How do we invest our clients& #39; money?

A thread of our investment philosophy, with 22 principles you should follow when investing money:

See: https://www.woodruff-fp.co.uk/our-investment-philosophy/

[Not">https://www.woodruff-fp.co.uk/our-inves... intended as advice, or individual recommendations. Investments can rise and fall in value.]

A thread of our investment philosophy, with 22 principles you should follow when investing money:

See: https://www.woodruff-fp.co.uk/our-investment-philosophy/

[Not">https://www.woodruff-fp.co.uk/our-inves... intended as advice, or individual recommendations. Investments can rise and fall in value.]

1. Plan before you invest

Take your time to think about why you are investing, and what you want to achieve. That will help you to avoid expensive mistakes later. You aim should be to build a repeatable process. Discipline & monitoring are important ways to manage your behaviour.

Take your time to think about why you are investing, and what you want to achieve. That will help you to avoid expensive mistakes later. You aim should be to build a repeatable process. Discipline & monitoring are important ways to manage your behaviour.

2. Only invest in what you understand

The media is full of fashionable investment recommendations. Start with simple investments - they work. You don& #39;t need complex, over-engineered investments. If you don& #39;t understand an investment, ignore it.

The media is full of fashionable investment recommendations. Start with simple investments - they work. You don& #39;t need complex, over-engineered investments. If you don& #39;t understand an investment, ignore it.

3. Regular reviews are vital

Many amateur investors fail to review regularly. review are vital to ensure you remain on track and bring investments back into line when they move off course. Gradual adjustments keep you on track.

Many amateur investors fail to review regularly. review are vital to ensure you remain on track and bring investments back into line when they move off course. Gradual adjustments keep you on track.

4. What is your investment term?

Consider the end point of your investments. Generally, if you don& #39;t need access for many years, you may be able to take greater risks (in the hope of greater returns). Shorter terms may need a more cautious approach.

Consider the end point of your investments. Generally, if you don& #39;t need access for many years, you may be able to take greater risks (in the hope of greater returns). Shorter terms may need a more cautious approach.

5. How long will you live?

You may live a lot longer than you imagine. Check out this data from @ONS on life expectancy in the UK. The longer you live, the greater to amount you will need to accumulate, and the bigger the effect of inflation.

You may live a lot longer than you imagine. Check out this data from @ONS on life expectancy in the UK. The longer you live, the greater to amount you will need to accumulate, and the bigger the effect of inflation.

6. Volatility is the price of long-term growth

Volatility is the fluctuation in the value of your investments over time. The general rule is that the greater the volatility you are prepare to accept, the greater the returns you should expect, on average over time.

Volatility is the fluctuation in the value of your investments over time. The general rule is that the greater the volatility you are prepare to accept, the greater the returns you should expect, on average over time.

7. How much risk are you prepared to take?

Before you start, establish the maximum risk you are prepared to accept, and crucially what this might mean in extreme situations. You are then in a better position to choose investments which balance the risks you are prepared to take.

Before you start, establish the maximum risk you are prepared to accept, and crucially what this might mean in extreme situations. You are then in a better position to choose investments which balance the risks you are prepared to take.

8. How would temporary falls in value affect your lifestyle?

Almost all investments fluctuate in value. Generally, the trend is upwards, but short-term, temporary falls are inevitable. Consider what would happen to your lifestyle were this to happen. What& #39;s your plan?

Almost all investments fluctuate in value. Generally, the trend is upwards, but short-term, temporary falls are inevitable. Consider what would happen to your lifestyle were this to happen. What& #39;s your plan?

9. How much risk do you *need* to take?

Most people consider the risks they are prepared to take, but few think about the risks they need to take. If you take greater risks we might assume greater returns. But what if you& #39;ll never spend the growth? Maybe less risk is the answer.

Most people consider the risks they are prepared to take, but few think about the risks they need to take. If you take greater risks we might assume greater returns. But what if you& #39;ll never spend the growth? Maybe less risk is the answer.

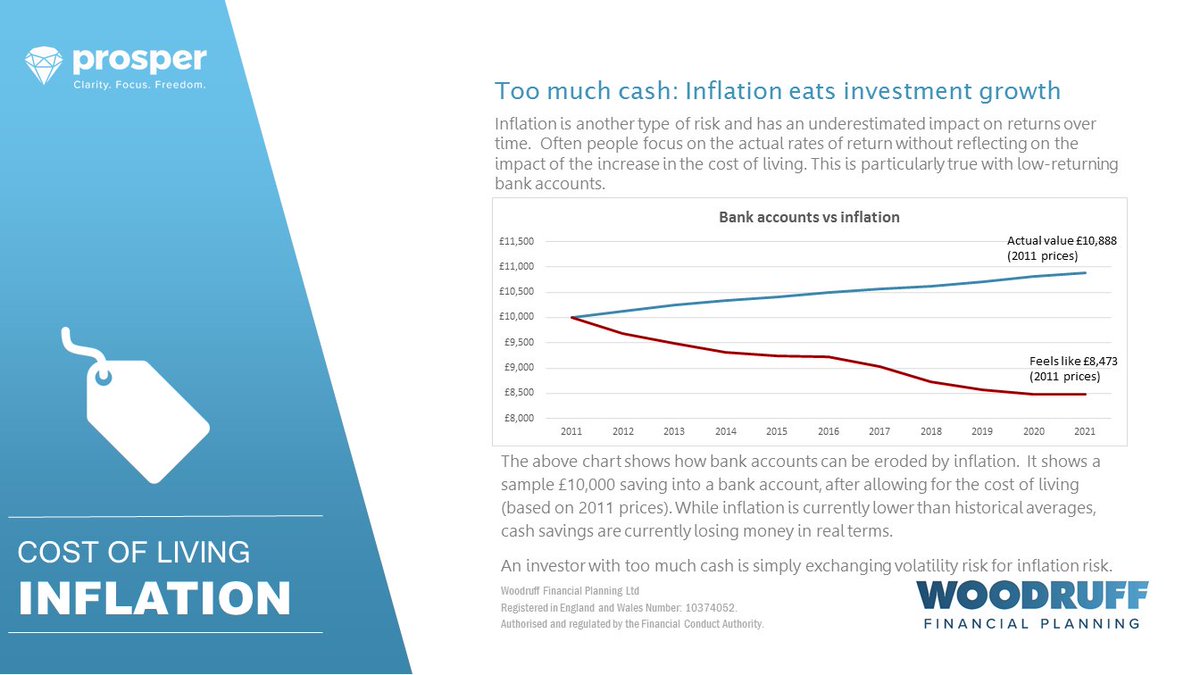

10. Inflation eats investment growth

Inflation is the effect of the rise in prices over time. If your investments grow at a slower rate than the cost of living, they& #39;ll feel like they are losing value. This is why having too much cash could be a bad idea.

Inflation is the effect of the rise in prices over time. If your investments grow at a slower rate than the cost of living, they& #39;ll feel like they are losing value. This is why having too much cash could be a bad idea.

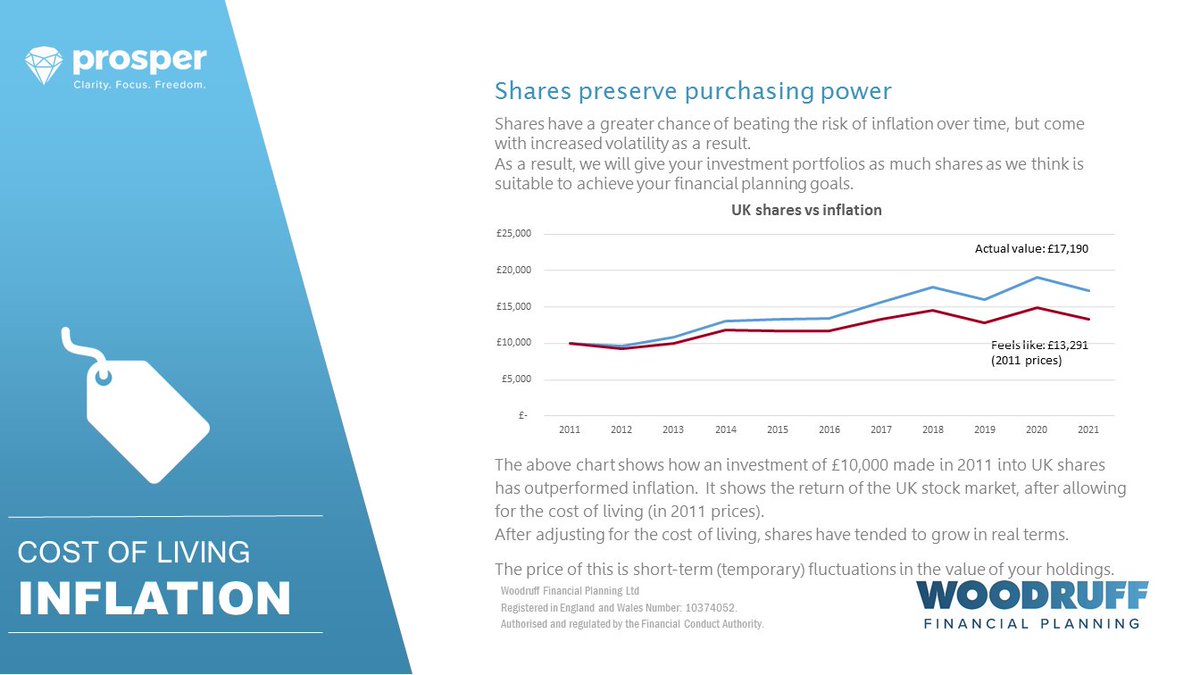

11. Shares can preserve purchasing power

Generally, shares have a greater chance to grow at a faster rate than inflation over time (not guaranteed!). If you want above-inflation growth over time, consider as much shares as you can bear.

Generally, shares have a greater chance to grow at a faster rate than inflation over time (not guaranteed!). If you want above-inflation growth over time, consider as much shares as you can bear.

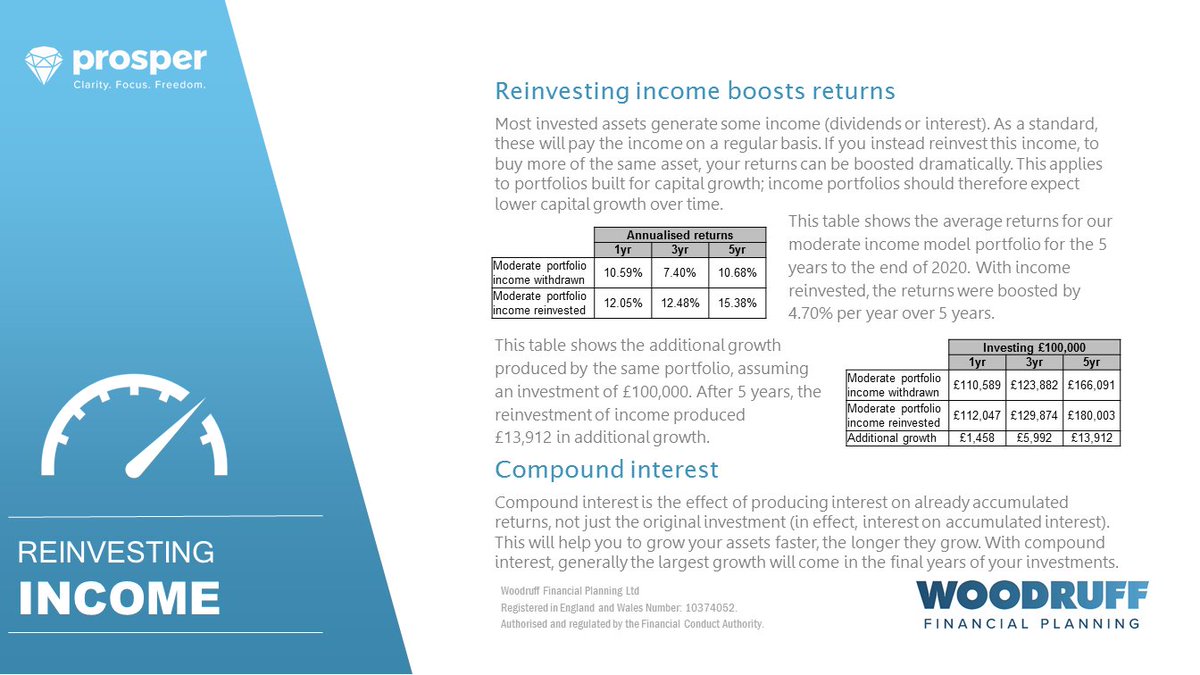

12. Reinvesting income boosts returns

Most investment generate capital growth and also income (think dividends or interest). If you reinvest that income this will compound up to grow faster over time. This really works.

Most investment generate capital growth and also income (think dividends or interest). If you reinvest that income this will compound up to grow faster over time. This really works.

13. Time in the market reduces the chance of losses

Generally, the longer you invest, the lower the chance of loss to your original capital. The UK stock market was up in 70% of the last 20 years, down 30% of the time. For rolling 10 year periods there are no negative results.

Generally, the longer you invest, the lower the chance of loss to your original capital. The UK stock market was up in 70% of the last 20 years, down 30% of the time. For rolling 10 year periods there are no negative results.

14. Spreading your risk improves the effect of time in the market

When we applied this principle of time in the market to our model investment portfolios we saw a reduced chance of loss, depending on the risk profile chosen.

When we applied this principle of time in the market to our model investment portfolios we saw a reduced chance of loss, depending on the risk profile chosen.

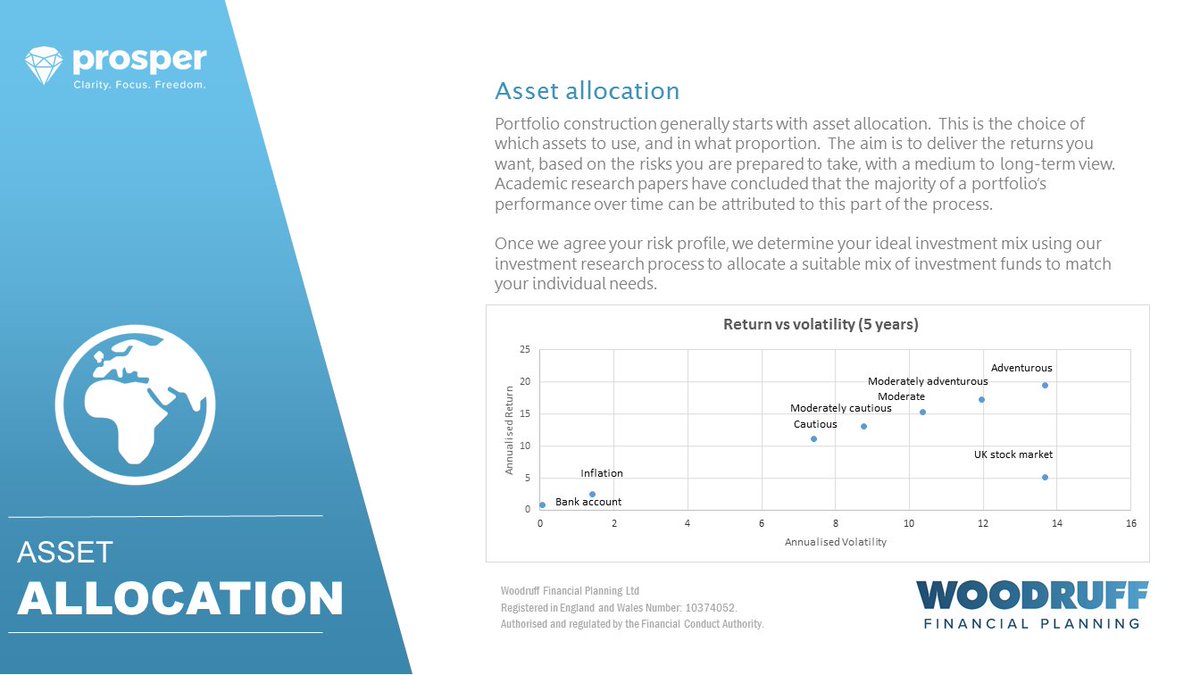

15. Asset allocation is vital

The choice of assets for your investments will be the primary driver of long-term returns. Once you have chosen your risk profile build a strategy for the type of assets in your portfolio, and stick to it.

The choice of assets for your investments will be the primary driver of long-term returns. Once you have chosen your risk profile build a strategy for the type of assets in your portfolio, and stick to it.

16. Typical investment returns

People often ask about the investment returns they should expect. The answer is that returns are based on a variety of factors: timing, risk, term, charges, tax etc. A better idea is to focus on a range of possible outcomes. All extremes are normal.

People often ask about the investment returns they should expect. The answer is that returns are based on a variety of factors: timing, risk, term, charges, tax etc. A better idea is to focus on a range of possible outcomes. All extremes are normal.

17. Diversification

The best way to manage risks is to diversify your investments. You can spread risks by increasing the number of holdings, types of assets or geographical locations. I& #39;m regularly surprised by how few investors properly diversify.

The best way to manage risks is to diversify your investments. You can spread risks by increasing the number of holdings, types of assets or geographical locations. I& #39;m regularly surprised by how few investors properly diversify.

18. It is difficult to predict investment winners

Predicting winners is *very* difficult. Take a look at this data for investment returns over the past 10 years, split into various types of investment. It is very difficult to spot a pattern, which is why you shouldn& #39;t try.

Predicting winners is *very* difficult. Take a look at this data for investment returns over the past 10 years, split into various types of investment. It is very difficult to spot a pattern, which is why you shouldn& #39;t try.

19. Rebalancing your investments

Your investments will each perform differently over time. If you do not change them you are likely to take greater risks over time. The solution is to rebalance your holdings regularly to return your portfolio to the ideal.

Your investments will each perform differently over time. If you do not change them you are likely to take greater risks over time. The solution is to rebalance your holdings regularly to return your portfolio to the ideal.

20. Don& #39;t try to time the market

It can be tempting to try to buy when markets are low, and sell when they are high. It sounds easier than it actually is! This approach is highly speculative, and should be avoided for most people. You& #39;re much better off buying and holding assets.

It can be tempting to try to buy when markets are low, and sell when they are high. It sounds easier than it actually is! This approach is highly speculative, and should be avoided for most people. You& #39;re much better off buying and holding assets.

With market timing you can react hastily. There are many examples of markets falling temporarily, but returning to growth equally as fast. 2020 was like that with Coronavirus. Markets fell, but recovered.

21. Holding cash is important

Consider how much cash you should hold in reserve, to balance inevitable short-term falls in value. This is especially important when you use your investments for income.

Consider how much cash you should hold in reserve, to balance inevitable short-term falls in value. This is especially important when you use your investments for income.

22. Costs are very important

You should aim to keep your investment costs low, as these will be a drag on your returns. This means the cost of your investments as well as the tax charged. Don& #39;t underestimate the negative effects of these costs.

You should aim to keep your investment costs low, as these will be a drag on your returns. This means the cost of your investments as well as the tax charged. Don& #39;t underestimate the negative effects of these costs.

If you like this thread you can view and download our investment philosophy document here: https://www.woodruff-fp.co.uk/our-investment-philosophy/

If">https://www.woodruff-fp.co.uk/our-inves... you& #39;re new to investing check out our beginner& #39;s guide: https://www.woodruff-fp.co.uk/investing-money-how-to-invest/">https://www.woodruff-fp.co.uk/investing...

If">https://www.woodruff-fp.co.uk/our-inves... you& #39;re new to investing check out our beginner& #39;s guide: https://www.woodruff-fp.co.uk/investing-money-how-to-invest/">https://www.woodruff-fp.co.uk/investing...

Read on Twitter

Read on Twitter![How do we invest our clients& #39; money?A thread of our investment philosophy, with 22 principles you should follow when investing money:See: https://www.woodruff-fp.co.uk/our-inves... intended as advice, or individual recommendations. Investments can rise and fall in value.] How do we invest our clients& #39; money?A thread of our investment philosophy, with 22 principles you should follow when investing money:See: https://www.woodruff-fp.co.uk/our-inves... intended as advice, or individual recommendations. Investments can rise and fall in value.]](https://pbs.twimg.com/media/E0xZ53JXEAAMqsu.jpg)