Former Commissioner & austerian-in-chief Olli Rehn& #39;s Keynesian turn is remarkable indeed

https://www.ft.com/content/05a12645-ceb2-4cd5-938e-974b778e16e0

I">https://www.ft.com/content/0... think Finland& #39;s (forced) shift from foreign to domestic sources of growth could offer some clues

It also highlights that austerity needs *external enablers*

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> https://twitter.com/paulkrugman/status/1391360507014168577">https://twitter.com/paulkrugm...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> https://twitter.com/paulkrugman/status/1391360507014168577">https://twitter.com/paulkrugm...

https://www.ft.com/content/05a12645-ceb2-4cd5-938e-974b778e16e0

I">https://www.ft.com/content/0... think Finland& #39;s (forced) shift from foreign to domestic sources of growth could offer some clues

It also highlights that austerity needs *external enablers*

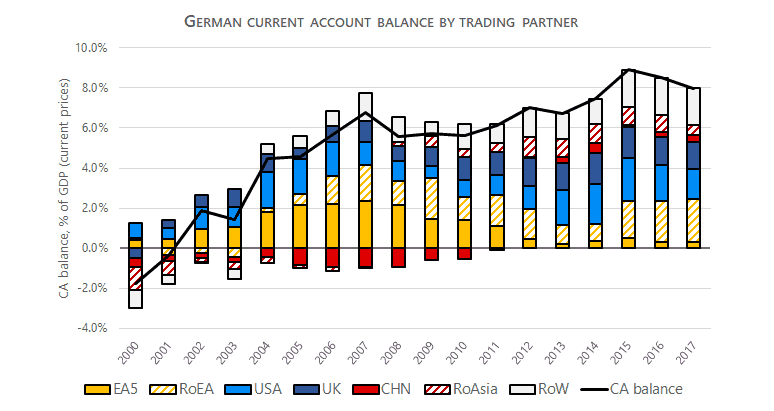

As the euro crisis hit & austerity squeezed demand throughout Europe, the only option to grow AND keep austerity was to rely on partners outside of Europe

This is what Germany did: rely on Chinese & US spending & refuse rebalancing

https://www.socialeurope.eu/german-rebalancing-out-of-exit-options">https://www.socialeurope.eu/german-re...

This is what Germany did: rely on Chinese & US spending & refuse rebalancing

https://www.socialeurope.eu/german-rebalancing-out-of-exit-options">https://www.socialeurope.eu/german-re...

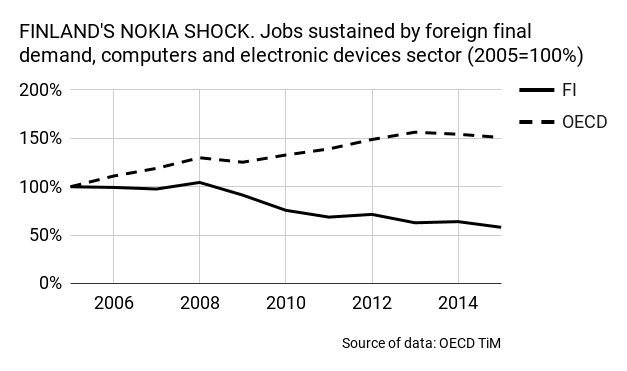

Finland& #39;s misfortune was that

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> their export champion company Nokia died

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> their export champion company Nokia died

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2"> their main partner outside Europe was Russia (slapped by trade sanctions)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2"> their main partner outside Europe was Russia (slapped by trade sanctions)

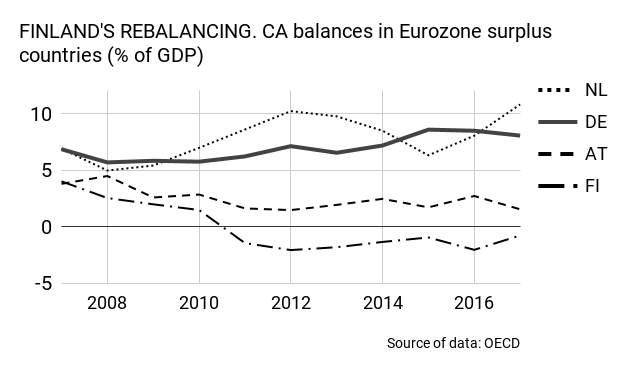

Deprived of enablers, they were forced to rebalance & spend more at home, a highly atypical path in the Eurozone

Deprived of enablers, they were forced to rebalance & spend more at home, a highly atypical path in the Eurozone

A lesson of Finland& #39;s trajectory could be that austerity is not a viable option if there are no trading partners on the other side & #39;enabling& #39; it. (And this may help explain the shift in Finnish macro policy)

See @M_C_Klein & @michaelxpettis for more https://yalebooks.yale.edu/book/9780300244175/trade-wars-are-class-wars">https://yalebooks.yale.edu/book/9780...

See @M_C_Klein & @michaelxpettis for more https://yalebooks.yale.edu/book/9780300244175/trade-wars-are-class-wars">https://yalebooks.yale.edu/book/9780...

The argument is explored in my first thesis paper https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Comments very welcome

https://palmapolyak.weebly.com/research.html ">https://palmapolyak.weebly.com/research....

Comments very welcome

https://palmapolyak.weebly.com/research.html ">https://palmapolyak.weebly.com/research....

... a reminder about Rehn& #39;s formerly austerian views  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://twitter.com/DanielaGabor/status/1125303377104113664">https://twitter.com/DanielaGa...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://twitter.com/DanielaGabor/status/1125303377104113664">https://twitter.com/DanielaGa...

... and more on the politics of rebalancing in the Eurozone by @stefwalter__ @ariray_ & @niredeker  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://global.oup.com/academic/product/the-politics-of-bad-options-9780198857020?cc=ch&lang=en&">https://global.oup.com/academic/...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://global.oup.com/academic/product/the-politics-of-bad-options-9780198857020?cc=ch&lang=en&">https://global.oup.com/academic/...

Read on Twitter

Read on Twitter

their export champion company Nokia died https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2"> their main partner outside Europe was Russia (slapped by trade sanctions)Deprived of enablers, they were forced to rebalance & spend more at home, a highly atypical path in the Eurozone" title="Finland& #39;s misfortune was that https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> their export champion company Nokia died https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2"> their main partner outside Europe was Russia (slapped by trade sanctions)Deprived of enablers, they were forced to rebalance & spend more at home, a highly atypical path in the Eurozone">

their export champion company Nokia died https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2"> their main partner outside Europe was Russia (slapped by trade sanctions)Deprived of enablers, they were forced to rebalance & spend more at home, a highly atypical path in the Eurozone" title="Finland& #39;s misfortune was that https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> their export champion company Nokia died https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2"> their main partner outside Europe was Russia (slapped by trade sanctions)Deprived of enablers, they were forced to rebalance & spend more at home, a highly atypical path in the Eurozone">

their export champion company Nokia died https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2"> their main partner outside Europe was Russia (slapped by trade sanctions)Deprived of enablers, they were forced to rebalance & spend more at home, a highly atypical path in the Eurozone" title="Finland& #39;s misfortune was that https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> their export champion company Nokia died https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2"> their main partner outside Europe was Russia (slapped by trade sanctions)Deprived of enablers, they were forced to rebalance & spend more at home, a highly atypical path in the Eurozone">

their export champion company Nokia died https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2"> their main partner outside Europe was Russia (slapped by trade sanctions)Deprived of enablers, they were forced to rebalance & spend more at home, a highly atypical path in the Eurozone" title="Finland& #39;s misfortune was that https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> their export champion company Nokia died https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2"> their main partner outside Europe was Russia (slapped by trade sanctions)Deprived of enablers, they were forced to rebalance & spend more at home, a highly atypical path in the Eurozone">