Extraordinary fiscal and #monetary policies have led to a booming #economy in many areas, which is likely to improve even further as the Covid vaccination effort continues apace and as the economy more fully reopens, but today’s headline #JobReport gain of 266K jobs disappointed.

Indeed, consensus estimates were closer to a million #jobs gained, and a decline in the #unemployment rate, rather than a small gain, to 6.1%.

However, one fact that is important to take note of is that the month’s #SeasonalFactor shaved 823,000 jobs off the not seasonally adjusted change; in fact, on a non-seasonally adjusted basis, the gain was 1.1 million jobs.

Furthermore, average hourly #earnings increased a strong 0.7% over the month, which left the year-over-year rate of change at 0.3%. The @BLS_gov suggested that this high #wage gain over the month implied a “rising demand for labor associated with the recovery from the pandemic.”

Large #wage gains were widespread across #industries too. To us this all suggests the strong demand for workers we see is meeting #LaborShortages, and that mismatch is forcing some firms to #pay more to get the workers they need.

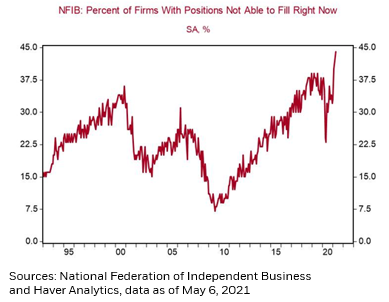

In fact, more #businesses surveyed by the @NFIB report not being able to fill positions now than we’ve seen in decades, which is at least partly due to #job mismatch/shortage issues.

Additionally, a great deal of the high frequency #economic data continued to improve over the past month, and in fact, #mobility as measured by U.S. miles driven versus analogous periods in 2019 has completely recovered.

So, from the standpoint of @federalreserve monetary policy, where does this leave us? Chair Powell suggested that the #FOMC would like to see a string of strong labor #market figures before it would be likely to make adjustments to its communication and then policy stance.

We are concerned that the longer the delay in #policy evolution, the narrower the window in which an eventual policy correction will have to be squeezed, risking a #disruptive adjustment.

The #Fed’s emergency policies in early-to-mid-2020 were absolutely critical to spurring the #economic recovery, but the fact is today there are many segments of the #economy where the primary #employment problem is not a lack of demand, but instead rather extreme labor shortages.

Read on Twitter

Read on Twitter