Thread: I don& #39;t think I& #39;ve been at all coy when it comes explaining why I doubt that Bitcoin will ever become a generally-accepted and widely-used medium for everyday payments, that is, "money." Misunderstood; but not coy.

Still, for @allenf32& #39;s sake I will sum-up my view here.

Still, for @allenf32& #39;s sake I will sum-up my view here.

But first I note that those reasons are irrelevant to the point I made in a tweet to which Allen responds. There I answered someone who, having found an instance of my claiming that BTC was unlikely to become money, or "currency," offered it as proof that I was "bearish" on BTC.

But to be "bearish" is to believe, not that an asset isn& #39;t about to become money (very few assets ever will), but that it& #39;s value will decline. And I have never taken any stand on the future course of BTC& #39;s price. BTC can continue to appreciate without becoming money.

It can also become money without continuing to appreciate. (I leave the other two possibilities as an exercise for readers.) The point is that, as a matter of simple logic, I don& #39;t contradict myself if I doubt that BTC will become money and yet deny being a Bitcoin bear.

Now, as for why I doubt that Bitcoin will become money, here we enter realm of speculation. I don& #39;t claim that it _can& #39;t_ become money. I only consider it highly unlikely.

If anyone is pretending to have a crystal ball, it& #39;s Bitcoin fans who insist (as many do) that it is _bound_ to eventually take the place of presently-established monies, even including (according to some) the dollar...

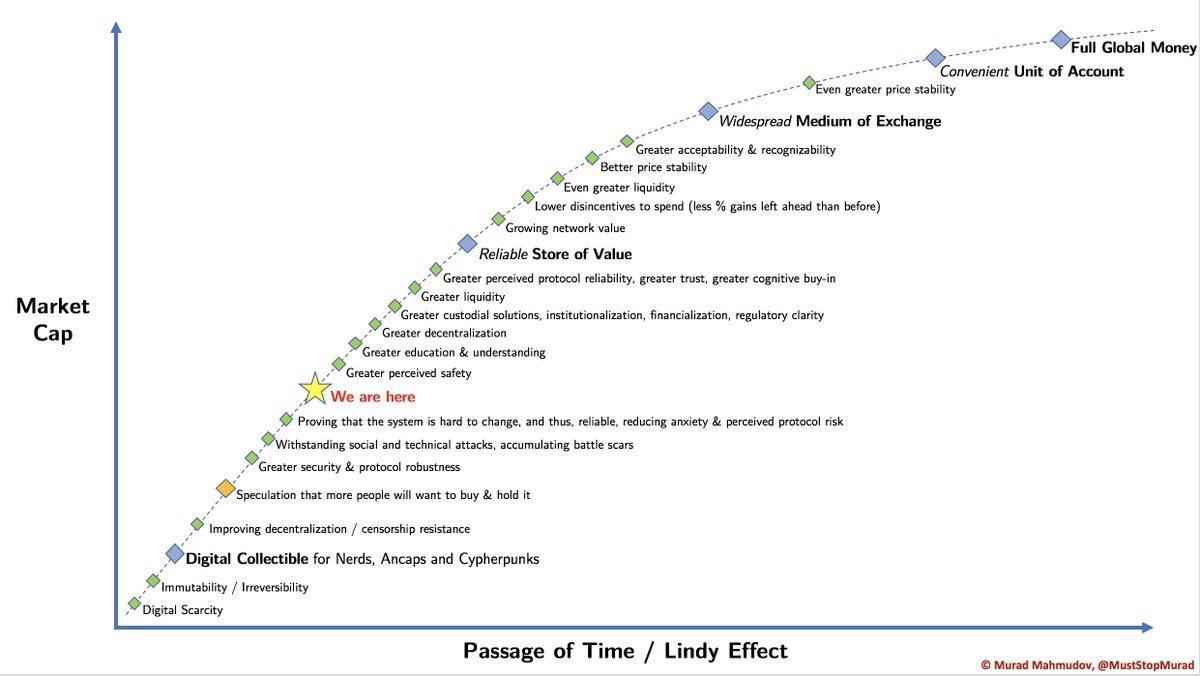

...while pretending that their mere conjectures are grounded in logic, using pseudoscientific arguments, and graphics like this one, purporting to show how the future "should" unfold:

These demonstrations all vaguely hearken back to Karl Menger& #39;s famous theory of the evolution of money---a theory that, it bears noting, is itself highly speculative; the actual story of past monies& #39; evolution is far more complicated, as Menger himself understood very well.

Still, Menger& #39;s is a very compelling demonstration. I say this as someone who has studied it and analyzed it in some detail ( http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.693.340&rep=rep1&type=pdf).">https://citeseerx.ist.psu.edu/viewdoc/d... But accepting its logic, that theory does _not_ imply what the Bitcoin-is-bound-to-become-money crowd think it implies.

On the contrary: it implies just the opposite. And that is the main reason why I am a Bitcoin-will-become-money skeptic.

You see, Menger& #39;s theory assumes an initial state in which _there is as yet no monetary medium_. Instead, barter prevails. Menger shows how a spontaneous process can result in one of many potential candidate commodities emerging as money.

Menger& #39;s theory is based on the fact that exchange media are what economists today call "network" goods: the greater the number of persons joining any given medium of exchange network, the more attractive membership in that network seems to others, ceteris paribus.

So, starting fro a state of barter, independent experiments in indirect exchange can result in certain goods acquiring small networks of users. These are then more likely to expand than others that fail to take off.

The outcome of the ensuing monetary horse race may for some have an uncertain outcome. (See my paper paper with @petergklein linked above for a demonstration.) But eventually one horse wins, its network becoming so large that everyone decides to join it.

So, Menger& #39;s theory shows how money can evolve spontaneously. But the very same Mengerian logic that makes this outcome possible also explains why, _once some money is firmly established in any economic community, it is exceedingly difficult for another to dislodge it_.

There are exceptions, of course. One obvious case is when two formerly independent economies, each having evolved a different money, merge. In that case, another horse race occurs between their two moneys. Generally that of the larger of the two economies will win.

But generally the larger an established money network is, the less vulnerable it is to any challenge. And that& #39;s true even if government& #39;s don& #39;t put their thumbs on the scale so as to further favor an incumbent money.

The dollar today is, by far, the most well-established of all monies. It& #39;s network covers not just the U.S. but much of the the planet. It& #39;s therefore extremely unlikely that it will be displaced, in int& #39;l trade or otherwise, by BTC, the Chinese Yuan, Diem, or anything else.

Contrary to what many Bitcoiners claim, the fact that the dollar and other fiat currencies steadily lose value is itself not at all sufficient to offset their established network advantage. As countless episodes of hyperinflation demonstrate, it takes very rapid depreciation...

...to get people to give-up on a formally-well entrenched currency and start using something else for ordinary exchanges.

And suppose they do finally switch. What are they likely to switch to? The answer is, an alternative that also has a big network. For the people of all countries save the U.S., that alternative isn& #39;t BTC: it& #39;s the USD.

Thus in Venezuela today, although there is indeed a fair amount of BTC exchange going on, the USD is by far the preferred backup medium of ordinary exchange, even despite laws against its use and the relatively high cost of procuring paper dollars.

(By now someone has probably tweeted that BTC& #39;s market cap makes it& #39;s "network" bigger than that of any national currencies. Wrong: market cap isn& #39;t a measure of network size. See the beginning of this thread.)

So it& #39;s not even all that likely that BTC will replace a basket-case currency like the Venezuelan bolivar in routine exchanges there. It has to get in line behind the USD. That said, I am far less inclined to rule out widespread use of BTC in such a case than I am in general.

None of this is to deny an important niche role for BTC, not only in basket-case situations, but wherever people place a high premium on pseudonimous exchange, as well as in specific sorts of payments, like remittances, for which established arrangements are clumsy and costly.

Finally, I& #39;m describing what I think is likely to happen or not happen--not what I "want" to see happen or not happen. Those who call me "anti-bitcoin" because of the doubts I& #39;ve expressed seem unable to appreciate this,...

...just as they seem unable to appreciate the difference between their own fervent wishes and what is or isn& #39;t likely to happen.

Afterthought: Note that I have not made any appeal here to Bitcoin& #39;s basic properties, such as it& #39;s long-term fixed supply or the cost of transacting in it with or without second-layer technology. That is because I consider all these to be of secondary importance.

In any monetary selection process, network size is of overwhelming importance except where a dominant currency has become intolerably inefficient or unreliable.

That& #39;s why, in my ill-fated debate with Saifedean, I merely offered the same arguments I& #39;ve made in this thread, and did not bring up Bitcoin& #39;s fixed supply and the macroeconomic problems that might pose IF bitcoin became a "standard" exchange medium and accounting unit.

That Saifedean became furious at me for not bringing up matters I considered secondary, because he& #39;d prepared to counter me if I did, was therefore very strange. That he& #39;s still fuming about it a year and a half later is even stranger! https://saifedean.com/podcast/53-allen-farringtons-adventures-with-fiat-intellectuals/">https://saifedean.com/podcast/5...

Read on Twitter

Read on Twitter