Thread on APL Apollo Tubes  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

Market cap: 15,967 crores

Revenues: 7,723 crores

P/E: 53.63

P/B: 10.10

ROE: 22.23%

ROCE: 20.12%

Here we go https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

1/25

Market cap: 15,967 crores

Revenues: 7,723 crores

P/E: 53.63

P/B: 10.10

ROE: 22.23%

ROCE: 20.12%

Here we go

1/25

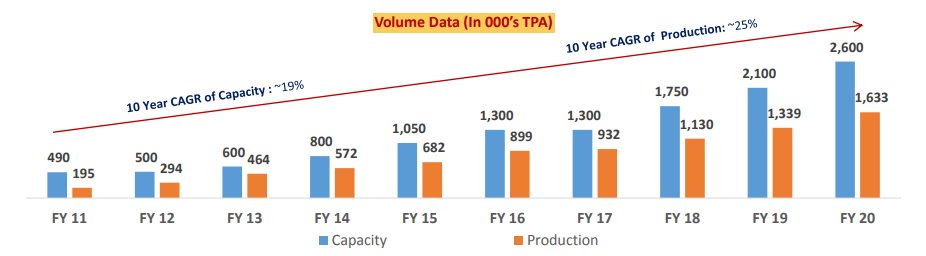

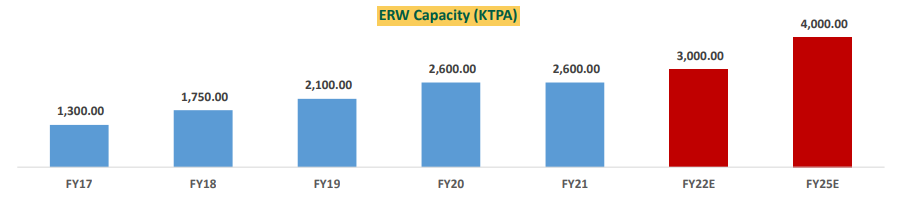

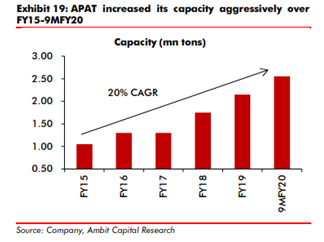

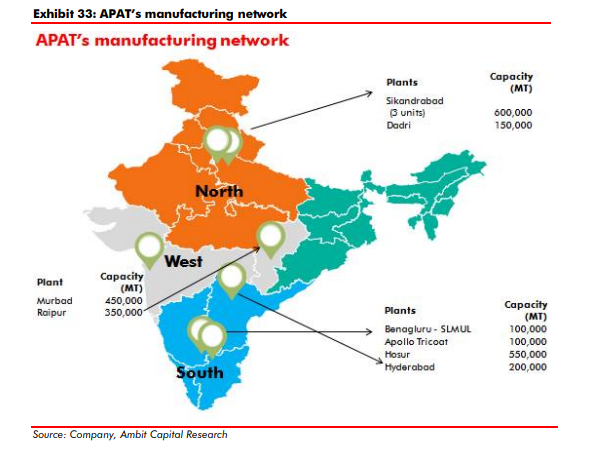

APL Apollo Tubes commenced operations in 1986 as a private limited company promoted by the late Mr. Sudesh Gupta. It has emerged as one of India’s leading Electric Resistance Welded (ERW) steel tubes manufacturers with a capacity of 2.6 MTPA across 10 plants.

2/25

2/25

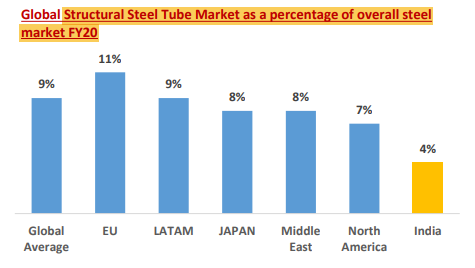

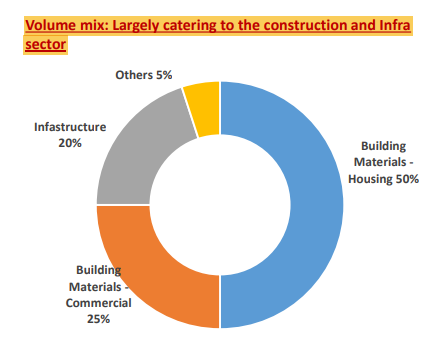

Over the years, company has developed structural steel tubes market in India, with strong focus on steel strength & building-material application along with launching new products with innovative sizes & shapes.

Has ~50% market share in the Indian structural steel tubes market.

Has ~50% market share in the Indian structural steel tubes market.

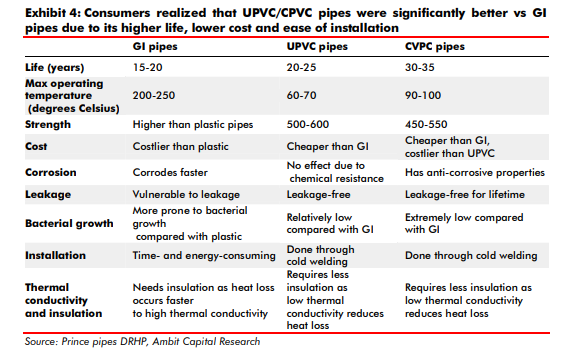

Company also deals in other structural steel products like galvanized iron (GI) pipes, MS black pipes, and newly introduced ‘Tricoat’ products;

Sanjay Gupta, a second-generation promoter, has been at the helm of the company since 2002 and the key driver of growth;

4/25

Sanjay Gupta, a second-generation promoter, has been at the helm of the company since 2002 and the key driver of growth;

4/25

The company has been the pioneer in bringing high speed mills from Europe and introducing pre-galvanized tubes and DFT technology in India. This allows cost-effective customization to meet client requirements. Access to DFT technology and in-line

galvanizing (ILG) allows -

5/25

galvanizing (ILG) allows -

5/25

manufacturing of niche eco-friendly products. Its strategy to develop products that replace wood, steel

angles, aluminum profiles & RCC has been yielding good results.

DFT technology can produce a custom size in 45 minutes vs 8-9 hours required in the erstwhile technology;

6/25

angles, aluminum profiles & RCC has been yielding good results.

DFT technology can produce a custom size in 45 minutes vs 8-9 hours required in the erstwhile technology;

6/25

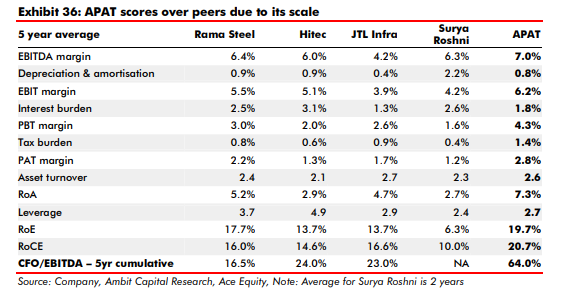

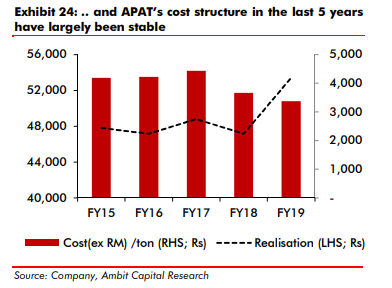

Considerable cost advantages coupled with higher asset turns have helped APAT generate a significantly higher return on capital employed.

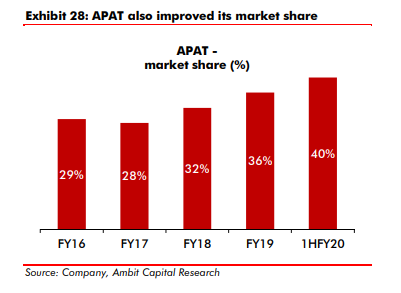

APAT has been investing savings from lower raw material costs to provide discounts to distributors, helping it gain market share.

7/25

APAT has been investing savings from lower raw material costs to provide discounts to distributors, helping it gain market share.

7/25

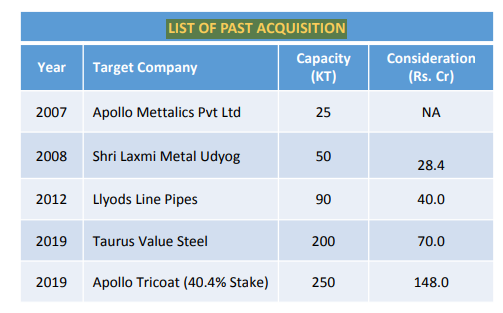

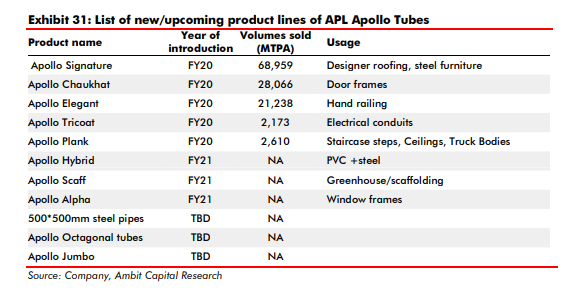

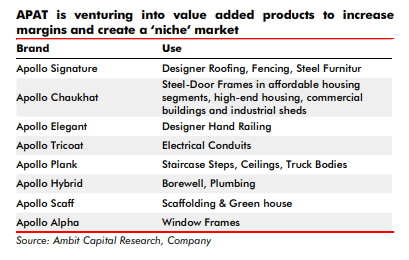

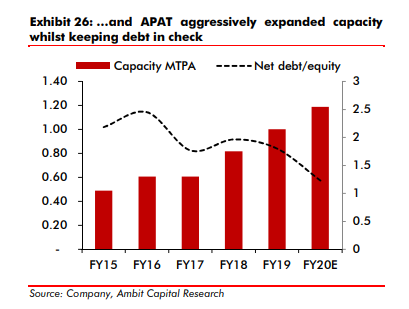

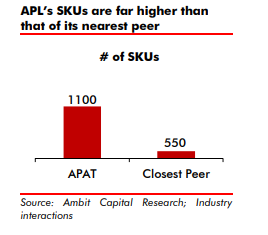

Capacity expansions have been via both, the organic & inorganic routes, while volume growth is driven by launch of new products buoyed by strong distribution and branding efforts. Share of value added products has now risen to 60% (40% in FY16) driving overall margin expansion.

Incurred a Capex of ~Rs. 5.5 Bn over FY17 to FY19 to expand its production capacity and add more SKUs to its product portfolio. Company has plans for organic expansion where the total manufacturing capacity will be increased to 3 MTPA by end of FY22.

9/25

9/25

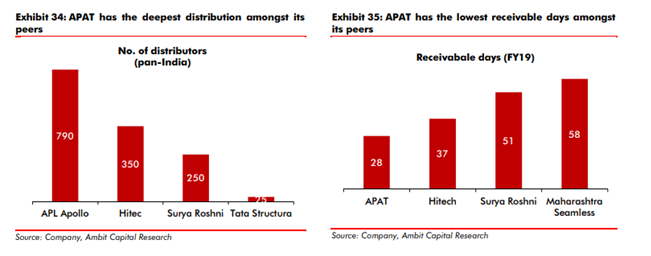

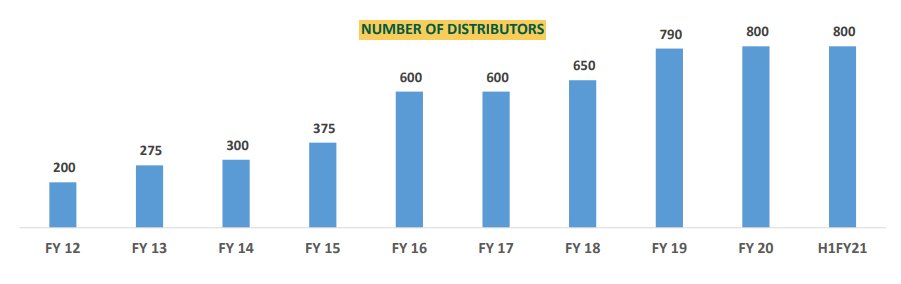

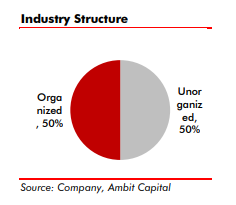

The company with its widest range of products, 800+ dealers, geographic diversity in terms of placement of manufacturing facilities and investment in brand building has achieved a market share of ~50% (both organized and unorganized Sector).

10/25

10/25

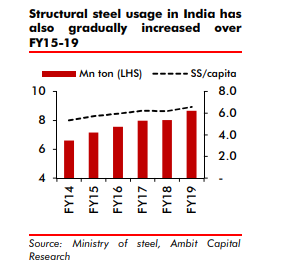

Hence, the benefit of the industry expansion and increased demand of structural steel pipes will directly pass through to APL Apollo. Muted competition is also a distinct advantage as the company enjoy, the second largest player has a market share of ~12%.

11/25

11/25

Warehousing, affordable housing, urban infrastructure and urban real estate have been identified as emerging sectors that would drive steel tubes’ demand over the next few years.

12/25

12/25

Acquisition of APL Tricoat provides access to the in-line galvanising technology, which seamlessly coats steel tubes with a three-layer protection in a continuous process.

13/25

13/25

This multi-layered coated tube (three-layer coating on outside and one layer inside) enjoys double the life of any other galvanised product. There are only about 10 such production lines globally, across 4-5 countries.

14/25

14/25

Management is targeting Rs9,000-10,000 of EBITDA/Tonne over the medium term, driven by improved cost efficiencies and higher premium on solutions being offered (door frame solutions). The merger with APL Apollo would also drive ~5% improvement in overall EBITDA/Tonne.

15/25

15/25

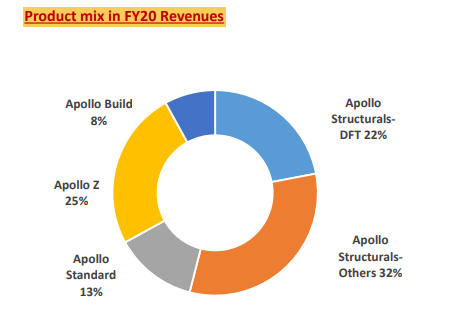

Apollo’s product profile includes Apollo Structural (hollow sections), Apollo Z (pre-galvanized), Apollo Build (galvanized) and Apollo Standard (Black pipes). At least 70% of the company’s products are niche categories that have limited competition.

16/25

16/25

APL Apollo derives ~80% of sales from distributors. Sale of steel tubes is through warehouses that cater to dealers/distributors who, in turn, sell to retailers. The company has also improved its engagement with architects and fabricators and, down the line, influencers.

17/25

17/25

Dedicated fabricator-meets are organized periodically across towns, to educate fabricators about new product offerings. Company is also connected with more than 200,000 fabricators through Apollo connect bonding programs where fabricator meets to promote the APAT Brand.

18/25

18/25

BRANDING- To drive the next leg of growth:

In November 2019, the company roped in Amitabh Bachchan as the brand ambassador for all the brands housed under APL Apollo, for two years. Large-scale print and TV commercials were launched to improve visibility.

19/25

In November 2019, the company roped in Amitabh Bachchan as the brand ambassador for all the brands housed under APL Apollo, for two years. Large-scale print and TV commercials were launched to improve visibility.

19/25

High-visibility sporting events were also used to maximize APL Apollo’s brand reach which included sponsoring the Delhi Team during IPL, 2019.

APAT also innovated on new ‘consumer’ products like plank and door panels;

20/25

APAT also innovated on new ‘consumer’ products like plank and door panels;

20/25

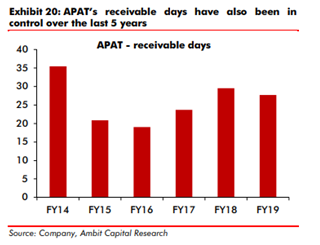

APAT; better receivable days over last 5 years. With APAT’s debt and working capital days in check, it is only fitting that it emerges the winner post this disruption.

21/25

21/25

Opportunity for APAT to consolidate the market"

In commodity industry, players enjoying high capacity and market share are likely to wield pricing power and thus emerge as an eventual winner;

Covid 19 lockdown can be an opportunity for APAT to increase its market share-

22/25

In commodity industry, players enjoying high capacity and market share are likely to wield pricing power and thus emerge as an eventual winner;

Covid 19 lockdown can be an opportunity for APAT to increase its market share-

22/25

From unorganized players (~50% of the market);

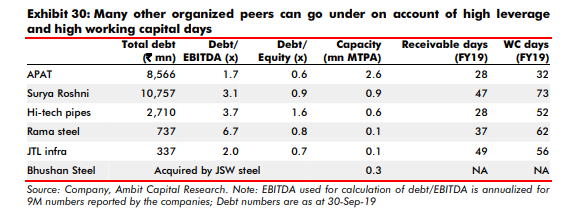

Over-leveraged and over-stretched peers:

Many of APAT’s competitors are over-leveraged and running very high receivable/working capital days;

This provides APAT the opportunity that it needs to Consolidate the market.

23/25

Over-leveraged and over-stretched peers:

Many of APAT’s competitors are over-leveraged and running very high receivable/working capital days;

This provides APAT the opportunity that it needs to Consolidate the market.

23/25

Key Risks:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts">Subdued steel demand growth: Softening steel demand, especially in the building & construction segment, could impact the company’s volume growth and margins in the near term.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts">Subdued steel demand growth: Softening steel demand, especially in the building & construction segment, could impact the company’s volume growth and margins in the near term.

24/25

24/25

End of thread

25/25

Read on Twitter

Read on Twitter