Something I& #39;ve been thinking about with DeFi recently is how you could use yield farming & staking to diversify your investments across L1s / L2s while making some money along the way

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Say you& #39;re bullish on @0xPolygon, but you also don& #39;t want to stop buying into Ethereum.

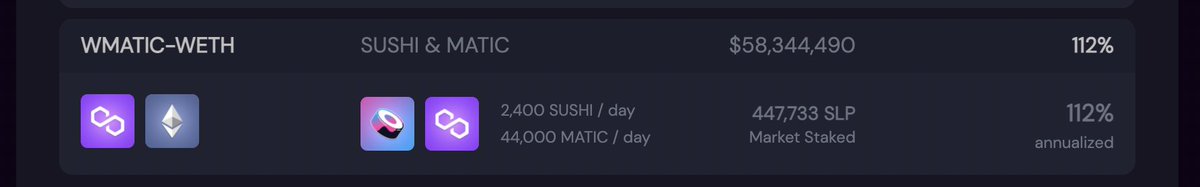

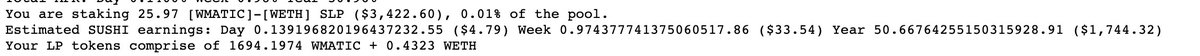

Well one option would be to move some money over to the Polygon network, buy a combination of Matic and Ether, provide those as liquidity on @SushiSwap, and then stake your LP tokens.

Well one option would be to move some money over to the Polygon network, buy a combination of Matic and Ether, provide those as liquidity on @SushiSwap, and then stake your LP tokens.

By doing this you& #39;re buying a combination of Ether / Matic so you have upside if either or both go up.

You also have some hedge if one goes up but the other doesn& #39;t.

And you& #39;re earning Sushi / Matic along the way by providing liquidity to SushiSwap.

You also have some hedge if one goes up but the other doesn& #39;t.

And you& #39;re earning Sushi / Matic along the way by providing liquidity to SushiSwap.

The MATIC/ETH stake on Sushi on Polygon right now is earning ~100% annualized.

It probably won& #39;t stay that high, but even if it& #39;s 10-20% that& #39;s some bonus upside you can earn for holding tokens you were interested in anyway.

Especially if you& #39;re bullish on Sushi (I am).

It probably won& #39;t stay that high, but even if it& #39;s 10-20% that& #39;s some bonus upside you can earn for holding tokens you were interested in anyway.

Especially if you& #39;re bullish on Sushi (I am).

Not investment advice and do your own research of course.

Obviously there are other platform risks and such, but this is a neat way to get some extra upside and get more involved in DeFi pretty passively.

And it& #39;s fun to watch your numbers in @vfat12 and @zapper_fi

Obviously there are other platform risks and such, but this is a neat way to get some extra upside and get more involved in DeFi pretty passively.

And it& #39;s fun to watch your numbers in @vfat12 and @zapper_fi

Read on Twitter

Read on Twitter