$AMRS DD Thread

Lets go!

Lets Define  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

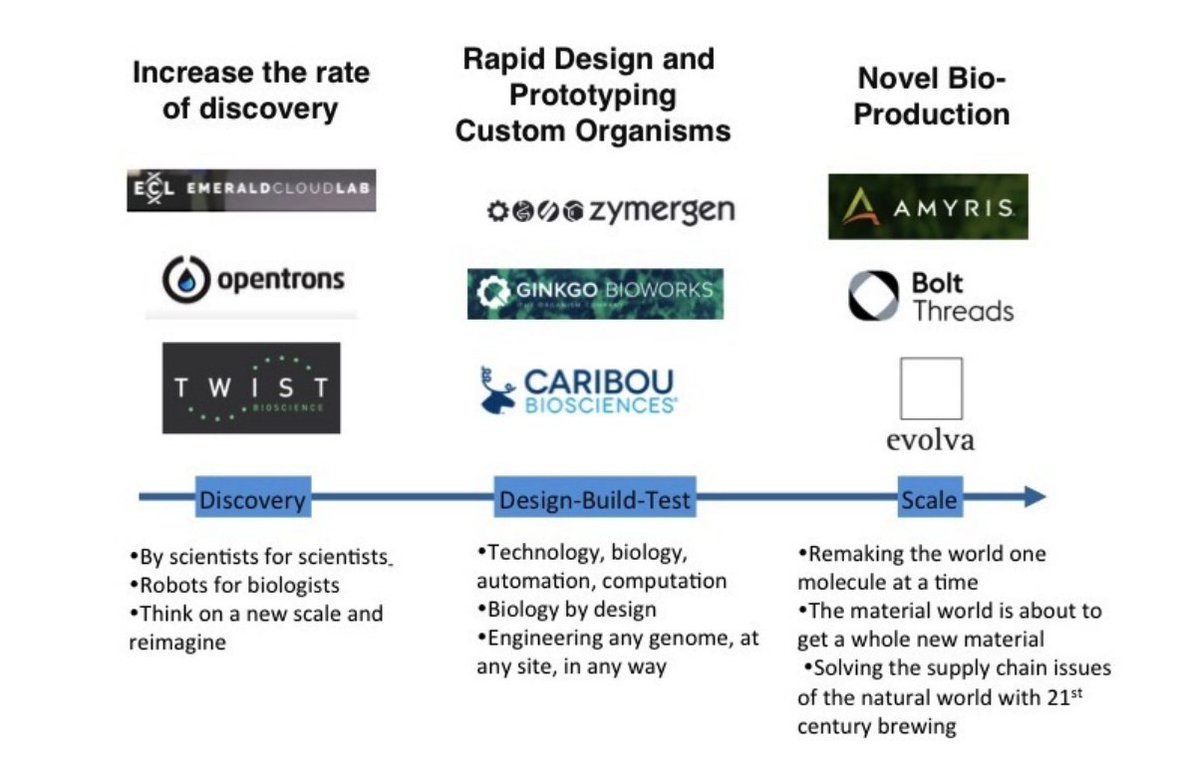

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧪" title="Test tube" aria-label="Emoji: Test tube">Synthetic biology: Engineering organisms to develop new abilities

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧪" title="Test tube" aria-label="Emoji: Test tube">Synthetic biology: Engineering organisms to develop new abilities

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧪" title="Test tube" aria-label="Emoji: Test tube">$AMRS engineers yeast to create a roster of molecules

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧪" title="Test tube" aria-label="Emoji: Test tube">$AMRS engineers yeast to create a roster of molecules

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧪" title="Test tube" aria-label="Emoji: Test tube">Molecules can be used as ingredients for everything from cosmetic products to sweeteners and cannabinoids

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧪" title="Test tube" aria-label="Emoji: Test tube">Molecules can be used as ingredients for everything from cosmetic products to sweeteners and cannabinoids

Following so far? Good https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille">

Following so far? Good

Why is this the next industrial revolution?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Moore’s law type progress: Molecule production now <1 year, compared 5 prev, and getting lower

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Moore’s law type progress: Molecule production now <1 year, compared 5 prev, and getting lower

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Cost: $AMRS& #39; Squalane for eg. is 1/3 traditional cost

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Cost: $AMRS& #39; Squalane for eg. is 1/3 traditional cost

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Global sustainability tailwinds

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Global sustainability tailwinds

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Greater purity control = Synthetic > Sourced

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Greater purity control = Synthetic > Sourced

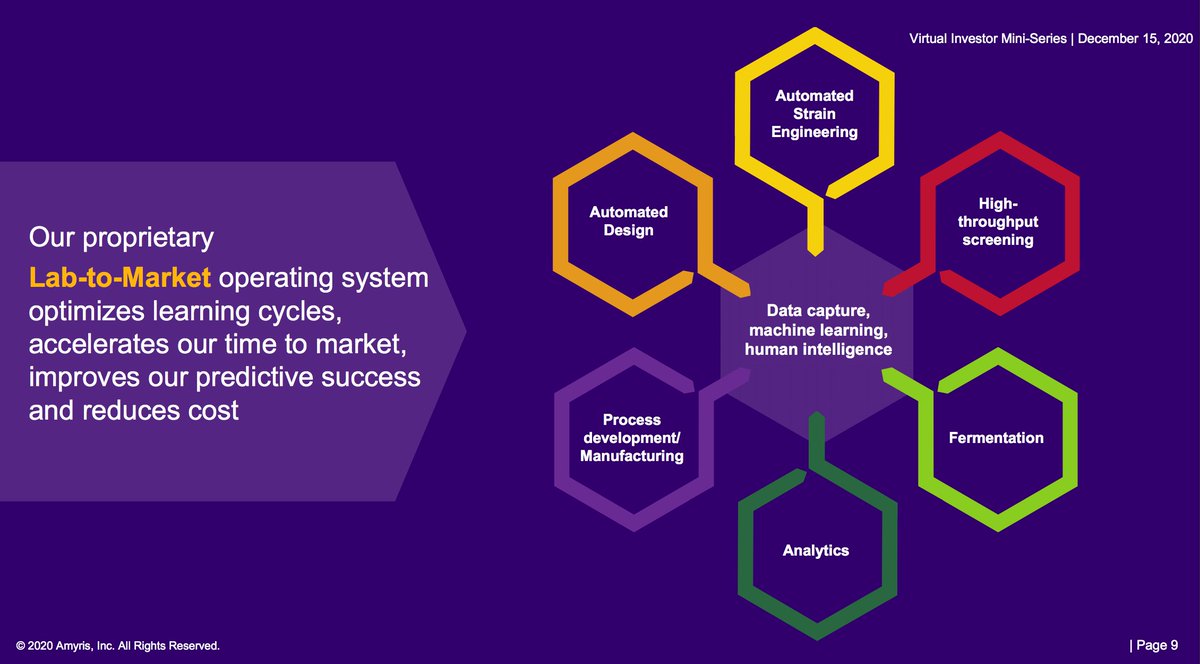

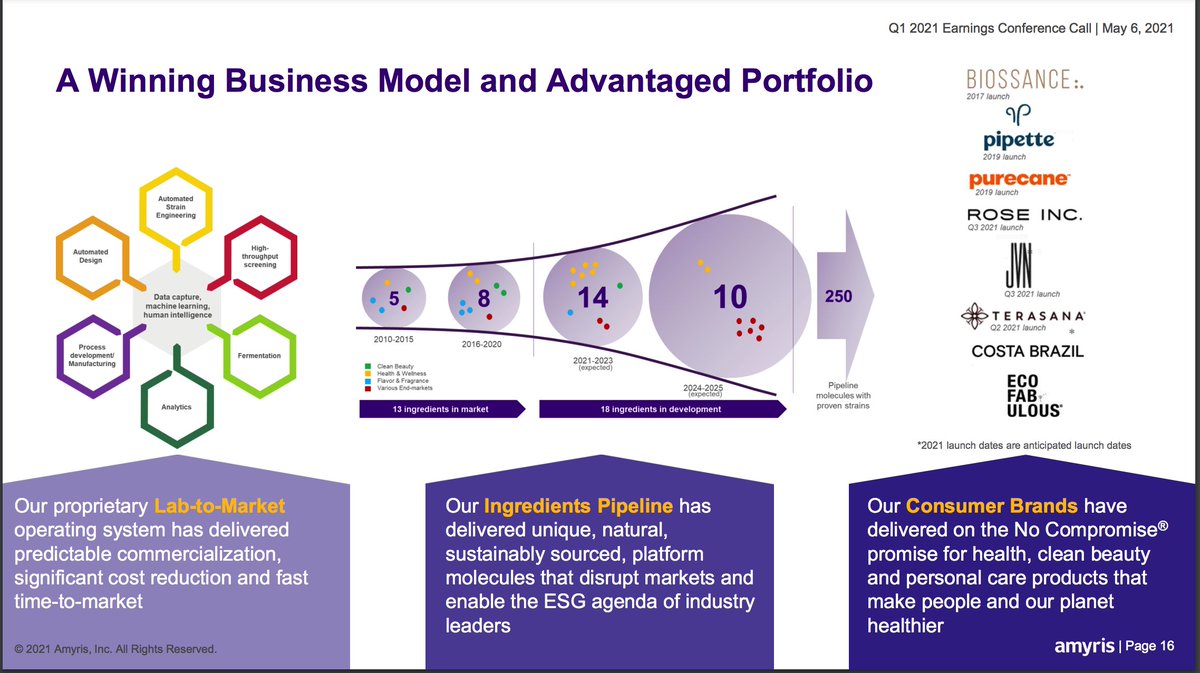

$AMRS has a lab-to-market platform

A challenging business model; but worth it if successful

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warnsignal" aria-label="Emoji: Warnsignal">Challenging: R&D, supply and brand mgmt all at once is difficult in terms of resource allocation and focus

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warnsignal" aria-label="Emoji: Warnsignal">Challenging: R&D, supply and brand mgmt all at once is difficult in terms of resource allocation and focus

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥇" title="Goldmedaille" aria-label="Emoji: Goldmedaille">But if executed well, $AMRS has control over supply and demand. They reap all cost savings and revenue rewards

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥇" title="Goldmedaille" aria-label="Emoji: Goldmedaille">But if executed well, $AMRS has control over supply and demand. They reap all cost savings and revenue rewards

$AMRS is currently valued at $3.1B

If you’ve read this far, know that I will not be able to include every piece of $AMRS insight into this thread

This is a summary of what I think is important

If you think something new needs to be highlighted, comment at the end

Got that, ok now lets move on

$AMRS brands include: Biossance, Pipette, Purecane

Exciting new brands include: Clean Beauty Collaborative with Rosie Huntington-Whiteley; and a new hair brand with Queereye’s Jonathan Van Ness

Amrys is going for the consumer jugular here

Consumer brands is $AMRS hedge on its tech stack

Syn-bio is innovating and right now the competition is in the tech stack

$AMRS is pushing its commercial headstart into consumer ownership

If a competitor develops better tech, Amyris has hedged this by owning downstream demand

Syn-bio is innovating and right now the competition is in the tech stack

$AMRS is pushing its commercial headstart into consumer ownership

If a competitor develops better tech, Amyris has hedged this by owning downstream demand

Interlude: Follow or give a like if you appreciate this DD

@riskrewardcap

What you can expect:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">DD on strong risk-reward opportunities

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">DD on strong risk-reward opportunities

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Applying my experience as a Strategist to analyse growth models

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Applying my experience as a Strategist to analyse growth models

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Updates, stock commentary and changes to thesis

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Updates, stock commentary and changes to thesis

Ok, back to work https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

@riskrewardcap

What you can expect:

Ok, back to work

Q1 financials and guidance

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$176.9M total reported rev (507% YOY)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$176.9M total reported rev (507% YOY)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$33M underlying rev (excl. A one-off payment)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$33M underlying rev (excl. A one-off payment)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">91% GM (underlying GM 52%)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">91% GM (underlying GM 52%)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$103M (Adjusted EBITDA)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$103M (Adjusted EBITDA)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">Debt lowered by $94M YOY

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">Debt lowered by $94M YOY

2021 Guidance

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$400M total revenue

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$400M total revenue

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">Positive full year adjusted EBITDA

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">Positive full year adjusted EBITDA

2021 Guidance

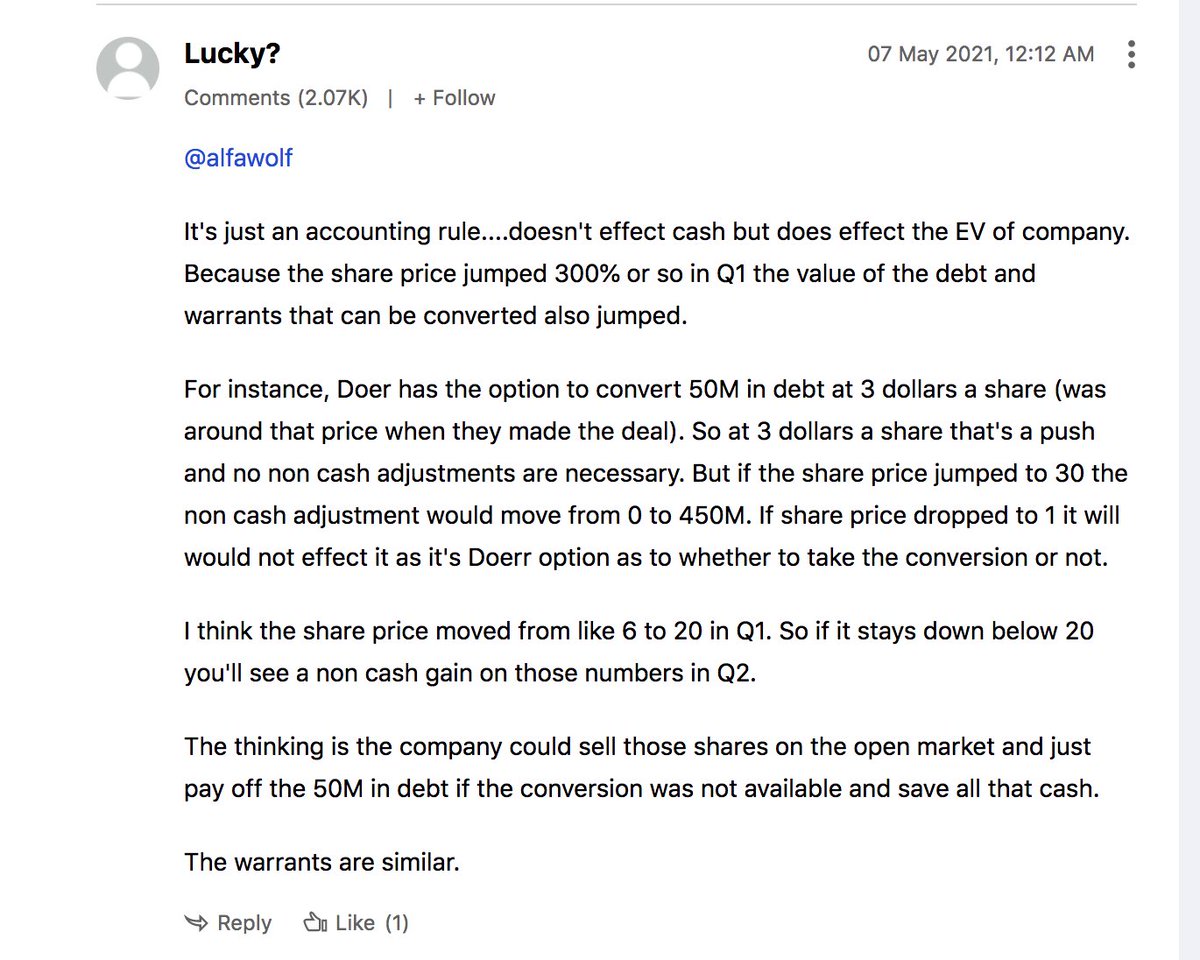

Credit SeekingAlpha

Investing in $AMRS is not without risks

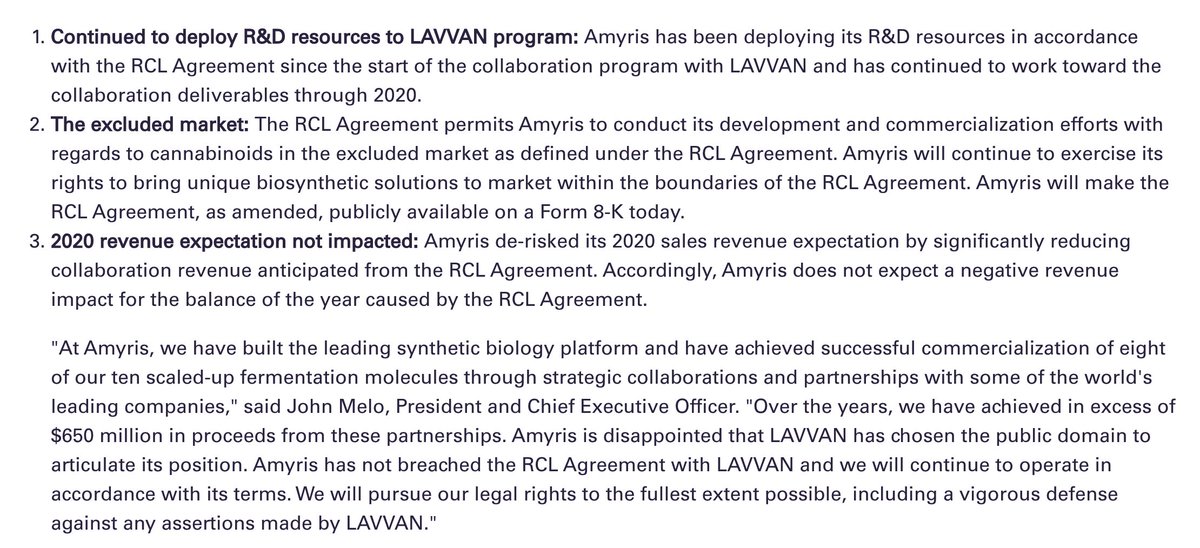

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">Amyris is facing a lawsuit from a partner. See response below

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">Amyris is facing a lawsuit from a partner. See response below

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">A rough history of pivoting through dead-ends ranging from malaria treatments to renewable fuels

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">A rough history of pivoting through dead-ends ranging from malaria treatments to renewable fuels

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">Anecdotally, retail holders have claimed CEO ‘overreaches’ on targets

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">Anecdotally, retail holders have claimed CEO ‘overreaches’ on targets

The bear case for $AMRS

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐻" title="Bärengesicht" aria-label="Emoji: Bärengesicht">Tech stack might not be as good as other competitors

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐻" title="Bärengesicht" aria-label="Emoji: Bärengesicht">Tech stack might not be as good as other competitors

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐻" title="Bärengesicht" aria-label="Emoji: Bärengesicht">Checkered past of difficulty in finding proper commercialisation use cases

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐻" title="Bärengesicht" aria-label="Emoji: Bärengesicht">Checkered past of difficulty in finding proper commercialisation use cases

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐻" title="Bärengesicht" aria-label="Emoji: Bärengesicht">Challenging to break traditional ingredient sourcing industry unless Amyris really has cost, purity, trust advantages

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐻" title="Bärengesicht" aria-label="Emoji: Bärengesicht">Challenging to break traditional ingredient sourcing industry unless Amyris really has cost, purity, trust advantages

The bull case for $AMRS

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">$4T global chemicals TAM

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">$4T global chemicals TAM

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Consumer brand ownership to hedge tech

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Consumer brand ownership to hedge tech

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Cheaper and purer than traditional manufacturing

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Cheaper and purer than traditional manufacturing

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Able to enter a large number of sectors such as pharma and industrial materials

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Able to enter a large number of sectors such as pharma and industrial materials

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Multiple long term revenue streams & good margins

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Multiple long term revenue streams & good margins

$AMRS business model: its greatest risk and strength

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warnsignal" aria-label="Emoji: Warnsignal">Risk: Focus and business prioritisation

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warnsignal" aria-label="Emoji: Warnsignal">Risk: Focus and business prioritisation

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Company needs to perform smart decision-making all the way from R&D to sales and marketing

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Company needs to perform smart decision-making all the way from R&D to sales and marketing

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">However within lies the biggest reward: a true lab-to-consumer play

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">However within lies the biggest reward: a true lab-to-consumer play

$AMRS has a commercialisation headstart against competitors

$ZY ($4b): only 1 product in market; no product sales revenue ( $AMRS 13 ingredients in market)

Ginkgo $SRNG ($20B): great company with disruptive tech and IP business model but no room for error with that valuation

$ZY ($4b): only 1 product in market; no product sales revenue ( $AMRS 13 ingredients in market)

Ginkgo $SRNG ($20B): great company with disruptive tech and IP business model but no room for error with that valuation

If executed well, this small cap will grow exponentially

My personal play

Don’t fight the (bear) trend in growth stocks, I fully expect prices to fall further

I have a starter position; will DCA in planned tranches

If the market cap falls to $2B I am buying with both hands

I am just a voice on Twitter, please do your own DD

Don’t fight the (bear) trend in growth stocks, I fully expect prices to fall further

I have a starter position; will DCA in planned tranches

If the market cap falls to $2B I am buying with both hands

I am just a voice on Twitter, please do your own DD

Conclusion: Why invest in $AMRS

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> $AMRS is a leader in a game-changing sector

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> $AMRS is a leader in a game-changing sector

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Lab-to-Consumer play could be a masterstroke

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Lab-to-Consumer play could be a masterstroke

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">IP + Brands approach can build a long term moat

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">IP + Brands approach can build a long term moat

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">If $AMRS executes successfully, its valuation should match the $4T TAM it aims to conquer

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">If $AMRS executes successfully, its valuation should match the $4T TAM it aims to conquer

Trade safe

Trade safe

Read on Twitter

Read on Twitter The next industrial revolution is already here https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏭" title="Fabrik" aria-label="Emoji: Fabrik"> $AMRS DD Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Synthetic Biology https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌎" title="Amerika auf dem Globus" aria-label="Emoji: Amerika auf dem Globus">$4 Trillion TAMhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">$177M Q1 revenue (500% YOY)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">91% Q1 GM https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤏" title="Kneifende Hand" aria-label="Emoji: Kneifende Hand">$3.1B valuation https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧴" title="Lotion bottle" aria-label="Emoji: Lotion bottle">Unique lab-to-consumer playhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⏳" title="Sanduhr mit fließendem Sand" aria-label="Emoji: Sanduhr mit fließendem Sand">Business model uses IP and brands to generate long term revenue Lets go!" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏭" title="Fabrik" aria-label="Emoji: Fabrik">The next industrial revolution is already here https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏭" title="Fabrik" aria-label="Emoji: Fabrik"> $AMRS DD Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Synthetic Biology https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌎" title="Amerika auf dem Globus" aria-label="Emoji: Amerika auf dem Globus">$4 Trillion TAMhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">$177M Q1 revenue (500% YOY)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">91% Q1 GM https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤏" title="Kneifende Hand" aria-label="Emoji: Kneifende Hand">$3.1B valuation https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧴" title="Lotion bottle" aria-label="Emoji: Lotion bottle">Unique lab-to-consumer playhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⏳" title="Sanduhr mit fließendem Sand" aria-label="Emoji: Sanduhr mit fließendem Sand">Business model uses IP and brands to generate long term revenue Lets go!" class="img-responsive" style="max-width:100%;"/>

The next industrial revolution is already here https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏭" title="Fabrik" aria-label="Emoji: Fabrik"> $AMRS DD Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Synthetic Biology https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌎" title="Amerika auf dem Globus" aria-label="Emoji: Amerika auf dem Globus">$4 Trillion TAMhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">$177M Q1 revenue (500% YOY)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">91% Q1 GM https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤏" title="Kneifende Hand" aria-label="Emoji: Kneifende Hand">$3.1B valuation https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧴" title="Lotion bottle" aria-label="Emoji: Lotion bottle">Unique lab-to-consumer playhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⏳" title="Sanduhr mit fließendem Sand" aria-label="Emoji: Sanduhr mit fließendem Sand">Business model uses IP and brands to generate long term revenue Lets go!" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏭" title="Fabrik" aria-label="Emoji: Fabrik">The next industrial revolution is already here https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏭" title="Fabrik" aria-label="Emoji: Fabrik"> $AMRS DD Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Synthetic Biology https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌎" title="Amerika auf dem Globus" aria-label="Emoji: Amerika auf dem Globus">$4 Trillion TAMhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">$177M Q1 revenue (500% YOY)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">91% Q1 GM https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤏" title="Kneifende Hand" aria-label="Emoji: Kneifende Hand">$3.1B valuation https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧴" title="Lotion bottle" aria-label="Emoji: Lotion bottle">Unique lab-to-consumer playhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⏳" title="Sanduhr mit fließendem Sand" aria-label="Emoji: Sanduhr mit fließendem Sand">Business model uses IP and brands to generate long term revenue Lets go!" class="img-responsive" style="max-width:100%;"/>

What does $AMRS dohttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧫" title="Petri dish" aria-label="Emoji: Petri dish">Amyris is a synthetic biology company that owns consumer brands and supplies sustainable and natural ingredientshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧪" title="Test tube" aria-label="Emoji: Test tube">AMRS has a Lab-to-market platform to engineer, manufacture and market high performance, natural and sustainably sourced products." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">What does $AMRS dohttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧫" title="Petri dish" aria-label="Emoji: Petri dish">Amyris is a synthetic biology company that owns consumer brands and supplies sustainable and natural ingredientshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧪" title="Test tube" aria-label="Emoji: Test tube">AMRS has a Lab-to-market platform to engineer, manufacture and market high performance, natural and sustainably sourced products." class="img-responsive" style="max-width:100%;"/>

What does $AMRS dohttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧫" title="Petri dish" aria-label="Emoji: Petri dish">Amyris is a synthetic biology company that owns consumer brands and supplies sustainable and natural ingredientshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧪" title="Test tube" aria-label="Emoji: Test tube">AMRS has a Lab-to-market platform to engineer, manufacture and market high performance, natural and sustainably sourced products." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">What does $AMRS dohttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧫" title="Petri dish" aria-label="Emoji: Petri dish">Amyris is a synthetic biology company that owns consumer brands and supplies sustainable and natural ingredientshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧪" title="Test tube" aria-label="Emoji: Test tube">AMRS has a Lab-to-market platform to engineer, manufacture and market high performance, natural and sustainably sourced products." class="img-responsive" style="max-width:100%;"/>

Moore’s law type progress: Molecule production now <1 year, compared 5 prev, and getting lowerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Cost: $AMRS& #39; Squalane for eg. is 1/3 traditional cost https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Global sustainability tailwindshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Greater purity control = Synthetic > Sourced" title="Why is this the next industrial revolution? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Moore’s law type progress: Molecule production now <1 year, compared 5 prev, and getting lowerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Cost: $AMRS& #39; Squalane for eg. is 1/3 traditional cost https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Global sustainability tailwindshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Greater purity control = Synthetic > Sourced" class="img-responsive" style="max-width:100%;"/>

Moore’s law type progress: Molecule production now <1 year, compared 5 prev, and getting lowerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Cost: $AMRS& #39; Squalane for eg. is 1/3 traditional cost https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Global sustainability tailwindshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Greater purity control = Synthetic > Sourced" title="Why is this the next industrial revolution? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Moore’s law type progress: Molecule production now <1 year, compared 5 prev, and getting lowerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Cost: $AMRS& #39; Squalane for eg. is 1/3 traditional cost https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Global sustainability tailwindshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Grüner Kreis" aria-label="Emoji: Grüner Kreis">Greater purity control = Synthetic > Sourced" class="img-responsive" style="max-width:100%;"/>

The $AMRS business modelhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💼" title="Aktenkoffer" aria-label="Emoji: Aktenkoffer"> $AMRS has a lab-to-market platformhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">Engineer microbes to ‘create’ molecules that can be used as ingredientshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">These ingredients are manufactured at industrial scalehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">$AMRS sells these ingredients through partnerships and consumer brands" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="💼" title="Aktenkoffer" aria-label="Emoji: Aktenkoffer">The $AMRS business modelhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💼" title="Aktenkoffer" aria-label="Emoji: Aktenkoffer"> $AMRS has a lab-to-market platformhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">Engineer microbes to ‘create’ molecules that can be used as ingredientshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">These ingredients are manufactured at industrial scalehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">$AMRS sells these ingredients through partnerships and consumer brands" class="img-responsive" style="max-width:100%;"/>

The $AMRS business modelhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💼" title="Aktenkoffer" aria-label="Emoji: Aktenkoffer"> $AMRS has a lab-to-market platformhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">Engineer microbes to ‘create’ molecules that can be used as ingredientshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">These ingredients are manufactured at industrial scalehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">$AMRS sells these ingredients through partnerships and consumer brands" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="💼" title="Aktenkoffer" aria-label="Emoji: Aktenkoffer">The $AMRS business modelhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💼" title="Aktenkoffer" aria-label="Emoji: Aktenkoffer"> $AMRS has a lab-to-market platformhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">Engineer microbes to ‘create’ molecules that can be used as ingredientshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">These ingredients are manufactured at industrial scalehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">$AMRS sells these ingredients through partnerships and consumer brands" class="img-responsive" style="max-width:100%;"/>

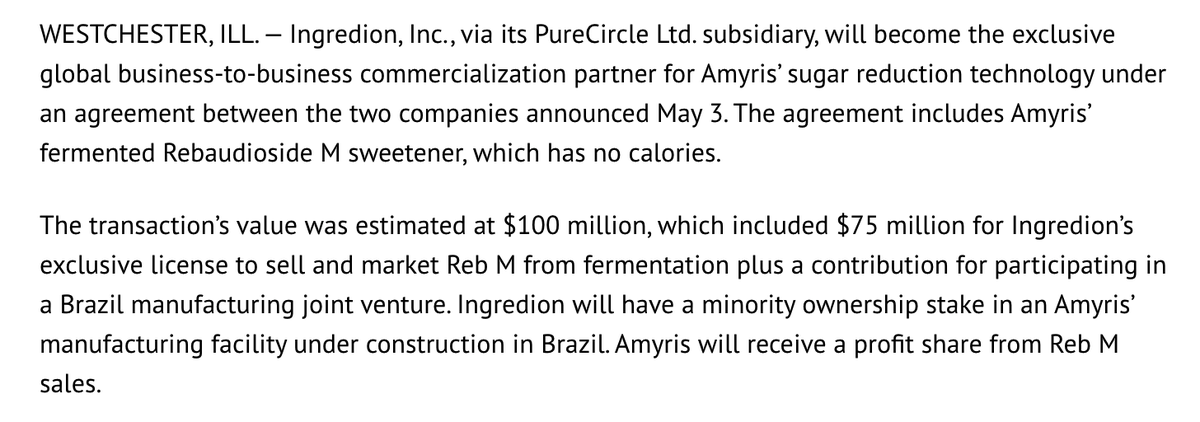

$AMRS has 2 revenue modelshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">Enter a supply partnership w/ MNCs (Ingredion), $AMRS receives licensing fees & profit share on sales. See belowhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">$AMRS also develops their own consumer brands like Biossance. They market and sell products directly to retailers and consumers" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$AMRS has 2 revenue modelshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">Enter a supply partnership w/ MNCs (Ingredion), $AMRS receives licensing fees & profit share on sales. See belowhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">$AMRS also develops their own consumer brands like Biossance. They market and sell products directly to retailers and consumers" class="img-responsive" style="max-width:100%;"/>

$AMRS has 2 revenue modelshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">Enter a supply partnership w/ MNCs (Ingredion), $AMRS receives licensing fees & profit share on sales. See belowhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">$AMRS also develops their own consumer brands like Biossance. They market and sell products directly to retailers and consumers" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$AMRS has 2 revenue modelshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">Enter a supply partnership w/ MNCs (Ingredion), $AMRS receives licensing fees & profit share on sales. See belowhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">$AMRS also develops their own consumer brands like Biossance. They market and sell products directly to retailers and consumers" class="img-responsive" style="max-width:100%;"/>

$AMRS has a massive TAMhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌎" title="Amerika auf dem Globus" aria-label="Emoji: Amerika auf dem Globus">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">Melo (CEO) stated that 1/3 of us already consume a product with an $AMRS moleculehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">Already serves a $257B TAM (Beauty, Flavors, Fragrance, Sweeteners)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">Could unlock a greater TAM for global chemicals of $4T $AMRS is currently valued at $3.1B" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌎" title="Amerika auf dem Globus" aria-label="Emoji: Amerika auf dem Globus"> $AMRS has a massive TAMhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌎" title="Amerika auf dem Globus" aria-label="Emoji: Amerika auf dem Globus">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">Melo (CEO) stated that 1/3 of us already consume a product with an $AMRS moleculehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">Already serves a $257B TAM (Beauty, Flavors, Fragrance, Sweeteners)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">Could unlock a greater TAM for global chemicals of $4T $AMRS is currently valued at $3.1B" class="img-responsive" style="max-width:100%;"/>

$AMRS has a massive TAMhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌎" title="Amerika auf dem Globus" aria-label="Emoji: Amerika auf dem Globus">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">Melo (CEO) stated that 1/3 of us already consume a product with an $AMRS moleculehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">Already serves a $257B TAM (Beauty, Flavors, Fragrance, Sweeteners)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">Could unlock a greater TAM for global chemicals of $4T $AMRS is currently valued at $3.1B" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌎" title="Amerika auf dem Globus" aria-label="Emoji: Amerika auf dem Globus"> $AMRS has a massive TAMhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌎" title="Amerika auf dem Globus" aria-label="Emoji: Amerika auf dem Globus">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">Melo (CEO) stated that 1/3 of us already consume a product with an $AMRS moleculehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">Already serves a $257B TAM (Beauty, Flavors, Fragrance, Sweeteners)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">Could unlock a greater TAM for global chemicals of $4T $AMRS is currently valued at $3.1B" class="img-responsive" style="max-width:100%;"/>

Brands live longer than IPhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌲" title="Immergrüner Baum" aria-label="Emoji: Immergrüner Baum">https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck">$AMRS believes the consumer business is more rewarding than their licensing sidehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck">The numbers dont lie (excl. One-offs, Consumer & Ingredients rev accounted for 85% of underlying revenue in Q1)https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck">$AMRS can truly go to a Lab to Consumer model" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌲" title="Immergrüner Baum" aria-label="Emoji: Immergrüner Baum">Brands live longer than IPhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌲" title="Immergrüner Baum" aria-label="Emoji: Immergrüner Baum">https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck">$AMRS believes the consumer business is more rewarding than their licensing sidehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck">The numbers dont lie (excl. One-offs, Consumer & Ingredients rev accounted for 85% of underlying revenue in Q1)https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck">$AMRS can truly go to a Lab to Consumer model" class="img-responsive" style="max-width:100%;"/>

Brands live longer than IPhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌲" title="Immergrüner Baum" aria-label="Emoji: Immergrüner Baum">https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck">$AMRS believes the consumer business is more rewarding than their licensing sidehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck">The numbers dont lie (excl. One-offs, Consumer & Ingredients rev accounted for 85% of underlying revenue in Q1)https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck">$AMRS can truly go to a Lab to Consumer model" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌲" title="Immergrüner Baum" aria-label="Emoji: Immergrüner Baum">Brands live longer than IPhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌲" title="Immergrüner Baum" aria-label="Emoji: Immergrüner Baum">https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck">$AMRS believes the consumer business is more rewarding than their licensing sidehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck">The numbers dont lie (excl. One-offs, Consumer & Ingredients rev accounted for 85% of underlying revenue in Q1)https://abs.twimg.com/emoji/v2/... draggable="false" alt="▶️" title="Nach rechts zeigendes Dreieck" aria-label="Emoji: Nach rechts zeigendes Dreieck">$AMRS can truly go to a Lab to Consumer model" class="img-responsive" style="max-width:100%;"/>

Consumer brands are high profilehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein"> $AMRS brands include: Biossance, Pipette, PurecaneExciting new brands include: Clean Beauty Collaborative with Rosie Huntington-Whiteley; and a new hair brand with Queereye’s Jonathan Van NessAmrys is going for the consumer jugular here" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">Consumer brands are high profilehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein"> $AMRS brands include: Biossance, Pipette, PurecaneExciting new brands include: Clean Beauty Collaborative with Rosie Huntington-Whiteley; and a new hair brand with Queereye’s Jonathan Van NessAmrys is going for the consumer jugular here" class="img-responsive" style="max-width:100%;"/>

Consumer brands are high profilehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein"> $AMRS brands include: Biossance, Pipette, PurecaneExciting new brands include: Clean Beauty Collaborative with Rosie Huntington-Whiteley; and a new hair brand with Queereye’s Jonathan Van NessAmrys is going for the consumer jugular here" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">Consumer brands are high profilehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein"> $AMRS brands include: Biossance, Pipette, PurecaneExciting new brands include: Clean Beauty Collaborative with Rosie Huntington-Whiteley; and a new hair brand with Queereye’s Jonathan Van NessAmrys is going for the consumer jugular here" class="img-responsive" style="max-width:100%;"/>

$176.9M total reported rev (507% YOY)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$33M underlying rev (excl. A one-off payment)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">91% GM (underlying GM 52%)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$103M (Adjusted EBITDA)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">Debt lowered by $94M YOY2021 Guidancehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$400M total revenuehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">Positive full year adjusted EBITDA" title="Q1 financials and guidancehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$176.9M total reported rev (507% YOY)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$33M underlying rev (excl. A one-off payment)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">91% GM (underlying GM 52%)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$103M (Adjusted EBITDA)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">Debt lowered by $94M YOY2021 Guidancehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$400M total revenuehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">Positive full year adjusted EBITDA" class="img-responsive" style="max-width:100%;"/>

$176.9M total reported rev (507% YOY)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$33M underlying rev (excl. A one-off payment)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">91% GM (underlying GM 52%)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$103M (Adjusted EBITDA)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">Debt lowered by $94M YOY2021 Guidancehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$400M total revenuehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">Positive full year adjusted EBITDA" title="Q1 financials and guidancehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$176.9M total reported rev (507% YOY)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$33M underlying rev (excl. A one-off payment)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">91% GM (underlying GM 52%)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$103M (Adjusted EBITDA)https://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">Debt lowered by $94M YOY2021 Guidancehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">$400M total revenuehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💵" title="Banknote mit Dollar-Zeichen" aria-label="Emoji: Banknote mit Dollar-Zeichen">Positive full year adjusted EBITDA" class="img-responsive" style="max-width:100%;"/>

But the stock plunged after earningshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔻" title="Nach unten zeigendes rotes Dreieck" aria-label="Emoji: Nach unten zeigendes rotes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">GAAP net earnings affected by -$377 million of unfavourable non-cash mark-to-market adjustments related to changes in the fair value of debt and derivativeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">A better way of explaining this is in the image belowCredit SeekingAlpha" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔻" title="Nach unten zeigendes rotes Dreieck" aria-label="Emoji: Nach unten zeigendes rotes Dreieck">But the stock plunged after earningshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔻" title="Nach unten zeigendes rotes Dreieck" aria-label="Emoji: Nach unten zeigendes rotes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">GAAP net earnings affected by -$377 million of unfavourable non-cash mark-to-market adjustments related to changes in the fair value of debt and derivativeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">A better way of explaining this is in the image belowCredit SeekingAlpha" class="img-responsive" style="max-width:100%;"/>

But the stock plunged after earningshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔻" title="Nach unten zeigendes rotes Dreieck" aria-label="Emoji: Nach unten zeigendes rotes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">GAAP net earnings affected by -$377 million of unfavourable non-cash mark-to-market adjustments related to changes in the fair value of debt and derivativeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">A better way of explaining this is in the image belowCredit SeekingAlpha" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔻" title="Nach unten zeigendes rotes Dreieck" aria-label="Emoji: Nach unten zeigendes rotes Dreieck">But the stock plunged after earningshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔻" title="Nach unten zeigendes rotes Dreieck" aria-label="Emoji: Nach unten zeigendes rotes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">GAAP net earnings affected by -$377 million of unfavourable non-cash mark-to-market adjustments related to changes in the fair value of debt and derivativeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">A better way of explaining this is in the image belowCredit SeekingAlpha" class="img-responsive" style="max-width:100%;"/>

Amyris is facing a lawsuit from a partner. See response belowhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">A rough history of pivoting through dead-ends ranging from malaria treatments to renewable fuelshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">Anecdotally, retail holders have claimed CEO ‘overreaches’ on targets" title="Investing in $AMRS is not without riskshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">Amyris is facing a lawsuit from a partner. See response belowhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">A rough history of pivoting through dead-ends ranging from malaria treatments to renewable fuelshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">Anecdotally, retail holders have claimed CEO ‘overreaches’ on targets" class="img-responsive" style="max-width:100%;"/>

Amyris is facing a lawsuit from a partner. See response belowhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">A rough history of pivoting through dead-ends ranging from malaria treatments to renewable fuelshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">Anecdotally, retail holders have claimed CEO ‘overreaches’ on targets" title="Investing in $AMRS is not without riskshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">Amyris is facing a lawsuit from a partner. See response belowhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">A rough history of pivoting through dead-ends ranging from malaria treatments to renewable fuelshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟡" title="Gelber Kreis" aria-label="Emoji: Gelber Kreis">Anecdotally, retail holders have claimed CEO ‘overreaches’ on targets" class="img-responsive" style="max-width:100%;"/>

Risk: Focus and business prioritisationhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Company needs to perform smart decision-making all the way from R&D to sales and marketinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">However within lies the biggest reward: a true lab-to-consumer play" title=" $AMRS business model: its greatest risk and strengthhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warnsignal" aria-label="Emoji: Warnsignal">Risk: Focus and business prioritisationhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Company needs to perform smart decision-making all the way from R&D to sales and marketinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">However within lies the biggest reward: a true lab-to-consumer play" class="img-responsive" style="max-width:100%;"/>

Risk: Focus and business prioritisationhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Company needs to perform smart decision-making all the way from R&D to sales and marketinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">However within lies the biggest reward: a true lab-to-consumer play" title=" $AMRS business model: its greatest risk and strengthhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warnsignal" aria-label="Emoji: Warnsignal">Risk: Focus and business prioritisationhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Company needs to perform smart decision-making all the way from R&D to sales and marketinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">However within lies the biggest reward: a true lab-to-consumer play" class="img-responsive" style="max-width:100%;"/>