NY Times best seller Predictably Irrational is a must read for all investors.

A study found that aroused participants judged themselves 136% more likely to engage in immoral activities vs. predicting their propensity in a & #39;cold& #39; state.

Here& #39;s 12 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">& #39;s to make you less irrational

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">& #39;s to make you less irrational

A study found that aroused participants judged themselves 136% more likely to engage in immoral activities vs. predicting their propensity in a & #39;cold& #39; state.

Here& #39;s 12

We tend to decide in relative terms. We compare stocks based on multiples (P/E). Most people don& #39;t know what they want until they see it in context.

Remove yourself from echo chambers & focus on the global context. I.e. the whole investable universe.

To make a thing coveted, make it rare. Sufficiently differentiate (eg. Starbucks) so your biz is not compared to competitors (regular cafes). This is pricing power.

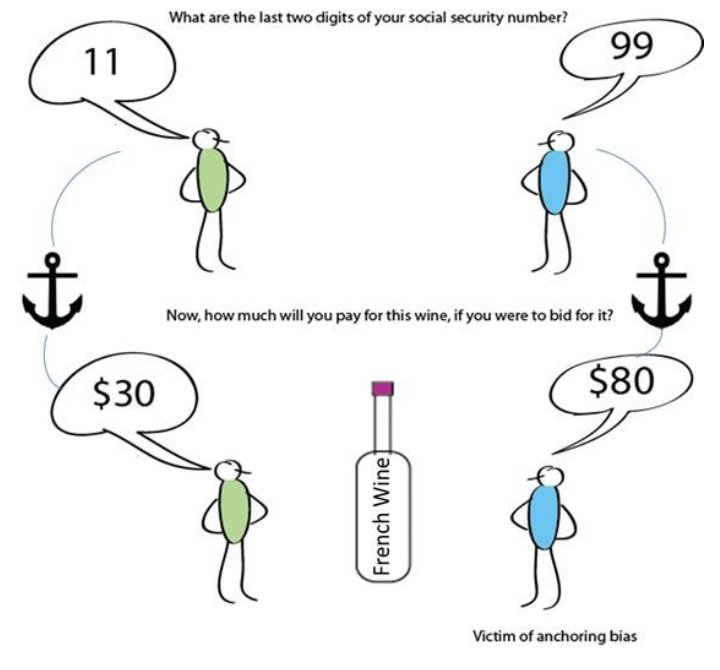

We can be easily anchored to previous prices. Question your decision making process.

We have a strong bias for FREE.

It& #39;s because we fear loss, & getting something for free tricks us into thinking we can& #39;t lose.

FREE brokerage has increased trading activity. But you still pay the spread. If you& #39;re not paying, you& #39;re the product.

We all have different states, like Dr. Jekyll & Mr. Hyde. Cold & aroused.

We act very differently when emotionally charged & this is really hard to predict.

Put in safeguards to stop your Mr. Hyde from doing something stupid.

Resisting temptation & instilling self control are general human goals.

Set rules & automate processes so you are not tempted. I.e. "I don& #39;t buy a stock until XYZ".

Automate an email to your wife if you spend more than $X on wine a month.

We value things we own highly.

When buying something, we compare our purchase to things similarly priced, but when selling we think about the memories and experience.

Giving something back feels like a loss. When selling, keep the buying mindset.

We have a bias to keep our options open.

This leads us to getting a worse result overall than picking one option & going with it.

Deciding between two highly similar options has little difference. Flip a coin. Taking a long time to decide is costly.

Expectations heavily shape our experiences.

If you are primed to dislike the taste of a drink, it will taste worse than if you were not primed.

To remove bias, present facts anonymously and have an independent third party.

Two mechanisms shape our expectations that make placebos work.

1. Belief, or our confidence in the drug.

2. Conditioning, like Pavlov& #39;s dogs.

Try to determine quality independently of price. We are biased to think a 50c aspirin works better than a 5c one

When posed with the opportunity to cheat, most people do a little ~10%.

Even though we know that honesty is best, our internal & #39;honesty& #39; monitors don& #39;t activate for small deviations only large transgressions.

When reminded about ethics, we don& #39;t cheat.

When dealing with money, we are primed to think about our actions & the honour code.

Once cash is a step away, we will cheat MUCH more than we think.

Would you steal a couple pens from work? Would you steal the equivalent ~$5 from the till?

Individuals more concerned with displaying their uniqueness will select a unique option regardless if they want that option or not, if the other options have been selected before.

Make your decision making process independent of others.

TL;DR

1. Remove yourself from echo chambers & focus on the global context.

2. We can be easily anchored to previous prices. Question your decision making process.

3. We have a strong bias for FREE. If you& #39;re not paying, you& #39;re the product.

1. Remove yourself from echo chambers & focus on the global context.

2. We can be easily anchored to previous prices. Question your decision making process.

3. We have a strong bias for FREE. If you& #39;re not paying, you& #39;re the product.

4. We act unpredictably when emotional. Put in safeguards to stop your Mr. Hyde from doing something stupid.

5. Resisting temptation & instilling self control are general human goals. Set rules & automate processes so you are not tempted.

6. When selling, keep the buying mindset.

5. Resisting temptation & instilling self control are general human goals. Set rules & automate processes so you are not tempted.

6. When selling, keep the buying mindset.

7. We have a bias to keep our options open. Pick one option and go with it.

8. Expectations heavily shape our experiences. To remove bias, present facts anonymously & have an independent third party.

9. Determine quality independently of price.

8. Expectations heavily shape our experiences. To remove bias, present facts anonymously & have an independent third party.

9. Determine quality independently of price.

10. Even though we know that honesty is best, our internal & #39;honesty& #39; monitors don& #39;t activate for small deviations only large transgressions.

11. Once cash is a step away, we will cheat MUCH more than we think.

12. Make your decision making process independent of others.

11. Once cash is a step away, we will cheat MUCH more than we think.

12. Make your decision making process independent of others.

That& #39;s it for now.

If you want more behavioural economics threads like this then...

Follow me ( @value_scientist) to make sure my next thread shows up on your feed!

If you want more behavioural economics threads like this then...

Follow me ( @value_scientist) to make sure my next thread shows up on your feed!

I also write a free newsletter about investing topics like the one I covered in this thread.

Join the club https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://valueinvestingscientist.substack.com/ ">https://valueinvestingscientist.substack.com/">...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://valueinvestingscientist.substack.com/ ">https://valueinvestingscientist.substack.com/">...

Join the club

Each  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel"> explores a force, that influences behaviour.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel"> explores a force, that influences behaviour.

We make the same mistakes over and over again, BUT, we can improve.

These forces impact us significantly but we severely underestimate their impact.

Add them to your decision making process.

We make the same mistakes over and over again, BUT, we can improve.

These forces impact us significantly but we severely underestimate their impact.

Add them to your decision making process.

Read on Twitter

Read on Twitter Fallacy of Supply & DemandTo make a thing coveted, make it rare. Sufficiently differentiate (eg. Starbucks) so your biz is not compared to competitors (regular cafes). This is pricing power.We can be easily anchored to previous prices. Question your decision making process." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Fallacy of Supply & DemandTo make a thing coveted, make it rare. Sufficiently differentiate (eg. Starbucks) so your biz is not compared to competitors (regular cafes). This is pricing power.We can be easily anchored to previous prices. Question your decision making process." class="img-responsive" style="max-width:100%;"/>

Fallacy of Supply & DemandTo make a thing coveted, make it rare. Sufficiently differentiate (eg. Starbucks) so your biz is not compared to competitors (regular cafes). This is pricing power.We can be easily anchored to previous prices. Question your decision making process." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Fallacy of Supply & DemandTo make a thing coveted, make it rare. Sufficiently differentiate (eg. Starbucks) so your biz is not compared to competitors (regular cafes). This is pricing power.We can be easily anchored to previous prices. Question your decision making process." class="img-responsive" style="max-width:100%;"/>

The Influence of ArousalWe all have different states, like Dr. Jekyll & Mr. Hyde. Cold & aroused. We act very differently when emotionally charged & this is really hard to predict.Put in safeguards to stop your Mr. Hyde from doing something stupid." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel"> The Influence of ArousalWe all have different states, like Dr. Jekyll & Mr. Hyde. Cold & aroused. We act very differently when emotionally charged & this is really hard to predict.Put in safeguards to stop your Mr. Hyde from doing something stupid." class="img-responsive" style="max-width:100%;"/>

The Influence of ArousalWe all have different states, like Dr. Jekyll & Mr. Hyde. Cold & aroused. We act very differently when emotionally charged & this is really hard to predict.Put in safeguards to stop your Mr. Hyde from doing something stupid." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel"> The Influence of ArousalWe all have different states, like Dr. Jekyll & Mr. Hyde. Cold & aroused. We act very differently when emotionally charged & this is really hard to predict.Put in safeguards to stop your Mr. Hyde from doing something stupid." class="img-responsive" style="max-width:100%;"/>

Why Cash Makes Us More HonestWhen dealing with money, we are primed to think about our actions & the honour code.Once cash is a step away, we will cheat MUCH more than we think.Would you steal a couple pens from work? Would you steal the equivalent ~$5 from the till?" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Why Cash Makes Us More HonestWhen dealing with money, we are primed to think about our actions & the honour code.Once cash is a step away, we will cheat MUCH more than we think.Would you steal a couple pens from work? Would you steal the equivalent ~$5 from the till?" class="img-responsive" style="max-width:100%;"/>

Why Cash Makes Us More HonestWhen dealing with money, we are primed to think about our actions & the honour code.Once cash is a step away, we will cheat MUCH more than we think.Would you steal a couple pens from work? Would you steal the equivalent ~$5 from the till?" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel">Why Cash Makes Us More HonestWhen dealing with money, we are primed to think about our actions & the honour code.Once cash is a step away, we will cheat MUCH more than we think.Would you steal a couple pens from work? Would you steal the equivalent ~$5 from the till?" class="img-responsive" style="max-width:100%;"/>