Today I’d like to share a thread on the Rise, Fall and Resurrection of Tala, East Africa’s notorious ex-digital lender, now a reformed crypto Fintech start up

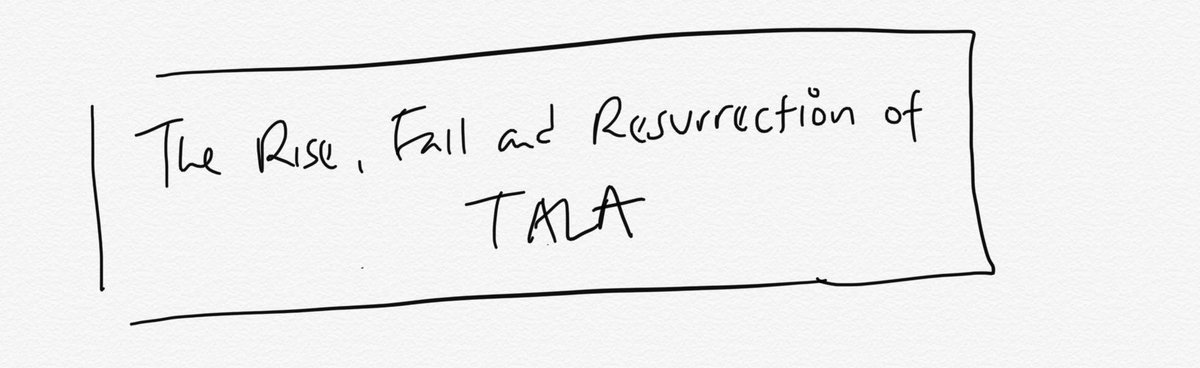

So tala started out as Mkopo rahisi, MFI style lender using mobile. The time was right around post MFI boom, the smart wazungus from Grameen and MFI, DFI we’re moving into the early stage of Fintech boom in East Africa

Mkopo rahisi and KIVA earliest lenders of small businesses and unsecured micro loans. Both quickly pivoted into the new a Fintech startup boom.

Kiva founders later formed Fintech digital lender, Branch.

Mkopo rahisi morphed into Tala, Mobile digital lender.

Kiva founders later formed Fintech digital lender, Branch.

Mkopo rahisi morphed into Tala, Mobile digital lender.

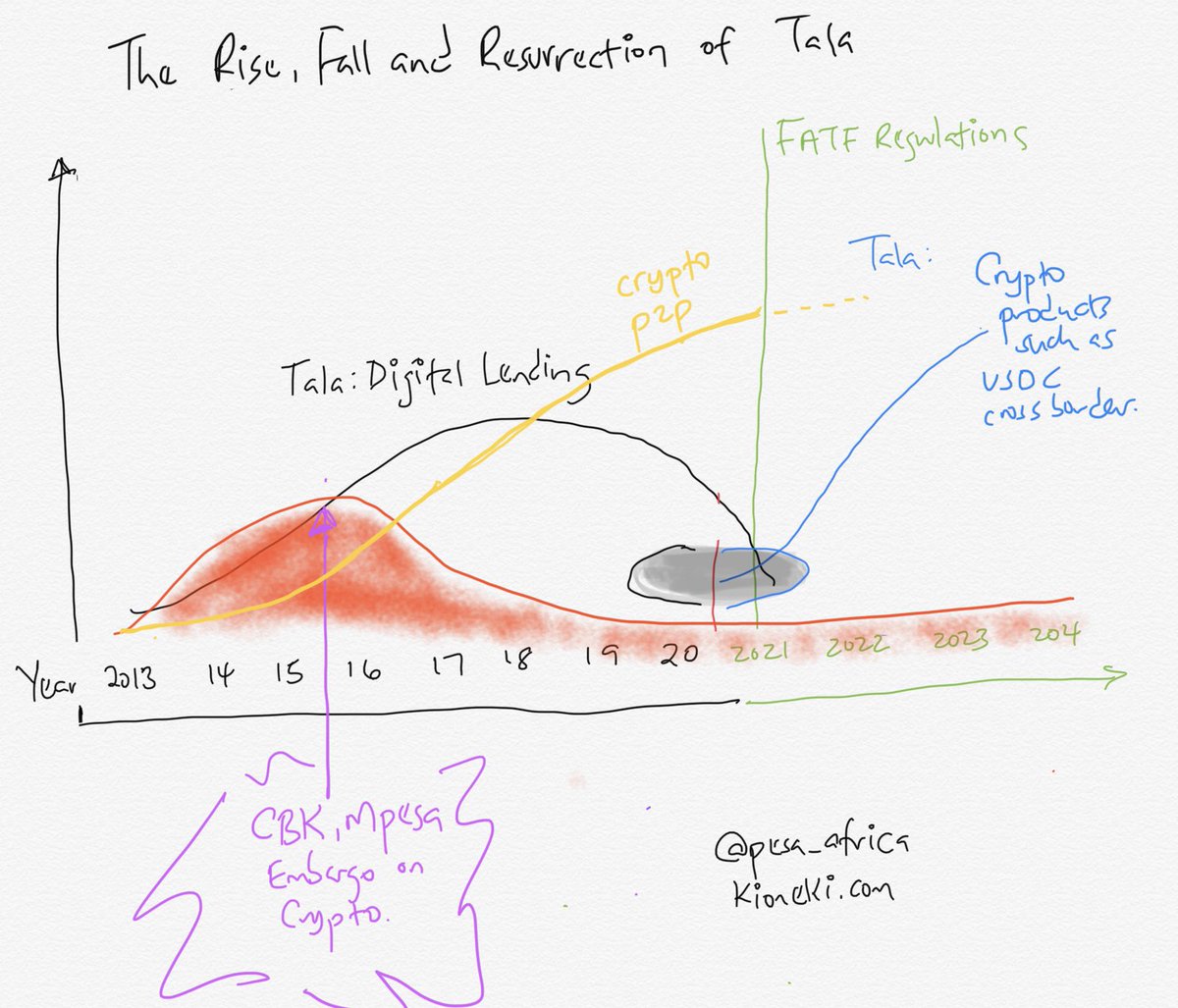

My sketch shows the boom years that followed, before the burst caused by public perception, regulatory measures and a post pandemic economic shock. Tala’s digital lending business is literally dead.

Red is corona

Green is day of CBK clampdown

Red is corona

Green is day of CBK clampdown

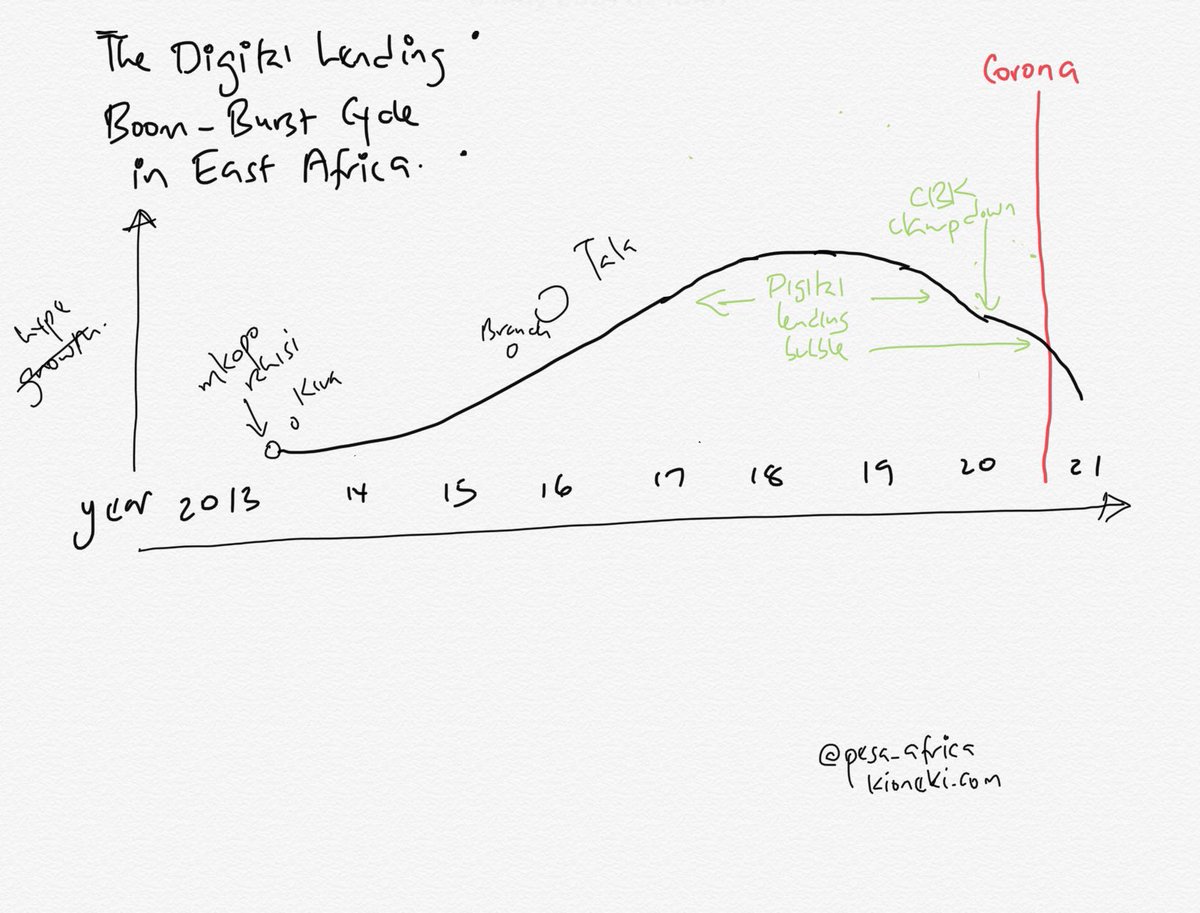

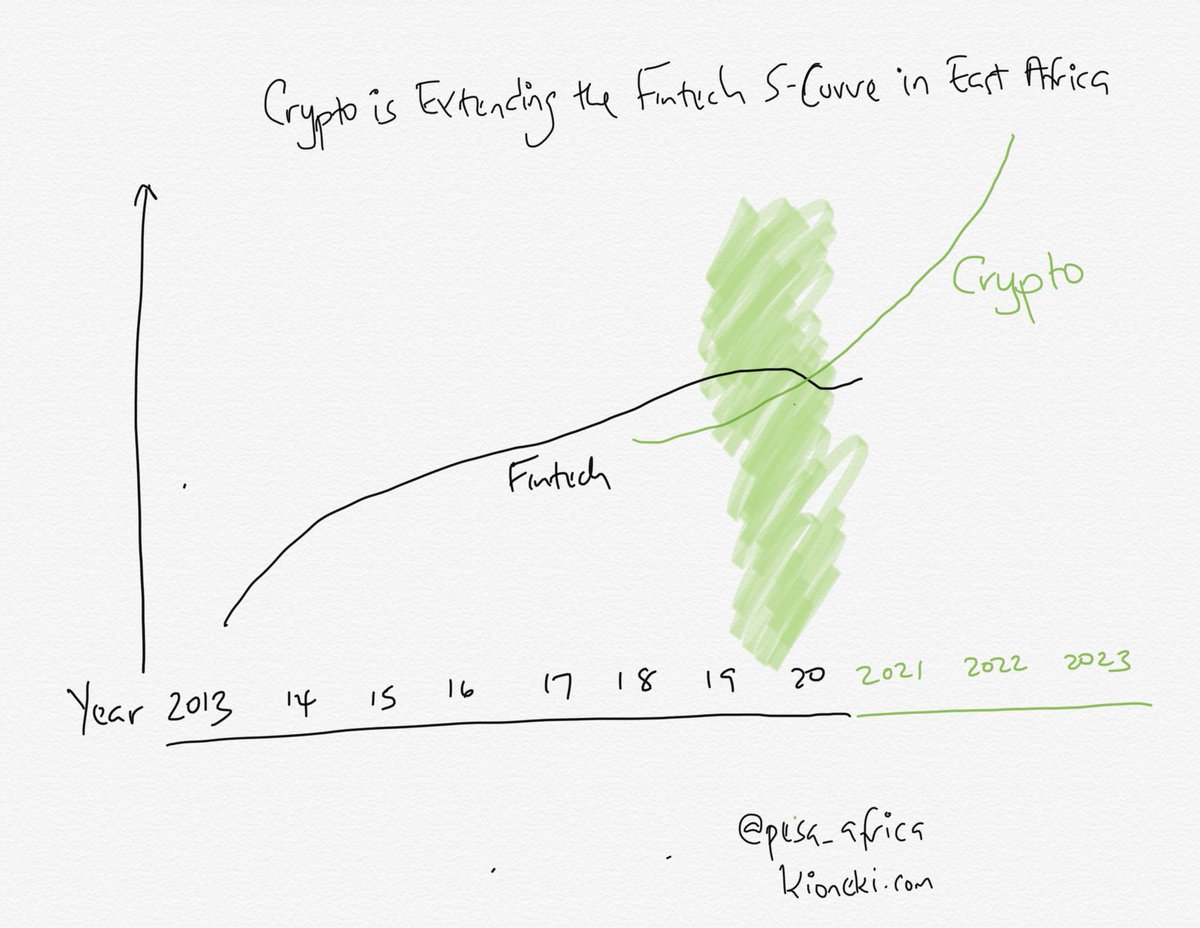

In the grand scheme of things, digital lending is a microcosm of a Fintech meta trend of other digital financial services besides lending. Each service has emerged at a different time. See

Purple (payments, investments, savings, lending).

Purple (payments, investments, savings, lending).

Some services like payments are part of Fintech since as far back as 2010, digital lending only exploded in 2017 and new banks like carbon is post 2020.

In black is Talas digital lending phase w/in a bigger Fintech trend from 2013 till post corona

In black is Talas digital lending phase w/in a bigger Fintech trend from 2013 till post corona

Cryptocurrencies is also part of Fintech. This is a timeline of 2 Crypto models in East Africa from 2013 to date.

Deep red is models dependent on regulators

Yellow is peer to peer models Independent of regulators

Deep red is models dependent on regulators

Yellow is peer to peer models Independent of regulators

Regulator dependent model performed well until a regulator clampdown in 2015 by Central Bank (green) killed this model.

Peer to peer model in yellow picked up and was able to withstand regulator controls. Paxful, binance peer to peer, LBC, Localcryptos, informal , offhsore

Peer to peer model in yellow picked up and was able to withstand regulator controls. Paxful, binance peer to peer, LBC, Localcryptos, informal , offhsore

The story of crypto from 2013 - 2021 is documented on this thread. Crypto performed better in growth and adoption despite corona and regulatory choke points https://twitter.com/pesa_africa/status/1357938874845175809">https://twitter.com/pesa_afri...

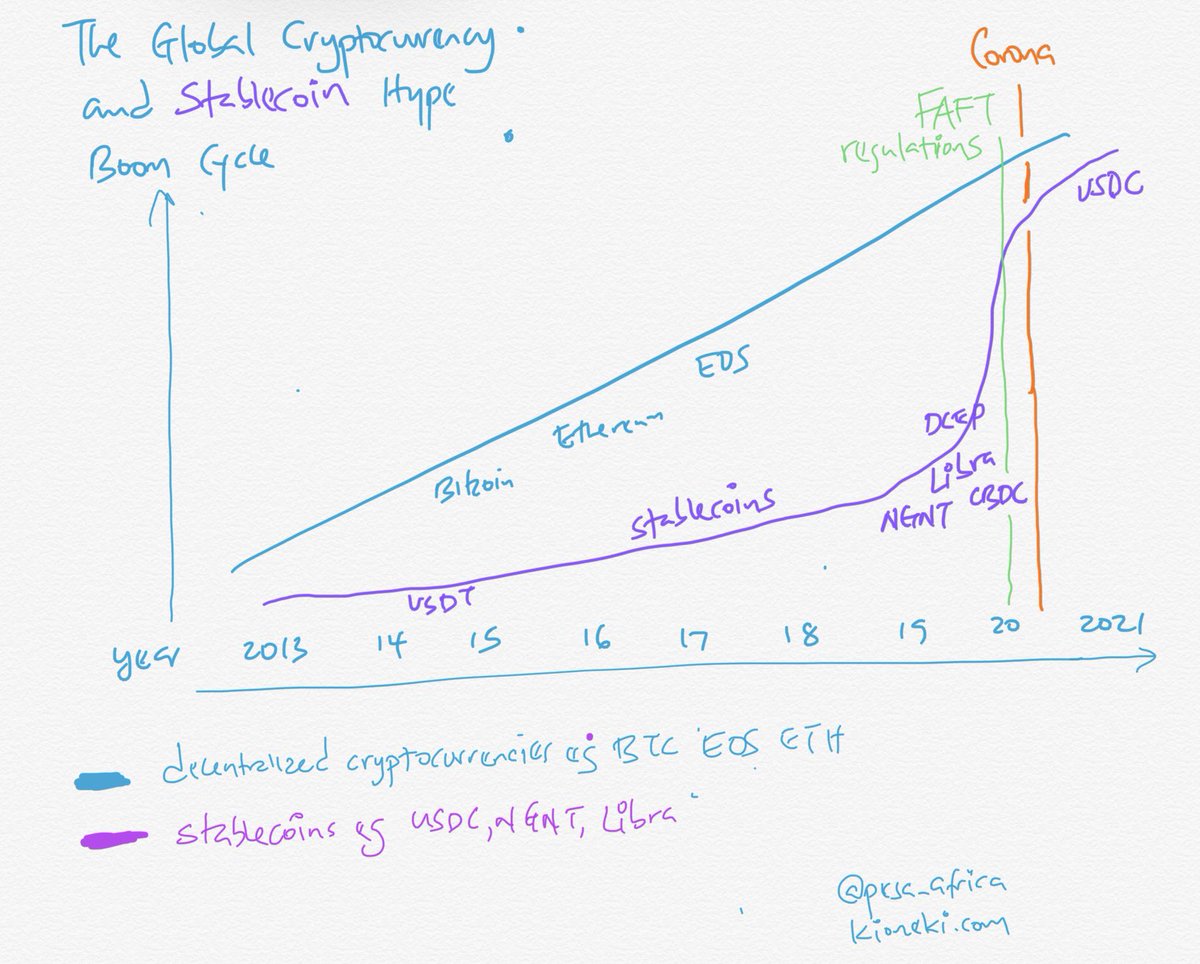

Globally, another trend has been unfolding. Since 2013 decentralized cryptocurrencies have grown in adoption and maturity. Even after corona

Stablecoins, backed by national currencies grew gradually but recently exploded due to regulations (green FATF) and corona

Stablecoins, backed by national currencies grew gradually but recently exploded due to regulations (green FATF) and corona

USDC is the latest compliant cryptocurrency backed by the US dollar. Issued by an American company Circle on the Stellar blockchain. Traditional payment Companies like VISA are taking Cryptocurrencies mainstream

VISA Is diving into cryptocurrencies https://twitter.com/pesa_africa/status/1388826868938326016">https://twitter.com/pesa_afri...

VISA Is diving into cryptocurrencies https://twitter.com/pesa_africa/status/1388826868938326016">https://twitter.com/pesa_afri...

VISA moves to payments settlement using USDC Cryptocurrencies https://twitter.com/pesa_africa/status/1376467563769704448">https://twitter.com/pesa_afri...

In recent times, VISA has moved to investing / acquiring/incubating startups in Fintech in Africa, even adapting its products for local market realities such as mobile money and mobile phones

So Visa is always looking for partners for last mile and distribution and acquisition..

So Visa is always looking for partners for last mile and distribution and acquisition..

Tala, is one such partner, one of many to come https://twitter.com/pesa_africa/status/1390174781530689540">https://twitter.com/pesa_afri...

Let’s tie it all together

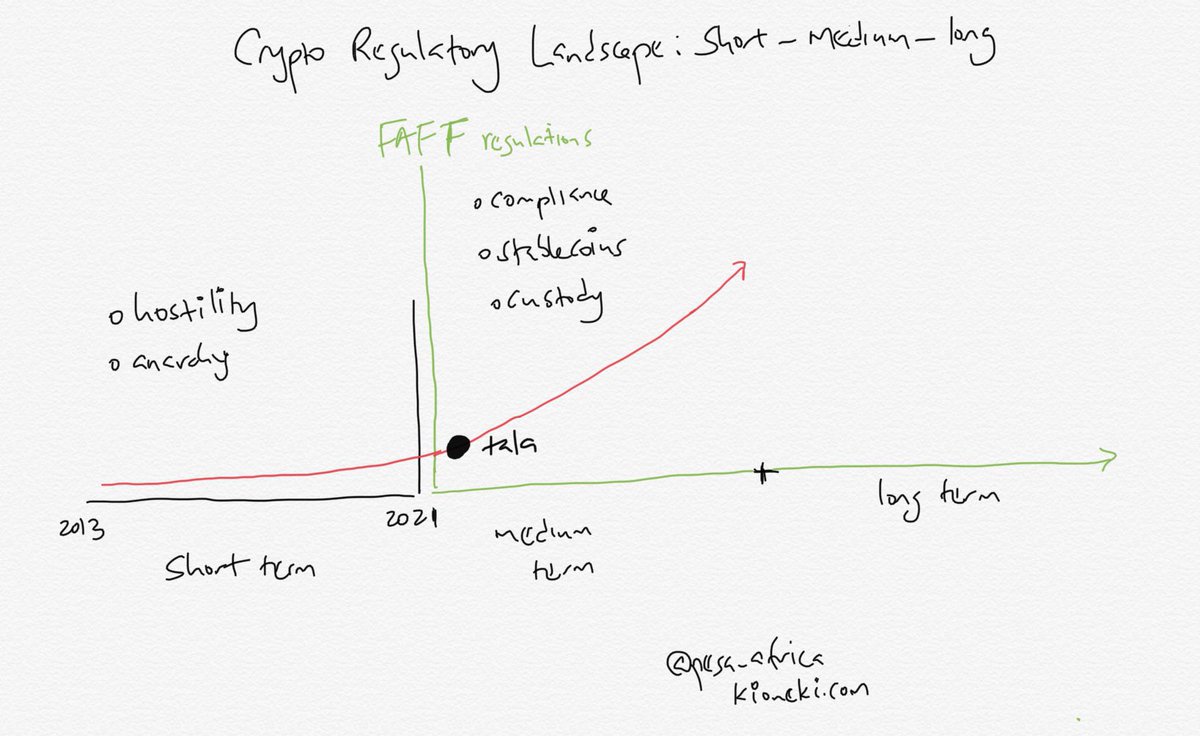

Tala used to be a digital lender, went through a business cycle, died after corona. Right around the same time, crypto regulations emerged from FATF drawing in compliant payment companies looking for partners like Tala who can now reinvent themselves

Tala used to be a digital lender, went through a business cycle, died after corona. Right around the same time, crypto regulations emerged from FATF drawing in compliant payment companies looking for partners like Tala who can now reinvent themselves

Tala has managed to pivot into another boom cycle just at the right time due to a change in regulatory environment. Pre and post FATF compliance. Tala is well position for the medium crypto cycle

Tala reportedly has 6 million customers

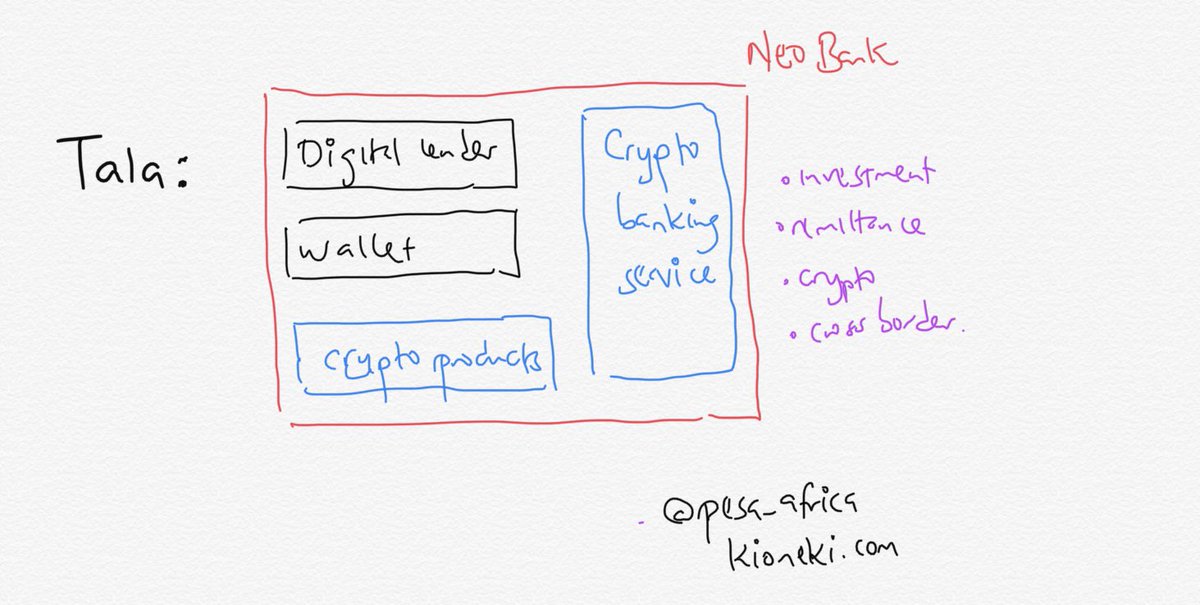

Press release says “Tala’s customers will gain access to the digital coin USDC in Tala& #39;s in app wallet, supporting asset storage, cross-border transfer, and crypto-fiat exchange functionalities.”

Press release says “Tala’s customers will gain access to the digital coin USDC in Tala& #39;s in app wallet, supporting asset storage, cross-border transfer, and crypto-fiat exchange functionalities.”

“Visa will provide Tala with the ability to issue Visa cards linked to the wallet, enabling Tala’s customers to spend against their USDC balance”

Tala now has massive capabilities to shape shift into anything crypto or banking related

Tala now has massive capabilities to shape shift into anything crypto or banking related

In Kenya  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇰🇪" title="Flagge von Kenia" aria-label="Emoji: Flagge von Kenia"> regulatory hostility since 2015 (marked purple arrow) has suppressed Crypto models reliant on gateways/banks for (area shaded in red) Virtual Asset Service Business

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇰🇪" title="Flagge von Kenia" aria-label="Emoji: Flagge von Kenia"> regulatory hostility since 2015 (marked purple arrow) has suppressed Crypto models reliant on gateways/banks for (area shaded in red) Virtual Asset Service Business

Peer to peer crypto models (yellow) continue to thrive, but their model too uncertain post FATF 2021

Peer to peer crypto models (yellow) continue to thrive, but their model too uncertain post FATF 2021

Kenya  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇰🇪" title="Flagge von Kenia" aria-label="Emoji: Flagge von Kenia"> is gearing up for Joint Fintech regulatory sandbox to find a path forward for crypto asset frameworks, after 7 years of hostility. This from a note by the Capital Markets Authority on it’s Capital markets soundness report q1 2021 page 33 https://www.cma.or.ke/index.php?option=com_phocadownload&view=category&download=616:the-capital-markets-soundness-report-cmsr-volume-xviii-quarter-1-2021&id=5:capital-markets-soundness-report&Itemid=261">https://www.cma.or.ke/index.php...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇰🇪" title="Flagge von Kenia" aria-label="Emoji: Flagge von Kenia"> is gearing up for Joint Fintech regulatory sandbox to find a path forward for crypto asset frameworks, after 7 years of hostility. This from a note by the Capital Markets Authority on it’s Capital markets soundness report q1 2021 page 33 https://www.cma.or.ke/index.php?option=com_phocadownload&view=category&download=616:the-capital-markets-soundness-report-cmsr-volume-xviii-quarter-1-2021&id=5:capital-markets-soundness-report&Itemid=261">https://www.cma.or.ke/index.php...

Tala will be ready for this markets. Tala can wait it out, while experimenting in its other markets. Tala has experience battling in grey areas, like unregulated digital lending. Tala is familiar with Kenya and East Africa.

By complying at a global level, Tala is also one foot ahead of local crypto companies. Tweeted about impact of global crypto regulations on local companies here https://twitter.com/pesa_africa/status/1381614836895911937">https://twitter.com/pesa_afri...

Generally I believe Crypto, and crypto rails is extending the Fintech S-curve in East Africa. The last 7 years was gradual, crypto was never seen as a contender. But its somehow crept into mainstream Fintech by insidious means. Who could have seen it?

Already some pan African Fintech’s are pivoting to crypto or adding crypto products or affiliating with crypto https://twitter.com/pesa_africa/status/1273177347274006536">https://twitter.com/pesa_afri...

https://twitter.com/asemota/status/1380461099519258629">https://twitter.com/asemota/s...

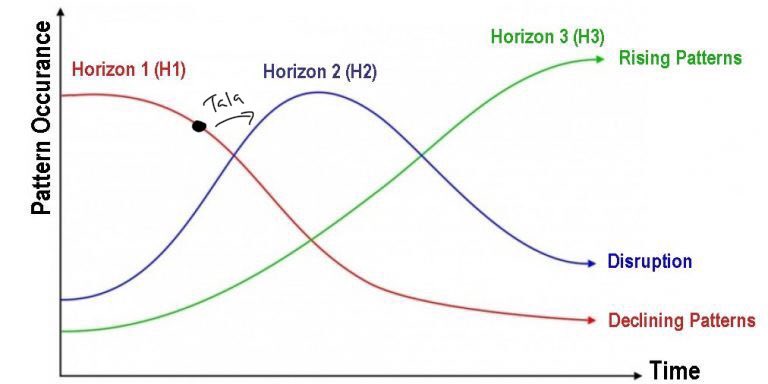

Ps: Muse for this thread inspired by the 3 horizon framework of thinking about the future https://twitter.com/pesa_africa/status/1222648418050486272">https://twitter.com/pesa_afri...

/End of thread

I will add links to prior threads as sources

I will add links to prior threads as sources

Read on Twitter

Read on Twitter

regulatory hostility since 2015 (marked purple arrow) has suppressed Crypto models reliant on gateways/banks for (area shaded in red) Virtual Asset Service BusinessPeer to peer crypto models (yellow) continue to thrive, but their model too uncertain post FATF 2021" title="In Kenya https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇰🇪" title="Flagge von Kenia" aria-label="Emoji: Flagge von Kenia"> regulatory hostility since 2015 (marked purple arrow) has suppressed Crypto models reliant on gateways/banks for (area shaded in red) Virtual Asset Service BusinessPeer to peer crypto models (yellow) continue to thrive, but their model too uncertain post FATF 2021" class="img-responsive" style="max-width:100%;"/>

regulatory hostility since 2015 (marked purple arrow) has suppressed Crypto models reliant on gateways/banks for (area shaded in red) Virtual Asset Service BusinessPeer to peer crypto models (yellow) continue to thrive, but their model too uncertain post FATF 2021" title="In Kenya https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇰🇪" title="Flagge von Kenia" aria-label="Emoji: Flagge von Kenia"> regulatory hostility since 2015 (marked purple arrow) has suppressed Crypto models reliant on gateways/banks for (area shaded in red) Virtual Asset Service BusinessPeer to peer crypto models (yellow) continue to thrive, but their model too uncertain post FATF 2021" class="img-responsive" style="max-width:100%;"/>

is gearing up for Joint Fintech regulatory sandbox to find a path forward for crypto asset frameworks, after 7 years of hostility. This from a note by the Capital Markets Authority on it’s Capital markets soundness report q1 2021 page 33 https://www.cma.or.ke/index.php..." title="Kenya https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇰🇪" title="Flagge von Kenia" aria-label="Emoji: Flagge von Kenia"> is gearing up for Joint Fintech regulatory sandbox to find a path forward for crypto asset frameworks, after 7 years of hostility. This from a note by the Capital Markets Authority on it’s Capital markets soundness report q1 2021 page 33 https://www.cma.or.ke/index.php..." class="img-responsive" style="max-width:100%;"/>

is gearing up for Joint Fintech regulatory sandbox to find a path forward for crypto asset frameworks, after 7 years of hostility. This from a note by the Capital Markets Authority on it’s Capital markets soundness report q1 2021 page 33 https://www.cma.or.ke/index.php..." title="Kenya https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇰🇪" title="Flagge von Kenia" aria-label="Emoji: Flagge von Kenia"> is gearing up for Joint Fintech regulatory sandbox to find a path forward for crypto asset frameworks, after 7 years of hostility. This from a note by the Capital Markets Authority on it’s Capital markets soundness report q1 2021 page 33 https://www.cma.or.ke/index.php..." class="img-responsive" style="max-width:100%;"/>

I did. Crypto is the new rails Already some pan African Fintech’s are pivoting to crypto or adding crypto products or affiliating with crypto https://twitter.com/pesa_afri..." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="😇" title="Lächelndes Gesicht mit Heiligenschein" aria-label="Emoji: Lächelndes Gesicht mit Heiligenschein"> I did. Crypto is the new rails Already some pan African Fintech’s are pivoting to crypto or adding crypto products or affiliating with crypto https://twitter.com/pesa_afri..." class="img-responsive" style="max-width:100%;"/>

I did. Crypto is the new rails Already some pan African Fintech’s are pivoting to crypto or adding crypto products or affiliating with crypto https://twitter.com/pesa_afri..." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="😇" title="Lächelndes Gesicht mit Heiligenschein" aria-label="Emoji: Lächelndes Gesicht mit Heiligenschein"> I did. Crypto is the new rails Already some pan African Fintech’s are pivoting to crypto or adding crypto products or affiliating with crypto https://twitter.com/pesa_afri..." class="img-responsive" style="max-width:100%;"/>