𝐅𝐨𝐫𝐰𝐚𝐫𝐝  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏩" title="Nach rechts zeigendes doppeltes Dreieck" aria-label="Emoji: Nach rechts zeigendes doppeltes Dreieck">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏩" title="Nach rechts zeigendes doppeltes Dreieck" aria-label="Emoji: Nach rechts zeigendes doppeltes Dreieck">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">Decentralized exchanges have provided a lot of benefit to the world which include increased privacy, security, control over your own funds, and financial inclusiveness.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">Decentralized exchanges have provided a lot of benefit to the world which include increased privacy, security, control over your own funds, and financial inclusiveness.

𝐅𝐨𝐫𝐰𝐚𝐫𝐝  https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💹" title="Tabelle mit Abwärtstrend und Yen-Zeichen" aria-label="Emoji: Tabelle mit Abwärtstrend und Yen-Zeichen">The main reason for their explosive growth is the use of Automated Market Makers (AMMs). This solved the liquidity issue that Dexs initially had. Even further Constant function market makers (CFMM& #39;s), were utilized to help with with pricing.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💹" title="Tabelle mit Abwärtstrend und Yen-Zeichen" aria-label="Emoji: Tabelle mit Abwärtstrend und Yen-Zeichen">The main reason for their explosive growth is the use of Automated Market Makers (AMMs). This solved the liquidity issue that Dexs initially had. Even further Constant function market makers (CFMM& #39;s), were utilized to help with with pricing.

𝐅𝐨𝐫𝐰𝐚𝐫𝐝  https://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">

The downside is that CFMM can be sometimes they are ineffective at pooling capital. The algorithm that is used only utilizes a fraction of the assets available in the pool at any given time. This leads to the majority of the pooled liquidity being wasted.

The downside is that CFMM can be sometimes they are ineffective at pooling capital. The algorithm that is used only utilizes a fraction of the assets available in the pool at any given time. This leads to the majority of the pooled liquidity being wasted.

𝐀𝐮𝐭𝐨𝐦𝐚𝐭𝐞𝐝 𝐌𝐚𝐫𝐤𝐞𝐭 𝐌𝐚𝐤𝐞𝐫𝐬 𝐀𝐌𝐌𝐬  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🖥️" title="Desktop-Computer" aria-label="Emoji: Desktop-Computer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🖥️" title="Desktop-Computer" aria-label="Emoji: Desktop-Computer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💻" title="Computer" aria-label="Emoji: Computer">An automated market maker (AMM) is a type of decentralized exchange (DEX) protocol that relies on a math formula to price assets. Traditional exchanges use an order book to do this.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💻" title="Computer" aria-label="Emoji: Computer">An automated market maker (AMM) is a type of decentralized exchange (DEX) protocol that relies on a math formula to price assets. Traditional exchanges use an order book to do this.

𝐂𝐨𝐧𝐬𝐭𝐚𝐧𝐭 𝐅𝐮𝐧𝐜𝐭𝐢𝐨𝐧 𝐌𝐚𝐫𝐤𝐞𝐭 𝐌𝐚𝐤𝐞𝐫𝐬 𝐂𝐅𝐌𝐌𝐬  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧮" title="Abacus" aria-label="Emoji: Abacus">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧮" title="Abacus" aria-label="Emoji: Abacus">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">They were designed by the crypto community to construct DEXs for digital assets & are based on a function that establishes a pre-defined set of prices based on available quantities of 2 or more assets

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">They were designed by the crypto community to construct DEXs for digital assets & are based on a function that establishes a pre-defined set of prices based on available quantities of 2 or more assets

𝐈𝐦𝐩𝐞𝐫𝐦𝐚𝐧𝐞𝐧𝐭 𝐋𝐨𝐬𝐬  https://abs.twimg.com/emoji/v2/... draggable="false" alt="➖" title="Dickes Minuszeichen" aria-label="Emoji: Dickes Minuszeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➖" title="Dickes Minuszeichen" aria-label="Emoji: Dickes Minuszeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin"> A temporary loss of funds occurring when providing liquidity. It’s very often explained as a difference between holding an asset versus providing liquidity in that asset. https://www.youtube.com/watch?time_continue=2&v=8XJ1MSTEuU0&feature=emb_logo">https://www.youtube.com/watch...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin"> A temporary loss of funds occurring when providing liquidity. It’s very often explained as a difference between holding an asset versus providing liquidity in that asset. https://www.youtube.com/watch?time_continue=2&v=8XJ1MSTEuU0&feature=emb_logo">https://www.youtube.com/watch...

𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔭" title="Teleskop" aria-label="Emoji: Teleskop">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔭" title="Teleskop" aria-label="Emoji: Teleskop">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛰️" title="Satellit" aria-label="Emoji: Satellit"> Lixir& #39;s main goal is to simply allow efficient allocation of capital to liquidity pools. Allocation is directly tied to ROI, which means the less capital you can lock up to earn a certain return, the better ROI you have.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛰️" title="Satellit" aria-label="Emoji: Satellit"> Lixir& #39;s main goal is to simply allow efficient allocation of capital to liquidity pools. Allocation is directly tied to ROI, which means the less capital you can lock up to earn a certain return, the better ROI you have.

𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐂𝐨𝐧𝐜𝐞𝐧𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐦𝐚𝐧𝐚𝐠𝐞𝐫  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage">It& #39;s a program that pools assets from users and automatically rebalances the concentration of your liquidity as price moves to maximize ROI on the next generation of AMMs like Uniswap v3.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage">It& #39;s a program that pools assets from users and automatically rebalances the concentration of your liquidity as price moves to maximize ROI on the next generation of AMMs like Uniswap v3.

𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐂𝐨𝐧𝐜𝐞𝐧𝐭𝐫𝐚𝐭𝐢𝐨𝐧  https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">They do two main things

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">They do two main things

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Incentivize new liquidity to come in so rebalancing is possible when the price of a pair moves

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Incentivize new liquidity to come in so rebalancing is possible when the price of a pair moves

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Auto manage rebalancings & incentives so that users earn fees and LP rewards consistently

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Auto manage rebalancings & incentives so that users earn fees and LP rewards consistently

𝐆𝐚𝐬 𝐟𝐞𝐞𝐬  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛽️" title="Benzinpumpe" aria-label="Emoji: Benzinpumpe">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛽️" title="Benzinpumpe" aria-label="Emoji: Benzinpumpe">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Kreditkarte" aria-label="Emoji: Kreditkarte">Users only spend gas when entering or exiting the pool, and the gas costs are limited to calculating the value of their incoming/outgoing assets. The fees are paid by the incoming users at each re-balance event, for which they are rewarded.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Kreditkarte" aria-label="Emoji: Kreditkarte">Users only spend gas when entering or exiting the pool, and the gas costs are limited to calculating the value of their incoming/outgoing assets. The fees are paid by the incoming users at each re-balance event, for which they are rewarded.

𝐓𝐨𝐤𝐞𝐧𝐨𝐦𝐢𝐜𝐬  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin">

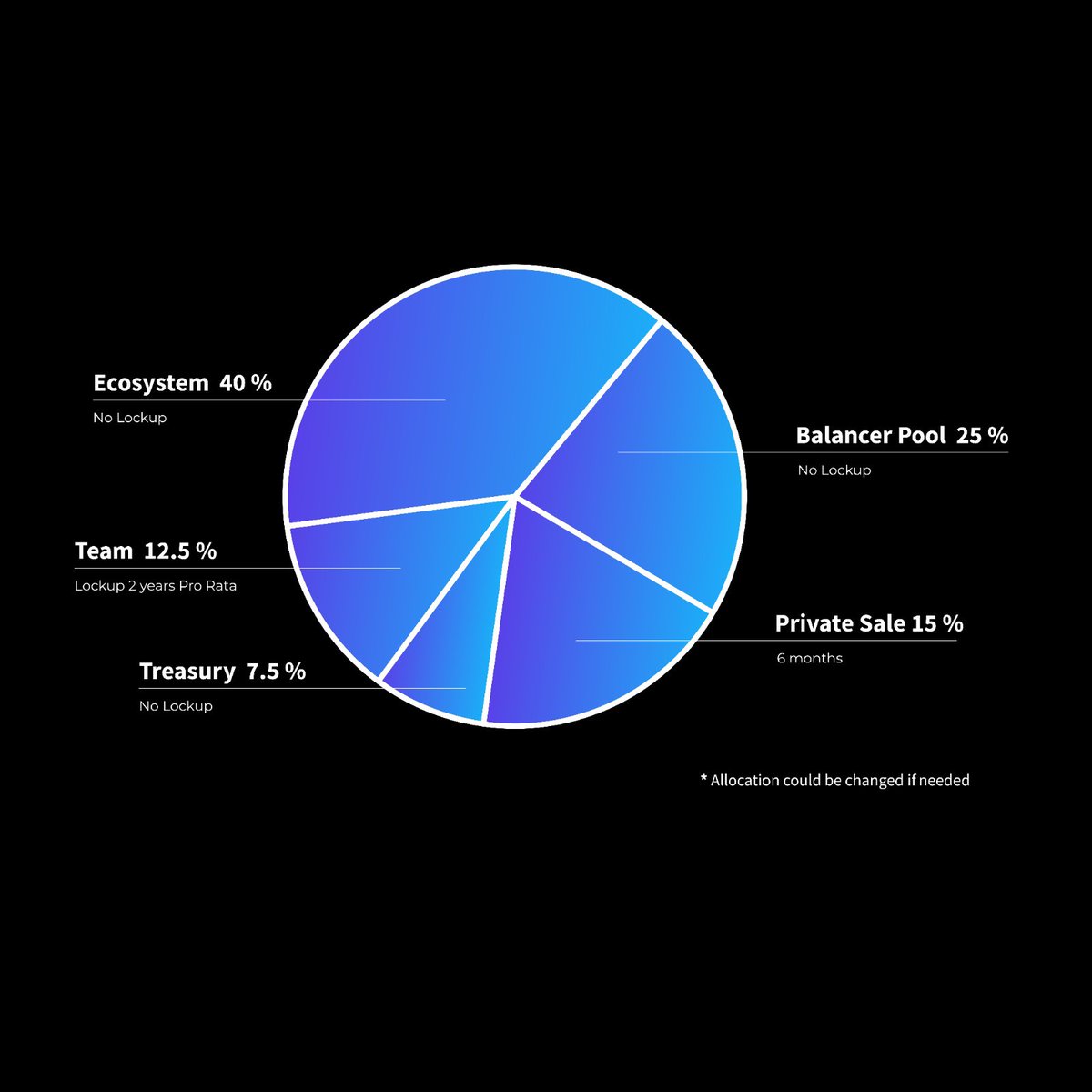

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Ecosystem: Tokens will benefit liquidity providers on Lixir, LP for $LIX itself and potential partnerships

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Ecosystem: Tokens will benefit liquidity providers on Lixir, LP for $LIX itself and potential partnerships

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Team: Is vested for the current, future, & other long-term team members

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Team: Is vested for the current, future, & other long-term team members

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Treasury: Tokens used to grant community projects & other proposals

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Treasury: Tokens used to grant community projects & other proposals

𝐓𝐡𝐞 𝐋𝐢𝐱 𝐓𝐨𝐤𝐞𝐧  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">2 purposes

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">2 purposes

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥩" title="Stück Fleisch" aria-label="Emoji: Stück Fleisch">Staking enables you to farm by staking your liquidity or providing liquidity for the token itself

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥩" title="Stück Fleisch" aria-label="Emoji: Stück Fleisch">Staking enables you to farm by staking your liquidity or providing liquidity for the token itself

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗳️" title="Wahlurne mit Stimmzettel" aria-label="Emoji: Wahlurne mit Stimmzettel">A governance token where holders vote for which new pairs are added to the platform & change the staked amount thresholds for classes

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗳️" title="Wahlurne mit Stimmzettel" aria-label="Emoji: Wahlurne mit Stimmzettel">A governance token where holders vote for which new pairs are added to the platform & change the staked amount thresholds for classes

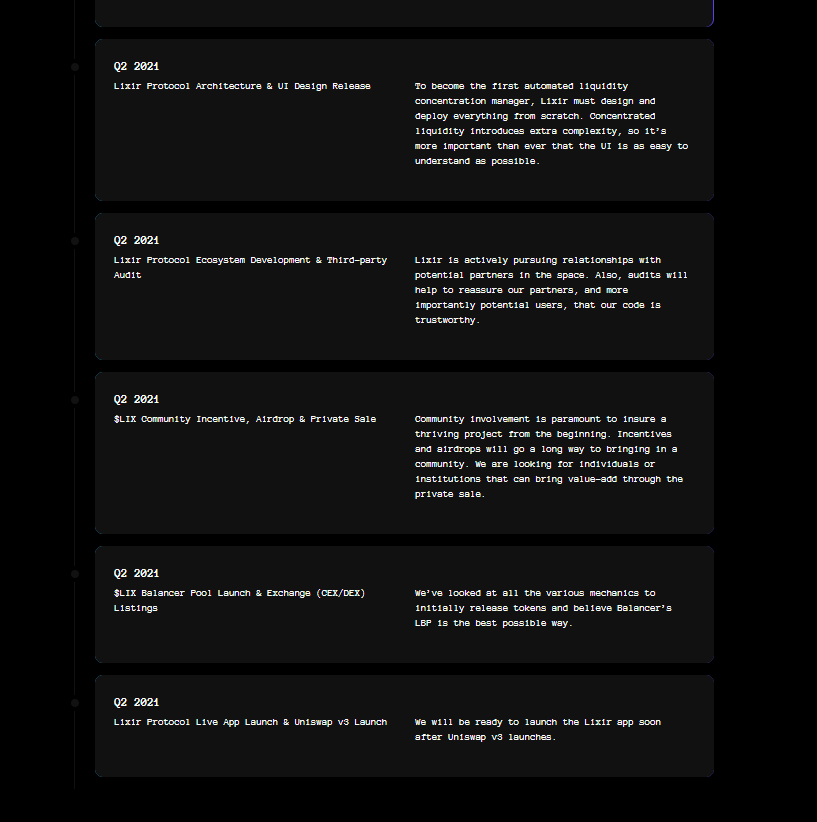

𝐑𝐨𝐚𝐝𝐦𝐚𝐩  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛣️" title="Autobahn" aria-label="Emoji: Autobahn">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛣️" title="Autobahn" aria-label="Emoji: Autobahn"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗺️" title="Weltkarte" aria-label="Emoji: Weltkarte">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗺️" title="Weltkarte" aria-label="Emoji: Weltkarte">

𝐋𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rotes Fragezeichen-Symbol" aria-label="Emoji: Rotes Fragezeichen-Symbol">The team wishes to remain anonymous at this time. I know that poses a red flag to many in regards to investing. However, I will say that very few teams put forth the effort this one has towards a project.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rotes Fragezeichen-Symbol" aria-label="Emoji: Rotes Fragezeichen-Symbol">The team wishes to remain anonymous at this time. I know that poses a red flag to many in regards to investing. However, I will say that very few teams put forth the effort this one has towards a project.

𝐋𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩  https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤖" title="Robotergesicht" aria-label="Emoji: Robotergesicht">The team took it upon themselves to to release the token at an artificially high price to thwart bots, would not accept VC funds, and have designed a mathematical formula aimed at helping investors maximize returns.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤖" title="Robotergesicht" aria-label="Emoji: Robotergesicht">The team took it upon themselves to to release the token at an artificially high price to thwart bots, would not accept VC funds, and have designed a mathematical formula aimed at helping investors maximize returns.

𝗖𝗼𝗻𝗰𝗹𝘂𝘀𝗶𝗼𝗻  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📖" title="Offenes Buch" aria-label="Emoji: Offenes Buch">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📖" title="Offenes Buch" aria-label="Emoji: Offenes Buch">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Schreibende Hand" aria-label="Emoji: Schreibende Hand">Lixir has a solution for a serious problem in regards to wasted liquidity and maximizing ROI for LPs. Lixir should do exceptionally well due to being the 1st mover in the space, having a token with an actual use case, & solving a major problem in DeFi

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Schreibende Hand" aria-label="Emoji: Schreibende Hand">Lixir has a solution for a serious problem in regards to wasted liquidity and maximizing ROI for LPs. Lixir should do exceptionally well due to being the 1st mover in the space, having a token with an actual use case, & solving a major problem in DeFi

𝗥𝗲𝗳𝗲𝗿𝗲𝗻𝗰𝗲𝘀  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📜" title="Schriftrolle" aria-label="Emoji: Schriftrolle">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📜" title="Schriftrolle" aria-label="Emoji: Schriftrolle">

https://balancer.exchange/#/swap/0xd0345D30FD918D7682398ACbCdf139C808998709

https://balancer.exchange/... href=" https://lixir-finance.medium.com/lixir-mechanics-6281f7febafd">https://lixir-finance.medium.com/lixir-mec... https://lixir.finance/ ">https://lixir.finance/">...

https://balancer.exchange/#/swap/0xd0345D30FD918D7682398ACbCdf139C808998709

Read on Twitter

Read on Twitter 𝐋𝐢𝐱𝐢𝐫 𝐏𝐫𝐨𝐭𝐨𝐜𝐨𝐥 https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚗️" title="Destillierkolben" aria-label="Emoji: Destillierkolben"> $LIX https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad">The world’s first automated liquidity concentration managerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad">Auto-balances LP positions accordingly to achieve maximum ROI, minimum Impermanent Loss & minimum inactive liquidityhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad">Not VC-funded, team members & early buyers are vested" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚗️" title="Destillierkolben" aria-label="Emoji: Destillierkolben"> 𝐋𝐢𝐱𝐢𝐫 𝐏𝐫𝐨𝐭𝐨𝐜𝐨𝐥 https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚗️" title="Destillierkolben" aria-label="Emoji: Destillierkolben"> $LIX https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad">The world’s first automated liquidity concentration managerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad">Auto-balances LP positions accordingly to achieve maximum ROI, minimum Impermanent Loss & minimum inactive liquidityhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad">Not VC-funded, team members & early buyers are vested" class="img-responsive" style="max-width:100%;"/>

𝐋𝐢𝐱𝐢𝐫 𝐏𝐫𝐨𝐭𝐨𝐜𝐨𝐥 https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚗️" title="Destillierkolben" aria-label="Emoji: Destillierkolben"> $LIX https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad">The world’s first automated liquidity concentration managerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad">Auto-balances LP positions accordingly to achieve maximum ROI, minimum Impermanent Loss & minimum inactive liquidityhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad">Not VC-funded, team members & early buyers are vested" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚗️" title="Destillierkolben" aria-label="Emoji: Destillierkolben"> 𝐋𝐢𝐱𝐢𝐫 𝐏𝐫𝐨𝐭𝐨𝐜𝐨𝐥 https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚗️" title="Destillierkolben" aria-label="Emoji: Destillierkolben"> $LIX https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad">The world’s first automated liquidity concentration managerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad">Auto-balances LP positions accordingly to achieve maximum ROI, minimum Impermanent Loss & minimum inactive liquidityhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚙️" title="Zahnrad" aria-label="Emoji: Zahnrad">Not VC-funded, team members & early buyers are vested" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">Decentralized exchanges have provided a lot of benefit to the world which include increased privacy, security, control over your own funds, and financial inclusiveness." title="𝐅𝐨𝐫𝐰𝐚𝐫𝐝 https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏩" title="Nach rechts zeigendes doppeltes Dreieck" aria-label="Emoji: Nach rechts zeigendes doppeltes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">Decentralized exchanges have provided a lot of benefit to the world which include increased privacy, security, control over your own funds, and financial inclusiveness." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">Decentralized exchanges have provided a lot of benefit to the world which include increased privacy, security, control over your own funds, and financial inclusiveness." title="𝐅𝐨𝐫𝐰𝐚𝐫𝐝 https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏩" title="Nach rechts zeigendes doppeltes Dreieck" aria-label="Emoji: Nach rechts zeigendes doppeltes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌐" title="Weltkugel mit Längengraden" aria-label="Emoji: Weltkugel mit Längengraden">Decentralized exchanges have provided a lot of benefit to the world which include increased privacy, security, control over your own funds, and financial inclusiveness." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💹" title="Tabelle mit Abwärtstrend und Yen-Zeichen" aria-label="Emoji: Tabelle mit Abwärtstrend und Yen-Zeichen">The main reason for their explosive growth is the use of Automated Market Makers (AMMs). This solved the liquidity issue that Dexs initially had. Even further Constant function market makers (CFMM& #39;s), were utilized to help with with pricing." title="𝐅𝐨𝐫𝐰𝐚𝐫𝐝 https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💹" title="Tabelle mit Abwärtstrend und Yen-Zeichen" aria-label="Emoji: Tabelle mit Abwärtstrend und Yen-Zeichen">The main reason for their explosive growth is the use of Automated Market Makers (AMMs). This solved the liquidity issue that Dexs initially had. Even further Constant function market makers (CFMM& #39;s), were utilized to help with with pricing." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💹" title="Tabelle mit Abwärtstrend und Yen-Zeichen" aria-label="Emoji: Tabelle mit Abwärtstrend und Yen-Zeichen">The main reason for their explosive growth is the use of Automated Market Makers (AMMs). This solved the liquidity issue that Dexs initially had. Even further Constant function market makers (CFMM& #39;s), were utilized to help with with pricing." title="𝐅𝐨𝐫𝐰𝐚𝐫𝐝 https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💹" title="Tabelle mit Abwärtstrend und Yen-Zeichen" aria-label="Emoji: Tabelle mit Abwärtstrend und Yen-Zeichen">The main reason for their explosive growth is the use of Automated Market Makers (AMMs). This solved the liquidity issue that Dexs initially had. Even further Constant function market makers (CFMM& #39;s), were utilized to help with with pricing." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💻" title="Computer" aria-label="Emoji: Computer">An automated market maker (AMM) is a type of decentralized exchange (DEX) protocol that relies on a math formula to price assets. Traditional exchanges use an order book to do this." title="𝐀𝐮𝐭𝐨𝐦𝐚𝐭𝐞𝐝 𝐌𝐚𝐫𝐤𝐞𝐭 𝐌𝐚𝐤𝐞𝐫𝐬 𝐀𝐌𝐌𝐬 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🖥️" title="Desktop-Computer" aria-label="Emoji: Desktop-Computer">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💻" title="Computer" aria-label="Emoji: Computer">An automated market maker (AMM) is a type of decentralized exchange (DEX) protocol that relies on a math formula to price assets. Traditional exchanges use an order book to do this." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💻" title="Computer" aria-label="Emoji: Computer">An automated market maker (AMM) is a type of decentralized exchange (DEX) protocol that relies on a math formula to price assets. Traditional exchanges use an order book to do this." title="𝐀𝐮𝐭𝐨𝐦𝐚𝐭𝐞𝐝 𝐌𝐚𝐫𝐤𝐞𝐭 𝐌𝐚𝐤𝐞𝐫𝐬 𝐀𝐌𝐌𝐬 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🖥️" title="Desktop-Computer" aria-label="Emoji: Desktop-Computer">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💻" title="Computer" aria-label="Emoji: Computer">An automated market maker (AMM) is a type of decentralized exchange (DEX) protocol that relies on a math formula to price assets. Traditional exchanges use an order book to do this." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">They were designed by the crypto community to construct DEXs for digital assets & are based on a function that establishes a pre-defined set of prices based on available quantities of 2 or more assets" title="𝐂𝐨𝐧𝐬𝐭𝐚𝐧𝐭 𝐅𝐮𝐧𝐜𝐭𝐢𝐨𝐧 𝐌𝐚𝐫𝐤𝐞𝐭 𝐌𝐚𝐤𝐞𝐫𝐬 𝐂𝐅𝐌𝐌𝐬 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧮" title="Abacus" aria-label="Emoji: Abacus">https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">They were designed by the crypto community to construct DEXs for digital assets & are based on a function that establishes a pre-defined set of prices based on available quantities of 2 or more assets" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">They were designed by the crypto community to construct DEXs for digital assets & are based on a function that establishes a pre-defined set of prices based on available quantities of 2 or more assets" title="𝐂𝐨𝐧𝐬𝐭𝐚𝐧𝐭 𝐅𝐮𝐧𝐜𝐭𝐢𝐨𝐧 𝐌𝐚𝐫𝐤𝐞𝐭 𝐌𝐚𝐤𝐞𝐫𝐬 𝐂𝐅𝐌𝐌𝐬 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧮" title="Abacus" aria-label="Emoji: Abacus">https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">They were designed by the crypto community to construct DEXs for digital assets & are based on a function that establishes a pre-defined set of prices based on available quantities of 2 or more assets" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage">It& #39;s a program that pools assets from users and automatically rebalances the concentration of your liquidity as price moves to maximize ROI on the next generation of AMMs like Uniswap v3." title="𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐂𝐨𝐧𝐜𝐞𝐧𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐦𝐚𝐧𝐚𝐠𝐞𝐫 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage">It& #39;s a program that pools assets from users and automatically rebalances the concentration of your liquidity as price moves to maximize ROI on the next generation of AMMs like Uniswap v3." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage">It& #39;s a program that pools assets from users and automatically rebalances the concentration of your liquidity as price moves to maximize ROI on the next generation of AMMs like Uniswap v3." title="𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐂𝐨𝐧𝐜𝐞𝐧𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐦𝐚𝐧𝐚𝐠𝐞𝐫 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage">It& #39;s a program that pools assets from users and automatically rebalances the concentration of your liquidity as price moves to maximize ROI on the next generation of AMMs like Uniswap v3." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">They do two main things https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Incentivize new liquidity to come in so rebalancing is possible when the price of a pair moveshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Auto manage rebalancings & incentives so that users earn fees and LP rewards consistently" title="𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐂𝐨𝐧𝐜𝐞𝐧𝐭𝐫𝐚𝐭𝐢𝐨𝐧 https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">They do two main things https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Incentivize new liquidity to come in so rebalancing is possible when the price of a pair moveshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Auto manage rebalancings & incentives so that users earn fees and LP rewards consistently" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">They do two main things https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Incentivize new liquidity to come in so rebalancing is possible when the price of a pair moveshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Auto manage rebalancings & incentives so that users earn fees and LP rewards consistently" title="𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐂𝐨𝐧𝐜𝐞𝐧𝐭𝐫𝐚𝐭𝐢𝐨𝐧 https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">They do two main things https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Incentivize new liquidity to come in so rebalancing is possible when the price of a pair moveshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">Auto manage rebalancings & incentives so that users earn fees and LP rewards consistently" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Kreditkarte" aria-label="Emoji: Kreditkarte">Users only spend gas when entering or exiting the pool, and the gas costs are limited to calculating the value of their incoming/outgoing assets. The fees are paid by the incoming users at each re-balance event, for which they are rewarded." title="𝐆𝐚𝐬 𝐟𝐞𝐞𝐬 https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛽️" title="Benzinpumpe" aria-label="Emoji: Benzinpumpe">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Kreditkarte" aria-label="Emoji: Kreditkarte">Users only spend gas when entering or exiting the pool, and the gas costs are limited to calculating the value of their incoming/outgoing assets. The fees are paid by the incoming users at each re-balance event, for which they are rewarded." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Kreditkarte" aria-label="Emoji: Kreditkarte">Users only spend gas when entering or exiting the pool, and the gas costs are limited to calculating the value of their incoming/outgoing assets. The fees are paid by the incoming users at each re-balance event, for which they are rewarded." title="𝐆𝐚𝐬 𝐟𝐞𝐞𝐬 https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛽️" title="Benzinpumpe" aria-label="Emoji: Benzinpumpe">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Kreditkarte" aria-label="Emoji: Kreditkarte">Users only spend gas when entering or exiting the pool, and the gas costs are limited to calculating the value of their incoming/outgoing assets. The fees are paid by the incoming users at each re-balance event, for which they are rewarded." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Ecosystem: Tokens will benefit liquidity providers on Lixir, LP for $LIX itself and potential partnershipshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Team: Is vested for the current, future, & other long-term team membershttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Treasury: Tokens used to grant community projects & other proposals" title="𝐓𝐨𝐤𝐞𝐧𝐨𝐦𝐢𝐜𝐬 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin">https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Ecosystem: Tokens will benefit liquidity providers on Lixir, LP for $LIX itself and potential partnershipshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Team: Is vested for the current, future, & other long-term team membershttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Treasury: Tokens used to grant community projects & other proposals" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Ecosystem: Tokens will benefit liquidity providers on Lixir, LP for $LIX itself and potential partnershipshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Team: Is vested for the current, future, & other long-term team membershttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Treasury: Tokens used to grant community projects & other proposals" title="𝐓𝐨𝐤𝐞𝐧𝐨𝐦𝐢𝐜𝐬 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin">https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Ecosystem: Tokens will benefit liquidity providers on Lixir, LP for $LIX itself and potential partnershipshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Team: Is vested for the current, future, & other long-term team membershttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Treasury: Tokens used to grant community projects & other proposals" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">2 purposeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🥩" title="Stück Fleisch" aria-label="Emoji: Stück Fleisch">Staking enables you to farm by staking your liquidity or providing liquidity for the token itselfhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🗳️" title="Wahlurne mit Stimmzettel" aria-label="Emoji: Wahlurne mit Stimmzettel">A governance token where holders vote for which new pairs are added to the platform & change the staked amount thresholds for classes" title="𝐓𝐡𝐞 𝐋𝐢𝐱 𝐓𝐨𝐤𝐞𝐧 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin">https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">2 purposeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🥩" title="Stück Fleisch" aria-label="Emoji: Stück Fleisch">Staking enables you to farm by staking your liquidity or providing liquidity for the token itselfhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🗳️" title="Wahlurne mit Stimmzettel" aria-label="Emoji: Wahlurne mit Stimmzettel">A governance token where holders vote for which new pairs are added to the platform & change the staked amount thresholds for classes" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">2 purposeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🥩" title="Stück Fleisch" aria-label="Emoji: Stück Fleisch">Staking enables you to farm by staking your liquidity or providing liquidity for the token itselfhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🗳️" title="Wahlurne mit Stimmzettel" aria-label="Emoji: Wahlurne mit Stimmzettel">A governance token where holders vote for which new pairs are added to the platform & change the staked amount thresholds for classes" title="𝐓𝐡𝐞 𝐋𝐢𝐱 𝐓𝐨𝐤𝐞𝐧 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪙" title="Coin" aria-label="Emoji: Coin">https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">2 purposeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🥩" title="Stück Fleisch" aria-label="Emoji: Stück Fleisch">Staking enables you to farm by staking your liquidity or providing liquidity for the token itselfhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🗳️" title="Wahlurne mit Stimmzettel" aria-label="Emoji: Wahlurne mit Stimmzettel">A governance token where holders vote for which new pairs are added to the platform & change the staked amount thresholds for classes" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗺️" title="Weltkarte" aria-label="Emoji: Weltkarte">" title="𝐑𝐨𝐚𝐝𝐦𝐚𝐩 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛣️" title="Autobahn" aria-label="Emoji: Autobahn">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗺️" title="Weltkarte" aria-label="Emoji: Weltkarte">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗺️" title="Weltkarte" aria-label="Emoji: Weltkarte">" title="𝐑𝐨𝐚𝐝𝐦𝐚𝐩 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛣️" title="Autobahn" aria-label="Emoji: Autobahn">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗺️" title="Weltkarte" aria-label="Emoji: Weltkarte">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rotes Fragezeichen-Symbol" aria-label="Emoji: Rotes Fragezeichen-Symbol">The team wishes to remain anonymous at this time. I know that poses a red flag to many in regards to investing. However, I will say that very few teams put forth the effort this one has towards a project." title="𝐋𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rotes Fragezeichen-Symbol" aria-label="Emoji: Rotes Fragezeichen-Symbol">The team wishes to remain anonymous at this time. I know that poses a red flag to many in regards to investing. However, I will say that very few teams put forth the effort this one has towards a project." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rotes Fragezeichen-Symbol" aria-label="Emoji: Rotes Fragezeichen-Symbol">The team wishes to remain anonymous at this time. I know that poses a red flag to many in regards to investing. However, I will say that very few teams put forth the effort this one has towards a project." title="𝐋𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="❓" title="Rotes Fragezeichen-Symbol" aria-label="Emoji: Rotes Fragezeichen-Symbol">The team wishes to remain anonymous at this time. I know that poses a red flag to many in regards to investing. However, I will say that very few teams put forth the effort this one has towards a project." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤖" title="Robotergesicht" aria-label="Emoji: Robotergesicht">The team took it upon themselves to to release the token at an artificially high price to thwart bots, would not accept VC funds, and have designed a mathematical formula aimed at helping investors maximize returns." title="𝐋𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩 https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤖" title="Robotergesicht" aria-label="Emoji: Robotergesicht">The team took it upon themselves to to release the token at an artificially high price to thwart bots, would not accept VC funds, and have designed a mathematical formula aimed at helping investors maximize returns." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤖" title="Robotergesicht" aria-label="Emoji: Robotergesicht">The team took it upon themselves to to release the token at an artificially high price to thwart bots, would not accept VC funds, and have designed a mathematical formula aimed at helping investors maximize returns." title="𝐋𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩 https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤖" title="Robotergesicht" aria-label="Emoji: Robotergesicht">The team took it upon themselves to to release the token at an artificially high price to thwart bots, would not accept VC funds, and have designed a mathematical formula aimed at helping investors maximize returns." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Schreibende Hand" aria-label="Emoji: Schreibende Hand">Lixir has a solution for a serious problem in regards to wasted liquidity and maximizing ROI for LPs. Lixir should do exceptionally well due to being the 1st mover in the space, having a token with an actual use case, & solving a major problem in DeFi" title="𝗖𝗼𝗻𝗰𝗹𝘂𝘀𝗶𝗼𝗻 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📖" title="Offenes Buch" aria-label="Emoji: Offenes Buch">https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Schreibende Hand" aria-label="Emoji: Schreibende Hand">Lixir has a solution for a serious problem in regards to wasted liquidity and maximizing ROI for LPs. Lixir should do exceptionally well due to being the 1st mover in the space, having a token with an actual use case, & solving a major problem in DeFi" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Schreibende Hand" aria-label="Emoji: Schreibende Hand">Lixir has a solution for a serious problem in regards to wasted liquidity and maximizing ROI for LPs. Lixir should do exceptionally well due to being the 1st mover in the space, having a token with an actual use case, & solving a major problem in DeFi" title="𝗖𝗼𝗻𝗰𝗹𝘂𝘀𝗶𝗼𝗻 https://abs.twimg.com/emoji/v2/... draggable="false" alt="📖" title="Offenes Buch" aria-label="Emoji: Offenes Buch">https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Schreibende Hand" aria-label="Emoji: Schreibende Hand">Lixir has a solution for a serious problem in regards to wasted liquidity and maximizing ROI for LPs. Lixir should do exceptionally well due to being the 1st mover in the space, having a token with an actual use case, & solving a major problem in DeFi" class="img-responsive" style="max-width:100%;"/>