1/ https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen">ton

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen">ton

Ok... kids are asleep, I& #39;ve finished reading the bill, so buckle up!

It& #39;s "Go time!"

We& #39;re gonna break down HR 2954, better known as "Securing a Strong Retirement Act of 2021."

( And even better known as SECURE Act 2.0!)

Here& #39;s the bill text:

http://waysandmeans.house.gov/sites/democrats.waysandmeans.house.gov/files/documents/BILLS-117hr2954ih.pdf">https://waysandmeans.house.gov/sites/dem...

Ok... kids are asleep, I& #39;ve finished reading the bill, so buckle up!

It& #39;s "Go time!"

We& #39;re gonna break down HR 2954, better known as "Securing a Strong Retirement Act of 2021."

( And even better known as SECURE Act 2.0!)

Here& #39;s the bill text:

http://waysandmeans.house.gov/sites/democrats.waysandmeans.house.gov/files/documents/BILLS-117hr2954ih.pdf">https://waysandmeans.house.gov/sites/dem...

2/

As always, I want to start with some high-level thoughts...

This one clocked in at 146 pages. While that pales in comparison to recent legislative endeavors (cough, cough... looking at you CAA https://twitter.com/CPAPlanner/status/1341111472269746180?s=20)">https://twitter.com/CPAPlanne... its worth a reminder that this is 100% retirement stuff!

As always, I want to start with some high-level thoughts...

This one clocked in at 146 pages. While that pales in comparison to recent legislative endeavors (cough, cough... looking at you CAA https://twitter.com/CPAPlanner/status/1341111472269746180?s=20)">https://twitter.com/CPAPlanne... its worth a reminder that this is 100% retirement stuff!

3/

So, there& #39;s actually a TON to digest here for planners. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙌" title="Erhobene Hände" aria-label="Emoji: Erhobene Hände">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙌" title="Erhobene Hände" aria-label="Emoji: Erhobene Hände">

Certainly more than we got from CAA. Maybe even more, in total, than we got from the original SECURE Act (though no one provision will have the impact that the & #39;death& #39; of the & #39;stretch& #39; had). https://abs.twimg.com/emoji/v2/... draggable="false" alt="😯" title="Schweigendes Gesicht" aria-label="Emoji: Schweigendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😯" title="Schweigendes Gesicht" aria-label="Emoji: Schweigendes Gesicht">

Now, do I think this...

So, there& #39;s actually a TON to digest here for planners.

Certainly more than we got from CAA. Maybe even more, in total, than we got from the original SECURE Act (though no one provision will have the impact that the & #39;death& #39; of the & #39;stretch& #39; had).

Now, do I think this...

4/

...this is going to pass?

Yep.

And while I& #39;d be surprised if there weren& #39;t SOME changes, I& #39;d be more surprised if it died altogether.

Has STRONG bipartisan support (politicians https://abs.twimg.com/emoji/v2/... draggable="false" alt="♥" title="Herz" aria-label="Emoji: Herz"> talking about how they saved your retirement).

https://abs.twimg.com/emoji/v2/... draggable="false" alt="♥" title="Herz" aria-label="Emoji: Herz"> talking about how they saved your retirement).

I& #39;d say 90% it gets passed in similar form.

...this is going to pass?

Yep.

And while I& #39;d be surprised if there weren& #39;t SOME changes, I& #39;d be more surprised if it died altogether.

Has STRONG bipartisan support (politicians

I& #39;d say 90% it gets passed in similar form.

5/

Let& #39;s get down to biz here and talk about what the bill says.

Fair warning, I& #39;m going to be going completely out of order, focusing on why I think are the bigger-news items first.

Let& #39;s begin with RMDs, b/c they basically impact all non-Roth IRA retirement acct owners...

Let& #39;s get down to biz here and talk about what the bill says.

Fair warning, I& #39;m going to be going completely out of order, focusing on why I think are the bigger-news items first.

Let& #39;s begin with RMDs, b/c they basically impact all non-Roth IRA retirement acct owners...

6/

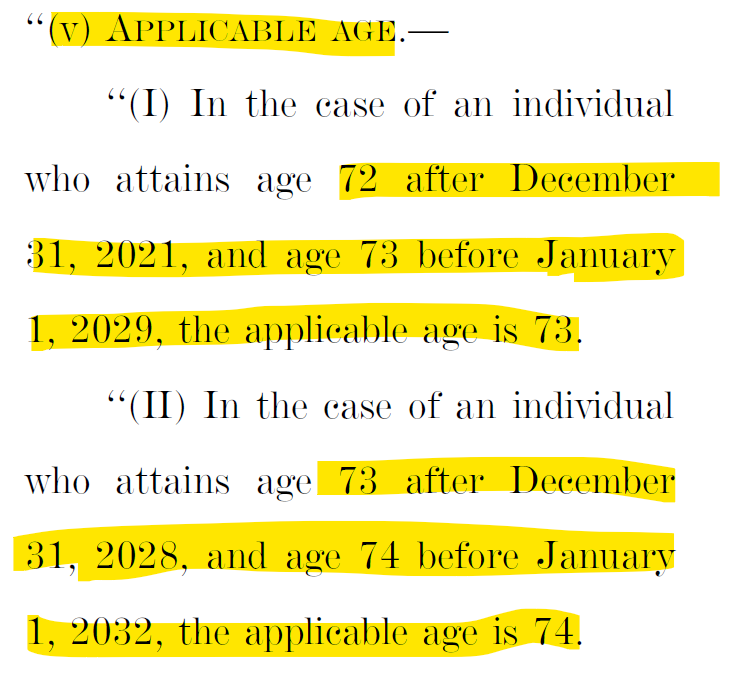

RMDs GRADUALLY get pushed back from 72 (current) to 75.

Yep. Instead of just making it 75 and having it be simple, Congress be Congressing...

RMDs would start at:

73 if you turn 72 from 2022-2027

74 if you turn 72 in 2028-2039

75 if you turn 72 in 2030 or later

F.M.L. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤕" title="Gesicht mit Kopfbandage" aria-label="Emoji: Gesicht mit Kopfbandage">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤕" title="Gesicht mit Kopfbandage" aria-label="Emoji: Gesicht mit Kopfbandage">

RMDs GRADUALLY get pushed back from 72 (current) to 75.

Yep. Instead of just making it 75 and having it be simple, Congress be Congressing...

RMDs would start at:

73 if you turn 72 from 2022-2027

74 if you turn 72 in 2028-2039

75 if you turn 72 in 2030 or later

F.M.L.

7/

Gonna jump here and go to Section 312, b/c I think it& #39;s sneaky important.

Right now, taxpayers generally have NO STATUTE OF LIMITATIONS for IRA penalties. So, theoretically, you miss an RMD today, and the IRS can come back in 20 years and assess the penalty, interest, etc...

Gonna jump here and go to Section 312, b/c I think it& #39;s sneaky important.

Right now, taxpayers generally have NO STATUTE OF LIMITATIONS for IRA penalties. So, theoretically, you miss an RMD today, and the IRS can come back in 20 years and assess the penalty, interest, etc...

8/

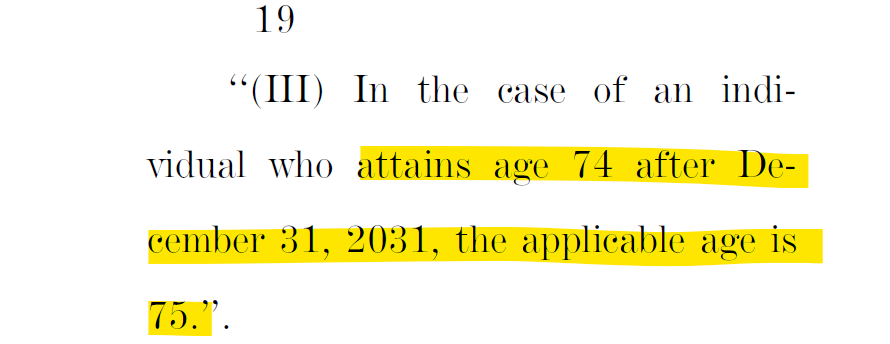

W/out boring you to death, the reason is b/c those penalties get reported on Form 5329. IRS and the Tax Court have previously agreed Form 5329 is its own RETURN (see https://casetext.com/case/paschall-v-commissioner-of-internal-revenue).

So,">https://casetext.com/case/pasc... no file Form (return) 5329 = no start of clock for statute of limitations...

W/out boring you to death, the reason is b/c those penalties get reported on Form 5329. IRS and the Tax Court have previously agreed Form 5329 is its own RETURN (see https://casetext.com/case/paschall-v-commissioner-of-internal-revenue).

So,">https://casetext.com/case/pasc... no file Form (return) 5329 = no start of clock for statute of limitations...

9/

No one just randomly files Form 5329, so unless you knew you had a penalty and filed, you were basically leaving yourself open to IRS scrutiny forever.

This would solve that by saying if you filed your income tax return (Form 1040), THAT starts the clock.

It even goes so...

No one just randomly files Form 5329, so unless you knew you had a penalty and filed, you were basically leaving yourself open to IRS scrutiny forever.

This would solve that by saying if you filed your income tax return (Form 1040), THAT starts the clock.

It even goes so...

10/

...far as to say that if you didn& #39;t file a return b/c you didn& #39;t have to, the statute of limitations starts when you otherwise would have filed your return (if you needed to).

Pretty taxpayer-friendly, and frankly, maybe my favorite thing in the whole bill.

Moving on...

...far as to say that if you didn& #39;t file a return b/c you didn& #39;t have to, the statute of limitations starts when you otherwise would have filed your return (if you needed to).

Pretty taxpayer-friendly, and frankly, maybe my favorite thing in the whole bill.

Moving on...

11/

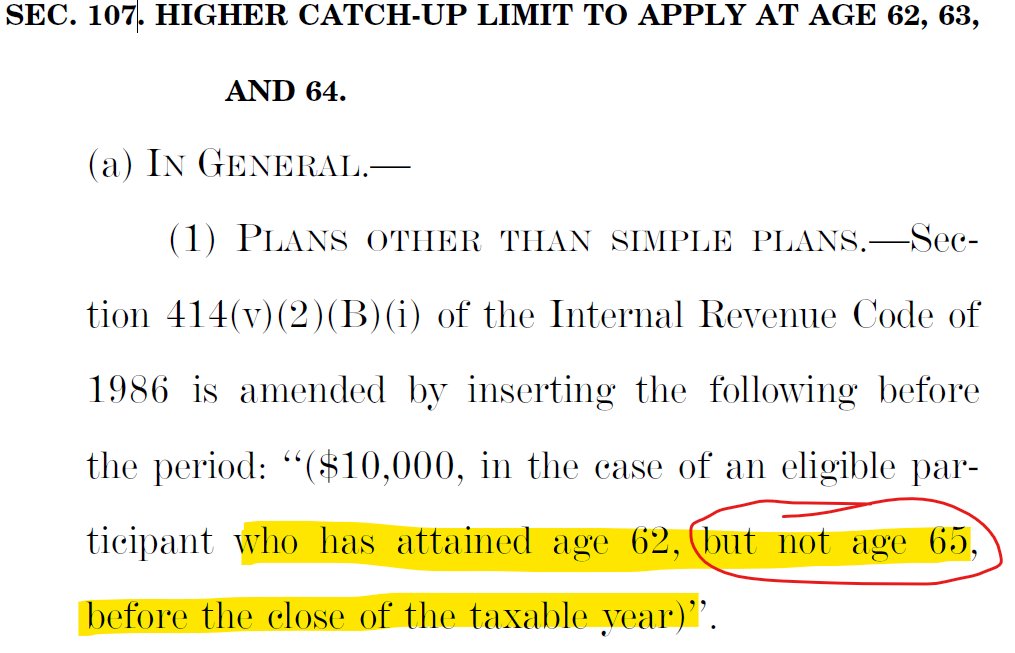

Let& #39;s talk about catch-up contributions, shall we?

Section 106 would FINALLY index IRA catch-up contributions for inflation.

Presently, the IRA contribution, plan salary deferral, plan catch-up contribution, and plan overall limits are ALL indexed for inflation.

But...

Let& #39;s talk about catch-up contributions, shall we?

Section 106 would FINALLY index IRA catch-up contributions for inflation.

Presently, the IRA contribution, plan salary deferral, plan catch-up contribution, and plan overall limits are ALL indexed for inflation.

But...

12/

...not the IRA catch-up contribution limit. It has to be increased by legislation, and that& #39;s only happened one time... for 2006!

This ends that stupidity. But we& #39;re not done with catch-up contributions (or, unfortunately, stupidity) yet.

Which brings us to Section 107...

...not the IRA catch-up contribution limit. It has to be increased by legislation, and that& #39;s only happened one time... for 2006!

This ends that stupidity. But we& #39;re not done with catch-up contributions (or, unfortunately, stupidity) yet.

Which brings us to Section 107...

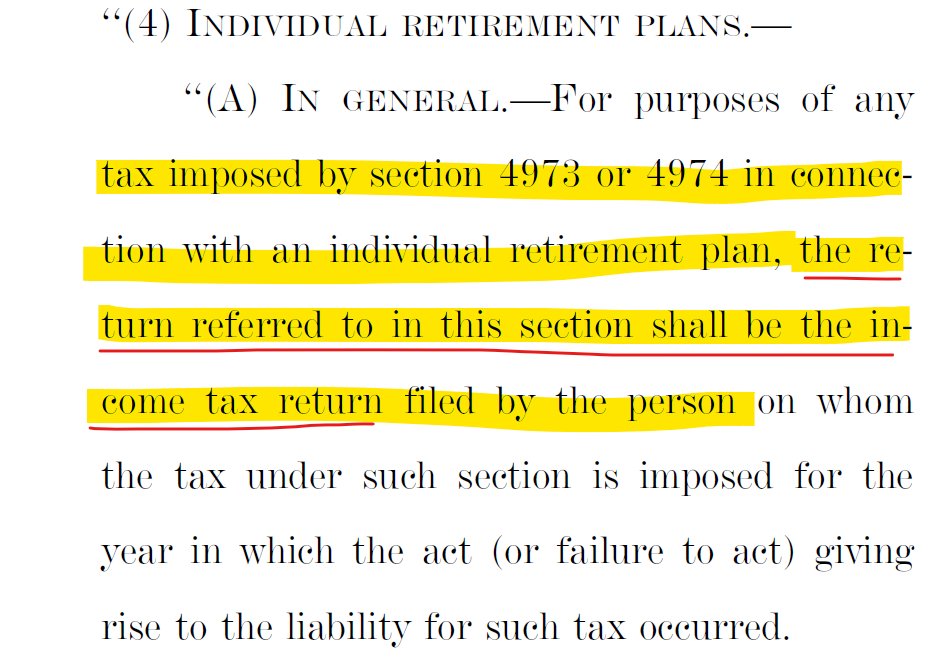

13/

...Section 107 creates new plan catch-up contribution limits in years a participant turns 62, 63 + 64.

Such (62-64) participants would have following catch-up contribution limits beginning in 2023:

- 401(k)s and similar plans: $10k ($6.5k today)

- SIMPLE: $5k ($3k today)

...Section 107 creates new plan catch-up contribution limits in years a participant turns 62, 63 + 64.

Such (62-64) participants would have following catch-up contribution limits beginning in 2023:

- 401(k)s and similar plans: $10k ($6.5k today)

- SIMPLE: $5k ($3k today)

14/

On the surface this is cool, but for the life of me, I can& #39;t understand why Congress is so interested in helping 62-64 year-olds save for retirement, but then wants to give 65-year-olds the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🖕" title="Stinke-Finger" aria-label="Emoji: Stinke-Finger">.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🖕" title="Stinke-Finger" aria-label="Emoji: Stinke-Finger">.

I mean, they go out of their way to ensure you that at 65, you can take a hike https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">

On the surface this is cool, but for the life of me, I can& #39;t understand why Congress is so interested in helping 62-64 year-olds save for retirement, but then wants to give 65-year-olds the

I mean, they go out of their way to ensure you that at 65, you can take a hike

15/

Thought we were done talking about catch-up contributions, huh?

Well, guess what? Fooled you!

(OK, it& #39;s not Star Wars, but it& #39;s close enough)

Anyway... Section 603 would require ALL CATCH-UP CONTRIBUTIONS TO BE MADE TO ROTH ACCOUNTS!!!!

I have a lot to say about this...

Thought we were done talking about catch-up contributions, huh?

Well, guess what? Fooled you!

(OK, it& #39;s not Star Wars, but it& #39;s close enough)

Anyway... Section 603 would require ALL CATCH-UP CONTRIBUTIONS TO BE MADE TO ROTH ACCOUNTS!!!!

I have a lot to say about this...

16/

First... not all plans have Roth options yet. What happens to those participants?

Notably, this would take effect next year! That& #39;s not all that much time with everything else businesses have going on these days.

Second, for those who continue to question whether...

First... not all plans have Roth options yet. What happens to those participants?

Notably, this would take effect next year! That& #39;s not all that much time with everything else businesses have going on these days.

Second, for those who continue to question whether...

17/

Uncle Sam will keep the Roth IRA around or whether it will be eliminated b/c it& #39;s "too good"...

Let this be the latest evidence of what I& #39;ve been saying for years...

Uncle Sam LOVES the Roth.

It brings in $ today, and people like it. Name me ANYTHING else that does that.

Uncle Sam will keep the Roth IRA around or whether it will be eliminated b/c it& #39;s "too good"...

Let this be the latest evidence of what I& #39;ve been saying for years...

Uncle Sam LOVES the Roth.

It brings in $ today, and people like it. Name me ANYTHING else that does that.

18/

OK, now we can FINALLY move on to something else besides catch-up contributions. But let& #39;s stick with the Roth now that I& #39;ve brought it up...

In another "pay-for" provision, Section 601 of SECURE Act 2.0 would create SEP and SIMPLE Roth accounts, and Section 604 would...

OK, now we can FINALLY move on to something else besides catch-up contributions. But let& #39;s stick with the Roth now that I& #39;ve brought it up...

In another "pay-for" provision, Section 601 of SECURE Act 2.0 would create SEP and SIMPLE Roth accounts, and Section 604 would...

19/

allow individuals to designate employer matching contributions to the Roth side.

Best I can tell, Roth SIMPLE IRA salary deferrals would work similarly to Roth 401k contributions.

As for SEP or matching contributions, I think they would just get added to the W-2 somehow.

allow individuals to designate employer matching contributions to the Roth side.

Best I can tell, Roth SIMPLE IRA salary deferrals would work similarly to Roth 401k contributions.

As for SEP or matching contributions, I think they would just get added to the W-2 somehow.

20/

On to the portion of this bill that was likely written by the Life Insurance lobbyists... ... don& #39;t kid yourself, they are a very powerful group.

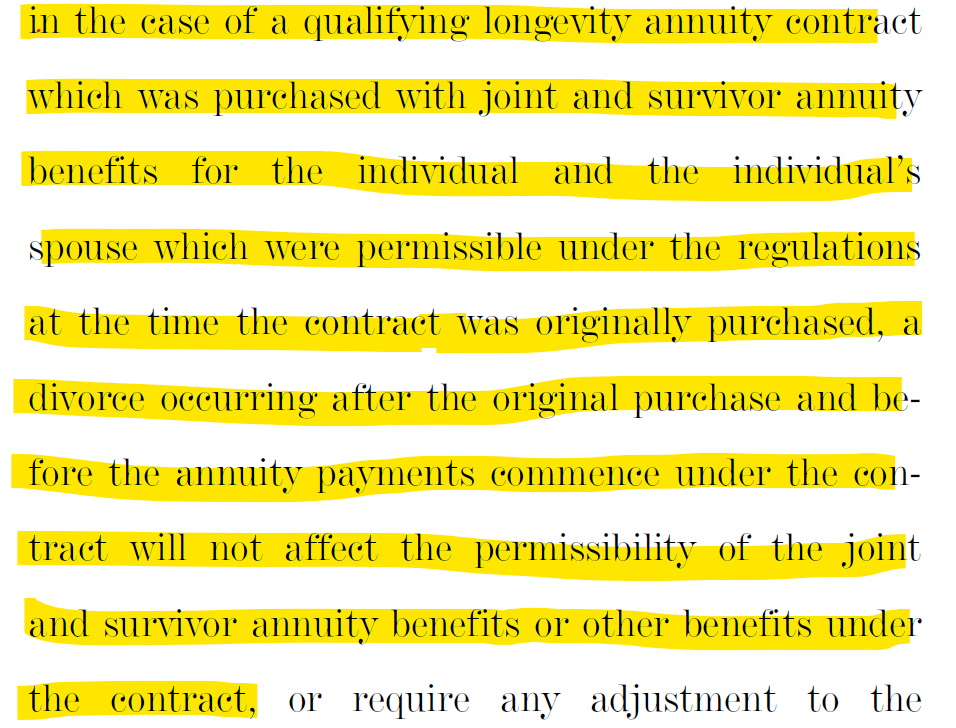

Section 202 would amend the QLAC rules to eliminate the 25% limit (of acct balance) on purchases. It appears to keep the...

On to the portion of this bill that was likely written by the Life Insurance lobbyists... ... don& #39;t kid yourself, they are a very powerful group.

Section 202 would amend the QLAC rules to eliminate the 25% limit (of acct balance) on purchases. It appears to keep the...

21/

current overall limit of $135k (indexed) in place. So, essentially, someone would be able to use all retirement acct dollars, up to $135k, to purchase a QLAC.

It also would clarify the treatment of contracts in the event of a divorce https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">, and allow up to a 90-day free-look...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">, and allow up to a 90-day free-look...

current overall limit of $135k (indexed) in place. So, essentially, someone would be able to use all retirement acct dollars, up to $135k, to purchase a QLAC.

It also would clarify the treatment of contracts in the event of a divorce

22/

Section 203 would expand investment options for insurance contracts. Specifically (but still subject to some limitations), insurance contracts would be able to incorporate ETFs into their offering.

So in the near future, we might see VUL and/or VA policies w/ ETF options...

Section 203 would expand investment options for insurance contracts. Specifically (but still subject to some limitations), insurance contracts would be able to incorporate ETFs into their offering.

So in the near future, we might see VUL and/or VA policies w/ ETF options...

23/

Coupled with potential changes to the capital gains rules (e.g., the top rate and changes to the step-up), low-cost ETFs inside a low-cost VA wrapper could become a particularly attractive option for some high-income taxpayers.

Will be interesting to see where this goes...

Coupled with potential changes to the capital gains rules (e.g., the top rate and changes to the step-up), low-cost ETFs inside a low-cost VA wrapper could become a particularly attractive option for some high-income taxpayers.

Will be interesting to see where this goes...

24/

Lastly on the insurance front, more flexibility would be given to income annuities in retirement accounts.

Such contracts could have:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Up to a 5% annual COLA on payments

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Up to a 5% annual COLA on payments

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Lump-sum payments that reduce or eliminate future payments

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Lump-sum payments that reduce or eliminate future payments

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Dividends (based on experience)...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Dividends (based on experience)...

Lastly on the insurance front, more flexibility would be given to income annuities in retirement accounts.

Such contracts could have:

25/

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">ROP less premium death benefits

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">ROP less premium death benefits

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Payments up to 12 months in the future paid now

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Payments up to 12 months in the future paid now

Previously, these benefits often would have caused the annuity to run afoul of various actuarial requirements.

Now I want to move on to talk about something I think is really cool...

Previously, these benefits often would have caused the annuity to run afoul of various actuarial requirements.

Now I want to move on to talk about something I think is really cool...

26/

Section 111 seeks to provide some well-deserved help for military spouses.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗝" title="Alter Schlüssel" aria-label="Emoji: Alter Schlüssel">issue = Military spouses often move around a lot, and so they are less likely to accumulate enough time w/ an employer to participate in and/or receive employer contributions under their plan so...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗝" title="Alter Schlüssel" aria-label="Emoji: Alter Schlüssel">issue = Military spouses often move around a lot, and so they are less likely to accumulate enough time w/ an employer to participate in and/or receive employer contributions under their plan so...

Section 111 seeks to provide some well-deserved help for military spouses.

27/

...SECURE Act 2.0 creates incentives for employers to create special provisions for certain "Military Spouses" (e.g., doesn& #39;t apply to highly-comped military spouses).

If employers allow military spouses to participate w/in 2 months of starting work and treat them as...

...SECURE Act 2.0 creates incentives for employers to create special provisions for certain "Military Spouses" (e.g., doesn& #39;t apply to highly-comped military spouses).

If employers allow military spouses to participate w/in 2 months of starting work and treat them as...

28/

...though they had 2 years of service ((e.g., for purposes of ER contributions), AND they fully vest them immediately (I like anything that& #39;s fully vested https://abs.twimg.com/emoji/v2/... draggable="false" alt="😜" title="Zwinkerndes Gesicht mit Zunge" aria-label="Emoji: Zwinkerndes Gesicht mit Zunge">), then the employer will be eligible for up to a $500 credit per military spouse for up to 3 years each.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😜" title="Zwinkerndes Gesicht mit Zunge" aria-label="Emoji: Zwinkerndes Gesicht mit Zunge">), then the employer will be eligible for up to a $500 credit per military spouse for up to 3 years each.

Woohoo!

...though they had 2 years of service ((e.g., for purposes of ER contributions), AND they fully vest them immediately (I like anything that& #39;s fully vested

Woohoo!

29/

OK, https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn">needs a break, so let& #39;s talk about some sillier parts of the bill.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn">needs a break, so let& #39;s talk about some sillier parts of the bill.

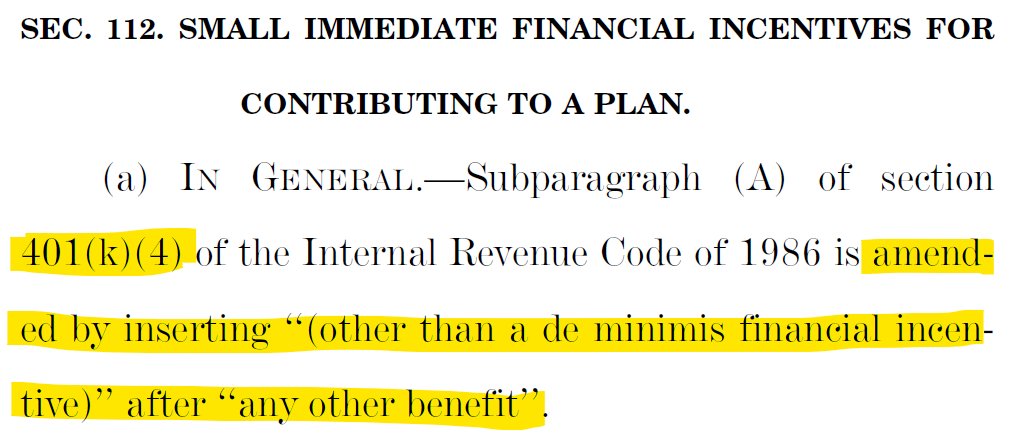

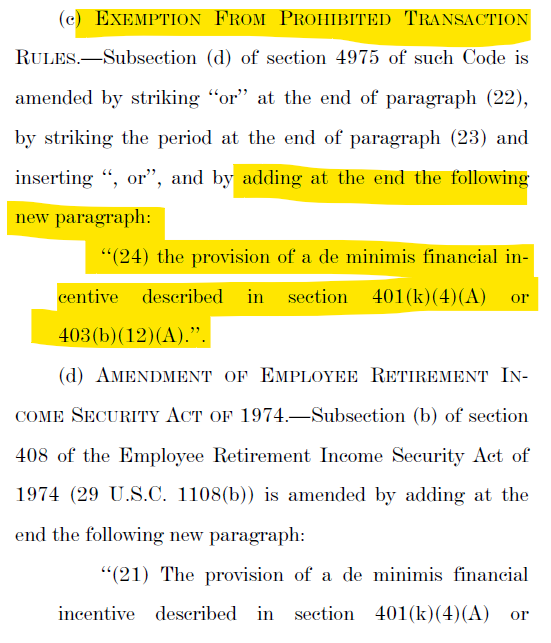

Sec 112 would update plan + prohibited transaction rules to allow "de minimis financial incentives".

So "enroll in your 401(k) and get a $25 @Starbucks gift card" is a real possibility in the future.

OK,

Sec 112 would update plan + prohibited transaction rules to allow "de minimis financial incentives".

So "enroll in your 401(k) and get a $25 @Starbucks gift card" is a real possibility in the future.

30/

And Section 305 allows plans to stop sending a whole bunch of crap to employees who are eligible to participate in the plan, but dont.

Let& #39;s be real, even those who DO participate don& #39;t read most https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen">they get from plans, so sending stuff to non-participants? Waste of

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💩" title="Dreckshaufen" aria-label="Emoji: Dreckshaufen">they get from plans, so sending stuff to non-participants? Waste of  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏳" title="Sanduhr mit fließendem Sand" aria-label="Emoji: Sanduhr mit fließendem Sand">+

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏳" title="Sanduhr mit fließendem Sand" aria-label="Emoji: Sanduhr mit fließendem Sand">+ https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

And Section 305 allows plans to stop sending a whole bunch of crap to employees who are eligible to participate in the plan, but dont.

Let& #39;s be real, even those who DO participate don& #39;t read most

Read on Twitter

Read on Twitter " title="6/ RMDs GRADUALLY get pushed back from 72 (current) to 75.Yep. Instead of just making it 75 and having it be simple, Congress be Congressing...RMDs would start at:73 if you turn 72 from 2022-202774 if you turn 72 in 2028-203975 if you turn 72 in 2030 or laterF.M.L.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤕" title="Gesicht mit Kopfbandage" aria-label="Emoji: Gesicht mit Kopfbandage">">

" title="6/ RMDs GRADUALLY get pushed back from 72 (current) to 75.Yep. Instead of just making it 75 and having it be simple, Congress be Congressing...RMDs would start at:73 if you turn 72 from 2022-202774 if you turn 72 in 2028-203975 if you turn 72 in 2030 or laterF.M.L.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤕" title="Gesicht mit Kopfbandage" aria-label="Emoji: Gesicht mit Kopfbandage">">

" title="6/ RMDs GRADUALLY get pushed back from 72 (current) to 75.Yep. Instead of just making it 75 and having it be simple, Congress be Congressing...RMDs would start at:73 if you turn 72 from 2022-202774 if you turn 72 in 2028-203975 if you turn 72 in 2030 or laterF.M.L.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤕" title="Gesicht mit Kopfbandage" aria-label="Emoji: Gesicht mit Kopfbandage">">

" title="6/ RMDs GRADUALLY get pushed back from 72 (current) to 75.Yep. Instead of just making it 75 and having it be simple, Congress be Congressing...RMDs would start at:73 if you turn 72 from 2022-202774 if you turn 72 in 2028-203975 if you turn 72 in 2030 or laterF.M.L.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤕" title="Gesicht mit Kopfbandage" aria-label="Emoji: Gesicht mit Kopfbandage">">

.I mean, they go out of their way to ensure you that at 65, you can take a hikehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">" title="14/On the surface this is cool, but for the life of me, I can& #39;t understand why Congress is so interested in helping 62-64 year-olds save for retirement, but then wants to give 65-year-olds thehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🖕" title="Stinke-Finger" aria-label="Emoji: Stinke-Finger">.I mean, they go out of their way to ensure you that at 65, you can take a hikehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">" class="img-responsive" style="max-width:100%;"/>

.I mean, they go out of their way to ensure you that at 65, you can take a hikehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">" title="14/On the surface this is cool, but for the life of me, I can& #39;t understand why Congress is so interested in helping 62-64 year-olds save for retirement, but then wants to give 65-year-olds thehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🖕" title="Stinke-Finger" aria-label="Emoji: Stinke-Finger">.I mean, they go out of their way to ensure you that at 65, you can take a hikehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">" class="img-responsive" style="max-width:100%;"/>

, and allow up to a 90-day free-look..." title="21/current overall limit of $135k (indexed) in place. So, essentially, someone would be able to use all retirement acct dollars, up to $135k, to purchase a QLAC.It also would clarify the treatment of contracts in the event of a divorcehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">, and allow up to a 90-day free-look..." class="img-responsive" style="max-width:100%;"/>

, and allow up to a 90-day free-look..." title="21/current overall limit of $135k (indexed) in place. So, essentially, someone would be able to use all retirement acct dollars, up to $135k, to purchase a QLAC.It also would clarify the treatment of contracts in the event of a divorcehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">, and allow up to a 90-day free-look..." class="img-responsive" style="max-width:100%;"/>

needs a break, so let& #39;s talk about some sillier parts of the bill.Sec 112 would update plan + prohibited transaction rules to allow "de minimis financial incentives".So "enroll in your 401(k) and get a $25 @Starbucks gift card" is a real possibility in the future." title="29/OK,https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn">needs a break, so let& #39;s talk about some sillier parts of the bill.Sec 112 would update plan + prohibited transaction rules to allow "de minimis financial incentives".So "enroll in your 401(k) and get a $25 @Starbucks gift card" is a real possibility in the future.">

needs a break, so let& #39;s talk about some sillier parts of the bill.Sec 112 would update plan + prohibited transaction rules to allow "de minimis financial incentives".So "enroll in your 401(k) and get a $25 @Starbucks gift card" is a real possibility in the future." title="29/OK,https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn">needs a break, so let& #39;s talk about some sillier parts of the bill.Sec 112 would update plan + prohibited transaction rules to allow "de minimis financial incentives".So "enroll in your 401(k) and get a $25 @Starbucks gift card" is a real possibility in the future.">

needs a break, so let& #39;s talk about some sillier parts of the bill.Sec 112 would update plan + prohibited transaction rules to allow "de minimis financial incentives".So "enroll in your 401(k) and get a $25 @Starbucks gift card" is a real possibility in the future." title="29/OK,https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn">needs a break, so let& #39;s talk about some sillier parts of the bill.Sec 112 would update plan + prohibited transaction rules to allow "de minimis financial incentives".So "enroll in your 401(k) and get a $25 @Starbucks gift card" is a real possibility in the future.">

needs a break, so let& #39;s talk about some sillier parts of the bill.Sec 112 would update plan + prohibited transaction rules to allow "de minimis financial incentives".So "enroll in your 401(k) and get a $25 @Starbucks gift card" is a real possibility in the future." title="29/OK,https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn">needs a break, so let& #39;s talk about some sillier parts of the bill.Sec 112 would update plan + prohibited transaction rules to allow "de minimis financial incentives".So "enroll in your 401(k) and get a $25 @Starbucks gift card" is a real possibility in the future.">