(1/8) NAUTILUS THREAD $NLS

Software integrated cardio and strength products through various brands. A value play on connected fitness.

Full deep-dive here: https://fundamentalsfirst.xyz/nautilus-growth-at-1x-sales/">https://fundamentalsfirst.xyz/nautilus-...

Software integrated cardio and strength products through various brands. A value play on connected fitness.

Full deep-dive here: https://fundamentalsfirst.xyz/nautilus-growth-at-1x-sales/">https://fundamentalsfirst.xyz/nautilus-...

(2/8) Noteworthy Brands

While Schwinn is recognized all over the world for their cycling hardware, Bowflex appears to be Nautilus& #39; long term winner. The brand sells a variety of software integrated cardio and strength products.

While Schwinn is recognized all over the world for their cycling hardware, Bowflex appears to be Nautilus& #39; long term winner. The brand sells a variety of software integrated cardio and strength products.

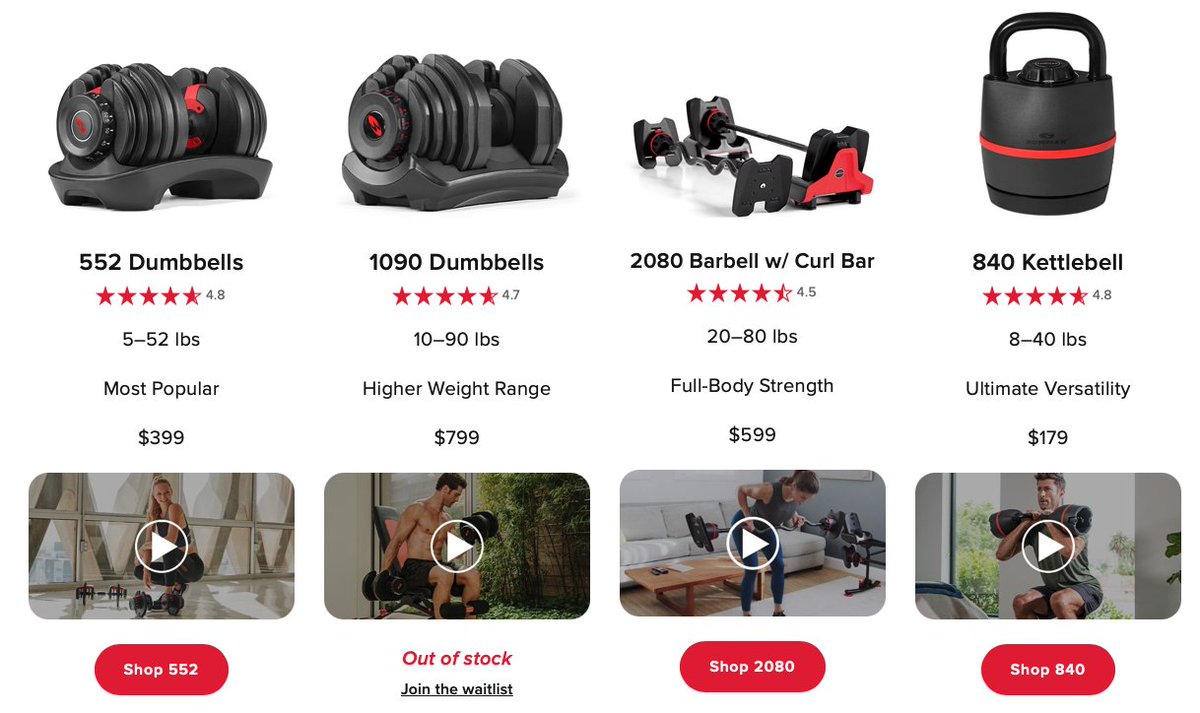

(3/8) Bowflex Strength Products

Direct to consumer strength product sales +372% YoY in 2020. These are the ultimate home gym solutions - buy 1 adjustable dumbbell instead of 20 different sizes. Trainer led lifting video workouts on app.

Direct to consumer strength product sales +372% YoY in 2020. These are the ultimate home gym solutions - buy 1 adjustable dumbbell instead of 20 different sizes. Trainer led lifting video workouts on app.

(4/8) Bowflex Cardio

Software enabled bikes, treadmills, ellipticals and more. Direct to consumer cardio sales +78% YoY in 2020. Wide product offering starting at $999. Caters to large demographic.

Software enabled bikes, treadmills, ellipticals and more. Direct to consumer cardio sales +78% YoY in 2020. Wide product offering starting at $999. Caters to large demographic.

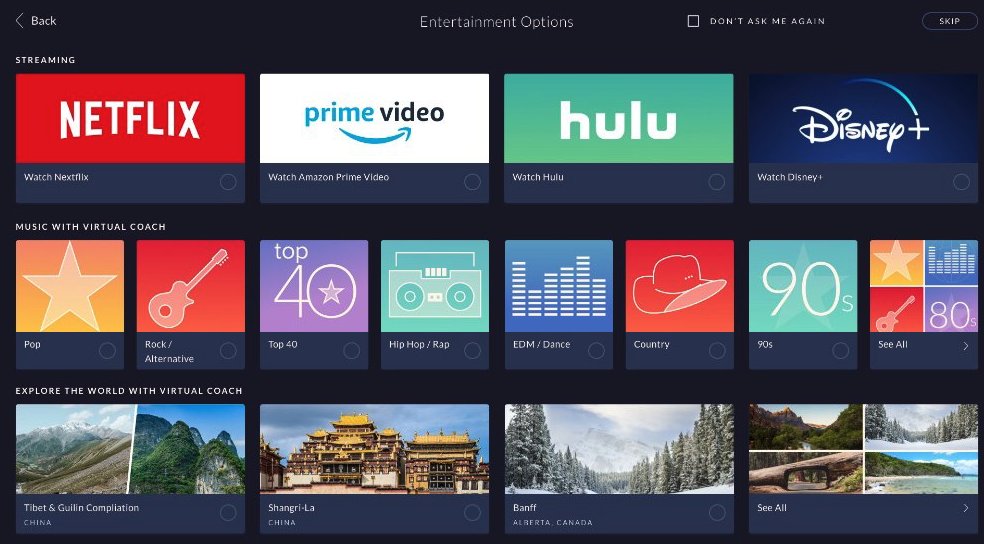

(5/8) JRNY Software

Uses machine learning to deliver personalized experiences for users with subscription ($20/month). E.g. your daily recommended trainer led workouts will gradually increase strain as you get stronger.

Uses machine learning to deliver personalized experiences for users with subscription ($20/month). E.g. your daily recommended trainer led workouts will gradually increase strain as you get stronger.

(6/8) Subscriber Trajectory  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">

4x increase in JRNY subscribers QoQ in Q4 2020.

Forecasts 2m subscribers by 2026. That& #39;s $480m annual, high margin, recurring revenues.

For reference, their market cap today is $490m (0.9x last year& #39;s sales).

4x increase in JRNY subscribers QoQ in Q4 2020.

Forecasts 2m subscribers by 2026. That& #39;s $480m annual, high margin, recurring revenues.

For reference, their market cap today is $490m (0.9x last year& #39;s sales).

(7/8) Expanding Margins

Gross margin 41% (+4.5% YoY)

Net income +730% 2019v2020 (11% net income margin).

Gross margin 41% (+4.5% YoY)

Net income +730% 2019v2020 (11% net income margin).

(8/8) Valuation

Market cap = $490m

2020 revenue = $553m

PE ratio = 9

EV/sales = 0.8x

Despite growing revenues, this is a value play on connected fitness for investors (or $AAPL as they scale Fitness+)

More detailed analysis here: https://fundamentalsfirst.xyz/nautilus-growth-at-1x-sales/">https://fundamentalsfirst.xyz/nautilus-...

Market cap = $490m

2020 revenue = $553m

PE ratio = 9

EV/sales = 0.8x

Despite growing revenues, this is a value play on connected fitness for investors (or $AAPL as they scale Fitness+)

More detailed analysis here: https://fundamentalsfirst.xyz/nautilus-growth-at-1x-sales/">https://fundamentalsfirst.xyz/nautilus-...

CC fellow connected fitness bulls @BobTreemore @PatternProfits @fatbabyfunds @PelotonHolder @profgalloway @QTRResearch @FromValue @Ryan_Burgio @ParrotStock @AndrewRangeley @ocshree @acouplecents @InvestmentTalkk

Read on Twitter

Read on Twitter