1/ "The really great painters are the ones that change how other people paint, like Picasso. David Swensen changed how everyone who is serious about investing thinks about investing,” says Charles Ellis, who chaired Yale’s endowment between 1997 and 2008.

2/ "Swensen understood the value of optionality intuitively and was also not afraid to play very aggressively when he thought the odds favoured him,” says Robert Wallace, who Swensen hired as an intern."

3/ "I think I learned as much from David during our conversations over the poker table as I did in the formal meetings,” he says.

For those not at the poker table, Swensen’s 2000 magnum opus, Pioneering Portfolio Management, allowed them to absorb his investment philosophy."

For those not at the poker table, Swensen’s 2000 magnum opus, Pioneering Portfolio Management, allowed them to absorb his investment philosophy."

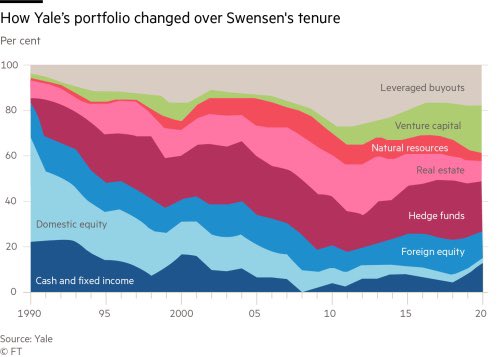

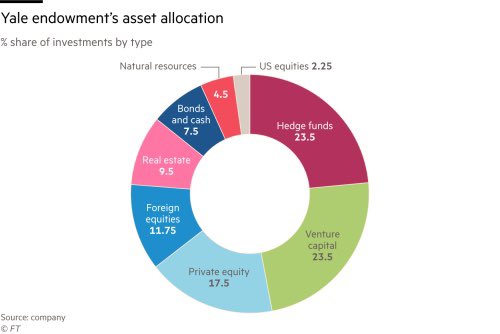

4/ "In 1985, Swensen inherited a portfolio that was 40% invested in bonds, with more than half in U.S. stocks. This was a classic “60/40” portfolio of stocks and bonds, mostly actively managed. By last year, only 2.5% of its holdings were in U.S. equities." https://www.bloomberg.com/opinion/articles/2021-05-07/david-swensen-death-yale-endowment-leader-transformed-investing">https://www.bloomberg.com/opinion/a...

5/ ".... bonds and cash accounted for 7.5%. Swensen& #39;s portfolio was dominated by absolute return hedge funds (23.5%), venture capital (also 23.5%) and leveraged buyout or private equity funds (17.5%). He also made forays into extremely illiquid real assets such as forestry."

Read on Twitter

Read on Twitter