Fedcoin Replacing the US Dollar

A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://piggybankcoins.com/fedcoin-replacing-the-us-dollar/">https://piggybankcoins.com/fedcoin-r...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://piggybankcoins.com/fedcoin-replacing-the-us-dollar/">https://piggybankcoins.com/fedcoin-r...

A thread

In this article we will learn about Fedcoin replacing the US Dollar. In addition, a new Federal Reserve digital dollar wallet is to be created.

Finally, we will see how the new digital currency is different from Bitcoin and how the wallet may be used as tool for social engineering.

““Banks, credit card companies and digital payments processors are nervously watching the push to create an electronic alternative to the paper bills Americans carry in their wallets, or what some call a digital dollar and others call a Fedcoin.

As soon as July, officials at the Federal Reserve Bank of Boston and the Massachusetts Institute of Technology, which have been developing prototypes for a digital dollar platform, plan to unveil their research, said James Cunha, who leads the project for the Boston Fed.” –…

…Bloomberg News Article, March 22, 2021 ( https://www.bloomberg.com/news/articles/2021-03-22/federal-reserve-s-digital-dollar-momentum-worries-wall-street)”">https://www.bloomberg.com/news/arti... –

Although the Federal Reserve and MIT are planning on revealing their research later this summer, rollout of the Fedcoin electronic currency may take years. In addition, Fedcoin replacing the us dollar will be a big deal which may involve US Legislators.

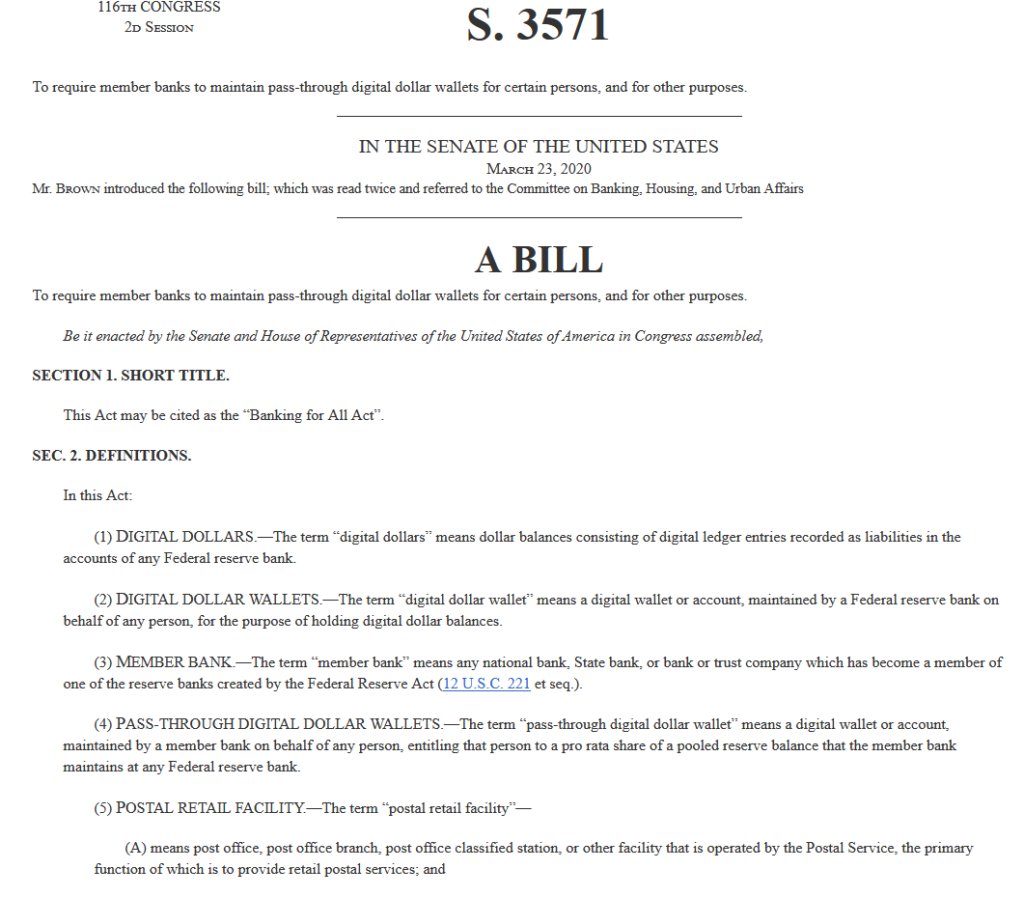

The Banking for All Act

During the midst of the COVID-19 crisis in 2020, Congress and the Senate quietly passed “The Banking for All Act.” The new law requires Federal Reserve “member banks to maintain pass-through digital dollar wallets” for Americans.

During the midst of the COVID-19 crisis in 2020, Congress and the Senate quietly passed “The Banking for All Act.” The new law requires Federal Reserve “member banks to maintain pass-through digital dollar wallets” for Americans.

If the rumor is true of Fedcoin replacing the US Dollar, there must be a digital wallet to accompany the Fedcoin.

““Digital Dollar Wallet means a digital wallet or account, maintained by a Federal reserve bank on behalf of any person, for the purpose of holding digital dollar balances.” – Website for the United States Congress, S.3571 ( https://www.congress.gov/bill/116th-congress/senate-bill/3571/text)”">https://www.congress.gov/bill/116t... –

The new digital dollar wallet is different than traditional banking. For example, interest is paid to the account holder. In addition, there are no minimum account balance requirements or account fees.

The ostensible purpose of the digital dollar wallet is to allow the Federal Reserve Bank to put money into American’s bank accounts. However, instead of collecting your personal banking information, the US Government is creating a new account for you.

As a result, Fedcoin replacing the us dollar in the digital space negates the use of the paper dollar.

Additionally, during times of crisis (like the COVID-19 Pandemic), governments can provide welfare payments to citizens. Unfortunately, allowing a central government to control your money may not be a good idea.

Some people are concerned that allowing government bureaucrats to control your money via a digital dollar wallet may be giving them too much power. For example, what if the administrators of your digital dollar wallet decide that you are purchasing things that are not acceptable?

Perhaps you bought too much beer or cigarettes using your account.

Would the Federal Reserve Bank then freeze your Fedcoin wallet, preventing you from buying anything? If you think this is impossible, it’s not. Governments can easily change citizen’s behavior by controlling money.

Furthermore, Fedcoin replacing the us dollar seems to be happening, whether we like it or not.

China’s Social Engineering Experiment

Think governments limiting citizen’s freedoms is a conspiracy theory? Think again. In early 2019, a report stated that China banned more than 20 million people from traveling. This was because their “social credit score” was too low.

““Skipped paying a fine in China? Then forget about buying an airline ticket.

Would-be air travelers were blocked from buying tickets 17.5 million times last year for “social credit” offenses including unpaid taxes and fines under a controversial system the ruling Communist Party says will improve public behavior.

Others were barred 5.5 million times from buying train tickets, according to the National Public Credit Information Center.

In an annual report, it said 128 people were blocked from leaving China due to unpaid taxes.” – AP News Article entitled, “China bars millions from travel for ‘social credit score’ offenses” – February 22, 2019 by Joe McDonald ( https://apnews.com/article/9d43f4b74260411797043ddd391c13d8)”">https://apnews.com/article/9... –

Social Engineering occurs when governments attempt to influence people’s decisions through incentives or disincentives.

““the use of centralized planning in an attempt to manage social change and regulate the future development and behavior of a society.” – Social Engineering defined, Google Dictionary ( http://www.google.com/ )”">https://www.google.com/">... –

The Federal Reserve Exploring Distributed Ledger (Block Chain) Technology

For several years, the US Federal Reserve bank has been researching distributed ledger technology. This technology, also known as block chain technology, is part of the building blocks of the cryptocurrency Bitcoin.

“With these important issues in mind, the Federal Reserve is active in conducting research and experimentation related to distributed ledger technologies and the potential use cases for digital currencies.” – Federal Reserve Governor Lael Brainard on August 13, 2020

Distributed Ledger (Block Chain) Technology: Bitcoin vs Fedcoin

The functionality of Bitcoin depends upon miners who contribute to the system. The miners use computers to complete complex calculations which build blocks on the block chain. Miners receive payment subsequent to completion of a block.

Without miners, the block chain would cease to operate and transactions would grind to a halt.

As a result, it is unclear how the Federal Reserve Bank will operate Fedcoin and the digital dollar wallets using distributed ledger technology.

The new system will likely be a simple, centralized network that does not use the proof of work model of solving equations like Bitcoin. There is no doubt that Fedcoin replacing the us dollar is under way. However, Bitcoin will remain a decentralized store of value.

It is important to understand that there is a critical difference between the cryptocurrency Bitcoin and Fedcoin. The primary difference is that Fedcoin is a centrally controlled currency. It does not use blockchain technology or a distributed ledger with a proof of work system.

Fedcoin is simply numbers on a computer screen. It is created by a central bank.

Bitcoin (BTC) Explained

BTC is a Peer-to-Peer Cryptocurrency Payment System

Bitcoin is an open-source, block chain-based technology. In addition, Bitcoin is a payment system. Furthermore, Bitcoin is secure and anonymous among individuals. Finally, Bitcoin is like digital cash.

Bitcoin is an open-source, block chain-based technology. In addition, Bitcoin is a payment system. Furthermore, Bitcoin is secure and anonymous among individuals. Finally, Bitcoin is like digital cash.

Using block chain technology to maintain its functionality, Bitcoin miners contribute to the system. In order for users to send and receive bitcoin, the block chain depends on miners. Moreover, miners use computers to complete complex calculations.

As a reward, the miners receive Bitcoin when each block is completed.

Bitcoin was born in January 2009.

It is unknown who invented bitcoin; however, a developer named Satoshi Nakamoto (probably a pseudonym) released a 9-page white paper entitled, “Bitcoin: A Peer-to-Peer Electronic Cash System.” ( https://bitcoin.org/bitcoin.pdf )">https://bitcoin.org/bitcoin.p... The Bitcoin white paper describes Bitcoin’s purpose and…

…how it works.

American Universal Basic Income

There’s a concern among some that digital dollar wallets will lead to the formation of a welfare state in the United States.

Moreover, if the Federal Reserve Bank has the ability to print currency to no end, creating money out of thin air, then why not give some directly to citizens?

““Universal Basic Income (UBI) is a government program in which every adult citizen receives a set amount of money on a regular basis.

The goals of a basic income system are to alleviate poverty and replace other need-based social programs that potentially require greater bureaucratic involvement.” –Investopedia ( https://www.investopedia.com/terms/b/basic-income.asp),">https://www.investopedia.com/terms/b/b... Universal Basic Income” –

By creating a special bank account or digital dollar wallet for American Citizens, the Federal Reserve Bank opens the door to the welfare state and to collective control of its citizens. This kind of quid pro quo banking keeps the masses under the thumb of government.

As a result, with Fedcoin replacing the us dollar, it will also play an important role in the growing social welfare state.

The New American Socialism: Universal Basic Income

43% of Americans Believe Socialism is a Good Thing

Providing Americans a digital dollar wallet is a form of socialism. Historically, America has been a population that embraced capitalism and entrepreneurship. However, beliefs in the 21st century appear to be changing.

In fact, Americans may be approaching a tipping point regarding the adoption of socialism.

According to a 2019 Gallup Poll ( https://news.gallup.com/poll/257639/four-americans-embrace-form-socialism.aspx),">https://news.gallup.com/poll/2576... 43% of Americans believe that socialism is a good thing. In contrast, only 25% of Americans supported socialism in 1942. Clearly, Americans have shifted to believe that socialism is a positive thing.

With Fedcoin replacing the us dollar, it is a way for the state to buy more votes for socialism.

The socialist idea of a universal basic income has become a mainstream political issue in 2020. Andrew Yang ( https://en.wikipedia.org/wiki/Andrew_Yang),">https://en.wikipedia.org/wiki/Andr... an American entrepreneur, ran as a presidential candidate in the 2020 Democratic primaries.

One of the policies of his political platform was to create a universal basic income for Americans. He called it the “Freedom Dividend” in which every American would receive $1,000 each month. This idea was wildly popular among many younger voters.

Wrap Up: Fedcoin Replacing the US Dollar

It seems clear that Fedcoin replacing the us dollar is happening now. The Federal Reserve, MIT and others in the US government are working hard to bring the plan to fruition. The new digital dollar wallet will be introduced sometime in 2021 by the Federal Reserve Bank and MIT.

Sometime later, everyone in the United States have a digital dollar wallet with Fedcoin in it.

““All Federal reserve banks shall, not later than January 1, 2021, make digital wallets available to all residents and citizens of the United States” – Website for the United States Congress, S.3571 ( https://www.congress.gov/bill/116th-congress/senate-bill/3571/text)”">https://www.congress.gov/bill/116t... –

Are you ready for Fedcoin?

Read More:

Are you ready for Fedcoin?

Read More:

Best Cryptocurrency ( https://piggybankcoins.com/best-cryptocurrency/)

The">https://piggybankcoins.com/best-cryp... Fastest Growing Cryptocurrency ( https://piggybankcoins.com/the-fastest-growing-cryptocurrency/)

One">https://piggybankcoins.com/the-faste... World Currency ( https://piggybankcoins.com/one-world-currency/)

Why">https://piggybankcoins.com/one-world... Saving Money is Important ( https://piggybankcoins.com/why-saving-money-is-important/)

The">https://piggybankcoins.com/why-savin... Best Budget App ( https://piggybankcoins.com/the-best-budget-app/)">https://piggybankcoins.com/the-best-...

The">https://piggybankcoins.com/best-cryp... Fastest Growing Cryptocurrency ( https://piggybankcoins.com/the-fastest-growing-cryptocurrency/)

One">https://piggybankcoins.com/the-faste... World Currency ( https://piggybankcoins.com/one-world-currency/)

Why">https://piggybankcoins.com/one-world... Saving Money is Important ( https://piggybankcoins.com/why-saving-money-is-important/)

The">https://piggybankcoins.com/why-savin... Best Budget App ( https://piggybankcoins.com/the-best-budget-app/)">https://piggybankcoins.com/the-best-...

US Dollar History: How the Dollar Became the World Reserve Currency ( https://piggybankcoins.com/us-dollar-history-how-the-dollar-became-the-world-reserve-currency/)

How">https://piggybankcoins.com/us-dollar... Much Savings You Should Have at 40 ( https://piggybankcoins.com/how-much-savings-you-should-have-at-40/)

Ways">https://piggybankcoins.com/how-much-... to Save Money on a Tight Budget ( https://piggybankcoins.com/ways-to-save-money-on-a-tight-budget/)

Best">https://piggybankcoins.com/ways-to-s... Budget Planner ( https://piggybankcoins.com/best-budget-planner/)">https://piggybankcoins.com/best-budg...

How">https://piggybankcoins.com/us-dollar... Much Savings You Should Have at 40 ( https://piggybankcoins.com/how-much-savings-you-should-have-at-40/)

Ways">https://piggybankcoins.com/how-much-... to Save Money on a Tight Budget ( https://piggybankcoins.com/ways-to-save-money-on-a-tight-budget/)

Best">https://piggybankcoins.com/ways-to-s... Budget Planner ( https://piggybankcoins.com/best-budget-planner/)">https://piggybankcoins.com/best-budg...

Home Buying Power ( https://piggybankcoins.com/home-buying-power/)

Purchasing">https://piggybankcoins.com/home-buyi... Power Risk ( https://piggybankcoins.com/purchasing-power-risk/)

Disclaimer:">https://piggybankcoins.com/purchasin...

Purchasing">https://piggybankcoins.com/home-buyi... Power Risk ( https://piggybankcoins.com/purchasing-power-risk/)

Disclaimer:">https://piggybankcoins.com/purchasin...

It is important to note that Piggy Bank Coins does not provide financial advice. We don’t endorse or recommend any financial investments. Instead, we provide information for educational purposes to those seeking knowledge regarding personal finance.

However, in the spirit of transparency, note that the author is an investor in cryptocurrencies, precious metals and some equities.

In addition, The Federal Trade Commission (FTC) requires that Piggy Bank Coins disclose to readers that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons.

Moreover, we try our best to keep things fair and balanced, to help you make the best choice for you.

This thread can be read here: https://piggybankcoins.com/fedcoin-replacing-the-us-dollar/">https://piggybankcoins.com/fedcoin-r...

Read on Twitter

Read on Twitter