Been hearing "Why is Coinbase trading like a shitcoin?" a lot lately. Here& #39;s why, IMO:

- Volume growth isn& #39;t as high or valuable as you think

- Wall St. is treating 2021 volume as mostly non-recurring

- $COIN hasn& #39;t yet proven its ability to reinvest cash productively

LFG:

- Volume growth isn& #39;t as high or valuable as you think

- Wall St. is treating 2021 volume as mostly non-recurring

- $COIN hasn& #39;t yet proven its ability to reinvest cash productively

LFG:

To get the facts out of the way:

- $263.70 closing price today

- $49B market cap

That& #39;s -39% off its $429 high, -31% from its $381 opening price. Yikes.

- $263.70 closing price today

- $49B market cap

That& #39;s -39% off its $429 high, -31% from its $381 opening price. Yikes.

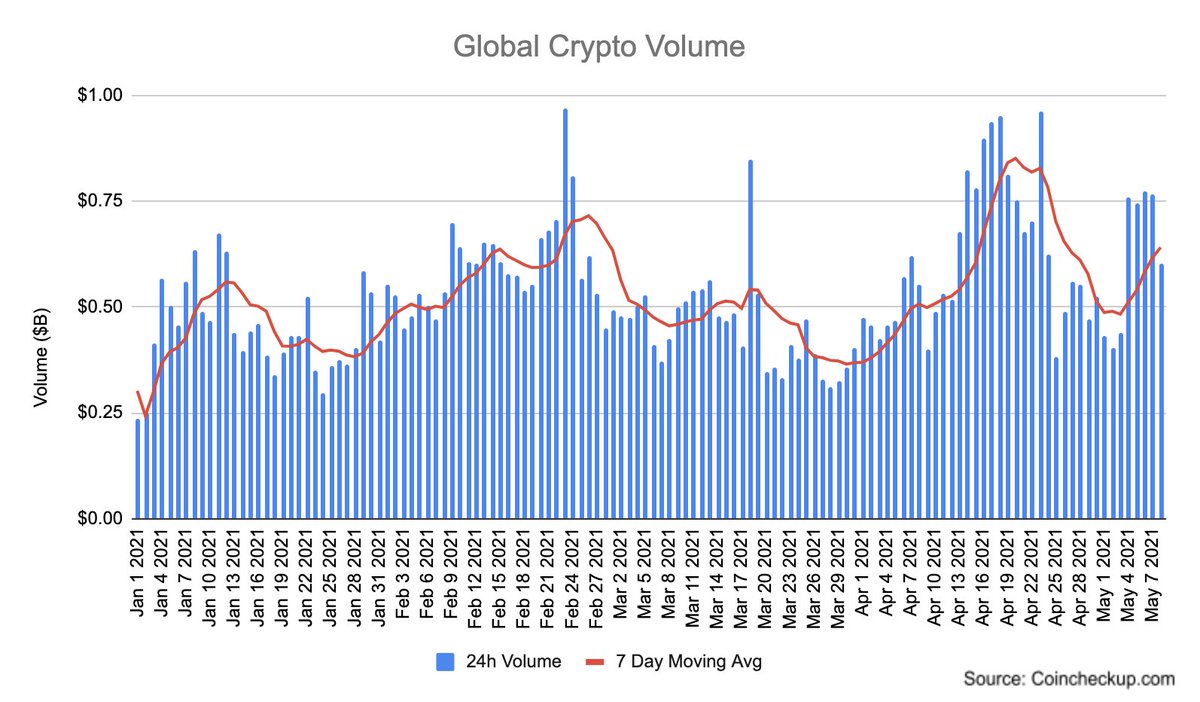

1. Volumes. Stare at this chart of global crypto volume, what do you see?

- High volatility

- Q1: $44.5B, Q2 to-date: $23.5B

- Avg volume +25% vs. Q1 so far

Quarter& #39;s ~halfway over, so let& #39;s say volume accelerates through the rest of the quarter and we end up with +30% vs. Q1.

- High volatility

- Q1: $44.5B, Q2 to-date: $23.5B

- Avg volume +25% vs. Q1 so far

Quarter& #39;s ~halfway over, so let& #39;s say volume accelerates through the rest of the quarter and we end up with +30% vs. Q1.

Everything is looking beast mode (especially $ETH) and total crypto market cap is up just +31% since April 1.

Yet that volume boost won& #39;t translate effectively into market cap.

Yet that volume boost won& #39;t translate effectively into market cap.

2. How do we value it?

Recapping Q1:

- $1.8B revenue (86% from trading)

- $1.1B EBITDA

Assume we keep the 0.56% take-rate even though it was way down from 0.67% prior Q as a result of:

- Margin-dilutive custody/institutional business

- People discovering @CoinbasePro??

Recapping Q1:

- $1.8B revenue (86% from trading)

- $1.1B EBITDA

Assume we keep the 0.56% take-rate even though it was way down from 0.67% prior Q as a result of:

- Margin-dilutive custody/institutional business

- People discovering @CoinbasePro??

So we have $1.55B of transaction-related revenue that grows +30% in Q2 --> $2B, and say the other $250M of custody/institutional grows at 50% to $375M.

Run-rate:

$8B transaction-related

$1.5B custody/recurring

So ~$10B of revenue and say $6.5B in EBITDA.

FUCKING MONSTER.

Run-rate:

$8B transaction-related

$1.5B custody/recurring

So ~$10B of revenue and say $6.5B in EBITDA.

FUCKING MONSTER.

So what& #39;s the deal?? 8x EBITDA??? How is that possible?

IMO the custody stuff is getting valued like a fast-growing SaaS business--15-20x revenue, so let& #39;s make the math easy and say $25B.

And they& #39;re getting no credit for the trading side of the business.

IMO the custody stuff is getting valued like a fast-growing SaaS business--15-20x revenue, so let& #39;s make the math easy and say $25B.

And they& #39;re getting no credit for the trading side of the business.

The remaining $24B of market cap implies a 3x multiple on transaction revenues.

Essentially Wall St. is saying, "Yeahhh so I& #39;m like, pretty sure you& #39;re not going to get this type of UP ONLY energy ever again."

2021 trading volume is being seen as a 1x event.

Essentially Wall St. is saying, "Yeahhh so I& #39;m like, pretty sure you& #39;re not going to get this type of UP ONLY energy ever again."

2021 trading volume is being seen as a 1x event.

Okay, you say, but Coinbase is actually *printing cash.* Like, billions of it. Can& #39;t they just reinvest it all into accelerating growth?

I mean, not really-- @brian_armstrong & team are already running into the Big Tech Monopoly problem.

They& #39;re already the largest US exchange.

I mean, not really-- @brian_armstrong & team are already running into the Big Tech Monopoly problem.

They& #39;re already the largest US exchange.

If you trade crypto in the U.S., you likely have Coinbase, which means Coinbase already has maximum mindshare within crypto.

The only way it can grow is onboarding new customers to crypto entirely--but that& #39;s going to happen secularly anyway, so more marketing isn& #39;t great ROI.

The only way it can grow is onboarding new customers to crypto entirely--but that& #39;s going to happen secularly anyway, so more marketing isn& #39;t great ROI.

3. New businesses

Finally, they don& #39;t (yet) have a track record of pumping out gigantic, recurring revenue businesses--it& #39;s not even clear what that would look like yet beyond custody and @BisonTrails.

* And Coinbase has to invent this new category of business to succeed. *

Finally, they don& #39;t (yet) have a track record of pumping out gigantic, recurring revenue businesses--it& #39;s not even clear what that would look like yet beyond custody and @BisonTrails.

* And Coinbase has to invent this new category of business to succeed. *

Read on Twitter

Read on Twitter