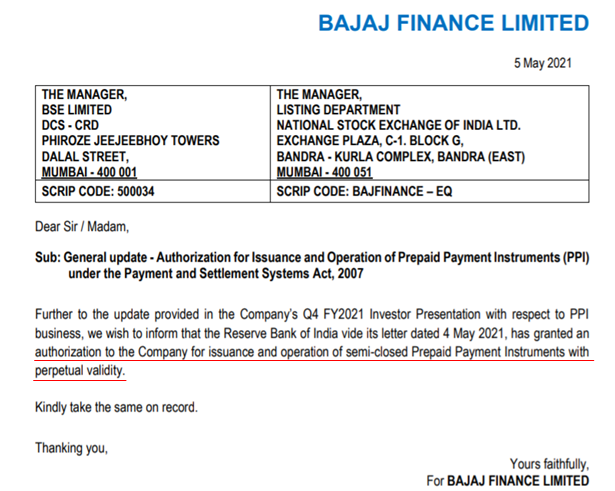

One interesting development during the week was that Bajaj Finance got RBI approval to issue and operate SEMI-CLOSED Prepaid Payment Instruments (PPI) with PERPETUAL validity.

Here is an explainer thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> on what this means for Bajaj Finance and potential implications.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> on what this means for Bajaj Finance and potential implications.

1/9

Here is an explainer thread

1/9

What are PPIs?

PPIs are instruments that facilitate purchase of goods & services or interpersonal money remittances, etc, against the value stored on such instruments.

While PPIs aren& #39;t entirely new (remember Sodexo coupons, Edenred cards), it was formalized by RBI in 2017.

2/9

PPIs are instruments that facilitate purchase of goods & services or interpersonal money remittances, etc, against the value stored on such instruments.

While PPIs aren& #39;t entirely new (remember Sodexo coupons, Edenred cards), it was formalized by RBI in 2017.

2/9

How is it different from Credit Cards?

Prepaid payment instruments come with a pre-loaded value and in some cases a pre-defined purpose of payment (more on this later).

PPIs makes it more convenient to get credit at the retail store, or to get an EMI without a physical CC.

3/9

Prepaid payment instruments come with a pre-loaded value and in some cases a pre-defined purpose of payment (more on this later).

PPIs makes it more convenient to get credit at the retail store, or to get an EMI without a physical CC.

3/9

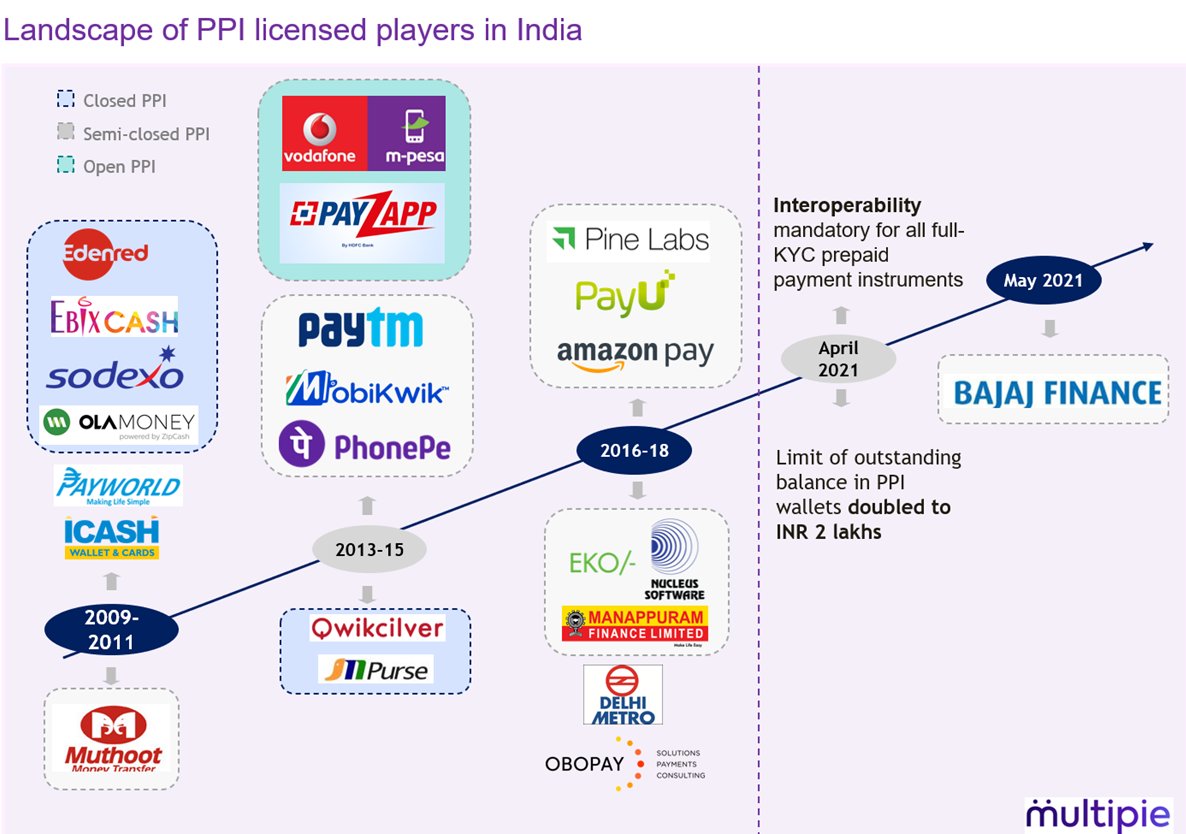

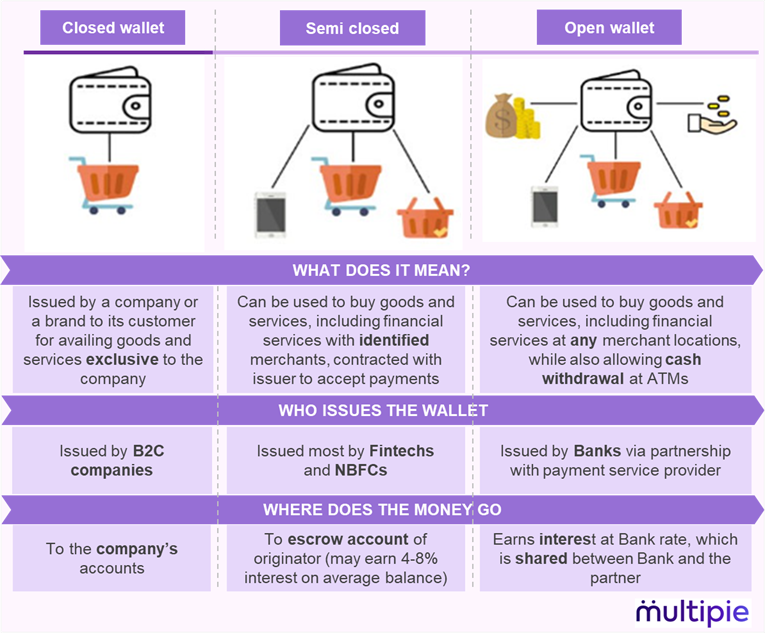

RBI categorizes 3 types of PPI wallets - Closed, Semi-closed and Open.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Closed: Brand-specific gift card, wallets etc (Sodexo, Ola Money, etc). More prominent in 2000s.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Closed: Brand-specific gift card, wallets etc (Sodexo, Ola Money, etc). More prominent in 2000s.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Semi-closed: Mostly e-wallets issued by Fintechs and NBFCs.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Semi-closed: Mostly e-wallets issued by Fintechs and NBFCs.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Open: Issued by Banks (eg: Travel cards).

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Open: Issued by Banks (eg: Travel cards).

4/9

4/9

Let& #39;s understand the landscape of PPI players in India. As we can see, single use closed wallets were prominent earlier and have since given way to mostly semi-closed PPIs/ e-wallets.

Open wallets such M-pesa (ICICI Bank) and Payzapp (HDFC Bank) have seen limited success.

5/9

Open wallets such M-pesa (ICICI Bank) and Payzapp (HDFC Bank) have seen limited success.

5/9

This brings us back to Bajaj Finance (BF). What does the PPI license mean for them?

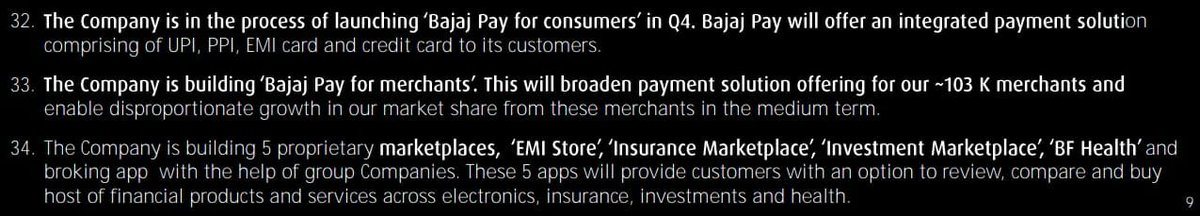

BF had indicated its& #39; Vision 2.0 via "Bajaj Pay" in their Q3 earnings call - an integrated payments solution of UPI, PPI & EMI Store (zero EMI). As per analysts, this should help cross-sell.

6/9

BF had indicated its& #39; Vision 2.0 via "Bajaj Pay" in their Q3 earnings call - an integrated payments solution of UPI, PPI & EMI Store (zero EMI). As per analysts, this should help cross-sell.

6/9

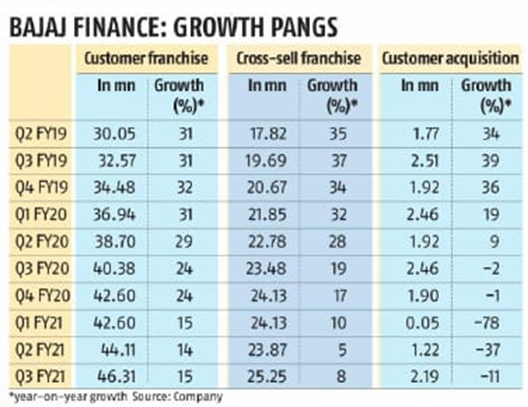

Over time, Bajaj has built a network of over 1 lakh merchants and ~5 crore customers. The two together create a base for a strong marketplace model, wherein payment capabilities was a missing link.

BF needs new legs to maintain growth, a key reason for its valuation premium.

7/9

BF needs new legs to maintain growth, a key reason for its valuation premium.

7/9

How big can this be for BF?

There have been two recent regulatory changes on PPI:

1. Mandatory interoperability for full KYC PPIs

2. Increased limit from ₹1 Lakh to ₹ 2 lakhs.

With these, some believe e-wallets may soon function as a Bank account.

8/9 https://www.livemint.com/news/india/rbi-policy-governor-das-announces-three-changes-to-mobile-wallets-11617772820637.html">https://www.livemint.com/news/indi...

There have been two recent regulatory changes on PPI:

1. Mandatory interoperability for full KYC PPIs

2. Increased limit from ₹1 Lakh to ₹ 2 lakhs.

With these, some believe e-wallets may soon function as a Bank account.

8/9 https://www.livemint.com/news/india/rbi-policy-governor-das-announces-three-changes-to-mobile-wallets-11617772820637.html">https://www.livemint.com/news/indi...

Conclusion:

While market reaction to this has been neutral, credit card expert @sandeepssrin had an optimistic take on this: "NBFC O/D line + prepaid + 2lakh limit + cash withdrawal + mandatory UPI linkage could be killer!"

Note: This is not an investment advice on BF.

9/9

While market reaction to this has been neutral, credit card expert @sandeepssrin had an optimistic take on this: "NBFC O/D line + prepaid + 2lakh limit + cash withdrawal + mandatory UPI linkage could be killer!"

Note: This is not an investment advice on BF.

9/9

What do you think of this development?

Let us know and we would love to discuss.

Please follow our page and subscribe to our blog ( http://blog.multipie.co"> http://blog.multipie.co ). We are just getting started.

Also do checkout our last podcast with @WeekendInvestng here:

https://podcast.multipie.co/alok-jain-founder-of-weekendinvestingcom-and-sebi-registered-investment-adviser/">https://podcast.multipie.co/alok-jain...

Let us know and we would love to discuss.

Please follow our page and subscribe to our blog ( http://blog.multipie.co"> http://blog.multipie.co ). We are just getting started.

Also do checkout our last podcast with @WeekendInvestng here:

https://podcast.multipie.co/alok-jain-founder-of-weekendinvestingcom-and-sebi-registered-investment-adviser/">https://podcast.multipie.co/alok-jain...

@threadreaderapp unroll please

Read on Twitter

Read on Twitter on what this means for Bajaj Finance and potential implications.1/9" title="One interesting development during the week was that Bajaj Finance got RBI approval to issue and operate SEMI-CLOSED Prepaid Payment Instruments (PPI) with PERPETUAL validity.Here is an explainer thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> on what this means for Bajaj Finance and potential implications.1/9" class="img-responsive" style="max-width:100%;"/>

on what this means for Bajaj Finance and potential implications.1/9" title="One interesting development during the week was that Bajaj Finance got RBI approval to issue and operate SEMI-CLOSED Prepaid Payment Instruments (PPI) with PERPETUAL validity.Here is an explainer thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> on what this means for Bajaj Finance and potential implications.1/9" class="img-responsive" style="max-width:100%;"/>

Closed: Brand-specific gift card, wallets etc (Sodexo, Ola Money, etc). More prominent in 2000s.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Semi-closed: Mostly e-wallets issued by Fintechs and NBFCs.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Open: Issued by Banks (eg: Travel cards).4/9" title="RBI categorizes 3 types of PPI wallets - Closed, Semi-closed and Open.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Closed: Brand-specific gift card, wallets etc (Sodexo, Ola Money, etc). More prominent in 2000s.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Semi-closed: Mostly e-wallets issued by Fintechs and NBFCs.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Open: Issued by Banks (eg: Travel cards).4/9" class="img-responsive" style="max-width:100%;"/>

Closed: Brand-specific gift card, wallets etc (Sodexo, Ola Money, etc). More prominent in 2000s.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Semi-closed: Mostly e-wallets issued by Fintechs and NBFCs.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Open: Issued by Banks (eg: Travel cards).4/9" title="RBI categorizes 3 types of PPI wallets - Closed, Semi-closed and Open.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Closed: Brand-specific gift card, wallets etc (Sodexo, Ola Money, etc). More prominent in 2000s.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Semi-closed: Mostly e-wallets issued by Fintechs and NBFCs.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Open: Issued by Banks (eg: Travel cards).4/9" class="img-responsive" style="max-width:100%;"/>