1) ~ Test of conditions mentioned Fri.

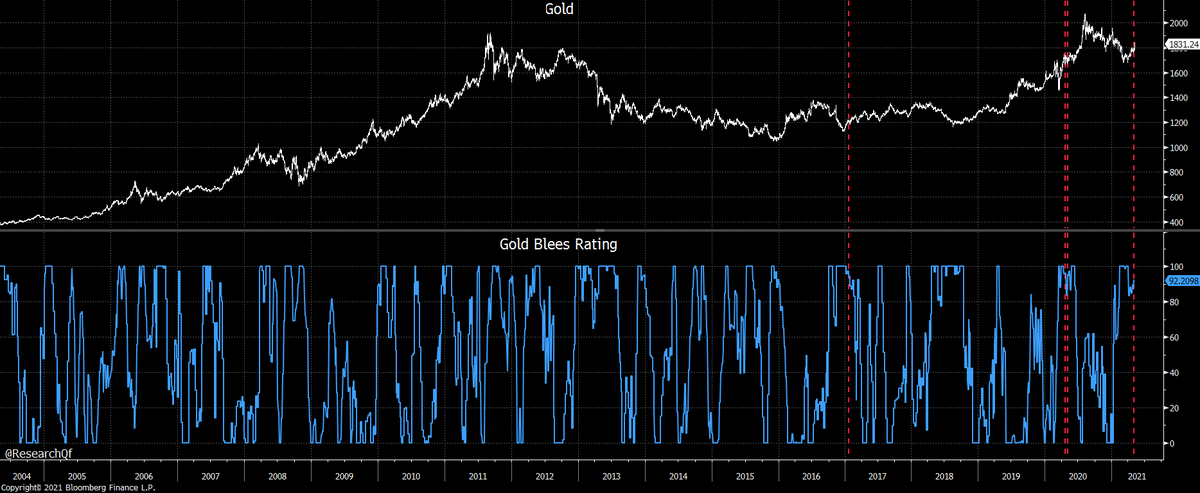

$Gold +5.57% since 3/30 lows on Tues (COT data from Fri is for Tues) but net commercial position much closer to highs of past 18W.

Happened 4 times 1996: 5/4/21, 1/24/17, 4/21/20, 5/5/20.

$SPY $QQQ $GLD $GDX $TLT

https://twitter.com/ResearchQf/status/1390754997663674373">https://twitter.com/ResearchQ...

$Gold +5.57% since 3/30 lows on Tues (COT data from Fri is for Tues) but net commercial position much closer to highs of past 18W.

Happened 4 times 1996: 5/4/21, 1/24/17, 4/21/20, 5/5/20.

$SPY $QQQ $GLD $GDX $TLT

https://twitter.com/ResearchQf/status/1390754997663674373">https://twitter.com/ResearchQ...

2) 3 priors? Just after a major low and before price acceleration (2020).

Only a 1st pass. Blees is programmed in so this takes a few min. Basically, non-comm net near lows ~ commercial net near highs. 18W Blees > 93 yet gold +5.57% in 25D.

This uses only days with new COT ...

Only a 1st pass. Blees is programmed in so this takes a few min. Basically, non-comm net near lows ~ commercial net near highs. 18W Blees > 93 yet gold +5.57% in 25D.

This uses only days with new COT ...

3) data (1 day/week). Other days are ignored since we don& #39;t have positioning (or Blees) info.

BTW, standard 18M Blees hitting 100 early Mar wasn& #39;t bad. Still remains a LT bullish sign. @BobLoukas

As mentioned before, the only failure was 2013 (taper ... https://twitter.com/ResearchQf/status/1368947849128534019">https://twitter.com/ResearchQ...

BTW, standard 18M Blees hitting 100 early Mar wasn& #39;t bad. Still remains a LT bullish sign. @BobLoukas

As mentioned before, the only failure was 2013 (taper ... https://twitter.com/ResearchQf/status/1368947849128534019">https://twitter.com/ResearchQ...

4) tantrum). Bernanke signaled his intentions May 2013.

I& #39;ve said a dozen times this isn& #39;t 2013.

After May 2013, nominal 10Y #yields rose 1.1% by Sep. #Inflation expectations FELL 0.2%, so real yields rose 1.3%!

We& #39;ve had a tantrum w/o a taper since last Aug. Nominal 10Y ...

I& #39;ve said a dozen times this isn& #39;t 2013.

After May 2013, nominal 10Y #yields rose 1.1% by Sep. #Inflation expectations FELL 0.2%, so real yields rose 1.3%!

We& #39;ve had a tantrum w/o a taper since last Aug. Nominal 10Y ...

5) rates rose +1.1% but inflation expectations are up +0.9%. So real rates only rose +0.2%.

So in 2013, real rates were 120% of the rise in nominal rates.

Since last Aug, real rates are just ~20% of rise in nominals.

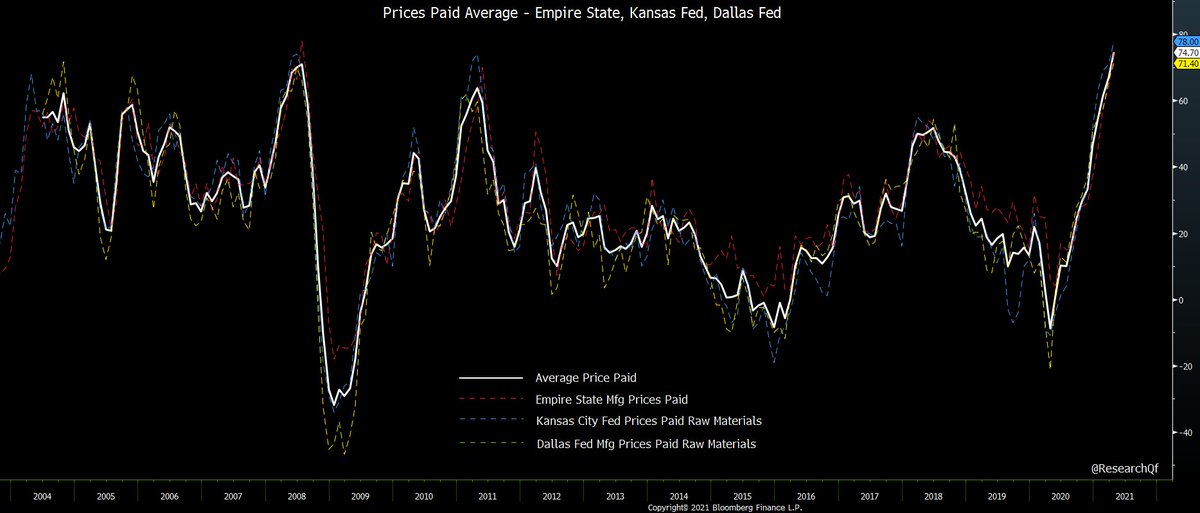

Also remember avg prices paid in Apr Fed surveys was ...

So in 2013, real rates were 120% of the rise in nominal rates.

Since last Aug, real rates are just ~20% of rise in nominals.

Also remember avg prices paid in Apr Fed surveys was ...

6) highest in over 2 decades at 75. This M/M diffusion index average was closer to 15 in 2013.

And #ISM prices index rose again to 89.6 in Apr (vs ~50 summer 2013).

There are many more very fundamental differences. Anyways, this will not be 2013. https://twitter.com/ResearchQf/status/1389236040364400640">https://twitter.com/ResearchQ...

And #ISM prices index rose again to 89.6 in Apr (vs ~50 summer 2013).

There are many more very fundamental differences. Anyways, this will not be 2013. https://twitter.com/ResearchQf/status/1389236040364400640">https://twitter.com/ResearchQ...

Read on Twitter

Read on Twitter