The incredible story of how I went down the  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐇" title="Hase" aria-label="Emoji: Hase">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐇" title="Hase" aria-label="Emoji: Hase"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🕳️" title="Loch" aria-label="Emoji: Loch"> and discovered what I believe are two of @AndreCronjeTech "unreleased" projects in the wild

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🕳️" title="Loch" aria-label="Emoji: Loch"> and discovered what I believe are two of @AndreCronjeTech "unreleased" projects in the wild

Time for a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

$YFI $Sushi $Eth @CryptoMessiah @bluekirbyfi @DeFiGod1 @CryptoCobain @CryptoSpider1 @UniswapD @Rafi_0x @bantg

Time for a

$YFI $Sushi $Eth @CryptoMessiah @bluekirbyfi @DeFiGod1 @CryptoCobain @CryptoSpider1 @UniswapD @Rafi_0x @bantg

First a little background...

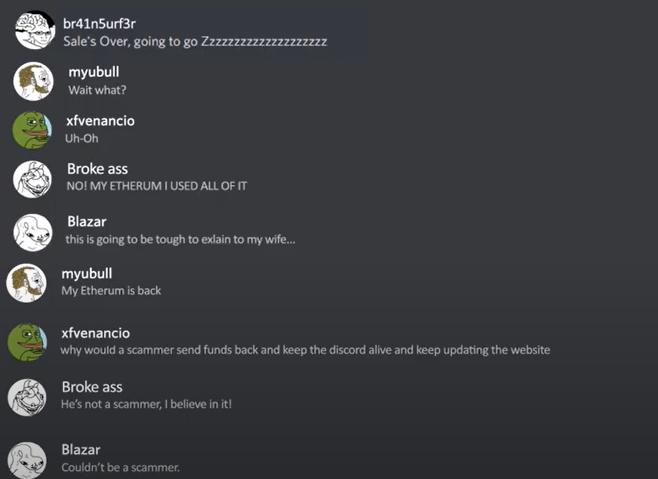

In Sep 2020, a dev named 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫 launched a pre-sale with 118 spots costing 1 $eth.

After pre-sale, there was no communication for months, and everyone assumed they got scammed.

Months later, the dev refunded pre-salers 0.11 $eth

In Sep 2020, a dev named 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫 launched a pre-sale with 118 spots costing 1 $eth.

After pre-sale, there was no communication for months, and everyone assumed they got scammed.

Months later, the dev refunded pre-salers 0.11 $eth

Then, in early February, 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫 arises from his slumber and gets ready to launch @yzyDAO with a medium post and a sweet launch video.

https://yzydao.medium.com/introducing-yzy-dao-yzy-6c973279dad5

https://yzydao.medium.com/introduci... href="

https://www.youtube.com/watch... href="https://twitter.com/certikorg">@certikorg audit in progress

https://yzydao.medium.com/introducing-yzy-dao-yzy-6c973279dad5

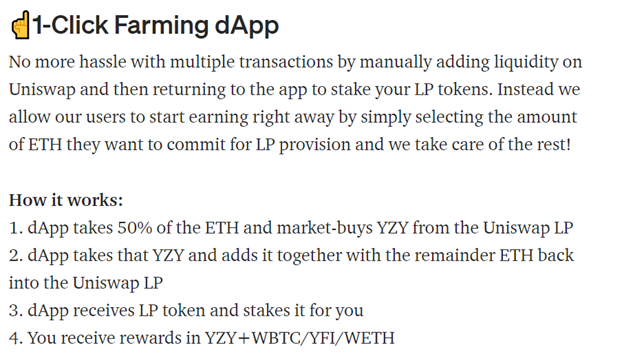

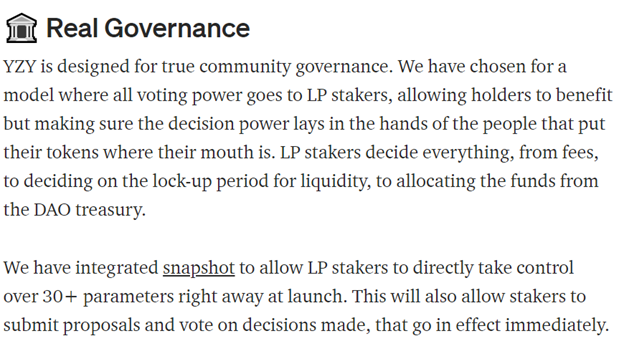

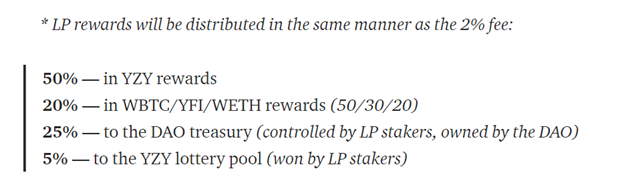

$YZY is a community owned DAO that gives voting power to LP Stakers. $YZY used an innovative 1-Click farming dApp that I have never seen in another platform and gave confidence in the devs abilities

Stakers earned $YZY, $BTC, $YFI ( https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">) and $ETH

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">) and $ETH

As a $YFI supporter, I was pumped

Stakers earned $YZY, $BTC, $YFI (

As a $YFI supporter, I was pumped

Now for the fun part https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Gesicht mit Monokel" aria-label="Emoji: Gesicht mit Monokel">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Gesicht mit Monokel" aria-label="Emoji: Gesicht mit Monokel">

By holding 1 $YZY in your wallet, you were invited into a secret discord channel called the Citadel. The Citadel was an awesome, friendly, and engaging community of degens that wanted to help build @yzyDAO into something great.

By holding 1 $YZY in your wallet, you were invited into a secret discord channel called the Citadel. The Citadel was an awesome, friendly, and engaging community of degens that wanted to help build @yzyDAO into something great.

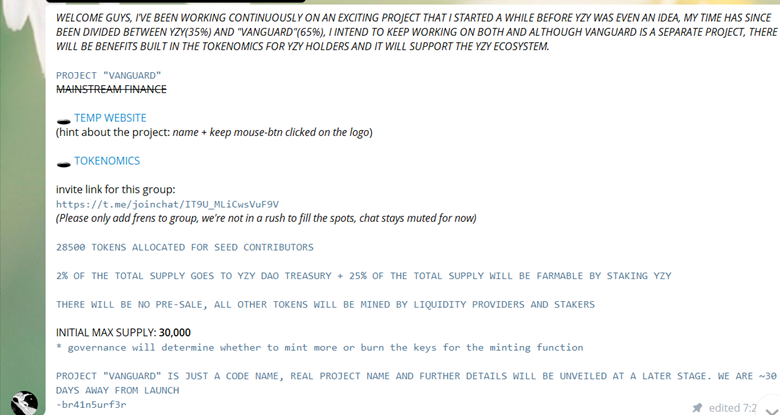

A few weeks into launch, 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫 announced in the Citadel an imminent launch of a $YZY secret sister project Vanguard and that he would continue working on both projects https://abs.twimg.com/emoji/v2/... draggable="false" alt="🕳️" title="Loch" aria-label="Emoji: Loch">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🕳️" title="Loch" aria-label="Emoji: Loch">

https://yzy.finance/vanguard/

Vanguard& #39;s">https://yzy.finance/vanguard/... tokenomics significantly benefit the @yzyDAO "ecosystem"

https://yzy.finance/vanguard/

Vanguard& #39;s">https://yzy.finance/vanguard/... tokenomics significantly benefit the @yzyDAO "ecosystem"

The sleuth will notice a few interesting clues other than max supply of 30,000 tokens ( https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">)

1. Hint about project: name + keep mouse clicked on logo.

Clicking on the logo creates a black hole effect. Also notice the use of black holes https://abs.twimg.com/emoji/v2/... draggable="false" alt="🕳️" title="Loch" aria-label="Emoji: Loch"> in the teaser message.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🕳️" title="Loch" aria-label="Emoji: Loch"> in the teaser message.

1. Hint about project: name + keep mouse clicked on logo.

Clicking on the logo creates a black hole effect. Also notice the use of black holes

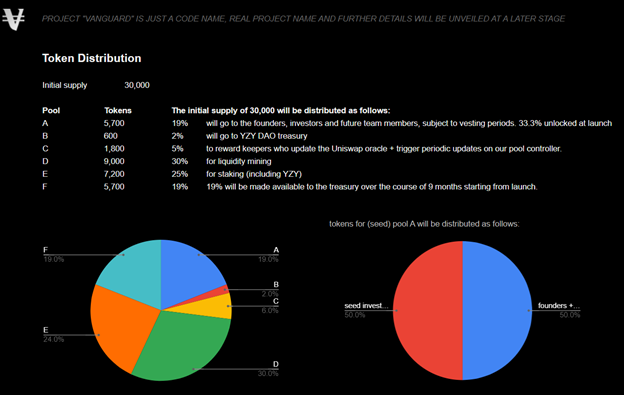

2. The Tokenomics

Take a look at Pool C. I have never seen a project build Keep3r rewards into the initial tokenomics. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

https://yzy.finance/vanguard/token/ ">https://yzy.finance/vanguard/...

Take a look at Pool C. I have never seen a project build Keep3r rewards into the initial tokenomics.

https://yzy.finance/vanguard/token/ ">https://yzy.finance/vanguard/...

I thought to myself, wow I think this is deriswap. Why?

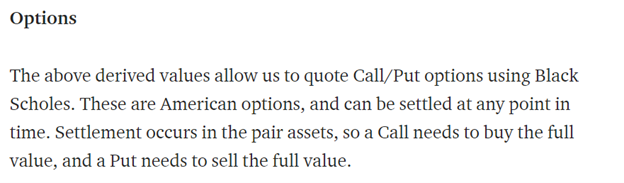

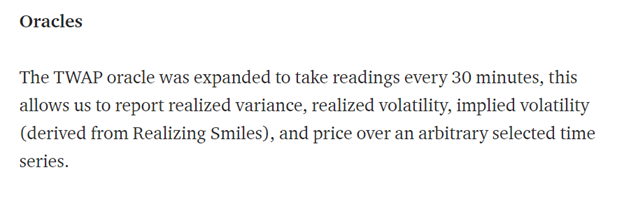

From deriswap medium post:

https://andrecronje.medium.com/deriswap-capital-efficient-swaps-futures-options-and-loans-ea424b24a41c

1.">https://andrecronje.medium.com/deriswap-... Black holes = Black Scholes

2. Keep3r oracle readings are the key component of Deriswap

3. Read the conclusion, sounds like the Vanguard of Defi to me

From deriswap medium post:

https://andrecronje.medium.com/deriswap-capital-efficient-swaps-futures-options-and-loans-ea424b24a41c

1.">https://andrecronje.medium.com/deriswap-... Black holes = Black Scholes

2. Keep3r oracle readings are the key component of Deriswap

3. Read the conclusion, sounds like the Vanguard of Defi to me

Still skeptical? This portion of the @BanklessHQ podcast is what sealed it for me:

https://www.youtube.com/watch?v=Tnl3WX5KI7Q&t=990s&ab_channel=Bankless

https://www.youtube.com/watch... href="https://twitter.com/AndreCronjeTech">@AndreCronjeTech literally tells everyone he mainly created Keep3r to support Deriswap. (See: tokenomics)

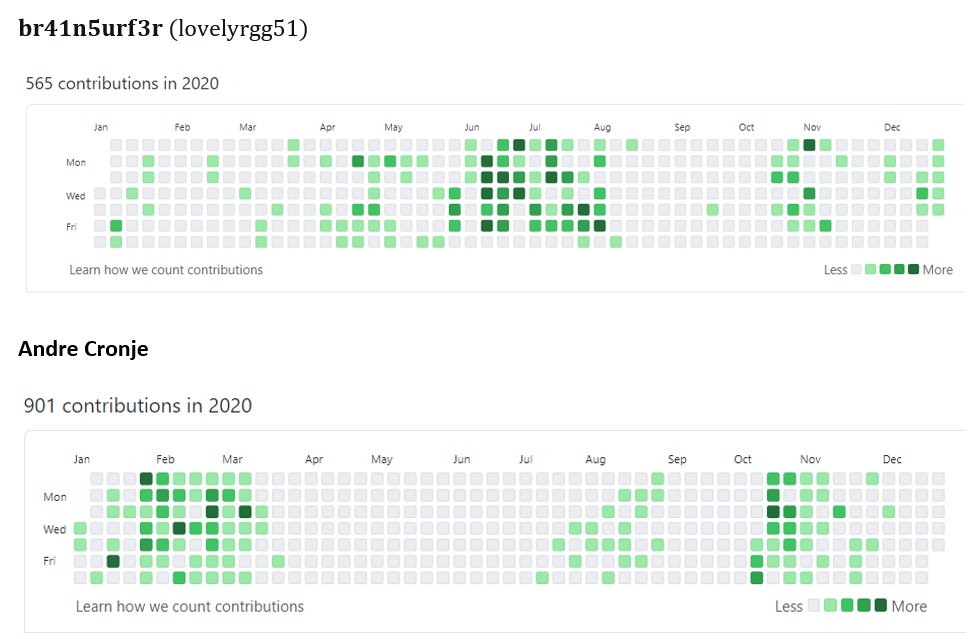

Btw, who else uses numbers for vowels? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫

https://www.youtube.com/watch?v=Tnl3WX5KI7Q&t=990s&ab_channel=Bankless

Btw, who else uses numbers for vowels?

𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫

We now know that $YZY and deriswap are linked. The earning of $YFI in the reward system and 30,000 max supply starts to give it some @iearnfinance ecosystem vibes.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

Listen to the end of that same @BanklessHQ podcast ">https://youtu.be/Tnl3WX5KI...

Listen to the end of that same @BanklessHQ podcast ">https://youtu.be/Tnl3WX5KI...

"It& #39;s deriswap, plus yearn, plus another entity" @AndreCronjeTech

OMFG, I& #39;m going to ape more! I am going to stop my mom from living paycheck to paycheck. I am going to finally buy a house, I& #39;m going take care of my newborn, I& #39;m going to give back, I& #39;m going to teach inner city

OMFG, I& #39;m going to ape more! I am going to stop my mom from living paycheck to paycheck. I am going to finally buy a house, I& #39;m going take care of my newborn, I& #39;m going to give back, I& #39;m going to teach inner city

There were many more hints, here are a few main ones:

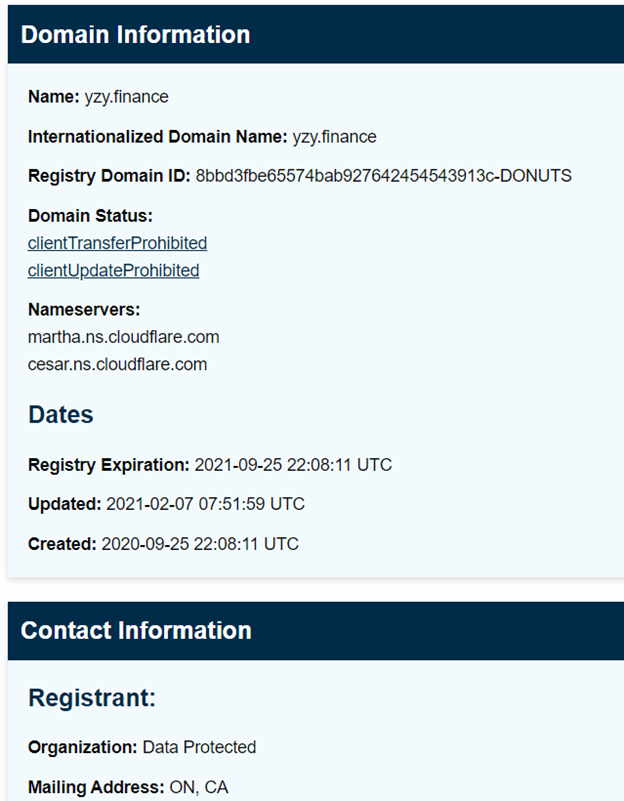

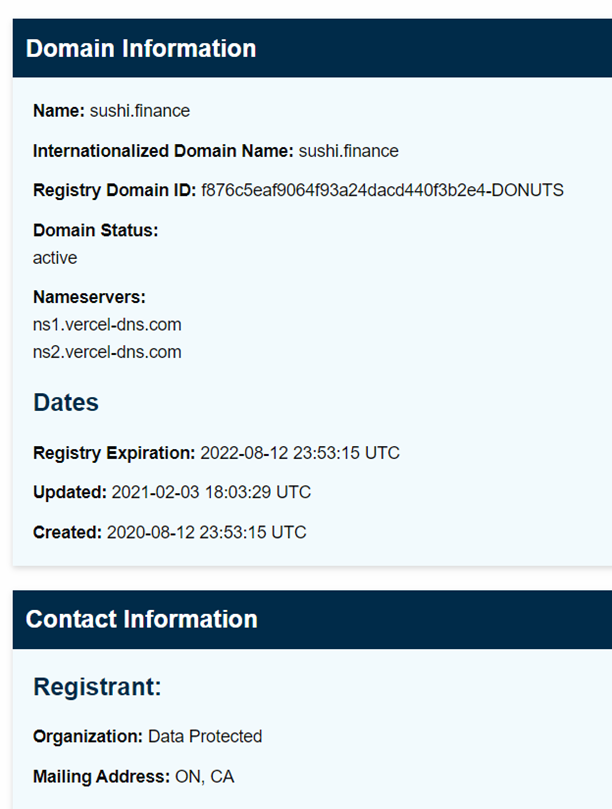

1. $yzy, $YFI, & $Sushi carry similar website naming conventions and sushi and yzy websites are registered to the same location (ON, CA). Deriswap is big part of $Sushi roadmap.

2. @yzyDAO follows mainly $YFI contributors

1. $yzy, $YFI, & $Sushi carry similar website naming conventions and sushi and yzy websites are registered to the same location (ON, CA). Deriswap is big part of $Sushi roadmap.

2. @yzyDAO follows mainly $YFI contributors

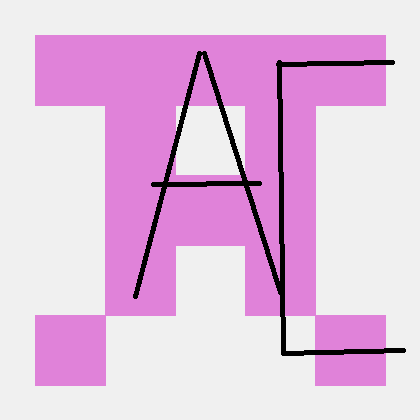

3. 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫& #39;s original github avatar (with my addition for clarity)

4. @yzyDAO display APY was fixed well below actual APY (~800%) to discourage APY mercenaries

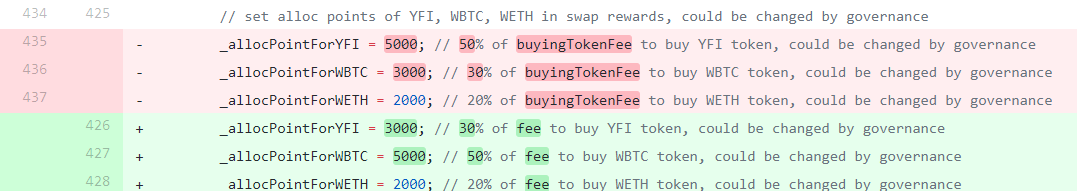

5. Original code called for 50% of trinity rewards to be $YFI ( https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">). Trinity rewards cannot be changed

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">). Trinity rewards cannot be changed

4. @yzyDAO display APY was fixed well below actual APY (~800%) to discourage APY mercenaries

5. Original code called for 50% of trinity rewards to be $YFI (

6. 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫 told us he had a top security researcher look at the code who claimed it was saifu.

A few weeks later, 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫 asked the community to donate treasury funds to @samczsun

How many devs can call @samczsun to look at their code as a favor?

A few weeks later, 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫 asked the community to donate treasury funds to @samczsun

How many devs can call @samczsun to look at their code as a favor?

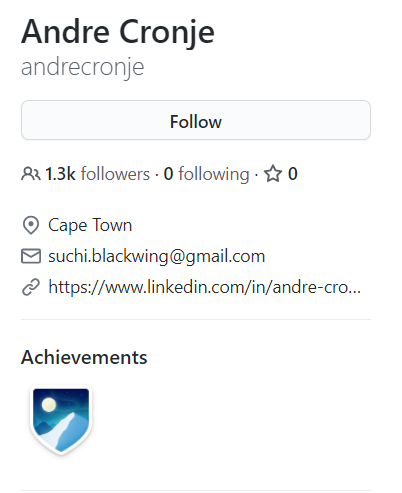

7. 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫& #39;s github on same timezone as Andre& #39;s (Odd timezone). They like to work on Sunday& #39;s and commits appear to line-up well to being an alternative account. Also both have recently added their email accounts to their bios.

So where are we now?

The IL was brutal because of price pressure from selling $YZY for $YFI, $BTC, $Eth (Trinity) rewards and early farmers selling but we were close to breaking even with rewards and given my research this was at least a 100x once deriswap launched imminently.

The IL was brutal because of price pressure from selling $YZY for $YFI, $BTC, $Eth (Trinity) rewards and early farmers selling but we were close to breaking even with rewards and given my research this was at least a 100x once deriswap launched imminently.

2 weeks ago without warning, the rewards were wiped, the treasury drained, and discord and TG deleted. I lost half my NW in a blink https://abs.twimg.com/emoji/v2/... draggable="false" alt="👁️" title="Auge" aria-label="Emoji: Auge">. I had to tell my pregnant wife days before giving birth that we were starting over.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👁️" title="Auge" aria-label="Emoji: Auge">. I had to tell my pregnant wife days before giving birth that we were starting over.

I am still in grief but am grateful for a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦾" title="Mechanischer Arm" aria-label="Emoji: Mechanischer Arm"> & healthy fam.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦾" title="Mechanischer Arm" aria-label="Emoji: Mechanischer Arm"> & healthy fam.

I am still in grief but am grateful for a

I just needed to write it because I thought it was an interesting story that I wanted to share. I hope writing my story helps me move on from this catastrophe so I can be strong & focus on rebuilding my portfolio to support my young family and mom.

I took a big swing and missed. I don& #39;t know why the dev decided to pull a 8 month rug. If it was 100% malicious he could have made a lot more $$.

I still believe in an alternative universe, $YZY was a $100m protocol if 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫 didn& #39;t abandon it.

I still believe in an alternative universe, $YZY was a $100m protocol if 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫 didn& #39;t abandon it.

I will never know if it was actually an Andre project, but I tried to lay out as much proof for you to be the judge.

@yzyDAO had an awesome and engaged community and it& #39;s sad it ended this way.

@CryptoLaird

@LinkHendrix

@UniHax0r4000

@Darth__Yall

@Bullishdotio

@cryptofrog202

@corsaircrypto

@WARONRUGS

@black_w_crypto

@astrobuni

@cryptowhelp

@andyjohnes

@ZafarHabib

@crypt0banks

@CryptoLaird

@LinkHendrix

@UniHax0r4000

@Darth__Yall

@Bullishdotio

@cryptofrog202

@corsaircrypto

@WARONRUGS

@black_w_crypto

@astrobuni

@cryptowhelp

@andyjohnes

@ZafarHabib

@crypt0banks

PS. In the very beginning 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫 thanked us for our trust and told us the team wouldn& #39;t let us down. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤡" title="Clownsgesicht" aria-label="Emoji: Clownsgesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤡" title="Clownsgesicht" aria-label="Emoji: Clownsgesicht">

Read on Twitter

Read on Twitter

) and $ETHAs a $YFI supporter, I was pumped" title=" $YZY is a community owned DAO that gives voting power to LP Stakers. $YZY used an innovative 1-Click farming dApp that I have never seen in another platform and gave confidence in the devs abilitiesStakers earned $YZY, $BTC, $YFI (https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">) and $ETHAs a $YFI supporter, I was pumped">

) and $ETHAs a $YFI supporter, I was pumped" title=" $YZY is a community owned DAO that gives voting power to LP Stakers. $YZY used an innovative 1-Click farming dApp that I have never seen in another platform and gave confidence in the devs abilitiesStakers earned $YZY, $BTC, $YFI (https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">) and $ETHAs a $YFI supporter, I was pumped">

) and $ETHAs a $YFI supporter, I was pumped" title=" $YZY is a community owned DAO that gives voting power to LP Stakers. $YZY used an innovative 1-Click farming dApp that I have never seen in another platform and gave confidence in the devs abilitiesStakers earned $YZY, $BTC, $YFI (https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">) and $ETHAs a $YFI supporter, I was pumped">

) and $ETHAs a $YFI supporter, I was pumped" title=" $YZY is a community owned DAO that gives voting power to LP Stakers. $YZY used an innovative 1-Click farming dApp that I have never seen in another platform and gave confidence in the devs abilitiesStakers earned $YZY, $BTC, $YFI (https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">) and $ETHAs a $YFI supporter, I was pumped">

) and $ETHAs a $YFI supporter, I was pumped" title=" $YZY is a community owned DAO that gives voting power to LP Stakers. $YZY used an innovative 1-Click farming dApp that I have never seen in another platform and gave confidence in the devs abilitiesStakers earned $YZY, $BTC, $YFI (https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">) and $ETHAs a $YFI supporter, I was pumped">

) and $ETHAs a $YFI supporter, I was pumped" title=" $YZY is a community owned DAO that gives voting power to LP Stakers. $YZY used an innovative 1-Click farming dApp that I have never seen in another platform and gave confidence in the devs abilitiesStakers earned $YZY, $BTC, $YFI (https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">) and $ETHAs a $YFI supporter, I was pumped">

https://yzy.finance/vanguard/... tokenomics significantly benefit the @yzyDAO "ecosystem"" title="A few weeks into launch, 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫 announced in the Citadel an imminent launch of a $YZY secret sister project Vanguard and that he would continue working on both projectshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🕳️" title="Loch" aria-label="Emoji: Loch"> https://yzy.finance/vanguard/... tokenomics significantly benefit the @yzyDAO "ecosystem"" class="img-responsive" style="max-width:100%;"/>

https://yzy.finance/vanguard/... tokenomics significantly benefit the @yzyDAO "ecosystem"" title="A few weeks into launch, 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫 announced in the Citadel an imminent launch of a $YZY secret sister project Vanguard and that he would continue working on both projectshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🕳️" title="Loch" aria-label="Emoji: Loch"> https://yzy.finance/vanguard/... tokenomics significantly benefit the @yzyDAO "ecosystem"" class="img-responsive" style="max-width:100%;"/>

)1. Hint about project: name + keep mouse clicked on logo. Clicking on the logo creates a black hole effect. Also notice the use of black holeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🕳️" title="Loch" aria-label="Emoji: Loch"> in the teaser message." title="The sleuth will notice a few interesting clues other than max supply of 30,000 tokens (https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">)1. Hint about project: name + keep mouse clicked on logo. Clicking on the logo creates a black hole effect. Also notice the use of black holeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🕳️" title="Loch" aria-label="Emoji: Loch"> in the teaser message." class="img-responsive" style="max-width:100%;"/>

)1. Hint about project: name + keep mouse clicked on logo. Clicking on the logo creates a black hole effect. Also notice the use of black holeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🕳️" title="Loch" aria-label="Emoji: Loch"> in the teaser message." title="The sleuth will notice a few interesting clues other than max supply of 30,000 tokens (https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">)1. Hint about project: name + keep mouse clicked on logo. Clicking on the logo creates a black hole effect. Also notice the use of black holeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🕳️" title="Loch" aria-label="Emoji: Loch"> in the teaser message." class="img-responsive" style="max-width:100%;"/>

https://yzy.finance/vanguard/..." title="2. The TokenomicsTake a look at Pool C. I have never seen a project build Keep3r rewards into the initial tokenomics. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht"> https://yzy.finance/vanguard/..." class="img-responsive" style="max-width:100%;"/>

https://yzy.finance/vanguard/..." title="2. The TokenomicsTake a look at Pool C. I have never seen a project build Keep3r rewards into the initial tokenomics. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht"> https://yzy.finance/vanguard/..." class="img-responsive" style="max-width:100%;"/>

). Trinity rewards cannot be changed" title="3. 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫& #39;s original github avatar (with my addition for clarity)4. @yzyDAO display APY was fixed well below actual APY (~800%) to discourage APY mercenaries 5. Original code called for 50% of trinity rewards to be $YFI (https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">). Trinity rewards cannot be changed">

). Trinity rewards cannot be changed" title="3. 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫& #39;s original github avatar (with my addition for clarity)4. @yzyDAO display APY was fixed well below actual APY (~800%) to discourage APY mercenaries 5. Original code called for 50% of trinity rewards to be $YFI (https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">). Trinity rewards cannot be changed">

). Trinity rewards cannot be changed" title="3. 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫& #39;s original github avatar (with my addition for clarity)4. @yzyDAO display APY was fixed well below actual APY (~800%) to discourage APY mercenaries 5. Original code called for 50% of trinity rewards to be $YFI (https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">). Trinity rewards cannot be changed">

). Trinity rewards cannot be changed" title="3. 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫& #39;s original github avatar (with my addition for clarity)4. @yzyDAO display APY was fixed well below actual APY (~800%) to discourage APY mercenaries 5. Original code called for 50% of trinity rewards to be $YFI (https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">). Trinity rewards cannot be changed">

). Trinity rewards cannot be changed" title="3. 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫& #39;s original github avatar (with my addition for clarity)4. @yzyDAO display APY was fixed well below actual APY (~800%) to discourage APY mercenaries 5. Original code called for 50% of trinity rewards to be $YFI (https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">). Trinity rewards cannot be changed">

). Trinity rewards cannot be changed" title="3. 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫& #39;s original github avatar (with my addition for clarity)4. @yzyDAO display APY was fixed well below actual APY (~800%) to discourage APY mercenaries 5. Original code called for 50% of trinity rewards to be $YFI (https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">). Trinity rewards cannot be changed">

" title="PS. In the very beginning 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫 thanked us for our trust and told us the team wouldn& #39;t let us down.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤡" title="Clownsgesicht" aria-label="Emoji: Clownsgesicht">" class="img-responsive" style="max-width:100%;"/>

" title="PS. In the very beginning 𝐛𝐫𝟒𝟏𝐧𝟓𝐮𝐫𝐟𝟑𝐫 thanked us for our trust and told us the team wouldn& #39;t let us down.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤡" title="Clownsgesicht" aria-label="Emoji: Clownsgesicht">" class="img-responsive" style="max-width:100%;"/>