Tide is fading. Who is swimming naked? Many of us are struggling because growth stocks have corrected so much. Many have been in denial hoping for a come up. The pattern is extremely similar to year 2000 tech bubble except big techs are behaving differently this time.

-cont

-cont

Market has been discounting speculative tech names due to rising yields, inflation fear, now potentially early Fed tapering & early chance of raising Fed rates.

Where do we go from here?

-cont

Where do we go from here?

-cont

My thoughts are:

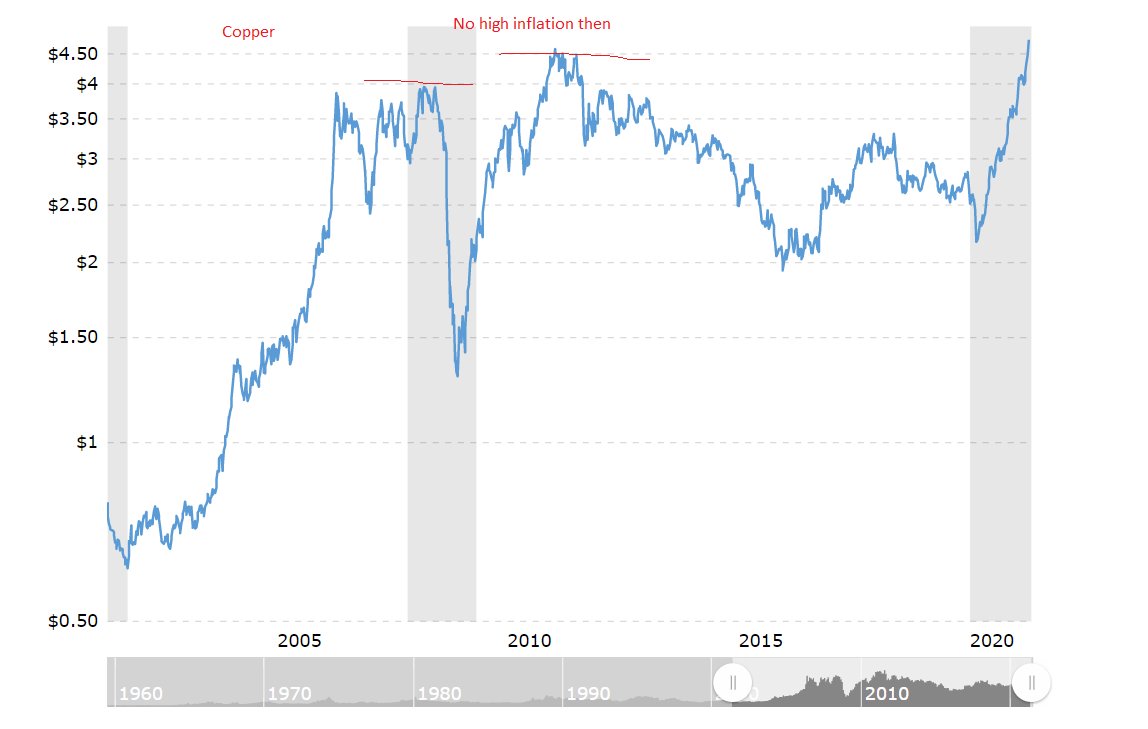

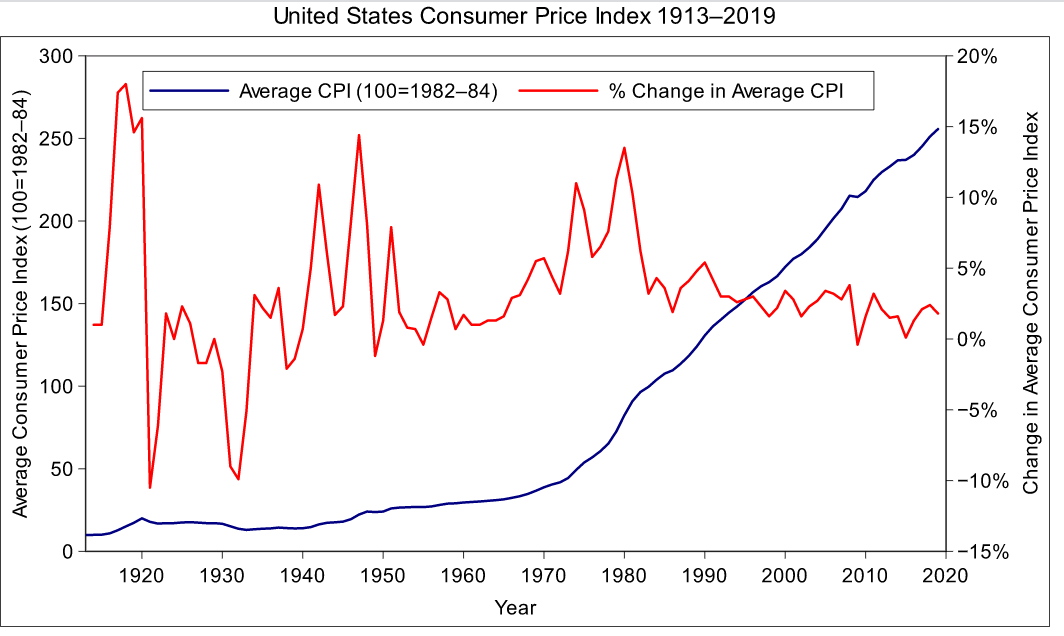

- Inflation is temporary b/c they are supply driven. I don& #39;t believe we will ever see demand driven inflation in our live span. Price rising in material won& #39;t necessarily translate into prolonged periods of high inflation in consumer prices.

-cont

- Inflation is temporary b/c they are supply driven. I don& #39;t believe we will ever see demand driven inflation in our live span. Price rising in material won& #39;t necessarily translate into prolonged periods of high inflation in consumer prices.

-cont

- Please note fixed assets, such as houses, stocks, NFTs, gold, cryptos, do not count as part of the inflation. They can keep going up with low consumer inflation. At least that& #39;s how Fed calculates it.

-cont

-cont

- 10 yr Yield will go back above 2% but with Fed& #39;s support we won& #39;t see too much over 3%. Ten year bond yield swang between 2-4 percent for the next 10 years after 2008 market crash. It wasn& #39;t much of a topic then.

-cont

-cont

-Fed won& #39;t raise rate for a long time IMHO. The reasoning is Covid will be with us for a while. Spanish flu lasted only two years but Covid could last longer. Ironically it is because we have vaccine. Vaccine puts off direct fight between human immune system & the virus imo

-cont

-cont

- The battle is effectively being dragged longer. I am not an expert on this. Just some gut feelings. Plus, Fed didn& #39;t raise rate for 6 year since 2008 crash.

-cont

-cont

In conclusion

-I like gold b/c they were falling behind & now doing catch up

-Copper is still good thanks to upcoming infrastructure plan & global recovery

-Good growth names will come back as rate will remain low for a long time. Some of good names are oversold already.

-cont

-I like gold b/c they were falling behind & now doing catch up

-Copper is still good thanks to upcoming infrastructure plan & global recovery

-Good growth names will come back as rate will remain low for a long time. Some of good names are oversold already.

-cont

As a trader or investor, adapting to the current market environment is imperative. Good traders from last year could be the worst ones this year.

Be adaptive. Be strong. Stay in control. Mange your risk. We will make it!

Be adaptive. Be strong. Stay in control. Mange your risk. We will make it!

Read on Twitter

Read on Twitter