WE SOLD WAVVE.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">

It started as passive income dream... that one day we& #39;d earn enough to pay our mortgages.

Now, it& #39;s going to change my entire family tree.

Here& #39;s a BIG THREAD with all the juicy details about selling @wavve.

It started as passive income dream... that one day we& #39;d earn enough to pay our mortgages.

Now, it& #39;s going to change my entire family tree.

Here& #39;s a BIG THREAD with all the juicy details about selling @wavve.

Let& #39;s start with that time we almost sold Wavve (way back in Jan 2019).

We were at $30k MRR with no plans to sell when we got an email from someone interested in buying.

If you& #39;re a founder and suddenly get an offer with all those zeroes, it& #39;s very hard to turn it down!

We were at $30k MRR with no plans to sell when we got an email from someone interested in buying.

If you& #39;re a founder and suddenly get an offer with all those zeroes, it& #39;s very hard to turn it down!

Now our business had a fixed number tied to it, and I suddenly had this newfound fear of loss.

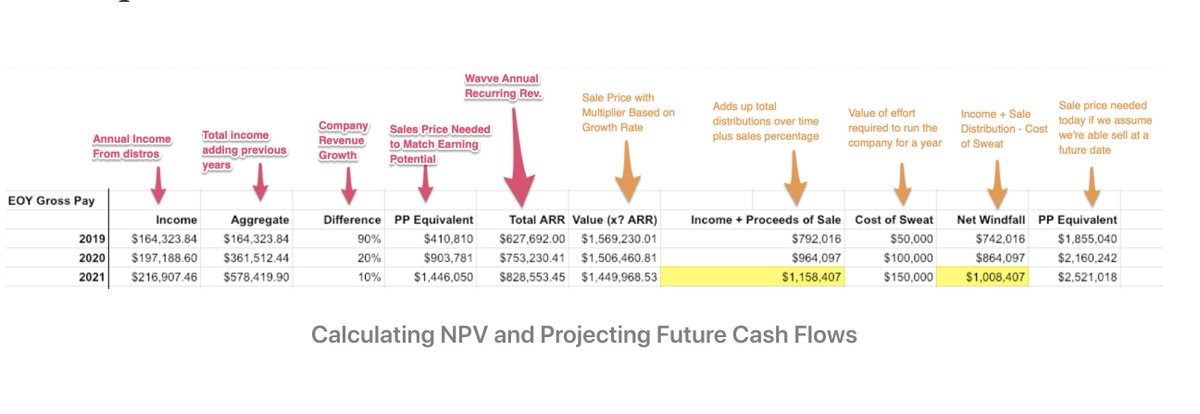

@BairdHall and I met for coffee and explored our options. The cash sounded great, but we took our time deliberating. I built some models to compare the offer to our future cash flows.

@BairdHall and I met for coffee and explored our options. The cash sounded great, but we took our time deliberating. I built some models to compare the offer to our future cash flows.

We decided to double down on Wavve for another year to grow its value even more. Our goal: a LIFE CHANGING amount of money

I was more motivated than ever, bc I knew what the business was worth. We reinvested profits, hired help, and got serious about projecting future growth.

I was more motivated than ever, bc I knew what the business was worth. We reinvested profits, hired help, and got serious about projecting future growth.

We spent all of 2019 Optimizing for a Sale:

- Launched a new product for podcasters, http://Wavve.link"> http://Wavve.link

- Branding refresh, new logo, and trademark

- Rewrote our API and launched Wavve 3.0

- Increased prices and introduced a new top tier plan

- Reduced customer churn

- Launched a new product for podcasters, http://Wavve.link"> http://Wavve.link

- Branding refresh, new logo, and trademark

- Rewrote our API and launched Wavve 3.0

- Increased prices and introduced a new top tier plan

- Reduced customer churn

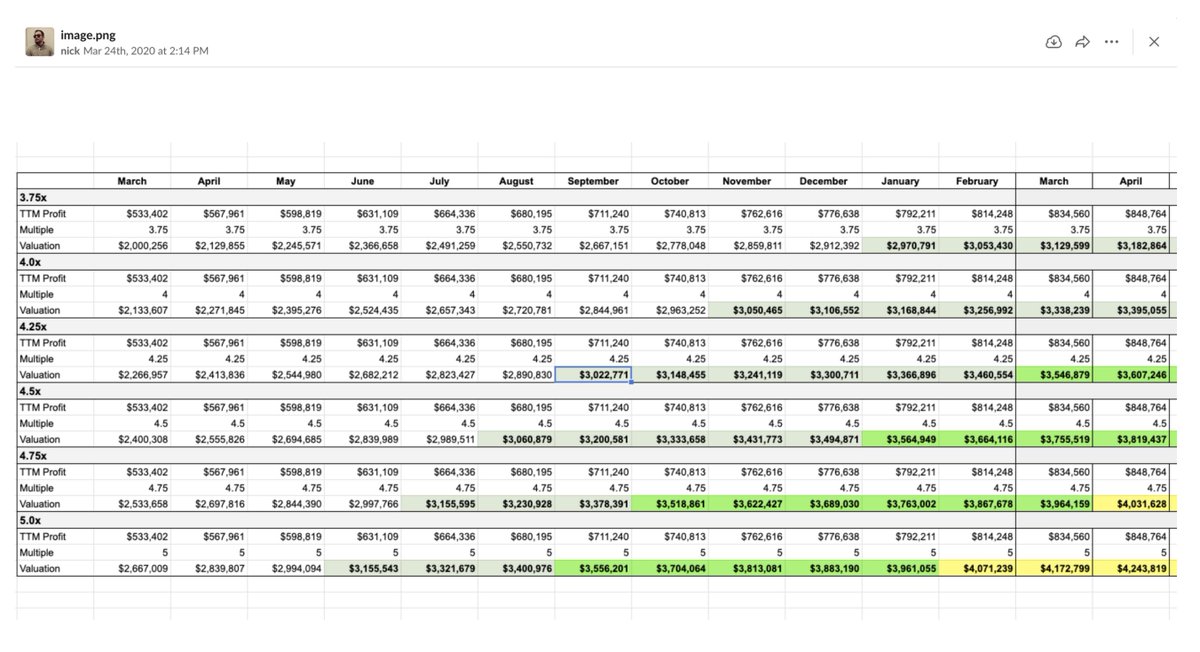

Tracking our Progress.

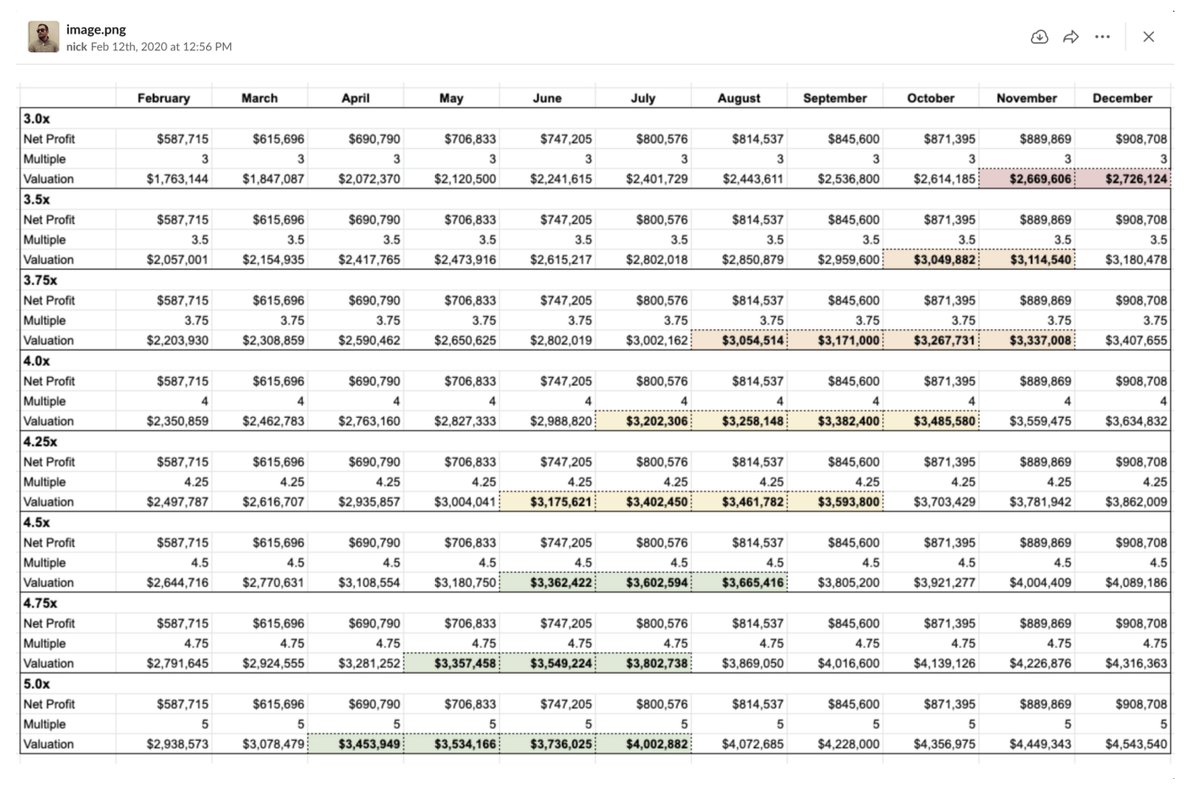

I built a valuation tracker to give us a better sense of our progress. By Jan 2020, my projections had Wavve at our target sale price.

Except for one mistake. I used a snapshot of current profits instead of Twelve Month Trailing. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤦♂️" title="Mann schlägt sich die Hand vors Gesicht" aria-label="Emoji: Mann schlägt sich die Hand vors Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤦♂️" title="Mann schlägt sich die Hand vors Gesicht" aria-label="Emoji: Mann schlägt sich die Hand vors Gesicht">

I built a valuation tracker to give us a better sense of our progress. By Jan 2020, my projections had Wavve at our target sale price.

Except for one mistake. I used a snapshot of current profits instead of Twelve Month Trailing.

Our margins were consistently 75%-80% so we weren& #39;t terribly far off. I updated our projections. It would take about six more months before TTM caught up to our target sale price.

So we scheduled a follow up with the broker during Q2 of 2020 with plans to list over the summer.

So we scheduled a follow up with the broker during Q2 of 2020 with plans to list over the summer.

Then COVID happened.

The buyers went home.

We would need to be more focused than ever now that we were in the midst of a global pandemic.

Knowing so much of my net worth was tied to Wavve was a big factor in my difficult decision to leave @CasaHODL last spring.

The buyers went home.

We would need to be more focused than ever now that we were in the midst of a global pandemic.

Knowing so much of my net worth was tied to Wavve was a big factor in my difficult decision to leave @CasaHODL last spring.

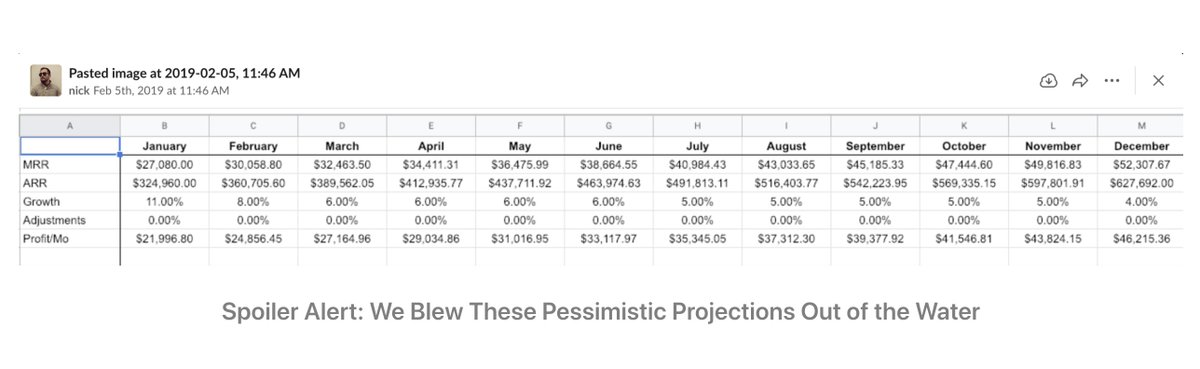

In April, May, and June we signed up record users every day. We blew my original Q2 projections out of the water.

We were lucky. It was the right kind of business for several new trends (work from home, creator economy, surge in podcasting, increased time on social media).

We were lucky. It was the right kind of business for several new trends (work from home, creator economy, surge in podcasting, increased time on social media).

We also used this time to get serious about churn.

When you& #39;re planning to sell your company, FEW things give you better ROI than cutting your churn rate.

After cutting user churn from 12% down to 9% (during a pandemic) we found our next business, @getchurnkey.

When you& #39;re planning to sell your company, FEW things give you better ROI than cutting your churn rate.

After cutting user churn from 12% down to 9% (during a pandemic) we found our next business, @getchurnkey.

The Final Chapter

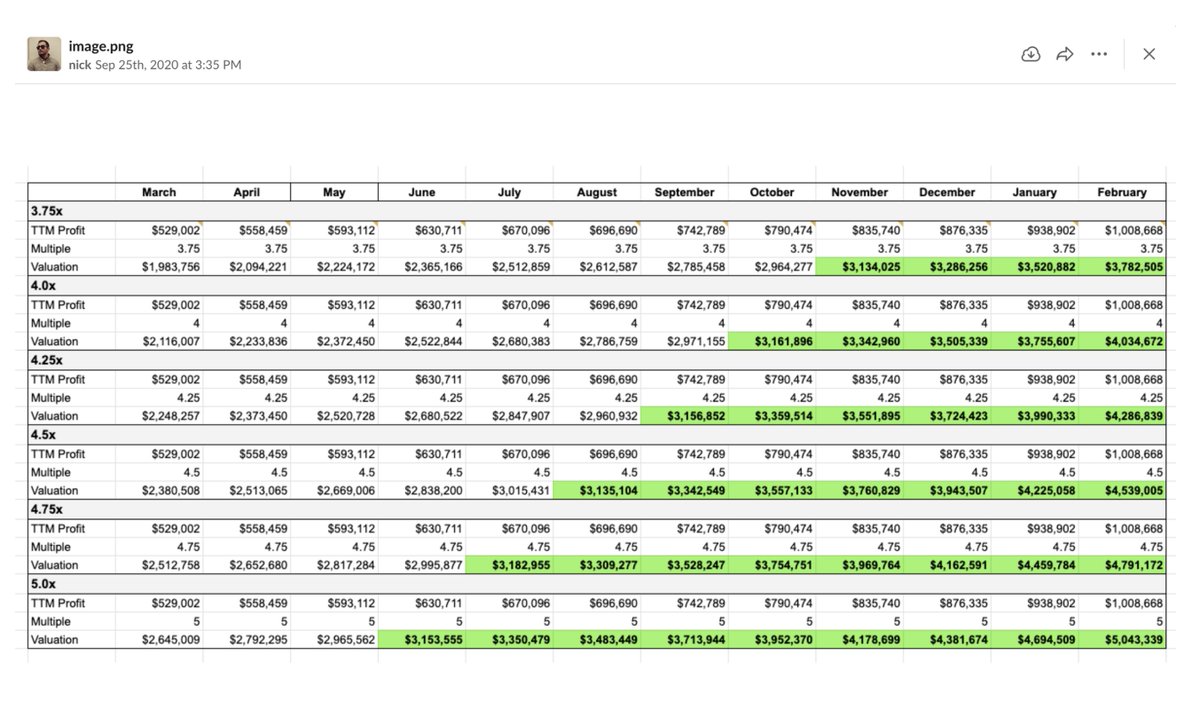

Last fall we kicked off sales discussions again with our broker. After sharing our numbers, our price target was more than attainable.

We could list for a much higher figure. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

Last fall we kicked off sales discussions again with our broker. After sharing our numbers, our price target was more than attainable.

We could list for a much higher figure.

In the two years since our first offer, we doubled down on growth and worked hard to build an incredible business.

- Automated business tasks,

- Hired a dedicated support person,

- Rewrote most of our tech stack, and

- Weathered a global pandemic

- Automated business tasks,

- Hired a dedicated support person,

- Rewrote most of our tech stack, and

- Weathered a global pandemic

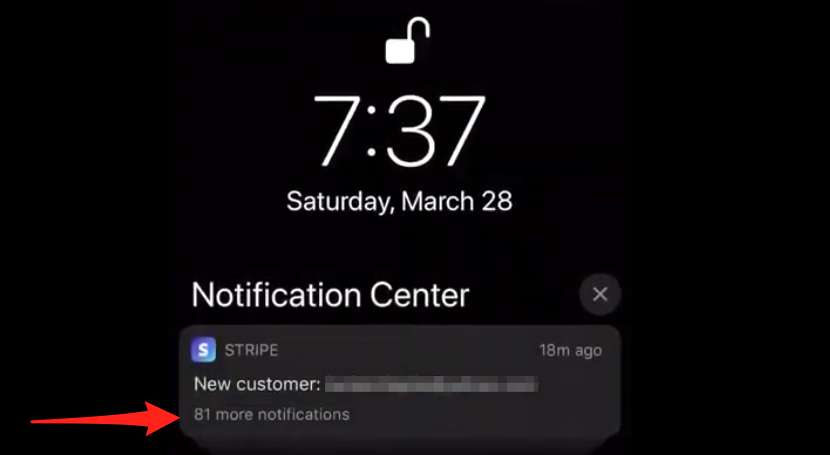

Now we owned a bona fide PRINTING PRESS.

A totally passive cash flow machine.

I& #39;ll never forgot waking up in Jackson Hole last October to check my Stripe notifications. I& #39;d been totally off the grid for a few days, and I woke up to see a flurry of new customer notifications.

A totally passive cash flow machine.

I& #39;ll never forgot waking up in Jackson Hole last October to check my Stripe notifications. I& #39;d been totally off the grid for a few days, and I woke up to see a flurry of new customer notifications.

If you& #39;re itching to exit, buyers are going to notice that and your valuation will reflect it. Build the dream business that you want to run, and your purchase price will reflect that.

At this point we were no longer in a rush to sell the business. Even if we never sold, we knew we& #39;d continue earning over $100k/mo in profits for the foreseeable future.

Our decision to sell ultimately came down to what would be best for the business and our customers.

Our decision to sell ultimately came down to what would be best for the business and our customers.

By late 2020, we were no longer interested in running the day to day operations and were ready to move on to something else (building @getchurnkey).

We scheduled a follow up meeting with the broker for January and made plans to finalize a listing in March, 2021.

We scheduled a follow up meeting with the broker for January and made plans to finalize a listing in March, 2021.

December threw us another curveball.

Without warning we started receiving interest from prospective buyers (all cold inbound). We spent most of the month on video calls with like 10 interested parties.

On the day before Christmas Eve, we received 5 Letters of Intent (LOIs). https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

Without warning we started receiving interest from prospective buyers (all cold inbound). We spent most of the month on video calls with like 10 interested parties.

On the day before Christmas Eve, we received 5 Letters of Intent (LOIs).

With so many options above or near our minimum price target, we decided to forgo the broker route and try to make the sale happen ourselves.

I& #39;m an attorney and typically help with any of our legal needs, but on this occasion I called in the big guns.

I& #39;m an attorney and typically help with any of our legal needs, but on this occasion I called in the big guns.

We hired a transactional lawyer, reviewed our top deal choices, and Calm Capital was the final favorite.

- Great culture fit.

- Excellent total deal value.

- And they were local.

- Great culture fit.

- Excellent total deal value.

- And they were local.

After signing the LOI on Jan 7th, it was a nerve-wracking waiting game as we went through due diligence, final sale negotiations, and planned the asset sale.

In the end, everything went smoothly and we saved a few hundred thousand dollars by not having to pay broker fees. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

In the end, everything went smoothly and we saved a few hundred thousand dollars by not having to pay broker fees.

83 days.

That& #39;s how long it took from signing the LOI to getting the funds in our bank account.

Fun fact: Bank of America business accounts have a maximum 30 day transfer limit. I hit that limit after the first wire transfer.

That& #39;s how long it took from signing the LOI to getting the funds in our bank account.

Fun fact: Bank of America business accounts have a maximum 30 day transfer limit. I hit that limit after the first wire transfer.

I& #39;m sure people have a lot of questions.

- What was the Wavve sale price?

- What& #39;s next for Wavve?

- Are you going to retire?

- Any advice for others?

I& #39;ve answered what I can in a detailed blog post. https://nickfogle.com/selling-wavve/ ">https://nickfogle.com/selling-w...

- What was the Wavve sale price?

- What& #39;s next for Wavve?

- Are you going to retire?

- Any advice for others?

I& #39;ve answered what I can in a detailed blog post. https://nickfogle.com/selling-wavve/ ">https://nickfogle.com/selling-w...

A huge thanks to:

@brittash for sticking with me through so many 80/hr work weeks.

Calm Capital partners @_davidhorne_ & @MartyBalkema.

Business partners @BairdHall & @robmoo_re.

And to the @IndieHackers community for inspiration and showing us that bootstrapping > VC.

@brittash for sticking with me through so many 80/hr work weeks.

Calm Capital partners @_davidhorne_ & @MartyBalkema.

Business partners @BairdHall & @robmoo_re.

And to the @IndieHackers community for inspiration and showing us that bootstrapping > VC.

Links for further reading:

Our joint post on the topic: https://churnkey.co/blog/wavve-has-been-acquired-by-calm-capital

From">https://churnkey.co/blog/wavv... Calm Capital& #39;s point of view: https://www.calmcapital.com/blog/calm-capital-acquires-wavve

From">https://www.calmcapital.com/blog/calm... the new CEO, Jeff Dolan: https://jeffdolan.com/achieving-a-major-life-goal

DM">https://jeffdolan.com/achieving... me here or reach out via email for further inquiries (hey@churnkey.co).

Our joint post on the topic: https://churnkey.co/blog/wavve-has-been-acquired-by-calm-capital

From">https://churnkey.co/blog/wavv... Calm Capital& #39;s point of view: https://www.calmcapital.com/blog/calm-capital-acquires-wavve

From">https://www.calmcapital.com/blog/calm... the new CEO, Jeff Dolan: https://jeffdolan.com/achieving-a-major-life-goal

DM">https://jeffdolan.com/achieving... me here or reach out via email for further inquiries (hey@churnkey.co).

Read on Twitter

Read on Twitter It started as passive income dream... that one day we& #39;d earn enough to pay our mortgages.Now, it& #39;s going to change my entire family tree.Here& #39;s a BIG THREAD with all the juicy details about selling @wavve." title="WE SOLD WAVVE. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf"> It started as passive income dream... that one day we& #39;d earn enough to pay our mortgages.Now, it& #39;s going to change my entire family tree.Here& #39;s a BIG THREAD with all the juicy details about selling @wavve." class="img-responsive" style="max-width:100%;"/>

It started as passive income dream... that one day we& #39;d earn enough to pay our mortgages.Now, it& #39;s going to change my entire family tree.Here& #39;s a BIG THREAD with all the juicy details about selling @wavve." title="WE SOLD WAVVE. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf"> It started as passive income dream... that one day we& #39;d earn enough to pay our mortgages.Now, it& #39;s going to change my entire family tree.Here& #39;s a BIG THREAD with all the juicy details about selling @wavve." class="img-responsive" style="max-width:100%;"/>

" title="Tracking our Progress.I built a valuation tracker to give us a better sense of our progress. By Jan 2020, my projections had Wavve at our target sale price.Except for one mistake. I used a snapshot of current profits instead of Twelve Month Trailing. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤦♂️" title="Mann schlägt sich die Hand vors Gesicht" aria-label="Emoji: Mann schlägt sich die Hand vors Gesicht">" class="img-responsive" style="max-width:100%;"/>

" title="Tracking our Progress.I built a valuation tracker to give us a better sense of our progress. By Jan 2020, my projections had Wavve at our target sale price.Except for one mistake. I used a snapshot of current profits instead of Twelve Month Trailing. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤦♂️" title="Mann schlägt sich die Hand vors Gesicht" aria-label="Emoji: Mann schlägt sich die Hand vors Gesicht">" class="img-responsive" style="max-width:100%;"/>

" title="The Final ChapterLast fall we kicked off sales discussions again with our broker. After sharing our numbers, our price target was more than attainable.We could list for a much higher figure. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">" class="img-responsive" style="max-width:100%;"/>

" title="The Final ChapterLast fall we kicked off sales discussions again with our broker. After sharing our numbers, our price target was more than attainable.We could list for a much higher figure. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">" class="img-responsive" style="max-width:100%;"/>