A look at China& #39;s digital yuan, in which I argue that on the spectrum from grand monetary revolution to big nothing-burger, it& #39;s a lot closer to the latter.

There are three bold claims about the eCNY, but none stand up to scrutiny--at least not yet. (1/x) https://www.economist.com/finance-and-economics/2021/05/03/will-going-digital-transform-the-yuans-status-at-home-and-abroad">https://www.economist.com/finance-a...

There are three bold claims about the eCNY, but none stand up to scrutiny--at least not yet. (1/x) https://www.economist.com/finance-and-economics/2021/05/03/will-going-digital-transform-the-yuans-status-at-home-and-abroad">https://www.economist.com/finance-a...

The three claims are that it will dramatically enhance China’s surveillance capabilities; that it will allow the state to wield far more control over money; and that digitisation will help the yuan challenge the dollar for global prominence. (2/x)

With all three claims, those seeing great promise or great peril in the digital yuan understate what China is already doing and/or overstate what the eCNY will allow it do. (3/x)

On surveillance: the central bank already has few blindspots, apart from cash itself (which it won& #39;t eliminate). The eCNY could lead to more consolidated oversight, but in practice that means going from three centralised networks to one. Not a huge difference. (4/x)

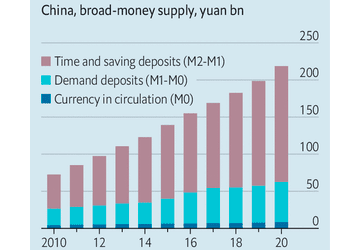

On monetary policy: the key is how modest the eCNY plans are. PBOC is aiming for just a small slice of M0, <5% of money supply! And it will distribute eCNY through banks. Will it get more adventurous in the future? Possibly. But it& #39;s wary of messing up the financial system. (5/x)

On yuan vs dollar: politics and policy, not technology, have held back the yuan. China is v cautious on capital controls, hence limiting the yuan& #39;s global appeal. And the main cross-border friction is a battery of checks on transfers. Digitisation is unlikely to solve that. (6/x)

Read on Twitter

Read on Twitter