Hi Guys,

@KR1plc have just released an article in Buisness insider. The link is here. https://www.businessinsider.com/crypto-investing-vc-polkadot-ethereum-kr1-defi-projects-trends-watch-2021-5?r=US&IR=T#

If">https://www.businessinsider.com/crypto-in... you can& #39;t get past the pay wall.

I& #39;ve copied and pasted the entire article to create a thread. Below https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Rückhand Zeigefinger nach unten (durchschnittlich dunkler Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (durchschnittlich dunkler Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Rückhand Zeigefinger nach unten (durchschnittlich dunkler Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (durchschnittlich dunkler Hautton)">

Enjoy.

#KR1 $KROEF #K4H #DOT #ETH #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> #ATOM #ICP

https://abs.twimg.com/hashflags... draggable="false" alt=""> #ATOM #ICP

@KR1plc have just released an article in Buisness insider. The link is here. https://www.businessinsider.com/crypto-investing-vc-polkadot-ethereum-kr1-defi-projects-trends-watch-2021-5?r=US&IR=T#

If">https://www.businessinsider.com/crypto-in... you can& #39;t get past the pay wall.

I& #39;ve copied and pasted the entire article to create a thread. Below

Enjoy.

#KR1 $KROEF #K4H #DOT #ETH #BTC

KR1 is one of Europe& #39;s leading blockchain & digital assets venture capital firms. The firm listed on the Aquis stock exchange in 2016 & has since invested in crypto projects such as @ethereum, @Polkadot and @SatoshiPay.

Since listing, the company& #39;s share price has surged over

Since listing, the company& #39;s share price has surged over

28,000% as it provides investors with indirect exposure to the world of crypto.

The founders of KR1, @georgemcdonaugh and @keldster recently spoke to Insider about their 5-part crypto investment strategy.

A specialization within the strategy is decentralized finance.

The founders of KR1, @georgemcdonaugh and @keldster recently spoke to Insider about their 5-part crypto investment strategy.

A specialization within the strategy is decentralized finance.

@KR1plc were early backers of Ethereum, which is a blockchain that powers a number of applications through its smart contract functionality & has frequently been leveraged by the decentralized finance movement.

Some of Eth& #39;s other crypto-related uses are non-fungible tokens

Some of Eth& #39;s other crypto-related uses are non-fungible tokens

backed by celebrity artists/ musicians/metaverses/ even digital racehorses.

Ethereum& #39;s native currency #ETH reached all-time highs this week. But despite investing in Ethereum, the firm has also invested big in protocols, such as @Polkadot and @cosmos, that could challenge

Ethereum& #39;s native currency #ETH reached all-time highs this week. But despite investing in Ethereum, the firm has also invested big in protocols, such as @Polkadot and @cosmos, that could challenge

Cryptos rising star, Etherum.

"We& #39;ve done a lot of DeFi investing, probably one of the most active in the space," Keld said.

WHAT IS DeFi?

Decentralized finance has surged in popularity in the last year alongside the cryptocurrency boom.

"We& #39;ve done a lot of DeFi investing, probably one of the most active in the space," Keld said.

WHAT IS DeFi?

Decentralized finance has surged in popularity in the last year alongside the cryptocurrency boom.

The movement seeks to replace a variety of centralized and regulated banking institutions with decentralized systems and products.

The products aim to remove the middleman, instead using blockchain technology to enable complex financial use cases directly between parties.

The products aim to remove the middleman, instead using blockchain technology to enable complex financial use cases directly between parties.

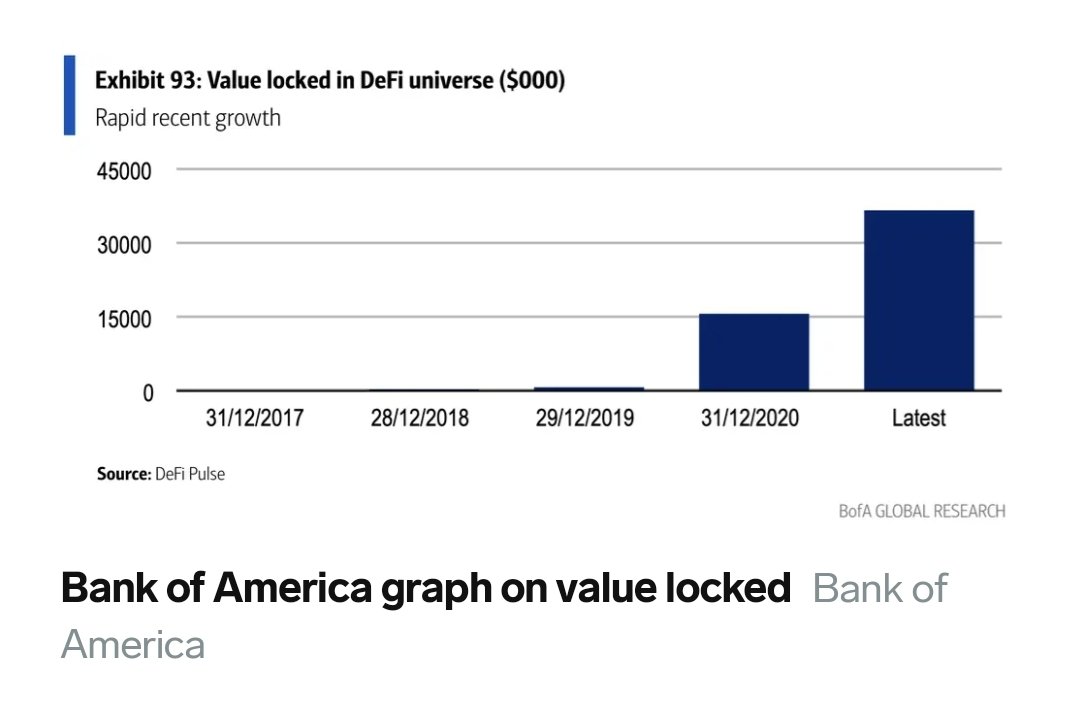

A common way of assessing DeFi adoption is through "value locked". This represents the quantity of ether and other coins posted within the smart contracts that make up a particular DeFi service.

Bank of America highlighted the surge in "value locked& #39; in a recent research note.

Bank of America highlighted the surge in "value locked& #39; in a recent research note.

KR1& #39;s DeFi outlook:

McDonaugh believes scarcity is at the core of the DeFi movement.

"What blockchains allow to happen is bring that sense of ownership into the digital realm," McDonaugh said.

Scarcity started with the creation of digital assets, which have limited supply,

McDonaugh believes scarcity is at the core of the DeFi movement.

"What blockchains allow to happen is bring that sense of ownership into the digital realm," McDonaugh said.

Scarcity started with the creation of digital assets, which have limited supply,

And the ability to trade them, McDonaugh said. Decentralized finance is an extension of that as it provides ecosystem for those digital assets.

"Deep down, I think it speaks to a human& #39;s desire to exchange with each other and I think the less barriers to exchange,

"Deep down, I think it speaks to a human& #39;s desire to exchange with each other and I think the less barriers to exchange,

the more prosperous we will all be as a society," McDonaugh said.

In the short-term, Schreven expects the momentum of the DeFi experimentation phase to continue, but at some point the centralized and decentralized worlds will have to mesh.

For example, he asks;

In the short-term, Schreven expects the momentum of the DeFi experimentation phase to continue, but at some point the centralized and decentralized worlds will have to mesh.

For example, he asks;

how will national and regulated stablecoins link into the decentralized world?

Investors will need to be cognizant of regulatory hurdles on the horizon. Schreven said.

DeFi Trends

The team at @KR1plc are watching two key DeFi trends right now.

1) Uncollateralized lending..

Investors will need to be cognizant of regulatory hurdles on the horizon. Schreven said.

DeFi Trends

The team at @KR1plc are watching two key DeFi trends right now.

1) Uncollateralized lending..

Currently in the DeFi space, many protocols are over collateralized, because if someone defaults then it& #39;s a way to protect yourself.

In traditional credit markets, they rely on identity for uncollateralized lending. This isn& #39;t possible within DeFi as identities can be anonymous

In traditional credit markets, they rely on identity for uncollateralized lending. This isn& #39;t possible within DeFi as identities can be anonymous

Several projects are trying to solve this problem. If done correctly with the right metrics, it could spur growth, Geroge said.

The team is invested in Union Finance, which is a project that hopes to solve the problem by using group social connections to offer credit lending to

The team is invested in Union Finance, which is a project that hopes to solve the problem by using group social connections to offer credit lending to

Individuals.

2) Fixed rate and derivatives products

"At the moment, a lot of DeFi [products] are all variable rates, people are looking at how to create longer term products with fixed rates," McDonaugh said.

KR1 is focused on projects solving the fixed rate problem,

2) Fixed rate and derivatives products

"At the moment, a lot of DeFi [products] are all variable rates, people are looking at how to create longer term products with fixed rates," McDonaugh said.

KR1 is focused on projects solving the fixed rate problem,

as well as those focused on the space of financial derivatives and synthetics. One project he& #39;s excited about is @vegaprotocol, a protocol for creating and trading derivatives on a decentralized network.

"It& #39;s all about offering people the freedom to exchange value and also

"It& #39;s all about offering people the freedom to exchange value and also

Investing BIG in @Polkadot

The team is also invested in Polkadot, a protocol that enables public blockchains to connect.

Although Polkadot is not a DeFi application, it could enable DeFi projects to communicate with one and other.

The team at KR1 believe in the future -

The team is also invested in Polkadot, a protocol that enables public blockchains to connect.

Although Polkadot is not a DeFi application, it could enable DeFi projects to communicate with one and other.

The team at KR1 believe in the future -

there might be a need for bespoke blockchains that perform specific functions & will need to communicate with one & other.

"You can design a blockchain to be an atomic trading or derivatives trading platform, then you can connect that sovereign blockchain to a wider network,"

"You can design a blockchain to be an atomic trading or derivatives trading platform, then you can connect that sovereign blockchain to a wider network,"

@georgemcdonaugh said.

Part of the reason the team invested in Polkadot was because it was built by Gavin Wood, who wrote the first version of Ethereum.

"[Polkadot] basically fixes a lot of the problems with Ethereum," Schreven said. "Once you frame who created it and why,

Part of the reason the team invested in Polkadot was because it was built by Gavin Wood, who wrote the first version of Ethereum.

"[Polkadot] basically fixes a lot of the problems with Ethereum," Schreven said. "Once you frame who created it and why,

then that becomes important."

The native token for Polkadot is DOT, which serves as a way to carry out key functions on the platform, similar to ETH for Ethereum.

DOT& #39;s price performance is roughly on a par with that of ether over the last year, with a gain of around 320%.

The native token for Polkadot is DOT, which serves as a way to carry out key functions on the platform, similar to ETH for Ethereum.

DOT& #39;s price performance is roughly on a par with that of ether over the last year, with a gain of around 320%.

But at just $38, it& #39;s worth a fraction of Ethereum& #39;s native token. Ether was up 3% on the day at $3,440 on Wednesday.

Polkadot can do many things that Ether can& #39;t, Keld said.

It& #39;s cheaper/faster, contains on chain voting & individuals don& #39;t need to fork for an upgrade, he adds.

Polkadot can do many things that Ether can& #39;t, Keld said.

It& #39;s cheaper/faster, contains on chain voting & individuals don& #39;t need to fork for an upgrade, he adds.

"[Polkadot& #39;s] going through the Ethereum emergence cycle of infrastructure on [to] it," Keld said.

One of the strong underlying narratives for moving to Polkadot as a developer is that it provides the tools and flexibility to create an infrastructure with an eye to the future

One of the strong underlying narratives for moving to Polkadot as a developer is that it provides the tools and flexibility to create an infrastructure with an eye to the future

where blockchains might want to talk to each other because of the benefits of shared liquidity.

McDonaugh said.

"We& #39;re seeing talent move on to Polkadot that was going to build on Ethereum. That& #39;s very exciting," Schreven said. " …

McDonaugh said.

"We& #39;re seeing talent move on to Polkadot that was going to build on Ethereum. That& #39;s very exciting," Schreven said. " …

And I think it& #39;s going to be one of the winners in the next few years, and then it& #39;s going to last for maybe 100 years." He added.

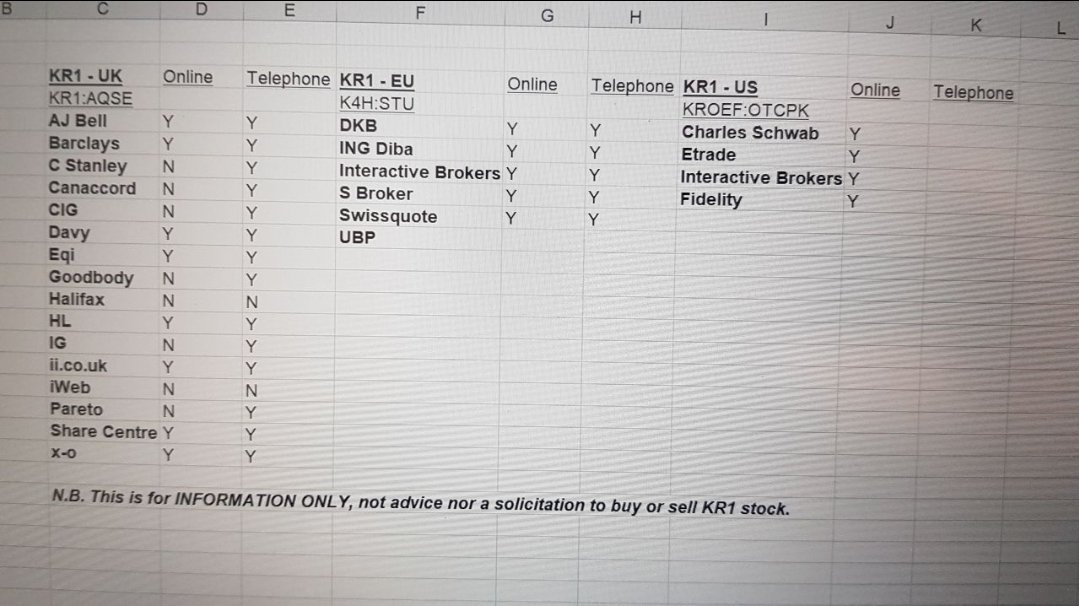

@KR1plc are currently listed on Londons @AquisStockEx. The website is being updated and will be going live very soon

Below is a pic/list of various brokers that you& #39;re able to purchase KR1 shares from.

Feel free to comment below with any questions.

Below is a pic/list of various brokers that you& #39;re able to purchase KR1 shares from.

Feel free to comment below with any questions.

Read on Twitter

Read on Twitter