1/ Steve Cohen is the hedge fund manager that owns the New York Mets. Worth $14B, he& #39;s also the inspiration behind Bobby Axelrod from the TV show "Billions".

The day-to-day details of Cohen as a trader are quite interesting.

Here some takeaways https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

The day-to-day details of Cohen as a trader are quite interesting.

Here some takeaways

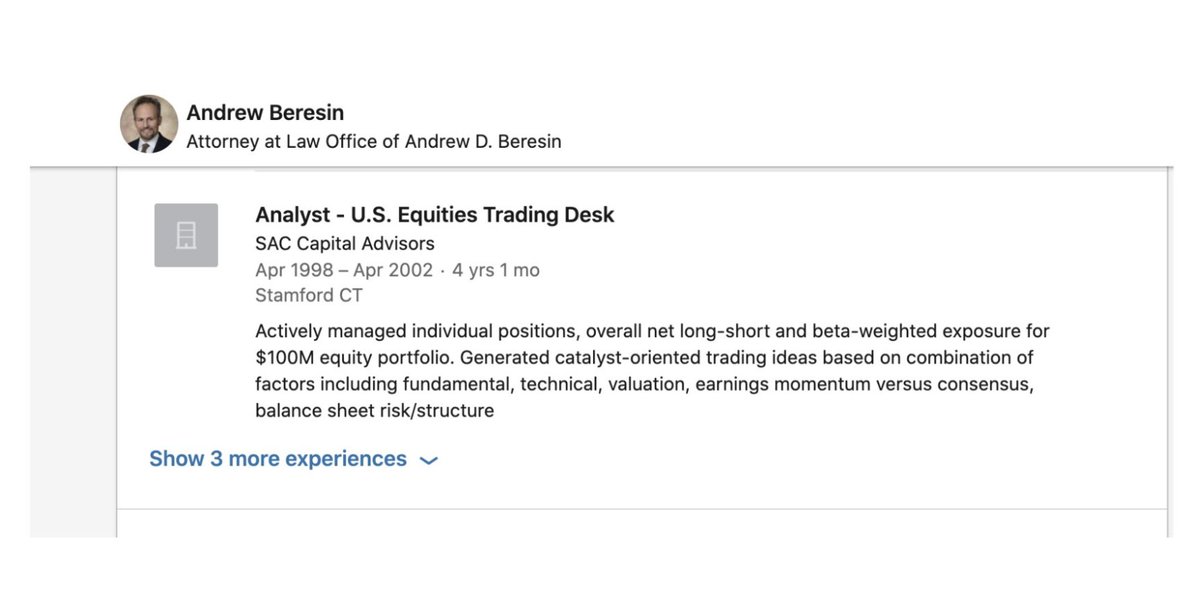

2/ The rundown of Cohen& #39;s trading tactics come from Andrew Beresin, who worked at Cohen& #39;s firm (SAC Capital Advisors) at the turn of the century.

Beresin worked "four feet from Cohen" and has vidid memories of the experience.

Beresin worked "four feet from Cohen" and has vidid memories of the experience.

3/ The elephant in the room: some of the tactics described led to an insider trading scandal.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">SAC paid a $1.8B fine for it

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">SAC paid a $1.8B fine for it

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> One of SAC& #39;s traders (Matthew Martoma) was sentenced to 9yrs in prison

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> One of SAC& #39;s traders (Matthew Martoma) was sentenced to 9yrs in prison

4/ Cohen was a trading savant

"[For Cohen] making large trades quickly is akin to breathing for most folks. I watched the man routinely multi-task dozens of stocks, trading millions of shares at a time, leaving an entire room of execution clerks panting like a dog sled team."

"[For Cohen] making large trades quickly is akin to breathing for most folks. I watched the man routinely multi-task dozens of stocks, trading millions of shares at a time, leaving an entire room of execution clerks panting like a dog sled team."

5/ Incredible instinct to enter (or exit) a trade

" Steve played a different game when it came to raising or folding, and that’s what set him apart. He knew when, and whether, to do one versus the other better than any other trader."

" Steve played a different game when it came to raising or folding, and that’s what set him apart. He knew when, and whether, to do one versus the other better than any other trader."

6/ Quick acting

"If a position wasn’t working & you didn’t understand why, sell 1/2, he& #39;d say...and, if soon thereafter it still wasn’t working, sell 1/2 again, thereby reducing your position by 75% from its original size & dramatically cutting the risk of a...bad result."

"If a position wasn’t working & you didn’t understand why, sell 1/2, he& #39;d say...and, if soon thereafter it still wasn’t working, sell 1/2 again, thereby reducing your position by 75% from its original size & dramatically cutting the risk of a...bad result."

7/ Cohen sat in the mix to expedite information flow

"When I arrived at SAC in 1998, Steve’s ability to supervise his employees was unfettered. We all sat within earshot—the research, portfolio management and trading was largely done right in front of him."

"When I arrived at SAC in 1998, Steve’s ability to supervise his employees was unfettered. We all sat within earshot—the research, portfolio management and trading was largely done right in front of him."

8/ Used a scoring system

"SAC had us come up w/ proprietary trading ideas...the highest-conviction ones were passed...to Steve, but without too much detail in order to insulate him. EG. by ranking ideas on a 1-10 scale."

(*A trade from this system lead to the insider scandal)

"SAC had us come up w/ proprietary trading ideas...the highest-conviction ones were passed...to Steve, but without too much detail in order to insulate him. EG. by ranking ideas on a 1-10 scale."

(*A trade from this system lead to the insider scandal)

9/ Cohen was basically a trading Terminator

"You could cut the phone lines and kill the power to the building, save for his stock ticker and his order-entry machine, and Steve would still come out alive with a positive P&L. You can’t teach that."

"You could cut the phone lines and kill the power to the building, save for his stock ticker and his order-entry machine, and Steve would still come out alive with a positive P&L. You can’t teach that."

10/ Oh, and he always had interest in sports teams:

"I overheard Steve conduct thousands of trades, discuss hundreds of ideas with SAC traders (a few of those being with me), and utter remarkable rhetorical statements, such as, “Should I buy The Jets?”

"I overheard Steve conduct thousands of trades, discuss hundreds of ideas with SAC traders (a few of those being with me), and utter remarkable rhetorical statements, such as, “Should I buy The Jets?”

11/ For more business breakdowns (and really dumb memes), smash that FOLLOW @TrungTPhan. https://twitter.com/TrungTPhan/status/1388861558529302532?s=20">https://twitter.com/TrungTPha...

12/ Source

Article here: https://observer.com/2017/02/sac-capital-book-black-edge-steve-cohen-review/

And,">https://observer.com/2017/02/s... if you want to dig deeper into the Cohen case (and Fed& #39;s 10yr mission to get him), read this amazing New Yorker article: https://newyorker.com/magazine/2017/01/16/when-the-feds-went-after-the-hedge-fund-legend-steven-a-cohen">https://newyorker.com/magazine/...

Article here: https://observer.com/2017/02/sac-capital-book-black-edge-steve-cohen-review/

And,">https://observer.com/2017/02/s... if you want to dig deeper into the Cohen case (and Fed& #39;s 10yr mission to get him), read this amazing New Yorker article: https://newyorker.com/magazine/2017/01/16/when-the-feds-went-after-the-hedge-fund-legend-steven-a-cohen">https://newyorker.com/magazine/...

13/ One final note: “I’m not uncertain”

Read on Twitter

Read on Twitter " title="1/ Steve Cohen is the hedge fund manager that owns the New York Mets. Worth $14B, he& #39;s also the inspiration behind Bobby Axelrod from the TV show "Billions". The day-to-day details of Cohen as a trader are quite interesting. Here some takeawayshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">" class="img-responsive" style="max-width:100%;"/>

" title="1/ Steve Cohen is the hedge fund manager that owns the New York Mets. Worth $14B, he& #39;s also the inspiration behind Bobby Axelrod from the TV show "Billions". The day-to-day details of Cohen as a trader are quite interesting. Here some takeawayshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">" class="img-responsive" style="max-width:100%;"/>

SAC paid a $1.8B fine for ithttps://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> One of SAC& #39;s traders (Matthew Martoma) was sentenced to 9yrs in prison" title="3/ The elephant in the room: some of the tactics described led to an insider trading scandal.https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">SAC paid a $1.8B fine for ithttps://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> One of SAC& #39;s traders (Matthew Martoma) was sentenced to 9yrs in prison" class="img-responsive" style="max-width:100%;"/>

SAC paid a $1.8B fine for ithttps://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> One of SAC& #39;s traders (Matthew Martoma) was sentenced to 9yrs in prison" title="3/ The elephant in the room: some of the tactics described led to an insider trading scandal.https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">SAC paid a $1.8B fine for ithttps://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> One of SAC& #39;s traders (Matthew Martoma) was sentenced to 9yrs in prison" class="img-responsive" style="max-width:100%;"/>