When you live and breathe Software as a Service (or SaaS), terms like ARR, MRR, LTV, and CAC just become part of your daily slang. Or Gross vs. Net MRR Churn, and how it is different from Customer Churn. It& #39;s just part of the SaaS life.

Let me explain it to you!

// THREAD //

Let me explain it to you!

// THREAD //

MRR: Monthly Recurring Revenue

The number of subscriptions that you bill each month, and users who will be billed automatically.

MRR is the reason SaaS companies are exciting to investors: predictable revenue.

The number of subscriptions that you bill each month, and users who will be billed automatically.

MRR is the reason SaaS companies are exciting to investors: predictable revenue.

ARR: Annualized Run Rate

MRR x 12 = ARR.

This is a great metric estimate of how much revenue the company can generate annually.

MRR x 12 = ARR.

This is a great metric estimate of how much revenue the company can generate annually.

ARR would be beautiful if it was guaranteed, but there are always going to be cancellations.

Luckily, there’s a simple way to estimate how much time a customer will stay based on historical customer behavior: this is known as the customer churn rate.

Luckily, there’s a simple way to estimate how much time a customer will stay based on historical customer behavior: this is known as the customer churn rate.

Some figures to help explain Churn:

January: 100 new users join a platform at $29/mo

MRR = $2900

February: 100 new users join but 10 customers from Jan unsubscribe.

They added $2900 in MRR but you lose $290 from the unsubscribers.

We now have 190 users & $5510 in MRR.

January: 100 new users join a platform at $29/mo

MRR = $2900

February: 100 new users join but 10 customers from Jan unsubscribe.

They added $2900 in MRR but you lose $290 from the unsubscribers.

We now have 190 users & $5510 in MRR.

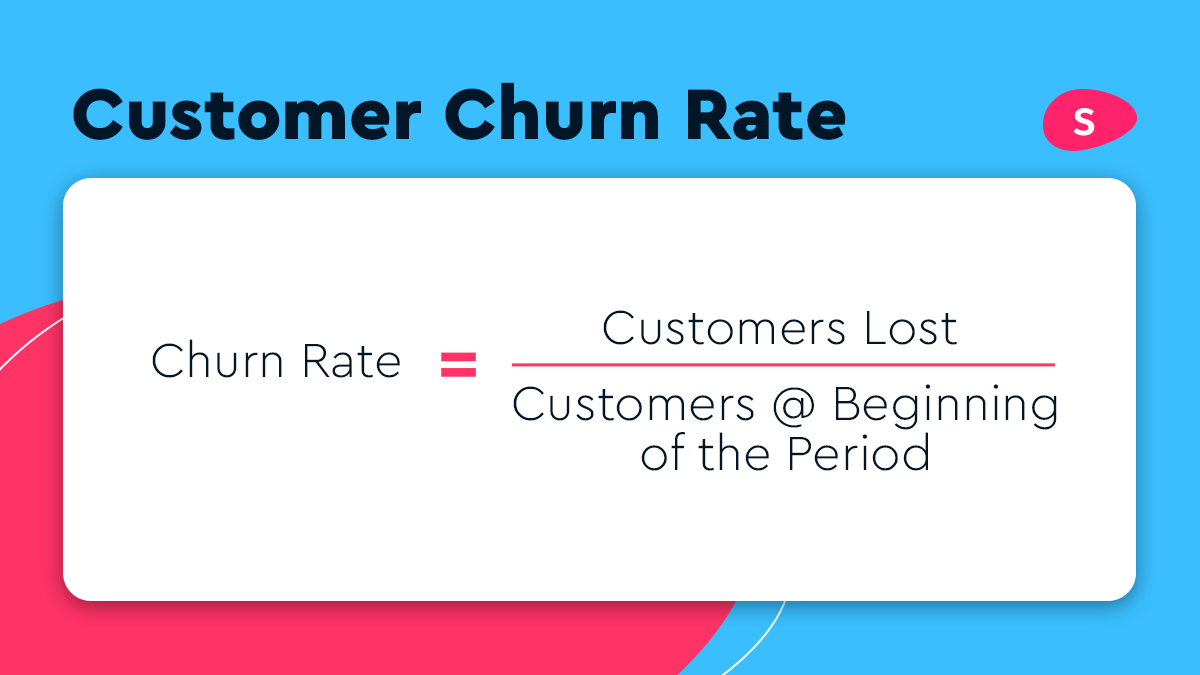

How to calculate Customer Churn Rate:

Out of 100 users, we lost ten. That means that our Customer Churn Rate is 10%.

We don’t count the 100 users that we added in Feb as they weren’t here at the beginning of the period.

The formula is:

Out of 100 users, we lost ten. That means that our Customer Churn Rate is 10%.

We don’t count the 100 users that we added in Feb as they weren’t here at the beginning of the period.

The formula is:

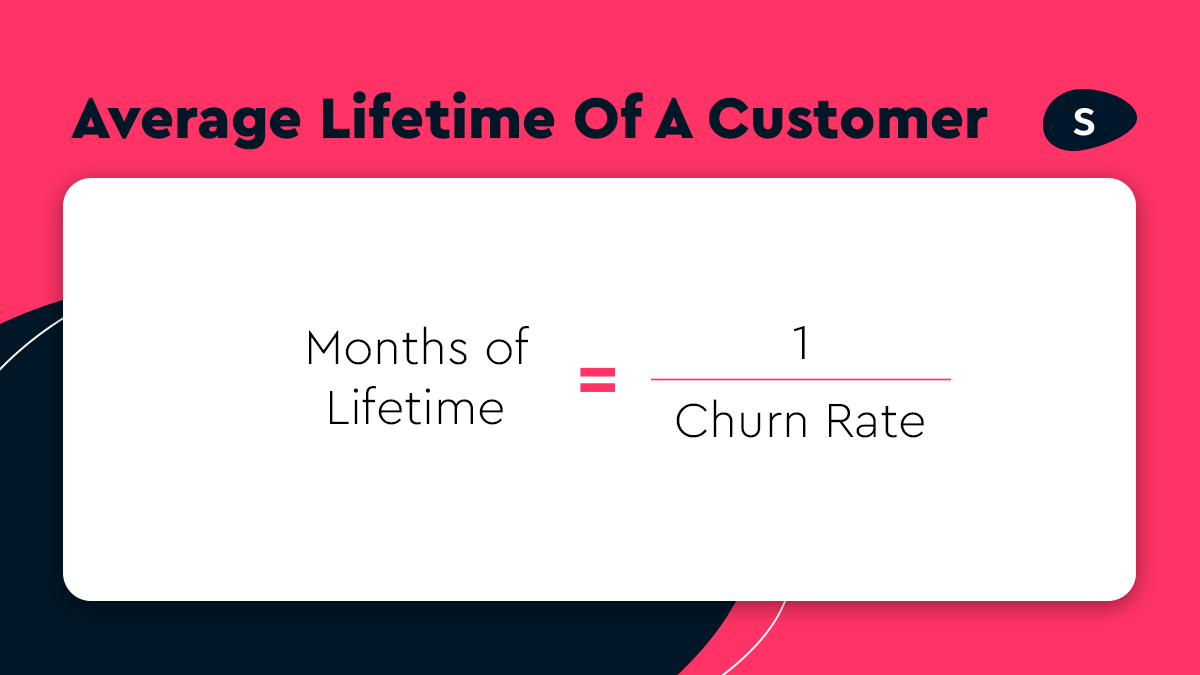

Churn is an essential formula.

If you divide one by a churn rate you’ll get the average lifetime of a customer (in months).

In our case: 1÷10% = 10.

This means the average user will stick around for 10 months.

If you divide one by a churn rate you’ll get the average lifetime of a customer (in months).

In our case: 1÷10% = 10.

This means the average user will stick around for 10 months.

Break that down: a cohort of 100 customers, when you lose 10%/mo, means that by month 10 you’ll have ~38 customers.

By month 24 you’ll have ~9 customers.

Even after 45 months, you should still have 1 customer!

By month 24 you’ll have ~9 customers.

Even after 45 months, you should still have 1 customer!

With a customer churn rate of 5%, the average lifetime would be about 20 months.

A churn rate of 3% means an average lifetime of 33 months.

The lower the churn rate, the longer the average lifetime.

A churn rate of 3% means an average lifetime of 33 months.

The lower the churn rate, the longer the average lifetime.

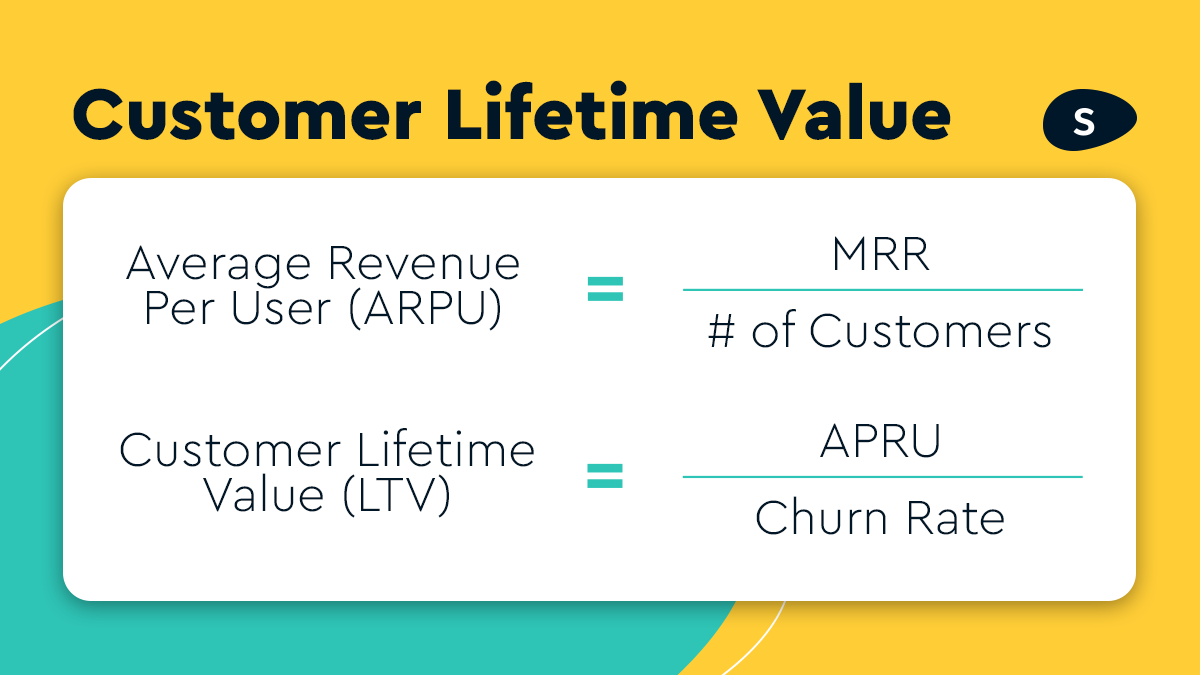

Now you have all the info to come up with a Customer Lifetime Value (LTV).

First, you’ll need the APRU (Average Revenue Per User).

Then you’ll divide ARPU by Churn % to get the LTV.

The formulas are:

First, you’ll need the APRU (Average Revenue Per User).

Then you’ll divide ARPU by Churn % to get the LTV.

The formulas are:

The Customer LTV is a great number to estimate what to spend to attain customers.

If you can estimate that the Customer LTV is $1000 you know that you can be aggressive and spend $400 to acquire that customer because you’ll eventually make that money back.

If you can estimate that the Customer LTV is $1000 you know that you can be aggressive and spend $400 to acquire that customer because you’ll eventually make that money back.

The most basic rule of business: whatever you are paying to bring customers in needs to be less than the money you make from said customer.

As a general rule of thumb, it’s considered that the cost of acquiring a customer is one-third of the lifetime value.

As a general rule of thumb, it’s considered that the cost of acquiring a customer is one-third of the lifetime value.

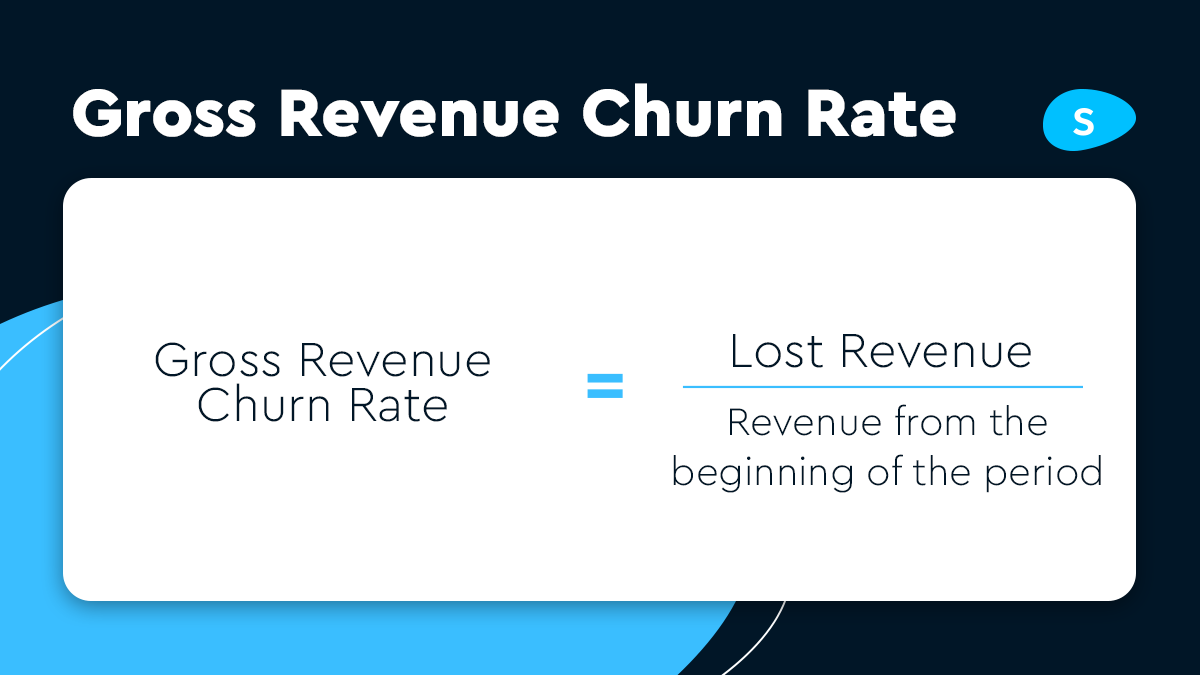

You also can calculate churn from revenue.

We divide the revenue lost by revenue that we had at the beginning of the period.

In our case, this would be $290 (lost revenue) divided by $2900 (revenue from the beginning of the period).

This gets us Gross Churn which is 10%.

We divide the revenue lost by revenue that we had at the beginning of the period.

In our case, this would be $290 (lost revenue) divided by $2900 (revenue from the beginning of the period).

This gets us Gross Churn which is 10%.

Why do we measure customer and revenue churn separately?

You can lose revenue without losing a customer (e.g. a customer moved to a different priced plan).

You can lose revenue without losing a customer (e.g. a customer moved to a different priced plan).

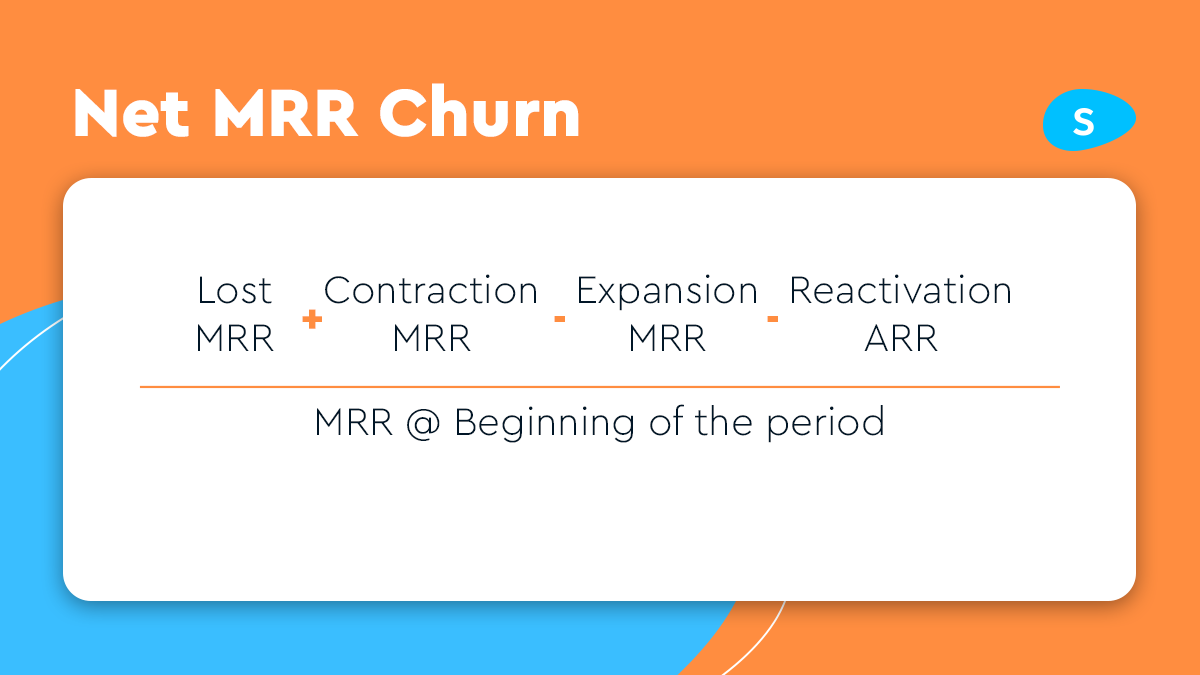

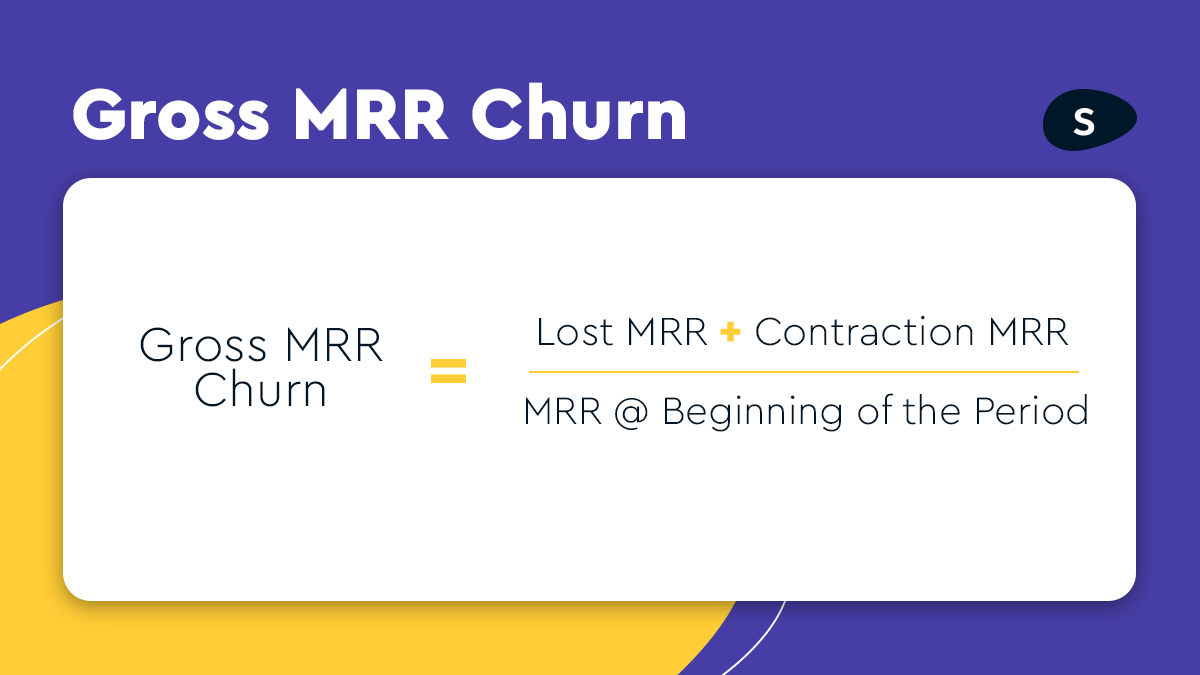

To calculate the Gross MRR Churn you’ll need:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔴" title="Roter Kreis" aria-label="Emoji: Roter Kreis">The contraction MRR (lost revenue from users moving plans)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔴" title="Roter Kreis" aria-label="Emoji: Roter Kreis">The contraction MRR (lost revenue from users moving plans)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔴" title="Roter Kreis" aria-label="Emoji: Roter Kreis">The lost MRR (lost revenue from users unsubscribing)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔴" title="Roter Kreis" aria-label="Emoji: Roter Kreis">The lost MRR (lost revenue from users unsubscribing)

Then, use the formula below:

Then, use the formula below:

But there are two great things to remember:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔴" title="Roter Kreis" aria-label="Emoji: Roter Kreis"> Users might upgrade to a more expensive plan (expansion revenue)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔴" title="Roter Kreis" aria-label="Emoji: Roter Kreis"> Users might upgrade to a more expensive plan (expansion revenue)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔴" title="Roter Kreis" aria-label="Emoji: Roter Kreis"> Users that have canceled their plans may reactivate their subscription (reactivation MRR)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔴" title="Roter Kreis" aria-label="Emoji: Roter Kreis"> Users that have canceled their plans may reactivate their subscription (reactivation MRR)

The sum of all these variables: reactivation, expansion, contraction, and lost customers gives us a number called Net MRR Churn, or Net Revenue Churn.

To us at @slidebean, it’s the most important number of all!

To us at @slidebean, it’s the most important number of all!

If you get a negative number when you use this formula you have negative churn - and that is a great thing.

Negative churn = SaaS Nirvana!

Negative churn = SaaS Nirvana!

Negative churn is the number that gets SaaS companies funded.

It means every month your existing customers are growing and you make more money from the same cohort of customers on top of new customers.

Negative MRR Churn is a beautiful thing that all SaaS CEOs fight for.

It means every month your existing customers are growing and you make more money from the same cohort of customers on top of new customers.

Negative MRR Churn is a beautiful thing that all SaaS CEOs fight for.

How do we keep up with these formulas?

We use @ChartMogul: a subscription data platform that plugs into your payment systems like @stripe, @PayPal, and @chargebee, and automatically generates all the subscription analytics that you need.

We use @ChartMogul: a subscription data platform that plugs into your payment systems like @stripe, @PayPal, and @chargebee, and automatically generates all the subscription analytics that you need.

Still have questions?

Reply below: we would love to hear from you!

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

Reply below: we would love to hear from you!

Need something a little more visual?

Check out our YouTube video on this topic. https://youtu.be/DceOkRXHqf8 ">https://youtu.be/DceOkRXHq...

Check out our YouTube video on this topic. https://youtu.be/DceOkRXHqf8 ">https://youtu.be/DceOkRXHq...

Read on Twitter

Read on Twitter

The contraction MRR (lost revenue from users moving plans)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔴" title="Roter Kreis" aria-label="Emoji: Roter Kreis">The lost MRR (lost revenue from users unsubscribing)Then, use the formula below:" title="To calculate the Gross MRR Churn you’ll need:https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔴" title="Roter Kreis" aria-label="Emoji: Roter Kreis">The contraction MRR (lost revenue from users moving plans)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔴" title="Roter Kreis" aria-label="Emoji: Roter Kreis">The lost MRR (lost revenue from users unsubscribing)Then, use the formula below:" class="img-responsive" style="max-width:100%;"/>

The contraction MRR (lost revenue from users moving plans)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔴" title="Roter Kreis" aria-label="Emoji: Roter Kreis">The lost MRR (lost revenue from users unsubscribing)Then, use the formula below:" title="To calculate the Gross MRR Churn you’ll need:https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔴" title="Roter Kreis" aria-label="Emoji: Roter Kreis">The contraction MRR (lost revenue from users moving plans)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔴" title="Roter Kreis" aria-label="Emoji: Roter Kreis">The lost MRR (lost revenue from users unsubscribing)Then, use the formula below:" class="img-responsive" style="max-width:100%;"/>