What is pyramiding?

It is simply adding to your winners.

Why use pyramiding?

1. It makes your winners bigger than your losers.

• Because you are adding positions when your trades are going your way, you are increasing your gains but your losers will be small comparatively.

It is simply adding to your winners.

Why use pyramiding?

1. It makes your winners bigger than your losers.

• Because you are adding positions when your trades are going your way, you are increasing your gains but your losers will be small comparatively.

2. You lose less during Draw-down time ( it saves you from losing big during whipsaws )

• Many times when the market is in sideways mode, Entering a trade with full risk might not be the best idea.

• Many times when the market is in sideways mode, Entering a trade with full risk might not be the best idea.

• So, you test the waters with a small position first, it could be ⅓ or ¼ of your total risk.

• So if the Breakout fails or whipsaws come, then you will only lose a small part of your overall risk.

• Then when position starts to go in your favor you can add to it.

• So if the Breakout fails or whipsaws come, then you will only lose a small part of your overall risk.

• Then when position starts to go in your favor you can add to it.

3. It helps you to concentrate on a few trades,

They say that don’t put all your eggs in one basket, but don’t put them in too many either.

• See, Everyone can see charts and find breakouts, pullbacks etc.

They say that don’t put all your eggs in one basket, but don’t put them in too many either.

• See, Everyone can see charts and find breakouts, pullbacks etc.

• but what matters is the allocation of capital in your winners vs your losers, if you understand this you have already won half the game.

• George Soros once said, “It’s not whether you’re right or wrong that’s important,

• George Soros once said, “It’s not whether you’re right or wrong that’s important,

but how much money you make when you’re right and how much you lose when you’re wrong.”

Now let’s see how we can use pyramiding using different techniques-

There are basically two ways to do pyramiding -

1. Logical price action based pyramiding.

2. Price based pyramiding.

Now let’s see how we can use pyramiding using different techniques-

There are basically two ways to do pyramiding -

1. Logical price action based pyramiding.

2. Price based pyramiding.

If you had tried pyramiding before you might know that many times when you add on to the positions, your stock reverses and you don& #39;t make any money on the stock.

where if you would have not done pyramiding you would have made some money.

So how to correct this?

where if you would have not done pyramiding you would have made some money.

So how to correct this?

By using Logical price action based pyramiding.

What I mean from this is that I consider each pyramid as a different entry.

Then you will need triggers to enter the pyramiding positions.

Those triggers will be based upon the price action.

What I mean from this is that I consider each pyramid as a different entry.

Then you will need triggers to enter the pyramiding positions.

Those triggers will be based upon the price action.

Now, everyone reads price action differently, so there could be many ways to enter your pyramiding positions.

These are Few ways you can do pyramiding-

•Squats.

•Reversal candles.

•Normal movement.

•Shakeouts.

•Consolidation breakout.

These are Few ways you can do pyramiding-

•Squats.

•Reversal candles.

•Normal movement.

•Shakeouts.

•Consolidation breakout.

1. SQUATS-

This is basically when a breakout Fails and stock Falls below the Entry point and stays below that for 2-5 candles.

And then Snaps back up above the entry point and close above it.

This is basically when a breakout Fails and stock Falls below the Entry point and stays below that for 2-5 candles.

And then Snaps back up above the entry point and close above it.

This is a type of a shakeout.

• Points to remember-

• Volume should be lower when the stock Falls and goes below the Entry point.

• It& #39;s better if the volatility decreases when stock goes below the entry point, if the candles are highly volatile then it may not work.

• Points to remember-

• Volume should be lower when the stock Falls and goes below the Entry point.

• It& #39;s better if the volatility decreases when stock goes below the entry point, if the candles are highly volatile then it may not work.

2. REVERSAL CANDLES-

After the First entry look for the Reversal or weak candles, and we will pyramid when the stock closes above that Weak candle.

The Focus should be on volume of the weak candle, if it& #39;s more than the Buy candles volume,

After the First entry look for the Reversal or weak candles, and we will pyramid when the stock closes above that Weak candle.

The Focus should be on volume of the weak candle, if it& #39;s more than the Buy candles volume,

3. Normal Reactions-

• Normal reactions are the down moves (Retracements) that happen after a breakout, but on relatively lower volumes than the buying volume.

• Normal reactions are the down moves (Retracements) that happen after a breakout, but on relatively lower volumes than the buying volume.

• The Abnormal reaction is when the stock tries to go up but fails to do so, and the price and volumes gives indication of that,

as the price falls and volume increases aggressively.( we will talk about this in some other thread)

as the price falls and volume increases aggressively.( we will talk about this in some other thread)

• So, what we want to do is pyramid when the stock shows the NORMAL reaction.

• We will normally wait for 5-6 candles or when the stock holds a particular level (will give some examples in the thread)

• We will normally wait for 5-6 candles or when the stock holds a particular level (will give some examples in the thread)

• Some traders also call this, Tennis ball reaction.

• Basically if the stock has strength it will try to jump quickly after the normal reaction.

• Now, there are two types of traders who do aggressive pyramiding and others who do conservative pyramiding.

• Basically if the stock has strength it will try to jump quickly after the normal reaction.

• Now, there are two types of traders who do aggressive pyramiding and others who do conservative pyramiding.

• Aggressive traders will try to enter on the lower levels of the normal reaction.

• Conservative traders will wait for a good bullish candle and then enter above the high of that candle.

• You can choose what suits you.

• Conservative traders will wait for a good bullish candle and then enter above the high of that candle.

• You can choose what suits you.

4. Shakeouts-

• Shakeout is basically when price breaks below an important pivot level and then Jumps back above that level furiously.

• See, the Pivots that you see are visible to everyone, and most traders place SL’s just below those pivots,

• Shakeout is basically when price breaks below an important pivot level and then Jumps back above that level furiously.

• See, the Pivots that you see are visible to everyone, and most traders place SL’s just below those pivots,

• so price sometimes Come down to Flush the weak hands and then again resumes the main trend.

• It doesn& #39;t mean you should hold your losses, if Your SL hits just get out of the trade.

• It doesn& #39;t mean you should hold your losses, if Your SL hits just get out of the trade.

• It can be used for entering a new trade, as well as for pyramiding.

• It& #39;s better if volume increases after the breakout.

• Shakeouts increase the probability of a trade to be a big winner.

• It& #39;s better if volume increases after the breakout.

• Shakeouts increase the probability of a trade to be a big winner.

• In case of a shakeout, wait for the swing high to breach and let the candle close above that before entering/pyramiding the trade.

• Shakeout example-

• Shakeout example-

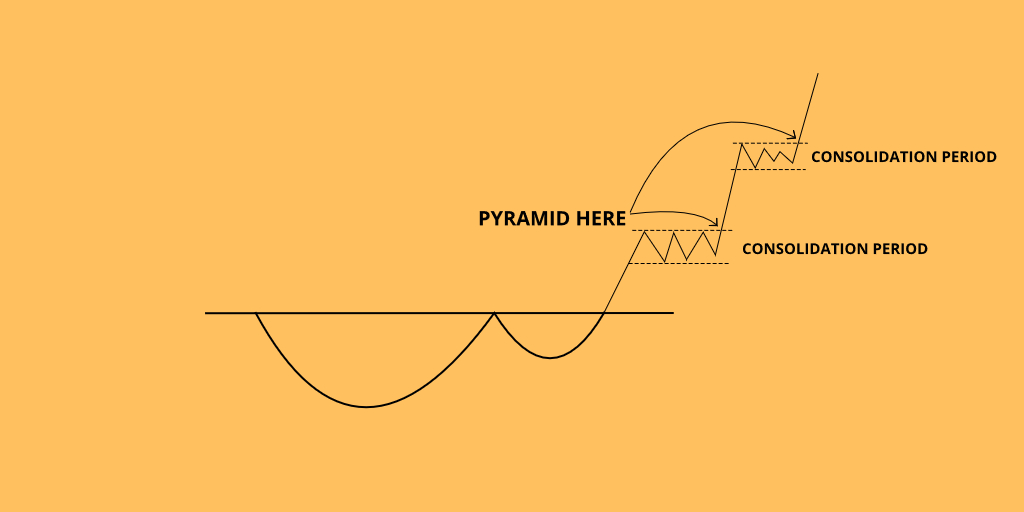

• Strong breakouts do not give much retracements.

• Sideways price action during an up move is an indication that stock is sustaining at higher prices and is loading up for the next up move.

• So we can enter when we see a breakout above a consolidation zone.

• Sideways price action during an up move is an indication that stock is sustaining at higher prices and is loading up for the next up move.

• So we can enter when we see a breakout above a consolidation zone.

• Of course the volume should be lower in the sideways period, compared to the up move volumes, otherwise it could be a potential distribution.

• And, focus should be more on the volatility during this period, for a good continuation to occur, the volatility should decrease .

• And, focus should be more on the volatility during this period, for a good continuation to occur, the volatility should decrease .

• If it& #39;s increasing during the sideways period then the breakouts above that zone are highly likely to fail.

• Consolidation examples-

• Consolidation examples-

• Now we know a few Price action patterns with which we can pyramid at right levels.

• But, Our first priority is Managing the risk, if we don’t keep an eye on risk, it will keep an eye on us.

• So, how to manage risk when we are adding positions on the way up?

• But, Our first priority is Managing the risk, if we don’t keep an eye on risk, it will keep an eye on us.

• So, how to manage risk when we are adding positions on the way up?

• First of all , Wait till your first entry becomes risk free.

• We would not want to risk so much that, if we end up being wrong , we would not lose our pants.

• We would not want to risk so much that, if we end up being wrong , we would not lose our pants.

• So, that& #39;s why it& #39;s a good idea to let the stock show that its got something and then when it shows any price action setup, pyramid at that level.

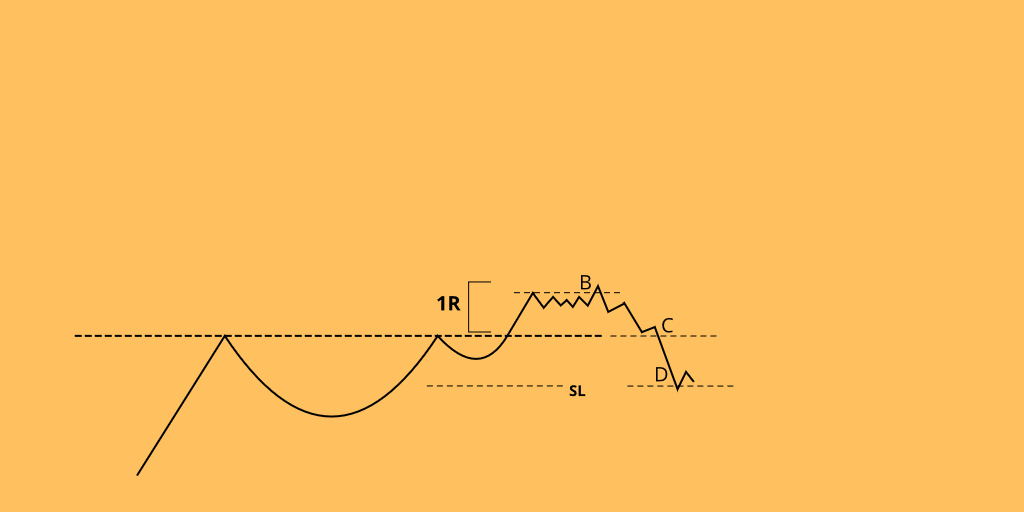

• Let& #39;s take an example of how to manage your risk when doing pyramiding-

We enter the stock at point A.

1R= ENTRY - SL

• Let& #39;s take an example of how to manage your risk when doing pyramiding-

We enter the stock at point A.

1R= ENTRY - SL

• Now, it depends on how we trail our position, but let& #39;s say we trail SL when price moves 1R above the entry.

• So, we will wait till our stop comes at entry price, so the trade becomes risk free.

• Why so?

• So, we will wait till our stop comes at entry price, so the trade becomes risk free.

• Why so?

Why are we waiting for the trade to become risk free and not pyramid earlier?

I will explain this with example and then will come back to the previous point-

• So you enter at Point A, and you risk 1% on your first entry.

I will explain this with example and then will come back to the previous point-

• So you enter at Point A, and you risk 1% on your first entry.

• Now, the stock is holding well above the entry point, and is consolidating for some time.

• And you see a breakout came at point B.

• You pyramid there, with 1% risk and 1R as SL.

• You didn& #39;t wait for your first entry to become risk free.

• Now, you have 2% open risk.

• And you see a breakout came at point B.

• You pyramid there, with 1% risk and 1R as SL.

• You didn& #39;t wait for your first entry to become risk free.

• Now, you have 2% open risk.

• The stock starts to tank and hits your pyramiding position SL at point C and then your first entry SL at point D.

• Now, you made a 2% loss on this position.

• Instead of increasing the rewards, you increased your risk and it hits you.

• Now, you made a 2% loss on this position.

• Instead of increasing the rewards, you increased your risk and it hits you.

• Now, you know why it& #39;s good to first let your First entry become risk free and then check for pyramiding .

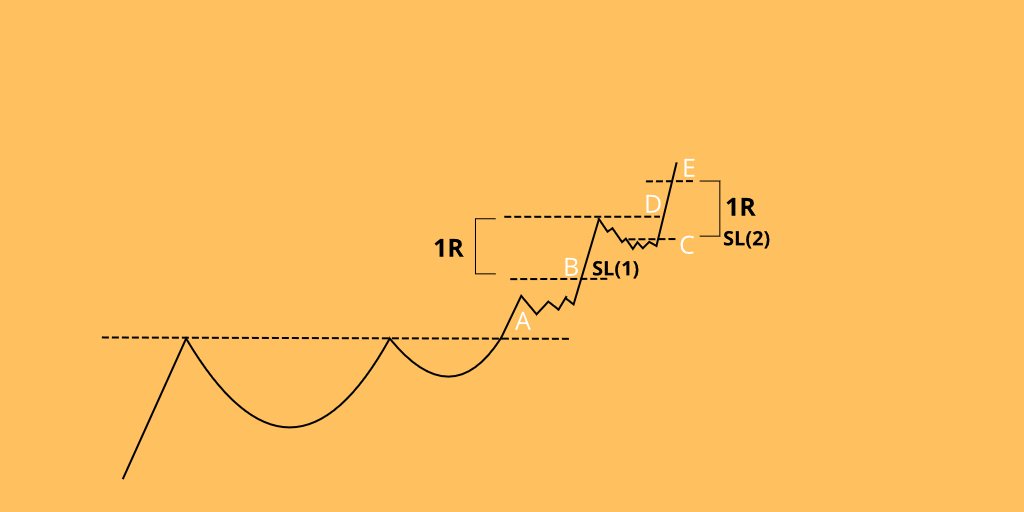

Now, let& #39;s get back to the earlier point on how to properly manage the risk.

Now, let& #39;s get back to the earlier point on how to properly manage the risk.

• We had entered at A.

• Now, wait till our first entry becomes risk free.

• At, point B We Trail our stop loss to our entry level, as price moved 1R from our entry.

• Now, we have no open risk, and our position is now risk free.

• Now, wait till our first entry becomes risk free.

• At, point B We Trail our stop loss to our entry level, as price moved 1R from our entry.

• Now, we have no open risk, and our position is now risk free.

• Now, we need to wait for any setup to form so that we can pyramid our 2nd entry.

• Now, the stock shows some strength and moves up initially from point B, but then it shows a natural reaction.

• we wait till the down moves stop and stock shows tennis ball action.

• Now, the stock shows some strength and moves up initially from point B, but then it shows a natural reaction.

• we wait till the down moves stop and stock shows tennis ball action.

• At Point, C we enter our second entry(pyramid) and our SL is 1R below the entry point.

• We risk 1% on the second entry.

• Now SL1 is at cost and SL2 is 1R below the second entry.

• We have 1% open risk as of now.

• We risk 1% on the second entry.

• Now SL1 is at cost and SL2 is 1R below the second entry.

• We have 1% open risk as of now.

• So, now even if both of our SL hit, then we will be only down 1% and if it moves up we will get a benefit of 2X positions.

• Now the stock again moves up and at point D the SL(1) moves to point B, so now we have locked 1% profit on the first position.

• Now the stock again moves up and at point D the SL(1) moves to point B, so now we have locked 1% profit on the first position.

• So now from point D if both the SL hits then we will exit with no profit - no loss.

• Here after this point, it depends on you if you want to wait for the second entry SL to move 1R before pyramiding or not.

• At point E you move the Trail SL of second position to Point C.

• Here after this point, it depends on you if you want to wait for the second entry SL to move 1R before pyramiding or not.

• At point E you move the Trail SL of second position to Point C.

• So, at this point you have No open risk, as your first position has 1% profit locked and your second position Sl is at cost so Risk is locked at 0%.

• So, this is how you manage the risk, while maximising your gains.

• So, this is how you manage the risk, while maximising your gains.

• Of Course there will be different situations as every time the stocks will move different ways, but this is a basic framework that you can use.

Now, let& #39;s look at some Real examples of pyramiding-

Now, let& #39;s look at some Real examples of pyramiding-

• This is Dixon’s daily chart, here you can see the stock first dropped about 35%+ from the highs and recovered all the way back to the high.

• Now it again drops, but the drop is only 13%,which is quite less as compared to the previous drop.

• Now it again drops, but the drop is only 13%,which is quite less as compared to the previous drop.

• o the volatility is dropping, the selling is being absorbed and the stock is sustaining at the highs and buying volumes are higher.

• Clear case of accumulation.

• Say you buy above the swing high, at 960 with 10% SL at 860.

And You took 1% risk on the first entry.

• Clear case of accumulation.

• Say you buy above the swing high, at 960 with 10% SL at 860.

And You took 1% risk on the first entry.

• The breakout looks good as the volume is above average and the stock closes in the higher range of the breakout candle.

• Now the stock moved 1R above your entry so you trail your SL at cost.

• Now, you have no open risk and you can find opportunities to pyramid more positions,

• Now, you have no open risk and you can find opportunities to pyramid more positions,

• Now after moving 17% up from the entry, the stock gives first red bar, but look at the volume its less as compared to the buying volume.

• So, this is most likely to be a natural reaction.

• So, this is most likely to be a natural reaction.

• Now, as expected the selling was just the normal pullback and the stock shows some support around 970-980 levels, just above the breakout levels.

• Now you wait for any bullish candle that closes in the higher range of the day . and you will pyramid above that.

• Now you wait for any bullish candle that closes in the higher range of the day . and you will pyramid above that.

• You get that candle, and you place a buying order above the high of that candle, which is 1070.

• So, you pyramid above 1071 with SL about 96 points lower at 975.

• Now you have two positions 1X at 960 and 1X at 1071.

• So, you pyramid above 1071 with SL about 96 points lower at 975.

• Now you have two positions 1X at 960 and 1X at 1071.

• The first position is risk free and the second position has 1% open risk.

• Now the stock moves another 1R from the first entry so we trail SL of the first entry 1R up at 1050 and we also move the second entry TSL to the same level.

• Now the stock moves another 1R from the first entry so we trail SL of the first entry 1R up at 1050 and we also move the second entry TSL to the same level.

• And from here on we will Trail both SL at same levels.

• No, we have 1% locked open profit on first position and we have reduced the open risk on second position to about only 0.25%.

• So Totally, we have locked 0.75% of profit, with 1x position at 960,

• No, we have 1% locked open profit on first position and we have reduced the open risk on second position to about only 0.25%.

• So Totally, we have locked 0.75% of profit, with 1x position at 960,

and 1x position at 1071.

• At this point if we get another good pyramiding setup, we can take the risk.

• Now, the stock gets a rejection candle from 1219 levels and again gives the normal reaction.

• At this point if we get another good pyramiding setup, we can take the risk.

• Now, the stock gets a rejection candle from 1219 levels and again gives the normal reaction.

• But because the selling was high at the red candle, we will not pyramid at pullback but wait for the high of that selling candle to break.

• We go long for the third entry at 1220 levels and SL 96 points below the third entry.

• We go long for the third entry at 1220 levels and SL 96 points below the third entry.

• And we also Trail the SL(1) and SL(2) 1R up to 1150, as the stock has moved 3R from the first entry.

• So, at this point we have 2% locked profit in first position, and about 0.75% profit in second position

• So, at this point we have 2% locked profit in first position, and about 0.75% profit in second position

• So, this is how you can increase your potential returns while managing your overall risk.

• Of Course there are many ways to do pyramiding and Trailing positions, this is only one way and you can find the way which suits you.

• Of Course there are many ways to do pyramiding and Trailing positions, this is only one way and you can find the way which suits you.

• I just gave you a framework which you can work upon and build something better according to your personality and trading techniques.

• For Price and indicator based pyramiding check this thread- https://twitter.com/Traderknight007/status/1343228990849306624?s=20">https://twitter.com/Traderkni...

• For Price and indicator based pyramiding check this thread- https://twitter.com/Traderknight007/status/1343228990849306624?s=20">https://twitter.com/Traderkni...

• I hope that you got to learn something from this thread, though there are few more things that I wanted to write about.

• But, then this thread will be super long, so I will write about them later

Haven& #39;t posted anything from last 1 month,as i there were many sos messages

• But, then this thread will be super long, so I will write about them later

Haven& #39;t posted anything from last 1 month,as i there were many sos messages

Floating around and didn& #39;t wanted to disrespect those messages, but now as the messages are lot less.

Thought to make your weekend a little productive.

Hope you guys are doing well, and i wish that the situation gets better with time.

Thought to make your weekend a little productive.

Hope you guys are doing well, and i wish that the situation gets better with time.

At last i want to end this thread with one of my favourite quote-

“Obstacles don’t have to stop you. If you run into a wall don’t turn around and give up. Figure out how to climb it, go through it, or work around it.” – Michael Jordan

Thanks for reading

Trader knight

“Obstacles don’t have to stop you. If you run into a wall don’t turn around and give up. Figure out how to climb it, go through it, or work around it.” – Michael Jordan

Thanks for reading

Trader knight

Read on Twitter

Read on Twitter