that& #39;s similar to bitcoin& #39;s. That& #39;s because EIP-1559 means ETH can become deflationary.

3/9 At a time when scarce assets are experiencing a premium relative to all other things, this puts ETH into an interesting category of being an asset to buy and hold.

Here& #39;s where it gets interesting...

Here& #39;s where it gets interesting...

4/9 Most ETH/BTC chart watchers think 0.1 is the checkered flag. I disagree... It& #39;s much higher.

Here& #39;s why...

ETH is not as liquid as bitcoin.

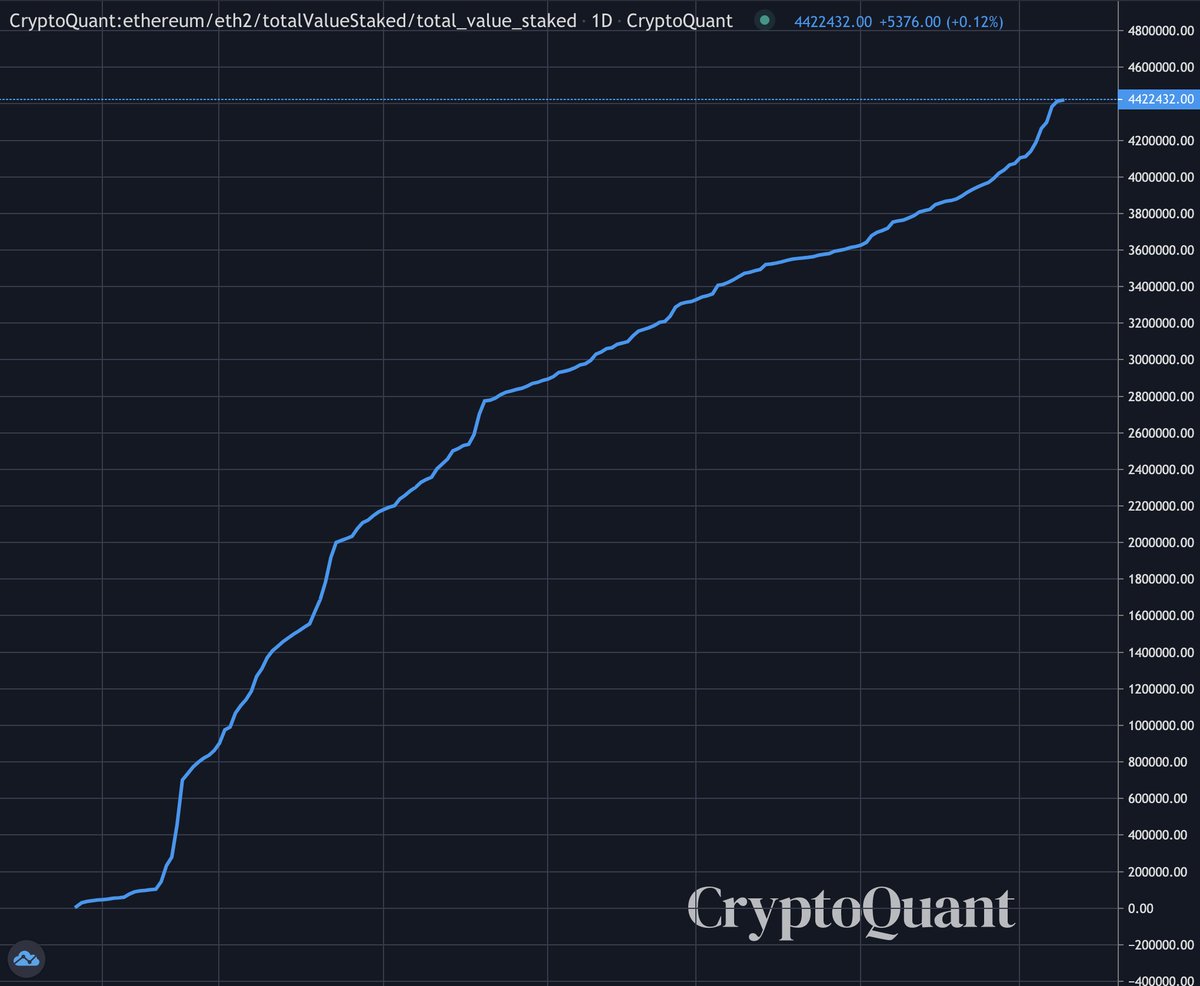

4.5m on ETH2

10.1m in DeFi protocols

3.2m in Grayscale

That& #39;s 15.5% of supply

ETH on ETH2:

Here& #39;s why...

ETH is not as liquid as bitcoin.

4.5m on ETH2

10.1m in DeFi protocols

3.2m in Grayscale

That& #39;s 15.5% of supply

ETH on ETH2:

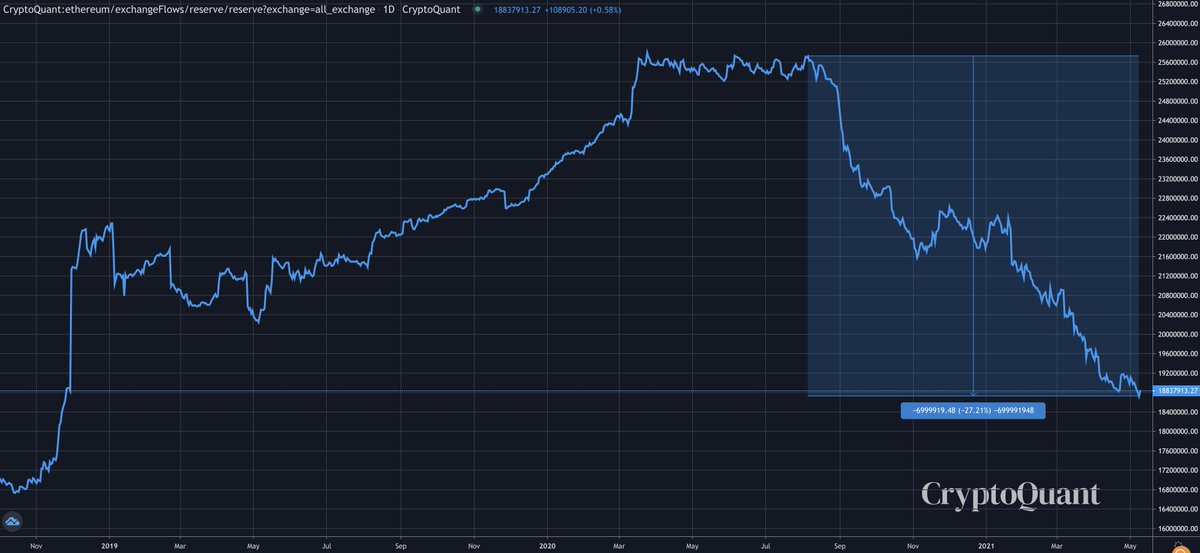

5/9 7 million ETH have left exchanges since the middle of 2020. This is over 27% less ETH than a year ago.

h/t: @cryptoquant_com and @ki_young_ju

h/t: @cryptoquant_com and @ki_young_ju

6/9 Just for some perspective, 15.5% of BTC supply is about 2.9 million BTC. That& #39;s a massive figure. And with so much ETH less liquid than the last bull cycle, we have a unique situation unfolding.

7/9 A rising singular narrative that larger buyers can wrap their hands and minds around, mixed with less liquid supply than ever before... This is like selling lumber in a housing boom.

Prices can go higher than anybody expects. They overshoot every analyst& #39;s price targets.

Prices can go higher than anybody expects. They overshoot every analyst& #39;s price targets.

8/9 Which is why I& #39;m leaning towards ETH/BTC rising above its previous weekly closing high of 0.15.

If you see a clear narrative take form in the mainstream media, that& #39;s your signal.

If you see a clear narrative take form in the mainstream media, that& #39;s your signal.

9/9 Any dip - while likely steeper than BTC - is sure to be eaten up harder and faster than any other coin moving forward.

If this interested you, be sure to learn more here: https://jarvislabs.substack.com/p/be-ready ">https://jarvislabs.substack.com/p/be-read...

If this interested you, be sure to learn more here: https://jarvislabs.substack.com/p/be-ready ">https://jarvislabs.substack.com/p/be-read...

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="0/9 Ethereum& #39;s Liquidity Crisis means its pricing relative to bitcoin will result in new highs.The catalyst is Ethereum& #39;s narrative.Upon the London upgrade, EIP-1559 will change ETH& #39;s monetary policy and with it, the narrative will take form. Here& #39;s what I mean..https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="0/9 Ethereum& #39;s Liquidity Crisis means its pricing relative to bitcoin will result in new highs.The catalyst is Ethereum& #39;s narrative.Upon the London upgrade, EIP-1559 will change ETH& #39;s monetary policy and with it, the narrative will take form. Here& #39;s what I mean..https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>