1/ A  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">on on-chain AMM pricing for options:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">on on-chain AMM pricing for options:

AMMs are useful for spot swaps, but the deterministic nature of AMM pricing makes it tough to accurately price complex derivatives that rely on exogenous, fast-moving inputs.

AMMs are useful for spot swaps, but the deterministic nature of AMM pricing makes it tough to accurately price complex derivatives that rely on exogenous, fast-moving inputs.

2/ Options pricing takes in multiple inputs: spot price, underlying volatility, strike price, time to expiry & rf interest rate. The Black-Scholes-Merton (BSM) uses a lognormal distribution to model spot price & outputs theoretical options prices.

3/ As virtually all of the above change on a trade by trade basis, a simple bonding curve AMM that only accounts for changes in token reserve (x*y=k) is insufficient for options. We’ll dive into two high level considerations for options AMMs (inputs & pricing models).

4/ INPUTS:

The AMM would require feeds for:

- Spot price oracles (S_t)

- Options price history and spot price history to model historical realised & live implied volatility (σ)

- A time decay parameter so that options naturally tend downwards towards expiry (T)

The AMM would require feeds for:

- Spot price oracles (S_t)

- Options price history and spot price history to model historical realised & live implied volatility (σ)

- A time decay parameter so that options naturally tend downwards towards expiry (T)

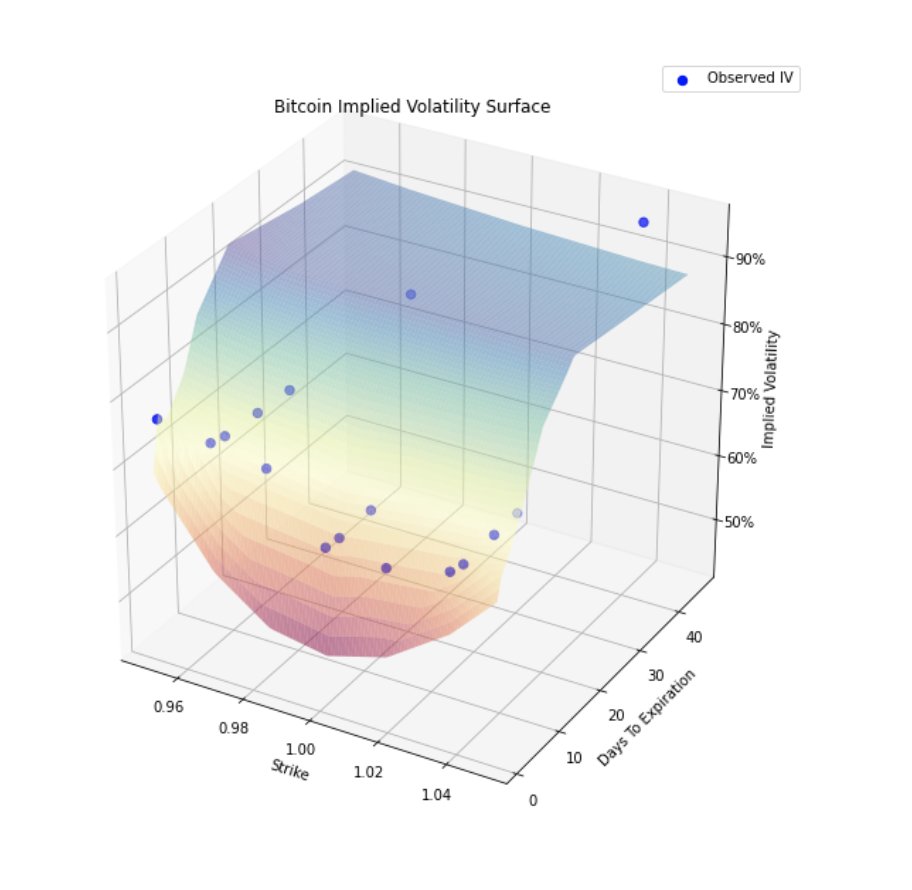

5/ Within this model, the most difficult parameter to estimate is how this volatility factor is sourced. Normally, this is done by building a model of historical IVs and interpolating current IV values based on a *live* vol surface (vol smile & term structure).

6/ Vol surfaces are important to calibrate model values esp. for long-tail assets with non-normal distributions like crypto-assets, but are complex to pull off on-chain, so computations + storage either need to be held off-chain or at least approximated using novel mechanisms.

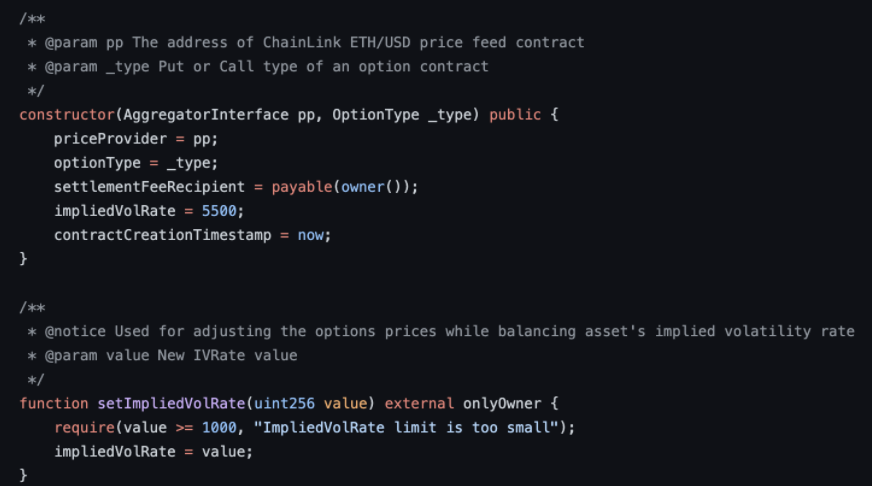

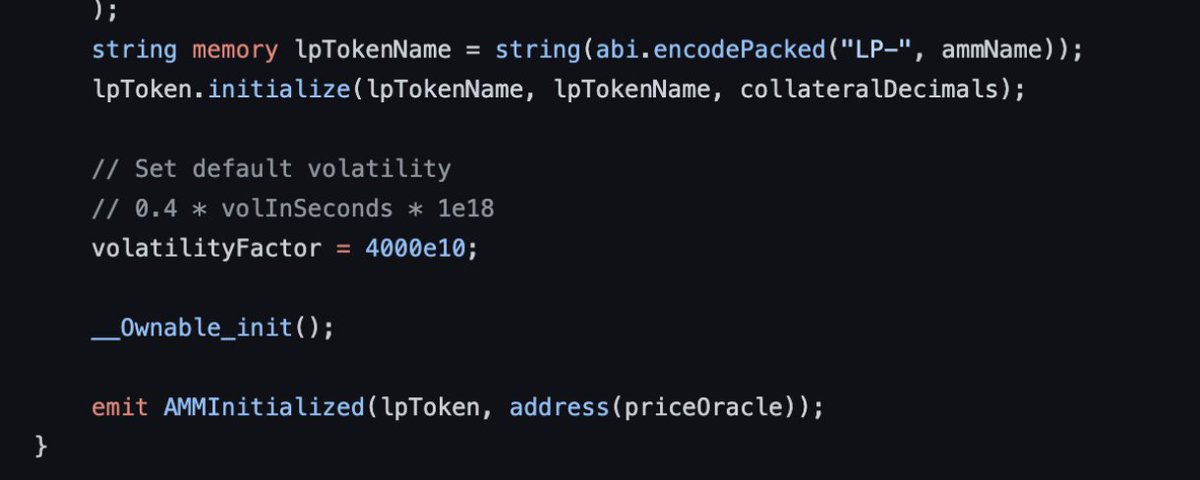

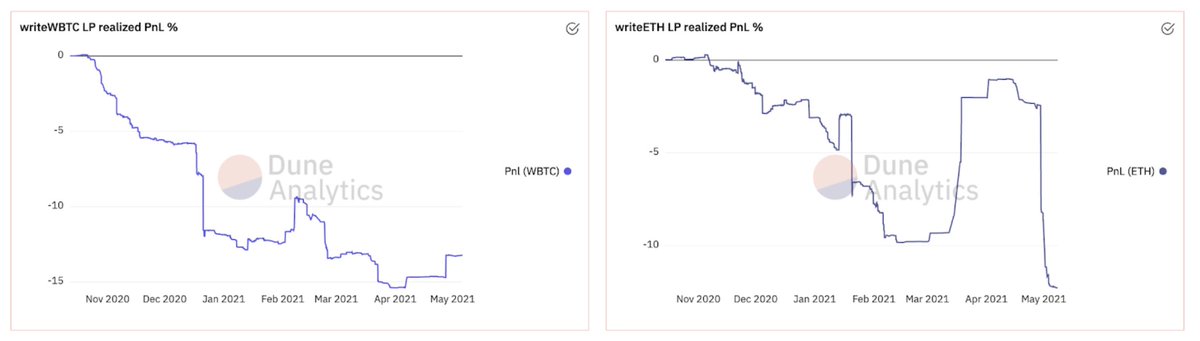

7/ For @HegicOptions v1 and @sirenprotocol v1, this volatility parameter is fixed by the protocol w/ no vol adjustments. It depends entirely on changes in spot pricing. Siren fixes its base IV at 40% which is manually adjusted weekly.

8/ This could be dangerous since these IV values can change dramatically & instantaneously with just a small change in market prices. (Note: Both products will be releasing updates to this input in future releases!)

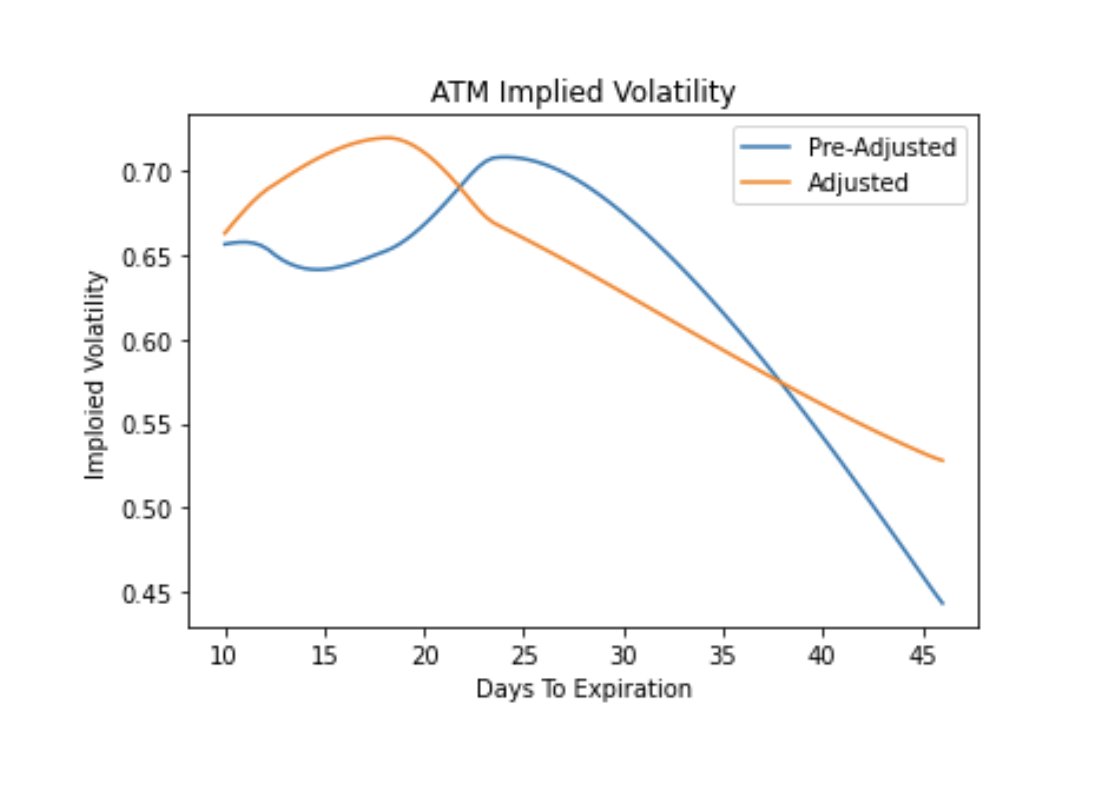

9/ @dopex_io, which recently launched, introduces dynamic adjustments on stale volatility. Dopex adjusts its vol input with a vol smile "oracle", calibrated by trusted delegates (crypto options MM firms) that vote to adjust the steepness of their curve.

10/ PRICING MODELS:

As useful as the BSM is, in order to reflect true market prices, options AMMs need a price discovery mechanism to adjust to market flows, as the BSM (or any fixed pricing formulas) alone doesn& #39;t capture impact of asymmetric edge known by participants.

As useful as the BSM is, in order to reflect true market prices, options AMMs need a price discovery mechanism to adjust to market flows, as the BSM (or any fixed pricing formulas) alone doesn& #39;t capture impact of asymmetric edge known by participants.

11/ Siren and Hegic use the BSM to approximate options pricing + constant product curve to determine slippage (size of the trade vs. current LP pool). The BSM price quoted to buyers is insensitive to liquidity or flows, which can result in pricing arbitrage opps (bad for LPs).

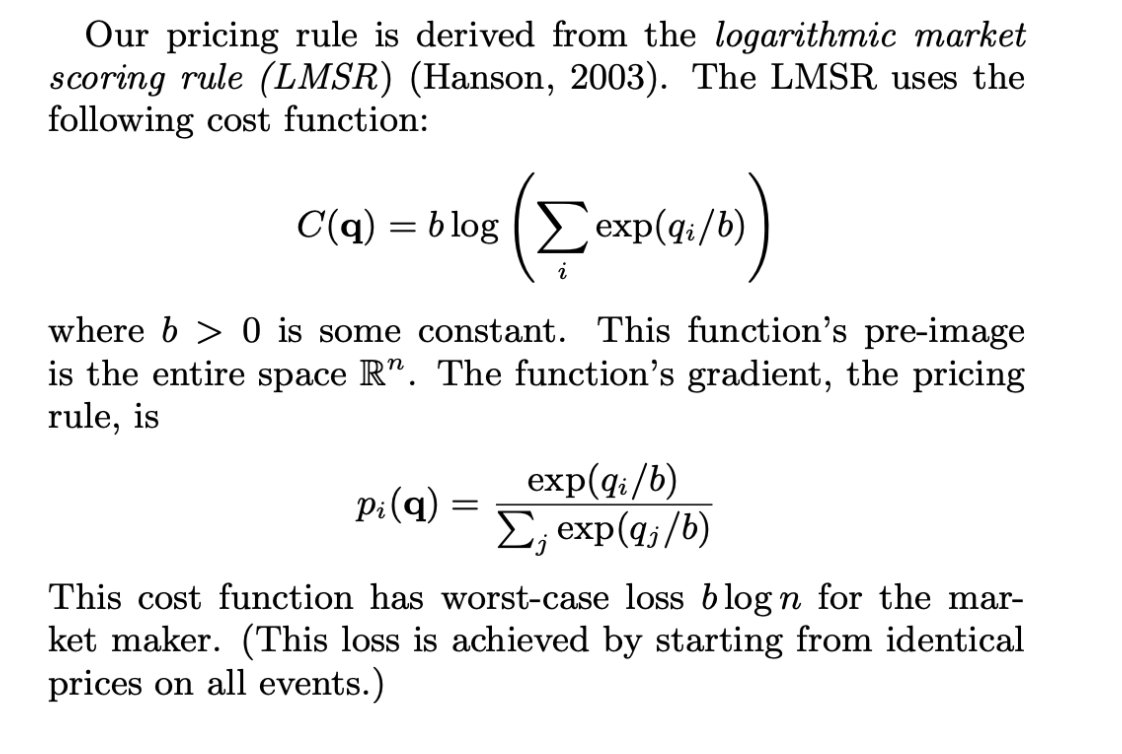

12/ @CharmFinance takes a novel approach that’s often used in prediction markets, called LS-LMSR (logarithmic market scoring rule). It uses a liquidity scoring function, with inputs being the open interest of tokenized options spreads (bull/bear call/put spreads).

13/ This cost function converges to the payoff of the options spreads at expiry & AMM pricing is abstracted away to become a liquidity vehicle. But the quantity of opts bought btwn each spread can differ (if q1 != q2) which could unnaturally skew pool pricing.

14/ @PotionLabs uses a new utilisation-rate based model w Kelly Criterion as a function of LP inventory risk & free collateral. Its LP curve is customisable & optimises for minimising drawdowns. Great for LPs but could output unfavourable prices for takers if util rates are high.

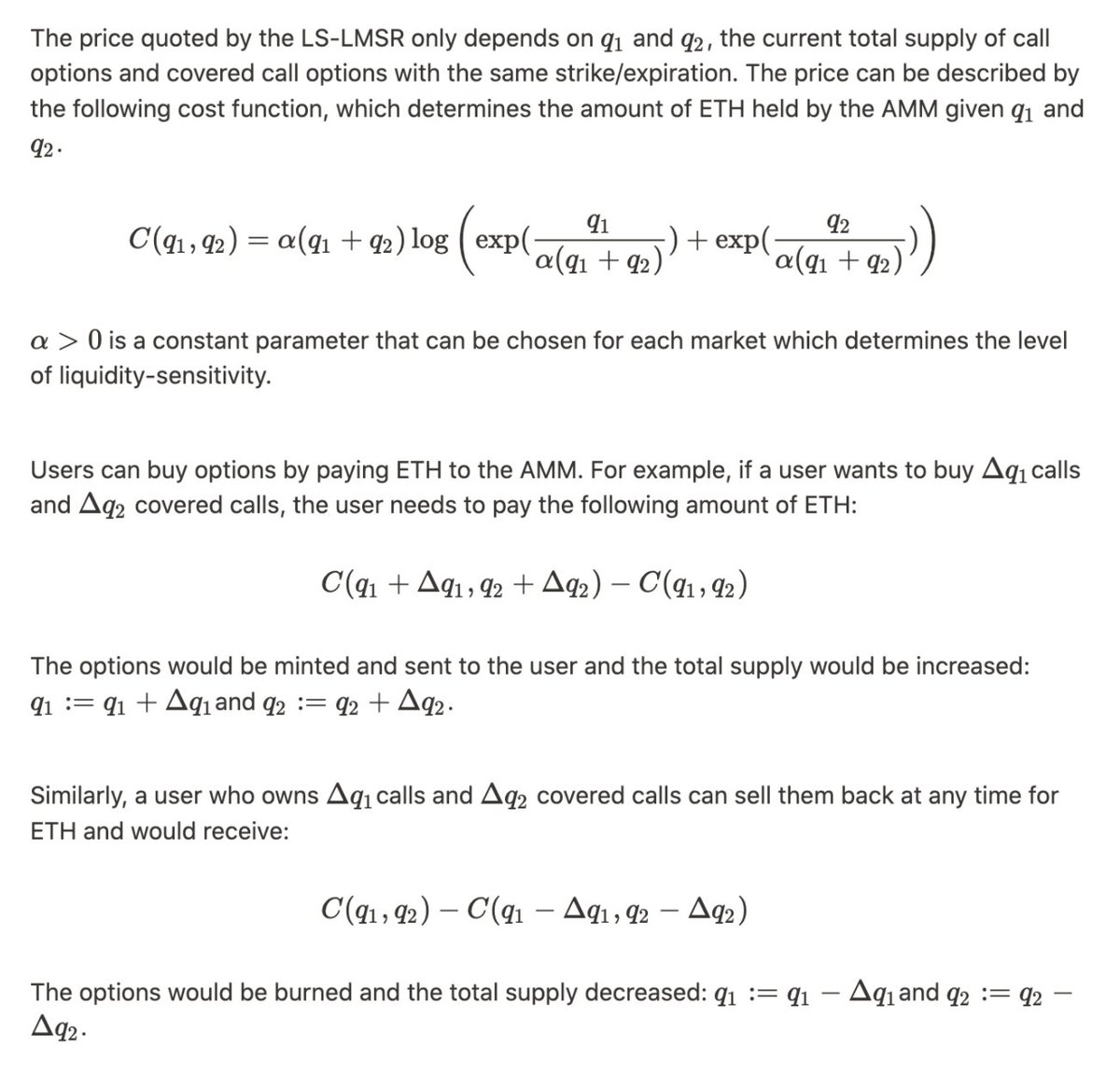

15/ The key problem w/ AMMs that are purely based on any fixed pricing model is that LPs are take-only sellers with no pricing power & will bleed money over time, b/c price discovery is stunted & LPs are constantly arbed against.

16/ We see this problem in Hegic’s LP returns, where LPs generally lose money over time due to poor volatility pricing & insensitivity to flows.

17/ To summarise, here are some Qs when evaluating the robustness of options AMMs:

- Where does the AMM get its volatility input from? How subjective is this?

- Does volatility get calibrated using a computed smile/surface w/ live options prices?

- Where does the AMM get its volatility input from? How subjective is this?

- Does volatility get calibrated using a computed smile/surface w/ live options prices?

18/ - Are vol adjustments self-contained within the platform or do they reference external platforms (Deribit/other options DEXes)?

- How does the AMM account for time decay?

- Is its pricing deterministic based on a BSM AMM/LP portfolios? Is it sensitive to flows?

- How does the AMM account for time decay?

- Is its pricing deterministic based on a BSM AMM/LP portfolios? Is it sensitive to flows?

Read on Twitter

Read on Twitter