An entrepreneur-friend of mine referred a company to me that I thought sounded interesting. But I also commented that the sales cycle seemed long but we& #39;ll see.

Today& #39;s thread - what makes a sales cycle long? Why is it relevant to VCs? How do you even know??

Read on >>

Today& #39;s thread - what makes a sales cycle long? Why is it relevant to VCs? How do you even know??

Read on >>

1) First, let& #39;s take a step back.

I& #39;ve often talked about how the VC asset class isn& #39;t about investing in good businesses. It& #39;s about finding the highest possible multiple-returning companies.

This was a total mind warp to me in going from entrepreneur to VC.

I& #39;ve often talked about how the VC asset class isn& #39;t about investing in good businesses. It& #39;s about finding the highest possible multiple-returning companies.

This was a total mind warp to me in going from entrepreneur to VC.

2) As an aside, angels have completely different incentives. As stewards of their own money, angels can invest for whatever reason.

VCs, though, manage other ppl& #39;s money, and those ppl invest solely BECAUSE they want the highest returning outcomes possible.

VCs, though, manage other ppl& #39;s money, and those ppl invest solely BECAUSE they want the highest returning outcomes possible.

3) On top of that, VCs are TOTALLY GUESSING at the earliest stages which businesses will be highest returning.

This is why there are MANY great businesses that will struggle to get VC funding.

This is why there are MANY great businesses that will struggle to get VC funding.

4) This is also why I often say for every check I write, there are ~4-5 other cos I pass on that will go on to do really well.

Last mon we saw 600 cos @HustleFundVC. It& #39;s doubtful we picked the exact correct subset of the highest returning companies in that pool.

Last mon we saw 600 cos @HustleFundVC. It& #39;s doubtful we picked the exact correct subset of the highest returning companies in that pool.

5) But you try your best.

So what does it mean to be "highest returning". It means that from entry pt to exit pt, there& #39;s a strong multiple.

I.e. if you invest $100 at $3m post money val, 100x means the company exits for $300m. Factoring in dilution at 50% -> $5k back

So what does it mean to be "highest returning". It means that from entry pt to exit pt, there& #39;s a strong multiple.

I.e. if you invest $100 at $3m post money val, 100x means the company exits for $300m. Factoring in dilution at 50% -> $5k back

6) In addition, VCs generally are 10 yr vehicles. So if you invest in yr 2, you& #39;re pretty much hoping this can all happen in the next few years.

Rough rule of thumb (dependent on valuation) that a co can get to $100m in rev runrate by yr 5.

This is HARD to do.

Rough rule of thumb (dependent on valuation) that a co can get to $100m in rev runrate by yr 5.

This is HARD to do.

7) Most companies won& #39;t hit that strong of market pull. So it& #39;s incredibly rare. But can be done.

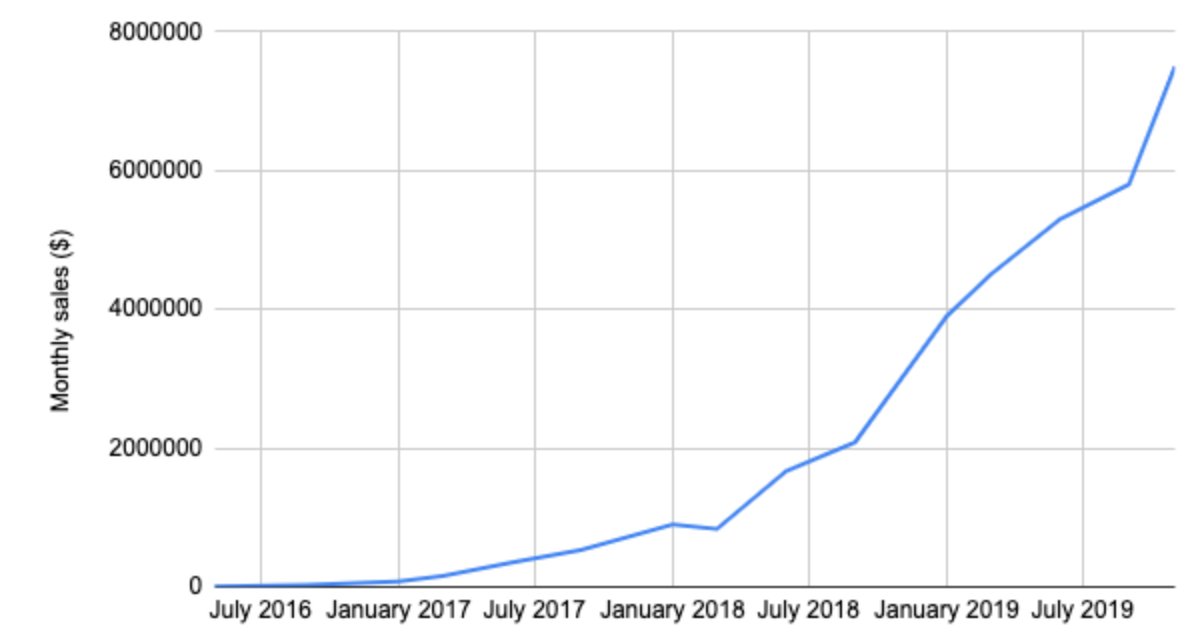

This is a real graph of a portfolio co that did this:

This is a real graph of a portfolio co that did this:

8) You can see this means that your sales cycles have to be fast, so that you can re-use the $$ coming back.

These days there are certainly loans / revenue based financing options to help w/ cash flow + VC dollars, but still tough to hit this if the sales cycles are long

These days there are certainly loans / revenue based financing options to help w/ cash flow + VC dollars, but still tough to hit this if the sales cycles are long

9) Let& #39;s spell out what this might look like:

Rev runrate:

Year 1 - $500k

Year 2 - $3m

Year 3 - $15m

Year 4 - $40m

Year 5 - $100m

That& #39;s HARD!

Rev runrate:

Year 1 - $500k

Year 2 - $3m

Year 3 - $15m

Year 4 - $40m

Year 5 - $100m

That& #39;s HARD!

10) This isn& #39;t the only way to get there. I& #39;ve seen some cos get to $100m runrate in 7 yrs and if it& #39;s content / SEO driven those first few yrs could look brutal but then really kick in at the end.

11) Also possible in enterprise sales where those initial contracts are small pilots. But then the big money kicks in later w/ upsells and expansion.

12) But it& #39;s not just about the customer acquisition channels and how they can mechanically deliver fast sales.

It& #39;s also about the value proposition.

It& #39;s also about the value proposition.

13) Through my own experience as a founder, I& #39;ve found that customer acq is easiest when:

you are

-making someone $$

-saving someone $$

-saving someone time (this is the weakest)

For B2b!

In consumer, ppl will also pay for love/lust + fame/cool factor.

you are

-making someone $$

-saving someone $$

-saving someone time (this is the weakest)

For B2b!

In consumer, ppl will also pay for love/lust + fame/cool factor.

14) If your product doesn& #39;t fit into any of these, it& #39;s generally a "nice to have" and very slow.

Sometimes there are weird pools of money:

-because of regulations (something must happen)

-because of budgets (already allocated)

Sometimes there are weird pools of money:

-because of regulations (something must happen)

-because of budgets (already allocated)

15) Additional considerations -- does an alternative need to be ripped out? Does workflow need to change? Are there frictions that are being introduced because of your product?

E.g. Salesforce -- it& #39;s not the best sales product. But everyone knows how to use it & already use it

E.g. Salesforce -- it& #39;s not the best sales product. But everyone knows how to use it & already use it

16) Are there timing considerations? Are your customers locked into a contract and can& #39;t buy now? These are hard sales.

17) Are you highly differentiated? Are you competing w/ a lot of other possibilities? All of these affect sales too because it takes time to evaluate everyone.

18) Lastly, do lots of decision makers need to get involved? If so, that will also take a lot of time.

19) So in short, this is how and why VCs think about long sales cycles.

They have a limited # of checks they can write each month/year. So which company is going to yield the fastest multiple? Fast sales cycles lend itself to that.

They have a limited # of checks they can write each month/year. So which company is going to yield the fastest multiple? Fast sales cycles lend itself to that.

Read on Twitter

Read on Twitter