Me: Ooh! I& #39;m so excited. I& #39;ll publish my blog on Security Stocks and how I picked a winner. Yay.

Markets: Not so fast! Catch https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔧" title="Schraubenschlüssel" aria-label="Emoji: Schraubenschlüssel">!

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔧" title="Schraubenschlüssel" aria-label="Emoji: Schraubenschlüssel">!

Me: https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥺" title="Pleading face" aria-label="Emoji: Pleading face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥺" title="Pleading face" aria-label="Emoji: Pleading face">  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😭" title="Laut schreiendes Gesicht" aria-label="Emoji: Laut schreiendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😭" title="Laut schreiendes Gesicht" aria-label="Emoji: Laut schreiendes Gesicht"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="😩" title="Mattes Gesicht" aria-label="Emoji: Mattes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😩" title="Mattes Gesicht" aria-label="Emoji: Mattes Gesicht">

Me: well here’s a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> anyway on investing in a growth sector like cybersecurity.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> anyway on investing in a growth sector like cybersecurity.

Markets: Not so fast! Catch

Me:

Me: well here’s a

There’s hardly been a month in the past decade that we’ve not heard of a major cybersecurity hack, data breach or ransomware attack.

No one’s safe. Not FB, LI, Not even the most powerful governments.

You can see an entire list of these here https://www.csis.org/programs/strategic-technologies-program/significant-cyber-incidents">https://www.csis.org/programs/...

No one’s safe. Not FB, LI, Not even the most powerful governments.

You can see an entire list of these here https://www.csis.org/programs/strategic-technologies-program/significant-cyber-incidents">https://www.csis.org/programs/...

Consequently, there are a great many companies & startups entering the cybersecurity space.

Depending on which research analyst you believe, Global Cyber Security market size is growing at a CAGR (Compounded Annual Growth Rate) of 10.9% to 12.5% and may reach USD 418.3 Billion by 2028.

Many of the publicly traded cyber security stocks have had phenomenal growths in stock price as well as earnings. Most of the big names are not profitable yet.

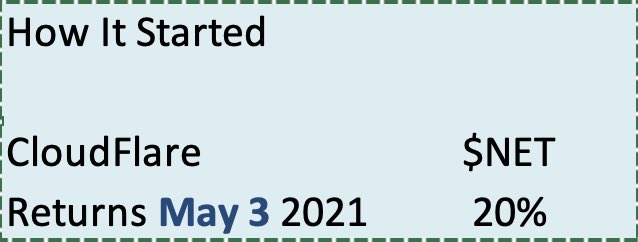

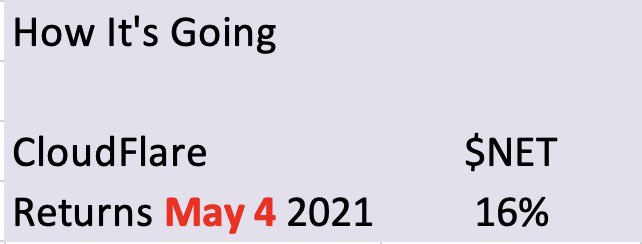

How It Started vs How it’s going.

After my analysis I picked Cloudflare $NET on March 9 2021

I was up 20% on May 3rd. Less than 2 months.

After my analysis I picked Cloudflare $NET on March 9 2021

I was up 20% on May 3rd. Less than 2 months.

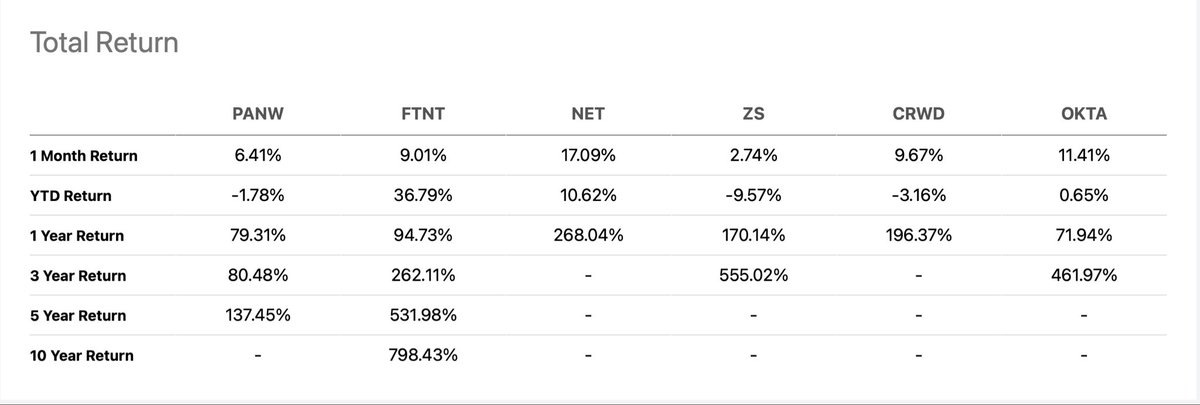

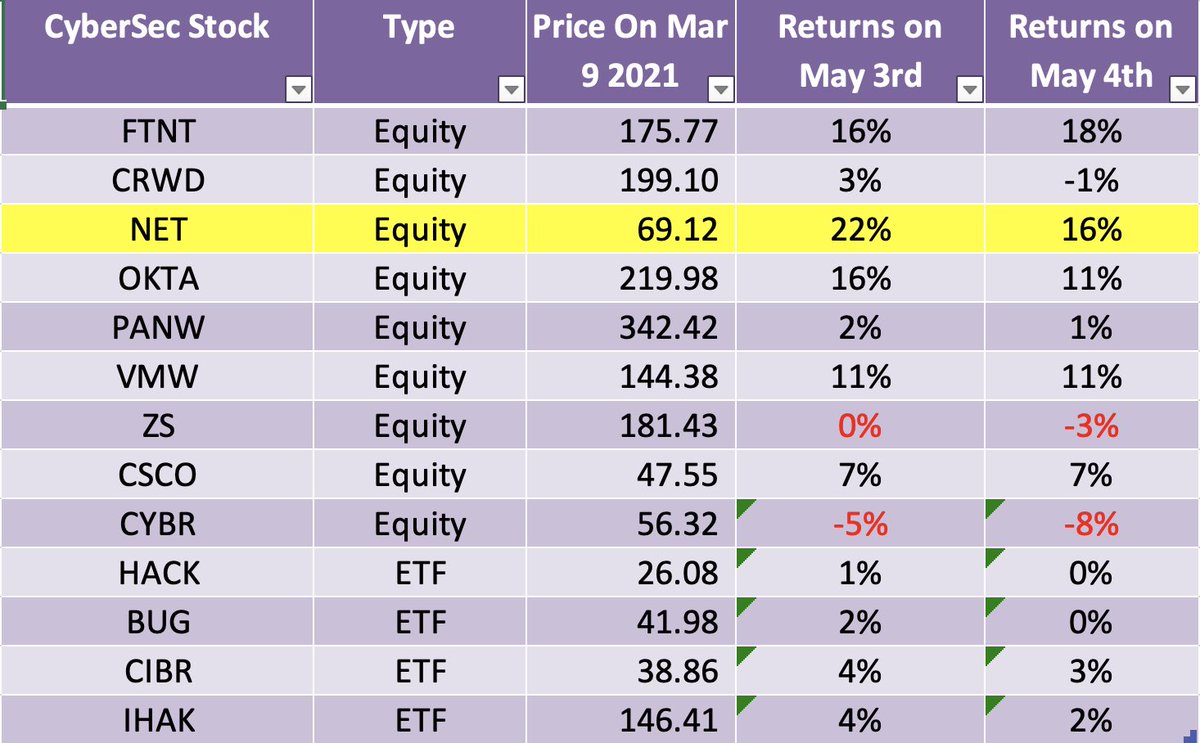

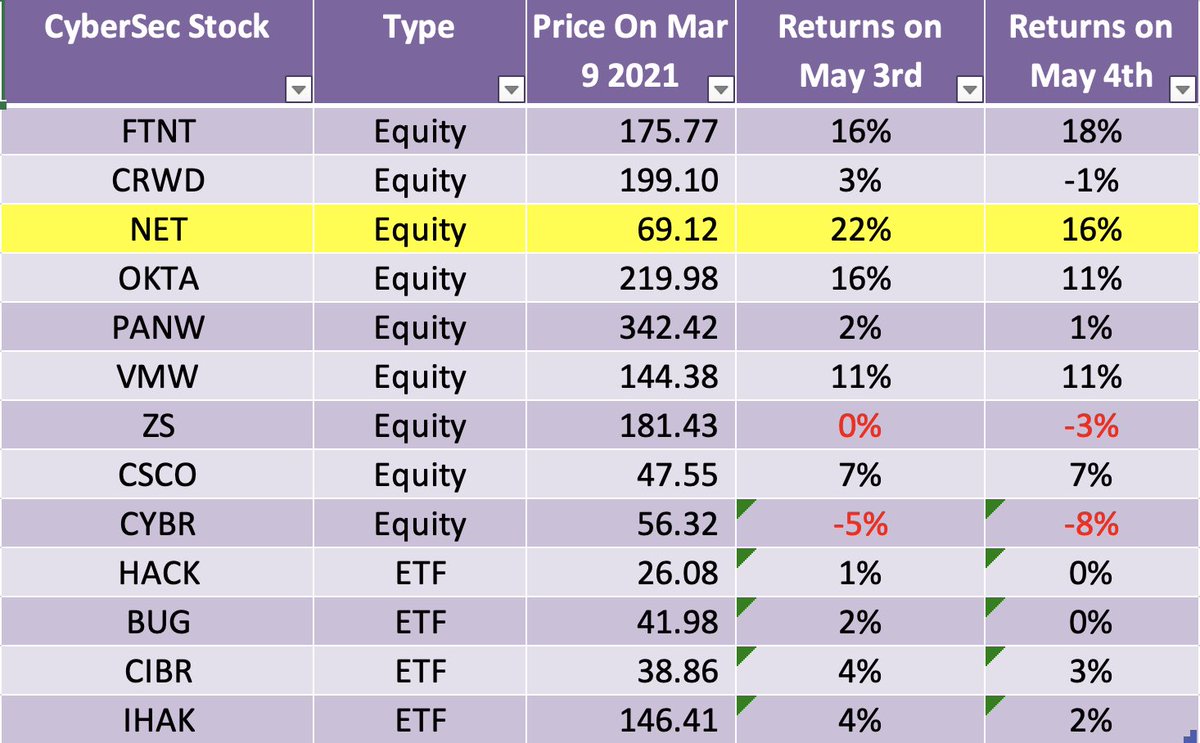

I compared many stocks as well as ETF’s

Here’s how they did.

Your gal didn’t do too shabby. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😌" title="Erleichtertes Gesicht" aria-label="Emoji: Erleichtertes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😌" title="Erleichtertes Gesicht" aria-label="Emoji: Erleichtertes Gesicht">

Here’s how they did.

Your gal didn’t do too shabby.

Max Stock returns of some cybersecurity stocks

Fortinet $FTNT 725% in 10 yrs

Zscaler $ZS 508% in in 3 yrs

$OKTA 444% in 3 yrs

PaloAlto Networks $PANW 120% in 1 year

CrowdStrike $CRWD 297% in 1 yr

Cloudflare $NET 230% in 1 yr.

How to choose among so many?

Fortinet $FTNT 725% in 10 yrs

Zscaler $ZS 508% in in 3 yrs

$OKTA 444% in 3 yrs

PaloAlto Networks $PANW 120% in 1 year

CrowdStrike $CRWD 297% in 1 yr

Cloudflare $NET 230% in 1 yr.

How to choose among so many?

I started reading Gartner research & articles about cybersecurity; what the strengths & weaknesses are for each.

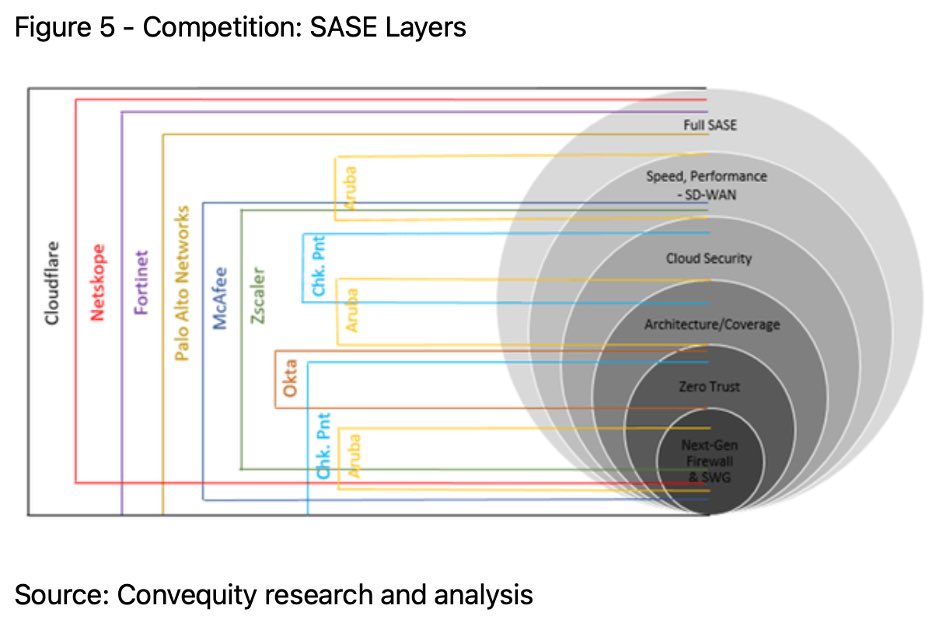

I like this illustration. It’s a good data point to see who can provide a breath of service & who are playing in niche areas like say, Identity protection.

I like this illustration. It’s a good data point to see who can provide a breath of service & who are playing in niche areas like say, Identity protection.

Next, I looked at analyst reports. I used @SeekingAlpha (SA) & @KoyfinCharts (KF) @YahooFinance for my analysis

You need a paid subscription for certain features in SA. I like using it thus far.

After reading many articles I settled on the following for further analysis:

You need a paid subscription for certain features in SA. I like using it thus far.

After reading many articles I settled on the following for further analysis:

Market Cap as on Mar 2021 , IPO date

CRWD: $43.57 B 6/19/2019

PANW: $30.81 B 6/12/2012

FTNT: $28.48 B 11/18/2009

VMW: $61.21 B 8/14/2007

ZS: $24.68 B 3/16/2018

NET: $22.14 B 9/13/2019

OKTA: $28.02 B 4/17/2017

CRWD: $43.57 B 6/19/2019

PANW: $30.81 B 6/12/2012

FTNT: $28.48 B 11/18/2009

VMW: $61.21 B 8/14/2007

ZS: $24.68 B 3/16/2018

NET: $22.14 B 9/13/2019

OKTA: $28.02 B 4/17/2017

As you can see, some are older & some are fairly new. Most had market cap in $20+ Billion range

CRWD stands out because it’s a fairly new entrant with a hefty market cap of $43.57

Question is which provides greatest value for greatest growth potential.

CRWD stands out because it’s a fairly new entrant with a hefty market cap of $43.57

Question is which provides greatest value for greatest growth potential.

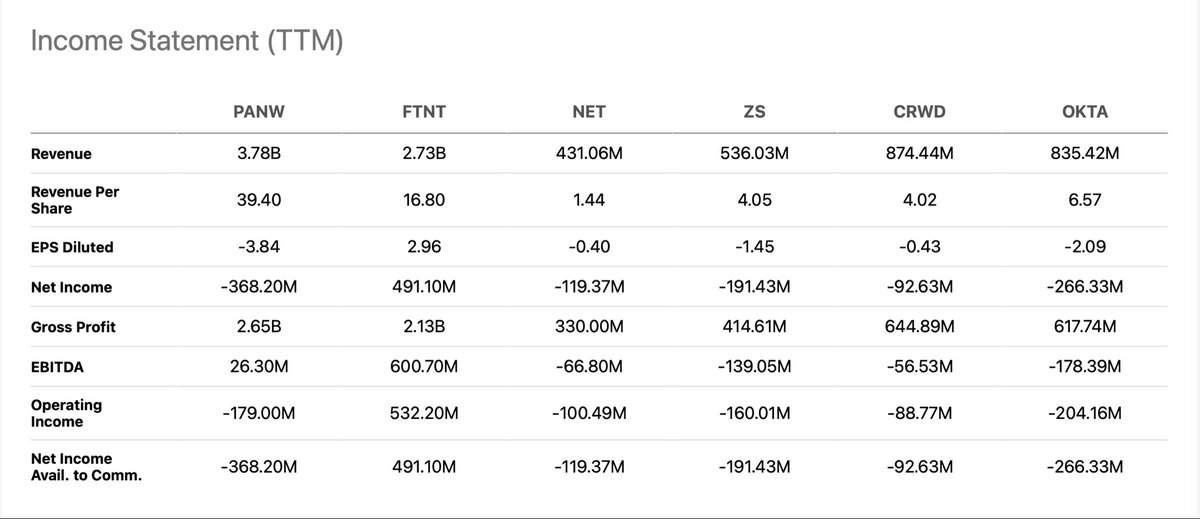

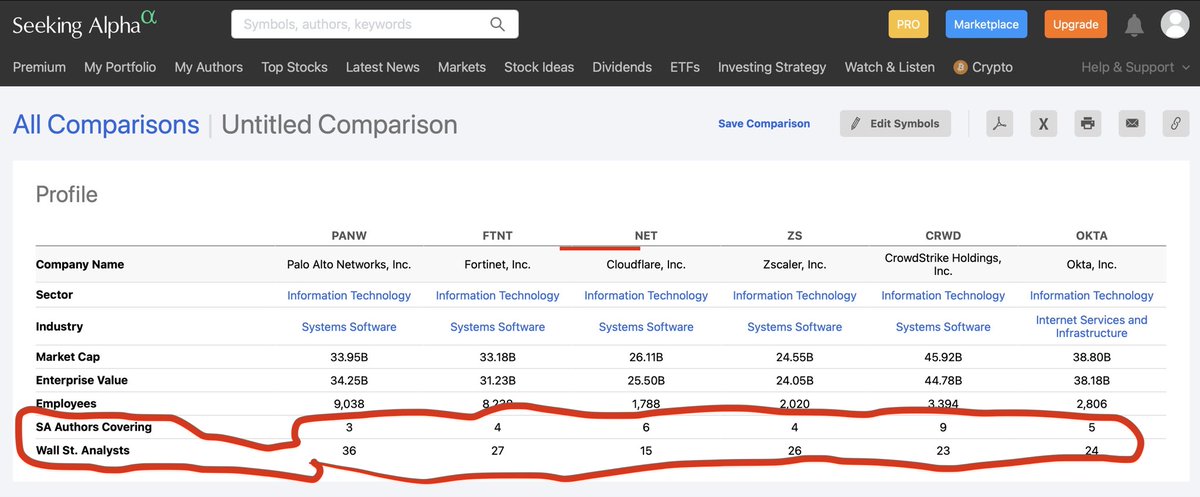

I used SA to do quick comparisons on income statement, balance sheet, Cashflow, profitability, growth, analyst ratings, total returns over the years, etc.

Here’s what an SA comparison looks like

Here’s what an SA comparison looks like

I started researching in March. Here’s what SA’s report looks like today .

From Mar-May you can see ratings have changed more positive.

From Mar-May you can see ratings have changed more positive.

I always like to see how many analysts are covering the stock. Peter Lynch says the fewer the better.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😁" title="Grinsendes Gesicht mit lächelnden Augen" aria-label="Emoji: Grinsendes Gesicht mit lächelnden Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😁" title="Grinsendes Gesicht mit lächelnden Augen" aria-label="Emoji: Grinsendes Gesicht mit lächelnden Augen">

$NET has 21 analysts covering which is fewest, but still it’s not small.

$NET has 21 analysts covering which is fewest, but still it’s not small.

SA have their own quantitative formula to grade a stock on value, growth, profitability & momentum

FTNT scores well on both Profitability & Momentum.

None of them scores well on value & that’s not surprising. These are growth stocks.

FTNT scores well on both Profitability & Momentum.

None of them scores well on value & that’s not surprising. These are growth stocks.

In the table above, you can also see how the stock price compares to the 52 week high & low.

Except for FTNT every stock is down in double digits from their 52 week high which could mean that the price now may give us good potential for growth. #BTFD right?

Except for FTNT every stock is down in double digits from their 52 week high which could mean that the price now may give us good potential for growth. #BTFD right?

However, you can also see that all of the stocks are much higher than the their 52 week lows. So perhaps the dip is not low enough? These are just points to consider. If you believe in the company & are going to hold it for 3-5 yrs, these shouldn’t matter so much.

Another comparison I like to consider are total returns. As a company grows over time, it becomes harder to give massive growths.

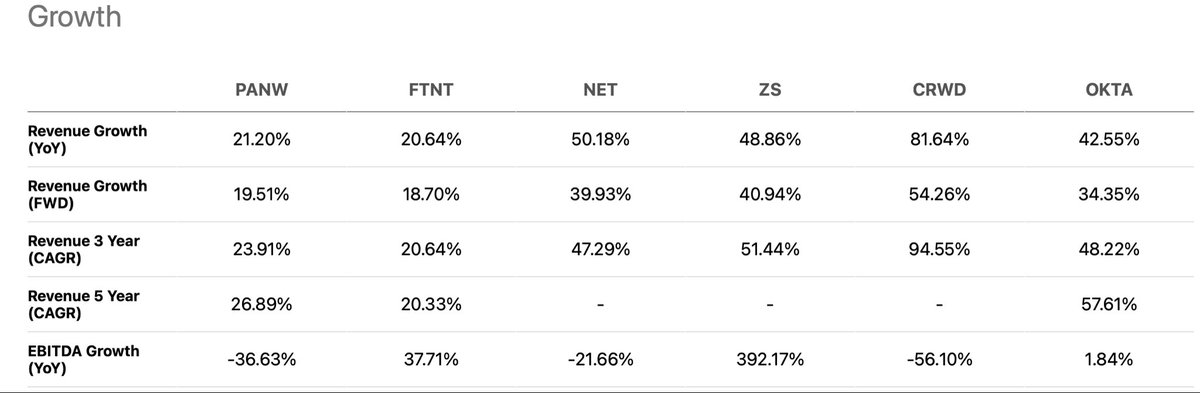

I love to look at this Revenue Growth & EBITDA & EPS Growths.

For Ex: If Revenue is growing but EBITDA is not, that means their Operating Costs are increasing faster than revenue.

For Ex: If Revenue is growing but EBITDA is not, that means their Operating Costs are increasing faster than revenue.

We can also look at Profitability, Gross Margins, Net Margins etc.

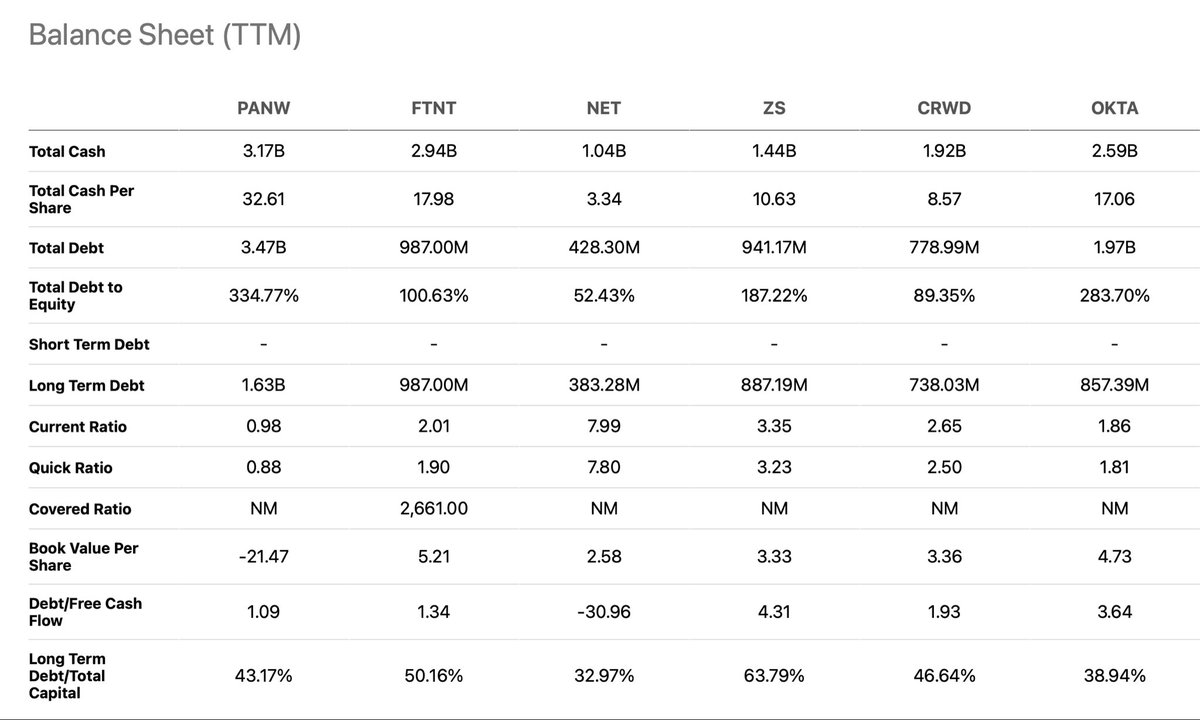

The best for last. I spend time in the Income Stmt, Balance Sheet & Cash Flow Statements. I’m conservative & debt worries me. I look at Debt/Equity & Debt/Free Cashflow Ratios.

I Picked $NET. What about you?

The best for last. I spend time in the Income Stmt, Balance Sheet & Cash Flow Statements. I’m conservative & debt worries me. I look at Debt/Equity & Debt/Free Cashflow Ratios.

I Picked $NET. What about you?

If you get too confused comparing stocks but still want to benefit from a growth industry like cybersecurity, you can consider ETF’s. They will give you a more modest return and may not be as volatile as individual stocks.

$IHAK $BUG $CIBR $HAK are some ETF’s to consider.

$IHAK $BUG $CIBR $HAK are some ETF’s to consider.

Hope you enjoyed/learned. Do let me know how I can improve these threads.

I’ll post a longer YouTube video InshaAllah soon.

/End https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

I’ll post a longer YouTube video InshaAllah soon.

/End

Read on Twitter

Read on Twitter

" title="I compared many stocks as well as ETF’sHere’s how they did.Your gal didn’t do too shabby. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😌" title="Erleichtertes Gesicht" aria-label="Emoji: Erleichtertes Gesicht">" class="img-responsive" style="max-width:100%;"/>

" title="I compared many stocks as well as ETF’sHere’s how they did.Your gal didn’t do too shabby. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😌" title="Erleichtertes Gesicht" aria-label="Emoji: Erleichtertes Gesicht">" class="img-responsive" style="max-width:100%;"/>

$NET has 21 analysts covering which is fewest, but still it’s not small." title="I always like to see how many analysts are covering the stock. Peter Lynch says the fewer the better. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😁" title="Grinsendes Gesicht mit lächelnden Augen" aria-label="Emoji: Grinsendes Gesicht mit lächelnden Augen"> $NET has 21 analysts covering which is fewest, but still it’s not small." class="img-responsive" style="max-width:100%;"/>

$NET has 21 analysts covering which is fewest, but still it’s not small." title="I always like to see how many analysts are covering the stock. Peter Lynch says the fewer the better. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😁" title="Grinsendes Gesicht mit lächelnden Augen" aria-label="Emoji: Grinsendes Gesicht mit lächelnden Augen"> $NET has 21 analysts covering which is fewest, but still it’s not small." class="img-responsive" style="max-width:100%;"/>