Vijay Kedia Success Story

~ A Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

~ A Thread

Dr. Vijay Kishanlal Kedia is an Indian investor/trader born in Calcutta.

He is involved in the market since he was 19. Kedia and his company - Kedia Securities Pvt. Ltd. are the largest shareholders (after the promoter) in several listed companies in the market.

He is involved in the market since he was 19. Kedia and his company - Kedia Securities Pvt. Ltd. are the largest shareholders (after the promoter) in several listed companies in the market.

As of April 2020, his net worth was estimated to be around Rs. 297 Cr

Early Life ~

Vijay was born into a family of stockbrokers. Right from his early age, he was always interested in the stock market.

He gained knowledge about the Stock Market when he was just 14 through his grandfather.

Vijay was born into a family of stockbrokers. Right from his early age, he was always interested in the stock market.

He gained knowledge about the Stock Market when he was just 14 through his grandfather.

After his father& #39;s death, he wanted to start his own business but couldn’t do it due to a lack of money.

Then He joined his family’s stockbroking business. But, he was not fascinated by stockbroking; That’s why at the age of 19, he started trading in the stock market.

Then He joined his family’s stockbroking business. But, he was not fascinated by stockbroking; That’s why at the age of 19, he started trading in the stock market.

Career as an investor ~

Although started his stock market journey as a trader, he quickly found out that trading isn& #39;t worth it compared to investing.

Once, while trading, he faced a loss of Rs. 70,000 in Hindustan Motors within 2-3 days.

Although started his stock market journey as a trader, he quickly found out that trading isn& #39;t worth it compared to investing.

Once, while trading, he faced a loss of Rs. 70,000 in Hindustan Motors within 2-3 days.

Having burnt his hands, he switched over to long-term investing.

His first stock in his investing career was Punjab Tractors.

His first stock in his investing career was Punjab Tractors.

He had only Rs. 35,000 at the beginning of this journey and invested all in Punjab Tractors.

Then, within the next three years, Punjab Tractors expanded to 4-5 times.

Then, within the next three years, Punjab Tractors expanded to 4-5 times.

In 1992-93, he picked ACC at Rs 300 and sold at around Rs 3,000 within a year and a half.

He used the money from that to buy his first home in Mumbai.

He used the money from that to buy his first home in Mumbai.

Over the years, he has picked up several multi-bagger stocks that have given him a significant return(>1000%).

A few of the stocks were Atul Auto, Aegis Logistics, and Cera sanitary ware.

A few of the stocks were Atul Auto, Aegis Logistics, and Cera sanitary ware.

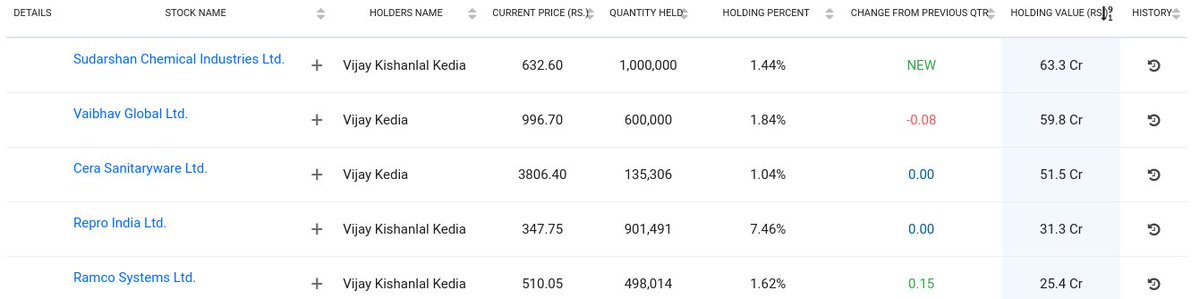

Current top 5 stocks in Vijay& #39;s portfolio in terms of holding value :

<Click on the image to expand>

<Click on the image to expand>

Vijay Kedia& #39;s investment strategy ~

Kedia strictly adheres to SMILE as a principle in investing; which translates into Small in size, Medium in experience, Large in aspiration, and Extra-large in market potential.

Kedia strictly adheres to SMILE as a principle in investing; which translates into Small in size, Medium in experience, Large in aspiration, and Extra-large in market potential.

On his investment strategy, Kedia said: "One should scout for companies which have good management... Find a very good management, a very honest management and see the product in which the management is going to grow...

...going to outperform its peers and the economy... invest in those companies for the next 10-15 years, and you cannot go wrong."

While luck plays a big part in stock market investments, knowledge, courage, and patience are the cornerstones according to him.

While luck plays a big part in stock market investments, knowledge, courage, and patience are the cornerstones according to him.

If you liked this Thread, do retweet the first tweet so that it reaches others too. Thanks! https://twitter.com/rktalksmoney/status/1391261317072187393">https://twitter.com/rktalksmo...

Also, check out my Thread on Rakesh Jhunjhunwala - "Warren Buffet of India"  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://twitter.com/rktalksmoney/status/1390964279096999937">https://twitter.com/rktalksmo...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://twitter.com/rktalksmoney/status/1390964279096999937">https://twitter.com/rktalksmo...

Read on Twitter

Read on Twitter " title="Vijay Kedia Success Story ~ A Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">" class="img-responsive" style="max-width:100%;"/>

" title="Vijay Kedia Success Story ~ A Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">" class="img-responsive" style="max-width:100%;"/>