Here& #39;s a tiny bit of Sunday night alpha for you.

There are a few billion dollars of ETH/USD liquidity sitting across all the major DEXes. The vast majority of that TVL exists only because it earns healthy protocol subsidies from the liquidity mining / yield farming programs.

There are a few billion dollars of ETH/USD liquidity sitting across all the major DEXes. The vast majority of that TVL exists only because it earns healthy protocol subsidies from the liquidity mining / yield farming programs.

Without those subsidies that TVL would vanish, as no one actually wants to be quoting such tight spreads for ETH/USD in a rampant bull market. Eventually, one day, these subsidies will start to dry up.

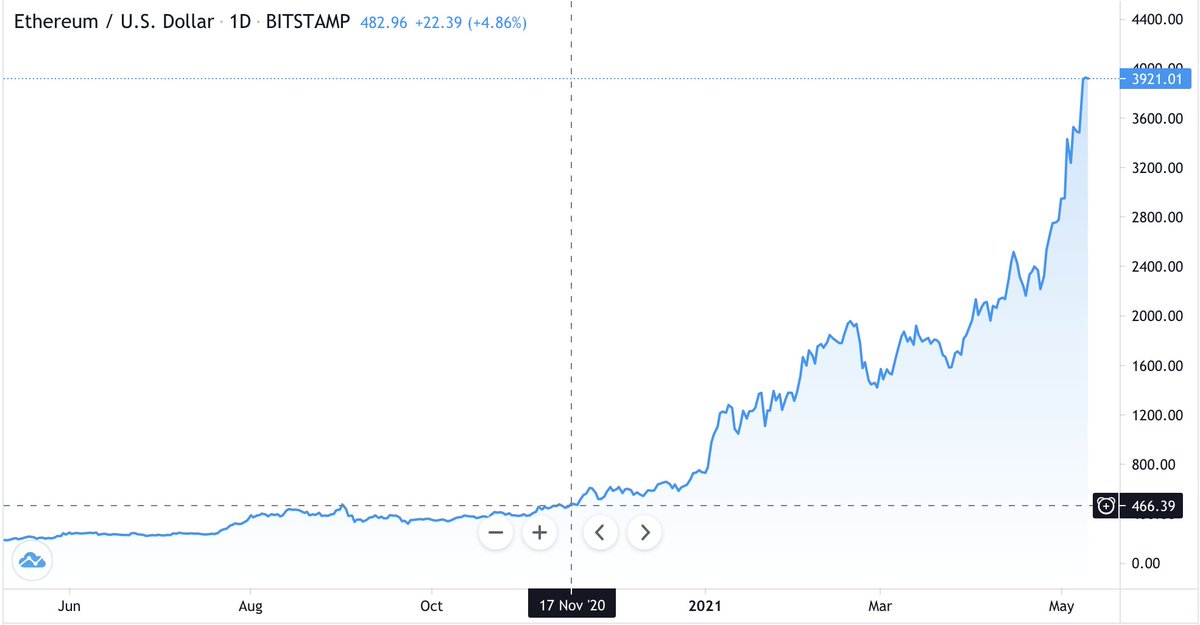

The point is, the ETH price is **artificially** being held down due to these protocol subsidies. Once they stop, the sell-side will dramatically dry up. How do we know? Because look at what happened to ETH/USD back when UNI farming ended in November.

It exploded up from the $450 mark and *never* turned back again. So keep an eye on various farming programs and keep an eye on TVLs. As a separate note, this works out nicely for all the institutions who are buying in and are finding decent entry liquidity. It& #39;s harmonious.

Read on Twitter

Read on Twitter