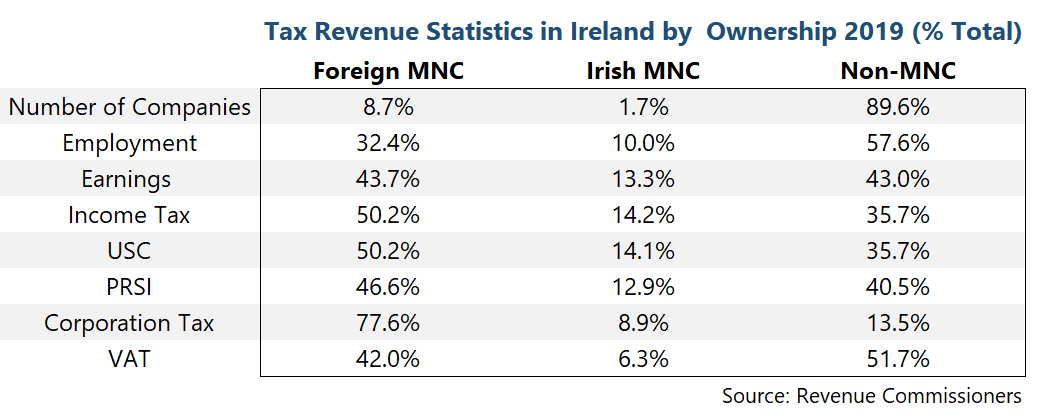

Foreign-owned multinationals in Ireland accounted for 32.4% of employment, 50.2% of income tax, and 77.6% of corporation tax revenue in 2019. Source: https://www.revenue.ie/en/corporate/information-about-revenue/research/research-reports/corporation-tax-and-international.aspx">https://www.revenue.ie/en/corpor...

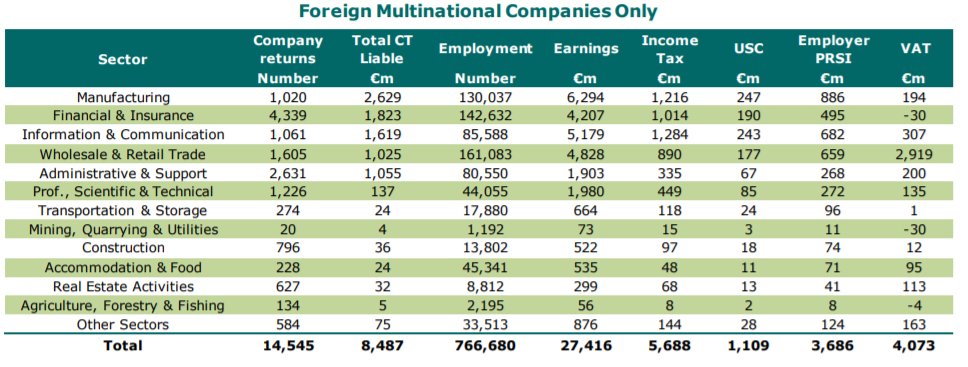

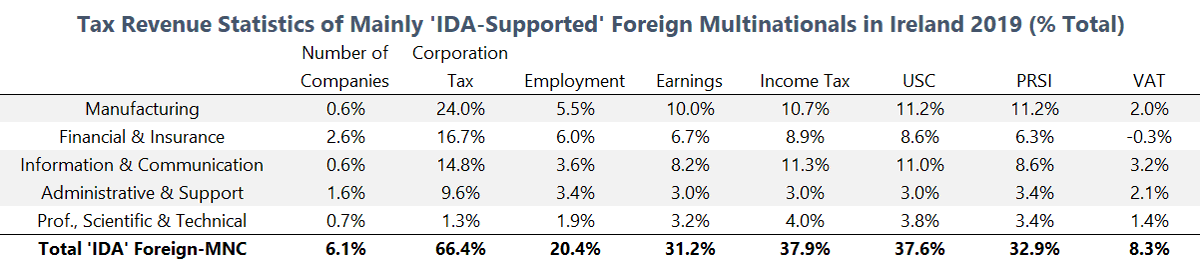

A sizable share of Foreign multinational employment and most of VAT are from non-& #39;IDA multinationals& #39; (e.g. in Wholesale & Retail and "Accommodation & Food).

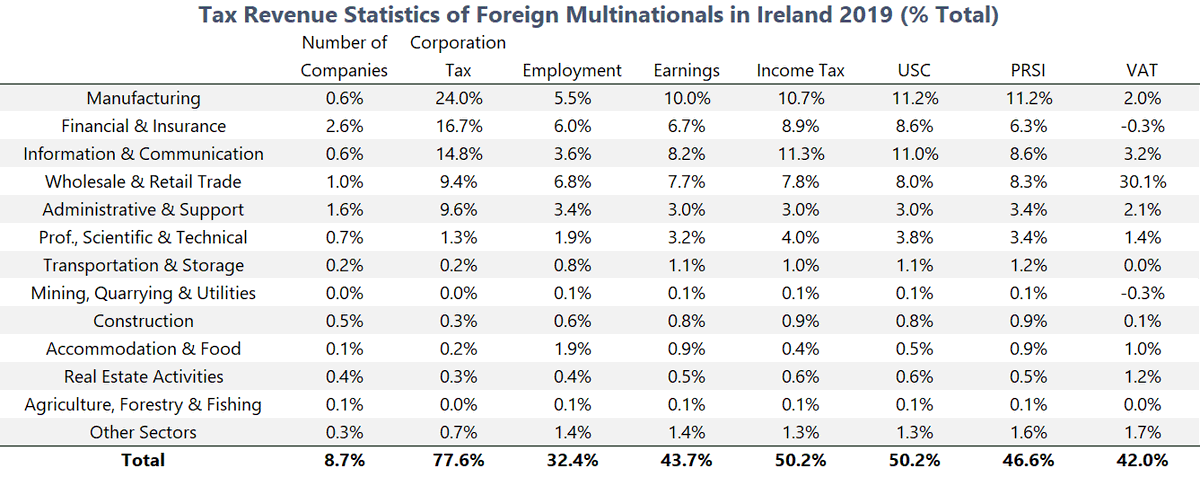

Foreign "Information & Communication" multinationals in Ireland accounted for 3.6% of employment, 11.3% of income tax, and 14.8% of corporation tax in 2019

Sectors dominated by & #39;IDA-supported export orientated& #39; multinationals accounted for 20.4% of total employment, 37.9% of income tax, and 66.4% of corporation tax in 2019.

(These are sectors noted in Revenue report as being mostly export orientated, though there would include some multinationals here for the domestic market (especially financial services)).

Ireland& #39;s corporation tax revenue by ownership and sector. In 2019 foreign multinationals accounted for 78% of corporation tax, Irish multinationals 9%, and other companies 13%. https://www.revenue.ie/en/corporate/information-about-revenue/research/research-reports/corporation-tax-and-international.aspx">https://www.revenue.ie/en/corpor...

Ireland& #39;s annual corporation tax receipts increased by €950 million in 2020 because of an increase from "Information & Communication" companies. However, receipts fell in most sectors.

Read on Twitter

Read on Twitter