So PagerDuty is one of the most interesting SaaS case studies

It IPO& #39;d at $125m ARR selling mainly to SMBs, with just 100 larger customers

But to get to $250m ARR, it went quite enterprise. But not until well >after< IPO

5 Interesting Learnings: https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

It IPO& #39;d at $125m ARR selling mainly to SMBs, with just 100 larger customers

But to get to $250m ARR, it went quite enterprise. But not until well >after< IPO

5 Interesting Learnings:

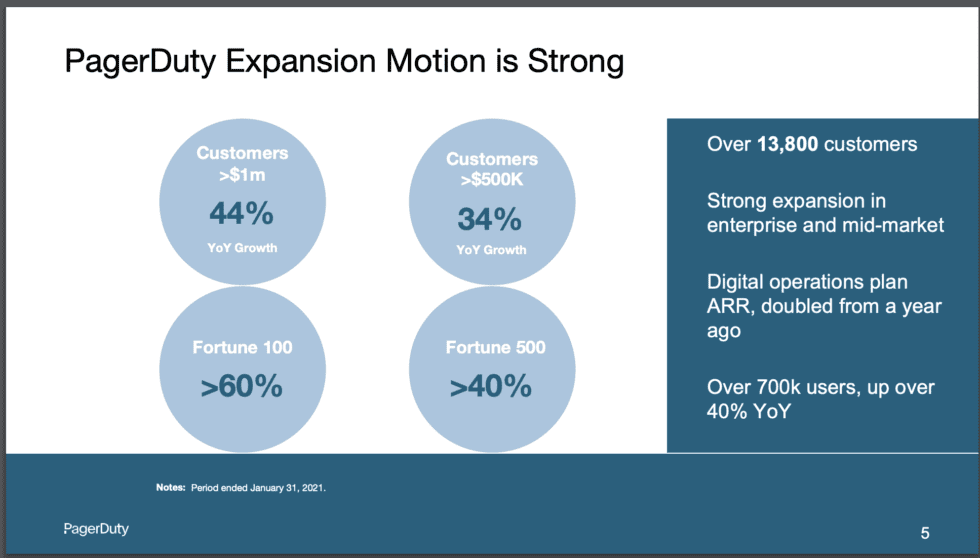

#1. PagerDuty’s biggest change has been in going upmarket and more enterprise post-IPO.

That segment is growing 44% vs. 28% overall

It’s an interesting contrast to Zoom, Zendesk, and Slack, which recently have seen enterprise and SMB growth be about equal post-Covid.

That segment is growing 44% vs. 28% overall

It’s an interesting contrast to Zoom, Zendesk, and Slack, which recently have seen enterprise and SMB growth be about equal post-Covid.

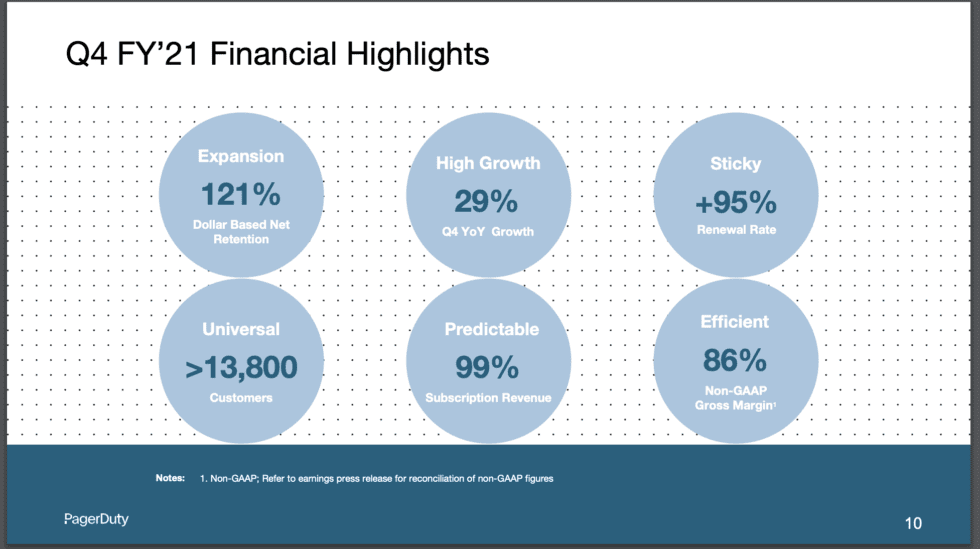

#2. NRR is up after going more enterprise, but not as much as you might think

PagerDuty’s NRR of 121% remains very impressive -- but is basically same as when they were more SMB, despite the largest growth being in $500k & $1m+ customers

PagerDuty’s NRR of 121% remains very impressive -- but is basically same as when they were more SMB, despite the largest growth being in $500k & $1m+ customers

#3. 95% renewal rate, even with 10,000+ SMBs.

Even with 10,000+ SMB customers out of 13,800 total, PagerDuty sees an incredible 95% renewal rate

This is far higher than many products that sell to small businesses

You can do it, too -- if you add enough value. #noexcuses

Even with 10,000+ SMB customers out of 13,800 total, PagerDuty sees an incredible 95% renewal rate

This is far higher than many products that sell to small businesses

You can do it, too -- if you add enough value. #noexcuses

#4. 8th straight quarter where at least 33% of its enterprise customer accounts expanded.

This is an interesting way to see NRR presented and maybe a good KPI to track, i.e. what % of your customers each quarter have grown?

At PagerDuty, it’s been 33%+ for 8+ quarters

This is an interesting way to see NRR presented and maybe a good KPI to track, i.e. what % of your customers each quarter have grown?

At PagerDuty, it’s been 33%+ for 8+ quarters

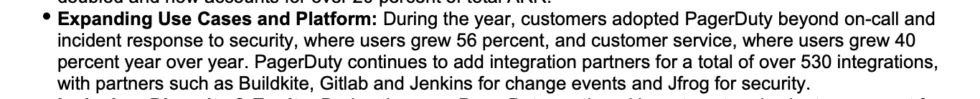

#5. Expanding beyond its core product is key to growth

We’ve seen this time & time again after $100m ARR

PagerDuty’s core product is incident response

* Customers who also use it for security grew 56%

* Customers who also used it for customer service grew 40%.

* vs 28% overall

We’ve seen this time & time again after $100m ARR

PagerDuty’s core product is incident response

* Customers who also use it for security grew 56%

* Customers who also used it for customer service grew 40%.

* vs 28% overall

A deeper dive here: https://www.saastr.com/5-interesting-learnings-from-pagerduty-at-250000000-in-arr/">https://www.saastr.com/5-interes...

Read on Twitter

Read on Twitter