The first paper out of a year-long project I& #39;ve been working on using leaked offshore bank data

https://brookings.edu/wp-content/uploads/2021/05/What-lies-beneath_Collin.pdf

Curious">https://brookings.edu/wp-conten... about who uses tax havens and how shell companies distort international statistics? Interested in corruption?

Thread

This is a story that involves hacker collectives, Russian billionaires and a tax haven, and that& #39;s even before the data analysis even begins

It& #39;s a wild ride

It& #39;s a wild ride

The story begins in 2016, when the hacktivist collective Phineas Fisher (who appears in @VICENews interviews in the form of, yes, a sock puppet) purportedly hacked into the Cayman National Bank, Isle of Man and stole some money

https://www.vice.com/en/article/ne8p9b/offshore-bank-targeted-phineas-fisher-confirms-hack-cayman-national-bank">https://www.vice.com/en/articl...

https://www.vice.com/en/article/ne8p9b/offshore-bank-targeted-phineas-fisher-confirms-hack-cayman-national-bank">https://www.vice.com/en/articl...

In late 2019, Fisher appeared to have returned and copied several of the bank& #39;s network hard drives

In November of 2019, the transparency collective @DDoSecret released about 2TB of information from the leak online

In November of 2019, the transparency collective @DDoSecret released about 2TB of information from the leak online

Since then, journalists and civil society organizations have used the data to write slew of stories about several of the bank& #39;s clients

These include stories about:

* A Russian billionaire currently fighting a US tax fraud charge @Global_Witness https://www.globalwitness.org/en/campaigns/oleg-tinkov-isle-of-man/">https://www.globalwitness.org/en/campai...

These include stories about:

* A Russian billionaire currently fighting a US tax fraud charge @Global_Witness https://www.globalwitness.org/en/campaigns/oleg-tinkov-isle-of-man/">https://www.globalwitness.org/en/campai...

* The former Armenian head of customs, who the @OCCRP reported was under investigation by the country& #39;s National Security Services

https://www.occrp.org/en/investigations/armenias-golden-palace-offshore-millions-evaded-investigators

*">https://www.occrp.org/en/invest... Children of the former Azerbaijan Minister of National Security, who liked to buy up UK property https://www.theguardian.com/uk-news/2020/may/31/children-of-azerbaijan-minister-eldar-mahmudov-built-up-100m-property-and-business-empire">https://www.theguardian.com/uk-news/2...

https://www.occrp.org/en/investigations/armenias-golden-palace-offshore-millions-evaded-investigators

*">https://www.occrp.org/en/invest... Children of the former Azerbaijan Minister of National Security, who liked to buy up UK property https://www.theguardian.com/uk-news/2020/may/31/children-of-azerbaijan-minister-eldar-mahmudov-built-up-100m-property-and-business-empire">https://www.theguardian.com/uk-news/2...

The media reported on the most problematic customers, but no one was using the data to ask systematic questions about how the customers of offshore banks organize their affairs

Leaks offer us a chance to pull back the lid on (possibly) illicit behavior and better understand it

Leaks offer us a chance to pull back the lid on (possibly) illicit behavior and better understand it

When the leak happened (I can& #39;t find the tweet), @gabriel_zucman said this would lead to a PhD thesis

I already have a PhD, but I thought - what the hell - I& #39;ll start going through the data

A year later, this is what I found:

I already have a PhD, but I thought - what the hell - I& #39;ll start going through the data

A year later, this is what I found:

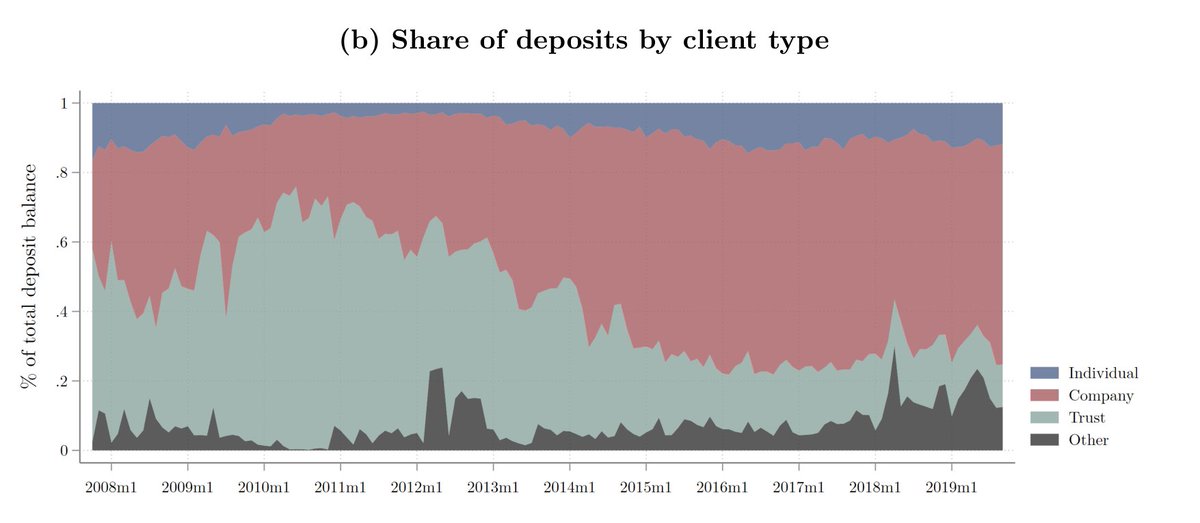

Most money being kept offshore isn& #39;t being held by people, it& #39;s being held by companies and trusts

But here& #39;s the thing, most of those companies aren& #39;t real in the sense that they employee people and make stuff

They are "shell" companies, just an address and a bank account

But here& #39;s the thing, most of those companies aren& #39;t real in the sense that they employee people and make stuff

They are "shell" companies, just an address and a bank account

That& #39;s a problem for figuring out who owns offshore wealth: shell companies are usually registered in tax havens when in fact the money is owned by someone living elsewhere

But the leak included info on the ultimate owners of those entities, so I could pinpoint their location

But the leak included info on the ultimate owners of those entities, so I could pinpoint their location

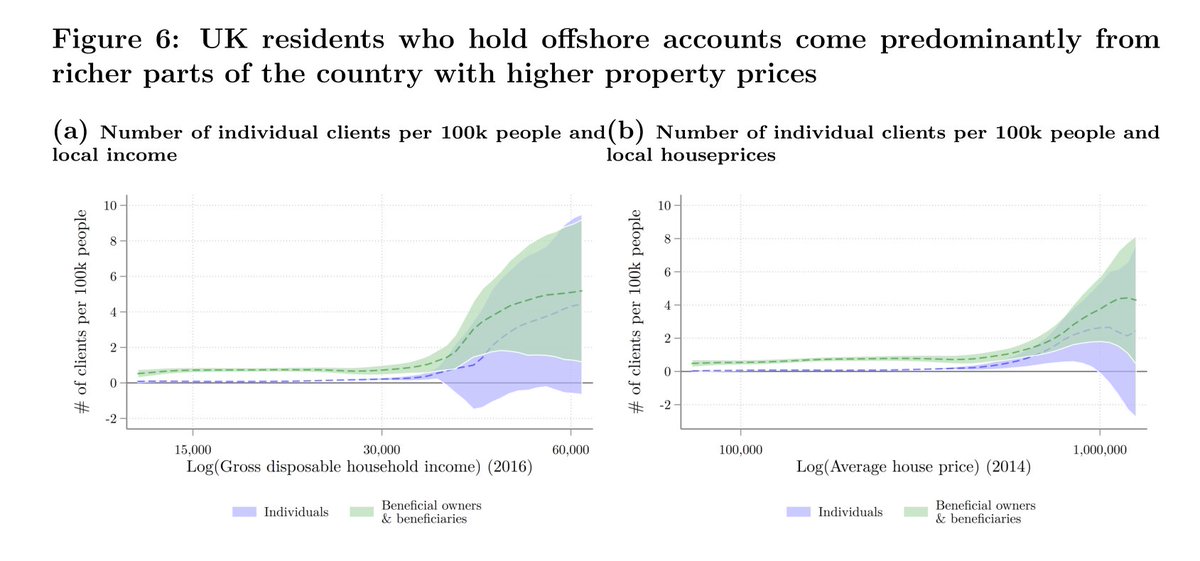

Finding 1:

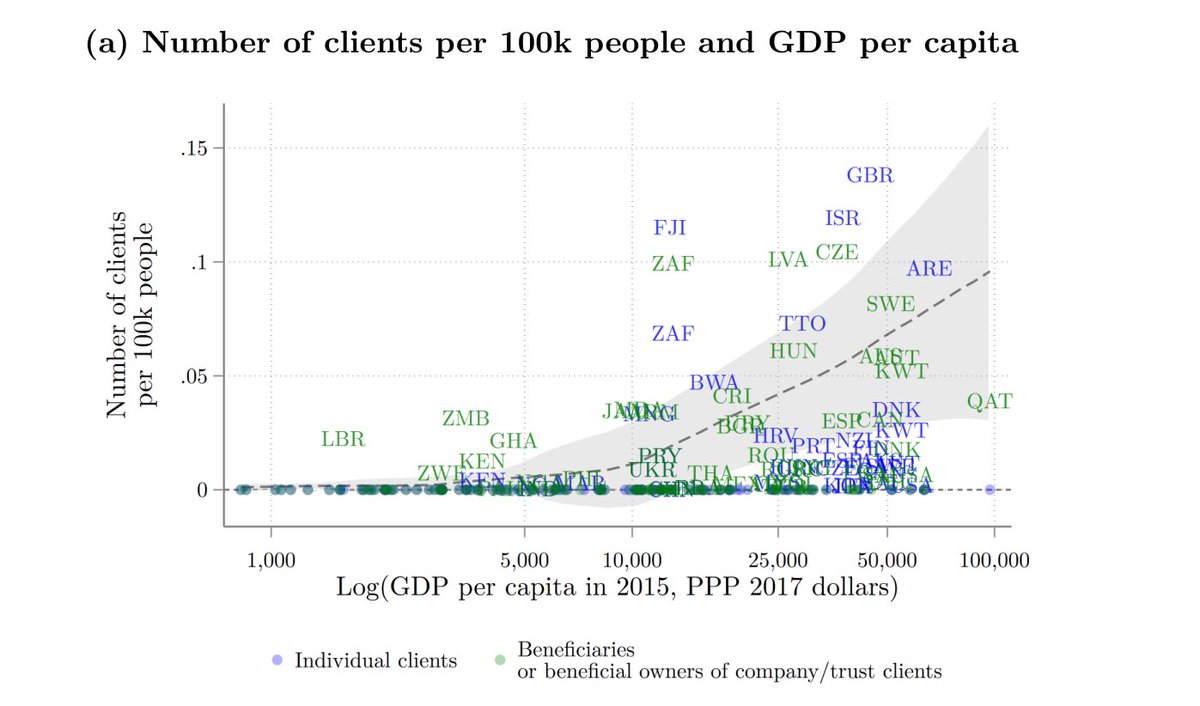

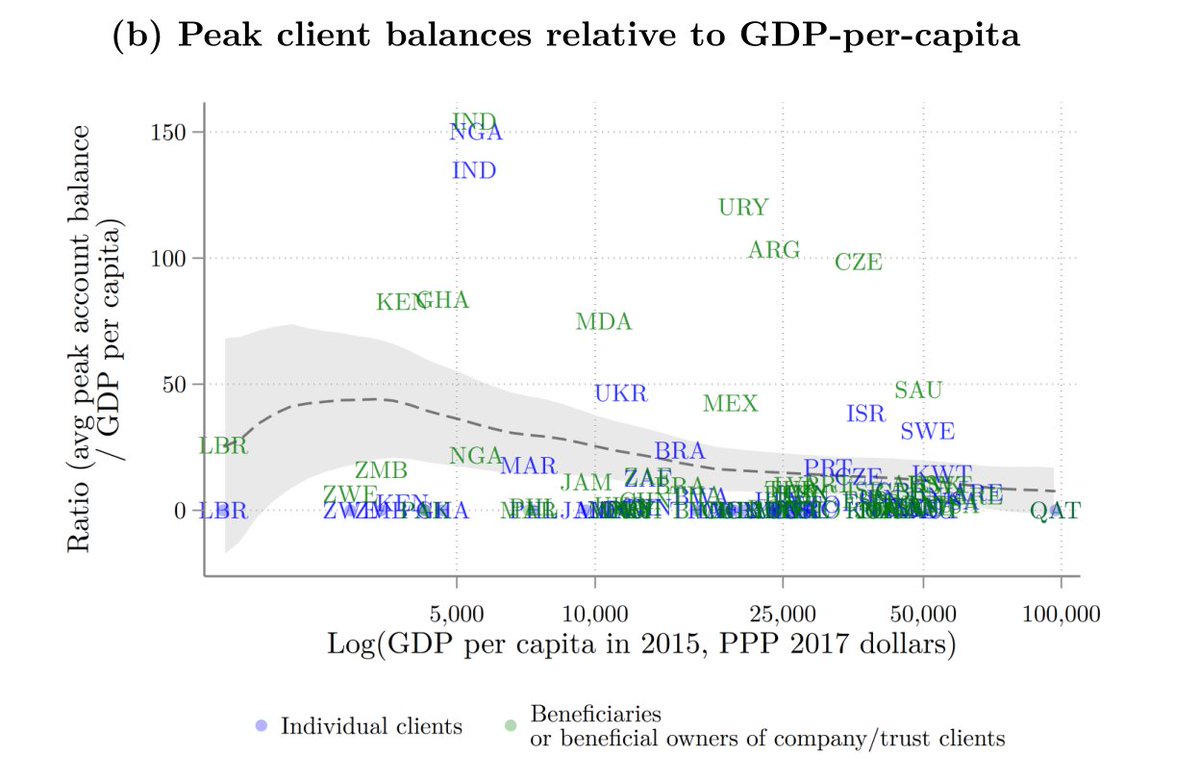

Surprise surprise, the clients of offshore banks are richer than average. They come from richer countries and are likely to be wealthy compared to others in their country of origin

This also holds *within* countries like the UK

Surprise surprise, the clients of offshore banks are richer than average. They come from richer countries and are likely to be wealthy compared to others in their country of origin

This also holds *within* countries like the UK

This reinforces what we already know from great work by @annette_als @juliana_londono @gabriel_zucman and many more: banking in tax havens is very much a rich person phenomenon

Given that tax authorities aren& #39;t great at detecting it, this should make us very, very worried

Given that tax authorities aren& #39;t great at detecting it, this should make us very, very worried

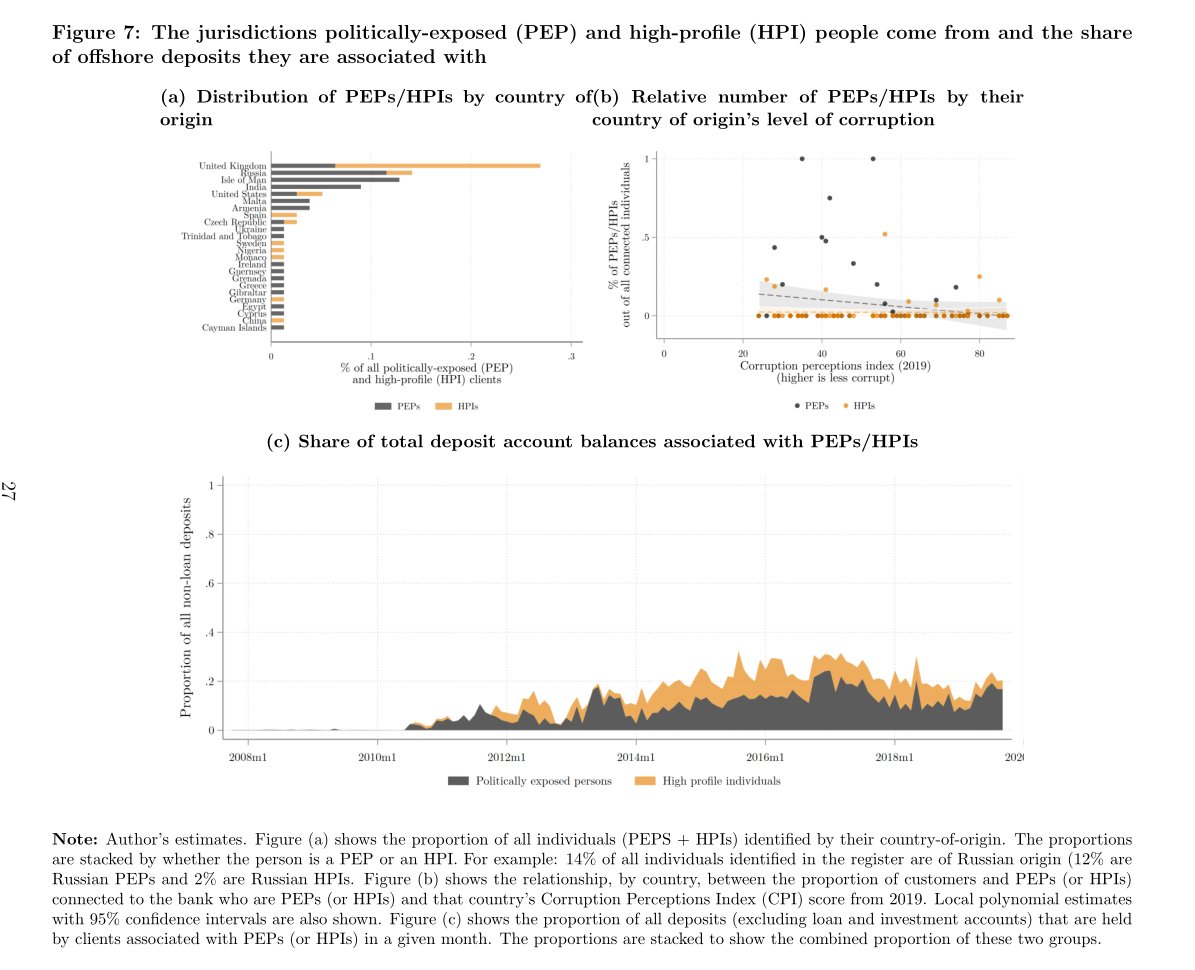

Finding 2: a lot of wealth appears to be controlled by clients connected to political elites

A # of these are from countries that have an issue with corruption

(clients connected to politically-exposed people are in black, "high profile persons" (e.g. celebrities) in orange)

A # of these are from countries that have an issue with corruption

(clients connected to politically-exposed people are in black, "high profile persons" (e.g. celebrities) in orange)

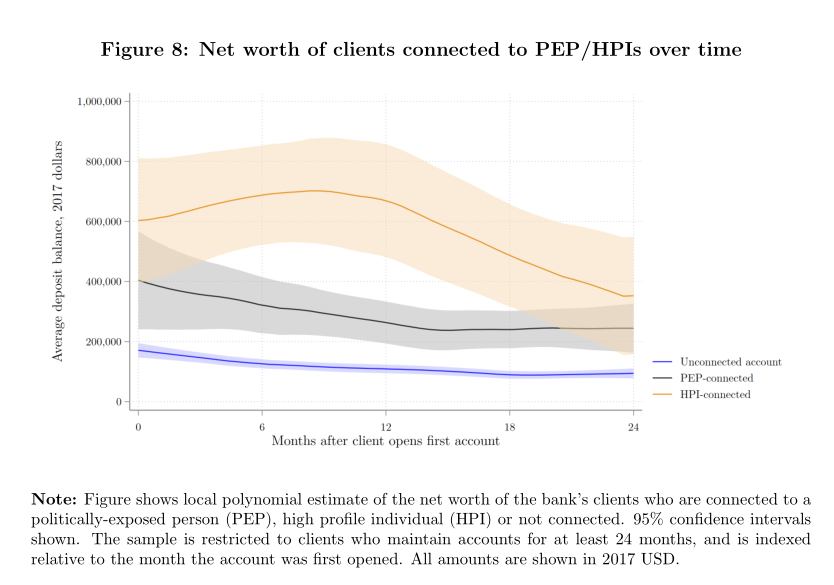

More unnerving: clients connected to politically-exposed persons control a lot more wealth than your average client

You heard it: those connected to political power are wealthier *compared to other tax haven clients*

You heard it: those connected to political power are wealthier *compared to other tax haven clients*

They are also more likely to be registered as being based in a tax haven, and receive a higher share of wire transfers from other tax havens

* Note it is possible this makes it easier for compliance officers to detect them and keep track of them, but even then: yikes

* Note it is possible this makes it easier for compliance officers to detect them and keep track of them, but even then: yikes

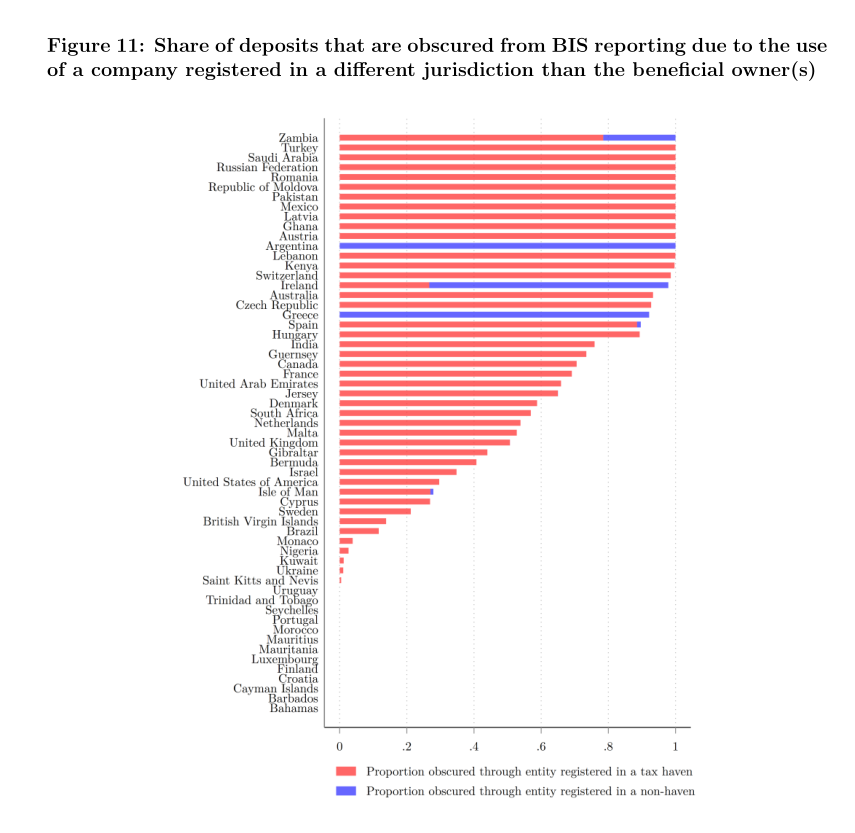

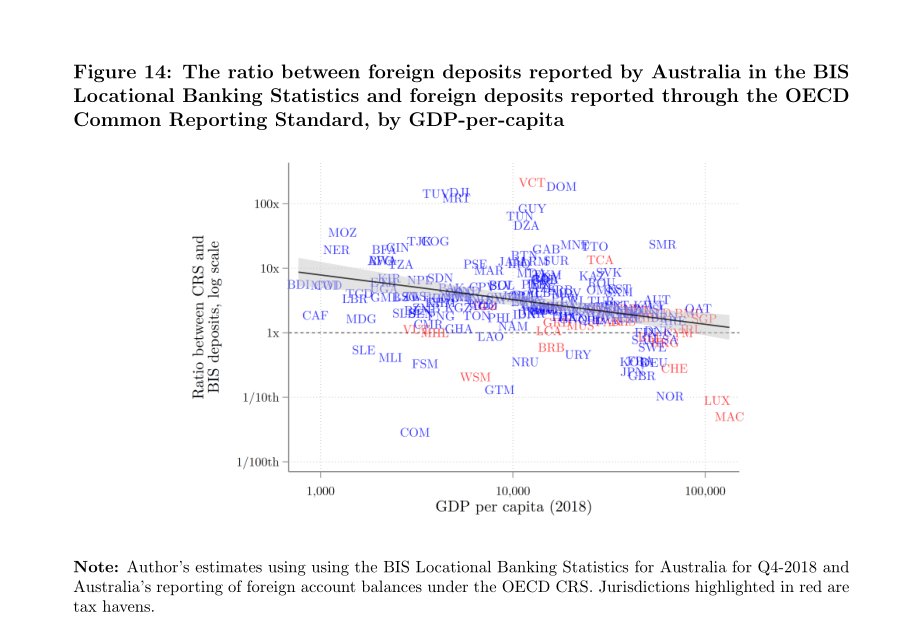

Finding 3: shell companies and trusts throw a wrench in international statistics used to measure offshore wealth

This is something researchers are aware of and have been grappling with for a while

Thanks to the ownership data in the leak, we can get a sense of how bad it is

This is something researchers are aware of and have been grappling with for a while

Thanks to the ownership data in the leak, we can get a sense of how bad it is

Once a quarter, banks in participating jurisdictions send reports summing the ownership of their deposits on a country-by-country basis

These in turn are sent to the @BIS_org for its "Locational Banking Statistics" (LBS) https://www.bis.org/statistics/bankstats.htm">https://www.bis.org/statistic...

These in turn are sent to the @BIS_org for its "Locational Banking Statistics" (LBS) https://www.bis.org/statistics/bankstats.htm">https://www.bis.org/statistic...

These are used for all sorts of analyses, but because the LBS will tell you the $ amount of deposits in, say, Luxembourg that are owned by French residents, it is one of the building blocks used by researchers to count up offshore wealth (or observe how it reacts to new policy)

But there& #39;s a snag: the LBS asks banks to aggregate based on the residence of the most immediate counterparty

If Matt Collin (USA) owns the account, they are put in the USA bucket

But if Matt Collin Inc. (Isle of Man) owns the account, they are put in the Isle of Man bucket

If Matt Collin (USA) owns the account, they are put in the USA bucket

But if Matt Collin Inc. (Isle of Man) owns the account, they are put in the Isle of Man bucket

But with the leaked data, I can look through Matt Collin Inc. (IOM) and assign that account to Matt Collin (USA), and thus experiment with how much this would change the headline figures the BIS produces (for this bank)

Does it make a difference? You bet it does

Does it make a difference? You bet it does

When deposits are assigned based on where the beneficial owner/beneficiary is based, reported deposits owned by tax havens falls by about 1/3

Deposits owned by those living outside of tax havens roughly *double*

Deposits owned by those living outside of tax havens roughly *double*

If we look on a country by country basis, *entire countries* are missing from these particular BIS LBS reports because their assets are owned through countries and trusts

It is hard to know what this looks like on a global scale, but it is concerning

It is hard to know what this looks like on a global scale, but it is concerning

No cross country-correlations leap out of the country-by-country corrected-estimates, but an earlier analysis I did suggests that the under-statement of offshore wealth by the BIS may be more common among developing countries

The answer? The BIS could easily start requiring banks to start collating deposits by the location of the ultimate owner

Banks *already* have this information on hand, they are required to collect it both for exchanging tax information and for their anti-money laundering duties

Banks *already* have this information on hand, they are required to collect it both for exchanging tax information and for their anti-money laundering duties

What about offshore wealth being controlled by those connected to politically exposed persons (PEPs)?

That& #39;s more tough: these people were already being monitored - banks are required to identify these people and keep track of them (which is how I found them)

That& #39;s more tough: these people were already being monitored - banks are required to identify these people and keep track of them (which is how I found them)

But here& #39;s the thing: regulators don& #39;t know any of this unless the bank files a suspicious activity report

That puts a lot of faith in banks to catch the most egregious cases

Banks already keep track of PEPs, why not aggregate that information and send it to the regulators?

That puts a lot of faith in banks to catch the most egregious cases

Banks already keep track of PEPs, why not aggregate that information and send it to the regulators?

This would add no additional due diligence requirements but would give authorities a "dashboard indicator" of whether their economy is in high demand by political elites from corrupt countries

This could feed directly into the risk assessments that governments conduct

This could feed directly into the risk assessments that governments conduct

Sorry stopping to eat something, but I& #39;ll be back in a moment to wrap up and highlight what is coming next

*Yes* there are more research projects coming out in the next few months

*Yes* there are more research projects coming out in the next few months

Seems like I broke the thread, it continues here: https://twitter.com/aidthoughts/status/1389992410176962561?s=20">https://twitter.com/aidthough...

Read on Twitter

Read on Twitter New working paper alerthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">The first paper out of a year-long project I& #39;ve been working on using leaked offshore bank data https://brookings.edu/wp-conten... about who uses tax havens and how shell companies distort international statistics? Interested in corruption?Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">New working paper alerthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">The first paper out of a year-long project I& #39;ve been working on using leaked offshore bank data https://brookings.edu/wp-conten... about who uses tax havens and how shell companies distort international statistics? Interested in corruption?Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

New working paper alerthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">The first paper out of a year-long project I& #39;ve been working on using leaked offshore bank data https://brookings.edu/wp-conten... about who uses tax havens and how shell companies distort international statistics? Interested in corruption?Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">New working paper alerthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">The first paper out of a year-long project I& #39;ve been working on using leaked offshore bank data https://brookings.edu/wp-conten... about who uses tax havens and how shell companies distort international statistics? Interested in corruption?Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>